CryptoCurrency

Retail Demand for BTC Provides Firm Underpinning in Weaker Crypto Market

By Omkar Godbole (All times ET unless indicated otherwise)

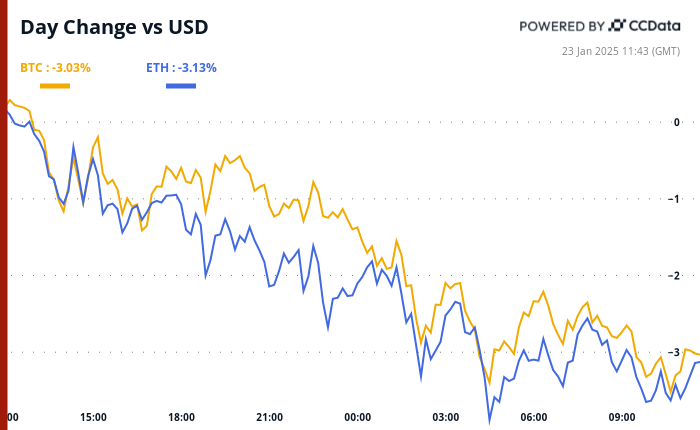

Bitcoin and most major cryptocurrencies are weaker after Chicago Mercantile Exchange, a proxy for institutional activity, denied reports of listing futures tied to XRP and SOL. Traditional markets are also holding their breath for the expected Bank of Japan interest-rate increase on Friday.

Despite BTC’s continued range play above $100,000, retail demand remains robust. Glassnode’s shrimp-Crab cohort, which includes addresses holding up to 10 BTC, have absorbed 1.9 times the newly mined supply last month, totaling over 25,600 BTC. Meanwhile, long-term holders have slowed their spending and profit-taking activities, indicating a cautious, but firm, commitment to their investments.

Still, dropping below $100,000 might prove costly. According to Wintermute’s OTC trader Jake Ostrovskis, that would “frame Monday’s inauguration as a sell-the-news event and the narrative could switch pretty quickly.”

Reports suggest the number of whale wallets holding between 1 million and 10 million XRP has surged to an all-time high of 2,083, signaling increased accumulation and confidence in its future performance.

In the world of innovation, chatter around Bitcoin Synths is gaining traction on X. These synthetic assets allow users to benefit from bitcoin’s price movements without actually owning the cryptocurrency. Bitcoin Synths can be traded or used as collateral in lending protocols, avoiding the complexities associated with wrapped tokens and specialized bridges.

Ethereum layer-2 protocols are also making headlines with record transaction volumes, even as concerns about their capacity nearing limits persist.

On the macroeconomic front, recent data from the Labor Department shows that the “all tenant rent” index, an indicator of shelter inflation in the Consumer Price Index (CPI), rose at a slower pace last quarter. The data suggest that recent worries about inflation may be overdone and the Fed could pivot away from its hawkish forecast, which would be a positive sign for risk assets. Stay alert!

What to Watch

- Crypto

- Macro

- Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

- Initial Jobless Claims Est. 215K vs. Prev. 217K.

- Jan. 23, 10:00 a.m.: The National Association of Realtors releases December 2024 U.S. Existing Home Sales report.

- Existing Home Sales Est. 4.16M vs. Prev. 4.15M.

- Existing Home Sales MoM Prev. 4.8%.

- Jan. 23, 4:30 p.m.: The Fed releases the H.4.1 report, the central bank balance sheet, for the week ended Jan. 22.

- Total Reserves Prev. $6.83T.

- Jan. 23, 6:30 p.m.: Japan’s Ministry of Internal Affairs and Communications releases December 2024’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. 0.6%.

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.7%.

- Inflation Rate YoY Prev. 2.9%.

- Jan. 23, 10:00 p.m.: The Bank of Japan (BoJ) releases Statement on Monetary Policy.

- Interest Rate Decision Est. 0.5% vs. Prev. 0.25%.

- Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

Token Events

- Governance votes & calls

- Morpho DAO is discussing reducing incentives by 30% across all networks and assets.

- Yearn DAO is discussing funding and endorsing a subDAO called Bearn to focus on building and launching products on Berachain.

- Frax DAO is discussing a $5 million investment in World Liberty Financial (WLFI), the crypto project backed by the family of U.S. President Donald Trump.

- Jan. 23: Livepeer (LPT) is hosting a Core Dev call.

- Jan. 24: Arbitrum BoLD’s activation vote deadline. BoLD allows anyone to participate in validation and defend against malicious claims to an Arbitrum chain’s state.

- Jan. 24: Hedera (HBAR) is hosting a community call at 11 a.m.

- Unlocks

- Jan. 31: Optimism (OP) to unlock 2.32% of circulating supply worth $52.9 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Token Launches

- Jan. 23: Sky (SKY) is being listed on Bitget.

- Jan. 23: Animecoin (ANIME) is launching, with claims starting at 8 a.m. The token will be listed on multiple exchanges including Binance, OKX and KuCoin.

Conferences:

Token Talk

By Francisco Rodrigues

- Azuki, a non-fungible token (NFT) collection, is introducing its Animecoin (ANIME) today on Ethereum and Arbitrum. The token was announced on Jan. 13.

- An airdrop will encompass Azuki NFT holders, Hyperliquid HYPE stakes, some Arbitrum ecosystem participants and Kaito yappers.

- It will also include certain anime communities and BNB token holders who, between Jan. 17 and Jan. 20, subscribed to Simple Earn with their tokens on Binance.

- The debut builds on a growing trend of NFT collections launching their own tokens, a trend that started in 2021 when Bored Ape Yacht Club (BAYC) launched ApeCoin.

- Other examples include DeGods’ DUST and Pudgy Penguins’ PENGU tokens, which have a $1.6 billion market capitalization.

- Other signs indicate the NFT market is heating up, with Nansen recently pointing out that a Crypto Punk was sold for 170 ETH (around $540,000) while an Azuki was sold for 165 ETH. The Azuki NFT had been bought a month before for 105 ETH.

Derivatives Positioning

- The cumulative volume delta indicator reveals that major cryptocurrencies, with the exception of TON, have experienced net selling pressure in the perpetual futures markets over the past 24 hours.

- Block flows on Deribit and Paradigm featured long positions in short-dated BTC puts at $100K, $95K and $70K. An entity bought ETH put at $2.9K.

- Front-end BTC and ETH calls now traded at par with puts.

Market Movements:

- BTC is down 4.1 % from 4 p.m. ET Wednesday to $102,020 (24hrs: -2.71%)

- ETH is down 3.85% at $3,206.18 (24hrs: -2.83%)

- CoinDesk 20 is down 3.61% to 3,799.21 (24hrs: -3.58%)

- CESR Composite Ether Staking Rate is down 15 bps to 3.15%

- BTC funding rate is at -0.0019% (-2.08% annualized) on OKX

- DXY is unchanged at 108.25

- Gold is down 0.35% at $2,761.10/oz

- Silver is down 0.73% to $30.57/oz

- Nikkei 225 closed up 0.79% at 39,958.87

- Hang Seng closed down 0.4% at 19,700.56

- FTSE is unchanged at 8,538.7

- Euro Stoxx 50 is unchangedat 5203.6

- DJIA closed +0.3% to 44,156.73

- S&P 500 closed +0.61% at 6,086.37

- Nasdaq closed +1.28% at 20,009.34

- S&P/TSX Composite Index closed +0.12% at 25,311.5

- S&P 40 Latin America closed +1.21% at 2,297.32

- U.S. 10-year Treasury is up 3 bps at 4.59%

- E-mini S&P 500 futures are down 0.19% to 6,109.00

- E-mini Nasdaq-100 futures are down 0.56% to 21,876.75

- E-mini Dow Jones Industrial Average Index futures are unchaged at 44,384.00

Bitcoin Stats:

- BTC Dominance: 58.59

- Ethereum to bitcoin ratio: 0.031

- Hashrate (seven-day moving average): 781 EH/s

- Hashprice (spot): $58.9

- Total Fees: 8.5 BTC/ $876,410

- CME Futures Open Interest: 188,396 BTC

- BTC priced in gold: 37.1 oz

- BTC vs gold market cap: 10.56%

Technical Analysis

- BTC’s retreat from Monday’s high is teasing a formation of a double top bearish reversal pattern.

