CryptoCurrency

How to Buy a House With Crypto?

Purchasing a house with cryptocurrency is increasingly popular, simplifying the path to owning your dream home! This article will guide you through the remarkable advantages, possible challenges, and necessary steps of buying a house with crypto.

From understanding what factors to consider before taking the plunge to explore examples of successful crypto real estate transactions, this guide has got you covered.

Benefits of buying a house with cryptocurrency

Diversify investment portfolio

Purchasing tangible assets like real estate with digital assets like cryptocurrencies can help you diversify your investment portfolio and reduce the overall risk you are taking. This allows you to access a wider range of markets, while also acquiring a new asset class with great potential to bring higher returns on investment.

A great way to cash out on crypto

If you are tired of digital assets and want to make more tangible purchases, investing in real estate is a smart way to cash out on crypto.

There are some fintech companies like BlockFi and UnchainedCapital that offer crypto-backed loans which can be used as a down payment for a house. This may sound like an intriguing option to you, especially if you have more dispensable crypto than fiat currency at the moment and would like to use some or all of it to buy real estate.

Of course, you always have the option to convert your cryptocurrency straight to cash and purchase a home. The alternative is to find a seller who accepts cryptocurrency directly and avoids the exchanging hassle.

Faster transactions with blockchain technology

Blockchain technology enables faster transactions than traditional payment methods, making it an attractive option for buyers and sellers. Transactions occur almost instantly with blockchain since the process is automated. This allows buyers to complete a purchase quickly, which can be beneficial when buying a house.

Elimination of third-party intermediaries

When it comes to buying a house with crypto, one of the biggest advantages is the elimination of third-party intermediaries. This means that you can avoid paying unnecessary fees and commissions to brokers, banks, and other financial institutions. With crypto, you can buy and sell directly from seller to buyer without any middleman involved.

Enhanced security and privacy

Using crypto to purchase a home can provide enhanced security and privacy compared to traditional methods. Transactions are securely stored on the blockchain, eliminating the need for third-party intermediaries. The blockchain is an immutable, distributed ledger system that records all cryptocurrency transactions, making it difficult for anyone to alter or tamper with them.

Information regarding the buyer and seller remains private throughout the entire process. Only their public keys are visible in the blockchain, ensuring that no one else has access to personal information or financial data during the transaction.

When using crypto for a real estate transaction, there is no need to worry about fraud. Paper-based documents and cash payments are not necessary, as all funds are transferred directly from buyer to seller. This eliminates the risk of counterfeiting and provides a more secure experience.

Fast and cheap international transactions

With cryptocurrency, you can make real estate transactions globally without the need for currency conversion. This means that no matter where you’re buying a house from in the world, you can use crypto to complete the transaction seamlessly.

Cryptocurrencies also have a much lower cost of transfer than other forms of payment, which makes them much more efficient than traditional methods.

Factors to consider before buying a house with crypto

Buying a house with cryptocurrency comes with its own set of considerations and factors that you should take into account before making the purchase.

Be sure to research these topics thoroughly to ensure you make an informed decision when it comes time to buy a home with cryptocurrency.

The volatility of the cryptocurrency market

Cryptocurrency prices can fluctuate wildly in a single day, and their value is often unpredictable.

Both the buyer and the seller share almost the same level of risk if the value of the cryptocurrency explodes the next day, you effectively cash out on a lower level of value, while if it crashes down to oblivion, you may consider yourself lucky and have made the deal of your life.

Legal and regulatory considerations

Depending on where you live, regulations may require that certain taxes be paid or that certain documents be filed. It’s best to check with your local government to make sure all applicable laws are being followed when purchasing a home using cryptocurrency.

Tax implications

When purchasing a home with cryptocurrency, it’s important to be aware of the tax implications involved. The IRS typically classifies cryptocurrency as property, so when used to buy a house, the sale is treated as if you sold an asset for cash. As such, you may owe capital gains taxes on any profits made from the sale.

Additionally:

- When you first purchase crypto for the purpose of buying a house, any increase in value is taxable when converted back to fiat currency.

- If you hold onto your crypto and use it to buy a house later on, any gains between acquisition and disposal will be subject to capital gains tax.

- Depending on how long you held onto your crypto before exchanging it for a house, long-term capital gain rates would apply.

- If you receive payments in crypto for renting out or selling your property, these payments are considered income and should be reported accordingly.

It’s important to understand how different types of transactions can affect your taxes before entering into any agreements related to buying or selling property with cryptocurrency.

Importance of due diligence

You need to be sure to conduct thorough due diligence when considering a cryptocurrency-related property purchase. It’s important to research the seller and their history, as well as any information available about the property you’re looking at buying.

Be sure to ask questions about the title of the property, any liens or encumbrances, and whether there are any outstanding debts associated with it. Additionally, you should verify that all documents related to your purchase are in order before making an offer on the house.

Make sure you also have access to professional help for guidance throughout the process – an experienced real estate lawyer can go a long way in helping ensure a successful transaction.

Lastly, be aware of any local laws or regulations that may affect the ownership of cryptocurrency-related properties. Taking these steps will give you peace of mind knowing that your investment is safe and secure.

Options for Buying a House with Crypto

Using crypto as collateral for real estate is one way, allowing you to transfer your crypto directly to the seller.

Another option is buying a house with an NFT – this has become increasingly popular in recent years.

You can also cash out your crypto and use those funds towards purchasing a property or use an intermediary service that allows you to buy a house with cryptocurrency or fiat currency.

Using Crypto as Collateral for Real Estate

Using crypto as collateral for real estate can be a great way to purchase a home without using traditional currency. This method allows you to use cryptocurrency as security for the loan, and then use the funds from the loan to purchase your home.

