CryptoCurrency

SOL Falls 8.8% as Nearly All Assets Trade Lower

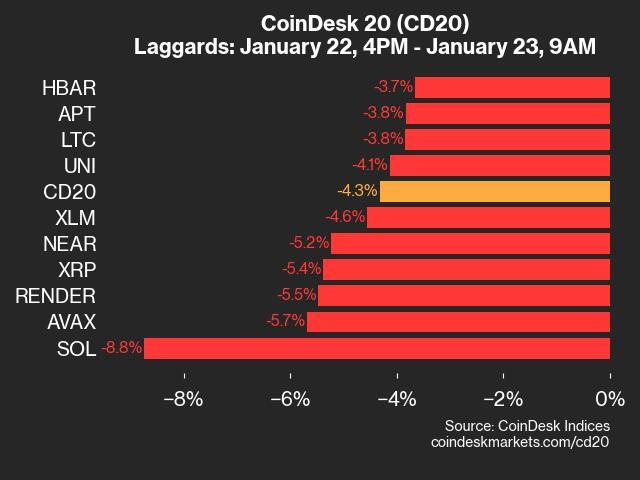

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3809.52, down 4.3% (-172.06) since 4 p.m. ET on Wednesday.

One of 20 assets are trading higher.

Leaders: ETC (+2.1%) and ETH (-1.4%).

Laggards: SOL (-8.8%) and AVAX (-5.7%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

CryptoCurrency

DAO Governance Platform Agora Acquires Older Competitor, Boardroom

Agora, a blockchain governance startup, is set to acquire its competitor Boardroom. The company framed the acquisition as a strategic move to enhance governance within the broader Ethereum ecosystem, citing expectations of renewed growth in decentralized governance due to President Trump’s promise of regulatory clarity for the blockchain industry.

“2025 is the year we make good governance the standard for all protocols in Ethereum,” Agora co-founder Yitong Zhang told CoinDesk.

Agora was founded in 2022 by Zhang, Charlie Feng, and Kent Fenwick. The trio initially started working on governance tooling at Nouns DAO, one of the buzzier blockchain protocols to emerge from 2021’s DAO (decentralized autonomous organization) and NFT hype cycle.

The term “DAO” generally describes crypto communities that are governed by their token holders. They’re a favorite among those who believe crypto’s decentralization ethos can be a world-changing force, albeit an unwieldy way to run a pseudo-company. That’s created an opening for support projects like Agora.

Agora was founded on the premise that token governance is central to the value of crypto protocols. It aims to provide user-friendly, open-source governance tools for DAOs like Uniswap and Optimism, which both currently use Agora to organize token holders and hold governance votes.

Boardroom, which predated Agora and has similar goals, took a more horizontal approach to blockchain governance. Boardroom has gradually transitioned from an Agora-style DAO tooling software to a data feed—similar to a “Bloomberg” for crypto governance data.

Agora declined to disclose how much it paid to acquire Boardroom. Boardroom’s employees have been offered roles at Agora, and Boardroom’s founder, Kevin Nielsen, will remain as an advisor. “There’s no plan to deprecate” Boardroom, according to Zhang. Rather, the Agora team will keep both platforms running and will work with users to determine how the tools might gradually be integrated.

A new day for DAOs?

“DAO” is less of a buzzword in 2025 than it was a few years ago. They were pitched as a way to leverage blockchain’s core strengths in decentralized coordination to advance a new kind of community-owned company, but they’ve been implemented in various ways and to varying degrees of success.

Many DAOs have floundered due to organizational difficulties; it can be hard to coordinate thousands of token-holders around a single goal. Improving DAO tooling can help to address this, but it is only one side of the equation. Another barrier for DAOs has been a lack of regulatory clarity, which has left open questions of legal liability and has made it difficult for DAOs to determine how tokens should be issued, and how decisions should be divided between token holders and a platform’s core developers.

“From a business perspective, DAOs are coming back in a really, really large way,” said Zhang, who says his own business has grown “10X” over the past year. “People haven’t noticed yet because people have so much trauma over DAO bulls**t.”

The Trump administration has signaled its intention to create clearer guidelines for cryptocurrency issuance, which has led to optimism among Zhang and some of his competitors.

“I think we’re gonna finally get reasonable definitions for sufficient decentralization, security, and compliant ways of doing a token,” said Zhang.”

