CryptoCurrency

Semler Scientific to raise $75M to fund Bitcoin buys as paper gains near $30M

Semler Scientific is planning to raise $75 million through a private offering of convertible senior notes, which will help fund further Bitcoin purchases.

CryptoCurrency

Mcoin’s Meteoric Rise Shakes Up the Digital Asset Sector

Within the realm of digital assets, mCoin has swiftly ascended to prominence, positioning itself as a notable contender through the strategic utilization of Blockchain technology.

The substantial market cap and daily trading volume underscore mCoin’s growing influence in the industry, sparking curiosity and drawing attention from seasoned investors and newcomers alike.

As we explore the factors propelling mCoin’s meteoric rise, a deeper examination of its trajectory and potential gains insight into the intricacies of navigating the ever-evolving landscape of cryptocurrencies.

Unveiling the underlying dynamics behind mCoin’s surge invites a closer look at the implications for both short-term and long-term market behavior, shedding light on the intricate tapestry of opportunities and challenges that define its journey in the digital asset space.

Digital Asset Market Trends

In the ever-evolving landscape of digital assets, market trends play a pivotal role in shaping investment strategies and decisions. Monitoring these trends provides investors with valuable insights into the potential growth or decline of specific assets, enabling them to make informed choices.

Understanding market dynamics, such as price fluctuations, trading volumes, and investor sentiment, is essential for staying ahead in the highly competitive digital asset industry.

By analyzing historical data and current market conditions, investors can identify opportunities for profit and mitigate risks effectively.

Mcoin’s Blockchain Technology Advancements

Monitoring digital asset market trends is essential for making informed investment decisions. Therefore, examining Mcoin’s Blockchain Technology Advancements sheds light on its innovative strides in this dynamic industry.

Mcoin has made significant advancements in its blockchain technology, enhancing security, scalability, and efficiency.

One notable development is the implementation of smart contracts, enabling automated and secure transactions without third-party interference.

Additionally, Mcoin has focused on improving interoperability with other blockchain networks, fostering seamless integration and enhancing user experience.

These technological upgrades not only showcase Mcoin’s commitment to innovation but also position it as a competitive player in the digital asset space. Investors looking to capitalize on the potential of blockchain technology should closely monitor Mcoin’s advancements as they continue to shape the future of the industry.

Growth Factors Driving Mcoin’s Success

Mcoin’s exponential growth in the digital asset industry can be attributed to its strategic partnerships and innovative technological advancements.

By forming collaborations with key players in the industry, Mcoin has been able to expand its reach and increase adoption among users. These partnerships have not only enhanced Mcoin’s credibility but have also opened up new opportunities for growth and development.

Additionally, Mcoin’s commitment to staying at the forefront of technological advancements has allowed it to offer cutting-edge solutions that cater to the evolving needs of its users.

This dedication to innovation has positioned Mcoin as a leader in the digital asset space, driving its success and solidifying its reputation as a forward-thinking and reliable platform.

Analyzing Mcoin Price Predictions

Amidst the dynamic landscape of the digital asset sector, the trajectory of mCoin’s price predictions unfolds as a focal point for strategic analysis and informed decision-making.

Short-term forecasts for mCoin suggest fluctuations between $0.38 and $0.80 from September to January while as of time of writing priced at $0.60.

Looking further ahead, long-term projections paint a picture of growth, with estimates reaching $12.24 by the end of 2024, $21.02 by 2025, and soaring to $54.71 by 2030. Despite fluctuations, the consensus indicates a positive outlook for mCoin’s value over time.

Investors considering mCoin should weigh these predictions against their investment goals and risk tolerance to make well-informed decisions in this evolving digital asset landscape.

Strategic Investment Insights for Mcoin

In the dynamic realm of digital asset investments, the strategic analysis of mCoin’s price predictions serves as a cornerstone for informed decision-making, particularly when considering long-term growth potential.

Assessing mCoin’s market cap of $107,963,421 and 24-hour trading volume of $2,856,936 provides insights into its current standing in the digital asset landscape.

Understanding these forecasts can aid investors in formulating strategic investment plans aligned with their financial objectives and risk tolerance levels.

Conclusion

In conclusion, mCoin’s rapid ascent in the digital asset industry can be attributed to its innovative use of Blockchain technology, market trends favoring digital assets, and strategic growth factors.

By analyzing price predictions and understanding the potential for long-term growth, investors can make informed decisions about mCoin as a strategic investment opportunity.

As mCoin continues to evolve and adapt within the digital asset landscape, its trajectory and value fluctuations will be closely monitored by industry observers.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Where to Buy Spot Bitcoin ETFs in 2025

What Are Spot Bitcoin ETFs?

Spot Bitcoin ETFs invest directly in Bitcoin as the underlying asset. Unlike Bitcoin futures ETFs, which rely on price derivatives, spot ETFs hold actual Bitcoin in custody. This makes them a straightforward way to gain exposure to Bitcoin’s price movements.

Where to Buy Spot Bitcoin ETFs

Spot Bitcoin ETFs are accessible on various online brokerage platforms, robo-advisors, and even retirement accounts like IRAs and solo 401(k)s. Here’s a comparison of popular platforms:

|

Platform |

Account Minimum |

Available Assets |

|

Fidelity |

$0 |

Coins, ETFs |

|

$0 |

Coins, ETFs |

|

|

Charles Schwab |

$0 |

ETFs |

|

E*TRADE |

$0 |

ETFs |

|

Interactive Brokers |

$0 |

Coins, ETFs |

|

eToro |

$50 ($200 for CopyTrader) |

Coins, ETFs |

|

tastytrade |

$0 |

Coins, ETFs |

|

Lightspeed |

$10,000 (web/mobile) |

Coins, ETFs |

Steps to Start Investing

Investing in spot Bitcoin ETFs involves a few simple steps:

- Open a Brokerage Account

Choose a platform that offers spot Bitcoin ETFs and sign up. Most accounts can be created online in under 30 minutes. - Fund Your Account

Transfer money from your bank or another brokerage account. Ensure you have enough to cover ETF costs and any fees. - Research ETFs

Review available ETFs. Look for those with high trading volumes, lower management fees, and reputable issuers. - Select Your ETF

Compare fees and align your choice with your investment goals. Most platforms offer a few options. - Place an Order

Use a market order for immediate purchase or a limit order to buy at a specific price. - Monitor Investments

Regularly check your ETF’s performance and stay updated on Bitcoin-related news.

