The crypto market has witnessed a massive outbreak in just a day, with liquidation data showing hundreds of thousands of traders have been liquidated and the market cap shrunk.

According to the data from CoinGlass on Dec. 10, market traders have seen major liquidations in a year, with $1.7 billion wiped out in just a day of trading. At the time of writing, over $1.53 billion was spent in long positions, and $155 million was spent in short positions.

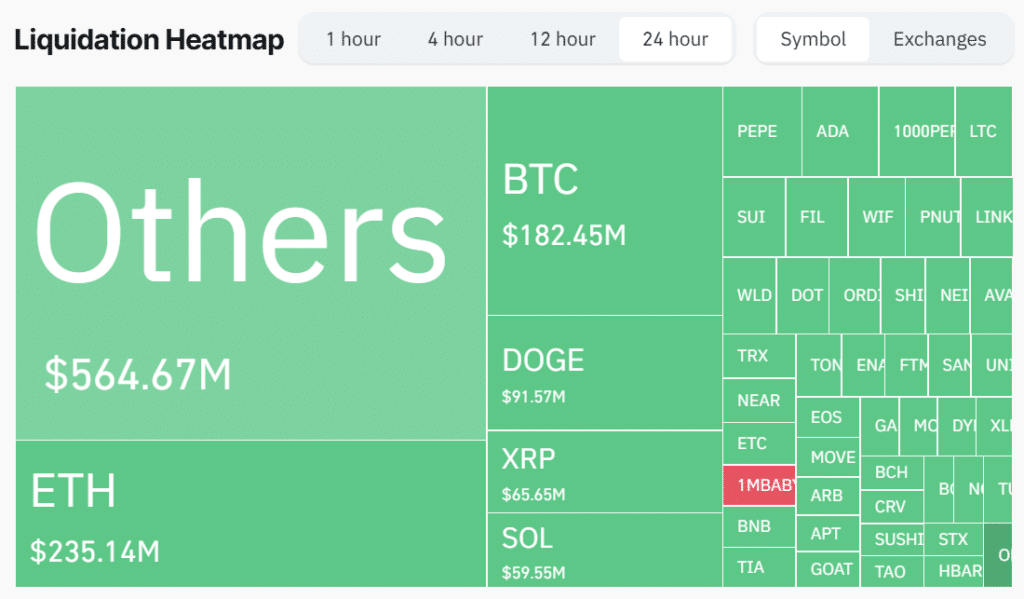

Small-cap crypto is leading the liquidations with $564 million in 24 hours, which is dominated by long positions of $543 million and short positions of only $21 million. Half of a million traders have lost today.

Ethereum (ETH) is the next token that saw major liquidation with $235 million – $214 million longs and $21 million shorts. The token dropped 7% from the highest level of the day to $3,686.

Bitcoin (BTC) community has also seen $182 million in liquidation, with $140 million in longs and $42 million in shorts. Bitcoin has shrunk under the $100,000 psychological level, around $96,652 in a day.

Data shows that Binance has recorded giant liquidations with over $739 million, followed by OKX and Bybit with $422 million and $369 million, respectively. Ethereum-USDT in Binance accounts for the biggest single liquidations with $19.69 million.

Moreover, the market cap fell by 6.62% to $3.44 trillion, while the market volume increased 113% to $313 billion in a day of trading.

Massive crypto liquidations in a year

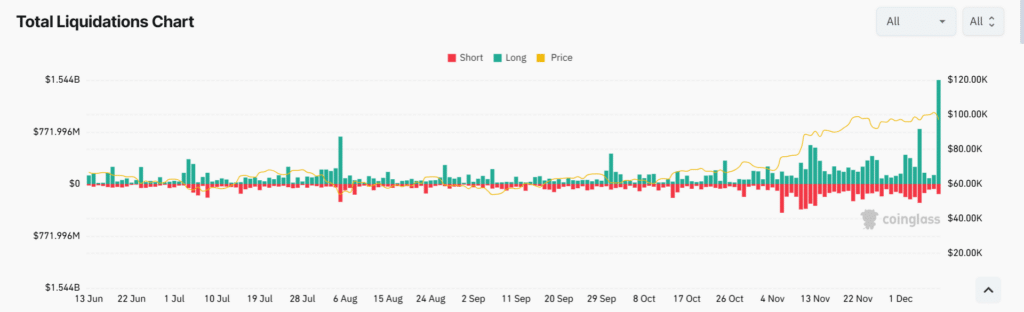

Today’s crypto liquidations are marked as the highest in the past year or become the largest liquidations since 2021, after the market have seen a skyrocketing increase in a few tokens, from BTC to XRP.

Last month, traders also saw a massive outbreak of around $500 million in several days, which indicates that crypto newcomers have entered the market. It has seen an increasing trend of liquidations over the year.

+ There are no comments

Add yours