CryptoCurrency

New Calamos ETF Promises 100% Downside Protection Against Bitcoin (BTC) Price Volatility

A new exchange-traded fund (ETF) by global investment management firm Calamos that promises to protect investors from the volatility in bitcoin’s price hit the market on Wednesday.

CBOJ, the first of three ETFs, provides investors with 100% downside protection while offering 10% to 11.5% upside potential over a one-year period, according to a press release. A representative of Calamos told CoinDesk that as of 12:11 p.m. ET, the ETF traded roughly 635,714 shares.

The other two funds, CBXJ and CBTJ, set to launch on Feb. 4, will provide 90% and 80% protection, respectively, with capped upside of 28% to 30% and 50% to 55%.

Downside protection is achieved through investments in U.S. Treasuries and options on Bitcoin index derivatives. The upside cap is set annually, and the period is reset every year with new terms.

In simple terms, if an investor bought $100 worth of shares in the ETF, Calamos would put a percentage of that in Treasury bonds that would grow back to $100 over a one-year period, ensuring that regardless of where the price of bitcoin stands at the time, the investor has the full $100.

The rest is used to buy options linked to the price of bitcoin, allowing exposure to the cryptocurrency while not directly owning it.

This safety blanket doesn’t come cheap, however. The management fee for the ETFs is set at 0.69%, higher than that of other ETFs that invest in bitcoin. The average fee for U.S.-based ETFs is about 0.51%, making these ETFs a bit expensive for investors. However, the higher price might be worth paying for investors looking for safety from the volatile digital assets market.

While “bitcoin maxis” and other investors believe in the long-term value increase of bitcoin, many, especially traditional institutional investors, worry about bitcoin’s volatility and periods of complete free-fall.

One question that may arise from the mechanics of the ETF is whether it would compete with MicroStrategy’s (MSTR) convertible bonds, as both offer some downside protections. However, according to CoinDesk analyst James VanStraten, that’s not the case. MSTR’s notes differ from Calamos’ ETF in that they don’t have a cap on the upside potential. If certain criteria are met, those get converted into equities, resulting in potentially higher risk but more upside.

ETFs protecting against the downside have, therefore, become a popular innovation by issuers in recent months, leading up to crypto-friendly President Donald Trump’s inauguration. This has spurred hope that many of those ETF applications will receive approval under the new Securities and Exchange Commission.

Crypto asset manager Bitwise revamped three of its futures-based crypto ETFs in October to include exposure to Treasuries to protect against crypto price drops. The funds will, therefore, rotate between investing in crypto and Treasuries depending on market signals.

CryptoCurrency

CME Says XRP, SOL Futures Leak Was an Error, No Decisions Are Made

An earlier leak on the website of Chicago Mercantile Exchange (CME) showing regulated XRP (XRP) and Solana (SOL) futures could start trading on Feb. 10 pending regulatory approval was an “error,” a representative of the company told CoinDesk.

“A beta page from our website was released in error earlier today,” the spokesperson said. “Many mock-ups are included in that test environment. No decisions have been made regarding XRP or SOL futures contracts.”

A screenshot of a beta page for XRP (XRP) and Solana (SOL) futures contracts was posted on X earlier on Wednesday, sparking rumors that the exchange might get ready to list those investment vehicles on Feb. 10.

Both tokens jumped as much as 3% following the post, before paring some of their gains.

CryptoCurrency

NBA star Tristan Thompson Signs for Sportsbet.io

NBA superstar Tristan Thompson is the latest big name to partner with Sportsbet.io, the world’s favorite crypto-first sports betting site, as its newest global ambassador.

Thompson, a Cleveland Cavaliers center and 2016 NBA Championship winner, will bring his star power and passion for cryptocurrency to the Sportsbet.io community for the next two years.

The Canadian basketball legend will be sharing his views on the latest action for Sportsbet.io, where fans will have the opportunity to take part in some exclusive promotions.

Shane Anderson, Director Partnership, Content and Brand, Yolo Entertainment, the operator of Sportsbet.io, added,

“We’d like to give a huge Sportsbet.io welcome to Tristan, an elite athlete whose passion for both basketball and cryptocurrency makes him a perfect match for us. We’re thrilled to have him on the team, and we already have some exciting plans in the works. Watch this space.”