Here are some advantages of this approach:

- You don’t need cash or credit to buy a house

- You benefit from potential upside in your crypto investment

- Loan terms are flexible

- Interest rates may be lower than with fiat-based loans

- Your cryptocurrency is insured against volatility.

Plus, many lenders now offer digital asset mortgage programs specifically designed for purchasing real estate with cryptocurrency. With this option, you might even get better interest rates and other benefits compared to more traditional financing options.

Transfer crypto directly to the seller

Transferring crypto directly to the seller of a property is an option that can provide a secure way to purchase real estate without involving traditional financing. This method of payment is fast, secure, and offers buyers the ability to buy with anonymity if they so choose. It also eliminates worry about having money tied up in escrow for long periods of time.

However, buyers must make sure they are dealing with reputable sellers and use due diligence when making an offer. Additionally, buyers should be aware that they may need to pay extra fees for using cryptocurrency as payment instead of cash or other forms of currency. There are also tax implications associated with this type of transaction which must be taken into consideration when buying a home using crypto.

Ultimately, it’s important to remember that transferring crypto is just one option available when purchasing real estate, and there may be more suitable alternatives depending on individual needs and preferences.

Buying a House with NFTs

Non-fungible tokens (NFTs) are digital assets with unique identifiers stored on the blockchain that represent real-world objects or abstract concepts. They have become popular in recent years, especially within the world of art and collectibles.

In terms of buying a house, NFTs can be used to store information about a property and transfer ownership from one person to another without needing third party intermediaries. This makes it easier, faster, and more secure for buyers to purchase a house without worrying about fraudulent activity or theft.

Additionally, since the transaction is recorded on the blockchain, it allows both parties involved to view all information related to the sale, which can help prevent any disagreements in the future.

Cashing Out Crypto for Buying a House

You can simply exchange your digital assets for a fiat currency at an exchange and proceed with the purchase of a new home. We at Coinlabz recommend doing your own research when selecting the best exchange, as they can differ in exchange rates, exchange fees, and some not-so-transparent terms and conditions, which may increase the overall cost of the transaction.

Use an intermediary to buy a house with cryptocurrency

Using an intermediary to purchase property with cryptocurrency can be a great way to ensure secure transactions and maximize savings.

By using a broker or real estate agent, you benefit from their experience in the field while taking advantage of the security that cryptocurrencies offer.

The intermediary will convert your crypto into cash, which is then used to buy the property. They will also be able to advice on the best ways to exchange currency without incurring heavy fees or losses due to price fluctuations.

Furthermore, they may even help you find properties that are willing to accept cryptocurrency payments directly, so you don’t have to go through the hassle of cashing out altogether.

Ultimately, having an intermediary involved in your transaction ensures maximum efficiency and peace of mind when making large-scale purchases with cryptocurrency.

Real Estate Companies that accept Crypto

Crypto Real Estate

Crypto Real Estate is a real estate company that specializes in helping customers purchase properties with cryptocurrency. They offer a wide range of real estate types, such as houses, apartments, cabins or even just land. Customers can easily search for a property using the filters provided, such as location, property type, price, size, and additional features. The process of buying a property is simple and straightforward, including legal consulting and a terms & contract agreement. Crypto Real Estate ensures the safety of customers by providing transparent transactions, an experienced legal team, and an AML and KYC process.

Crypto Real Estate operates pretty much all around the globe, including countries such as Spain, Italy, Thailand, Bali, USA, Canada, Mexico and many others.

BitPay

BitPay is a leading cryptocurrency payment service provider which offers a directory of real estate companies that accept Bitcoin and other cryptocurrencies as payment.

They facilitate crypto real estate transactions on behalf of the buyers and sellers. If you are a seller and you don’t want to receive cryptocurrency directly, BitPay can convert the crypto into dollars to complete the purchase. The seller can generate an email invoice, which the buyer receives and pays from their crypto wallet. BitPay then transfers the funds to the seller via direct deposit.

In addition to private sellers, there are several real estate groups like Magnum Real Estate, Pacaso, and Condos.com, who have partnered with BitPay for property purchases.

You can use your Bitcoin or Ethereum for real estate payments on the BitPay platform. They also accept Bitcoin Cash, Dogecoin, Shiba Inu Coin, Litecoin, XRP, Dai, Binance USD, USD Coin, Wrapped Bitcoin, Pax Dollar, and Gemini Dollar.

Magnum Real Estate Group

Magnum Real Estate Group is a real estate company based in New York that notably accepts Bitcoin as payment for its properties. Part of their $4 billion portfolio are historic buildings, new developments, and commercial properties. Their acquisition strategies have increased their portfolio to more than 100 New York properties.

One of their most popular assets is on 196 Orchard Street on the Lower East Side, which features 94 luxury condos and ground-floor retail space.

The company’s commitment to accessibility has resulted in a website that is straightforward to navigate.

Redfin

Redfin is a real estate brokerage that was founded in 2004 that accepts cryptocurrencies as payment. They are also the largest brokerage website in the US, with more than 1 million potential buyers and sellers visiting their site and app on a daily basis.

One of the reasons for their success is that Redfin agents are in the top 1% of real estate agents working nationwide, which assists their clients in making the best possible deals on the current market.

Coinlabz suggests using the safest option, and you can’t go much wrong with Redfin as they are a well-established real estate brokerage with experienced agents and an enormous online presence.

BitcoinWide

The idea of BitcoinWide came to life in Thailand when the company founder wanted to buy a ticket to Singapore using digital currencies.

BitcoinWide is a directory of businesses that accept cryptocurrencies as payment, including real estate companies. Currently, more than 80 real estate companies are listed as accepting Bitcoin and other digital currencies on their platform. As the adoption of cryptocurrencies in real estate is gradually rising and more widespread, expect BitcoinWide to add more real estate companies to their list.

