CryptoCurrency

How AI Helps Inexperienced Traders Profit from Crypto

What Makes a Smart Trader?

Smart traders approach the market with discipline and strategy. Some of their key qualities include:

- Data-Driven Decisions

They avoid emotional trading. Instead, they rely on charts, analytics, and indicators to understand market trends and patterns. - Risk Management

Smart traders know when to enter or exit a trade. This helps reduce unnecessary losses and maximize gains. - Tech-Savviness

They embrace new tools like AI bots, advanced charts, and backtesting strategies to gain a competitive edge.

AI trading bots, like AlgosOne, empower smart traders by reducing daily workloads and increasing profitability. These tools are becoming indispensable for both beginners and experienced traders.

How AlgosOne Capitalizes on Popular Coins

AlgosOne uses advanced AI algorithms to help traders make better decisions. Here’s how it works with XRP, DOGE, Bitcoin, and Solana:

1. XRP

XRP’s price often reacts to regulatory news. AlgosOne analyzes events in real time, such as SEC announcements, and adjusts its strategies accordingly.

For instance, when rumors about changes in SEC leadership emerged, the bot identified this as positive for Ripple and executed timely trades.

2. DOGE

DOGE is highly influenced by social media buzz and endorsements from figures like Elon Musk. AlgosOne tracks social sentiment and predicts price movements with accuracy, enabling traders to capitalize on DOGE’s rapid shifts.

3. Bitcoin

Bitcoin requires analyzing vast amounts of data. AlgosOne monitors market sentiment, support levels, and news, ensuring traders are well-positioned for potential price swings.

4. Solana

Solana has gained attention due to potential ETF approvals and institutional interest. AlgosOne scans its price movements and identifies optimal buy or sell moments to maximize profitability.

Key Features of AlgosOne

AlgosOne offers several features to enhance the trading experience:

|

Feature |

Details |

|

No Hidden Fees |

No inactivity or hidden fees. A $300 deposit is enough to start trading. |

|

Reserve Fund |

A $40 million reserve fund protects users during market or technical failures. |

|

Fixed APY |

Offers up to 150% APY for users on the highest tier. |

|

Trade Success Ratio |

More than 80% success rate in trades, improving as algorithms learn. |

|

AiAO Token |

Provides governance rights and potential 10,000x capital growth. |

|

User-Friendly Interface |

Simple design for beginners, as reviewed by YouTuber Crypto Nitro. |

Why Traders Choose AlgosOne

Traders prefer AlgosOne for its efficiency, reliability, and ease of use. It caters to both beginners and experienced traders, offering tools that simplify complex trading tasks. The platform’s 4.6-star TrustPilot rating reflects its success and user satisfaction.

The crypto market offers countless opportunities, but trading successfully requires the right tools and strategies. Inexperienced traders now rely on AI trading bots like AlgosOne to improve their chances of success. AlgosOne gives traders the ability to profit on coins like XRP, DOGE, Bitcoin, and Solana with features like real-time analysis and an intuitive UI.

This is an excellent moment to investigate AI-powered cryptocurrency trading. AlgosOne offers a 15% welcome bonus and a risk-free trial for new users. Take the next step and start your trading journey today!

CryptoCurrency

Bitcoin Trade Volume Wednesday Was One of the Largest Ever

Bitcoin continues to trade at record levels.

