CryptoCurrency

Lido Co-Founder Teases ‘Second Foundation’ for Ethereum Amid Community Backlash

Konstantin Lomashuk, the founder of the Lido staking protocol, has teased his intention to build a “Second Foundation” to advance Ethereum’s ecosystem.

Over the past several days, Ethereum co-founder Vitalik Buterin has outlined plans for a major restructuring of the Ethereum Foundation (EF), the nonprofit organization responsible for supporting Ethereum’s development. In a series of posts on X (formerly Twitter), Buterin shared details of the reorganization, which he said would streamline decision-making processes and address inefficiencies.

The announcement has sparked criticism, with some arguing that Buterin’s central role in the restructuring process undermines Ethereum’s ethos of decentralization.

The Ethereum Foundation, however, has long been scrutinized for its own centralizing influence within the Ethereum ecosystem. Over the past year, the organization has faced mounting pressure to define a clearer vision for Ethereum’s future as competing networks like Solana make strides.

Read more: Ethereum’s Vitalik Buterin Goes on Offense Amid Major Leadership Shake-up

The EF has also been criticized for its “rollup-centric” roadmap, which prioritizes “layer-2” networks that enable faster and cheaper transactions atop Ethereum. While these layer-2 rollups have boosted Ethereum’s throughput, they’ve also drawn concerns about potential trade-offs, such as diminished security guarantees and a notable dent in Ethereum’s base fee revenues.

Lomashuk, who has previously voiced concerns about the Ethereum Foundation’s direction, hinted at the concept of a “Second Foundation” in a December post on X. “The idea of a ‘Second Foundation’ is more about creating competition between different groups, giving the community a choice,” Lomashuk wrote. “EF is super deep, and it’s almost impossible for outsiders to contribute without building long-term research muscle. Without competition, we risk losing the right path.”

On Wednesday, Lomashuk published another X post sharing a newly established account for “Second Foundation.”

Representatives for Lomashuk did not immediately respond to a request for comment, but Martin Köppelmann, a prominent Ethereum developer close to Lomashuk, told CoinDesk that the “Second Foundation” proposal is authentic.

“He is certainly seriously thinking about it,” Köppelmann said. “The goal of course is to make it open to anyone who subscribes to the same ideas – roughly that Ethereum needs to scale better and faster.”

Lido, the protocol founded by Lomashuk, allows users to pool their ETH to participate in Ethereum’s staking mechanism, which lets users “stake” (lock up) crypto with the network in exchange for interest. Stake correlates to power in Ethereum’s governance system, making Lido a pivotal entity in the ecosystem: Currently, Lido accounts for around 28% of Ethereum’s staked ETH, making it the network’s single-largest validator.

In addition to Lido, Lomashuk co-founded P2P Validator, a company providing infrastructure for Ethereum validators, and cyber.Fund, a venture capital firm he operates alongside another Lido co-founder. His growing influence raises questions about the potential dynamics between a “Second Foundation” and the existing Ethereum Foundation as the network continues to evolve.

CryptoCurrency

Exploring Crypto's Potential: 6 Creative Uses Beyond Just Trading

A close up of two coins on a table photo – Free Coin Image on Unsplash

Cryptocurrency has evolved significantly since the launch of Bitcoin in 2009. Initially viewed as a digital currency for speculation and investment, crypto has expanded its reach into various sectors, creating unique opportunities that go far beyond just trading. Today, cryptocurrency is shaping new industries, offering innovative solutions to everyday problems, and providing creative ways for individuals to engage with technology.

1. Charitable Donations and Fundraising

Cryptocurrency is making waves in the world of philanthropy, offering a new way for individuals and organizations to donate to causes they care about. Crypto donations are becoming increasingly popular, as they offer several advantages over traditional charitable giving methods. One of the biggest benefits is that cryptocurrency donations are often faster and cheaper than traditional payment methods, as they bypass intermediaries like banks and payment processors.

Cryptocurrency also allows for greater transparency in donations. Since blockchain technology is public and immutable, charitable organizations can track how funds are being spent, ensuring that donations go directly to the intended cause. This level of transparency builds trust between donors and organizations, making it easier for people to feel confident in their contributions.