Matthew D’Emanuele, CEO at Yolo Entertainment, the operator of Sportsbet.io, added:

“We’d like to give a huge Sportsbet.io welcome to Tristan, an elite athlete whose passion for both basketball and cryptocurrency makes him a perfect match for us. We’re thrilled to have him on the team, and we already have some exciting plans in the works. Watch this space.”

Thompson’s crypto credentials are already well established; he’s been a vocal supporter of Bitcoin, and recently celebrated as it reached a new all-time high in price. He will be providing weekly betting tips on a range of sports, including NFL, MLB, European soccer, tennis, golf, UFC and boxing.

The partnership with Thompson marks another exciting new chapter for Sportsbet.io, which has earned a reputation for both its innovative approach to gaming, and its star-studded line-up of ambassadors, including World Cup winning Brazilian footballer Denilson, Kenyan rapper King Kaka and many more.

Sportsbet.io is also an official partner of LALIGA and Newcastle United.

About Sportsbet.io

Founded in 2016 as part of Yolo Group, Sportsbet.io is the leading crypto sportsbook. Sportsbet.io has redefined the online betting space by combining cutting-edge technology, with cryptocurrency expertise and a passion for offering its players with the ultimate fun, fast and fair gaming experience.

Official Regional Partner of LALIGA, Official Betting Partner of English football team, Hull City and a Club Partner of Premier League team Newcastle United, Sportsbet.io provides an expansive range of betting action across all major sports and eSports, offering players more than 1M pre-match events per year and comprehensive in-play content.

As the first crypto sportsbook to introduce a cash out function, Sportsbet.io is recognised as a leader in both online sports betting and within the crypto community.

In December 2023, a lucky Sportsbet.io won the biggest ever online slots jackpot while playing on the site, turning a $50 spin into a prize of more than $42 million.

Sportsbet.io prides itself on its secure and trustworthy betting service, with withdrawal times of less than 90 seconds, among the fastest in the industry.

For more information about Sportsbet.io, please visit https://sportsbet.io..

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

Bitcoin can hit $700K amid currency debasement fears — BlackRock CEO

Despite a rally in the US Dollar Index and cooler-than-expected Consumer Price Index data, inflationary fears persist.

CryptoCurrency

Cryptos set for price surge: SUI, RBLK, AVAX, SHIB

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sui (SUI), Rollblock (RBLK), Avalanche (AVAX), and Shiba Inu (SHIB) listed as cryptos set for notable price surges.

Some of the top crypto projects on track for a bull run this year have already started to rally. The Sui price has an year-to-date uptick of over 300%. Avalanche is now changing hands at $37.06, which is an improvement of 23.20% in the last year.

As the meme coin craze rages on, Shiba Inu continues to lead the charge with an uptick of 124.32% on its annual chart. Shiba Inu’s community has advanced beyond meme culture with Shibarium and ShibaSwap, enhancing scalability and utility.

Rollblock is also gaining traction among top crypto holders. Its ongoing presale has raised nearly $9 million, and at a discounted price of $0.046, RBLK is tipped to surge to $0.052 by the next stage.

Rollblock joins top crypto rank amid a rally of over 250%

Rollblock is showing great potential for becoming a top crypto asset, with a 260% surge from its presale entry price of $0.01. RBLK is now changing hands at $0.046, and analysts anticipate further upside before the token launches.

Rollblock is creating a GambleFi protocol. The online gambling scene is saturated with outdated casinos that lack transparency and accountability. Rollblock introduces provably fair games where each transaction is on-chain, giving players peace of mind about their winnings.

Rollblock’s unique revenue share model, where a stake of the profits is distributed among RBLK holders, is also attractive. The presale only offers 60% of RBLK.

Investor interest in SUI increases

SUI is counted among the top crypto gainers now that its price registered a near 300% surge in the last year. A Layer-1 solution for the blockchain trilemma, SUI is a delegated proof-of-stake blockchain that promotes low-latency and high-throughput dApps.

SUI’s ecosystem is expanding with a total value lock of $2 billion, which is a 100% increase from $1 billion just three months ago. Also, SUI’s strategic partnership with Chainlalysis could strengthen its security and further attract institutional investors.

Avalanche

AVAX is at a massive 74% drop from its ATH. If AVAX recovers, holders will register a meteoric surge in their portfolios. AVAX is showing some signs of a bullish recovery, with its price increasing 23% over the last year despite a drop of 5% in the last month. AVAX’s Layer-1 ecosystem excels in terms of high throughput and low latency. MeWe, an emerging privacy-centric social network, is one of the dApps that have launched on Avalanche. Market watchers suggest this could lead to a bull run for AVAX in 2025.

