CryptoCurrency

Governments And Large Institutions Can Buy All The Bitcoin They Want (Except Yours)

An X post by Anita Posch warning about the risks of governments and institutions buying up large amounts of bitcoin went viral this week— even if just because of the trollish community note that appeared underneath it. I think the main concern here is that these big holders could influence the Bitcoin consensus rules to impose censorship.

When it comes to censorship specifically, mining centralization is actually a more direct threat. But if it’s just miners censoring, it would only last for as long as a majority of miners is willing to keep doing it— at the expense of forfeiting transaction fees. If and when the censorship stops, transactions would start confirming again as if nothing happened.

If economic nodes were to enforce censorship as new protocol rules as well, however, it can indeed be considered a soft fork. In this scenario, miners can’t revert from the censorship without splitting the blockchain between “upgraded” (censoring) and non-upgraded nodes; that would constitute a hard fork. Buyers and sellers of the two versions of bitcoin would then determine which blockchain is more valuable; this is why some bitcoiners are concerned about governments and other large institutions accumulating a significant share of the bitcoin supply.

It’s a reasonable concern, and something to be aware of. At the same time (and similar to my argument in this Take), it’s not obvious to me that governments or large institutions would be willing to risk it all by betting on a censorship fork of Bitcoin. But even more importantly, there isn’t much we can do to stop governments or other institutions from buying bitcoin anyways— nor should there be, as that would (ironically) itself represent a form of censorship.

The best countermeasure, in this regard, was actually already proposed by Nikolaus: Don’t sell MicroStrategy your bitcoin.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CryptoCurrency

Trump’s executive order declares crypto national priority, Graphite Network shows how to bridge blockchain and TradFi

‘’We’re embracing the future with crypto and leaving the slow and outdated big banks behind’’, President Donald Trump declared, signaling a shift in his administration’s approach to digital assets.

The vision was formalized on Thursday, when signed an executive order establishing a working group on digital asset markets. The order reaffirms the administration’s commitment to key crypto principles, including coding transparency, self-custody, and fair banking access, aiming to integrate blockchain technology responsibly into the U.S. financial system.

This idea of blending blockchain with traditional financial systems is bold, and Graphite Network offers the means to make it happen with its scalable and compliant solutions tailored to meet the modern financial needs of banks and financial institutions of all sizes.

Speaking to crypto.news, Graphite Network CTO Marko Ratkovic said:

“While it’s clear that the world is changing and the new US administration is becoming more open to cryptocurrencies, concrete regulations are still up in the air. What’s certain, though, is that Graphite Network offers the infrastructure banks need to make this transition. We can help traditional finance connect with the decentralized economy, and this support is just as important for mass adoption as the regulations will be.”

Bank Integration Demo is built to address pressing challenges facing financial institutions as they struggle to implement blockchain adoption on their own through:

- Building Reliable Infrastructure: Graphite Network’s blockchain is built on a Proof-of-Authority Polymer 2.0 consensus mechanism, ensuring high security, scalability, and energy efficiency. This will assist financial institutions in adopting blockchain technology without compromising their existing and legacy business.

- Bridging Compliance and User Empowerment: By integrating ZKP-based KYC processes and reputation scoring, Graphite Network bridges the gap between institutional requirements and user autonomy.

- Strategic Partnerships: Graphite Network continues to collaborate with banks and other financial institutions and tailoring blockchain solutions to address any specific needs.

Other bank-compliant Graphite Network’s features

Predictable Fees, Even During Peak Activity

Graphite Network’s Layer 1 blockchain is built to keep fees reasonable, even during periods of high network activity. For banks and financial institutions, this predictability is crucial for managing costs and ensuring smooth operations. In contrast, Ethereum lagged in 2024, with fees spiking unpredictably — averaging $3.52 per transaction during peak times. Such volatility can disrupt cost projections and scalability, making Graphite Network a more reliable choice for institutions integrating blockchain technology.

Non-Intrusive KYC

Graphite Network’s optional KYC system is a game-changer for balancing privacy and compliance. The system is built with Zero-Knowledge Proof technology which allows third parties to verify user data such as age or location without revealing personal information. This ensures data security and privacy while providing regulatory agencies and financial institutions with a verifiable, compliant system. User data submitted during the KYC process is kept off-chain to minimize the likelihood of data breaches or unauthorized access.

Trust Score and Interaction Preferences

Graphite Network’s Trust Score reflects a user’s reputation based on things like their KYC status, transaction history, account activity, and interactions with others. It even looks at whether any fraud claims are associated with their account. However, Graphite Network doesn’t impose strict rules—it lets users decide how they want to manage their interactions. They can choose whether to complete KYC, who to engage with, how to filter transactions, and more. This flexibility is important because it gives users control over their own decisions.

