CryptoCurrency

Is It Time To Give Up On Ethereum Below $4,000? Analyst Weighs The Facts

Crypto analyst Ali Martinez has discussed Ethereum current price action as the second largest crypto by market cap remains below $4,000. The analyst outlined some facts to give a clearer picture of whether or not it is the right time to give up on ETH.

Analyst Discusses Whether It Is Time To Give Up On Ethereum

In an X post, Ali Martinez outlined certain facts to determine whether it is time to give up on Ethereum. First, the analyst noted that ETH has been one of the weakest performers lately, a development that looks to have prompted Vitalik Buterin to shake things up by changing the Ethereum Foundation’s leadership team.

Related Reading

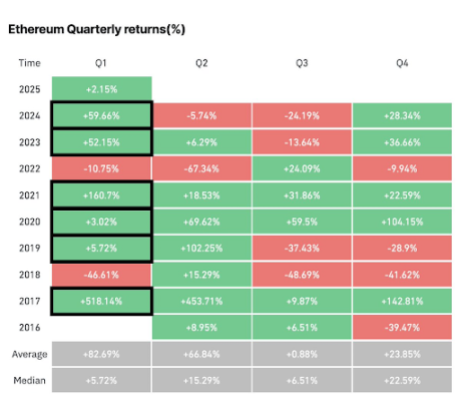

Martinez then alluded to historical data showing that Ethereum performs well in the first quarter of each year. The analyst had previously hinted that this year is unlikely to be different. Back then, he noted that ETH delivers its strongest performance in Q1, particularly in odd-numbered years, and 2025 is one such year.

Given Ethereum’s positive Q1 performance, Martinez remarked that this could explain why crypto whales have accumulated over $1 billion worth of ETH in the past week alone. He previously revealed that these whales had bought over 330,000 ETH, valued at over $1 billion.

Furthermore, the crypto analyst remarked that the buying pressure is also evident in the exchange outflows, with nearly $2 billion in Ethereum withdrawn from crypto platforms over the past month. Specifically, 540,000 ETH, worth $1.84 billion, were withdrawn from exchanges over the past month. This accumulation trend is a positive as it indicates investors are still bullish on ETH.

However, for Ethereum to break out bullishly, Martinez mentioned that it must overcome several key resistance levels. From an on-chain perspective, the crypto analyst highlighted the $3,360 to $3,450 zone as the major supply wall. This range is the most critical resistance level for ETH, while the key support zone is between $3,066 and $3,160.

From A Technical Analysis Perspective

Martinez also provided insights into the Ethereum price action from a technical analysis perspective. He stated that ETH appears to be forming the right shoulder of a head-and-shoulders pattern, with a neckline of $4,000. He added that a decisive breakout above this level could fuel a rally toward $7,000.

Related Reading

The crypto analyst also revealed that this upside target aligns with the Ethereum 3.2 Market Value to Realized Value (MVRV) Pricing Band, which is currently hovering around $7,000. Amid this bullish outlook, Martinez mentioned that one concerning sign is Ethereum’s network growth, which has slowed down. The number of new ETH addresses is said to have declined by 9.32%, indicating reduced adoption.

Despite that, Martinez believes that Ethereum’s outlook is still bullish. He told market participants to keep an eye on the $2,700 to $3,000 support zone. According to him, this demand zone must hold to maintain ETH’s bullish outlook.

At the time of writing, Ethereum is trading at around $3,200, down 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

CryptoCurrency

Is Ethereum’s Weak Performance a Reason to Worry or an Opportunity in Disguise? (Santiment)

The current bull market has seen top alternative cryptocurrencies, except Ethereum, shine, and now, ETH holders are becoming frustrated. Market sentiment signals extreme negativity among the Ethereum community, and the crypto project’s slumping market cap growth is not helping matters.

Compared to other assets like Ripple (XRP) and Solana (SOL), whose market capitalizations have grown by 36.9% and 32.2% in the past month, ETH has been struggling and even recorded a 4.7% decline.

Factors Driving ETH Underperformance

A new report by the market intelligence platform Santiment analyzed factors driving Ethereum’s underperformance.

According to the analysis, the crypto community has been criticizing Buterin for periodically selling off large amounts of ETH. Although the Ethereum co-founder has explained severally that those sales were executed to fund personal expenses or support projects related to the blockchain, community members see them as a sign that he may not be confident in the network’s future.