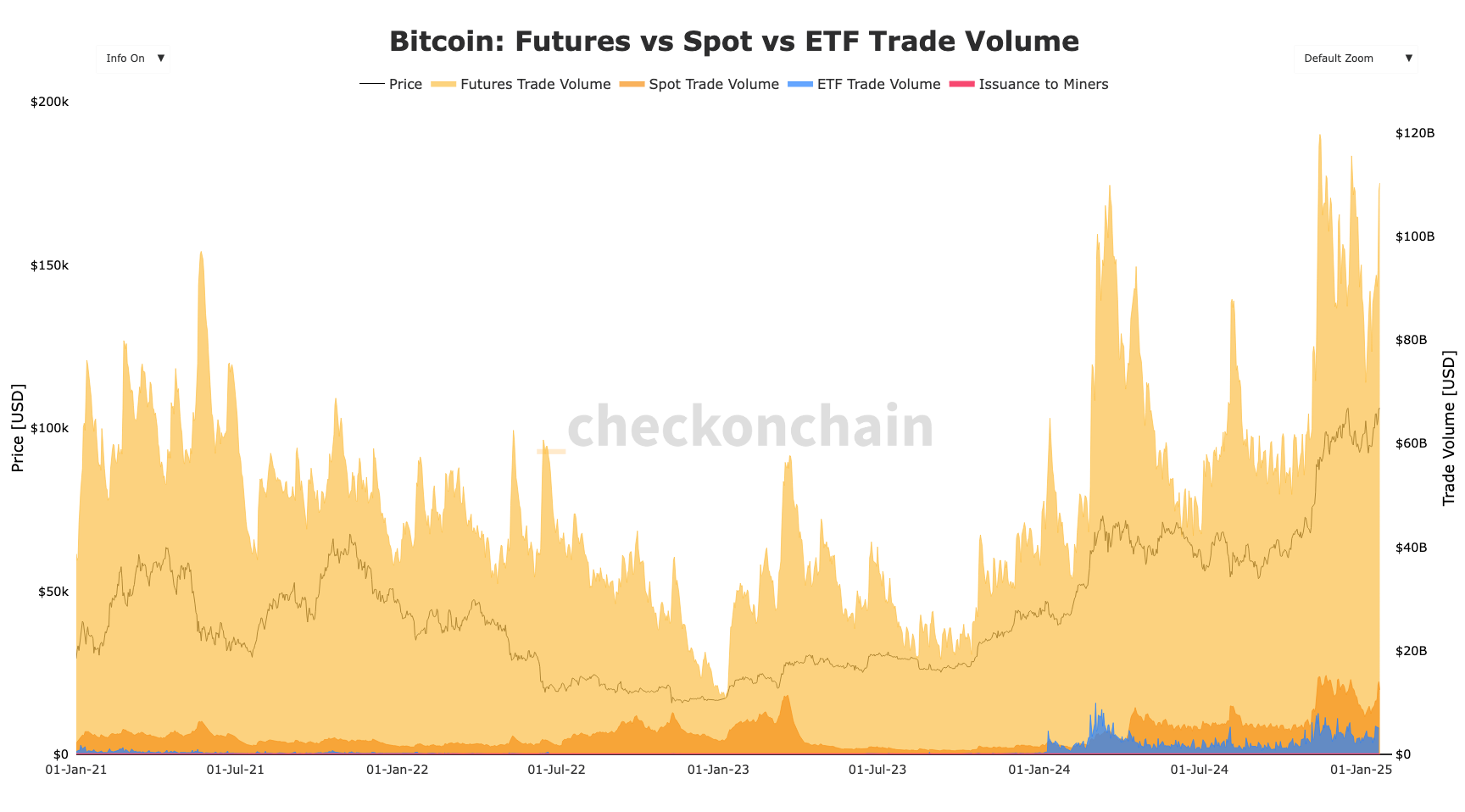

According to checkonchain data, Wednesday’s $130 billion bitcoin (BTC) volume was one of the highest in its history. Trade volume has soared since President Trump won the U.S. election at the start of November, doubling from a daily average of $65 billion.

The futures market (the total traded in futures contracts) yesterday saw $110 billion worth of volume. This was the fifth-highest futures trade volume recorded, only bettered on a handful of days in November and December last year.

The spot market saw roughly $15 billion of traded volume, which is approaching an all-time high. Meanwhile, bitcoin ETFs saw around $5 billion worth of trade volume, which is around half the all-time high seen in March 2024.

It is worth noting that options volume has not been included in the $130 billion daily volume figure, but it too is growing rapidly. According to Glassnode data, the total amount of options contracts traded in the last 24 hours is more than $3 billion.

With bitcoin is vying to be a global settlement layer, the more volume and liquidity that can be generated, the greater the asset’s chance of onboarding institutions that want to settle in billions of dollars at a moment’s notice.

CryptoCurrency

Ethereum And Cardano Drowned By Remittix's Success As Early Investors Bag 50% Returns In Just Three Weeks

A new cryptocurrency called Remittix has become a market favorite instead of Ethereum (ETH) and Cardano (ADA). The PayFi project attracts global investors with its innovative approach. The three-week presale of Remittix has delivered a 50% return to investors who joined early.

This remarkable growth has not only turned heads but also raised the question: is Remittix the next big thing in crypto? The DeFi project solves market problems by providing simple crypto-to-fiat payment solutions and easy cross-border transactions. It stands as a movement that could transform how people use cryptocurrencies.

Trump Goes On Ethereum (ETH) Buying Spree

The Ethereum coin is among the most sluggish in the market right now. Its value has been consolidating within a narrow range with some analysts calling it a sleeping giant. CoinMarketCap data shows the value of Ethereum (ETH) has dropped by 8.9% in the last two weeks.

Fortunately, the poor price movement has not swayed investors. Ash Crypto reveals that Trump’s World Liberty Finance has bought over $58 million ETH in the past few weeks. This increased accumulation could mean a price surge is on the way.

The analyst told his followers that something big is cooking. Besides, a crypto expert called MisterrCrypto notes that the Ethereum crypto has hit rock bottom.

They said Trump’s ETH accumulation could spark a rally soon. So, Misterrcrypto advised investors to remain patient. The analyst accompanying their post shows the ETH/BTC pair soaring to $0.11. Poseidon says the Ethereum price might hit $5k before February.

Cardano (ADA) Key Support Level To Watch

In a recent post on X, a top analyst called InvestingHaven told his followers the value of the Cardano coin could skyrocket in the coming weeks. However, the expert told them to watch out for a key support level at $0.824. InvestingHaven says holding this level could push the Cardano price to a new level. He posted a target of $1.9-$2.5 if this level holds.

Meanwhile, another analyst called FLASH posted a similar Cardano price prediction. They say the value of the altcoin could pump to $2 next. Technical indicators like the relative strength index support this potential uptrend. The indicator is above the 50 mark which means that bulls are in control.

In the meantime, CoinMarketCap data reveals Cardano (ADA) is showing upward movement on the daily chart. The cryptocurrency is currently consolidating close to the $1 mark and is among the top altcoins that could surge higher in the coming weeks.

Investors Jump Into Remittix (RTX) As Price Pumps To New High

Remittix (RTX) is a top crypto ICO that has shaken the market in the past few weeks. The project has sold over 270 million RTX coins which shows huge interest from investors. Currently priced at $0.0282, Remittix is the best DeFi cryptocurrency to buy. Its value could increase by 20x in 2025.

At its core, Remittix brings cryptocurrency into the mainstream financial world through its innovative cross-border payment solution. This advanced solution helps users and businesses move funds across borders quickly while maintaining low fees and easy transfer methods.