For banks, this is useful because it allows them to have insight into the trustworthiness of users without forcing everyone into a one-size-fits-all system. Banks can also benefit from knowing that users can set their own preferences while still maintaining the ability to track and assess risk through the Trust Score.

Reputation-Based Smart Contracts

Graphite Network will also provide tools for banks and businesses to develop smart contracts that consider reputation metrics, enabling customization of services for targeted user groups. A bank, for example, could create a contract to issue loans only to customers with verified credit scores or a history of account activity, meeting both business objectives and regulatory standards.

Directed Fund Management

Graphite Network is planning to introduce tagged addresses to improve transparency and accountability in blockchain transactions. These addresses will be linked to specific purposes, such as business-related payments or loan servicing, ensuring that funds are directed where they’re intended. For example, if a bank transfers funds to a loan repayment-tagged address, it will be clear that the payment is for that purpose. If the funds are later misused — say, spent on unauthorized transactions — the system will flag it immediately.

Additionally, smart contracts will be able to block transactions from suspicious addresses, adding an extra layer of security. While this feature isn’t live yet, it’s a significant step toward making blockchain transactions more secure and trustworthy for financial institutions.

Equitable Rewards, Directly from the Blockchain

Earlier, crypto.news reported that Graphite Network is the first platform enabling transport (or entry-point) node operators to earn directly from its blockchain through a dual-layer node system. Entry-point nodes onboard transactions, earning 50% of transaction fees in @G, while authorized nodes validate blocks, earning 100% of fees for independent transactions and 50% for transactions involving entry-point nodes.

This structure ensures fair rewards for both types of nodes, creating a secure, scalable, and incentivized network that transforms participation into an income opportunity. Marko Ratkovic, recently reiterated one of Graphite Network’s central visions, explaining:

“One of our key goals is to democratize access to blockchain revenue streams. With our dual-layer node system, we’ve ensured that participants at every level can earn rewards while supporting the growth and security of the network.”

Bank Integration Demo is closely tied to @G, Graphite Network’s native token, which is weaved into key operations across the network as well, including paying fees, verifying accounts, distributing rewards, and more.

By prioritizing reputation, trust, and scalability, Graphite Network offers a clear path for financial institutions to integrate blockchain responsibly — an approach that could help leaders like Donald Trump turn his vision of blockchain’s role in traditional finance into a reality.

CryptoCurrency

ADA Nears Major Breakout Moment

Cardano remains in a consolidation phase within a triangle pattern, reflecting indecision in the market. A breakout from this structure is critical for determining the cryptocurrency’s next significant move.

Technical Analysis

By Shayan

The Daily Chart

ADA’s price has been consolidating inside a triangle pattern following a rejection at the critical $1.2 resistance level. This rejection halted the prior upward momentum and introduced a prolonged period of market indecision. The price structure now suggests a balance between buyers and sellers, as evidenced by the RSI indicator hovering near the neutral 50 level.

The triangle pattern represents a coiling price action behavior, signaling that a decisive breakout is imminent. A successful bullish breakout would likely pave the way for Cardano to reclaim the $1.2 mark and initiate a sustained upward trend. Conversely, a bearish breakdown could lead to heightened selling pressure, delaying a recovery.

The 4-Hour Chart

On the 4-hour timeframe, ADA encountered rejection at the $1.2 critical resistance zone after a bounce from the 0.5 Fibonacci retracement level at $0.8. It resulted in a period of sideways consolidation, with the price forming a slight ascending wedge pattern within the broader triangle.

The current market conditions suggest that a bullish breakout is the more probable scenario, as the wedge’s structure often signals a continuation of upward momentum. If buyers succeed, the asset will likely surge toward and potentially break above the $1.2 resistance zone.

On the other hand, if selling pressure intensifies, Cardano’s 0.5-0.618 Fibonacci retracement range will serve as a critical support level, potentially absorbing downward momentum and preventing a deeper decline.

This breakout will heavily influence the market’s next move, making the current phase critical for traders and investors.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

CryptoCurrency

CoinShares Seeks Approval For Spot Litecoin And XRP ETF In Latest Market Move

Ronaldo is an experienced crypto enthusiast dedicated to the nascent and ever-evolving industry. With over five years of extensive research and unwavering dedication, he has cultivated a profound interest in the world of cryptocurrencies.

Ronaldo’s journey began with a spark of curiosity, which soon transformed into a deep passion for understanding the intricacies of this groundbreaking technology.