On several occasions, Buterin’s ETH sales have triggered multi-week-long sell-offs among traders amid heightened concerns about Ethereum’s future and decentralization. Some market participants insist that Buterin, a few big players, and the Ethereum Foundation have too much control over the network because of their large ETH holdings.

These players include Coinbase, Binance, and Lido Finance, and their influence has raised centralization concerns among users. Additionally, users are worried about Ethereum following government rules in some cases, such as blocking transactions to the crypto mixer Tornado Cash.

A Good Sign?

From a more technological perspective, some analysts believe Ethereum’s underperformance could also be linked to its decision to go modular. Modularization in this context refers to Ethereum splitting its responsibilities across smaller, specialized projects called layer-2 solutions.

While going modular could have a positive impact on Ethereum in the long term, ETH is struggling currently because these layer-2 solutions are taking away some of the attention and investment that used to go to the cryptocurrency. One illustration of this issue is the ETH supply spiking significantly after the Dencun upgrade because transaction fees declined, and less ETH got burned.

Regardless of these factors, Santiment believes that the extremely negative social side of Ethereum is a good sign for the short-term future of ETH because the market often moves in the opposite direction from general investor sentiment. So, ETH could finally break past the $4,000 range in the coming weeks if retail traders remain bearish and sell off their coins to long-term holders and key stakeholders out of frustration.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Expert Bullish On Cardano: Forecasts Explosive Rally To $3 Once This Resistance Is Broken

Cardano (ADA) has struggled to maintain the bullish momentum it experienced in recent weeks, with its price still trailing approximately 67% below its all-time high of $3.09, reached during the 2021 bull run.

Despite this significant gap, analysts believe that the potential for a robust price recovery exists in the coming weeks and months ahead of the new year.

Cardano Consolidates Above Key Moving Averages, Poised For Breakout

Trend Rider, a prominent analyst on the social media platform X (formerly Twitter), provided insights on Cardano’s current price action, noting that the price dipped below the parabolic line, indicating a cooling-off period, which occurred just above the $1 mark last week.

However, he emphasized that the Cardano price is consolidating above its moving averages, suggesting it is preparing for a potential breakout while “shaking out weaker hands.”

Trend Rider further anticipates a resumption of bullish momentum soon, forecasting that once the Cardano price breaks through the $1.25 resistance level, it could rapidly surge toward the $3 mark, inching closer to its previous record peak.

Adding to the optimistic outlook, analyst Ali Martinez pointed out that after experiencing a 44% correction, Cardano began its second leg up during the week of February 1, 2021.

Given that ADA has already undergone a 43% correction recently, the analyst suggests that the next upward movement for ADA could be just two to three weeks away, with a target of $6 in sight.

Analysts Identify Key Support And Price Targets

Another analyst, AV Sebastian, also weighed in, suggesting that the price recent dip may be over, and that the Cardano price is poised to break out of a triangular pattern. He highlighted the last two candles as particularly bullish and expects a significant rally in the coming days.

In analyzing short-term price actions, several analysts noted that ADA is exhibiting a “very bullish market structure” on the daily timeframe. On the chart is observed a double bottom formation leading to a breakout and a V-shaped recovery along a descending channel.

It is further believed that a retest of the key support zone at $1.3886 appears inevitable for ADA’s price in the near-term, which would then lead to price uptrend with a main target of $1.7748.

Further support zones have also been identified, with the $0.824 level being crucial to watch early in 2025. Holding this support could unlock significant upside potential, and analysts are eyeing May 2025 as a key timeframe for achieving targets.

At the time of writing, ADA was trading at $1.14, up 1.13% for the 24-hour period.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

BTC Hashprice Hits its Highest Level for Over a Month

Hashprice, a metric coined by Luxor that gauges mining profitability, estimates the daily income of miners relative to their estimated contribution to the Bitcoin network’s hash power. In other words, it is the expected value miners can expect from 1 TH/s of hashing power per day.