The basic design and practical features of Remittix drive its success. Through Remittix Pay API businesses can add cryptocurrency payment options to their business operations regardless of size or location. The business can expand its customer base worldwide while gaining market share and standing out against competitors. Remittix enables companies to create merchant accounts for handling transactions.

Through Remittix businesses gain complete control over crypto operations and profit withdrawal while benefiting from multiple currency choices and trading pair access. Remittix combines crypto speed and convenience with traditional banking features to help everyone access global finance and build the future of international money transfers.

Investors Rush To This Altcoin For More Profits

Remittix has emerged as the best crypto to buy right now. Not only has the RTX coin given investors more than 50% gains, but it can also soar another 20x before the end of the quarter. Therefore, investors interested in purchasing a good cryptocurrency in January 2025 can join the presale before it’s too late.

Join the Remittix (RTX) presale and community:

Join the Remittix (RTX) Community

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Vitalik Buterin takes aim at ‘unlimited political bribery’ using tokens

The Ethereum co-founder warned against crypto projects offering “sugar-high short-term fun” rather than those used to build wealth.

CryptoCurrency

Low-cap meme coin to challenge ETH and SOL

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BeerBear, a new low-cap meme coin, is looking to challenge Ethereum and Solana.

The crypto world is buzzing with talk of a low-cap meme coin that’s set to challenge giants like Ethereum (ETH) and Solana (SOL). With predictions of massive returns, speculators are flocking to this hidden gem in search of massive profits. The name making waves? BeerBear.

BeerBear: A unique crypto opportunity

Time is ticking, and the crypto world is buzzing about BeerBear, the token that looks to rewrite the rules of profit. With early presale discounts and high growth potential, BeerBear could be a chance to secure fast, substantial gains before the bull run hits full speed.

BeerBear’s presale started at $0.0001 per token and will ramp up to $0.0020 by the 20th stage. The math doesn’t lie – early adopters stand to rake in up to 1,900% returns in record time.

BeerBear isn’t just another token – it’s an adrenaline-packed ecosystem designed to grow fast and reward its investors quickly:

- Presale growth: Opportunity to get in from the start and watch investments multiply with each stage.

- Gamified ecosystem: Prepare for BeerBear’s Bar Brawl Beat ‘Em Up Game, where rare items and rewards can be unlocked. Think Streets of Rage meets crypto dominance – play, earn, and collect exclusive perks.

- Massive rewards with Beer points: Every token purchase earns Beer points, unlocking additional bonuses like NFTs, airdrops, and premium game access. The bigger the purchase, the bigger the rewards.

Beer points reward system

Earn 6%-12% Beer points based on the size of token purchase:

- Small contributions ($10-$250) earn 6% in Beer points.

- Medium contributions ($1,000-$2,500) earn 9% in Beer points.

- Large contributions ($10,000+) unlock the maximum reward of 12% in Beer points.

Example: A $700 purchase earns 5,600 Beer points, boosting potential bonuses and rewards.

USDT-BSC multi-level referral program

- Earn up to 9% for direct referrals, with additional bonuses for referrals made by referees.

- Share the referral link and turn every connection into passive USDT income.

- Weekly payouts ensure rewards arrive fast — no waiting around.

- Start small or go big and watch referrals generate consistent profits.

Interested investors can join the BEAR presale.

Ethereum: King of smart contracts

Ethereum has dominated the blockchain space with its smart contract functionality and a massive developer ecosystem. Its role as the backbone of decentralized applications (dApps) and DeFi has cemented its place at the top of the crypto hierarchy.

Despite its success, Ethereum’s scalability issues and high transaction fees have caused many traders to explore alternative investments for higher returns.

Solana: The high-speed contender

Solana has emerged as a top competitor to Ethereum, boasting lightning-fast transaction speeds and low fees. Its ability to handle thousands of transactions per second has made it a favorite for developers and traders alike.

With a growing ecosystem and strong backing, SOL has become a go-to choice for those seeking a high-performing blockchain. However, as Solana gains traction, speculators are turning their attention to the next big opportunity.

The meme coin set for massive gains

BeerBear is offering a fresh opportunity for traders chasing massive returns. Priced at $0.0002 during its presale, BeerBear provides a low entry point for those ready to ride the wave. With a multi-stage presale model that rewards early adopters, BeerBear is capturing the attention of whales and retail investors alike.

What sets BeerBear apart is its ability to generate hype and foster a community of degens who thrive on high-risk, high-reward plays. The buzz surrounding BeerBear is growing by the day.

Conclusion

Ethereum and Solana are proven leaders in the crypto space but BeerBear’s potential and low presale price make it a unique opportunity for speculators. With predictions of massive returns, BeerBear is a meme coin that could redefine portfolios in 2025.

For more information on BeerBear, visit their website, X, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Could This be the Future of Crypto Wallets? $BEST Token Presale Nears $8M Milestone

Tired of juggling multiple different platforms to manage your crypto?

Best Wallet (BEST) has created an all-in-one solution – and its BEST token presale is going from strength to strength.

With nearly $8 million raised, could BEST live up to all the early hype?

Best Wallet – The New Wallet Aiming to Transform Crypto Management

Best Wallet is aiming to be the complete crypto hub, offering a wide range of features for both new and experienced traders.

Users can store assets, swap tokens, and even access exclusive presale projects in one easy-to-use platform.