2. Crypto Gaming

Cryptocurrency is transforming the gaming industry, offering new ways for players to earn rewards and enjoy secure, fast transactions. In play-to-earn (P2E) games, players can earn cryptocurrency or NFTs by participating in in-game activities, allowing them to monetize their time and efforts. These games are built on decentralized networks that ensure transparency and security, with rewards tied to the value of digital assets, which can be traded or used for in-game purchases.

Online crypto casinos are also growing in popularity, enabling players to deposit and withdraw cryptocurrencies like Bitcoin and Ethereum. This provides faster transactions, increased privacy, and a more secure experience than traditional payment methods. Bitcoin casinos offer a wide variety of games, from blackjack to slots, with live dealer options available. With exclusive bonuses and lower fees, crypto casinos are quickly becoming the preferred choice for many players.

3. Decentralized Finance (DeFi)

Cryptocurrency has introduced a new era of decentralized finance (DeFi), a system that allows users to lend, borrow, and earn interest on their digital assets without the need for traditional intermediaries like banks. DeFi platforms leverage blockchain technology to create open, permissionless financial services that are accessible to anyone with an internet connection.

Through DeFi, individuals can participate in activities such as yield farming, staking, and liquidity provision. Yield farming allows users to earn passive income by lending their cryptocurrency to others in exchange for interest, while staking involves locking up digital assets in a network to support its security in exchange for rewards. Liquidity provision involves adding funds to a decentralized exchange (DEX) to facilitate trades and earn a share of the transaction fees.

4. Tokenizing Real-World Assets

Another innovative application of cryptocurrency is the tokenization of real-world assets. Tokenization refers to the process of converting ownership of real-world assets—like real estate, art, or even stocks—into virtual tokens that can be traded via the blockchain. These tokens represent ownership or a stake in the underlying asset and can be bought, sold, or exchanged with greater ease.

For example, a real estate property could be tokenized, with each token representing a fractional share of the property. Investors can then buy or sell these tokens without needing to go through traditional property buying or selling processes, which can be time-consuming and costly. Tokenization opens up investment opportunities to a wider audience, allowing individuals to invest in assets that were previously out of reach due to high entry costs.

5. Digital Identity and Authentication

Cryptocurrency and blockchain technology are also paving the way for more secure and privacy-focused digital identities. With concerns over data privacy and security becoming increasingly prevalent, blockchain-based identity solutions are gaining traction. These decentralized digital identities give individuals greater control over their personal information and reduce the risk of data breaches.

Blockchain-powered digital identity systems can be used for a variety of purposes, including secure login processes, online voting, and identity verification in financial services. By using cryptographic methods to secure personal data, these systems allow users to authenticate their identity without relying on centralized institutions or risking their sensitive information being compromised.

6. Tokenized Rewards and Loyalty Programs

Loyalty programs have long been a staple of consumer engagement, but cryptocurrency is now transforming how rewards and incentives are offered. Brands are exploring ways to tokenize loyalty points, offering customers cryptocurrency-based rewards that can be redeemed across multiple platforms. These tokens can also be traded or sold, adding value to the loyalty program beyond simple discounts or gifts.

By tokenizing rewards, businesses create a more flexible, transparent, and transferable incentive system that benefits both customers and companies. Customers can earn tokens for purchasing products, sharing content, or engaging with brands, and these tokens can then be used to access special perks, products, or experiences within a decentralized ecosystem.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

Ethereum fee earnings rise in 2024 despite cost-saving Dencun upgrade: CoinGecko

The Ethereum blockchain’s earnings from fees saw a 3% year-on-year rise from 2023 to 2024 despite the Dencun upgrade early last year, which reduced network fees.

CryptoCurrency

This under $0.50 crypto may crush Shiba Inu and Pepe coin in 2025

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Meme coins like SHIB and PEPE are fading as Rexas Finance, under $0.50, emerges as the leading choice for 2025.

Meme coins like Shiba Inu (SHIB) and Pepe coin (PEPE), which first gained popularity with their viral appeal and community-driven expansion, have helped to define the crypto industry. But the days of depending on memes might be fading as investors pay more attention to tokens of great use.

Under $0.50, one new project, Rexas Finance (RXS), is poised to surpass SHIB and PEPE as the cryptocurrency of choice for 2025. This utility-packed coin is positioned here to lead the next bull cycle.