- A move below the horizontal line would confirm the pattern, potentially bringing more chart-led sellers to the market.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $377.31 (-3.03%), down 1.89% at $370.19 in pre-market.

- Coinbase Global (COIN): closed at $295.85 (+0.56%), down 2.59% at $288.18 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$32.81 (+4.99%)

- MARA Holdings (MARA): closed at $19.69 (+0.66%), down 2.54% at $19.19 in pre-market.

- Riot Platforms (RIOT): closed at $13.14 (+3.14%), down 1.75% at $12.91 in pre-market.

- Core Scientific (CORZ): closed at $15.97 (+4.58%%), down 1.63% at $15.71 in pre-market.

- CleanSpark (CLSK): closed at $11.14 (+1.64%), down 2.51% at $10.86 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.53 (+2.24%), up 2.58% at $28.27 in pre-market.

- Semler Scientific (SMLR): closed at $62.11 (-4.36%), up 2% at $64.90 in pre-market.

- Exodus Movement (EXOD): closed at $41.00 (+2.5%), down 2.07% at $40.15 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: $248.7 million

- Cumulative net flows: $39.23 billion

- Total BTC holdings ~ 1.161 million.

Spot ETH ETFs

- Daily net flow: $70.7 million

- Cumulative net flows: $2.81 billion

- Total ETH holdings ~ 3.648 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows a spike in the number of active addresses on Solana.

- Addresses holding USDC led the growth as TRUMP token frenzy gripped the market over the weekend.

While You Were Sleeping

In the Ether

CryptoCurrency

What Is 4CHAN Crypto – Coinlabz

4CHAN hit the scene on May 3rd, 2023, aiming to be the latest meme coin sensation with a whopping 10 quadrillion tokens. Thanks to its **viral potential** and some big-name shoutouts, 4CHAN is buzzing in the crypto world.

While not as widely known as some other cryptocurrencies, it has sparked interest due to its unique features and potential for growth.

As with any investment in the cryptocurrency space, it is essential to conduct thorough research and understand the risks involved before diving in.

4chan Crypto’s impact on the digital asset landscape remains to be seen, and investors should approach it with caution and careful consideration.

Key Takeaways

- When evaluating 4chan Crypto, it is essential to assess the associated risks and potential rewards carefully.

- The token presents unique features and active community participation; however, it is important to acknowledge its limited price volatility and relatively low presence on exchanges.

- Investors are advised to approach this investment option with caution and closely monitor the token’s performance before making any decisions.

- Remaining well-informed and maintaining a vigilant stance are essential when navigating the ever-evolving and intricate realm of cryptocurrency.

4CHAN Crypto Features

4CHAN Crypto presents several distinctive features within the cryptocurrency market. These include the ability to onboard new team members, facilitate social interactions, enable event sharing, and offer event moderation tools. The platform also incorporates whitepapers that delve into event sharing capabilities, event specifics, and details on exchanges and markets, enriching user understanding.

The technical strengths of 4CHAN include a rapid and scalable platform, high transaction speeds, minimal block time latency, adaptable blockchain structures, and developer-centric features with robust support resources.

Current price of 4CHAN Token

The current price of the 4CHAN Token is $0,00000000000006661, representing a -96.50% decrease from its all-time high of $0.012338831 reached on July 21, 2023. 4CHAN holds the rank of #1990 in the cryptocurrency market cap.

Despite fluctuations, the current price indicates a level of stability relative to its historical extremes.

This pricing information is valuable for investors and stakeholders to gauge market sentiment and potential future trends. Monitoring the token’s price movements and market cap can offer insights into its performance and position in the cryptocurrency market.

What is the daily trading volume of 4Chan (4CHAN)

The recent market trends for 4CHAN Token have led to a notable increase in the daily trading volume of 4Chan (4CHAN), which now stands at $314,870.21. This surge in trading activity represents a substantial growth compared to the previous day. The 38.70% increase in daily trading volume indicates a heightened interest and participation in the token within the market.

Despite a 7-day price decline of -21.50%, the elevated trading volume suggests a potential shift in market sentiment towards 4CHAN. The token is listed on exchanges such as Uniswap V2, LBank, and DigiFinex, providing users with multiple platforms to actively trade 4CHAN. The current trading volume reflects a dynamic market environment for 4CHAN, offering traders opportunities to engage with its price movements.

Monitoring the trading volume of 4CHAN can offer valuable insights into the token’s market dynamics and community interest as it continues to navigate the cryptocurrency landscape.

What is the all-time high for 4Chan (4CHAN)

The highest price ever reached by 4CHAN was $0,000000000001252 on Jul 21, 2023. Presently, the price is down by -96.50% from this peak but remains 1,422.70% above the lowest recorded value.

What is the all-time low for 4Chan (4CHAN)

4Chan (4CHAN) experienced a significant drop to its lowest price on May 18, 2023. The token hit an all-time low of 0,000000000000005485 on that day.

The data indicates a fluctuating journey for 4Chan (4CHAN), showcasing both highs and lows within a relatively short timeframe. Investors and enthusiasts closely monitor such movements to understand the token’s volatility and potential for future growth.

Evaluating The Future Of 4CHAN Token:

In comparison to its counterparts, the future prospects of 4Chan’s token depend on its ability to reverse the substantial price decline it has undergone and regain competitiveness within the cryptocurrency sphere.

As 4Chan navigates through market obstacles, its focus on maintaining a positive price performance, boosting trading volume, and leveraging its unique characteristics could drive its future success. By capitalizing on its strengths and addressing weaknesses, 4Chan aims to position itself favorably within the competitive cryptocurrency market, attracting more participants to its ecosystem.

Should you invest in 4CHAN

Before deciding to invest in 4CHAN, it’s important to carefully consider the potential risks and rewards associated with the token. Factors such as market volatility, technical advantages, and trading options should be taken into account to determine if 4CHAN aligns with your investment objectives.

Conduct a thorough analysis of the token’s value and market dynamics to make an informed decision about investing in 4CHAN.

Pros of investing in 4CHAN

Investing in 4CHAN presents an opportunity that may appeal to investors due to its current low price and potential for gains. The token has shown a notable increase of 1,422.70% from its all-time low, indicating the possibility of significant returns.

Furthermore, the token benefits from stable liquidity of 80.85 K on Uniswap v2, providing a reliable platform for trading. From a technical perspective, 4CHAN offers a fast and scalable platform with industry-leading transaction speeds and customizable blockchain infrastructures, making it an attractive option for investors seeking to diversify their portfolio with a promising token.