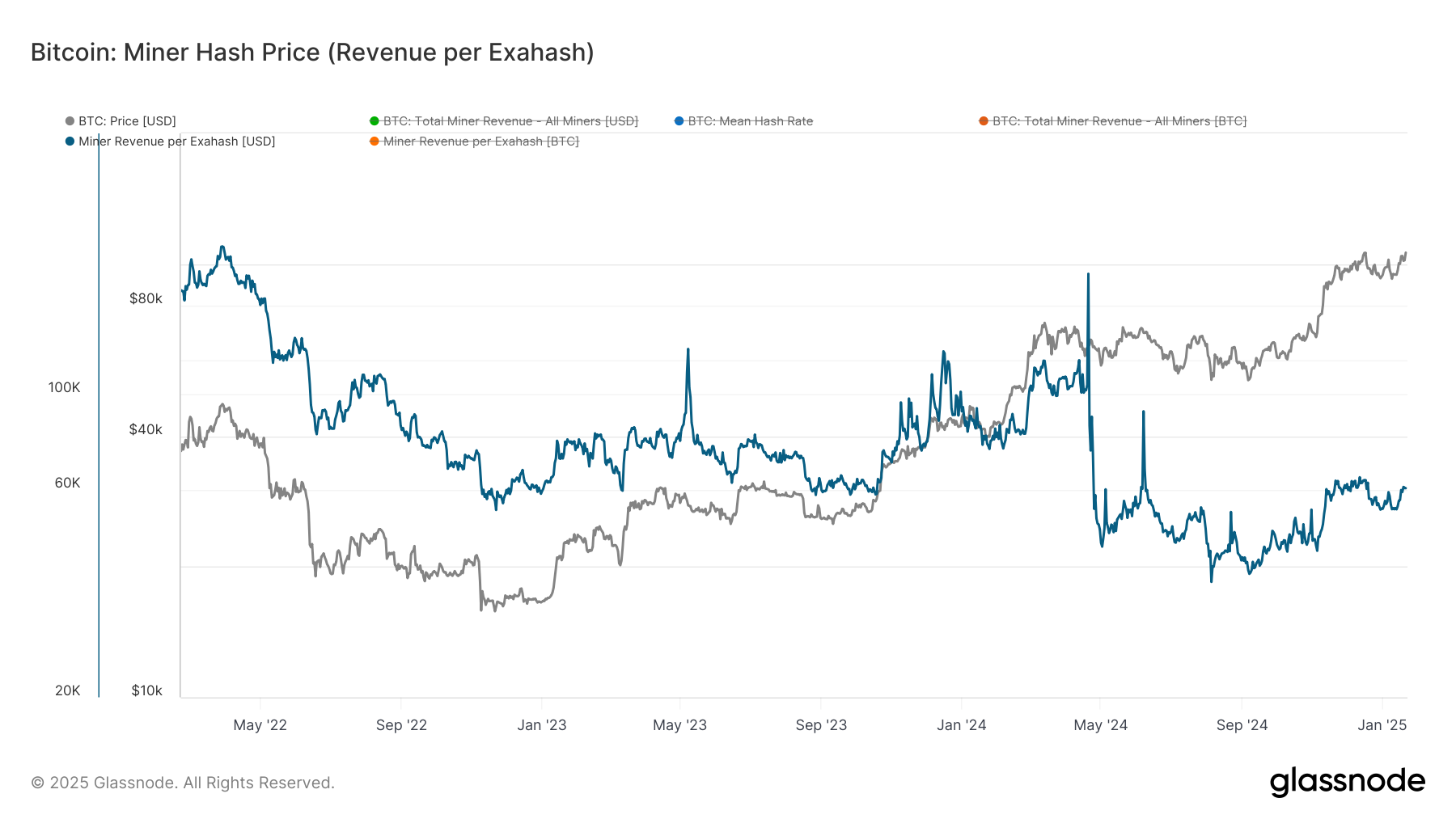

According to Glassnode, hashprice is hovering above $62 PH/s, around the highest level since mid-December.

What’s driving the increase in hashprice? Well bitcoin (BTC) has surged to well over $100,000, a 56% increase in three months and has given the miners some relief. The network has also seen a slight increase in miner fees of late, roughly 12 BTC per day, the highest amount for over a month, partly driven by the network’s inscription activity.

Due to the halving in April 2024, where the mining rewards get cut in half, the hashprice had dropped from around $115 PH/s.

As a result of the halving, miners struggled in share price appreciation on average last year; while mining revenue for much of 2024 was below the rolling 365-simple moving average (SMA). Only since November has it reclaimed this moving average, which is a historically bullish signal.

While the hash rate, the computational power in order to mine on a proof-of-work blockchain, recently hit all-time highs, as a result sent the network difficulty to all-time highs, which eats into mining profitability, as it becomes harder for miners to receive rewards.

European head of research at Bitwise, Andre Dragosch, told CoinDesk exclusively about miners being in a healthier position than last year.