The rise and challenges of meme coins

Shiba Inu and Pepe coin showed the force of community enthusiasm in the crypto market. Making advantage of the meme coin boom in 2021, SHIB gave early investors exponential returns. Like PEPE, which attracted interest in 2023 with its internet culture appeal and humor-driven marketing, Both initiatives have challenges maintaining their pace despite their initial accomplishments.

While Pepe Coin’s reliance on virality raises issues regarding long-term value, Shiba Inu has battled to increase the meaning of its ecosystem significantly. As the market ages, investors increasingly choose projects with clear uses and expansion prospects.

Introducing Rexas Finance: The next big thing under $0.50

Redefining what it means to be a cryptocurrency in 2025 is Rexas Finance. Unlike sentimentally driven meme coins, RXS is based on practical use and emphasizes tokenizing valuable assets utilizing innovative technologies like its Rexas GenAI platform. At $0.20 in its 12th presale round, Rexas Finance attracted almost $41.5 million and sold 427.6 million tokens, indicating great investor confidence.

Recently, the project polled its members to choose a further presale round and a $0.25 listing price. With June 19, 2025, as its debut date, RXS is ready to hit the ground running once it becomes available.

Utility beyond hype: What makes RXS unique?

Rexas Finance appeals mostly because of its dedication to addressing practical issues. Its tokenization system lets users fractionalize ownership of precious assets like fine art and real estate, democratizing access to once-off investment prospects.

The Rexas GenAI system allows users to produce and oversee tokens with little technical knowledge. This instrument reduces the barrier to entry for companies and individuals wishing to employ blockchain technology, increasing the range of uses for RXS. Rexas Finance is miles ahead of meme coins like SHIB and PEPE, which lack comparable functional ecosystems — this mix ofunique features and utility places.

Strong community backing and momentum

Community involvement has greatly aided Rexas Finance ‘s success. Its holder community explicitly decided to include a further presale round and increase the listing price, demonstrating great investor participation.

This cooperative approach has created enthusiasm and trust among the participants, thus separating RXS from its rivals. Furthermore, Rexas Finance’s listing on CoinMarketCap and CoinGecko is increasing its profile and legitimacy in the crypto market. As the initiative prepares for formal introduction, this early exposure will inspire greater acceptance.

How RXS compares to SHIB and PEPE

While SHIB and PEPE mostly depend on community excitement, RXS combines community strength with a strong technological basis. This double method helps one be more suited to provide long-term value and withstand changes in the market.

For example:

- Shiba Inu: Driven mostly by its meme reputation, SHIB has battled to grow its ecosystem outside of staking and with a small ShibaSwap platform.

- Pepe Coin: PEPE has profited from internet culture but lacks innovation or practical value to keep expanding.

- Rexas Finance is a complete investment opportunity with a fully developed ecosystem, including tokenizing tools, AI-powered features, and real-world applications.

Why RXS could dominate 2025

Projects with strong foundations, creative ideas, and engaged communities should be rewarded in the 2025 bull market. By meeting all these criteria, RXS positions itself as a major competitor for significant expansion. With a listing price of $0.25 and a presale price of $0.20, Rexas Finance is accessible to investors looking for high-growth prospects. According to analysts, its real-world use cases and innovative characteristics might push its value dramatically, possibly surpassing meme coins and even established companies in the market.

Conclusion: A new leader for 2025

Although Shiba Inu and Pepe Coin have made their mark in crypto history, tokens like Rexas Finance — which blends creativity, utility, and great community involvement — have their future. Projects with clear value propositions are more likely to thrive as the market changes; RXS drives the change. Rexas Finance offers an unmatched opportunity for those seeking to turn small investments into significant returns. With its emphasis on practical applications and a June 19, 2025 debut date, RXS is poised to compete with and surpass SHIB and PEPE. For those looking for the next great thing under $0.50, Rexas Finance might be the solution they’ve been waiting for.