On BitcoinWide, you can list your services for free, create a verified listing for a $9 monthly fee or use the premium listing option for businesses for $20 per month.

Challenges of Buying Real Estate with Cryptocurrency

Buying real estate with cryptocurrency can present some challenges.

Firstly, the acceptance of crypto is still not widespread in the real estate market, so it’s important to be aware of potential fraud or scams.

Additionally, financing a property purchase with cryptocurrency may be difficult, and you may find yourself without many options in case of disputes.

Lastly, it’s also important to consider the uncertain future of cryptocurrency regulations when making any decisions regarding its use for real estate purchases.

Lack of widespread acceptance in the real estate market

Although real estate brokers and agents are beginning to explore the option of accepting crypto payments, there is still a lack of widespread acceptance in the real estate market. Many take a traditional view on transactions and are hesitant to accept cryptocurrency as payment for real estate. This can put potential buyers in a difficult situation, as they must either find an agent or broker who will accept crypto or convert their cryptocurrency into fiat currency in order to make their purchase.

With this option, buyers must also pay fees associated with conversion rates. It’s clear that the real estate industry has not yet fully embraced cryptocurrencies, and until it does, buying a house with crypto may be more challenging than expected.

Potential for fraud and scams

When considering cryptocurrency payments for real estate, it’s important to be aware of the potential for fraud and scams. To help protect yourself, you should:

- Educate yourself on the basics of cryptocurrency transactions

- Understand how blockchain works

- Learn about crypto wallets and security protocols

- Research the seller thoroughly

- Check their credentials with friends or advisors in the industry

- Verify references online and investigate any red flags

- Process payments through an escrow service

- Compare fees from multiple services before selecting one

- Read all terms & conditions carefully before signing any documents

Difficulty in obtaining financing with cryptocurrency

Getting financing for a real estate purchase with cryptocurrency can be difficult. Cryptocurrency is still relatively new and not widely accepted, so finding lenders that will provide financing for it can be tricky.

Some lenders may require additional documentation to demonstrate the source of funds, or they may not accept cryptocurrencies as a form of payment at all. Furthermore, the volatile nature of cryptocurrency means that its value can change rapidly which makes it an unattractive investment for many traditional lenders.

As such, buyers should investigate any potential lender thoroughly before committing to a loan agreement and ensure that they have the resources to pay off the loan in full if necessary.

Limited recourse in case of disputes

If you’re considering purchasing real estate with cryptocurrency, it’s important to be aware that there are limited options for recourse in case of a dispute. When dealing with cryptocurrency-based transactions, there is no centralized authority to help resolve disputes and no protections offered by government or international law. This means that buyers must take extra precautions when entering into an agreement.

Uncertain future of cryptocurrency regulations

Due to the ever-changing regulatory landscape surrounding cryptocurrencies, buyers must be aware of the potential risks and uncertainties associated with these types of transactions.

Cryptocurrency is a new and emerging asset class that has yet to gain widespread acceptance or adoption. Governments around the world are just beginning to grapple with how best to regulate digital currencies, and this could lead to changes in laws that may impact buyers who use cryptocurrency for purchasing real estate.

Furthermore, there may be additional taxes or fees imposed by governments on using cryptocurrencies for purchases, which could add costs and complexity to the transaction process. In addition, most banks do not accept cryptocurrency as a form of payment so it can be difficult for buyers to complete their purchase without taking on significant risk.

It’s essential for potential homebuyers using crypto assets to carry out thorough research before committing funds in order to ensure they understand all applicable regulations and any future changes that could affect their investment.

Examples of Successful Real Estate Transactions with Cryptocurrency

San Francisco

In 2017, the first-ever real estate transaction on the blockchain was completed. It allowed a Ukrainian investor to purchase a property in San Francisco using Bitcoin. The transaction was recorded on the blockchain, which made it tamper-proof and transparent while reducing the risks of fraud and errors and making the transaction process incredibly efficient.

Miami

In a deal in 2020, a penthouse in Miami was sold for the staggering amount of $22.5 million, which was all paid in Bitcoin.

Manhattan

There is one popular case where the owner of a luxury apartment in Manhattan’s upper Eastside wanted only Bitcoin as payment. The price of the apartment was $29 million when it reached the market and was offered by the Magnum Real Estate Group.

Austin

In 2022, a mansion located in Austin, Texas, was sold for $18.5 million in cryptocurrency by Scooter Braun, who is better known as the manager of the stars. Some of his clients are Ariana Grande, J Balvin, Justin Bieber, and many more. Who is the buyer? It was Wayne Vaughan, who is the CEO of Tierion, which is a company focused on using blockchain to verify data or business processes on an international scale.

Conclusion

Buying a house with cryptocurrency can be a great way to invest in real estate. It’s important to consider all the factors involved. While it may take some time and effort, you’ll reap the rewards if done correctly. As the old adage goes, ‘A house is an investment that will pay dividends for years to come.’

With careful planning and research, buying a home with crypto can be a smart option.

CryptoCurrency

Elizabeth Warren proposes Elon Musk pay more taxes for gov’t efficiency

Senator Elizabeth Warren urged DOGE Chair Elon Musk to cut wasteful spending, proposing full IRS funding and closing the carried interest loophole.

CryptoCurrency

Made in USA altcoins like XRP and Solana poised for growth under Trump’s shadow

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Donald Trump’s return ignites a crypto bull run, with meme coin XYZ set for a 99,900% surge, surpassing past performers.

Trump’s inauguration sparks crypto surge: XYZ meme coin set for 99,900% growth

Donald Trump’s return to the political spotlight has sent shockwaves through the crypto market, paving the way for an unprecedented bull run. While established coins scrape by with modest gains, meme coins are stealing the limelight with jaw-dropping potential.

