Cryptocurrency trading has consistently been a high-risk strategy. With a market characterized by volatility and rapid price fluctuations, thorough preparation is essential before getting involved. A reliable method for gaining market insight is by studying past crypto trends. But how do you go about it, and why is it crucial?

Here, you will get all the answers. We’ll discuss the benefits and challenges of analyzing old crypto prices. Also, you will learn some tools and techniques and how the PlasBit History Calculator widget helps. So, let’s get into the details!

What are Crypto Trends?

In simple terms, a crypto trend is a consolidated price movement in a specified direction. Generally, a trend can move in 3 directions:

- Upwards (Uptrend): When the price of a cryptocurrency consistently surges.

- Downwards (Downtrend): When the price of a cryptocurrency consistently falls.

- Sideways (Consolidation): When the price moves back and forth between 2 fixed levels.

The duration of a crypto trend can vary from hours to days and months. Regardless of how long a trend lasts, traders can always benefit from every trend by analyzing past trend data.

Why Analyzing Previous Trends is Important?

Analyzing previous trends is crucial because it is a key skill that leads a person to become a profitable trader. Without the knowledge of previous trends, a trader’s toolkit is incomplete. A person can never trade confidently without the proper knowledge of previous trends. They will always be anxious about their decisions and get stuck in analysis paralysis.

Benefits of Understanding Previous Crypto Trends

Analyzing previous crypto trends has numerous benefits for a trader, and a few of them are listed below:

- A trader can quickly form a probability bias for the future by looking at the historical data and how the market reacted to something similar that happened in the past.

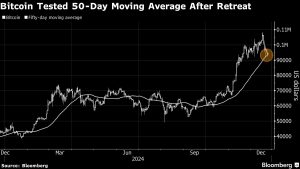

- One of the best examples of this is the Bitcoin halving cycle. After analyzing the data of all the previous Bitcoin halvings, we can almost certainly say that after the halving of 2024, the price will surge to a new all-time high (not financial advice).

- Previous data can also help you identify the effect of external factors on the market trend.

- When FTX collapsed, Bitcoin dumped by almost 28% in a few Similarly, if Binance collapses, we can be ready for an identical or even worse scenario.

- Previous trends are also helpful in estimating the duration of the current trend and can prepare you for a reversal.

- They are also vital in estimating the percentage by which the market will rise or fall after the reversal.

To sum up, understanding previous crypto trends gives traders peace of mind and confidence in their ability by giving them the power to be prepared for the future.

What Will Happen if You Jump Into Crypto Trading Without Preparation?

If you jump into trading without preparation, it’s similar to jumping on a train with no destination. You will find yourself lost without any idea of what you are doing. You will buy at the wrong prices, overtrade, over risk, and eventually lose all your money.

Financial markets, especially the crypto market, are extremely volatile. Statistically, 95% of traders fail, and there is a reason for that. Without the right mindset, strategies, and tools, it’s impossible to become successful in trading.

The barrier to entry in trading is so low that people expect to become profitable without putting in the hard work. So, it’s advisable for anyone considering trading to train themselves before stepping on the field.

Utilizing Tools & Strategies

The utilization of different tools and strategies is vital in trading as they help you become better in a short period.

As far as tools are concerned, there are plenty of tools like the profit calculator, the funding rate indicator, the mining calculator, and the fear and greed index. Tools like these help you build confidence around your analysis and make you mentally prepared for what’s to come.

Moving on, you can find plenty of profitable strategies online, and the best one works for you. To check if a strategy is suitable, you need to backtest it extensively to determine how it aligns with your style.

Here you can find more information about the most important crypto trading indicators.

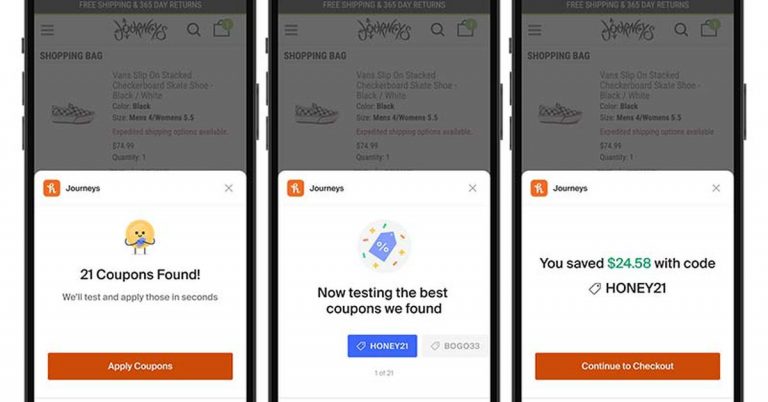

Taking Advantage of the Crypto History Calculator

A Crypto history calculator is also one of the tools that can help you make an informed decision while trading. It tells you about the price of every cryptocurrency on a specific date and time from the past. This way, you can compare the price of your favorite assets and get an idea of their long-term performance.

One fantastic Crypto History Calculator is in the Plasbit Widgets section. The widget is exceptionally efficient and has kept a record of many cryptocurrencies’ previous prices. You can instantly obtain trends of crypto coins like Bitcoin, Ethereum, Cardano, Dogecoins, Polygon, Cosmos, and others. Our widget allows you to select the date and even time and deliver you the exact price of that time.

On the PlasBit Widgets page, click on the History Calculator in the last, and you are set to go. You can also explore our different widgets and tools. You can also discover our different products, such as their secure crypto wallet, wire transfer facility, and Crypto Cards.

+ There are no comments

Add yours