For more information about Rexas Finance, visit their website, giveaway, X, Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

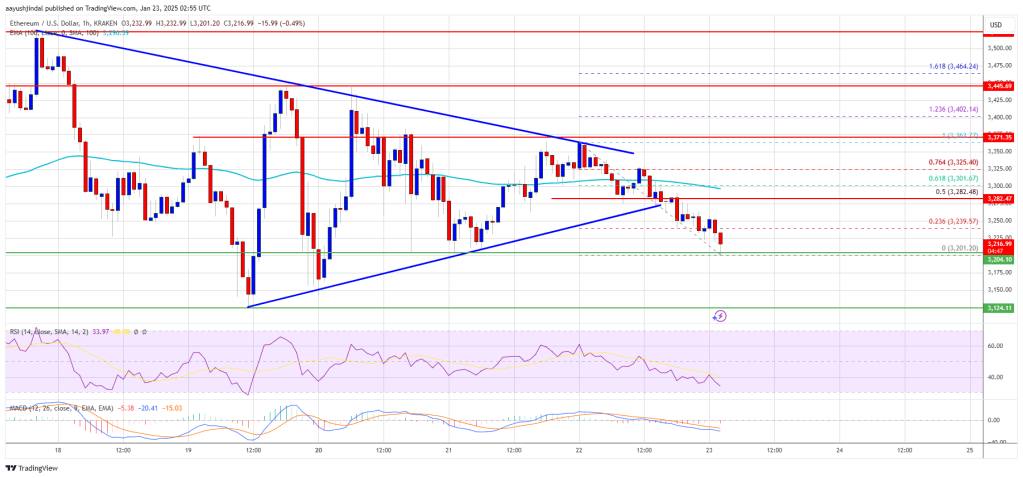

Ethereum Bears Emerge: Is a Deeper Pullback Coming?

Ethereum price is struggling below the $3,400 resistance. ETH is showing a few bearish signs and might decline below the $3,150 support.

- Ethereum failed to gain pace for a close above $3,350 and $3,400.

- The price is trading below $3,300 and the 100-hourly Simple Moving Average.

- There was a break below a key contracting triangle with support at $3,270 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start another increase if it stays above the $3,120 support level.

Ethereum Price Breaks Support

Ethereum price started a decent upward move from the $3,220 level but upsides were limited compared to Bitcoin. ETH cleared the $3,300 resistance before the bears appeared.

A high was formed at $3,361 and the price is now moving lower. There was a move below the $3,250 and $3,220 support levels. Besides, there was a break below a key contracting triangle with support at $3,270 on the hourly chart of ETH/USD.

A low was formed at $3,201 and the price is now consolidating. Ethereum price is now trading below $3,300 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,280 level or the 50% Fib retracement level of the downward move from the $3,363 swing high to the $3,201 low.

The first major resistance is near the $3,300 level or the 61.8% Fib retracement level of the downward move from the $3,363 swing high to the $3,201 low. The main resistance is now forming near $3,350.

A clear move above the $3,350 resistance might send the price toward the $3,450 resistance. An upside break above the $3,450 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,550 resistance zone or even $3,580 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $3,300 resistance, it could start another decline. Initial support on the downside is near the $3,200 level. The first major support sits near the $3,150.

A clear move below the $3,150 support might push the price toward the $3,120 support. Any more losses might send the price toward the $3,050 support level in the near term. The next key support sits at $3,000.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $3,200

Major Resistance Level – $3,300

CryptoCurrency

CME Says XRP, SOL Futures Leak Was an Error, No Decisions Are Made

An earlier leak on the website of Chicago Mercantile Exchange (CME) showing regulated XRP (XRP) and Solana (SOL) futures could start trading on Feb. 10 pending regulatory approval was an “error,” a representative of the company told CoinDesk.

“A beta page from our website was released in error earlier today,” the spokesperson said. “Many mock-ups are included in that test environment. No decisions have been made regarding XRP or SOL futures contracts.”

A screenshot of a beta page for XRP (XRP) and Solana (SOL) futures contracts was posted on X earlier on Wednesday, sparking rumors that the exchange might get ready to list those investment vehicles on Feb. 10.

Both tokens jumped as much as 3% following the post, before paring some of their gains.

CryptoCurrency

NBA star Tristan Thompson Signs for Sportsbet.io

NBA superstar Tristan Thompson is the latest big name to partner with Sportsbet.io, the world’s favorite crypto-first sports betting site, as its newest global ambassador.

Thompson, a Cleveland Cavaliers center and 2016 NBA Championship winner, will bring his star power and passion for cryptocurrency to the Sportsbet.io community for the next two years.

The Canadian basketball legend will be sharing his views on the latest action for Sportsbet.io, where fans will have the opportunity to take part in some exclusive promotions.