Recent performers like PNUT with its 4,500% climb and FRED’s 6,000% explosion have faded into memory, unable to sustain their momentum. But the crypto world thrives on evolution, and a new contender has entered the arena, ready to redefine profit potential. Meet XYZ, the meme coin phenomenon set to obliterate records with a meteoric 99,900% surge.

XYZ: The new king of meme coins

XYZ isn’t just another meme coin — it’s a game-changer for sports and crypto enthusiasts. Built for true competitors, XYZ is the ultimate token for those who live for the thrill of winning.

As Trump reshapes the market dynamics, XYZ steps into the ring as the coin for fearless investors. With its sports-driven identity and relentless growth, XYZ is here to dominate, leaving weaker tokens in the dust.

Presale gains signal monumental potential

The XYZ presale is already a roaring success:

- Launch Price: $0.0001

- Current Price: $0.002 (+2,000% increase)

- Next Stage: $0.0025 (+25%)

- Final Goal: $0.1

With a planned 99,900% growth trajectory, XYZ is destined to become the crown jewel of meme coins.

Why XYZ is different

Fueled by the competitive spirit of sports and a commitment to game-changing gains, XYZ offers investors a chance to ride the next crypto tidal wave. The token embodies strength, ambition, and the pursuit of excellence, making it the ideal asset for bold traders who thrive on action.

Don’t miss out

The XYZ presale is moving fast, with early adopters already seeing exponential returns. Secure your position now and be part of the next crypto success story.

XRP

Over the past six months, XRP has surged by 425.54%. In the last month alone, it grew by 43.19%, and this past week, it climbed another 18.19%. These impressive gains have placed XRP in a current price range between $2.39 and $3.46.

The consistent upward trend suggests that XRP’s price may continue to rise. The simple moving averages over 10 and 100 days are closely aligned at around $3.17 and $3.16, indicating a stable growth pattern. The Relative Strength Index is at 47.93, which is near neutral, suggesting there’s room for further upward movement before reaching overbought levels.

Looking ahead, the nearest resistance level is at $3.97. Breaking through this could see XRP aiming for the second resistance level at $5.03, potentially yielding an increase of about 45%. On the downside, the nearest support level is at $1.83. If the price dips to this point, it would represent a decrease of roughly 23%. Traders will be watching these levels closely as XRP continues its dynamic performance.

Solana

Solana (SOL) has seen impressive gains recently. In the past week, its price jumped by 35.68%. Over the last month, it increased by 41.10%, and in the past six months, it grew by 48.00%. This consistent upward trend shows strong interest from investors.

Currently, SOL is trading between $182.53 and $308.44. The nearest resistance level is at $364.82. If the price moves above this point, it could aim for the next resistance at $490. The nearest support level is at $113. If the price drops below this, it might see further declines.

Technical indicators suggest potential for growth. The 10-day simple moving average is $254.24, slightly higher than the 100-day average of $252.18. This indicates short-term bullish momentum. The Relative Strength Index (RSI) is at 56.03, suggesting the price is in a stable zone. The MACD level is positive at 2.935, supporting a possible upward movement. Based on this data, Solana’s price may continue to rise, possibly breaking through current resistance levels.

Cardano

Cardano’s ADA token has been on a notable journey lately. In the past week, its price dipped by a modest 1.50%, settling within a range of $0.86 to $1.15. Zooming out, the picture brightens: over the past month, ADA’s price has climbed by 11.45%, and over the last six months, it has surged an impressive 148.86%. This growth reflects a strong upward trend in the medium term.

Technical indicators paint an interesting scenario. The Relative Strength Index (RSI) sits at 40.23, inching toward the oversold threshold, which could suggest an upcoming bullish reversal. The Simple Moving Averages over 10 and 100 days are close, at $1.00 and $1.04 respectively, indicating that the current price is hovering around these averages. Additionally, the Stochastic oscillator is low at 11.70, and the MACD level is slightly negative at -0.00345, both hinting at potential upward momentum if buying interest increases.

Looking ahead, the nearest resistance level for ADA is at $1.30. Breaking through this point could open the path toward the second resistance at $1.59, representing possible gains of around 13% to 38% from current prices. On the flip side, the first support level is at $0.72, with a deeper support at $0.43. Investors are watching these levels closely, as holding above support may sustain confidence, while surpassing resistance could signal further growth. The coming weeks will reveal whether ADA can capitalize on this setup amid the dynamic crypto market.

Chainlink

Chainlink (LINK) has been on a noteworthy upward trajectory recently. In the past week, its price surged by 25.67%, while over the last month, it climbed 15.99%. Even more impressively, LINK’s price has nearly doubled in the past six months with a 97.88% increase. This consistent growth suggests a strong market interest and potential for continued expansion.

Currently trading between $19.23 and $28.02, LINK is approaching its nearest resistance level at $31.74. If it breaks through this point, the next target could be the second resistance level at $40.52, marking a significant gain from current prices. On the downside, the nearest support level is at $14.16, providing a cushion against potential price drops.

Technical indicators provide additional insight. The Relative Strength Index (RSI) stands at 45.24, indicating that LINK is neither overbought nor oversold. The 10-day Simple Moving Average (SMA) is $26.28, slightly above the 100-day SMA of $24.90, suggesting a modest short-term upward trend. The MACD level is positive at 0.1368, hinting at bullish momentum. However, the Stochastic value is low at 6.5768, which could imply that the coin is oversold and may be poised for a rebound. Considering these factors, LINK’s price may continue to rise, but traders should watch the resistance and support levels closely.

Conclusion

Altcoins like XRP, SOL, ADA, and LINK show promise, but XYZVerse stands out as a pioneering sports meme coin with massive growth potential and a unique, community-driven ecosystem.