“We have recently seen a decline in network hash rate since the all-time highs in early January. Meanwhile, the price of bitcoin has increased, and the overall transaction count has picked up again. This has led to a recovery in hash price, which should technically incentivize miners to continue ramping up their hash rate”.

Dragosch says, “overall, bitcoin miners appear to be well capitalized judging by the continued increase in bitcoin miner holdings since the beginning of the year which implies that miners are selling less than they are mining on a daily basis”.

CryptoCurrency

Donald and Melania Trump’s Meme Coins Decline from Peak Highs as Lightchain AI Gathers Momentum

The crypto market has witnessed a surge in celebrity-driven meme coins, including those tied to Donald and Melania Trump. However, the hype around these coins appears to be fading as investors turn their attention to more utility-focused projects.

One such standout is Lightchain AI, a blockchain project that has already raised $12.3 million during its presale, with a token price of $0.005625. This innovative platform is making waves for its ability to address critical blockchain inefficiencies, drawing interest from investors seeking long-term growth.

Trump Meme Coins – From Hype to Market Decline

Donald Trump’s start of the $TRUMP meme coin on January 17, 2025 has caused much talk in the crypto world. At first, the coin’s worth shot up, hitting a market size of about $7.8 billion. But this quick rise was soon followed by ups and downs; as of January 21, 2025, $TRUMP is trading near $38 which shows a drop of 49% from its highest point.

Critics say that the coin has no real money value. It mostly works as a guess item. There are also worries about possible unfair deals since the Trump Organization holds 80% of the coin’s part.

Also, the next start of Melania Trump’s $MELANIA coin has added to market chaos. These changes show the risky kind of ͏meme coins and point out the dangers for buyers. People in the market should be careful, because the future path of $TRUMP and like things is not clear.

Lightchain AI Utility-Driven Alternative for Smart Investors

The backbone of Lightchain AI is designed to tackle the challenges of tomorrow with unmatched efficiency and innovation

At its core lies the Artificial Intelligence Virtual Machine (AIVM), a dedicated layer built specifically for AI tasks such as model training and inference, seamlessly integrated into the blockchain for peak performance.

Complementing this is the revolutionary Proof of Intelligence (PoI), a unique consensus mechanism that not only secures the network but also incentivizes nodes to perform valuable AI computations.

To ensure scalability, Lightchain AI incorporates advanced technologies like sharding and Layer 2 solutions, enabling it to handle high-speed, high-throughput AI tasks effortlessly. This robust infrastructure positions Lightchain AI as a powerful, utility-driven solution for future-facing smart investors.

From Noise to Innovation Future of Crypto

The fall of Donald and Melania Trump’s meme coins highlights a hard lesson for the crypto world: hype alone won’t last.

Enter Lightchain AI—a utility-driven project that’s turning heads and redefining what blockchain technology can do. This isn’t just another fleeting trend; it’s a movement toward real innovation and lasting impact.

For investors hungry for sustainable growth and meaningful returns, Lightchain AI is leading the charge. With an impressive presale performance and groundbreaking features, it’s primed to shape the next wave of blockchain advancements. Ready to join the future?

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Asset tokenization can unlock financial inclusion for LATAM’s unbanked

Blockchain-powered asset tokenization is set to reshape Latin America’s financial systems, driving efficiency, inclusion and transparency.

CryptoCurrency

What is WhiteBIT? A Guide to the Leading Crypto Exchange

Overview of WhiteBIT

WhiteBIT is a centralized crypto exchange offering tools for traders of all levels. Here’s a quick summary:

|

Feature |

Details |

|

Founded |

2018, in Kharkiv, Ukraine |

|

Founder |

Volodymyr Nosov |

|

Users |

5.5+ million |

|

Trading Volume |

$6 billion (spot) daily |

|

Supported Assets |

300+ cryptocurrencies, 600+ trading pairs |

|

Global Reach |

Operates in 150+ countries |

Key Features of WhiteBIT

WhiteBIT offers several features suitable for both new and experienced traders:

- Robust Security

- 96% of funds stored in cold wallets.

- Advanced security tools like Web Application Firewall (WAF).

- Regular third-party security audits.

- Diverse Trading Options

- Spot, margin, and futures trading with up to 100x leverage.

- Integration with TradingView for advanced charting and analysis.

- User-Friendly Experience

- Multilingual 24/7 customer support, including voice assistance.

- Demo tokens for beginners to practice risk-free.