Benefits of Spot Bitcoin ETFs

Spot Bitcoin ETFs offer several advantages:

- Ease of Use: Trade these ETFs on traditional platforms like NYSE and Nasdaq. No need for crypto wallets.

- Liquidity: Spot Bitcoin ETFs bring more liquidity to the market, making trading smoother.

- Regulated Environment: Unlike direct crypto investments, these ETFs are subject to stricter regulatory oversight.

- Tax Efficiency: ETFs might offer better tax treatment compared to directly holding Bitcoin.

Risks of Spot Bitcoin ETFs

Investing in spot Bitcoin ETFs carries certain risks, including:

- Volatility: The cryptocurrency market is highly volatile, and ETFs reflect these price swings.

- Regulatory Changes: Governments may alter regulations, affecting ETF availability or profitability.

- Counterparty Risk: The Bitcoin held by ETFs is managed by third parties, posing security concerns.

Fees to Consider

Management fees can significantly impact returns. While some ETFs, like the VanEck Bitcoin ETF, temporarily waive fees, others charge as high as 1.50%. Aim for ETFs with fees ranging from 0.20% to 0.50%.

Alternatives to Spot Bitcoin ETFs

If you’re unsure about investing in these ETFs, consider these alternatives:

- Buy Bitcoin Directly: Own Bitcoin through exchanges or wallets for more control, though it requires technical knowledge.

- Invest in Crypto Company Stocks: Companies like Coinbase or MicroStrategy offer indirect exposure to Bitcoin.

- Legacy ETFs: Established ETFs like Grayscale Bitcoin Trust provide a longer track record of performance.

Pros and Cons Summary

|

Pros |

Cons |

|

Easy to trade on traditional platforms |

High market volatility |

|

Regulated and safer than crypto exchanges |

Regulatory uncertainty |

|

Can be included in retirement accounts |

Counterparty risks (e.g., hacking) |

|

Tax benefits over direct Bitcoin ownership |

Limited direct control over Bitcoin |

Should You Invest?

Spot Bitcoin ETFs simplify Bitcoin investing. If you want exposure to cryptocurrency without the hassle of direct ownership, they’re worth considering. However, assess your risk tolerance and stay informed about market and regulatory changes.

By exploring platforms, monitoring fees, and understanding risks, you can make informed decisions in this growing market.

CryptoCurrency

Analysts says Bitcoin’s support level is at $97K; ATH soon?