To learn more about XYZVerse, visit their website, Telegram, or X.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Frax Finance Targets ‘Made in USA’ DeFi Ecosystem with Investment in Trump-Affiliated WLFI

Frax Finance has proposed a $5 million investment in WLFI – the native token of World Liberty Financial (WLFI), a decentralized finance (DeFi) platform tied to US President Donald Trump. The main objective behind this move is to position itself as a leading player in the “Made in USA” DeFi ecosystem.

The proposal, which was presented for community feedback, also includes an additional $5 million follow-on investment subject to the partnership’s success. This makes a potential total commitment of $10 million.

Fuels Frax Finance’s Bet on WLFI

Frax Finance claims that World Liberty Financial (WLFI), which is built on Aave, is well-positioned to benefit from the Trump administration’s pro-crypto stance. WLFI is described as a key project aimed at introducing millions of Americans to DeFi, focusing on US-based initiatives and partnerships with companies like Chainlink and Ethena Labs. With $70 million invested in prominent DeFi assets such as Ethereum (ETH), Wrapped Bitcoin (WBTC), and Chainlink (LINK), WLFI has established a notable presence in the sector in a very short duration.

In addition to Frax Finance’s strategic alignment with WLFI to strengthen its status as a premier US-origin stablecoin, the decentralized stablecoin protocol is also co-founded by Stephen Moore, who happens to be a former economic advisor to President Trump.

By integrating FRAX’s frxUSD stablecoin as collateral within WLFI’s platform, Frax said that the focus is also on expanding its distribution, gaining access to millions of potential users, as well as influencing key governance decisions within the WLFI framework.

With WLFI’s valuation already surging from $1.5 billion to $5 billion, the investment offers potential for significant appreciation, particularly if WLFI succeeds in its mission to drive mass DeFi adoption under the Trump administration’s pro-crypto stance.

Justin Sun Deepens Ties with WLFI

Trump unveiled World Liberty Financial in September last year to simplify access to financial services by removing intermediaries. Despite a rocky start, the project’s cumulative sales soared to $300 million by January 23, according to data compiled by Dune Analytics.

This week, Tron founder Justin Sun announced increasing TRON DAO’s stake with an additional $45 million investment, bringing the total to $75 million. Previously, Sun made a $30 million token purchase in November last year which made him the biggest stakeholder in the platform. WLFI later confirmed his appointment as an adviser the next day.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bitcoin Price Likely To Fluctuate Between $100,000 And $110,000 Until FOMC Meeting, Says Analyst

After a flash crash to $89,256 earlier this month, Bitcoin (BTC) made a swift recovery, reaching a new all-time high (ATH) of $108,786 on January 20. However, according to a crypto analyst, further upside could be limited until the Federal Open Market Committee (FOMC) meeting later this month.

Bitcoin To Remain Range-Bound Until FOMC Meeting

The world’s largest cryptocurrency has been on a bullish trajectory since November, fueled by Donald Trump’s victory in the US presidential election. Over the past three months, BTC has surged from approximately $67,000 to $104,536 at the time of writing, posting gains of over 50%.

Related Reading

However, crypto analyst Krillin predicts that BTC may continue to “chop” in the $100,000 to $110,000 range until the FOMC meeting. The analyst suggests that unless the Bank of Japan takes extraordinary policy measures, BTC is unlikely to break out of this range before the end of the month.

At present, the CME FedWatch tool indicates a 99.5% probability that the US Federal Reserve (Fed) will not cut interest rates at the upcoming meeting. Krillin expects a market dump to follow the anticipated hawkish meeting, which may be partially offset by a dovish-sounding press conference hinting at future quantitative easing (QE).

For the uninitiated, QE is a monetary policy where central banks inject money into the economy by purchasing government bonds and other financial assets to lower interest rates and stimulate economic activity. This increased money supply can weaken fiat currencies, potentially driving investors toward assets like BTC, boosting its price as a hedge against inflation and currency devaluation.

Krillin’s prediction aligns with a recent market observation which states that BTC profit-taking has declined by 93% from its December peak, and that the long-term holders are back in accumulation mode, preparing for the next leg up. However, how long the current consolidation phase may last is anyone’s guess.