CryptoCurrency

Ross Is Free, But This Is Far From Over

Ross is now free. I predict this will be the one good thing to come out of this administration in the grand scheme of things. The reasons behind this pardon were purely political, but regardless of that I am incredibly happy to see Ross reunited with his family and loved ones. Even taking all the accusations against him at prima facie, both those actually charged and those not, Ross has unquestionably served his time.

Actual murders and rapists serve a tiny fraction of the sentence that was levied against Ross, even after multiple offenses in some cases. His sentencing was entirely political, and in no way proportional to the charges brought against him. The severity was so high for one reason: to set an example.

He is not the only example governments have tried to make since 2013. The Samourai Wallet team are currently under house arrest awaiting trial for hosting the backend for a 100% self-custodial service. Roman Sterlingov is in jail for running a centralized mixer, with no evidence other than flawed blockchain heuristics. The Tornado Cash case has developers dealing with cases and jail time in multiple jurisdictions.

All of these go far beyond the pale of what happened to Ross, in terms of legal standing. Ross’s sentence was insanely disproportionate, but the legal basis itself for these other cases is non-existent. They charged them anyway. Some of them, they convicted them anyways. These people are sitting in jail, just like Ross, anyways.

The government is not going to stop making examples. It doesn’t matter that Trump enjoys the benefits of the unregulated monetary extraction possible in this space, it doesn’t matter that Wall Street and D.C. see value they can take advantage of, none of that matters.

These power brokers and figure heads realizing they can set up a grift, or skim money out of the economy being built here, doesn’t change anything. It doesn’t make them fans of privacy. It doesn’t make them fans of true sovereignty for the individual. It doesn’t make them fans of actually free markets that don’t cater to corporate interests preferentially.

We need tools to actually facilitate all of these things, but building them means you are a potential target.

If you actually care about these things, you know this isn’t over. One man who was unjustly imprisoned is free, and that is an amazing thing. He can see his parents again, his wife, his friends, and that is truly a priceless accomplishment.

But this is not over. Not by a long shot. The music came on, people switched chairs, and it stopped again. But it’s still the same game being played, and we can’t lose sight of that.

CryptoCurrency

LBank Introduces Red Packet with 100 Million Giveaway to Cheer 2025

Singapore, Singapore, January 23rd, 2025, Chainwire

LBank, a leading global cryptocurrency exchange, is thrilled to announce the launch of its Red Packet alongside a 100 Million Giveaway valued at $5 Million which is set to take place from January 24 to January 27, 2025. This exciting event marks a celebration of LBank’s latest achievements and reaffirms its commitment to delivering exceptional value to its growing global user base.

The Red Packet activity comes as part of LBank’s broader push to enhance user experience. Designed to promote social sharing and community engagement, this feature allows users to send and share red packets, creating a more interactive and enjoyable experience.

To celebrate this launch, LBank is introducing a 100 Million red packet giveaway valued at $5 Million, featuring rewards in a variety of tokens. The event will run from January 24 to January 27, 2025, and is open to all LBank users.

Now serving over 15 million users globally, LBank’s position as a leading exchange has been further validated by being awarded Crypto.news’ Best CEX Award. These achievements highlight the platform’s growing presence and impact within the cryptocurrency industry.

As LBank continues to grow its ecosystem, the platform remains committed to offering a wide range of assets and services. By introducing innovative features and providing robust trading solutions, LBank seeks to strengthen its position in the cryptocurrency industry while supporting users in navigating the evolving landscape of crypto innovation.

About LBank

Founded in 2015, LBank is a leading global cryptocurrency exchange, serving over 15 million registered users in more than 210 countries and regions. With daily derivatives trading volume of more than $67 billion, LBank is committed to delivering a comprehensive and user-friendly trading experience. Through innovative trading solutions, LBank has helped users achieve average returns of over 130% on newly listed assets.

As a pioneer in the Meme coin market, LBank has listed over 240 mainstream Meme coins and 40 Meme gems, with several achieving gains of over 500%. As the industry leader in first-time Meme coin listings, LBank has become the go-to platform for Meme coin investors.

Users can follow LBank for Updates

Website: https://www.lbank.com/

Twitter: https://twitter.com/LBank_Exchange

Telegram: https://t.me/LBank_en

Instagram: https://www.instagram.com/lbank_exchange

LinkedIn: https://www.linkedin.com/company/lbank

ContactPR & Communications TeamLBankpress@lbank.com

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Bitcoiners donated $270K to fund Ross Ulbricht’s ‘personal expenses‘

The Silk Road founder’s financial status was unclear, but many crypto users have donated to his ”transition into his new life” since he received a presidential pardon.

