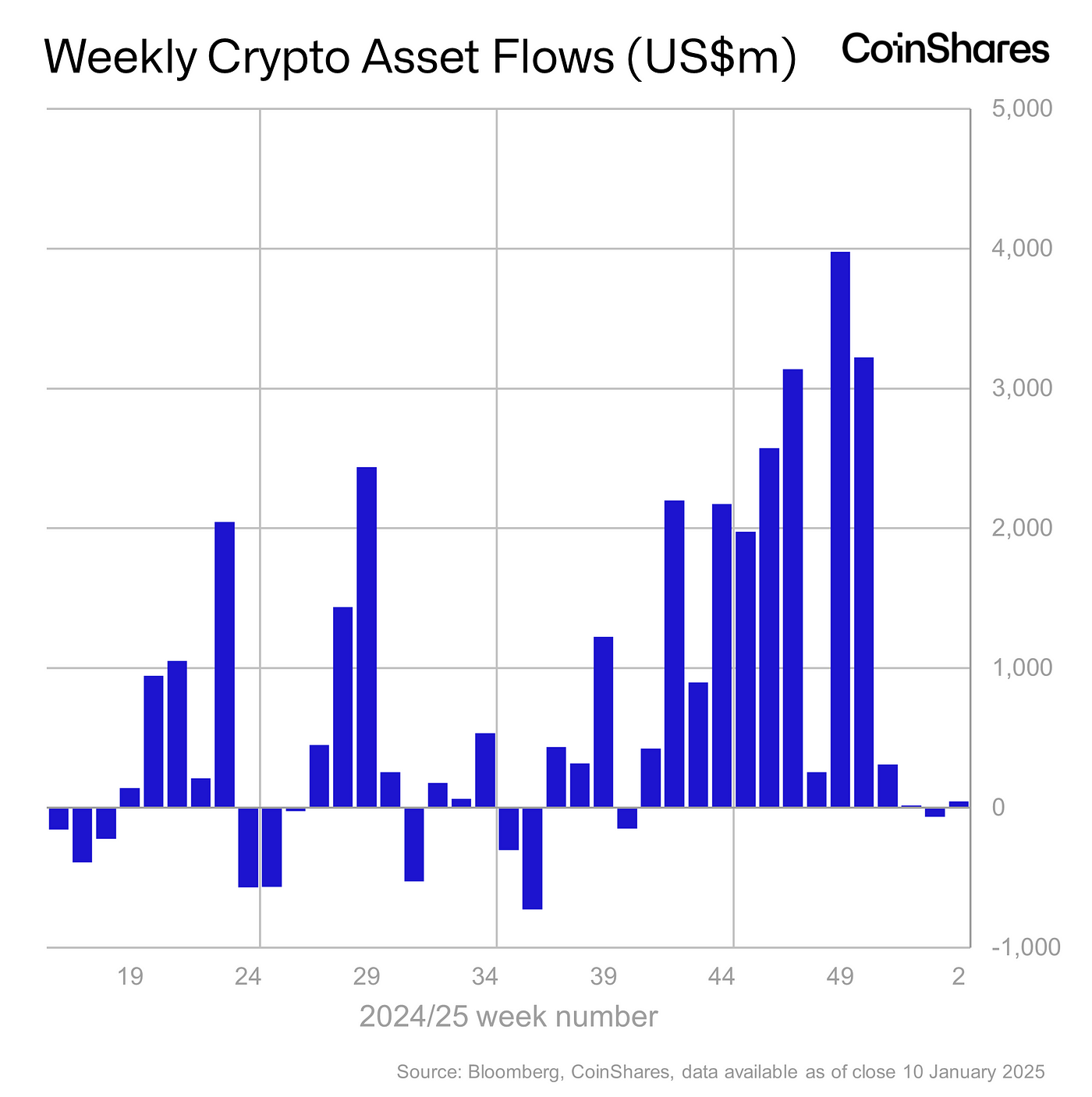

Macroeconomic signals drove sharp reversals in crypto flows last week, CoinShares reports, with $940 million in outflows wiping out early inflows.

Digital asset investment products saw $48 million in net inflows, but nearly $1 billion that poured in earlier in the week was offset by $940 million in outflows as fresh economic data and hawkish Federal Reserve minutes rattled investors, said James Butterfill, head of research at CoinShares, in a Jan. 13 research report.

Bitcoin (BTC) led with $214 million in inflows but faced the largest outflows among digital assets later in the week. Butterfill notes that despite the outflows, BTC remains the “best-performing asset with $799 million in inflows year-to-date.”

Ethereum (ETH) faced a challenging week, with $256 million in outflows, which Butterfill linked to the broader tech sell-off rather than issues specific to Ethereum. At the same time, Solana (SOL) remained resilient, attracting $15 million in inflows.

XRP (XRP) attracted $41 million in inflows, driven by “political and legal factors,” Butterfill says, noting that inflows suggest “heightened optimism ahead of the Jan. 15 SEC appeal deadline.”

Several altcoins posted inflows despite weak price performance. For instance, Aave (AAVE), Stellar (XLM), and Polkadot (DOT) were standouts, drawing $2.9 million, $2.7 million, and $1.6 million, respectively. Butterfill says the latest figures show that the post-U.S. election “honeymoon is clearly over,” adding further that “macroeconomic data is once again a key driver of asset prices.”

+ There are no comments

Add yours