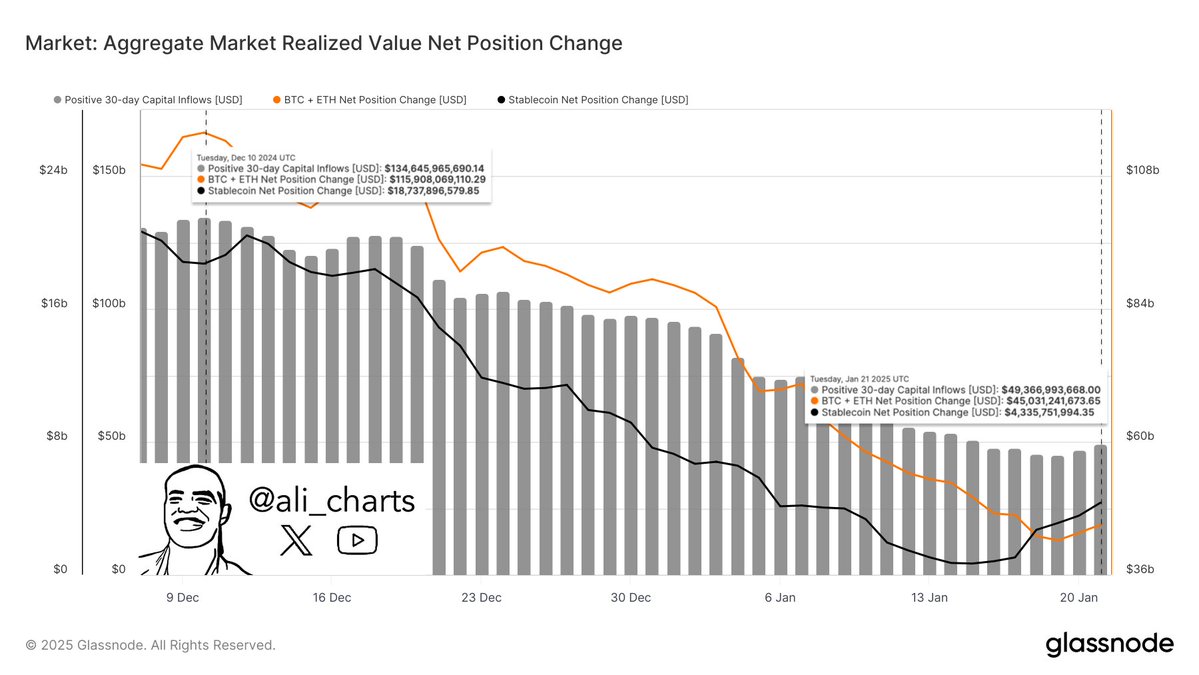

Meanwhile, crypto analyst Ali Martinez notes a sharp decline in capital inflows into the digital assets market, from $134 billion on December 10 to $43.37 billion. This low liquidity could result in sharp price swings, increasing the risk of liquidations for leverage traders.

Will BTC Peak In Q2 2025?

As BTC awaits the FOMC meeting to determine its next price trend, some analysts remain optimistic that the cryptocurrency could hit its market cycle peak in Q2 2025 as more institutions embrace the asset under favourable regulations.

Related Reading

For example, crypto analyst Dave The Wave recently predicted that BTC will likely peak in the summer of 2025. A report by Bitfinex supports this outlook, forecasting that Bitcoin could surge to $200,000 by mid-2025, albeit with minor corrections along the way.

That said, Bitcoin must defend the $100,000 price level, as failure to do so could see the asset drop to as low as $97,500. At press time, BTC trades at $104,536, up 1.4% in the past 24 hours.

Featured image from Unsplash, Charts from X and TradingView.com

CryptoCurrency

Crypto Critic Elizabeth Warren Probes Trump’s Meme Coin Venture ($TRUMP)

Senator Elizabeth Warren is calling foul on President Donald Trump’s meme coin, pressing for the U.S. Office of Government Ethics and financial regulatory agencies to dig into the ethical and regulatory details around the $TRUMP token.

Warren, who is the top Democrat on the Senate Banking Committee that oversees U.S. financial regulators, says the assets, including First Lady Melania Trump’s own eponymous meme coin, pose conflict-of-interest hazards for the president and highlight the most destructive and volatile corner of the crypto sector.

“Nearly overnight, President Trump and his wife’s net worth skyrocketed to $58 billion,” Warren wrote in the letter alongside Representative Jake Auchincloss, a fellow Massachusetts Democrat who serves on the House Energy and Commerce Committee. “Anyone, including the leaders of hostile nations, can covertly buy these coins, raising the specter of uninhibited and untraceable foreign influence over the President of the United States, all while President Trump’s supporters are left to shoulder the risk of investing in $TRUMP and $MELANIA.”

Launched the Friday before his inauguration this week, Trump’s token — for which his company retains some 80% of the coins in circulation — rose rapidly from about $3 last week to almost $37 on Thursday. It’s opened a possibility for Trump to make “extraordinary profits off his presidency,” the lawmakers noted.

The letter was sent to the Treasury Department, Securities and Exchange Commission and the Commodity Futures Trading Commission — each of which now has a new Trump pick at the helm. Warren and Auchincloss raised the point that Trump is in charge of appointing the permanent heads of these regulatory agencies that will make decisions affecting the future of his crypto tokens.

None of the three federal agencies immediately responded to CoinDesk’s requests for comment on the letter, or whether they’re reviewing the tokens in any other capacity.

“$TRUMP and $MELANIA present grave risks to President Trump’s ability to impartially govern our nation — and to investors in these coins, who may be made victims of a rug pull scheme orchestrated by the Trump family,” Warren’s letter concluded.

The lawmakers join other Democrats who have similarly raised concerns about Trump issuing these assets right before taking office. Representative Gerry Connolly, the top Democrat on the House Oversight Committee, called for an investigation in a letter sent to his committee’s Republican chairman one day into Trump’s new term, additionally raising issues with World Liberty Financial and its ties to Tron blockchain founder Justin Sun. And Representative Maxine Waters, the ranking Democrat on the House Financial Services Committee, also shared her alarm about Trump’s coin.

Read More: House Dems Warn of Corruption in Trump’s Crypto Business Moves

CryptoCurrency

President Trump Signs Executive Order To Ban Central Bank Digital Currencies (CBDC)

Today, U.S. President Donald Trump signed an executive order (EO) related to Bitcoin and cryptocurrency, titled “Strengthening American Leadership In Digital Financial Technology”. This EO officially banned the creation and issuance of a central bank digital currency (CBDC) in the United States, defining a CBDC as “a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.”

“Except to the extent required by law, agencies are hereby prohibited from undertaking any action to establish, issue, or promote CBDCs within the jurisdiction of the United States or abroad,” the order announced. “Except to the extent required by law, any ongoing plans or initiatives at any agency related to the creation of a CBDC within the jurisdiction of the United States shall be immediately terminated, and no further actions may be taken to develop or implement such plans or initiatives.”

The new EO will also establish a presidential working group to create a federal regulatory framework governing digital assets (including stablecoins), and evaluate the creation of a strategic national digital assets stockpile.

“The Working Group’s report shall consider provisions for market structure, oversight, consumer protection, and risk management,” stated the order. “The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

The EO defines the term “digital asset” as any digital representation of value that is recorded on a distributed ledger — which would include cryptocurrencies such as bitcoin, digital tokens, and stablecoins.