Cons of investing in 4CHAN

Investing in 4CHAN presents significant risks due to its notable price volatility and the potential for substantial losses. The token has experienced drastic price swings, indicating a high level of risk and the possibility of significant financial downturns.

Its relatively low liquidity and trading volume may pose challenges when buying and selling 4CHAN, affecting the ease of transactions. Its underperformance in the global market point to instability and a lack of demand for 4CHAN within the broader cryptocurrency landscape.

The limited market activity and the narrow range of exchanges for 4CHAN could make executing trades and determining accurate prices more challenging. Concerns surrounding the token’s technical capabilities and security features also raise doubts about its underlying technology and potential vulnerabilities.

Where can you buy 4Chan

When considering the purchase of 4CHAN tokens, individuals can access them through various decentralized and centralized exchanges, such as Uniswap V2, LBank, and DigiFinex. These platforms facilitate the trading of 4CHAN tokens efficiently. To interact with 4CHAN further, users can integrate the token into their MetaMask wallet by importing it through the contract address or utilizing platforms like CoinGecko.

Frequently Asked Questions

What Is 4CHAN in Crypto?

4chan is a cryptocurrency project known for its significant volatility. Trading options, and rankings are subjects of interest for investors and analysts. Understanding the dynamics of 4chan can be beneficial for those navigating the crypto space, as it presents unique opportunities and risks.

How Much Is 4CHAN Token Worth?

The current value of 4chan token is $0,00000000000006661, with one active market listed. It includes features such as team member additions, social activity integration, event sharing, and moderation.

How to Buy 4CHAN Coin?

To purchase 4CHAN coin, you can engage in trading activities on established cryptocurrency exchanges such as Uniswap V2, LBank, or DigiFinex.

Conclusion

4chan Crypto has garnered attention within the cryptocurrency community due to its meme-based approach and unique tokenomics. Despite its appeal, the token has experienced significant price volatility, resulting in fluctuations that can present both risks and opportunities for investors.

The platform offers distinctive features such as social integration and event sharing, emphasizing community engagement and participation.

While 4CHAN’s low price and substantial liquidity may suggest potential for significant gains, it’s crucial to approach this investment with caution. The high price volatility and relatively limited market activity make it imperative to conduct thorough research and maintain a vigilant stance.

Investors should consider the token’s technical capabilities, security, and trading platforms when making investment decisions.

The future success of 4CHAN depends on its ability to regain competitiveness and attract a broader audience. Ultimately, investors should weigh the pros and cons, closely monitor the token’s performance, and assess their risk tolerance before investing in 4CHAN.

Other cryptocurrencies to check:

GROK Crypto, Everlodge crypto, TitanX Crypto, Digitoads crypto and Xen Crypto.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Binance Labs rebrands to YZi Labs with CZ at the helm

Binance Labs, the venture capital arm and incubator of Binance Holdings, is getting a fresh start as Changpeng Zhao transitions it into a family office.

On Jan. 23, Binance Labs announced its rebranding to YZi Labs and unveiled a new leadership team led by Binance founder and former CEO Changpeng Zhao, known also as CZ.

According to the announcement, CZ will run YZi Labs alongside Ella Zhang, who co-founded Binance Labs in 2018. During her tenure at the VC platform, Zhang oversaw the incubation of multiple crypto projects that have grown into top ecosystems in the market, including Polygon, Injective, Dune Analytics, Certik, and SafePal.

Under its new family office initiative, YZi Labs will expand its focus beyond cryptocurrency and blockchain. The announcement highlighted new areas of investment, including artificial intelligence, web3 and biotechnology.

“Rebranding to YZi Labs is more than a name change—it signifies an expanded vision as we broaden our horizons to include transformative sectors like AI and biotech,” CZ said.

Zhao stepped down as Binance CEO in 2023 after reaching a settlement with U.S. authorities. He also served a four-month prison sentence in the U.S. before returning to the industry following his release from a correctional facility in California on Sept. 27, 2024.

Binance’s decision to sever ties with its VC arm began taking shape after CZ’s release. In a post on X following his incarceration, Zhao stated that he would focus on “impact” investments rather than financial returns. He also announced plans for an educational project called Giggle Academy.

With YZi Labs, CZ plans to refine the venture capital unit’s incubation program, which will include reintroducing residency initiatives for project founders. The firm will also continue to support its existing portfolio of 250 projects.

CryptoCurrency

BTC Faces Massive Volatility Above $100K as Liquidations Surge to $300M

Bitcoin’s price actions were somewhat dull for most of the day, but the asset went on a wild rollercoaster in the past hour or so, pumping and dumping by several grand.

This has caused a lot of pain for over-leveraged traders, with more than 120,000 such market participants getting wrecked in the past 24 hours.

As reported earlier today, the primary cryptocurrency had started to lose traction following the Monday drop, subsequent all-time high, and yet another decline, and stood at $102,000. Its value decreased a bit more as the day progressed and slipped to $101,200.

It recovered some ground to $102,000 but then exploded out of the blue to $106,000 within minutes. This somewhat surprising rally was met by a steep rejection that pushed it south to $102,500 before the bulls sent it to $104,000 as of now.

Perhaps the most evident reason behind this substantial volatility is a cryptic couple of tweets by US Senator from Wyoming – Cynthia Lummis. The long-term BTC supporter, who has actively been pushing for a Bitcoin reserve in the US, used the asset’s logo to say, “₿ig things are coming” at 10 AM (probably EST).

Although that time has passed and there’s no big announcement yet, her comments were seen by almost 4 million people in an hour, which could explain the hype around BTC.

Fox Business’ Eleanor Terrett picked up the post and said that Lummis is likely to be voted in to become the chair of the digital asset subcommittee.

The Senate Banking Committee is set to vote at a 10AM EST markup on @SenLummis becoming chair of the digital assets subcommittee.

Unclear if anything else will be announced. https://t.co/OfTE4WHd7I

— Eleanor Terrett (@EleanorTerrett) January 23, 2025

Data from CoinGlass shows that the total value of liquidations is up to $300 million on a daily scale, with 124,000 traders wrecked within the same timeframe. The biggest liquidated position took place on OKX and was worth almost $6 million.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Best Crypto Presales to Buy Now for 100x — Larry Fink’s $700K Bitcoin Prediction

BlackRock, one of the biggest investment companies in the world, has given crypto enthusiasts a new reason to be excited. Its CEO, Larry Fink, has said that Bitcoin can be expected to make huge price moves, potentially reaching the $700K mark soon.

The BlackRock CEO explained how political and economic instability is acting as a catalyst for Bitcoin, which serves as an internationally recognized currency free from any local fears. What’s more, Bitcoin is still holding steady above $104K, with a 12% uptick in the last month.

With all the signs looking positive for BTC, and keeping in mind that the overall crypto market follows Bitcoin’s footprints, now is one of the best times to be a crypto investor. To help you out, here are 5 crypto presales that can offer up to a 100x return.

1. Wall Street Pepe ($WEPE) – Overall Best Crypto Presale for First-Time Investors

Wall Street Pepe ($WEPE) has undoubtedly been one of the best crypto presale performances to date. Launched just over a month ago, $WEPE’s presale has already raised over $57.5M, with both retailers and whales gobbling it up at a breakneck pace.

The presale ends in 24 days, so this could be your last chance to grab one of the best meme coins.