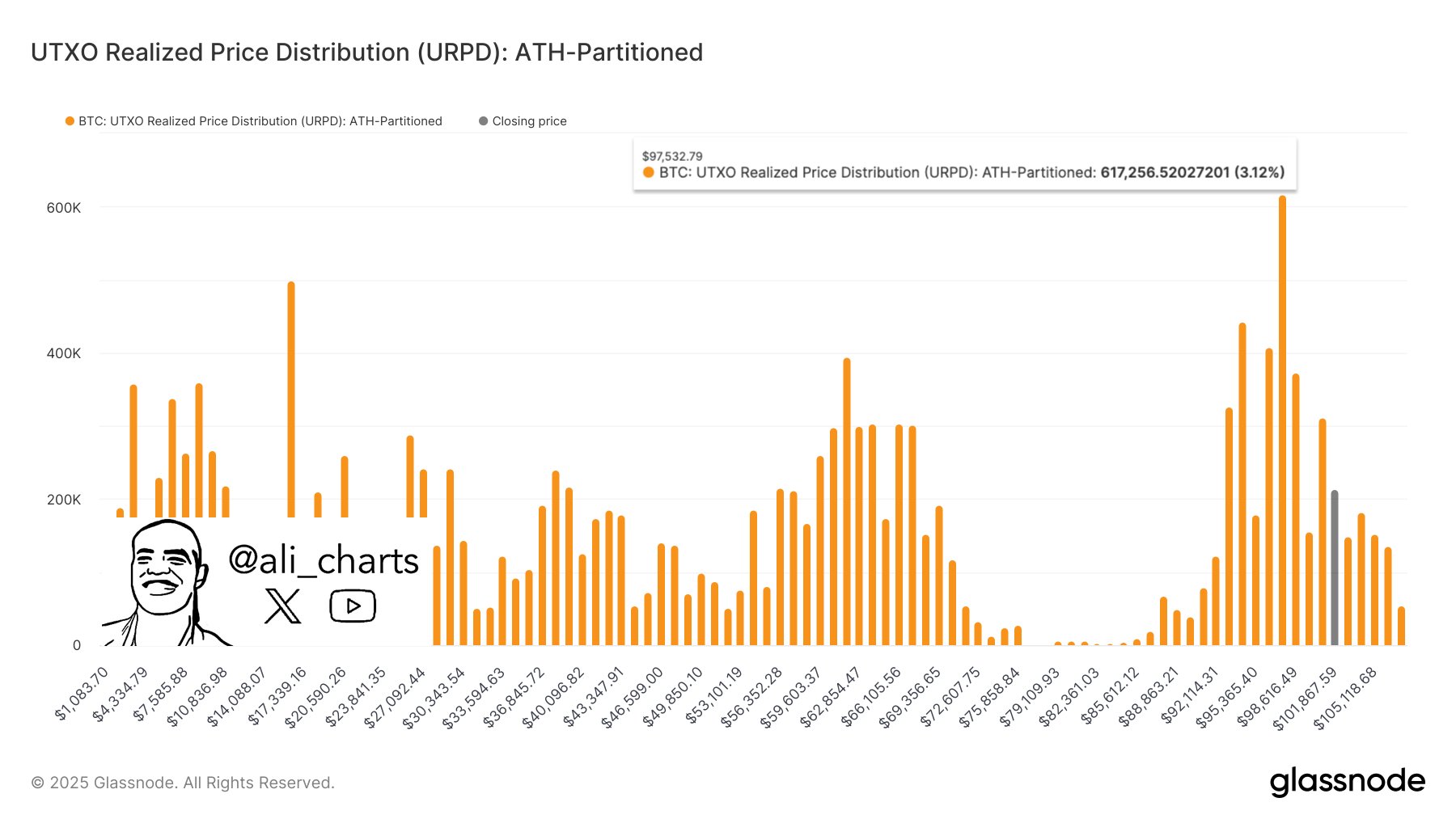

Ali, a crypto analyst, points to Bitcoin’s potential support level at $97,530 as key in sustaining the current bullish momentum. The main support level to be monitored for Bitcoin is $97,530. Staying over this level is critical to keeping the current bullish momentum afloat, believes Ali.

Bitcoin (BTC) has been trading in a tight range since hitting a new all-time high (ATH) of $109K on Jan. 20, 2025, and is now quoted at $105,128.95 as of Jan. 24. This reflects a 3.5% decline from the previous high, as per CoinMarketCap.

Understanding Bitcoin’s support level

In crypto trading, support levels are an important price point, where buying demand usually increases. Should BTC remain above this significant threshold, it may continue its trajectory upward, with investors feeling confident in this bullish decision. This level is a key litmus test of BTC’s market strength during volatility.

As posted by analyst Ali, the UTXO Realized Price Distribution (URPD) informs traders of where Bitcoin holders purchased their BTC or last moved their BTC. It indicates the number of BTC that have last moved to wallets priced at various price levels.

At $97,530, the URPD chart shows a cluster of activity, which means many investors bought or are sitting on a holding of BTC around this level. Strong buying interest at this level reinforces its role as a psychological and technical support.

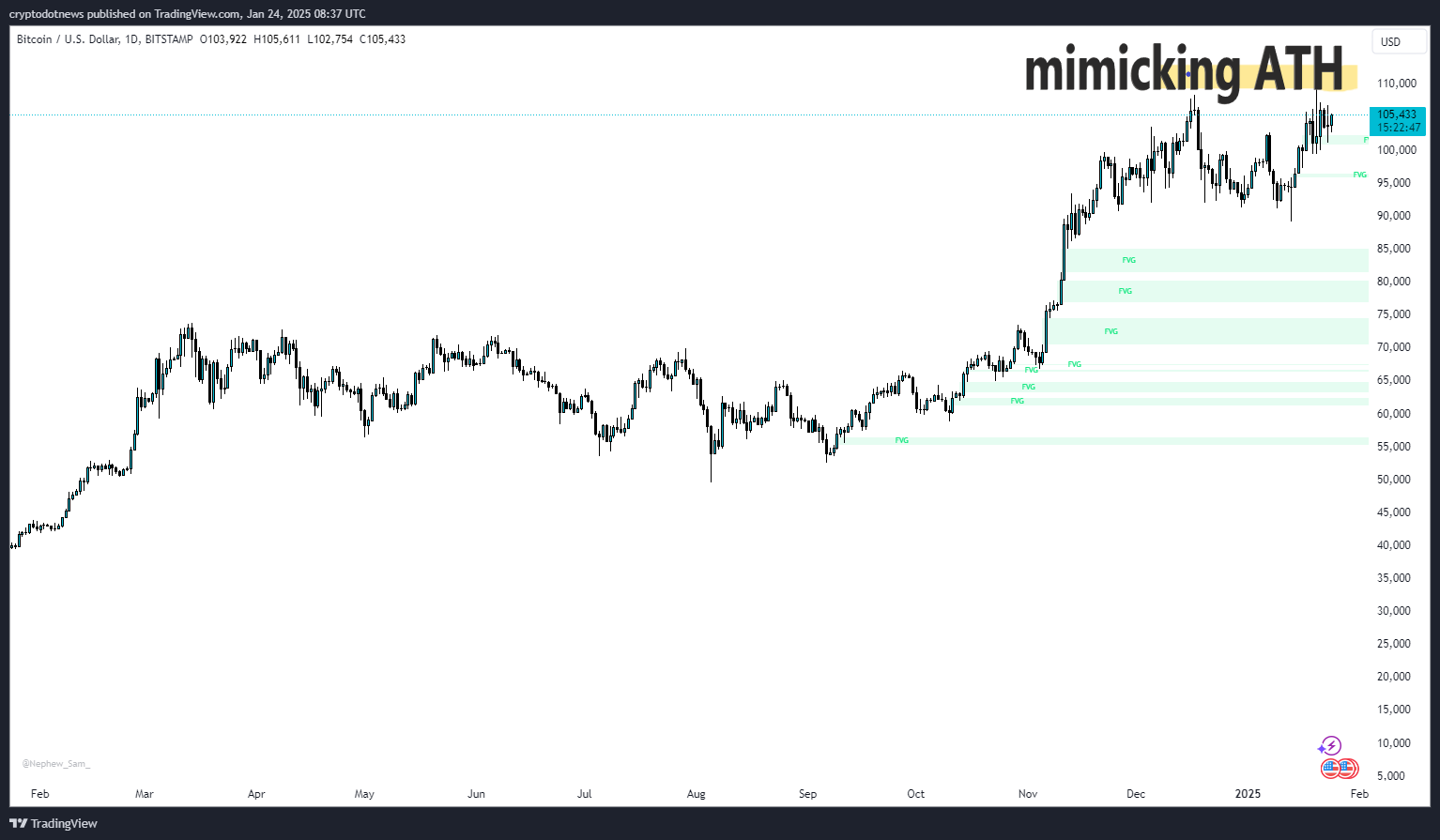

Bitcoin mimicking past ATH trend

The behavior around $97,530 mimics that seen in previous ATH consolidation phases for BTC. As with prior cycles, the price is stabilizing near a supportive zone with the potential for an upside. This level showed strong buyer confidence, though there are some light pullbacks.