One of Best Wallet’s standout features is its built-in DEX.

This DEX lets users buy, sell, and swap their favorite tokens without leaving the Best Wallet app.

Plus, the app’s staking protocol lets them stake BEST to earn APYs of 228%, which is far higher than the industry average.

If that wasn’t enough, Best Wallet’s team plans to launch “Best Card” – a debit card that lets investors spend their crypto as if it were cash.

But it’s not just about convenience since Best Wallet is designed with security in mind.

Best Wallet protects users’ assets with two-factor authentication and insurance through Fireblocks.

And let’s not forget about the BEST token itself.

Holding BEST unlocks several perks, including reduced trading fees, higher staking rewards, and a say in the platform’s future.

BEST Token Presale Nears $8M as Investor Demand Ramps Up

The BEST token presale is generating serious buzz right now.

With nearly $8 million raised and a daily funding rate exceeding $200,000, investors are clearly excited about Best Wallet’s potential.

That’s unsurprising, given that the wallet offers new features, a user-friendly app, and a strong development team.

The BEST token presale, which kicked off in mid-November, has seen steady demand.

This shows it’s not just a temporary fad – there’s real momentum behind it.

Early investors can now grab BEST tokens for $0.0237 each, but that price will increase as the presale progresses.

That means those who get in the earliest will receive a lower entry point.

Adding to the hype, Best Wallet has been audited by Coinsult, a well-known security firm, who found no issues.

The Best Wallet community is also growing fast, with Twitter and Telegram channels seeing an influx of members.

And to top it off, the project has even received shout-outs from some big names in the crypto world, like Austin Hilton and Borch Crypto.

Upcoming Tokens Feature Provides Early Access to the Next Crypto Gems

One of the big drivers behind Best Wallet’s presale success is the “Upcoming Tokens” feature.

This is where users can discover and invest in promising new projects before they hit exchanges.

Imagine getting in on the next Dogecoin early.

That’s the kind of opportunity that the Upcoming Tokens feature offers.

It’s simple to use: Users can browse ongoing presales, learn about the project’s details, and invest directly through the Best Wallet app.

They can even track their token balance and be notified about important events, such as when to claim their tokens.

Best Wallet users have already seen some incredible returns from this feature.

Pepe Unchained, for example, saw nearly 700% upside from its presale price to its post-launch high.

Catslap soared over 2,500% from its initial launch price.

And with Upcoming Tokens now featuring the Meme Index project, this might be the next big thing.

So, if you’re looking for a crypto wallet with a twist, Best Wallet is worth checking out.

It very well could be the future of digital asset management.

Visit Best Wallet Token Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

A New (Digital) Age at the SEC

As technology evolves, the U.S. Securities and Exchange Commission (SEC) must evolve with it. Nowhere is this truer than in crypto, and now: The market for crypto assets has grown in size and sophistication such that the SEC’s recent harmful approach of enforcement and abdication of regulation needs urgent updating.

While the long-term future of the crypto industry in the U.S. will likely require Congress to sign a comprehensive regulatory framework into law, here are six steps the SEC could immediately take to create “fit-for-purpose” regulations – without sacrificing innovation or critical investor protections.

#1 Provide guidance on ‘airdrops’

The SEC should provide interpretive guidance for how blockchain projects can distribute incentive-based crypto rewards to participants — without those being characterized as securities offerings.

Blockchain projects typically offer such rewards — often called “airdrops” — to incentivize usage of a particular network. These distributions are a critical tool for enabling blockchain projects to progressively decentralize, as they disseminate ownership and control of a project to its users.

If the SEC were to provide guidance on distributions, it would stem the tide of these rewards only being issued to non-U.S. persons — a trend that is effectively offshoring ownership of blockchain technologies developed in the U.S., yet at the expense of U.S. investors and developers.

What to do:

Establish eligibility criteria for crypto assets that can be excluded from being treated as investment contracts under securities laws when distributed as airdrops or incentive-based rewards. (For example, crypto assets that are not otherwise securities and whose market value is, or is expected to be, substantially derived from the programmatic functioning of any distributed ledger or onchain executable software.)

#2 Modify crowdfunding rules

The SEC should revise Regulation Crowdfunding rules so they are suitable for crypto startups. These startups often need a broader distribution of crypto assets to develop critical mass and network effects for their platforms, applications, or protocols.

What to do:

Expand offering limits so the maximum amount that can be raised is on par with crypto ventures’ needs (e.g., up to $75 million or a percentage of the overall network, depending on the depth of disclosures).

Exempt crypto offerings in a manner similar to Regulation D, allowing access to crowdfunding platforms beyond accredited investors.

Protect investors through caps on the amounts any one individual may invest (as Reg A+ currently does); robust disclosure requirements that encompass the material information relevant to the crypto venture (e.g. relating to the underlying blockchain, its governance, and consensus mechanisms); and other safeguards.

These changes would empower early-stage crypto projects to access a wide pool of investors, democratizing access to opportunities while preserving transparency.

#3 Enable broker-dealers to operate in crypto

The current regulatory environment restricts traditional broker-dealers from engaging meaningfully in the crypto industry — primarily because it requires brokers to obtain separate approvals to transact in crypto assets, and imposes even more onerous regulations around broker-dealers who wish to custody crypto assets.

These restrictions create unnecessary barriers to market participation and liquidity. Removing them would enhance market functionality, investor access, and investor protection.

What to do:

Enable registration so broker-dealers can deal in – and custody – crypto assets, both securities and nonsecurities.