CryptoCurrency

DWP warning: State pensioners in poverty continue to rise as thousands miss out on £3,900 annual boost

The Department for Work & Pensions has issued an urgent warning after new figures revealed the number of pensioners pushed in poverty continues to rise.

Around 800,000 of those affected are missing out on a crucial benefit which could help top up income and provide a yearly boost worth £3,900.

This morning, the DWP published figures showing that 13 per cent of pensioners are in poverty. The number of single pensioners struggling financially has increased, with 18 per cent now living in low resources, up from last year.

David Brooks, Head of Policy at leading independent financial services consultancy Broadstone, said: “Today’s data is well timed as the Work and Pensions Committee has begun its review of pensioner poverty, and the Government is expected to kick off a review of adequacy in pensions later this year.

“Understanding the causes of pensioner poverty will be key to ensuring the system is working as it should and supporting those in need.

“For example, increasing the take up of benefits that pensioners are entitled to, particularly those targeted at poorer retirees like Pension Credit, will be critical to lifting more people out of poverty in later-life.”

Around 800,000 people are missing out on Pension Credit worth an average of £3,900 per year

GETTY

The figures highlight ongoing concerns about financial hardship among the UK’s retired population, with nearly two million pensioners facing poverty.

Around 800,000 people are missing out on Pension Credit worth an average of £3,900 per year, according to the DWP. The benefit tops up weekly income to £218.15 for single pensioners and £332.95 for couples.

Those eligible can also receive additional support with housing, council tax and heating bills. Over-75s who qualify are also entitled to a free TV licence, which will cost £174.50 from April 2025.

Pensions Minister Torsten Bell said that the Government is taking action to raise awareness of the benefit. The lack of awareness about Pension Credit’s existence is believed to be the main reason for low take-up rates among eligible pensioners.

Recipients could get an extra £81.50 weekly if they have qualifying disabilities or receive certain benefits like Attendance Allowance or Personal Independence Payment.

The DWP has launched a major awareness campaign this month, writing to 11 million pensioners about Pension Credit eligibility. The letters will be sent as part of the annual state pension uprating exercise, including leaflets promoting Pension Credit.

From April, the State Pension will increase by 4.1 percent to £230.30 per week. Guaranteed Pension Credit payments will also rise, with single pensioners receiving £221.86 weekly, up from £218.15.

Couples will see their Pension Credit increase from £332.95 to £338.61 per week.

LATEST DEVELOPMENTS:

The initiative aims to boost benefit uptake, as research shows 77 percent of pensioners living in poverty currently receive neither pension credit nor housing benefits.

Pensioner poverty is particularly severe among those in rented accommodation, affecting 34 per centof pensioner renters compared to the overall 16 per cent rate.

Research from the Fabian Society shows that those who retired before April 2016 on the basic state pension face higher poverty levels.

The old pension rules made it more difficult to qualify for the full amount, while some on the new state pension also struggle due to housing costs and National Insurance gaps.

Sasjkia Otto, Fabian Society senior researcher, said: “Neither the state pension nor benefits guarantee protection from poverty, and many are falling through the cracks, especially those renting.”

The situation could worsen as the number of pensioners in rented accommodation increases, with 40 per centof all pensioners in poverty being renters.

The state pension remains “too low” according to researchers, despite previous improvements in pensioner poverty rates.

CryptoCurrency

The Legal Challenges Facing DOGE and Musk

What Is the Federal Advisory Committee Act?

FACA, established in 1972, aims to ensure that federal advisory committees operate transparently and accountably. Key requirements include:

- Balanced Representation: Committees must represent diverse viewpoints relevant to their purpose.

- Transparency: Meetings and decisions must be publicly accessible, with notices published at least 15 days prior.

- Accountability: Committees must file reports and maintain records.

These regulations are designed to prevent undue influence and promote public trust in governance.

The Lawsuits Against DOGE

Three lawsuits filed in the US District Court for the District of Columbia accuse DOGE of FACA violations:

- Public Citizen Inc. v. Trump et al

- Lentini et al v. Department of Government Efficiency et al

- American Public Health Association v. Office of Management and Budget et al

The plaintiffs argue that DOGE lacks fair representation and fails to meet FACA’s transparency requirements. Notably, these lawsuits do not include injunctions to halt DOGE’s operations, allowing it to continue functioning while the legal process unfolds.