Driven by an insatiable thirst for knowledge, Ronaldo has delved into the depths of the crypto space, exploring its various facets, from blockchain fundamentals to market trends and investment strategies. His tireless exploration and commitment to staying up-to-date with the latest developments have granted him a unique perspective on the industry.

One of Ronaldo’s defining areas of expertise lies in technical analysis. He firmly believes that studying charts and deciphering price movements provides valuable insights into the market. Ronaldo recognizes that patterns exist within the chaos of crypto charts, and by utilizing technical analysis tools and indicators, he can unlock hidden opportunities and make informed investment decisions. His dedication to mastering this analytical approach has allowed him to navigate the volatile crypto market with confidence and precision.

Ronaldo’s commitment to his craft goes beyond personal gain. He is passionate about sharing his knowledge and insights with others, empowering them to make well-informed decisions in the crypto space. Ronaldo’s writing is a testament to his dedication, providing readers with meaningful analysis and up-to-date news. He strives to offer a comprehensive understanding of the crypto industry, helping readers navigate its complexities and seize opportunities.

Outside of the crypto realm, Ronaldo enjoys indulging in other passions. As an avid sports fan, he finds joy in watching exhilarating sporting events, witnessing the triumphs and challenges of athletes pushing their limits. Furthermore, His passion for languages extends beyond mere communication; he aspires to master German, French, Italian, and Portuguese, in addition to his native Spanish. Recognizing the value of linguistic proficiency, Ronaldo aims to enhance his work prospects, personal relationships, and overall growth.

However, Ronaldo’s aspirations extend far beyond language acquisition. He believes that the future of the crypto industry holds immense potential as a groundbreaking force in history. With unwavering conviction, he envisions a world where cryptocurrencies unlock financial freedom for all and become catalysts for societal development and growth. Ronaldo is determined to prepare himself for this transformative era, ensuring he is well-equipped to navigate the crypto landscape.

Ronaldo also recognizes the importance of maintaining a healthy body and mind, regularly hitting the gym to stay physically fit. He immerses himself in books and podcasts that inspire him to become the best version of himself, constantly seeking new ways to expand his horizons and knowledge.

With a genuine desire to become the best version of himself, Ronaldo is committed to continuous improvement. He sets personal goals, embraces challenges, and seeks opportunities for growth and self-reflection. Ultimately, combining his passion for cryptocurrencies, dedication to learning, and commitment to personal development, Ronaldo aims to go hand-in-hand with the exciting new era that the emerging crypto technology is bringing to the world and societies.

CryptoCurrency

Next Stop for DePIN: Taco Bell

The DePIN revolution is coming to a fast food franchise near you. The movement that started with Helium and has spread to numerous categories, including mapping and car data, this year is now spreading to hospitality. The initiative shows how quickly DePINs — or decentralized networks of physical infrastructure — are becoming mainstream.

The fast food and hospitality industry, often associated with consistency and efficiency, is quietly upgrading as decentralized technologies make their way into the mainstream. The adoption of DePIN by major franchises like Taco Bell and KFC signals a shift in how these businesses operate and engage with technology.

At the core of this transformation is the integration of DePIN devices — sensors, routers, and other physical infrastructure — powered by blockchain and token-based incentives. These networks enable businesses to contribute to shared ecosystems while gaining real-time operational insights and being rewarded for their participation. It’s a forward-thinking approach that combines cutting-edge technology with the practical needs of fast-food and hospitality businesses, paving the way for greater efficiency, sustainability and customer satisfaction.

With DePIN, the industry is embracing a strategic evolution — one that reflects the growing potential of decentralized technologies to enhance traditional models while creating new opportunities for growth.

For franchisees, the potential benefits of DePIN are significant. By integrating DePIN devices into their operations, they can unlock a wealth of opportunities:

- Enhanced operational efficiency: DePIN devices, such as air quality sensors from Ambient Network, can provide real-time data on environmental conditions. This information can be used to optimize HVAC systems, improve indoor air quality, and reduce energy consumption.

- Increased customer satisfaction: By leveraging DePIN-powered solutions, franchises can offer a more personalized and convenient customer experience. For instance, indoor cell site deployments from Helium Mobile or XNET can provide reliable connectivity, while blockchain-based supply chain management can ensure product quality and freshness.

A case study: the power of collaboration

A prime example of DePIN’s impact on the franchise industry is the partnership between major fast-food chains and Ambient Network, the largest decentralized air quality network on Solana. By deploying air quality sensors across hundreds of stores, from coast to coast, these franchises are not only improving air quality for their customers but also contributing to a cleaner environment. Moreover, they are generating valuable data insights that can be used to optimize operations and reduce costs.