Reduced selling pressure on Shiba Inu

The Ethereum-based meme coin continues to spark bullish sentiment, with its price increasing over 120% over the last year. While SHIB is down 10% in the last month, holders remain highly optimistic, with 89% expressing bullish sentiment. Whales are accumulating more SHIB, with records showing a spike in whale activity of 2,000%.

For more information on Rollblock, visit their website or socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

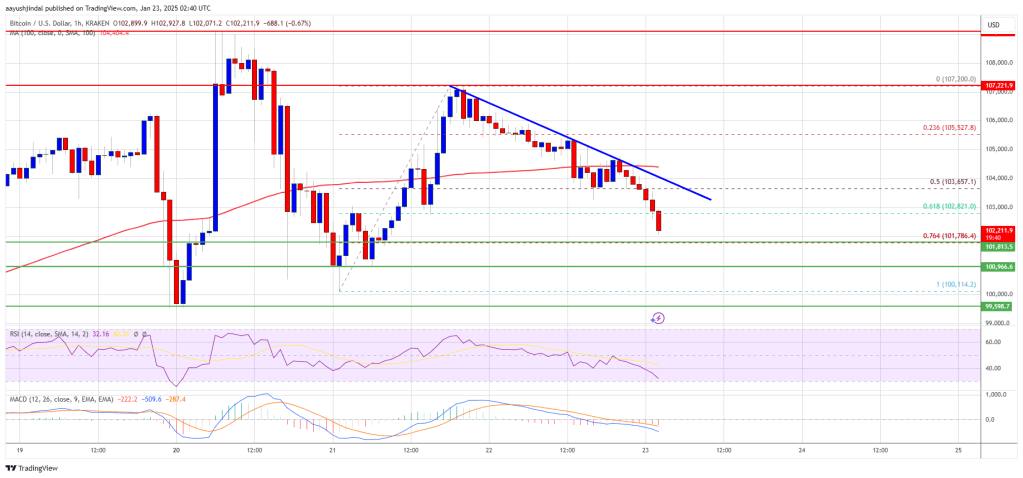

Can Bulls Defend Key Levels?

Bitcoin price struggled to clear the $107,200 resistance zone. BTC is correcting gains and might revisit the $100,000 support zone.

- Bitcoin started a downside correction from the $107,200 zone.

- The price is trading below $104,500 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance at $103,650 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $100,500 support zone.

Bitcoin Price Dips Again

Bitcoin price started a decent upward move above the $103,500 zone. BTC was able to climb above the $104,500 and $105,000 levels.

The bulls even pushed the price above the $106,000 level. However, the bears were active near the $107,200 zone. A high was formed at $107,200 and the price is now correcting gains. There was a move below the $105,000 level.

There was a move below the 50% Fib retracement level of the upward move from the $100,114 swing low to the $107,200 high. Bitcoin price is now trading below $104,500 and the 100 hourly Simple moving average.

On the upside, immediate resistance is near the $103,000 level. The first key resistance is near the $103,500 level. There is also a key bearish trend line forming with resistance at $103,650 on the hourly chart of the BTC/USD pair. A clear move above the $103,650 resistance might send the price higher. The next key resistance could be $104,500.

A close above the $104,500 resistance might send the price further higher. In the stated case, the price could rise and test the $107,200 resistance level and a new all-time high. Any more gains might send the price toward the $112,500 level.

More Losses In BTC?

If Bitcoin fails to rise above the $104,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $101,750 level or the 76.4% Fib retracement level of the upward move from the $100,114 swing low to the $107,200 high. The first major support is near the $100,500 level.

The next support is now near the $100,000 zone. Any more losses might send the price toward the $88,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $101,650, followed by $100,500.

Major Resistance Levels – $103,650 and $104,500.

CryptoCurrency

Grant Cardone Wants to Use Real Estate Cash Flow to Buy Bitcoin. Here’s How

Grant Cardone is the founder and CEO of Cardone Capital, a firm that manages about $5 billion in real estate. And he just introduced a new fund that invests property-generated cash flow into bitcoin (BTC).

“Nobody else has ever done this to scale. Nobody’s ever done this particular model,” Cardone told CoinDesk in an interview. “And the response from our investors is phenomenal.”