Shane Anderson, Director Partnership, Content and Brand, Yolo Entertainment, the operator of Sportsbet.io, added,

“We’d like to give a huge Sportsbet.io welcome to Tristan, an elite athlete whose passion for both basketball and cryptocurrency makes him a perfect match for us. We’re thrilled to have him on the team, and we already have some exciting plans in the works. Watch this space.”

Matthew D’Emanuele, CEO at Yolo Entertainment, the operator of Sportsbet.io, added:

“We’d like to give a huge Sportsbet.io welcome to Tristan, an elite athlete whose passion for both basketball and cryptocurrency makes him a perfect match for us. We’re thrilled to have him on the team, and we already have some exciting plans in the works. Watch this space.”

Thompson’s crypto credentials are already well established; he’s been a vocal supporter of Bitcoin, and recently celebrated as it reached a new all-time high in price. He will be providing weekly betting tips on a range of sports, including NFL, MLB, European soccer, tennis, golf, UFC and boxing.

The partnership with Thompson marks another exciting new chapter for Sportsbet.io, which has earned a reputation for both its innovative approach to gaming, and its star-studded line-up of ambassadors, including World Cup winning Brazilian footballer Denilson, Kenyan rapper King Kaka and many more.

Sportsbet.io is also an official partner of LALIGA and Newcastle United.

About Sportsbet.io

Founded in 2016 as part of Yolo Group, Sportsbet.io is the leading crypto sportsbook. Sportsbet.io has redefined the online betting space by combining cutting-edge technology, with cryptocurrency expertise and a passion for offering its players with the ultimate fun, fast and fair gaming experience.

Official Regional Partner of LALIGA, Official Betting Partner of English football team, Hull City and a Club Partner of Premier League team Newcastle United, Sportsbet.io provides an expansive range of betting action across all major sports and eSports, offering players more than 1M pre-match events per year and comprehensive in-play content.

As the first crypto sportsbook to introduce a cash out function, Sportsbet.io is recognised as a leader in both online sports betting and within the crypto community.

In December 2023, a lucky Sportsbet.io won the biggest ever online slots jackpot while playing on the site, turning a $50 spin into a prize of more than $42 million.

Sportsbet.io prides itself on its secure and trustworthy betting service, with withdrawal times of less than 90 seconds, among the fastest in the industry.

For more information about Sportsbet.io, please visit https://sportsbet.io..

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

Bitcoin can hit $700K amid currency debasement fears — BlackRock CEO

Despite a rally in the US Dollar Index and cooler-than-expected Consumer Price Index data, inflationary fears persist.

CryptoCurrency

Cryptos set for price surge: SUI, RBLK, AVAX, SHIB

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sui (SUI), Rollblock (RBLK), Avalanche (AVAX), and Shiba Inu (SHIB) listed as cryptos set for notable price surges.

Some of the top crypto projects on track for a bull run this year have already started to rally. The Sui price has an year-to-date uptick of over 300%. Avalanche is now changing hands at $37.06, which is an improvement of 23.20% in the last year.

As the meme coin craze rages on, Shiba Inu continues to lead the charge with an uptick of 124.32% on its annual chart. Shiba Inu’s community has advanced beyond meme culture with Shibarium and ShibaSwap, enhancing scalability and utility.

Rollblock is also gaining traction among top crypto holders. Its ongoing presale has raised nearly $9 million, and at a discounted price of $0.046, RBLK is tipped to surge to $0.052 by the next stage.

Rollblock joins top crypto rank amid a rally of over 250%

Rollblock is showing great potential for becoming a top crypto asset, with a 260% surge from its presale entry price of $0.01. RBLK is now changing hands at $0.046, and analysts anticipate further upside before the token launches.

Rollblock is creating a GambleFi protocol. The online gambling scene is saturated with outdated casinos that lack transparency and accountability. Rollblock introduces provably fair games where each transaction is on-chain, giving players peace of mind about their winnings.

Rollblock’s unique revenue share model, where a stake of the profits is distributed among RBLK holders, is also attractive. The presale only offers 60% of RBLK.

Investor interest in SUI increases

SUI is counted among the top crypto gainers now that its price registered a near 300% surge in the last year. A Layer-1 solution for the blockchain trilemma, SUI is a delegated proof-of-stake blockchain that promotes low-latency and high-throughput dApps.