What makes Wall Street Pepe stand out is its personal vendetta against crypto whales, who have been abusing insider information to manipulate the crypto market and feast on innocent retailers.

The project aims to eliminate this lopsidedness by creating a frog army of retail investors and providing them with unique market insights, trading strategies, and real-time alpha calls.

If you, too, want to beat the market and become a profitable crypto investor, join the $WEPE army for just $0.0003665 per token. For more, here’s how to buy $WEPE.

2. Solaxy ($SOLX) – World’s First-Ever Layer 2 Solana Ecosystem

Solaxy ($SOLX) has been created to unlock the full potential of Solana, which currently struggles with issues like network congestion, failed transactions, and limited scalability. Solaxy has set aside a healthy 30% of its total token supply to resolve these issues.

After raising $350K in the first 24 hours, the $SOLX presale is still going strong, with the total presale purse reaching over $13M. Don’t miss out on one of the next 100x meme coins, and get some for only $0.001612 each. Here’s a guide on how to buy $SOLX.

3. Mind of Pepe ($MIND) – AI Agent Offering Crypto Investment Advice

MIND of Pepe ($MIND) is a self-sovereign AI agent with the ability to adapt and form his own opinions, as well as drive conversations and trends on dApps and online platforms such as X.

$MIND uses hive-mind analysis to identify market trends before anybody else. He’ll then share his insights and access to new investment opportunities on his X and Telegram channels, giving token holders a real edge in the market.

You can grab the best AI agent coin for just $0.0031762 if you get in now — here’s how to buy $MIND. Prices increase in the next 11 hours, so interested investors should hurry up.

4. Rexas Finance ($RXS) – Transforming Real-World Asset Tokenization

$RXS is the native currency of Rexas Finance, an interesting crypto project that’s tokenizing real-world assets, such as real estate, gold, art, and commodities. The biggest benefit of this platform is that it simplifies investments.

Investing in gold and other precious metals, for instance, will no longer be difficult and will involve just a few clicks.

Plus, token holders will get to participate in fractional ownership. For example, let’s say there’s a massive mansion spread across multiple acres of land, and you don’t have enough funds to buy it all by yourself.

In that case, you can use Rexas to own a fraction of the property for a fraction of the price. Speaking of $RXS’s presale, it’s coming to an end, meaning prices aren’t as low as they were, say, a couple of months ago.

However, they’re still the lowest you’ll ever get them for. Each token is priced at $0.200, with the total presale funding at $43M so far. Out of the 500,000,000 total token supply, 434,925,318 have already been sold.

5. LuckHunter ($LHUNT) – Online Casino Where You Can Create a Custom Metaverse

$LHUNT is the official token of the LuckHunter online casino. The platform itself is like any other: you can play casino games, bet, and win. However, what makes it unique is it lets you create a metaverse of your own digital casinos that you can rent.

These casinos will be based in different cities, Las Vexus and Utlantic City (modeled after the real Las Vegas and Atlantic City), and you can lease the tables at your virtual casino for short-term or long-term profits.

You can also customize the tables and ambiance and create your own gaming rules. What’s more, you can even host VIP events involving high-stakes games and special tournaments to earn luxurious rewards.

1 $LHUNT is currently available for $0.00138, but the price will increase by 10.5% as it enters the next stage of presale in just a couple of hours from now.

Having already raised $1.1M in its ongoing presale, $LHUNT’s official website mentions that its potential listing price will be $0.005, which is more than 260% of the current price.

Bottom Line

While there’s little doubt that the above-mentioned crypto presales can go to the moon in 2025, it’s important to mix caution with chaos and only invest an amount you’re comfortable losing. There will be ups and downs, so make sure you do enough cardio to prepare your heart!

Also, none of the above is financial advice, and we highly recommend doing your own research (DYOR) before investing.

CryptoCurrency

A Game-Changer for Modern Financial Advising

In today’s issue, Alec Beckman from Advantage Blockchain explains stablecoins and their growing use cases for institutions and advisors.

Then, CK Zheng from ZX Squared Capital shares tips on preparing for tax season in Ask and Expert.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Stablecoin Use Case for Advisors

One of the primary hurdles for blockchain adoption to date has been utility, especially when looking through the lens of financial advisors and how these public blockchains and decentralized finance (DeFi) protocols can impact their clients.

Stablecoins – digital currencies pegged to stable assets like the U.S. dollar – have emerged as a powerful tool for modernizing savings, payments, and settlement processes. These innovations present a significant opportunity for advisors to enhance the value they offer to clients while staying ahead of market trends.

How can advisors leverage stablecoins to streamline operations, reduce costs, and provide cutting-edge financial solutions? Here’s how stablecoins can become a transformative tool for your clients:

Savings account / going bankless

- Financial Inclusion: Stablecoins provide a way for clients to store value outside of traditional banking systems, granting access to financial services for the unbanked or underbanked. Anyone with an internet connection can use stablecoins.

- Stability: Unlike volatile cryptocurrencies, full-reserve, dollar-backed stablecoins maintain a consistent value (ex. USDC is tied to the value of $1).

- Liquidity & Accessibility: Funds in stablecoins are globally accessible 24/7, offering liquidity without dependence on conventional banking hours.

- Better Yield: Using on-chain finance, stablecoins can generate significantly more yield than a savings account (Ex. Coinbase offers slightly over 4% APY, beating traditional savings accounts).

- Self Custody: Many people, including myself, have been held up by a third-party custodian or bank. If someone can keep you from spending/sending money, it is not your money. The ability to self custody your own assets provides a more seamless way of transacting your own funds.

Payments

- Efficiency: Transactions using stablecoins are fast and cost-effective with no global restrictions, relevant for those sending payments domestically or cross-border.

- Value Retention: The stability of these digital assets ensures that the amount sent is equal to the amount received.

- Adoption by Institutions: Financial institutions are recognizing stablecoins as a complementary payment system, signaling growing mainstream acceptance.

- Adoption by Commerce: Stablecoins are less costly and more efficient than credit card payments for merchants.

Settlement

- Instantaneous Transactions: Settlements via stablecoins are near instantaneous, improving liquidity and reducing counterparty risks for clients managing high-value transactions.

- Lower Costs: By eliminating traditional clearing and settlement processes, stablecoins significantly reduce fees.

- Global Versatility: Whether your clients are trading internationally or managing investments across borders, stablecoins streamline and simplify the settlement process.

Real-world application: SpaceX’s strategic use of stablecoins

SpaceX uses stablecoins to manage foreign exchange (FX) risks from its global Starlink operations. SpaceX shields itself from FX volatility by collecting payments in various currencies and converting them into stablecoins. The stablecoins, pegged to the U.S. dollar, provide a stable intermediary before being converted back to dollars.

This approach offers several advantages:

- Reduced Currency Risk

- Enhanced Efficiency

- Liquidity Preservation

This strategy demonstrates how stablecoins can be a powerful tool for multinational corporations and can be applied to managing client portfolios.

Why This Matters to You and Your Clients For financial advisors, stablecoins can elevate portfolios and modernize financial strategies. These assets aren’t just a novelty – they’re a bridge to a more inclusive, efficient, and adaptable financial future. By integrating stablecoins into conversations about savings, payments, or settlements, you position yourself as a forward-thinking advisor prepared to navigate these changes.

– Alec Beckman, president, Advantage Blockchain

Ask an Expert

Q: What’s the 101 on stablecoins and liquidity?