“There’s a buddy of mine who’s known me for 15 years. He’s never invested a penny with me. He’s also never bought any bitcoin. He told me bitcoin was too risky, and the real estate was too slow. When I showed him the fund, he put $15 million in the deal,” Cardone said.

How does it work?

For his pilot project, Cardone bought an apartment complex on the Space Coast in Melbourne, Florida, for $72 million, and ploughed an extra $15 million in bitcoin into the fund, for a total of $88 million. The cash flow generated by the property will be dollar-cost averaged into bitcoin every month for the next four years — or at least until the fund’s asset ratio, currently at 85% real estate and 15% bitcoin, shifts to 70% real estate and 30% bitcoin.

If the top cryptocurrency, now trading for $104,000, reaches the $158,000 mark within a year, the entire fund will grow by 25% in value. If it reaches $251,000 in two years, that number shoots up to 61%. Cardone’s projections assume that bitcoin will hit $1 million per coin within the next five years, and keep going up after that.

And his ambition is to roll out 10 other such projects before June, for a grand total investment of $1 billion. If bitcoin rises according to Cardone’s projections, Cardone Capital may end up with a bitcoin reserve potentially worth hundreds of millions of dollars solely off the back of its real estate cash flow.

Taking a page out of Saylor’s book

Cardone has been buying real estate for 30 years, and he’s famous for it, with over 4.8 million followers on Instagram, 2.7 million on YouTube, and 1.1 million on X. Cardone Capital manages 15,000 units — 6,000 of which belong to Cardone himself, and 9,000 of which have been crowdfunded across 18,400 investors, accredited or not. The firm distributes $80 million a year in dividends, and its last six deals were all paid in cash. “We don’t take institutional money,” Cardone said. “No sovereign funds, no Wall Street.”

“I am definitely a risk-taker, but I’m a real estate guy, so compared to the degenerates in the blockchain industry, I am so conservative, it’s unbelievable,” Cardone said. Despite studying bitcoin for seven years, he did not see a way to combine real estate and bitcoin until MicroStrategy (MSTR) co-founder Michael Saylor suggested the model to him. “This is really a version of what he’s doing at MicroStrategy,” Cardone said.

One of the advantages of the real estate-bitcoin fund is that it allows the firm to raise capital much faster. Not only are investors piling into the initiative, but Cardone plans on issuing corporate bonds to get some long-term, cheap money, and somewhat replicate Saylor’s convertible note formula.

He also wants to put up combined mortgages against the projects. Bitcoin mortgage products do not yet exist, he noted, but Cardone expects that to change after he’s done plowing hundreds of millions of dollars into these hybrid projects. “$700 million worth of real estate paid for with cash, $300 million worth of bitcoin, and no debt. Who wouldn’t give me a loan for $500 million against the combination?” he said. “I’m talking about very friendly long-term debt, no margin calls. Seven to 10 years.”

Not to mention the possibility of the firm going public, which Cardone says could occur in 2026.

Cardone plans to buy bitcoin in a price-agnostic way — meaning that he won’t be focused on buying dips, but will simply purchase bitcoin within 72 hours of the monthly distributions coming in. Nor will the firm take exposure to bitcoin through any spot exchange-traded funds (ETFs); the plan is to hold the cryptocurrency through an institutional custodian.

Does he ever plan on selling? Not in the immediate future. But he still has concerns about the growing frenzy surrounding cryptocurrencies.

“The place I’m at in my life, I can take this chance. I don’t need more cash flow,” Cardone said. “But if you’re 25 years old and you’re trying to get some cash flow for life, bitcoin is not a solution. It’s a bet, it’s a gamble, and you got to pay rent, you got to take care of your family, you got to pay your bills. And bitcoin just doesn’t do that.”

CryptoCurrency

What Can Crypto Traders Learn from Traditional Forex Platforms?

When the concept of cryptocurrency was introduced back in 2009 – when the first Bitcoin whitepaper was released by the anonymous creator, Satoshi Nakamoto – its unique selling point was that it was different. By that we mean, the idea of a decentralised, peer-to-peer digital currency that could operate independently was revolutionary for the financial market.

Trading crypto, too, was a different experience compared to trading on traditional Forex platforms. Unlike Forex markets, which are heavily regulated and rely on central authorities like banks or brokers, cryptocurrency transactions are recorded on blockchain, a distributed ledger that is transparent and independent of any governing body, introducing a whole new dynamic for traders.