Establish oversight mechanisms to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Collaborate with industry authorities like FINRA to issue joint guidance that addresses operational risks tailored to crypto assets.

This approach would promote a safer and more efficient marketplace, enabling broker-dealers to bring their expertise in best execution, compliance, and custody to the broader crypto market.

#4 Provide guidance on custody and settlement

Ambiguity over regulatory treatment and accounting rules has deterred traditional financial institutions from entering the crypto custody market. This means that many investors are not getting the benefit of fiduciary asset management for their investments, and instead are left investing on their own and arranging their own custody alternatives.

What to do:

Clarify guidance on how investment advisers can custody crypto assets under the Investment Advisers Act, ensuring adequate safeguards such as multi-signature wallets and secure offchain storage. Also provide guidance on staking and voting on governance decisions for crypto assets in the custody of investment advisers.

Develop specific guidance on settlement for crypto transactions – including timelines, validation processes, and error resolution mechanisms.

Establish a flexible, technology-neutral framework that can adapt to custody solution innovations, meeting regulatory standards without imposing prescriptive technological mandates.

Rectify accounting treatment by repealing SEC Staff Accounting Bulletin 121 and its handling of balance sheet liabilities for custodied crypto assets. (SAB 121 moves custodied crypto assets onto the custodian’s balance sheet — a practice that is at odds with the traditional accounting treatment of custodied assets.)

This clarity would provide greater institutional confidence, increasing market stability and competition among service providers while improving protections for both retail and institutional crypto investors.

#5 Reform ETP standards

The SEC should adopt reform measures for exchange-traded products (ETPs) that can foster financial innovation. The proposals promote broader market access to investors and fiduciaries used to managing portfolios of ETPs.

What to do:

Revert to the historical market-size test, requiring only that sufficient liquidity and price integrity for the regulated commodity futures market exists to support a spot ETP product. Currently, the SEC’s reliance on the “Winklevoss Test” for surveillance agreements with regulated markets that satisfy arbitrary predictive price discovery has delayed approval of bitcoin and other crypto-based ETPs. This approach overlooks the significant size and transparency of current crypto markets, their regulated futures markets, and creates an arbitrary distinction in the standards applicable to crypto-based ETP listing applications and all other commodity-based listing applications.

Permit crypto ETPs to settle directly in the underlying asset. This will result in better fund tracking, reduce costs, provide greater price transparency, and reduce reliance on riskier derivatives.

Mandate robust custody standards for physically settled transactions to mitigate risks of theft or loss. Additionally, provide for the option of staking idle underlying assets of the ETP.

#6 Implement certification for ATS listings

In a decentralized environment where the issuer of a crypto asset may play no significant continuing role, who bears responsibility for providing accurate disclosures around the asset? There’s a helpful analog from the traditional securities markets here, in the form of Exchange Act Rule 15c2-11, which permits broker-dealers to trade a security when current information for the security is available to investors.

Extending that principle into crypto asset markets, the SEC could permit regulated crypto trading platforms (both exchanges and brokerages) to trade any asset for which the platform can provide investors with accurate, current information. The result would be greater liquidity for such assets across SEC-regulated markets, while simultaneously ensuring that investors are equipped to make informed decisions.

What to do:

Establish a streamlined 15c2-11 certification process for crypto assets listed on alternative trading system (ATS) platforms, providing mandatory disclosures about the assets’ design, purpose, functionality, and risks.

Require exchanges or ATS operators to perform due diligence on crypto assets, including verifying issuer identity as well as important feature and functionality information.

Mandate periodic disclosures to ensure investors receive timely and accurate information. Also, clarify when reporting by an issuer is no longer necessary due to decentralization.

This framework would promote transparency and market integrity while allowing innovation to flourish.

***

By taking the above steps now, the SEC can begin to rotate away from its historic and heavily contested focus on enforcement efforts, and instead add much-needed regulatory guidance. Providing practical solutions for investors, fiduciaries, and financial intermediaries will better balance protecting investors with fostering capital formation and innovation — achieving the SEC’s mission.

A longer version of this post originally appeared on a16zcrypto.com.

CryptoCurrency

Did You Miss Bonk and Dogwifhat's 10,000% Rallies In 2024? This New Altcoin Is Expected To Be Even Bigger In 2025

The cryptocurrency sector had some incredible activity in 2024. With their value soaring by over 10,000% and transforming fortunate early investors into overnight millionaires, Bonk and Dogwifhat stole the show. However, not everyone had the same luck; many were left wondering how they missed the next great thing.

Don’t worry if you’ve been kicking yourself for missing out on those benefits; there is still time to get in on another amazing opportunity. In its presale stage, Remittix, a rising star in the cryptocurrency space, is already creating a stir. With more than $5.2 million raised and forecasts of a 100x increase in 2025, this cryptocurrency might be your second opportunity to succeed.

What Drove Bonk and Dogwifhat to 10,000% Gains?

To understand why Remittix is generating so much excitement, let’s first examine what made Bonk and Dogwifhat so successful:

● Community Power: The enormous support that both coins received from their respective communities increased their market presence and reach.

● Affordability: Due to their modest initial prices, these tokens were available to a wide spectrum of investors.

● Market Timing: As investors sought the next big thing, the 2024 memecoin frenzy helped push these tokens to amazing heights.

● FOMO (Fear of Missing Out): As word got out about their rapid expansion, more people joined, which raised costs even further.