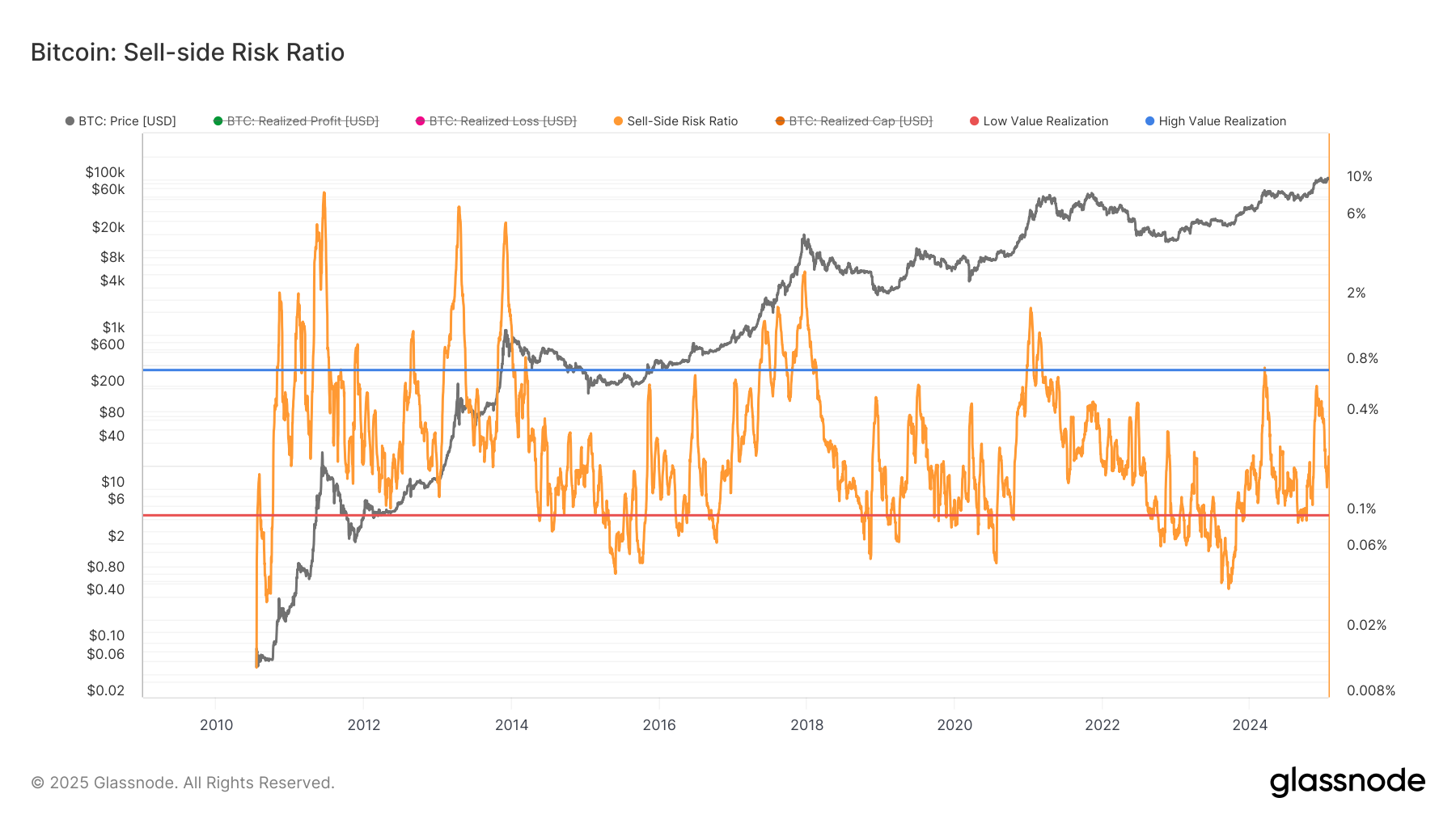

Analyzing sell-side risk of Bitcoin

The Sell-Side Risk Ratio, which measures the pressure from investors who are liquidating holdings, has declined as the amount of BTC sent to exchanges for sale has fallen. Such diminishing sell-side pressure is bolstering the current price stability of BTC. Glassnode also highlights shrinking volatility metrics, with BTC trading in an exceptionally narrow 60-day price range, which is often a precursor to significant market events.

Will Bitcoin sustain the bull run?

To reiterate crypto analyst Ali, the ongoing bull run will largely depend on whether BTC can maintain its key support level at $97,530. On-chain fundamental data confirms diminished sell-side pressure and consistent accumulation by long-term holders as indicators that the market is in a solid position to sustain upward movement.