“With the growing maturity of tokens and decentralized technologies, we’re seeing a shift in how we can use these assets within our stores and properties,” explains Pushpak Patel, Founding Principal at CMG Companies, one of the largest operators of KFC, Taco Bell, Sonic, Little Caesars, Rent-A-Center, and Ace Hardware franchises in the US.

“By installing 1,000 DePIN devices from Ambient Network, we’re enhancing our ability to gather operational insights across our locations. Having air quality sensors installed doesn’t just provide real-time conditions, both outdoor and indoor — it also enables us to participate in demand-response programs. And with the strategic density of our locations, we can help unlock greater coverage for the network, which in turn generates additional data insights. This is a game-changer.”

Franchisees may partner with third parties to deploy and manage the infrastructure, or they can manage the devices in-house to improve operational efficiency with the devices and potentially generate an excellent return on investment. With Helium, these deployer participants are seeing ROI from a few dollars to tens of dollars per day based on factors like location, miner density and network demand.

Parami Investors, one of the largest deployers of Helium and Ambient devices in North America, has also been bullish on DePIN opportunities for franchise locations. We are clearly seeing greater adoption by retailers and hospitality providers to adopt and deploy decentralized solutions such as Helium and Ambient. Ambient is now deployed across highly dense commercial shopping and dining centers like the Japanese Village Plaza in Los Angeles’ Little Tokyo district, hotels like the Best Western in Las Vegas and fast food chains like Taco Bell, KFC and Five Guys. Revolutions start on the street with franchisees pushing the envelope for wider corporate adoption.

The road ahead

As DePIN technology continues to mature, we can expect to see even more innovative applications in the franchise industry. From decentralized energy grids like Powerledger and community-powered solar from Glow, to blockchain-based loyalty programs from Hang, the possibilities are endless.

For fast food retailers and franchisees, deploying DePIN devices is not just a technological trend — it’s an investment in a more efficient, profitable, and sustainable future. From generating passive income to collecting valuable data and optimizing operations, the benefits are clear. As the technology continues to evolve, franchisees and other small businesses will find even more ways to leverage DePIN devices to improve both the customer experience and their bottom line.

Decentralized solutions are building an ecosystem that benefits everyone, driving participation through incentives. And DePIN devices are a key part of that vision. By embracing these new technologies, franchisees are setting themselves up for long-term success, ensuring that they remain competitive in an ever-changing market.

CryptoCurrency

Can Trump Meme Coin Beat Solana in 2025? Experts Back DTX Exchange as Next 10,000% Listing

Trump’s meme coin (TRUMP) has been making waves, with some wondering if it could outperform established giants like Solana (SOL) in 2025. While this SOL-based asset surges in popularity, DTX Exchange (DTX) is stealing the spotlight as the true underdog with massive potential.

Experts are already backing DTX Exchange as the next big listing, with predictions of an incredible 10,000% rally very soon. With its innovative hybrid trading model, DTX offers something truly unique, drawing attention from savvy investors looking for the next game-changing platform. Keep reading to learn more!

Solana (SOL) Soars as Trump Meme Coin (TRUMP) Takes Center Stage

Solana’s native token, SOL, skyrocketed over the last weekend, breaching the $290 price level following the launch of a meme coin tied to President Donald Trump. Dubbed the Official Trump coin (TRUMP) and launched on the Solana blockchain, this meme coin now has a $7 billion market cap, making it one of the largest on the network.

Notably, Solana shines as a cheaper and faster alternative to Ethereum. It hosts popular meme coins, DeFi platforms, and gaming projects. With ETF proposals for SOL piling up, the Solana price trajectory looks promising.

Trump’s Latest Meme Coin Delivered a 1,000% Surge

The Official Trump coin burst onto the scene late Friday. The launch was announced on President Trump’s X and Truth Social accounts during the Crypto Ball, a celebration of his White House return hosted by crypto leaders in Washington, D.C.

Launching at $6.24, the coin skyrocketed 1,000+% to $75.35 within 24 hours, according to CoinMarketCap. Designed as a symbol of support for Trump’s ideals, it comes with a disclaimer that it’s not intended as an investment or security.

With 200 million coins initially available — set to grow to 1 billion over three years — just 10% is public, while 80% is reserved for creators and Trump’s CIC Digital affiliate.