Despite their remarkable success, investors began to doubt the long-term viability of both tokens since they were excessively hyped. At the same time, Remittix started doing crazy numbers and attracting the attention of crypto enthusiasts.

Why Remittix Is the Best Altcoin to Watch in 2025

Remittix isn’t just another crypto riding the hype train. It’s a well-planned enterprise that fills a significant market gap: crypto-to-fiat transactions. Here’s why it’s quickly becoming one of the best altcoins of 2025:

● Addressing Actual Issues: High costs, protracted delays and a lack of transparency are common features of international remittances and cryptocurrency transfers. By enabling users to convert more than 40 cryptocurrencies into cash and transfer money straight to any bank account in the globe, Remittix is revolutionizing the market.

● Fixed Fees and Complete Openness: Remittix charges flat costs, in contrast to many other providers that conceal expenses or manipulate currency rates. This makes it perfect for overseas transactions since the recipient receives precisely what you sent.

● Momentum of Presale: With more than $5.2 million already raised, the Remittix presale is among the most popular on the market at the moment. Early adopters have a rare chance to lock in their position before the price unavoidably rises, since tokens are just $0.0282.

Comparing Remittix to Bonk and Dogwifhat

Even if Bonk and Dogwifhat had amazing gains, their dependence on hype calls into doubt their long-term worth. Remittix, on the other hand, blends innovation, utility and growth potential.

● Utility: Remittix appeals to both individual and institutional investors due to its genuine use case in international payments, unlike memecoins.

● Sustainability: Remittix’s emphasis on finding solutions to real-world issues positions it for long-term success, whereas memecoins tend to fade as the initial excitement subsides.

● Growth Potential: According to analysts, Remittix will grow 100 times, greatly surpassing Bonk and Dogwifhat’s gains.

Remittix is putting itself in a strong position to be one of the best altcoins of 2025 with these benefits. It stands out from the competitors because of its creative strategy for bridging the gap between blockchain and traditional finance.

Now’s The Time To Join Remittix

Although there are many surprises in the cryptocurrency industry, certain projects are more notable than others. Although Bonk and Dogwifhat garnered media attention in 2024, Remittix is positioned to emerge as 2025’s biggest star. It’s a coin worth considering because of its creative ideas, clear costs and enormous development potential.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Chinese traders made millions from TRUMP, Coinbase in Philippines? Asia Express

Top Chinese crypto traders earn millions on TRUMP, Coinbase may expand to Philippines, what on Earth is Bimcoin? Asia Express.