If this level is maintained as support, then BTC could see a retest and a new market peak towards its former all-time high, boosting the ongoing bullish run. However, failing to hold $97,530 could introduce risks to the bull run.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CryptoCurrency

Artyfact Set for Epic Games Store Debut with Innovative GameFi Features

[PRESS RELEASE – Majuro, Marshall Islands, January 23rd, 2025]

Artyfact, a video game inspired by a cyberpunk aesthetic, is scheduled for release on the Epic Games Store on January 24, 2025. Developed using Unreal Engine 5, the game combines traditional gaming elements with GameFi functionalities, offering high-quality visuals and diverse gameplay modes such as battle royales, races, and adventure scenarios. Players can explore a dynamic digital environment designed to enable exploration, competition, and creative engagement.

Integrating NFTs and AI to Enhance Gameplay

Artyfact introduces NFTs as a supplementary feature to enhance personalization and strategy. Players can acquire NFTs such as character skins, weapons, and virtual real estate, which allow for tailored in-game experiences. Notably, 50% of the revenue from NFT sales is allocated to a player-driven prize pool, rewarding participants for their achievements.

Artificial intelligence plays a crucial role in the game’s development, focusing on improving gameplay quality. AI technology powers adaptive NPC behavior, generates diverse content, enhances security with cheat detection, and customizes experiences based on player interactions. These AI-driven enhancements are designed to provide an engaging, continually evolving experience for players.

$ARTY Token: Supporting the In-Game Economy

The $ARTY token underpins Artyfact’s economic framework, functioning as a utility token within the game’s ecosystem. With a reported market capitalization of $18 million and a fully diluted valuation of $21 million, $ARTY facilitates transactions for in-game assets, serves as a reward for player achievements, and supports governance decisions via the Artyfact DAO. Additionally, staking and token-burning mechanisms contribute to the ecosystem’s sustainability.

Fostering a Player-Centric Community

Artyfact emphasizes community engagement through platforms such as X, Discord, and Telegram, where players can contribute feedback and ideas. This collaborative approach to development aims to ensure the game remains relevant and aligned with the interests of its user base.

The game’s roadmap includes regular content updates, community-driven events, and further integration of its economic model. The goal is to create a sustainable ecosystem where digital ownership, player influence, and immersive gameplay converge.

About Artyfact

Artyfact is a blockchain-powered video game that merges traditional gameplay with innovative GameFi features. Built using Unreal Engine 5, Artyfact provides players with a cyberpunk-inspired world to explore, compete, and create. The game integrates NFTs and AI technologies to enhance player experiences while fostering a community-driven ecosystem. With a focus on sustainability and player engagement, Artyfact aims to redefine the intersection of gaming and digital ownership.

Learn More About Artyfact

To explore the features of Artyfact and its approach to gaming innovation, users can visit the official website or follow its social channels:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bitcoin NVT Golden Cross Hits 60-Day Low: Is This Bullish?

On-chain data shows the Bitcoin Network Value to Transactions (NVT) Golden Cross has plummeted recently. Here’s what this could mean for BTC’s price.

Bitcoin NVT Golden Cross Has Plunged Into Bottom Zone Recently

As explained by an analyst in a CryptoQuant Quicktake post, the BTC NVT Golden Cross has declined to the lowest level in two months recently. The “NVT Ratio” refers to an indicator that keeps track of the ratio between the Bitcoin market cap and transaction volume.

When the value of this metric is high, it means the value of the network (that is, the market cap) is high compared to its ability to transact coins (the transaction volume). Such a trend implies the asset may be overvalued.

On the other hand, the indicator being low suggests the cryptocurrency could be due to a bullish rebound as its volume is high compared to its market cap.

In the context of the current topic, the normal version of the NVT Ratio isn’t of interest, but rather a modified form known as the NVT Golden Cross. This metric compares the short-term trend of the NVT Ratio with its long-term one to determine whether its value is near a top or bottom.

The NVT Golden Cross uses the 10-day moving average (MA) of the NVT Ratio to track short-term trends and the 30-day MA for long-term ones.

Now, here is a chart that shows the trend in the Bitcoin NVT Golden Cross over the last couple of months:

In the graph, the quant has highlighted two zones that have historically proven to be relevant to the Bitcoin NVT Golden Cross. The red zone, situated above a value of 2.2, is where the indicator has been the most likely to see a reversion to the mean zero level.

Similarly, the green zone corresponding to values under -1.6 is where bottoms in the metric have tended to form. As the color coding already implies, ventures into these zones have often meant a bullish and bearish outcome for BTC, respectively.

From the chart, it’s apparent that the NVT Golden Cross surged into the overheated territory around the time of last month’s price top. Since then, the indicator has gradually been making its way down, with its value today finding itself submerged in the undervalued region.

The current value of -2.21 is the lowest that the metric has been in around 60 days. Given the historical pattern, it’s possible that this could imply Bitcoin may be near a local bottom, if one isn’t already in.

BTC Price

Bitcoin has settled into a phase of sideways movement during the last few days as its price is still trading around the $105,200 mark.

CryptoCurrency

Prediction Markets Don’t Have a Gambling Problem, Says Crypto Attorney

Singapore and Thailand recently moved to ban Polymarket from their respective jurisdictions, arguing that the site was just another gambling platform.

On the surface, that argument seems logical. Polymarket’s inclusion of sports prediction markets makes it seem like a competitor to licensed sportsbooks around the world.

After all, even prediction market’s harshest critics acknowledge that there’s some kind of value in an investment mechanism to hedge against events like an election, but the outcome of a sporting match just doesn’t have the same material impact as an election or war.

But, beneath the surface, the argument that prediction markets are simply a Web3 version of gambling falls short, argues New York-based crypto attorney Aaron Brogan.

“If you are a state-licensed gambling product, then you are taking one side of the bet. You’re essentially betting against your users,” Brogan said. “You’re booking the bets…and offering certain odds to users. Whether you make money or not depends on the odds you set.”

Prediction markets like Polymarket and Kalshi, in contrast, act as neutral intermediaries that match trades without taking a side, making money via transaction fees.