The stablecoin market cap has reached a record $215 billion, predominantly concentrated in the two coins Tether and USDC, having a combined 85% of the market cap. The liquidity of the stablecoin market stays healthy as more stablecoin issuers such as Visa, Stripe, and PayPal enter this unique digital asset sub-class. Given the new Trump administration’s pro-crypto attitude, we expect more crypto-friendly rules and regulations for this asset in the coming months, which will support the further growth of the stablecoin market.

Q: Are stablecoins risky compared to traditional finance (TradFi)?

Stablecoins are typically designed to stay pegged to the U.S. dollar (though they don’t need to be). The functionality of stablecoins in the crypto market is comparable to money market funds in the traditional financial market. The money market funds have reached a $10 trillion market cap, which serves the purpose of short-term investment and a place to park money. Stablecoins will serve a similar purpose in the digital asset space. The quality and liquidity of the issuer’s holdings of fiat-denominated short-term assets are some of the critical risks associated with stablecoins, especially when the financial market is under great stress.

Q: Do country borders matter when it comes to stablecoins?

Country borders matter greatly as different countries may have different rules, regulations and license requirements for the stablecoin market. One of the key regulatory requirements associated with stablecoins is around the stability, liquidity, disclosure and transparency of the short-term assets the issuers hold for the underlying stablecoins.

– CK Zheng, co-founder & CIO, ZX Squared Capital

Keep Reading

CryptoCurrency

Bitcoin Deep Dive Data Analysis & On-Chain Roundup

Bitcoin appears poised for significant upside movement following a strong start to 2025. However, questions remain about the market’s overall health and whether the current bullish momentum can be sustained over the coming weeks and months. Here, we’ll take an unbiased and data-driven look into the underlying numbers supporting our current trend.

For a more in-depth look into this topic, check out a recent YouTube video here: Bitcoin Data Driven Analysis & On-Chain Roundup

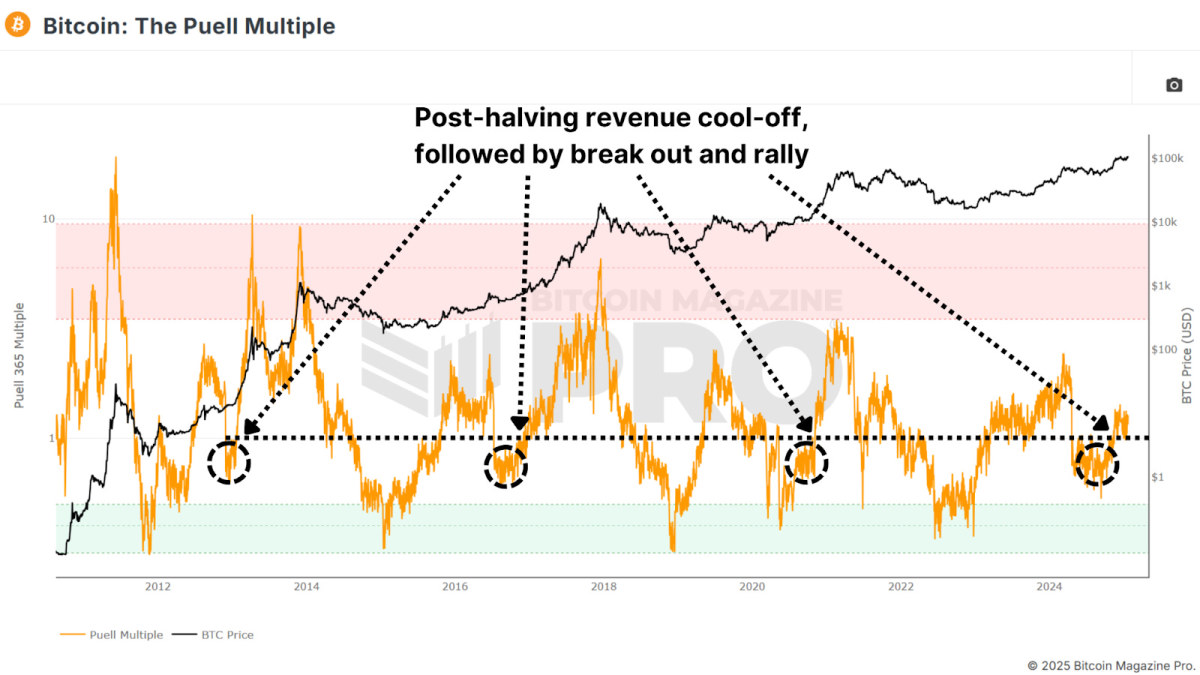

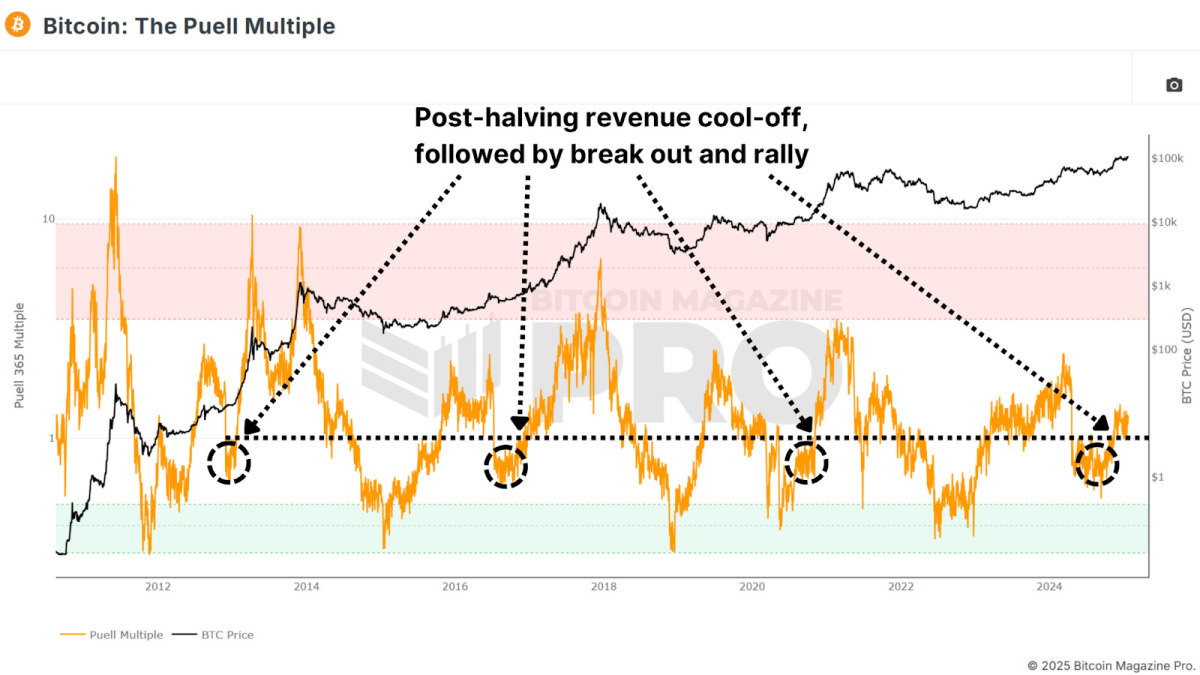

Miner Recovery

The Puell Multiple, a measure comparing miners’ daily USD revenue to its yearly average, suggests that Bitcoin’s fundamental network strength remains strong. Historically, after a halving event, miner revenue experiences a significant dip due to the 50% block reward reduction. However, the Puell Multiple recently climbed above the key value of 1, indicating a recovery and a potentially bullish phase.