- Passive Income Opportunities

- Lending programs offering up to 18% interest annually.

- Auto-invest features for regular portfolio growth.

- Low Fees

- Spot trading fees capped at 0.1%.

- Futures trading fees start as low as 0.0585%.

- WBT holders receive up to 80% fee discounts.

WhiteBIT Ecosystem

WhiteBIT has built a complex ecosystem that extends beyond basic trading services:

|

Product/Feature |

Description |

|

Whitechain |

Blockchain with Proof-of-Authority (PoA) for scalability and efficiency. |

|

WhiteBIT Token (WBT) |

Native token offering fee discounts and staking rewards. |

|

Whitepay |

A crypto payment gateway for businesses and customers. |

|

Visa-powered card for global crypto-to-fiat transactions. |

|

|

WhiteSwap |

Decentralized exchange supporting DeFi applications. |

Competitive Advantages

Ethical Practices

WhiteBIT supported humanitarian efforts during the Ukraine conflict, using its Whitepay solution to facilitate donations.

Accessibility

Its tools cater to beginners and advanced traders. Demo tokens help users practice strategies without financial risk.

Regional and Global Presence

WhiteBIT has partnered with organizations like FC Barcelona and Turkish football clubs. It also plans to expand into highly regulated markets, including the U.S.

Passive Income and Rewards

Users can participate in lending programs or earn through trading competitions and affiliate programs. Token burns keep WBT’s supply deflationary, driving value for holders.

Subscribe to Coinbackyard and read more crypto exchange reviews!

WhiteBIT Coin (WBT)

WBT is the backbone of Whitechain and plays a key role in its ecosystem. Here are its main features:

|

Feature |

Details |

|

Supply Cap |

400 million coins |

|

Use Cases |

Fee reductions, staking rewards, and ecosystem payments. |

|

Interoperability |

Supports Ethereum (ERC-20) and Tron (TRC-20) tokens. |

|

Current Price |

$28 (as of January 2024) |

Whitepay and WhiteEX

Whitepay is a payment gateway allowing businesses to accept crypto payments seamlessly. It offers secure and scalable solutions for merchants. WhiteEX, another WhiteBIT innovation, simplifies crypto-to-fiat conversions for real-world use.

WhiteBIT’s focus on security, accessibility, and user-centric innovation has helped it develop from a local business to a major force in the world. Its alliances and growing ecosystem make it a competitive option for both institutional and retail traders.

CryptoCurrency

Coinbase CEO apologizes for multi-hour outage, pledges tier 1 support

After yet another technical hiccup, this time with Solana, Coinbase’s CEO apologized and pledged to scale infrastructure and provide “tier 1” support for high-demand periods.

Coinbase CEO Brian Armstrong has apologized for the Solana delays caused by the exchange’s infrastructure issues, which left users dealing with canceled or slow transactions.

In a post on X on Jan. 22, Armstrong admitted that the platform has the Solana backlog “triaged,” adding that transactions “should generate quickly again.” For users who suffered losses or missed out on the hype due to hours-long disruptions in depositing or withdrawing Solana (SOL) tokens, Armstrong issued his “apologies for the trouble.”

“We have the Solana backlog triaged, and transactions should generate quickly again. If your transaction got canceled you can retry it now – apologies for the trouble.”

Brian Armstrong

He admitted Coinbase needs to do better when it comes to supporting Solana, saying “it’s clear we need to step up our game on Solana, scale our infrastructure, and provide native support for common use cases like DEX/memecoin trading.” Armstrong also promised to give Solana the same top-level support as Bitcoin (BTC), Ethereum (ETH), and Base, though he didn’t go into specifics.

The crypto community remains skeptical. One user, @PAGANDWOLF, pointed out that the exchange “had many years to fix these problems, including issues from last bull markets when volume is high.” The latest incident, tied to Solana’s surge in activity, seems to have overwhelmed the platform’s systems.

Armstrong noted that the increased traffic is a good thing for Solana but admitted the exchange needs to handle it better. “The surge in activity is great for the ecosystem (and these are high quality problems to have), but we need to do a better job serving our customers during periods of high demand,” he said.

CryptoCurrency

Over 5,000% Growth? Dogecoin Analyst Predicts $20 Price Tag

A crypto analyst has set a lofty price target for Dogecoin: $20. Based on the meme coin’s current price of $0.365, the forecast represents a substantial 5,380% increase.