DTX Exchange (DTX): A New Innovative Project Set To Revolutionize The Way You Trade

DTX Exchange enters the crypto scene as a game-changing trading platform. Designed to redefine the DeFi landscape, DTX lets you trade a wide array of assets, including cryptocurrencies, stocks, bonds, ETFs, and forex pairs.

It’s no wonder experts believe this viral altcoin has what it takes to dominate the 2025 bull cycle. Let’s dive into other features that make DTX Exchange a standout:

-

Diverse Asset Range: Unlike platforms focused solely on crypto, DTX Exchange opens the door to multiple investment opportunities, giving traders unmatched flexibility.

-

Unbeatable Speed: Powered by the VulcanX blockchain, DTX Exchange delivers jaw-dropping speeds of 200,000 transactions per second (TPS), outpacing Solana’s 600 TPS. Faster trades mean better entries, exits, and higher profit potential.

-

Passive Income Opportunities: The platform unlocks passive income streams that allow users to grow wealth effortlessly through its exclusive DTX RWA (Real World Assets) segment.

-

Phoenix Wallet: Managing your assets has never been easier. The Phoenix Wallet supports over 120,000 assets and provides a secure, all-in-one solution for tracking and storing investments.

Why DTX Exchange (DTX) Is The Perfect Altcoin for 2025

DTX Exchange has already captured investors’ interests thanks to its fair launch system. Unlike other projects dominated by whales and VCs who manipulate prices, DTX is backed by a growing and enthusiastic community of investors. This ensures transparency, equality, and price stability.

Adding to this fairness, DTX’s incremental cliff pricing model steadily increases token value over time, making it one of the most reliable investments in DeFi today. Right now, DTX Exchange is in its eighth presale stage and has raised over $12.5M so far.

Its tokens are priced at $0.16 each with a potential listing price of $0.20. Early adopters have enjoyed over 700% gains and are looking forward to the 10,000% projected by experts when it lists on top-tier exchanges.

Final Verdict

While TRUMP and Solana made a recent splash in the crypto market, it’s clear that DTX Exchange is a must-have altcoin in 2025. With its innovative hybrid trading model and massive growth potential, experts are backing DTX Exchange as the next 10,000% listing, ready to take the crypto world by storm.

If you’re looking for the next big thing in crypto, all eyes should be on DTX Exchange — it’s setting the stage for a future that’s nothing short of explosive.

Learn more about DTX Exchange here:

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Oversight committee Republicans launch debanking investigation

While Democrats are calling for an investigation into Donald Trump’s potential conflicts of interest on crypto, House Republicans said they would explore debanking claims.

CryptoCurrency

Raydium targets $10, CATZILLA steals spotlight with high growth potential

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CATZILLA is stealing the spotlight from Raydium’s $10 target with its high growth potential.

While Raydium sets its sights on a notable target, the real buzz centers around CATZILLA. This emerging contender has investors talking about its potential to surge by high values.

CATZILLA: The meme coin redefining success

CATZILLA is generating a seismic buzz in the crypto world with its growth potential. This emerging meme coin is more than just a flashy newcomer — it’s a bold, community-driven project poised to challenge crypto norms and deliver massive returns.

CATZILLA’s mission is to confront greed, expose scammers, and create a fairer crypto ecosystem. With a rebellious spirit and a fierce drive for innovation, its rallying investors, meme enthusiasts, and DeFi advocates to join its mission of decentralized financial empowerment.

CATZILLA isn’t just another fleeting meme coin. It’s designed with longevity and value at its core, offering early investors an incredible 88% presale discount. Starting at $0.0002, its 14-stage presale gradually increases prices, ensuring those who act early benefit the most.

Triple utility power:

- Governance – Empowering the community to shape CATZILLA’s future.

- Incentives – Rewarding active engagement and contributions.

- Staking – Offering opportunities for passive income by holding and staking CATZILLA tokens.

By blending humor, financial opportunity, and a transparent roadmap, CATZILLA is turning heads as a serious contender in the meme coin arena.

CATZILLA’s strength lies in its passionate community and commitment to inclusivity. It’s a platform where creativity meets innovation, uniting seasoned investors and meme fans in a collective pursuit of financial freedom.

Whether for the laughs, the gains, or the mission, CATZILLA promises a fresh approach to crypto — a space where collaboration thrives and possibilities are endless.

Interested investors can join the CATZILLA movement via presale.

Raydium eyes further growth

Raydium’s recent surge is catching eyes as its price maintains between $5.79 and $8.67. With a 6-month climb of over 227%, the potential for more growth is compelling. The nearest resistance sits at $9.57, signaling a pivotal point. If broken, the path to the second resistance at $13.07 opens, hinting at more than a 50% gain from current levels.