“You are not taking a side of the bet as the market in that case, which fundamentally changes the incentives involved and makes the product different in a holistic way,” Brogan said, pointing out that prediction market platforms don’t ban their best users in the same way casinos boot out card counting pros as it kills the house’s mathematical edge.

“Prediction markets aren’t gambling because they’re not structured to be,” Brogan said. “They’re tools for understanding, hedging, and creating public goods. That’s what makes them fundamentally different.”

Getting an online gambling license in the U.S. was a herculean effort, and one might wonder why the new players in the space, like Draft Kings or incumbents like MGM, which followed in opening up online sports betting operations, don’t go after prediction markets at the state level where gambling is regulated.

The key legal distinction, says Brogan, lies in the regulatory framework. In the U.S., prediction markets that are registered as Designated Contract Markets (DCMs) fall under federal regulation via the Commodity Exchange Act, which preempts state gambling laws.

“Federal law in the United States preempts state law,” Brogan explained. “The Commodity Exchange Act includes a specific provision that precludes state regulation of federally registered derivatives. If you are federally registered, the states can’t regulate you.”

Kalshi seems to feel confident in this argument, as the prediction market platform, which actively pursued registration with the Commodities Futures and Trading Commission – and fought its initial attempts to block election-related prediction markets – recently launched Super Bowl betting markets.

But this might not work for its competitors.

“Polymarket, for example, is not registered in the United States, so arguably, states could go to its founder and say, ‘You’ve been facilitating sports betting, which is a felony in this state,’ and bring legal action. Registered exchanges, however, don’t face this issue because of their federal status,” Brogan said.

While Polymarket and Kalshi are the two most recognizable names in the space, there are plenty of other new entrants which are following in their footsteps.

One of which is the crypto exchange Crypto.com, which recently launched Crypto.com sports after filing self-certification as a DCM with the CFTC.

The key thing is, Brogan explained, is that if the CFTC does not take action within 24 hours after the self-certification papers are filed, then the applicant can treat that as a green light.

“If these are able to proliferate, and if the CFTC doesn’t take action, which they haven’t done yet, they’re going to end up eating these sportsbooks’ lunch. This is a $21 billion industry, and this new product is going to be way better,” he concludes.

CryptoCurrency

Simplifying Crypto Payments: Introducing Bybit Pay

Dubai, United Arab Emirates, January 24th, 2025, Chainwire

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is excited to launch Bybit Pay, an innovative payment platform designed to seamlessly connect traditional finance with the digital economy. This new solution is about processing payments and building strategic partnerships that drive growth, innovation, and financial inclusion on a global scale.

Bybit Pay is a next-generation payment solution designed to simplify transactions across fiat and cryptocurrencies. With seamless integration across websites, mobile apps, and point-of-sale (POS) systems, Bybit Pay empowers businesses to offer efficient, secure, and low-cost payment options to their customers. Whether it’s for online platforms, in-store purchases, or cross-border payments, Bybit Pay bridges the gap between traditional payment methods and the growing demand for digital financial services.

Bybit Pay is happy to welcome more forward-thinking partners joining its ecosystem – businesses, payment providers, and service platforms looking to innovate and scale their operations in the evolving digital finance landscape. Partners gain access to:

- A Global User Base: Instantly connecting with Bybit’s network of over 60 million global users.

- Seamless Integration: Easily incorporating Bybit Pay into existing financial infrastructures and business systems.

- Scalable Solutions: Growing with flexible, future-proof payment technologies designed to adapt to market needs.

- Cross-Industry Collaboration: Unlocking opportunities through partnerships across e-commerce, traditional finance, and digital asset sectors.

Empowering Businesses and Customers Alike

For businesses, Bybit Pay offers the tools to drive potential revenue growth, reduce operational costs, and improve financial efficiency. At the same time, customers are able to benefit from faster transactions, lower fees, and the freedom to choose between fiat and cryptocurrency payment methods – creating a frictionless payment experience for all.

A Vision for the Future

Joan Han, Bybit’s Sales and Marketing Director, envisions a brighter future for payments, noting: “Bybit Pay represents a shift in how we connect businesses to the digital future. It’s more than a payment platform; it’s a call to partners to innovate and redefine transactions with solutions that are efficient, accessible, and forward-thinking.”

The Future of Payments Starts Here

Bybit Pay represents a new chapter in digital finance – where innovation, scalability, and reliability come together to create unparalleled opportunities for growth.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

ContactHead of PRTonyBybittony.au@bybit.com

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Vitalik outlines strategy for scaling Ethereum and strengthening ETH

Vitalik Buterin released a blog post outlining an Ethereum scaling roadmap, including layer-2 growth, blob scaling and ETH as a core ecosystem driver.

CryptoCurrency

What Is Byte Crypto – Coinlabz

Byte Crypto is a digital currency that has gained attention for its innovative technology and unique features within the cryptocurrency realm.

Unlike more prominent cryptocurrencies, Byte Crypto has been quietly establishing itself in the market. Its technical design and functionalities have piqued the interest of many observers.

As we examine Byte Crypto further, it becomes evident that its potential for growth is a topic of discussion within the cryptocurrency community. The opportunities it presents in the digital currency landscape are being closely monitored.

Byte Crypto’s distinct characteristics and its approach to addressing various challenges in the industry contribute to its standing as a noteworthy player in the market.

By analyzing Byte Crypto objectively, we can appreciate its position as a promising contender in the digital currency sector. Its evolution and adaptation to the changing dynamics of cryptocurrency underline its relevance and potential for further development.

Key Takeaways

- Byte Crypto is a meme token inspired by popular culture and Elon Musk, reflecting the Grok AI project.

- It operates on a zero-tax policy and emphasizes a community-driven approach, promoting transparency and ecosystem support.