CryptoCurrency

Coinbase Rolled Out the Newest State of Crypto Report

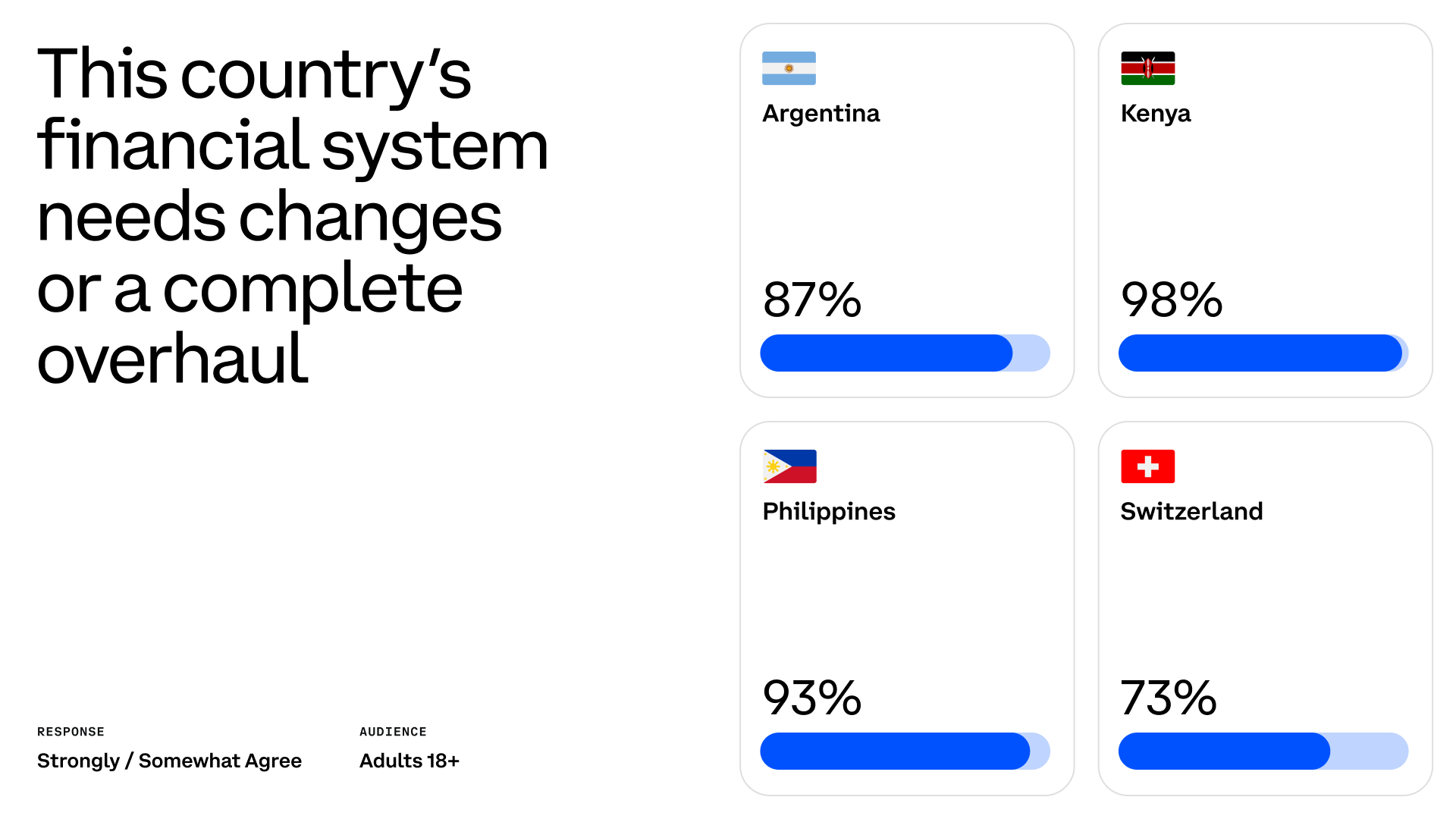

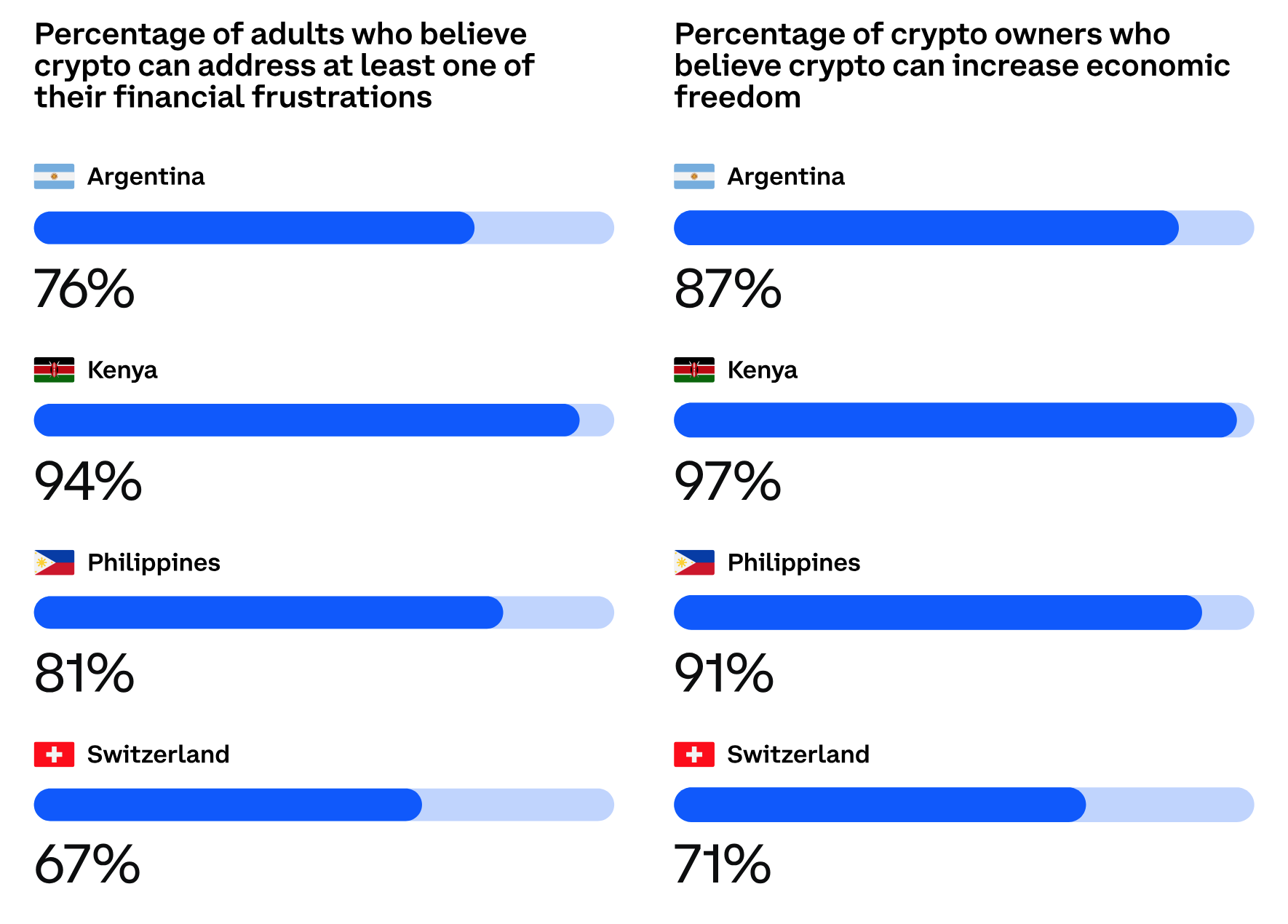

Coinbase rolled out the newest State of Crypto report. The study was conducted by Ipsos. It observes how crypto and blockchain technology are viewed in Argentina, Kenya, the Philippines, and Switzerland and how it impacts the lives of people in these countries.

For most of the part, the study is based on surveys with 4,000 adults (not specifying the age rates) in Argentina, Kenya, the Philippines, and Switzerland conducted on behalf of Coinbase. The choice of countries aims to give an outlook of societies living in markedly different socioeconomic conditions in different parts of the world (none of these countries belong to the same continent, with the Philippines being an archipelago-based country).