Previous cycles show that crossing and retesting the value of 1 often precedes major price rallies. This pattern is repeating, signaling strong market support from mining activity.

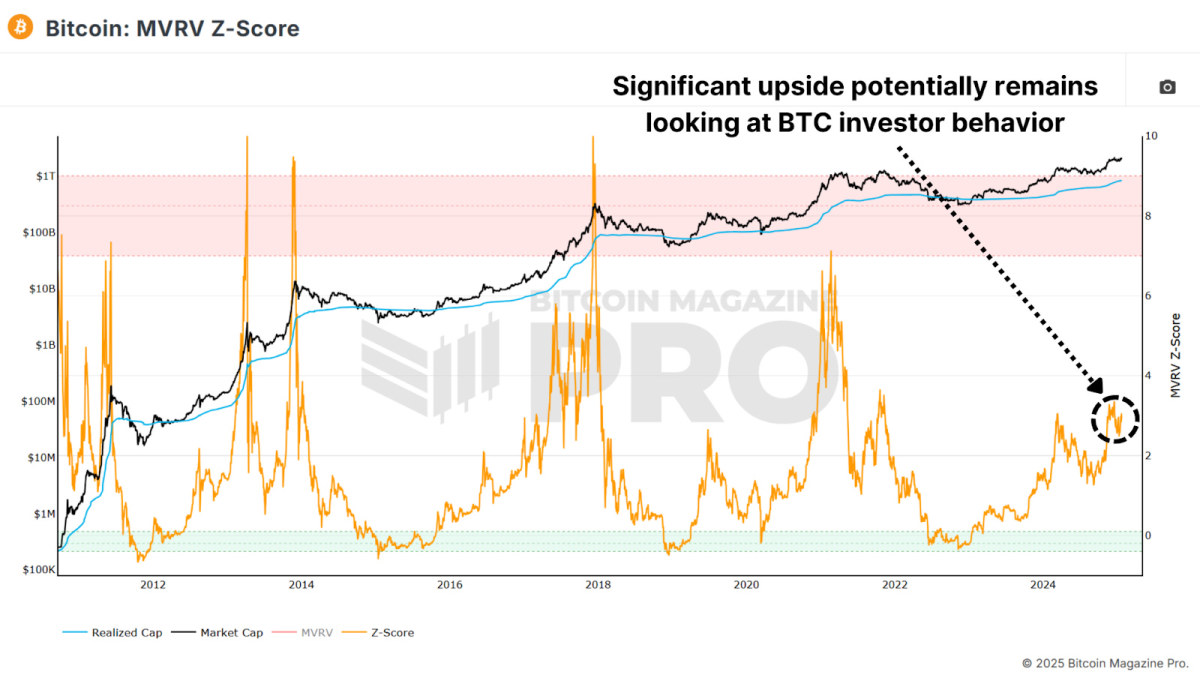

Substantial Upside Potential

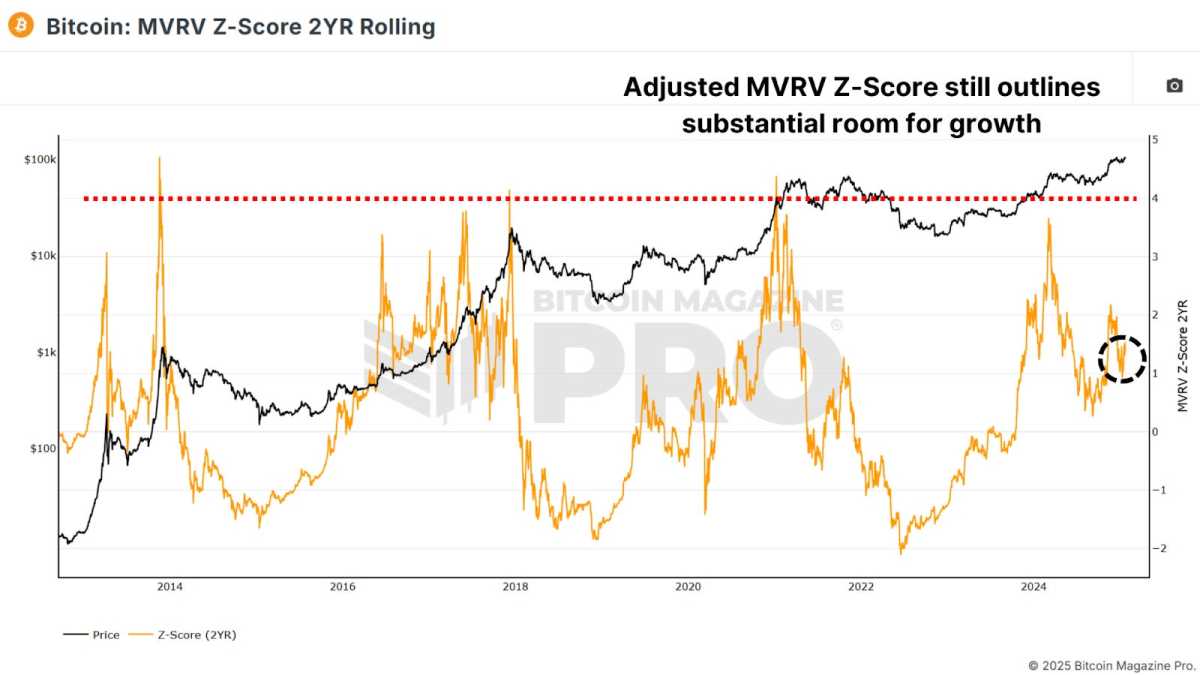

The MVRV Z-Score, a metric analyzing Bitcoin’s market value relative to its realized value, or average accumulation price for all BTC, suggests current values remain well below historical peak regions, outlining considerable room for growth.

A two-year rolling version of the MVRV Z-Score, which adjusts for evolving market dynamics, also shows bullish potential. Even by this adjusted measure, Bitcoin is far from previous cycle peak levels, leaving the door open for further price appreciation.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

Sustainable Sentiment

The Bitcoin Fear and Greed Index is currently at a healthy and sustainable amount of Greedy sentiment, indicating greedy but sustainable sentiment. Historical data from the 2020-2021 bull cycle shows that greed levels around 80-90 can persist for months, supporting prolonged bullish momentum. Only when values approach extreme levels (95+) does the market typically face significant corrections.