- Investors can buy Byte Crypto on decentralized platforms like Uniswap V2 or centralized exchanges like Bilaxy, benefiting from its unique utility and potential value appreciation through token burning.

Byte Launch

Byte Launch is a meme token that incorporates elements of popular culture into the cryptocurrency space.

Known for its zero-tax policy and community-driven approach, Byte Launch has gained attention within the cryptocurrency community. The token draws inspiration from Elon Musk’s announcements and the Grok AI project, reflecting a mix of technological innovation and cultural references.

Byte Key Features

Byte Key Features showcase the unique characteristics that differentiate Byte in the cryptocurrency market. Byte crypto is recognized for its meme token status, combining cryptocurrency with elements of popular culture.

The zero-tax policy and community-driven approach are key factors contributing to Byte’s appeal. Transparency is emphasized through measures such as the permanent burning of Byte’s liquidity and the renouncement of contract ownership.

Byte tokens serve various purposes within the ecosystem, including facilitating airdrops, ensuring secure transactions, enabling Bitcoin ATM transactions, and supporting technical applications. The Byte Wallet app offers secure storage and management of BYTE tokens, featuring functionalities like backup, recovery using a 12-word seed phrase, and customizable fee settings.

Byte Current Price

Based on the latest data from Coinbase and third-party vendors, the current price of Byte Crypto is $0.00000267. Byte is a cryptocurrency that draws inspiration from Elon Musk, who named his dog ‘Byte.’

This digital currency combines cryptocurrency features with elements of popular culture, featuring a zero-tax policy and a community-driven ethos. Byte is designed for various purposes, including airdrops, Bitcoin ATM transactions, and technical applications.

The market performance of Byte has been volatile, with a 24-hour price change of $0.00001070, indicating an 80.04% decrease in value. Byte’s market cap is $3,305,104, with a market cap/FDV ratio of 1.0, supported by a circulating supply of 960 billion BYTE tokens.

Byte is actively traded against pairs such as Byte/SOL, Byte/ETH, Byte/WBNB, Byte/WETH, and Byte/USDT, underscoring its presence in the digital asset market.

Byte Price Predictions

Byte Crypto’s price prediction is a complex task due to its current market volatility. The recent attention received by Byte, partly linked to Elon Musk’s mention of ‘Floki,’ his dog, and the association with Byte’s ‘Grok’ persona, hasn’t established a direct correlation to price movements.

Factors like Byte’s contract ownership transparency and investor relations are critical considerations for price forecasting.

Market trends, technological advancements, and investor sentiment also influence Byte’s price predictions. As Byte navigates the evolving crypto landscape, its price may fluctuate based on these dynamic elements.

Monitoring Byte’s developments and market conditions can aid in making informed decisions regarding its price trajectory.

Should you Buy Byte

Byte Crypto, with a circulating supply of 960 billion tokens, has attracted attention due to its unique utility within the cryptocurrency space.

This meme token facilitates various transactions, including airdrops and Bitcoin ATM transactions, offering users versatility in their digital asset interactions.

One notable aspect of Byte is its zero-tax policy, which may appeal to investors seeking to maximize their returns while minimizing transaction costs.

Additionally, Byte adheres to the ERC-20 token standard, ensuring compatibility with a wide range of platforms and wallets, enhancing its accessibility and usability in the crypto market.

Furthermore, the permanent burning of a portion of Byte tokens has the potential to create scarcity and drive value appreciation over time.

These factors, combined with the possibility of future growth, may make Byte a strategic addition for those looking to diversify their cryptocurrency portfolio.

Where to Buy Byte

To purchase Byte Crypto, consider utilizing decentralized platforms like Uniswap V2 or Meteora, as well as centralized exchanges such as Bilaxy. Byte, designed with a playful theme and a dog byte reference, can be obtained through these channels.

Decentralized platforms enable byte-to-byte trading, showcasing Byte’s unique characteristics. These platforms often employ one-time addresses for enhanced security, ensuring the confidentiality of your transactions.

For a more traditional exchange experience, you can explore platforms like Bilaxy, where Byte can be easily exchanged for other cryptocurrencies or fiat currencies. Prioritize platforms that offer the BYTE/WETH trading pair for smooth transactions.

Whether you choose decentralized platforms for their distinct byte byte vibe or centralized exchanges for convenience, the decision on where to buy Byte ultimately depends on your preferences and security needs.

Frequently Asked Questions

What Is Byte Good For?

Byte is good for a variety of uses, such as airdrops, Bitcoin ATM transactions, and wallet management. Its zero-tax policy and community-driven approach make it a unique and transparent option for crypto enthusiasts like you.

Is Byte a Meme Coin?

Byte is indeed a meme coin, embodying the fun and creativity of the crypto world. With its unique features and community-driven ethos, Byte stands out in the market as a symbol of innovation and inspiration.

What Is Byte App Used For?

The Byte app is used for secure storage and management of BYTE tokens, allowing you to send/receive assets, set custom fees, and participate in the Byte Federal ecosystem for transactions. Securely store and manage your tokens.

What Is the Concept of Byte?

Explaining the concept of Byte involves understanding its meme token nature, zero-tax policy, and community-driven ethos. Byte’s utility spans airdrops, Bitcoin ATM transactions, wallet management, and technical applications, all managed securely via the Byte Wallet app.

Conclusion

As you delve into the world of Byte Crypto, you’ll find a complex ecosystem with various potential opportunities.

The digital currency market can be volatile, so it’s important to approach it with caution and a solid understanding of the market dynamics.

By continuously educating yourself and staying informed about the latest developments, you can make more informed decisions when it comes to investing in Byte Crypto.

Remember that success in this field often requires a combination of knowledge, strategy, and patience.