The similarities between these countries are the mostly Christian populations and the government systems revolving around the republic model. Nevertheless, the countries have strikingly different areas, positions on the map, historical experiences, cultures, languages, climates, economic states, etc.

Coinbase, however, outlines another similarity between Argentina, Kenya, the Philippines, and Switzerland: according to the exchange team, the residents of these countries feel that the local financial systems need to be improved. More than that, generally, the polled residents see cryptocurrencies and blockchain as tools that may enhance their lives in terms of financial wealth and overall give more freedom and independence.

The state of economy in these countries

The report starts with the statistics demonstrating that in each country, less than a half of all respondents believe that the current financial direction in their country will make them live better than the previous generation. However, even fewer people believe that they will live worse than their parents in Argentina and the Philippines.

So it’s fair to say that in Kenya and Switzerland, people don’t approve of the current financial politics in contrast to the past years, while Argentina and the Philippines rather dislike both the current and the previous efforts, believing that nowadays things are a bit better than before. Respondents in all these countries agree that the local financial system should be changed or overhauled completely. They refer to the financial systems of their countries as “slow,” “expensive,” and “unstable.” They also cited a lack of innovation as one of the problems.

The study reveals four main concerns of the respondents named in the surveys: lack of fairness (discrimination), centralization, decreasing value of the national currency, and too much hard work to earn enough or save money.

The distribution of concerns varies from country to country, with Kenya and the Philippines being most critical towards centralization, discrimination, and wage slavery. Switzerland is least concerned about many of these issues while being cautious towards the government’s dependency on banks. Argentinians have the biggest trust issues with their financial institutions and a problem with saving money.

Crypto as a remedy

Most people polled by Ipsos for the study want to be in charge of their financial state and gain more freedom and control over their money. 7 in 10 respondents see cryptocurrency and blockchain as the way to achieve these goals. More than that, both crypto owners and those who don’t have crypto agree that digital currencies can help them gain more freedom and control over their wealth.

Switzerlanders are markedly less interested in crypto than respondents from other countries. However, over 70% of crypto owners in Switzerland believe that crypto offers them more control and freedom. Less than half of the surveyed Switzerlanders with no crypto believe that they need it.

Wider blockchain adoption is also viewed as a favorable factor that may improve the local financial systems and individual wealth. Most respondents believe that blockchain promotes innovation and facilitates control over individual finances. Respondents hope that blockchain will make the system faster and more accessible.

In all polls, Switzerland is presented with lower numbers. It reflects the lower expectations associated with Bitcoin and blockchain and the lower level of dissatisfaction with the financial status quo.

Looking into this study, you may notice a strong connection between the level of satisfaction with the country’s financial direction and the level of support for cryptocurrencies and blockchain. The residents of Switzerland and Argentina are less concerned with the current financial state of their countries, and they are less into crypto than Kenya and the Philippines. Probably, that’s one of the reasons why not only Kenya but Africa in general, where the population has little to no access to banking services but has smartphones, are usually seen as the driver of the mass adoption of cryptocurrency and blockchain-based solutions as the substitute of traditional banks.

CryptoCurrency

Harry Jung Appointed to Guide CFTC’s Crypto and Digital Asset Strategy

In a leadership shakeup at the Commodity Futures Trading Commission (CFTC), Acting Chair Caroline Pham appointed Harry Jung as Acting Chief of Staff on Wednesday.

Jung, who previously served as Pham’s Counselor and Senior Policy Advisor, will lead the agency’s crypto and digital assets engagement and will build on his experience at Citigroup and prior regulatory roles.

CFTC’s Crypto Engagement

The appointment comes as part of broader leadership changes shortly after Pham’s interim appointment by President Donald Trump.

Pham has been involved in several digital asset initiatives at the CFTC, including the creation of a Digital Asset Markets subcommittee. In 2023, she proposed the establishment of a regulatory sandbox to develop a framework for emerging technologies and outlined plans for a digital asset pilot program.

The Trump administration has not yet named a permanent replacement for Rostin Behnam, who will leave the CFTC on February 7th. Former CFTC Commissioner Brian Quintenz is reportedly a top contender for the position.

Throughout his four years at the CFTC, Behnam strongly advocated for the agency to lead the regulation of Bitcoin and other digital currencies. He emphasized the importance of robust oversight as the digital asset market grew rapidly. Under his leadership, the CFTC took major enforcement measures, such as reaching a $2.7 billion settlement with Binance.

In its final push, the agency subpoenaed crypto exchange, Coinbase for customer information tied to Polymarket, a prediction market platform accused of regulatory violations. This last-ditch effort just before the Trump takeover came amidst allegations of market manipulation and gambling law breaches at Polymarket.

SEC, FDIC Shuffle

Besides Pham for CFTC, Mark Uyeda was appointed as the acting chair of the US Securities and Exchange Commission (SEC) by President Donald Trump, replacing Gary Gensler. A vocal critic of Gensler’s crypto policies, Uyeda will serve in this role until the Senate confirms a permanent successor. The American attorney has a history of advocating for a more lenient regulatory approach to crypto, particularly against enforcement actions targeting non-fraudulent crypto firms. Paul Atkins, a pro-crypto figure, is Trump’s nominee for permanent SEC chair.

At the Federal Deposit Insurance Corporation (FDIC), on the other hand, Travis Hill has been named temporary chair following Marty Gruenberg’s resignation. The FDIC has faced criticism, including allegations from Senator Cynthia Lummis, over its handling of digital asset records tied to “Operation Choke Point 2.0.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login