The stockpile is expected to include or be fully in bitcoin. Last summer at The Bitcoin 2024 Conference in Nashville, Donald Trump pledged to create a national strategic bitcoin stockpile using the bitcoin already held by the government obtained from hacks and seizures. According to Arkham Intelligence data, the U.S. currently holds 198,109 bitcoin worth over $20.1 billion.

BREAKING: 🇺🇸 DONALD TRUMP PLEDGES TO NEVER SELL #BITCOIN AND HOLD IT AS A STRATEGIC RESERVE ASSET IF ELECTED PRESIDENT pic.twitter.com/bbPRxlZfGZ

— Bitcoin Magazine (@BitcoinMagazine) July 27, 2024

Following Trump’s speech at the conference, U.S. Senator Cynthia Lummis presented legislation to also create a Strategic Bitcoin Reserve, but in a different manner. Her bill would see the U.S. government purchase 200,000 bitcoin per year, for 5 years, until it has bought a total of 1,000,000 BTC. This legislation, however, would have to pass through both the House of Representatives and the Senate before making its way to the president’s desk for final approval.

So far, President Trump has kept his word on the Bitcoin related promises he made on the campaign trail. Earlier this week, President Trump gave a full and unconditional pardon to Bitcoin pioneer and Silk Road founder Ross Ulbricht, which Trump pledged to accomplish in addition to creating a Strategic Bitcoin Reserve, banning CBDC, creating a working group/advisory council, and more.

The full details of the executive order can be found here.

CryptoCurrency

Why Are Litecoin Investors Turning To New Viral PayFi Altcoin Remittix Over Shiba Inu In 2025

There have been significant losses for Litecoin and Shiba Inu in the last 24 hours as many holders look to new projects hoping for better returns. Among these is Remittix (RTX), a PayFi project that raised over $5.2 million in its presale in just a few weeks. The project tackles problems that have been plaguing the global payments sector for many years now, offering a modern alternative. This is a market worth $190 trillion and Remittix could grab a big slice. So how will Shiba Inu (SHIB), Litecoin (LTC) and Remittix (RTX) fare in Q1 of 2025?

Shiba Inu (SHIB) Plummets 7% Overnight

Shiba Inu has kept its holders guessing with major fluctuations through most of January so far. In just 24 hours, Shiba Inu (SHIB) has plummeted by 7.3%, putting Shiba Inu at a value of $0.00002026, dipping to 0.00002040 earlier today. The MACD still signals a slight bullish crossover despite the asset’s losses, so some upward movement or at least some consolidation could be coming soon. On-chain activity too is up, with active addresses up 15% last week, which is at least a sign of healthy network engagement for Shiba Inu (SHIB).

Litecoin (LTC) Sees 24 Hour Dip After Strong Weekly Gain

Litecoin (LTC) too has been facing fluctuations. The asset had a strong week, with a net gain of 15.81%, but it has hurtled down in the last 24 hours, losing 4.06% of its value. Litecoin (LTC) is now trading around the $120 mark, climbing as high as $128.23 earlier today before dipping to $114.44. Litecoin’s RSI is at 62, which means it’s creeping toward overbought territory, but there’s still room for growth. On the contrary, Litecoin’s MACD shows some solid bullish momentum, lining up with the recent price jumps. Looking ahead, Litecoin’s big play for 2025 is getting a U.S.-based ETF approved, and if that happens, it could be a game-changer.

Remittix Switches Things Up in the Global Payments Space

With Remittix, users can convert over 40 cryptocurrencies into fiat and transfer money to any global bank account. By removing hidden fees and implementing transparent flat-rate pricing, Remittix tackles common frustrations associated with traditional international payments. Its rapid transaction processing positions it as a cost-effective and efficient alternative to existing solutions.

The entire process is simple. Users can send funds to any global bank account, with transactions typically completed in under 24 hours. For those weary of navigating complex banking systems, Remittix offers a straightforward yet powerful alternative.

Businesses can also derive great benefit from Remittix, particularly through the Remittix Pay API. This powerful piece of tech enables businesses to receive cryptocurrency payments and settle them in fiat currency. Eliminating digital asset management headaches, the platform supports more than 30 fiat currencies and 50 cryptocurrency pairs, enabling smooth financial operations across regions. Freelancers and merchants with global clients will find this function particularly useful to simplify payments and cut costs.

Recognizing the need for user independence, Remittix ensures that recipients do not know that payments were sent via its platform or that the transactions originated in cryptocurrency.

Remittix Storms Through Presale, Surpassing $5.2 Million

So far, Remittix has raised $5.2 million during its presale, which continues to gain traction. With a focus on privacy, efficiency, and user autonomy, Remittix is positioned to disrupt the $190 trillion cross-border payments market. Some analysts predict significant gains for Remittix (RTX), with forecasts of an 800% price surge during the presale and a potential 5,000% rally post-launch, as the project prepares to lead the PayFi sector.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Bitcoin drops after Trump signs executive order on crypto and ‘national digital asset stockpile’

Bitcoin price falls after President Trump signs an executive order creating a working body for researching and designing a “national digital asset stockpile.”

CryptoCurrency

Pepeto is poised to be the next meme coin giant

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

TRUMP and MELANIA tokens generate buzz, but PEPETO, with strong utility and growth, is quickly gaining momentum in the meme coin market.

Trump and Melania enter crypto, but Pepeto captures growing momentum

The cryptocurrency world was electrified as President-elect Donald Trump introduced the TRUMP token ahead of his inauguration. Initially capped at 200 million tokens, with plans to expand to 1 billion over the next three years, TRUMP saw a staggering $36.15 billion in 24-hour trading volume.