While this is still true today, however, as the cryptocurrency market has evolved, significant similarities between both markets have come to light. In 2025, crypto traders can learn a lot from traditional Forex platforms, with both markets having merged in terms of accessibility, tools, and strategies. Whether it’s through Forex trading apps or crypto trading platforms, traders now have access to similar features that enable them to execute trades efficiently and strategically, and if you look closely, the way in which they do so is not so different.

Learning to Manage Risk

Everyone knows that the cryptocurrency market is volatile. One day, the price of Bitcoincould be reaching a high of $106,000, the next it could have dropped down to $95,000. As a result, entering the crypto market is a risk in itself, but there are ways to mitigate that risk and ensure it never becomes too damaging.

Forex traders have long used risk management strategies to protect their capital, with stop-loss orders, take-profit orders, and position sizing being common risk management tools that can be found on Forex platforms. By setting a stop-loss at a predetermined price, traders can limit potential losses if the market moves against them. Similarly, setting take-profit orders allows traders to lock in profits when the market reaches a specific level.

These are standard practices in the traditional Forex market, and they can be beneficial practices in the crypto market too. For investors buying BTC, ETH, or any other altcoin, adopting risk management strategies can work to mitigate the high volatility and unpredictable nature of what is a very unpredictable market.

Learning to Trade Responsibly

Another thing that crypto traders can learn from traditional Forex platforms is the ability to trade responsibly. In Forex trading, emotional control and maintaining discipline are critical factors for long-term success. Provided an investor utilises a trusted, regulated platform, they should not only be receiving access to the financial market, but information and guidance on how to safely navigate that access.

To give an example, on the Exness app – one of the up-and-coming platforms for both Forex and crypto traders alike – investors can access a wide range of educational resources, including guidelines on trading psychology, discipline, and emotional control. For those asking: “is Exness legit?”, this is one of the key signifiers that a platform is committed to helping traders succeed, and it’s also must-have information in both a Forex and crypto context.

As an investor, it can be very easy to let emotions get the better of you. The fast-paced nature of both Forex and crypto markets often triggers impulsive decisions based on a range of factors, and this emotional response can easily lead to overtrading, chasing losses, or taking unnecessary risks that ultimately erode profits. Through digesting the tips and guidelines of platforms like Exness, however, it’s possible to learn how to mitigate these symptoms and make informed, strategic decisions based on fact rather than emotion.

Learning to Manage

Whether you’re a new investor in crypto or Forex – or both – you’ll learn very quickly that you are your own manager. You can follow all the necessary guidelines and steps, but ultimately, you are in charge of your portfolio, and it’s up to you to manage it effectively. One of the reasons Forex trading has become more accessible in recent years, however, is because the platforms are specifically designed to support this level of personal responsibility, offering tools and features that enable traders to take full control of their investments.

As mentioned before, this includes risk management tools, but also real time access to market data. On a Forex platform, you can track live price movements, monitor currency pair fluctuations, and follow global economic events that are bound to affect market behaviour. You can also utilise automated trading options, such as bots or algorithms that program the platform to execute trades for you based on specific criteria – helping you stick to your plan without getting swayed by emotional impulses.

In terms of the crypto market, it is these kinds of tools that you can learn from and utilise when managing your crypto portfolio. In both markets, of course, diversification is crucial in mitigating risk, but especially in the crypto-verse, this makes it harder to keep control in a volatile space and remain aware of everything going on. To succeed, it is crucial to take advantage of platforms offering this level of help, working to keep you on top of your game and flourishing, no matter where the market swings.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

Bitcoin price probably ‘chops’ in $100K–$110K range until FOMC meeting

Analysts believe US interest rates will not change, but Bitcoin price could benefit if the Federal Reserve mentions quantitative easing at the next FOMC.

CryptoCurrency

Cardano and XRP investors get in early on new wallet technology

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cardano (ADA) and XRP investors are buzzing about 1Fuel’s wallet technology, looking to get in early.

Cardano (ADA) and Ripple (XRP) are widely known for their blockchain solutions, and achieved more fame when they announced plans to collaborate. But lately, their investors have been more interested in 1Fuel (OFT), especially since its new wallet technology might transform the DeFi landscape.

This DeFi wallet is important to 1Fuel’s ecosystem, offering cross-chain transaction capability and privacy tools. With the 1Fuel presale quickly progressing, there has been a lot of excitement surrounding the public listing.

