The FTSE 100 hit a fresh record high on Monday, climbing to 8,521 points as markets rallied ahead of President Donald Trump returning to the White House.

This confidence among investors comes as the Republican President is understood to not be immediately imposing sweeping tariffs upon taking office.

However, during his inaugural speech, Trump did not commit to introducing tariffs at some point in his presidency.

He said: “We will tariff and tax foreign countries to enrich our citizens. For this purpose, we are establishing the External Revenue Service to collect all tariffs, duties and revenues.”

London’s blue-chip index gained 15 points, marking a 0.2 per cent rise and its second consecutive day of record-breaking performance.

Rather than implementing immediate tariffs, Trump is set to sign a broad trade memorandum directing federal agencies to evaluate trading relationships with China, Canada and Mexico.

Commodity firms led the FTSE’s gains, with Anglo American, Fresnillo and Glencore all posting strong performances.

The rally came as markets anticipated Trump’s business-friendly agenda, including promised deregulation for finance firms and energy companies.

The newly elected President has particularly championed a “drill baby drill” agenda for the oil and gas industry.

Despite expectations that Trump would sign approximately 100 executive orders after taking office, the absence of immediate tariffs has particularly buoyed market sentiment.

According to the Wall Street Journal, Trump’s trade memo will instruct federal agencies to study and assess unfair trade practices and currency policies with key trading partners.

Concerns have been raised how the UK economy will be impacted if sweeping tariffs are introduced by the US President.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The UK stock market has rallied despite Trump’s commitment to tariffs

GETTY

The memo marks a significant shift from Trump’s campaign rhetoric, which had promised universal tariffs of 10 per cent to 20 per cent on all imports.

A senior policy adviser in the Trump team told the Wall Street Journal that the memo was an attempt to lay out the President’s agenda in “a measured way”.

It is understood this approach will likely involve trade investigations under legal authorities such as Section 232 national security trade law and Section 301 unfair trade practices statute.

These investigations could take months to complete. The market response to Trump’s softer stance on trade was immediate, with the US dollar slumping broadly against major trading partners’ currencies.

Sterling gained over 1.1 per cent against the dollar, hovering just under $1.23.

“The dollar is incredibly sensitive to the tariff outlook right now, and the new administration is already setting a tone suggesting that the fast-moving, shock-and-awe trade policy that Trump had promised is likely to be more measured than the market had expected,” said Kyle Chapman, FX Markets Analyst at Ballinger Group.

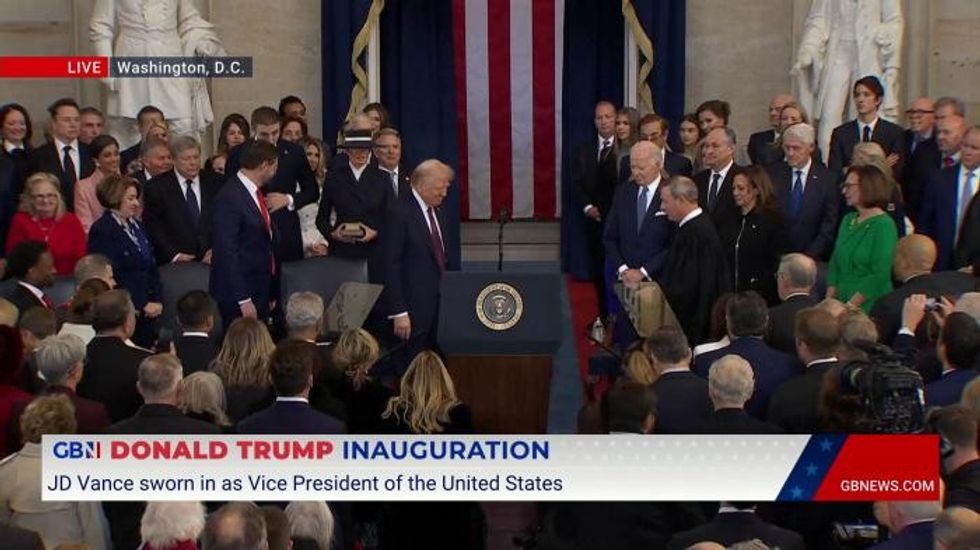

Donald Trump is sworn in as 47th president of the United StatesGB NEWS

Donald Trump is sworn in as 47th president of the United StatesGB NEWS The euro, Canadian dollar, Mexican peso and Chinese yuan all saw significant upswings against the dollar.

Punitive tariffs would typically strengthen the dollar, as protectionist policies tend to reinforce inflationary pressures, keeping interest rates higher for longer.

During his election campaign, Trump had promised to impose a blanket tariff of at least 10 per cent on all foreign goods entering the US. For Chinese imports specifically, Trump had proposed a steep 60 per cent levy.

He had also threatened a 25 per cent tariff on all goods from Canada and Mexico from his first day in office.

Speaking over the weekend, Darren Jones, chief secretary to the Treasury, expressed confidence that Britain would avoid the worst of Trump’s tariffs. “I don’t think we’re going to be in that scenario,” Jones said.

He added: “We shouldn’t be looking at president-elect Trump’s inauguration as a risk, or a bad thing for the UK. It could be an enormously positive thing with lots of opportunities.”

In Europe, France’s CAC 40 closed 0.3 per cent higher, while Frankfurt’s DAX rose 0.5 per cent. US markets, including the S&P 500 and Dow Jones, remained closed for Martin Luther King Jr Day.

The pound strengthened by 0.9 per cent against the US dollar, reaching $1.228. Against the euro, sterling declined by 0.2 per cent to 1.182. In oil markets, the price of Brent crude oil fell by 0.9 per cent, to about $80 US dollars per barrel.

LATEST DEVELOPMENTS:

The FTSE 100 rallied this morning

GETTY

The biggest risers on the FTSE 100 were Fresnillo, up 19.5p to 685.5p, Anglo American, up 72.5p to 2620.5p, Spirax, up 185p to 7455p, Experian, up 83p to 3820p, and Melrose Industries, up 12.4p to 580p.

Among the biggest fallers on the FTSE 100 were Rentokil, down 8.5p to 377.8p, Hiscox, down 24p to 1080p, Beazley, down 12.5p to 833.5p, Pearson, down 18.5p to 1270.5p, and LondonMetric Property, down 2.5p to 181p.

Vince Truong, a financial adviser and partner at GSB, said: “The impact of higher tariffs on the investment markets will depend on how gradual and surgical they are.

“If they’re a sudden sledgehammer, that will have at least a short-term negative impact, likely causing a dip or correction (five to 10 per cent drop).

“But if they are surgical, measured and gradual, then the impact should be nominal. As we don’t know the nature of the tariffs it would be best to temper excitement during what will be a period of short-term volatility to better assess what actually gets enacted.”

+ There are no comments

Add yours