The RSI at 43.34 suggests room to run before overbought levels. The MACD’s positive nature bolsters this bullish sentiment. Recent 1-week and 1-month gains of over 39% and 54% respectively reflect growing momentum. As traders eye these levels, Raydium’s future looks promising in what could be shaping up to be an altcoin season.

Conclusion

While coins like RAY show limited short-term potential, Catzilla stands out as a meme coin aiming to bring financial freedom. With a 700% ROI potential during its presale — starting at $0.0002 and rising to $0.0016 over 14 stages — it offers governance features, rewards for loyalty, and staking options. Catzilla looks to unite enthusiasts to challenge toxic systems and reach new heights.

For more information on Catzilla, visit their website, X, or Telegram News.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Ethereum Achieves 17x Scaling with Layer 2, but Challenges Persist, Says Buterin

Layer 2 protocols have played a critical role in scaling the Ethereum network. The blockchain’s co-founder Vitalik Buterin noted that Layer 2s in 2025 represents a significant evolution from their experimental beginnings in 2019, having achieved certain decentralization milestones, secured billions of dollars in value, and scaled Ethereum’s transaction capacity by 17-fold, all while simultaneously lowering fees.

However, Buterin stated that challenges remain, particularly around scaling and heterogeneity.

Blob Space and Interoperability Challenges

In his latest blog post, Buterin pointed out that Ethereum’s current blob space – a resource for storing and processing data on the blockchain – barely meets the demands of today’s Layer 2s and their use cases. As such, this limitation could hinder the platform’s ability to accommodate future growth.

Additionally, the heterogeneity of Layer 2s creates challenges when it comes to interoperability, composability, and user experience.

While Ethereum’s initial vision for scaling involved a shard-based system of homogenous blockchains, Buterin noted that Layer 2s have instead evolved into a fragmented ecosystem of chains created by different actors, each with different standards and infrastructure requirements.

To address these challenges, the Ethereum co-founder outlined several key steps. On the Layer 1 side, Ethereum must accelerate scaling blobs and expand the Ethereum Virtual Machine (EVM) and gas limits to handle activities such as proofs, large-scale DeFi, deposits, withdrawals, and mass exit scenarios.

On the Layer 2 front, he stressed the need for improved security, ensuring guarantees such as censorship resistance, light client verifiability, and the absence of trusted parties. Interoperability across Layer 2s and wallets must also be prioritized to enable easy interactions across chains through standardized addresses, message-passing protocols, bridges, and efficient cross-chain payments.

For users, Ethereum should feel like a unified ecosystem rather than a collection of disparate chains, Buterin added.

Strengthening ETH as a Triple-Point Asset

Buterin also stated that Ethereum’s future as a strong triple-point asset – functioning as a store of value, medium of exchange, and unit of account – requires a “multi-pronged” strategy to maximize the value of ETH.

The first step is to cement ETH as the primary asset across the combined Layer 1 and Layer 2 Ethereum economy. This includes prioritizing ETH, the main collateral for decentralized applications and financial ecosystems.

Next comes incentivizing Layer 2s to allocate a portion of their fees toward the broader Ethereum ecosystem, which could generate sustainable funding. This may involve burning part of the fees, staking them, or channeling proceeds into public goods for the Ethereum network.

Third, while rollups offer opportunities for Layer 1 to capture value through MEV, it’s important to maintain flexibility, recognizing that not all rollups can adopt this model due to different application requirements. Finally, Ethereum could explore raising the blob count as a potential revenue stream.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

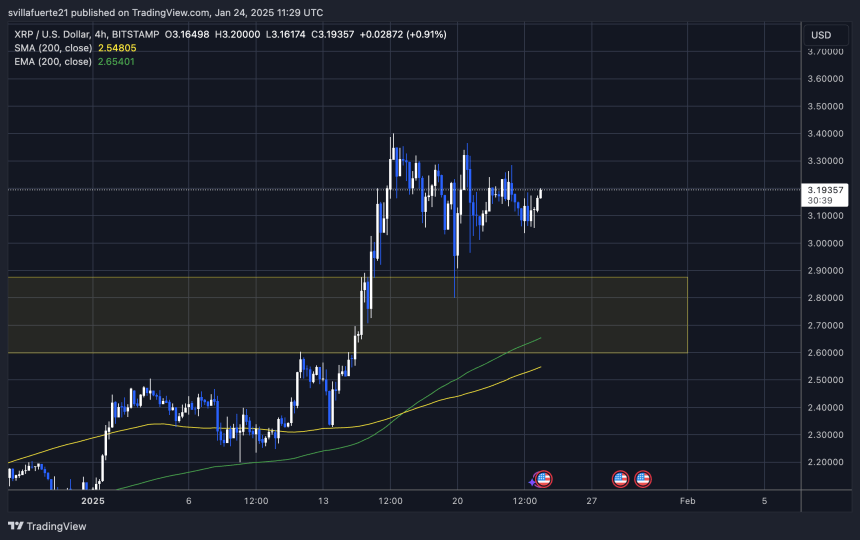

XRP Forms A Bullish Pattern In 4-Hour Chart – Analyst Expects $4.20 After Breakout