Although a captivating concept, this perspective was sufficient to elicit both optimism and skepticism within the cryptocurrency community.

Related Reading

History Shows Dogecoin Thrives After US Political Shifts

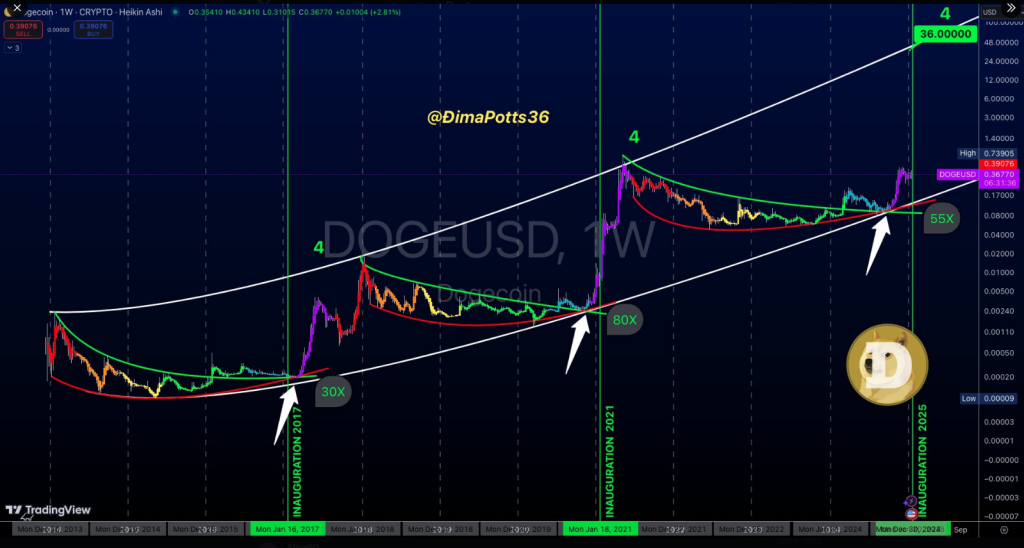

Dima James Potts connects his forecast to past trends, noting that Dogecoin usually goes up after US presidential inaugurations. He points out past instances when the coin’s value went up a lot because of heightened political and social interest.

While historical performance doesn’t guarantee future success, this trend offers an intriguing glimpse into DOGE’s potential.

Potts examined Dogecoin’s weekly chart, paying particular attention to the cryptocurrency’s notable price fluctuations following the last two US presidential inaugurations.

Following the occurrence, DOGE saw a spectacular 30x price surge in 2017, and in 2021, it exceeded forecasts with an 80x rally. These past spikes have set the meme coin up for a trend of impressive post-inauguration performance.

$DOGE $10+ DOGECOIN?! 🚀🚀

This weekly chart of #DOGECOIN shows its performance in the days and weeks following each presidential inauguration (indicated by vertical green lines).

• 1st cycle (2017): Dogecoin increased 30X after the inauguration date.

• 2nd cycle (2021):… pic.twitter.com/3unXeJ8YKu

— Ðima James Potts (@DimaPotts36) January 19, 2025

Potts predicts comparable growth potential for the 2025 cycle. Just before the inauguration, Dogecoin was selling at $0.38. He believes that a 55x surge, which is the average of the prior cycles, might push the price above $20.

With the help of celebrity endorsements, especially billionaires like Elon Musk, Dogecoin’s exceptional ability to attract public attention may be crucial to this prediction. Historical momentum and strong community support could pave the way for yet another significant rally.

$20 Is Bold, But Not Impossible

Potts believes Dogecoin’s path to $20 depends on key developments within its ecosystem. A heightened level of utility, new use cases, or relationships with companies around the world might all increase its value.

However, such a value would required levels of adoption and persistent market demand previously unseen.

Skeptics say that DOGE may be unable to sustain such growth since it is not as utilitarian as other cryptocurrencies. Still, given its meme coin status, anything is possible in the volatile crypto market.

Broader Market Dynamics

The state of the world market will have a big impact on Dogecoin’s growth. Potts claims that macroeconomic conditions that are favorable to DOGE may cause it to approach his $20 target.

On the other hand, regulatory pressures or the general pessimism in the market could get in the way of the coin’s trajectory.

At the time of writing, DOGE was trading at $0.3651, up 7.3% and 1.2% in the daily and weekly timeframes.