SUI’s ecosystem is expanding with a total value lock of $2 billion, which is a 100% increase from $1 billion just three months ago. Also, SUI’s strategic partnership with Chainlalysis could strengthen its security and further attract institutional investors.

Avalanche

AVAX is at a massive 74% drop from its ATH. If AVAX recovers, holders will register a meteoric surge in their portfolios. AVAX is showing some signs of a bullish recovery, with its price increasing 23% over the last year despite a drop of 5% in the last month. AVAX’s Layer-1 ecosystem excels in terms of high throughput and low latency. MeWe, an emerging privacy-centric social network, is one of the dApps that have launched on Avalanche. Market watchers suggest this could lead to a bull run for AVAX in 2025.

Reduced selling pressure on Shiba Inu

The Ethereum-based meme coin continues to spark bullish sentiment, with its price increasing over 120% over the last year. While SHIB is down 10% in the last month, holders remain highly optimistic, with 89% expressing bullish sentiment. Whales are accumulating more SHIB, with records showing a spike in whale activity of 2,000%.

For more information on Rollblock, visit their website or socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

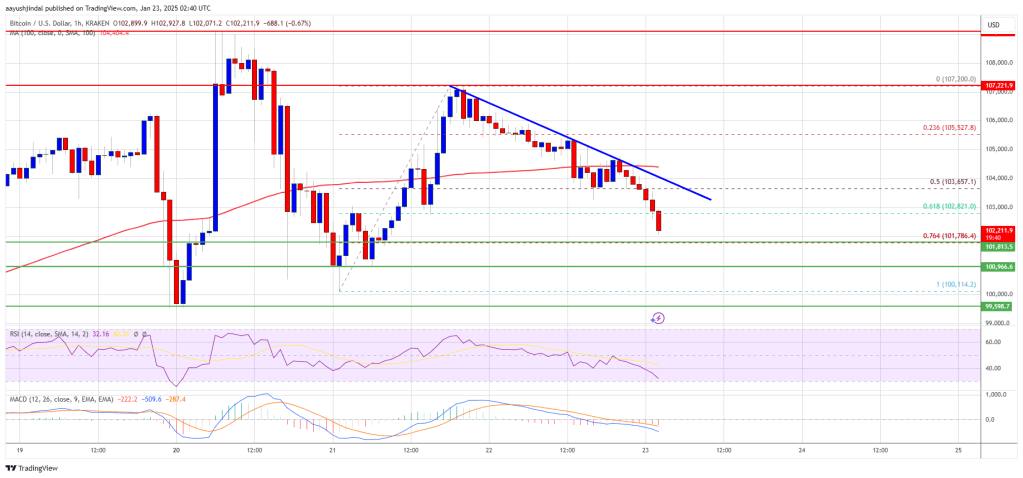

Can Bulls Defend Key Levels?

Bitcoin price struggled to clear the $107,200 resistance zone. BTC is correcting gains and might revisit the $100,000 support zone.

- Bitcoin started a downside correction from the $107,200 zone.

- The price is trading below $104,500 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance at $103,650 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $100,500 support zone.

Bitcoin Price Dips Again

Bitcoin price started a decent upward move above the $103,500 zone. BTC was able to climb above the $104,500 and $105,000 levels.

The bulls even pushed the price above the $106,000 level. However, the bears were active near the $107,200 zone. A high was formed at $107,200 and the price is now correcting gains. There was a move below the $105,000 level.

There was a move below the 50% Fib retracement level of the upward move from the $100,114 swing low to the $107,200 high. Bitcoin price is now trading below $104,500 and the 100 hourly Simple moving average.

On the upside, immediate resistance is near the $103,000 level. The first key resistance is near the $103,500 level. There is also a key bearish trend line forming with resistance at $103,650 on the hourly chart of the BTC/USD pair. A clear move above the $103,650 resistance might send the price higher. The next key resistance could be $104,500.

A close above the $104,500 resistance might send the price further higher. In the stated case, the price could rise and test the $107,200 resistance level and a new all-time high. Any more gains might send the price toward the $112,500 level.

More Losses In BTC?

If Bitcoin fails to rise above the $104,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $101,750 level or the 76.4% Fib retracement level of the upward move from the $100,114 swing low to the $107,200 high. The first major support is near the $100,500 level.

The next support is now near the $100,000 zone. Any more losses might send the price toward the $88,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $101,650, followed by $100,500.