Network Activity

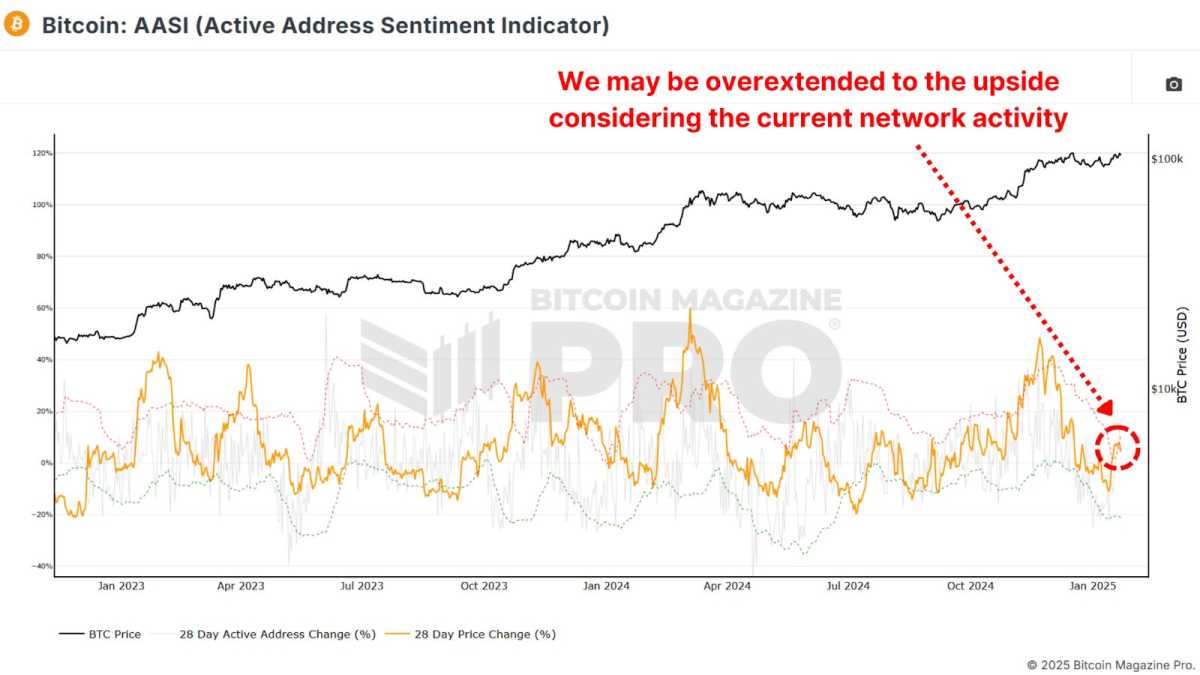

The Active Address Sentiment Indicator reveals a slight dip in network activity, suggesting retail investors have yet to fully re-enter the market. However, this could be a positive sign, indicating untapped retail demand that might fuel the next leg of the rally.

Risk Appetite Shifts

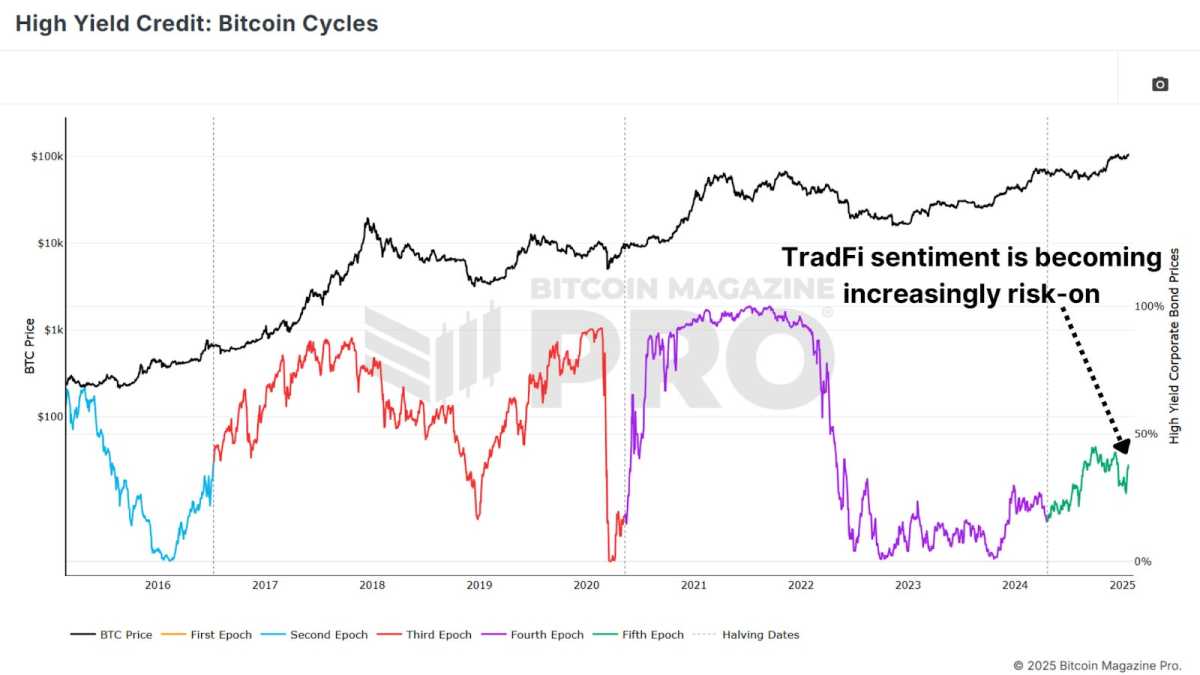

Traditional market sentiment is showing improving signals. High Yield Credit appetite is increasing as the macro-economic environment shifts to a more risk-on outlook. Looking at corporate bonds that offer higher interest rates due to their lower credit ratings compared to investment-grade bonds. Historically, there has been a strong correlation between Bitcoin’s performance and periods of heightened global risk appetite, which have often aligned with bullish phases in Bitcoin’s price.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Bitcoin’s on-chain metrics, market sentiment, and macro perspective all point to a continuation of the current bull market. While short-term volatility is always possible, the convergence of these indicators suggests that Bitcoin is well-positioned to reach and potentially surpass our current all-time high in the near future.

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

CryptoCurrency

Bitcoin Could Hit $250k, Price Projections for Ethereum, Lightchain AI and Solana

With Bitcoin projected to hit $250K, the crypto market is abuzz with price predictions for leading projects like Ethereum, Solana, and Lightchain AI.

While Ethereum and Solana remain strong contenders, Lightchain AI is gaining traction as a revolutionary blockchain project integrating artificial intelligence. Currently in its presale phase at $0.005625 per token, Lightchain AI has already raised $12.7 million, reflecting strong investor confidence.

Its innovative approach positions it alongside major players, offering the potential for substantial growth in the rapidly evolving cryptocurrency landscape.

Bitcoin’s Path to $250k and Its Impact on Crypto Market

Bitcoin’s trajectory toward $250,000 is supported by several key factors. Fundstrat’s Tom Lee suggests that Bitcoin could reach $250,000 in 2025, attributing this potential surge to the cryptocurrency’s cyclical price patterns and the anticipated supply shock from the 2024 halving event.

Additionally, the pro-crypto stance of the incoming U.S. administration under President-elect Donald Trump is expected to foster a favorable regulatory environment, further boosting investor confidence. However, it’s important to note that the cryptocurrency market remains volatile, and while these factors contribute to a bullish outlook, investors should exercise caution and conduct thorough research before making investment decisions.

Price Projections for Ethereum, Solana, and Other Key Players

Ethereum (ETH) is currently trading at $3,218.67. Analysts suggest that if current demand and supply dynamics persist, ETH could surpass $5,000 in 2025. However, internal challenges within the Ethereum Foundation may impact investor confidence and price performance.

Solana (SOL) is priced at $251.28. Projections for 2025 vary, with some analysts forecasting a rise to $500, while others anticipate a more conservative estimate of around $257.33. Factors influencing SOL’s price include technological advancements and potential regulatory changes.

It’s important to note that the cryptocurrency market is highly volatile, and these projections are speculative. Investors should conduct thorough research and consider multiple perspectives before making investment decisions.