Keep exploring the possibilities that Byte Crypto offers, and strive to make well-informed choices to navigate this ever-changing landscape effectively.

Other Cryptocurrencies to Check:

Coreum Crypto, TriasLab Crypto, IronFish Crypto, Metacade Crypto and Galaxy Fox Crypto.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Mantle Network’s MNT rallies 17% amid ecosystem expansion plans

MNT, the native token of the L2 scaling solution Mantle Network, resumed its ongoing rally as the project unveiled several upcoming developments.

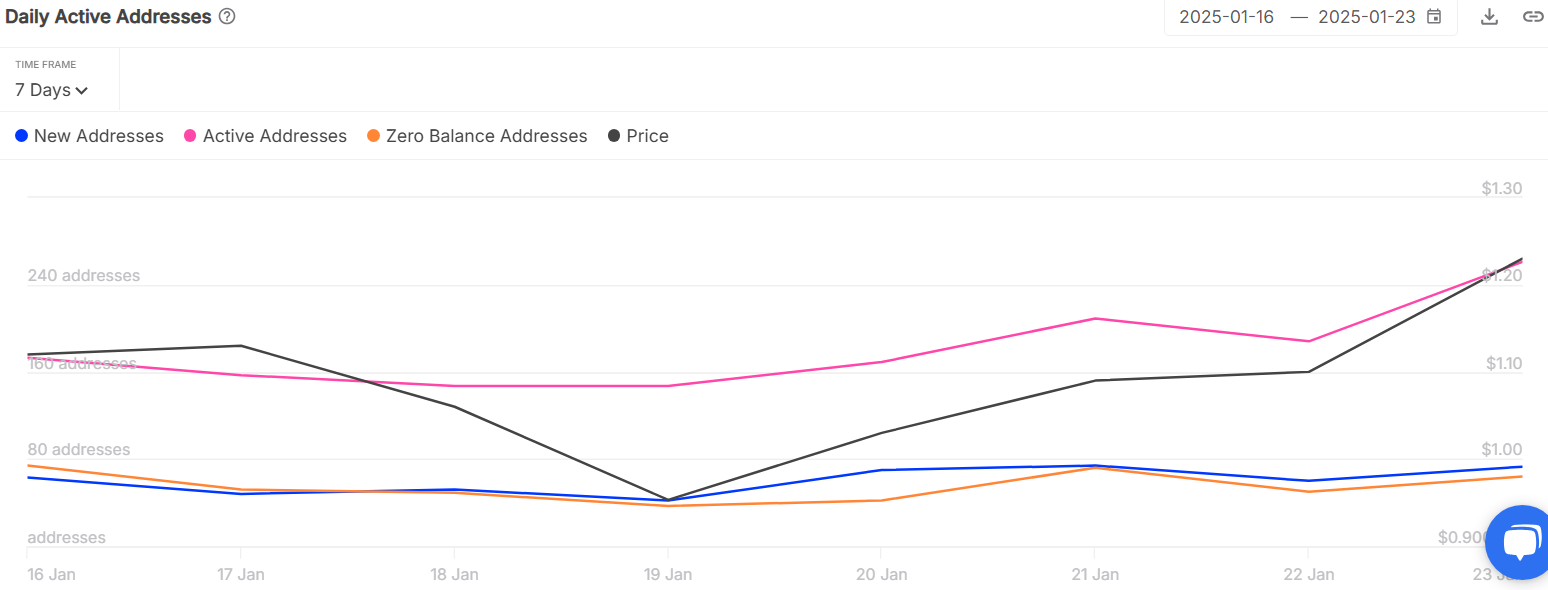

Mantle (MNT) bounded 17% to an intraday high of $1.28 on Jan. 24 while bringing its market to nearly $4.2 billion at press time. The price surge came along with a 60% jump in the altcoin’s daily trading volume which was hovering over $213 million.

Notably, the altcoin began its price upswing on Jan. 20 and has gained 32% since then, while its gains over the past year have reached 104%. The altcoin currently stands as the 40th largest crypto asset per data from CoinGecko, with a circulating supply of over 3.36 billion tokens.

What led the MNT rally?

MNT rallied after its developers announced six key products the project is working on this year to expand its ecosystem. The Mantle ecosystem already includes the modular layer-2 blockchain Mantle Network, the mETH protocol—a liquid staking product—and its wrapped BTC product ‘Ignition FBC.’

However, the project has now introduced three new pillars to support its growth: a crypto fund called Enhanced Index Fund, a blockchain-based banking platform named Mantle Banking, and MantleX, a platform focused on creating AI agents.

The rally was also supported by a surge in Mantle’s daily active and new addresses involved in MNT transactions. On-chain data from IntoTheblock shows a 50% jump in the number of active addresses completing at least one MNT transaction over the past week. Additionally, the number of new addresses created has also increased by nearly 16% during the period.

An uptick in daily active addresses and new addresses is a sign of strong network health and indicates growing adoption of the network.

Buyer demand for MNT has also been on the rise, with data from CoinGlass showing increasing withdrawals from exchanges since the start of the year.

Such exchange outflows suggest that these buyers intend to hold onto their investments, anticipating further potential gains over the long term.

MNT price analysis

On the daily USDT price chart, Mantle has climbed back above the 50-day moving average, signaling that bulls are regaining control of the market. The MACD line has also crossed above the signal line and is pointing upwards, indicating that bullish momentum is building.

Further, the Aroon indicator shows the Aroon Up at 92% while Aroon Down showed a reading of 71%, which means the strength of the uptrend is far higher which could help the rally extend further in the coming days.

Based on these indicators, the MNT could likely continue its rally to test its Jan. 6 resistance level at $1.42, a break above which could push prices towards the next psychological resistance at $1.5.

When writing, MNT’s price stood at $1.23, down a little over 19% from its all-time high.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login