Challenges in Enforcing Compliance

Legal experts believe enforcing compliance could be difficult for several reasons:

- Speed of Operations: DOGE’s fast-paced approach, reflective of Silicon Valley’s “move fast and break things” ethos, may outpace legal challenges.

- Executive Power: The enforcement of court rulings depends on the executive branch, led by President Trump, who has shown a willingness to bypass norms.

- Historical Precedents: Comparisons to Andrew Jackson’s defiance of the Supreme Court highlight the potential vulnerabilities in the enforcement process.

The Role of Courts in Balancing Speed and Accountability

The courts have become a critical arena for addressing these legal disputes. While the Supreme Court currently leans conservative, legal scholars argue that justices prioritize institutional trust over political loyalty. This balance could influence the outcome of challenges to DOGE and similar initiatives.

Key Issues Highlighted by FACA Violations

The lawsuits show the importance of balancing innovation with democratic accountability. DOGE’s critics emphasize that federal advisory committees must:

- Ensure diverse representation.

- Adhere to transparency standards.

- Avoid favoring private interests over public welfare.

Failure to meet these standards undermines public trust and creates legal vulnerabilities.

Table: Key FACA Requirements vs. Allegations Against DOGE

|

FACA Requirement |

Allegations Against DOGE |

|

Balanced representation |

Committee lacks diverse viewpoints, favoring tech executives. |

|

Transparent decision-making |

Insufficient public access to meetings and records. |

|

Accountability through reporting |

Inadequate compliance with filing and reporting rules. |

The Broader Implications

This case highlights the friction between rapid technological progress and the deliberate pace of government processes. While DOGE aims to streamline governance, ignoring legal frameworks could lead to long-term challenges for similar initiatives.

Legal and political systems must adapt to innovations without sacrificing democratic values. Whether DOGE can align its operations with FACA remains to be seen, but the outcome will set a precedent for future tech-driven advisory committees.

CryptoCurrency

Why “Made in USA” is the Next Big Narrative

Bitcoin and cryptocurrencies kicked off a new era with the inauguration of the first-ever pro-crypto president. The key question is whether the shift towards crypto-positive regulation and rising market activity is a sustainable one or a temporary reaction to changing political tides.

Made in USA crypto tokens have performed well this week, emerging as the most relevant narrative in the sector.

Bitcoin and crypto markets break record in market activity

Donald Trump’s election as U.S. President fueled hopes of crypto traders and firms. A pro-crypto administration supported the narrative of a new age for cryptocurrencies paved with greater certainty and higher market activity.

According to CCData’s latest exchange review report, one of the key measures of market participation hit a milestone in 2024. Aggregated spot and derivatives trade volume climbed to $75 trillion against the 2021 record of $64 trillion.

The two key catalysts were the speculation surrounding the November 2024 election and the Bitcoin bull run, at the end of 2024. Both November and December were record breaking months for crypto with $10.51 trillion and $11.31 trillion in monthly volumes.

Stablecoin market capitalization helps identify market activity, participation and onboarding of new users within the ecosystem. Stablecoins act as fiat on and off ramp for new traders and beginners in crypto, therefore representing market participation and adoption. Data from DeFi tracker DeFiLlama shows a large spike in stablecoin market capitalization on President Trump’s inauguration day.

Market cap crossed $210 billion and observed a year-to-date increase of 3.3% as liquidity and trade volume across centralized and decentralized exchanges spiked. A massive influx of capital from traders supported the spike.

As of Thursday, January 23, stablecoin market capitalization is $214.407 billion, as seen in the DeFiLlama chart below.

Crypto traders are optimistic on made in USA tokens

President Donald Trump’s statement that he wanted all remaining Bitcoin to be “made in the USA” led to the rise of a new crypto narrative, the made-in-USA tokens. CoinMarketCap and CoinGecko have launched a category of tokens under “made in USA.”

XRP (XRP), Solana (SOL), Cardano (ADA), Chainlink (LINK) and Avalanche (AVAX) are the top five altcoins in the list, and the category’s market capitalization exceeds $541 billion.

CCData report states that the basket of crypto tokens in this category has outperformed the remainder of the market. The coins are up 360% since the election, as traders anticipate a positive regulatory environment and more favorable conditions for the tokens made in the states.