Not long after, First Lady-to-be Melania Trump unveiled her own token, MELANIA, built on the Solana blockchain. Early investors have already seen massive returns, with TRUMP’s market cap surpassing $9 billion. However, critics are questioning the longevity of these political meme coins due to their heavy centralization and lack of utility.

Meanwhile, a new contender is stealing the spotlight: PEPETO, the god of frogs. Unlike TRUMP and MELANIA, which rely heavily on branding and hype, PEPETO combines narrative-driven appeal with robust utility and a rapidly growing community. With over $3.7 million raised in its presale and a social media following exceeding 55,000 users, PEPETO is proving to be a force to reckon with in the meme coin space.

TRUMP & MELANIA: Hype vs. sustainability?

TRUMP and MELANIA have used their ties to the Trump name to create buzz. Early whales have already capitalized, with one investor reportedly turning $12 million into $23.8 million within hours of TRUMP’s launch. However, concerns about centralization loom large, as 80% of TRUMP tokens are controlled by affiliated organizations, leading to skepticism about its long-term potential.

Why PEPETO is winning over analysts and investors

In stark contrast, PEPETO is gaining traction for its emphasis on utility and sustainability. Here’s what sets it apart:

- High Staking Rewards: With annual returns of 387%, PEPETO provides an unmatched opportunity for passive income.

- Cross-Chain Bridge: Pepeto’s technology enables seamless 30-second transfers across blockchains, reducing fees and delays.

- PepetoSwap Exchange: A zero-fee platform designed to streamline meme coin trading, eliminating liquidity issues and high costs.

- Community Governance: Through its DAO model, PEPETO empowers its community with decision-making power, fostering transparency and trust.

- Low Entry Price: Currently priced at just $0.000000105 in presale, PEPETO offers an affordable opportunity for early investors to join a high-potential project.

A thriving community and growing hype

Unlike the centralized dynamics of TRUMP and MELANIA, PEPETO thrives on grassroots support. Its community has surpassed 55,000 across platforms like Twitter, Telegram, and Instagram, with daily growth reflecting its increasing popularity. This strong foundation not only boosts its credibility but also highlights its potential as a leader in the meme coin space.

Whales are betting big on PEPETO

Whale trackers have reported significant accumulation of PEPETO tokens, a strong indicator of confidence from high-net-worth investors. While TRUMP faces volatility due to its hype-driven nature, PEPETO’s utility-first approach offers a more sustainable path to growth. Analysts believe its upcoming exchange listings and groundbreaking features position PEPETO as a game-changer.

The next big meme coin?

As TRUMP and MELANIA dominate headlines, PEPETO quietly builds a foundation for long-term success. With its presale nearing conclusion and the launch of PepetoSwap and exchange listings imminent, PEPETO is not just a meme coin — it’s a movement.

How to join the PEPETO movement

Getting started with PEPETO is simple:

- Set Up a Wallet: Use MetaMask, Trust Wallet, or any Ethereum-compatible wallet.

- Fund a Wallet: Add ETH, USDT, or BNB.

- Connect to the Presale: Visit pepeto.io to purchase tokens.

- Stake Tokens: Start earning staking rewards right away.

About PEPETO

PEPETO combines the fun of meme coins with real-world utility, including a zero-fee exchange, cross-chain bridge, and lucrative staking rewards. As the god of frogs, PEPETO is redefining the meme coin space for 2025 and beyond.

For more information on PEPETO, visit their website, X, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Hackers Use Nasdaq’s X Account in $80M Fake Meme Coin Scam

The official X account of the global electronic marketplace Nasdaq was apparently hacked and used to promote a fake meme coin named STONKS.

Blockchain data shows that the bogus token’s market cap skyrocketed to $80 million before eventually collapsing.

How the Scam Unfolded

According to various reports, the attackers took control of the Nasdaq account and linked it to a fake X profile, @nasdaqmeme, complete with a gold verified badge marking it as an affiliate.

They then made a post promoting the fake STONKS coin and retweeted it with the Nasdaq account, which has over 133,000 followers. The retweet and the apparent connection between the two accounts created a facade of credibility, duping unsuspecting investors into buying the token.

Within hours, STONK’s value soared 390 times its original price, with data from DEXscreener showing that the token reached a market capitalization of $80 million and trading volumes in excess of $185 million.

However, the cryptocurrency’s meteoric rise ended abruptly as its value plummeted to zero, leaving investors with huge losses. Some accounts suggest that the scammers walked away with at least $4 million after rugging the coin.

Interestingly, the fraudulent profile used in the con was a copycat of an existing Solana meme coin, STNK, with the social media handle @STONKS_SOL.

The legitimate STONKS team has warned the crypto community about the rip-off and announced plans to sue the sham project.

STNK was launched in April 2021 as the first-ever joke token on the Solana network. It is based on the “Stonks” meme created in 2017 by Henry Hooper and made famous by the Gamestop short squeeze saga on r/wallstreetbets.

Social Accounts Under Threat

The hacking incident sparked widespread reactions across the community, with many expressing disbelief at its audacity and sophistication. Crypto trader CRG described it as the “best grift” they had ever seen, while other users pointed out the alarming ease with which the fraudsters secured a verified affiliate badge.

At the time of this writing, Nasdaq had not commented on the incident, although the offending post has been deleted, and the @nasdaqmeme account has been suspended.

Incidents of bad actors taking over social media accounts to promote phony cryptocurrencies have been on the rise lately. Towards the end of last year, blockchain investigator ZachXBT exposed an elaborate scheme where hackers compromised 15 X accounts and used them to promote fake coins. The criminals reportedly made away with at least $500,000 from the operation.

In another incident, a different group of scammers targeted the social media accounts of celebrities, including singer Usher, rapper Wiz Khalifa, and actor Dean Norris, to push a slew of counterfeit tokens on Pump.fun, stealing as much as $3.5 million in the process.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login