XRP is currently at a critical juncture, trading at a key level after breaking its all-time high just eight days ago. Despite the market’s inherent volatility, price action remains robust, fueling optimism among investors and analysts. As the broader crypto market enters a bullish phase, XRP is gaining attention as a potential leader in the next major rally.

Related Reading

Market sentiment is growing increasingly positive, with analysts predicting a massive move into price discovery. Among them, crypto expert Carl Runefelt has shared an intriguing technical analysis on X, highlighting a bullish setup for XRP. According to Runefelt, the price is forming a bullish pennant pattern on the 4-hour timeframe, a classic indicator of potential upward continuation. This pattern suggests that XRP is consolidating before a significant breakout, which could propel the price into uncharted territory.

As excitement builds, investors are watching closely to see whether XRP can sustain its momentum and capitalize on the bullish market environment. A breakout from the bullish pennant could confirm XRP’s trajectory toward new milestones, reinforcing its position as one of the market’s most dynamic assets.

XRP About To Enter Price Discovery

XRP is on the verge of entering price discovery as the broader crypto market signals a bullish rally. Following a strong pump in early November, XRP’s price action has remained resilient, fueling optimism for substantial gains in the months ahead. As the market flirts with a decisive phase, XRP continues to stand out as a top contender for life-changing returns for investors and traders.

Renowned crypto analyst Carl Runefelt has shared an insightful technical analysis on X, highlighting a bullish setup for XRP. According to Runefelt, the price is forming a bullish pennant pattern on the 4-hour timeframe, a classic indicator of potential upward continuation. Based on this setup, Runefelt has set a price target of $4.20 in the coming weeks, aligning with broader expectations of a market-wide rally.

The bullish pennant suggests that XRP is consolidating before its next major move. If the pattern holds, the breakout could propel XRP into uncharted territory, confirming its position as a leading asset in this market cycle.

Related Reading

As the market gears up for a potentially explosive phase, XRP is well-positioned to capitalize on the momentum. With its strong price action and favorable technical setup, XRP has the potential to deliver significant returns. Investors and traders are closely watching as XRP prepares for its next move, with anticipation building for what could be a pivotal rally.

Price Testing Critical Levels

XRP is currently trading at $3.19, following a massive surge above its previous all-time high last week. The recent price action highlights XRP’s strength as it continues to attract investor interest during this bullish phase. However, the asset has entered a brief consolidation phase, which could signal preparation for its next move.

For bulls to maintain momentum and sustain the uptrend, reclaiming the $3.25 resistance level is critical. Breaking above this mark would likely reignite buying pressure and pave the way for another push toward new all-time highs. Achieving this would reinforce the bullish structure and solidify XRP’s position as one of the market’s top-performing assets.

Conversely, holding above the $3.05 support level is equally important to confirm the ongoing trend. This level has become a key line of defense, and a breakdown below it could signal weakness, potentially leading to a deeper correction and testing lower demand zones.

Related Reading

As XRP consolidates, investors are closely monitoring these crucial levels. A breakout above $3.25 or a strong defense of $3.05 will provide clearer direction for XRP’s next move. The coming days will be pivotal in determining whether XRP can sustain its bullish momentum or face temporary headwinds.

Featured image from Dall-E, chart from TradingView

CryptoCurrency

It’s Easier Than You Think to Build With AI and Web3

Remember those middle-school writing prompts: Describe your favorite cookie.

Your teacher told you to write it as if to an alien, a being who had never encountered a cookie before, which meant touching on each sense – sight, sound, smell, touch, taste. You might not have realized it then, but describing something in a way that allows people to get a clear picture is actually quite hard.

Let me try to describe Matheus Pagani, founder and CEO of Venture Miner. Matheus is a male with light caramel skin and dark brown hair. Even though his hair is cut close, you can tell it’s curly. He’s got a thick dark brown, almost black beard, which connects to a mustache. His eyes are dark brown behind thin wire glasses. His bottom lip sticks out a little further from his top lip, giving him a look of assurance, but not arrogance.