Major Resistance Levels – $103,650 and $104,500.

CryptoCurrency

Grant Cardone Wants to Use Real Estate Cash Flow to Buy Bitcoin. Here’s How

Grant Cardone is the founder and CEO of Cardone Capital, a firm that manages about $5 billion in real estate. And he just introduced a new fund that invests property-generated cash flow into bitcoin (BTC).

“Nobody else has ever done this to scale. Nobody’s ever done this particular model,” Cardone told CoinDesk in an interview. “And the response from our investors is phenomenal.”

“There’s a buddy of mine who’s known me for 15 years. He’s never invested a penny with me. He’s also never bought any bitcoin. He told me bitcoin was too risky, and the real estate was too slow. When I showed him the fund, he put $15 million in the deal,” Cardone said.

How does it work?

For his pilot project, Cardone bought an apartment complex on the Space Coast in Melbourne, Florida, for $72 million, and ploughed an extra $15 million in bitcoin into the fund, for a total of $88 million. The cash flow generated by the property will be dollar-cost averaged into bitcoin every month for the next four years — or at least until the fund’s asset ratio, currently at 85% real estate and 15% bitcoin, shifts to 70% real estate and 30% bitcoin.

If the top cryptocurrency, now trading for $104,000, reaches the $158,000 mark within a year, the entire fund will grow by 25% in value. If it reaches $251,000 in two years, that number shoots up to 61%. Cardone’s projections assume that bitcoin will hit $1 million per coin within the next five years, and keep going up after that.

And his ambition is to roll out 10 other such projects before June, for a grand total investment of $1 billion. If bitcoin rises according to Cardone’s projections, Cardone Capital may end up with a bitcoin reserve potentially worth hundreds of millions of dollars solely off the back of its real estate cash flow.

Taking a page out of Saylor’s book

Cardone has been buying real estate for 30 years, and he’s famous for it, with over 4.8 million followers on Instagram, 2.7 million on YouTube, and 1.1 million on X. Cardone Capital manages 15,000 units — 6,000 of which belong to Cardone himself, and 9,000 of which have been crowdfunded across 18,400 investors, accredited or not. The firm distributes $80 million a year in dividends, and its last six deals were all paid in cash. “We don’t take institutional money,” Cardone said. “No sovereign funds, no Wall Street.”

“I am definitely a risk-taker, but I’m a real estate guy, so compared to the degenerates in the blockchain industry, I am so conservative, it’s unbelievable,” Cardone said. Despite studying bitcoin for seven years, he did not see a way to combine real estate and bitcoin until MicroStrategy (MSTR) co-founder Michael Saylor suggested the model to him. “This is really a version of what he’s doing at MicroStrategy,” Cardone said.

One of the advantages of the real estate-bitcoin fund is that it allows the firm to raise capital much faster. Not only are investors piling into the initiative, but Cardone plans on issuing corporate bonds to get some long-term, cheap money, and somewhat replicate Saylor’s convertible note formula.

He also wants to put up combined mortgages against the projects. Bitcoin mortgage products do not yet exist, he noted, but Cardone expects that to change after he’s done plowing hundreds of millions of dollars into these hybrid projects. “$700 million worth of real estate paid for with cash, $300 million worth of bitcoin, and no debt. Who wouldn’t give me a loan for $500 million against the combination?” he said. “I’m talking about very friendly long-term debt, no margin calls. Seven to 10 years.”

Not to mention the possibility of the firm going public, which Cardone says could occur in 2026.

Cardone plans to buy bitcoin in a price-agnostic way — meaning that he won’t be focused on buying dips, but will simply purchase bitcoin within 72 hours of the monthly distributions coming in. Nor will the firm take exposure to bitcoin through any spot exchange-traded funds (ETFs); the plan is to hold the cryptocurrency through an institutional custodian.

Does he ever plan on selling? Not in the immediate future. But he still has concerns about the growing frenzy surrounding cryptocurrencies.

“The place I’m at in my life, I can take this chance. I don’t need more cash flow,” Cardone said. “But if you’re 25 years old and you’re trying to get some cash flow for life, bitcoin is not a solution. It’s a bet, it’s a gamble, and you got to pay rent, you got to take care of your family, you got to pay your bills. And bitcoin just doesn’t do that.”

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login