Like most cryptocurrencies, the value of Dogecoin is influenced by sentiment and demand. Maintaining any obvious progress will thus depend on keeping a strong community presence while drawing fresh investment.

Related Reading

Proceed With Caution

While some people find the idea of Dogecoin hitting $20 exciting, investors should be careful. The crypto market is very unpredictable, and even the best forecasts can be thrown off by unexpected events.

Featured image from DALL-E, chart from TradingView

CryptoCurrency

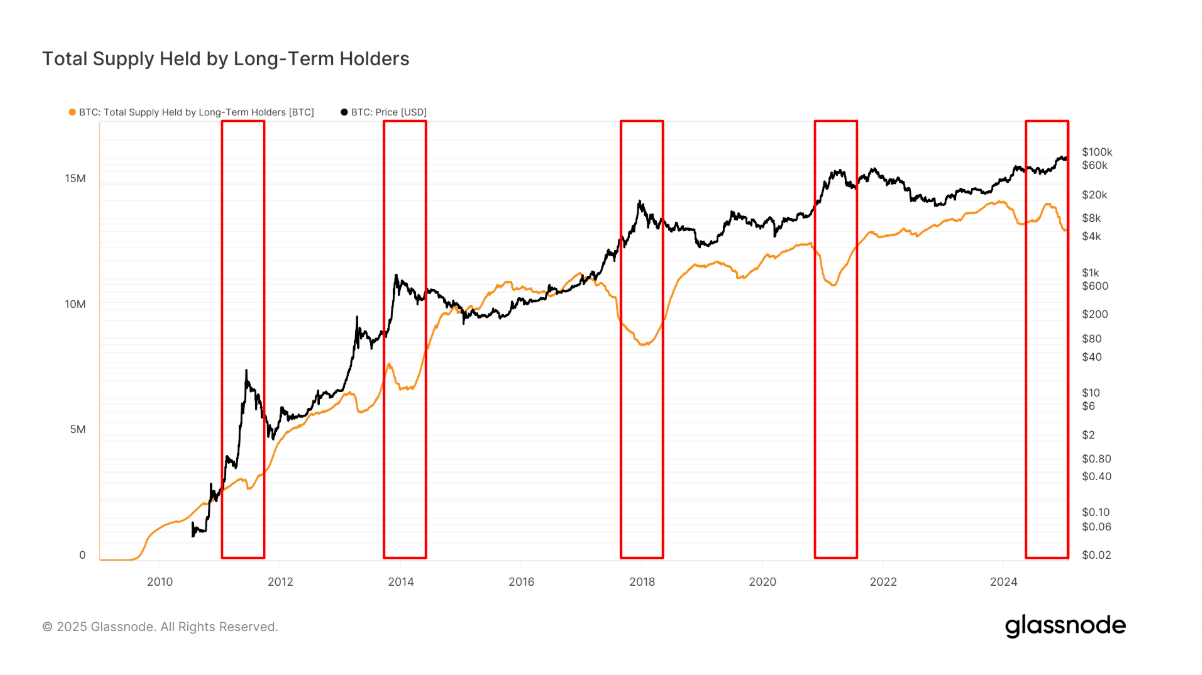

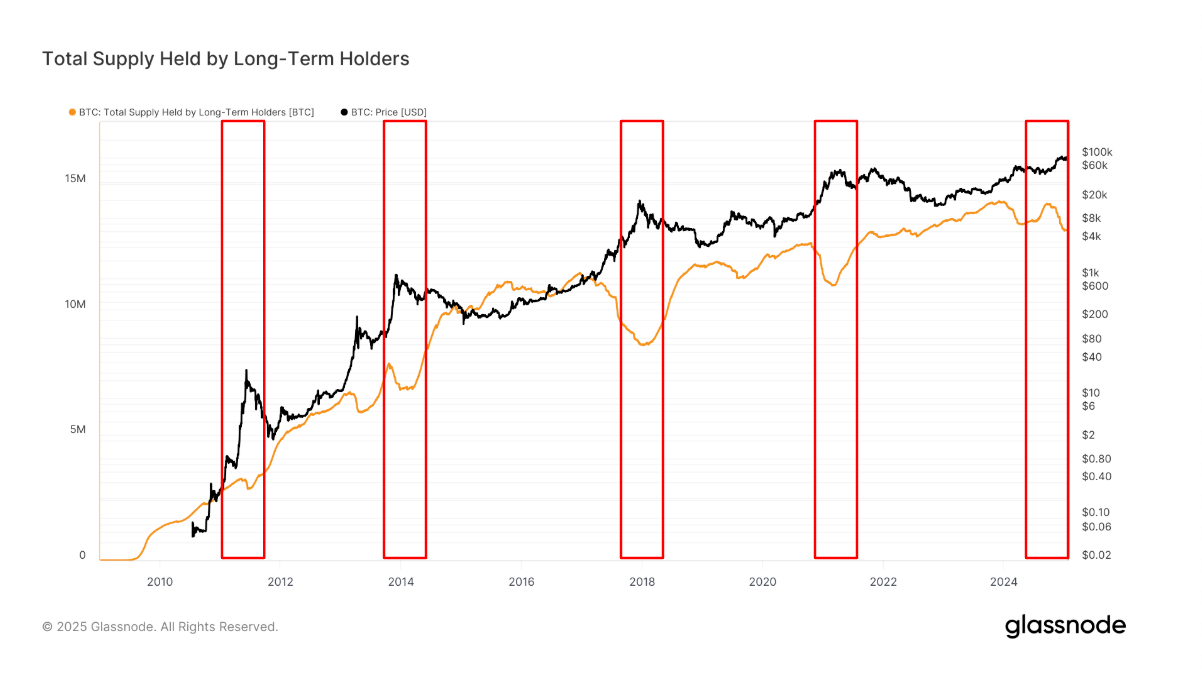

Long-Term Bitcoin (BTC) Holder Sales Seem to Have Bottomed Out: Van Straten

Long-term holders of bitcoin (BTC) seem to ended their selling spree, a change in strategy that’s helped convert the psychological $100,000 resistance price into a support level for the first time.

With one, short-lived exception, the largest cryptocurrency has held above $100,000 since Jan. 17. The past few days have been extremely volatile due to President Donald Trump’s inauguration, which saw a spike in volatility.

Long-term holders, or investors who have held bitcoin for over 155 days, have been among the biggest contributors to selling pressure on the market, according to CoinDesk research in December. They are deemed “smart money” because they tend to buy when bitcoin prices are depressed and sell into strength, a pattern that’s been observed over the past four months.

In September, this cohort held 14.2 million BTC. It now holds 13.1 million BTC. While the investors held back around the start of the year, sales have picked up again in recent days as the price rose, though at a reduced pace.

The trend to watch out for is when they stop selling. This tends to mark a top in the cycle, which has occurred in 2013, 2017, 2021 and 2024.

CryptoCurrency

Jellyverse Launches its Synthetic Assets Protocol jAssets

Sei Network-based (SEI) community-led decentralized finance (DeFi) platform Jellyverse is launching its own synthetic assets protocol, jAssets.