Why Lightchain AI Stands Out Among 2025’s Top Price Predictions

Lightchain AI stands out among 2025’s top price predictions due to its strategic roadmap and focus on delivering real-world value. The roadmap highlights steady growth, beginning with the prototype development phase (November 2024) and progressing to the testnet rollout (January 2025) for real-world testing. The mainnet launch in March 2025 activates decentralized functionality, followed by ecosystem growth and global adoption later in the year.

Its low-latency infrastructure ensures efficient, real-time processing, making it ideal for demanding applications. To address scalability and resource constraints, Lightchain AI employs sharding and dynamic resource allocation, ensuring consistent performance under heavy workloads. This combination of innovation and sustainability positions it as a standout project for long-term success.

Invest today in Lightchain AI’s presale and join the journey toward a more efficient and scalable blockchain ecosystem. As always, remember to conduct thorough research before making investment decisions. Let’s see where the future of cryptocurrency takes us!

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

BTC price whipsaws to $106K as US strategic reserve rumors return

BTC price volatility returns with a vengeance as US Senator Cynthia Lummis leaks a cryptic 10am announcement.

CryptoCurrency

Britain to face ‘more frequent’ downturns in blow to economy, analysts warn

Britain is projected to face more frequent technical recessions in the coming years as the economy’s growth potential has significantly slowed, new analysis from Bloomberg Economics has revealed.

The study suggests the UK’s reduced economic capacity has made it more vulnerable to growth shocks, painting a concerning picture for the nation’s financial future.

A recession is defined as happening when a nation’s economy experiences two consecutive quarters of negative gross domestic product (GDP) growth.

While these more frequent downturns may not necessarily lead to major job losses, they represent a significant challenge for both Government and Bank of England policymakers.

The analysis reveals a dramatic decline in Britain’s trend growth rate – the sustainable pace at which the economy can expand without triggering inflation

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Analysts are warning the UK faces multiple recessions

GETTY

From 1955 to 2009, the UK’s trend growth rate averaged 2.5 per cent annually but this has now halved to just 1.2 per cent for the years ahead.

Bloomberg Economics identified 15 episodes since 1955 when the economy experienced shocks substantial enough to trigger a technical recession, based on current trend growth rates.

The frequency of these downturns is expected to increase significantly, with recessions potentially occurring every five years and marks a concerning shift from the historical pattern, where recessions typically happened once every eight years.

Bloomberg Economics’ chief UK economist Dan Hanson said: “There are good reasons to think technical recessions will be more frequent in coming years than in the past.

Experts are warning the UK economy could take a hit GETTY

Experts are warning the UK economy could take a hit GETTY “The UK’s trend rate of growth has fallen, meaning the shocks that would previously have prompted growth just to slow, are now enough to generate a fall in output.”

However, Hanson offered some reassurance, noting that these more frequent technical recessions are unlikely to result in major economic downturns accompanied by surging unemployment.

The UK economy has already shown signs of this increased vulnerability to downturns, having experienced a mild recession in the latter half of 2023.

This downturn was primarily driven by the combined pressures of inflation and higher interest rate with more recent data showing the economy continued to struggle, as GDP showed no growth in the third quarter of 2024.

The Bank of England’s outlook remains cautious, with expectations of zero growth for the fourth quarter of 2024 as well. While some improvement is anticipated for 2025, growth is expected to remain significantly below pre-financial crisis levels.

These recent economic indicators appear to support Bloomberg Economics’ analysis of a more fragile British economy, increasingly susceptible to periods of negative growth.

LATEST DEVELOPMENTS:

Starmer has promised to grow the UK economy

KEIR STARMER

Labour’s Chancellor Rachel Reeves has emphasised her commitment to addressing these economic challenges. Speaking at Davos on Wednesday, Reeves highlighted the need to “turbocharge the economy” in an interview with Bloomberg News Editor-in-Chief John Micklethwait.

She specifically pointed to the importance of infrastructure projects and planning decisions, arguing that Britain needs to change its approach.

“That’s been the problem in Britain for a long time,” Reeves said. “That when there was a choice between something that would grow the economy and sort of anything else, anything else always won.”

The Chancellor also stressed that the “answer can’t always be no” when it comes to major infrastructure projects. This comes as Prime Minister Keir Starmer’s Labour Government, which took power last July, faces pressure over a sharp economic slowdown during their tenure.

CryptoCurrency

Ethereum, Solana, XRP, and Rollblock compete to dominate in 2025

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Rollblock, with its GambleFi solutions, may outshine Ethereum, Solana, and XRP in the race to dominate crypto in 2025.

Things are heating up in the crypto arena, with top tokens rushing to amazing returns. Ethereum is still the second-placed token, but it is losing the market cap race to XRP and the growth rate to Solana. However, Ethereum is still a massive DeFi token and, therefore, cannot be overlooked. However, for great gains, it would be foolish to overlook the smaller tokens appearing in the crypto arena. These tokens may be giant killers, none more so than the new crypto casino Rollblock.

Rollblock: Innovating DeFi with GambleFi

Rollblock is carving out a unique niche in the crypto arena by merging decentralized finance (DeFi) with the rapidly growing online gambling sector. It’s a marriage made in heaven, as Rollblock already promises massive wealth created through a weekly dividend from the income generated by its online casino to its token holders.

But now Rollblock is adding a DeFi element, too. RBLK tokens can be staked for APY rates unmatched by anything in the TradFi sector, making Rollblock a surefire winner.

Ethereum: Strong on DeFi, but struggles to hold place

Looking at the Ethereum market cap’s size, it would seem foolish to see it as an underperforming token. Ethereum’s DeFi holdings alone are 6x that of Solana’s. But Ethereum is struggling. Its growth rate is far lower than that of Solana’s and XRPs, and XRP is already creeping up on Ethereum’s market cap. And if Solana continues to do what it is doing, Ethereum can expect to drop not just one spot on the market cap rankings but even two.

Solana: Securing a top-5 spot in the crypto arena

Solana has flipped BNB again to now occupy the number 5 spot. If not for XRP’s incredible gains, it would be at number 4, breathing down the neck of Tether. Solana’s slow-but-steady market cap growth is an existential threat to Ethereum. Solana, after all, is a direct competitor to Ethereum but is much faster and cheaper to operate. Over the last 4 years, Solana has outpaced Ethereum in year-on-year growth, with the mathematical inevitability that Solana will replace Ethereum at the number two spot behind Bitcoin. Solana is a strong DeFi player, too, sitting number two behind Ethereum.

XRP: Punching above its weight

As little as three months ago, XRP struggled to be in the top ten tokens by market cap. Now, it is at number three, threatening to take Ethereum’s coveted number 2 spot. The good news for Ethereum is that XRP is less than half the market cap of ETH. XRP’s market cap must double to take the crown from Ethereum. Considering how well XRP has done to date, doubling again is a tall order. But XRP’s global mass adoption is imminent, which may give it enough clout to get it past the $400 billion market cap mark.

Conclusion

The stiff competition at the head of the crypto arena is great news for crypto, as it gives legitimacy to the assets. Any of the tokens discussed here will make a valuable addition to a crypto portfolio, and as DeFi markets and crypto adoption grow, so will these tokens. It is Rollblock, however, that promises to deliver the greatest returns of any of the tokens currently in the crypto arena. Rollblock is now available at $0.046.

To learn more about Rollblock, visit the website and socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login