Cardano and Ripple plan collaborative projects

Recently, the founder of Cardano, Charles Hoskinson, and the CEO of Ripple, Brad Garlinghouse, announced that they have been discussing collaborations. Once this news broke out, the value of the two altcoins increased in a week. Cardano‘s price increased by 1.14% while XRP rose by 20.68%, further attracting investor interest.

This potential collaboration has caused investors to rank ADA and XRP among the best altcoins. With their rising in value, these tokens can be easily managed on wallets like MetaMask and Trust Wallet.

New wallet technology piques widespread interest

1Fuel has emerged with a new wallet technology which is attracting a lot of attention, especially from ADA and XRP whales. This technology is expected to transform the DeFi space, driving 1Fuel’s value as one of the best altcoins.

One of the best parts of this wallet is cross-chain transactions and one-click technology. This is a major advantage over platforms like MetaMask and Trust Wallet, which require multiple wallets and tokens for cross-chain swaps. With only the 1Fuel token, investors can freely send altcoins from one blockchain to another.

1Fuel is also fitted with highly advanced financial tools that make it easy to manage digital assets. These include crypto debit and credit cards, peer-to-peer (P2P) exchange, disposable wallets, and AI-driven features. With all of these, 1Fuel could be a top DEX wallet, especially as it features an inbuilt privacy mixer and cold storage. These are privacy features that are usually lacking in well-known platforms like MetaMask and Trust Wallet.

1Fuel presale sees fast progress

The 1Fuel presale has been moving at an impressive pace, which is a sign of the widespread investor interest and confidence. In just a week, stage 1 achieved 100% completion while stage 2 had a similar progress. Now it is in stage 3 and over 30% complete, selling over 146 million tokens and raising $1.4 million.

Investors can buy the token at $0.017 in stage 3. Analysts predict that 1Fuel could rise by 100x in 2025, and investors are highly anticipating long-term growth.

1Fuel’s launch

Investors are looking forward to 1Fuel’s public listing in Q2 2025. Supported by a robust DeFi ecosystem, 1Fuel could change how digital assets are managed. The exchange technology is offering an edge over widely known blockchain systems like Cardano and Ripple.

To find out more about 1Fuel, visit their website, Telegram, or X.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

2025 Will Be a Year of Self-Custody

An industry-wide debate over crypto institutional adoption and centralized custody risk will trigger a surge of interest in self-custody, OKX’s President Hong Fang said in a recent interview with CoinDesk.

While institutional adoption and the increasing popularity of crypto ETFs are a net positive for the industry, there may be a shift in industry narrative to caution against custody concentration risk, Fang argued. She predicts that most native crypto users will adopt self-custody this year.

On OKX, assets held in its self-custody wallets (almost $50 billion) exceed assets on its centralized exchange ($30.8 billion).

This series is brought to you by Consensus Hong Kong. Come and experience the most influential event in Web3 and Digital Assets, Feb.18-20. Register today and save 15% with the code CoinDesk15.

“The tension between adoption and concentration risk will come under a spotlight,” said Fang, who will be a speaker at Consensus Hong Kong in February. “Against this backdrop, I anticipate more industry campaigns to educate why self-custody is important and how to use it, and more products to make it easier for the masses to use self-custody and alleviate the risks accordingly.”

According to Fang, OKX DEX volume has increased 20 times. But she argues that DEXs and centralized exchanges are complementary.

“The crypto-native audience will want to be able to use CEX for reliability and DEX for catching innovations,” she said. “Such supply-demand dynamics will drive further adoption of DEX to enable innovation while supporting the gradual maturity of the crypto regulatory framework.”

A bitcoin strategic reserve?

A national bitcoin strategic reserve, a policy touted by the new Trump administration, would serve to centralize the leading cryptocurrency. But many in crypto doubt it will actually happen, if bettors on Polymarket are any guide (as of Jan. 22, they were putting the chances of Trump creating such a reserve in the first 100 days of his administration at just 30 percent.)

Fang agrees with this sentiment.

“I personally find it hard to believe that major sovereign countries like the U.S. will officially adopt bitcoin strategic reserve at the federal level at this stage, but it is very possible that smaller sovereign countries or states could,” she said.

But, this being crypto, anything is possible.

Very unexpected events — like a lack of follow through by the Trump administration on its crypto promises — could dampen the bull run quickly, she said. But the biggest risk according to Fang remains over-centralization.

For that risk there’s a vaccine: self-custody. Which, according to OKX, the market is quickly adopting.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login