According to a Jan. 21 announcement, jAssets will allow users to mint their own synthetic asset tokens that would approximately track the value of traditional assets. The value of those tokens would be tied to real-world assets like stocks, commodities and precious metals.

Jellyverse moved ahead with the implementation of the new feature following a proposal seeing a positive outcome in an integration vote by the protocol’s decentralized autonomous organization (DAO.) Minting jAssets by locking up crypto as collateral allows for on-chain portfolio diversification.

Benedikt Keck, co-founder at Jellyverse developer Blkswn, explained that the new product will allow for “portfolio diversification in DeFi by offering a range of innovative investment strategies, including long, short, and leveraged positions.” The new synthetic assets protocol also allows for multi-collateral troves, with support for “wETH, wBTC, JLY, SEI, USDC, USDT, FRAX or GEM or a combination of these assets as collateral,” he explained.

Jellyverse relies on decentralized oracles and over-collateralization to ensure that the value of the collateral exceeds the synthetic assets and prevent the protocol from losing assets. The oracles in question are based on Pyth Network (PYTH).

A blockchain oracle is a tool or service that feeds external, real-world data into a blockchain so smart contracts can act on it. Usually, data that is external to blockchains cannot be accessed in the smart contracts that govern the DeFi space.

Oracles serve as a bridge providing up-to-date data — in this case real-worAld asset pricing data. This bridge is also a potential centralized point of failure in a decentralized system, which is why a lot of effort has been dedicated to developing decentralized oracles such as Chainlink (LINK) and Pyth Network.

Jellyverse runs on the Sei Network, a layer one blockchain with parallel Ethereum Virtual Machine (EVM) execution. This allows the smart contracts that the DeFi space relies on to run much faster and allow for faster trades.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login