Key Trends for 2025

- Pro-Crypto Policies Boost Confidence

Donald Trump’s return to the White House with a pro-crypto administration is boosting investor confidence. Institutional and retail players are more optimistic about the future. With less uncertainty, more investors are likely to enter the market.

- Institutional Adoption

Big names like BlackRock and Fidelity are leading the way with blockchain-based solutions. Interest in Bitcoin ETFs and other cryptocurrencies is growing. This increased participation from institutions could stabilize the market and make it more accessible to smaller investors.

- Regulatory Clarity

Clearer regulations are expected to roll out in 2025. These rules will provide a roadmap for institutional players, encouraging broader adoption. Defined guidelines could also reduce risks for investors.

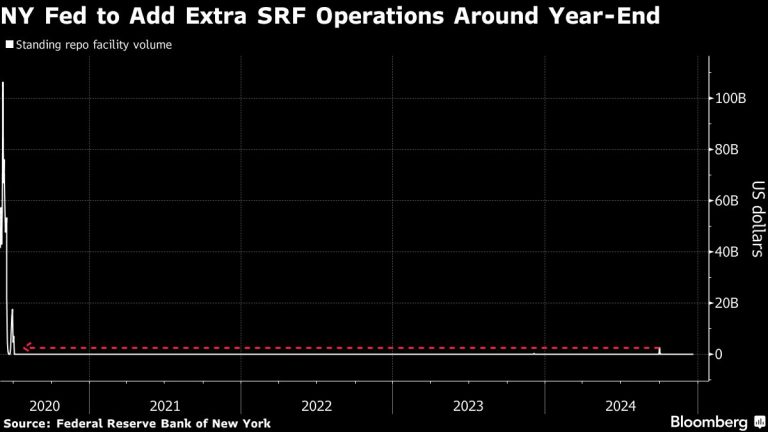

Interest Rates: A Game-Changer

Falling interest rates in the U.S. and Canada have already benefited investors in 2024. Further cuts expected in 2025 will likely lower borrowing costs. This could free up more funds for crypto investments.

Advancements in Technology

Technological innovations will play a big role in shaping the crypto market:

|

Innovation |

Impact |

|

Smart Contracts |

Automates and secures transactions across industries. |

|

Speeds up Bitcoin transactions and reduces costs. |

|

|

Blockchain in Supply Chains |

Enhances transparency and efficiency. |

These improvements will make cryptocurrencies more efficient and scalable, encouraging adoption in sectors like DeFi and logistics.

Challenges on the Horizon

The crypto market remains volatile. Diversification of digital assets may reduce some of these swings, but risks persist.

Political challenges are another concern. Trump’s proposed tariffs and deportation policies could create economic instability. Consumer debt and labor market worries might also weigh on investor sentiment.

2025 Outlook

The crypto market in 2025 is a mix of opportunities and challenges:

Opportunities:

- Institutional adoption.

- Technological advancements.

- Lower interest rates.

Challenges:

- Market volatility.

- Political and economic uncertainty.

Staying informed and adaptable will be key for investors navigating this dynamic year.

+ There are no comments

Add yours