Picturing him yet? How confident are you?

Oh yeah, and he’s Brazilian.

Got it?

Let’s see what Matheus Pagani actually looks like.

Is this what you had come up with in your head from my description? Doubt it. Whenever I told you he was Brazilian, did you accessorize him in bright colors and a feathered headdress? Something like this?

If so, check your bias, but also you’re thinking like an AI. That was what ChatGPT came up with from the prompt “some Brazilians having fun.” Pagani showed this and other examples spit out by our generative AI (Italians have fun by sitting around long tables with multiple generations eating pizza) during the AI2Web3 Bootcamp in NYC in early December.

The bootcamp, run by Pagani and Build City, brought together 59 participants across all skill levels to learn how the two buzziest (and often misunderstood) technologies can be brought together to create useful products and services. Pagani used a version of the middle-school assignment to explain how and why AI made the significant leaps that have kept us all excited and on edge over the past few years. Before there was largely only text data being used to train AIs, and as the exercise highlights, that only goes so far. But mix text information with visual data, and you get a fuller picture.

And understanding this, getting hands on with both AI and blockchain technology to understand its core components is what the bootcamp was all about. For Pagani, these skills are going to be relevant for nearly all people – engineers, tech users, journalists, artists, doctors – real soon.

“We want to join brilliant minds from all backgrounds to come and work with AI and Web3, since the junction of their multiple perspectives can uncover new use cases that we would never envision just with a specialized Web3 or AI mindset alone,” Pagani said. “Nowadays we have tools to easily enable any non-technical enthusiasts to build practically functional applications and systems just with “plain English,” so what matters is bringing passionate people interested in solving problems together with the proper education. When you have this combination, you just need to light the match and watch it burn.”

Mind-Boggling Building

What makes the intersection of these two technologies so exciting is just how much you can build in such a short amount of time without really any prior technical experience.

Not only will AI source whole codebases with the right prompt, but the crypto industry is also building tools to help make developing at the intersection of both more intuitive and accessible.

For instance, Coinbase, who sponsored the bootcamp, launched AgentKit in November. The framework allows developers to build AI agents with their own crypto wallets, enabling the agents to interact autonomously with blockchain networks. This could be used to build a squad of agents that can monitor the markets and execute trades automatically based on predefined rules and guardrails.

“One day, we’ll have AI agents own their own cars and operate their own taxi service that gets paid by customers in crypto and then uses that crypto to purchase repairs,” Lincoln Murr, associate product manager at Coinbase, told the attendees.

Coinbase currently has a grants program ongoing for building with AgentKit. “What you build doesn’t have to be useful; we have a bias towards cool stuff,” Murr told the bootcamp, hoping to inspire projects and applications that no one has yet thought of.

Ora Network also has an interesting model for developers looking to build AI-enabled Web3 applications or vice versa. The network allows developers to utilize current large language models, including Meta’s Llama3 and Stable Diffusion, but it also enables developers to build their own models and offer a so-called initial model offering (IMO) to crowdfund its continued development.

“It’s kind of winner-takes-all right now in AI, but with this model, we’re allowing the crowdfunding of AI building and training, so people can have a share of the models, which is empowering if we think these models will run society in a decade,” Alec James, partnerships and growth lead at Ora, said during the bootcamp. “If that’s the case, we’ll want that development distributed.”

Near, Fleek and Alora were also among the companies that sponsored the bootcamp and presented their various tools and programs for building at the intersection of these two innovative technologies.

Can Devs Do Something?

During the final day of the bootcamp, nine teams presented working prototypes for projects that blended Web3 and AI. These projects ranged from AI assistants meant to help you pick gifts, order delivery or diversify your financial portfolio to applications to help crypto operators pump out memecoins with big virality potential.

Jackie Joya, a participant who had flown in from San Francisco, said the bootcamp has really inspired her to keep building. With a background in animal science, Joya is still new to engineering, but was amazed how much a novice could build with the tools available.

Other participants, across all skill levels, said similar things. Choudhury Imtiaz, a market researcher from Bangladesh, who is in the U.S. on an H-1B1 Visa waiting for a placement, hasn’t heard of Web3 before the bootcamp, but was able to pitch a team project on the last day. And Isayah Culbertson, who has worked as an engineer for both crypto and AI projects separately, was able to learn skills for building with both, which he thinks has the potential to change the world for the better.

“I see the combination accelerating the research and development of so many different fields, while also allowing for a more equitable distribution of wealth generated from that R&D,” he said.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login