The narrative depends on policy and actions of the CFTC and the SEC, and whether President Trump delivers a strategic Bitcoin reserve during his time in office. Four-year crypto market cycle could see a shift and stray from historical trends.

Made in USA vs. China coins narrative

In 2024, the China coins narrative trended on X and other social media platforms as traders flocked to buy cryptocurrencies made in China, like Neo (NEO), VeChain (VET), Huobi (HTX), Filecoin (FIL), Qtum (QTUM), and Ontology (ONT), among others.

With the shifting tides in politics and regulation, the made-in-USA narrative has the potential to compete with Chinese coins. President Trump appointed SEC Commissioner Hester Peirce as head of a new “crypto task force” to provide clarity and support to the industry. There is an expectation that the new task force will support gains for made-in-USA tokens.

Bitcoin traders could gain from these 5 tokens

Solana, XRP, Sui (SUI), Aptos (APT) and Injective (INJ) could rally in the coming weeks, building on the made in USA narrative. Solana was conceptualized in California and is popular for its fast transactions and scalability.

The issuance of President Trump and First Lady Melania’s meme coins on the Solana blockchain has contributed to the rising activity on the chain.

Crypto firm Ripple was fined $125 million for violation of securities laws in its institutional sales of XRP, both sides (SEC and Ripple) appealed the ruling and the SEC has argued that XRP’s institutional and secondary market sales should be treated in a similar manner.

While XRP traders await an outcome in the appeals process, XRP holds steady above $3, after hitting a new all-time high in January 2025.

SUI and APT are US-backed Layer 1 tokens that enable higher scalability and faster transactions for traders while deriving security from the Ethereum base chain.

INJ is a DeFi token with a focus on innovation and AI, the project is made in the USA and could benefit from the DeFAI narrative.

On-chain analysis of top 5 made-in-USA tokens

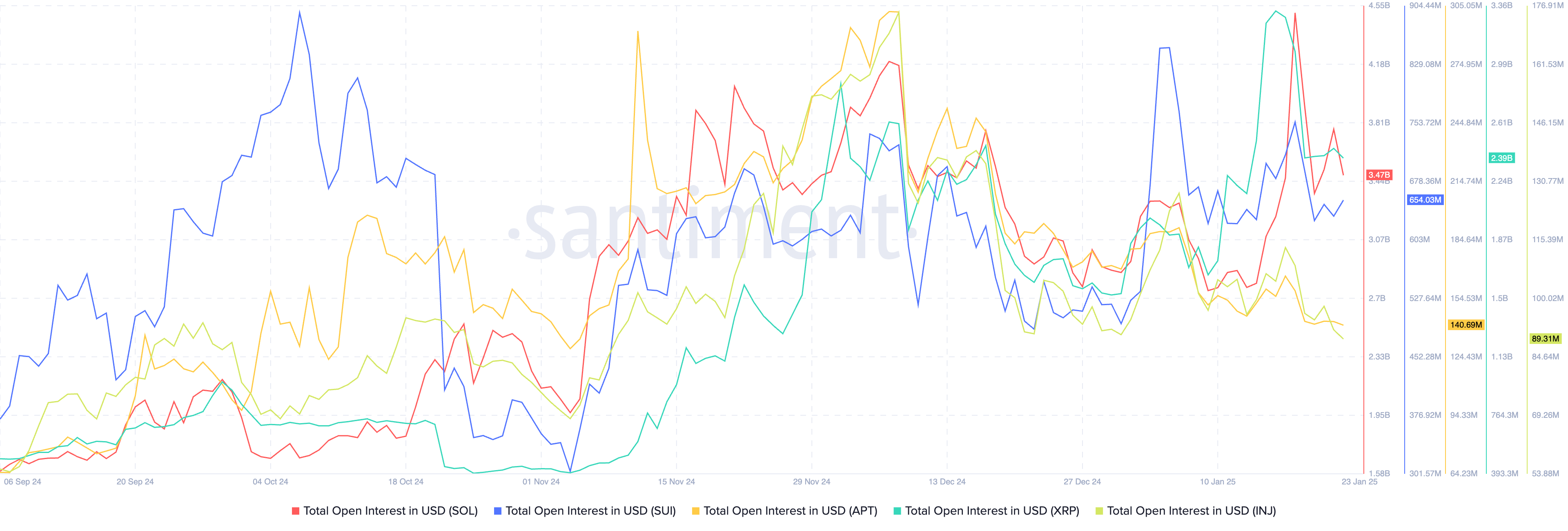

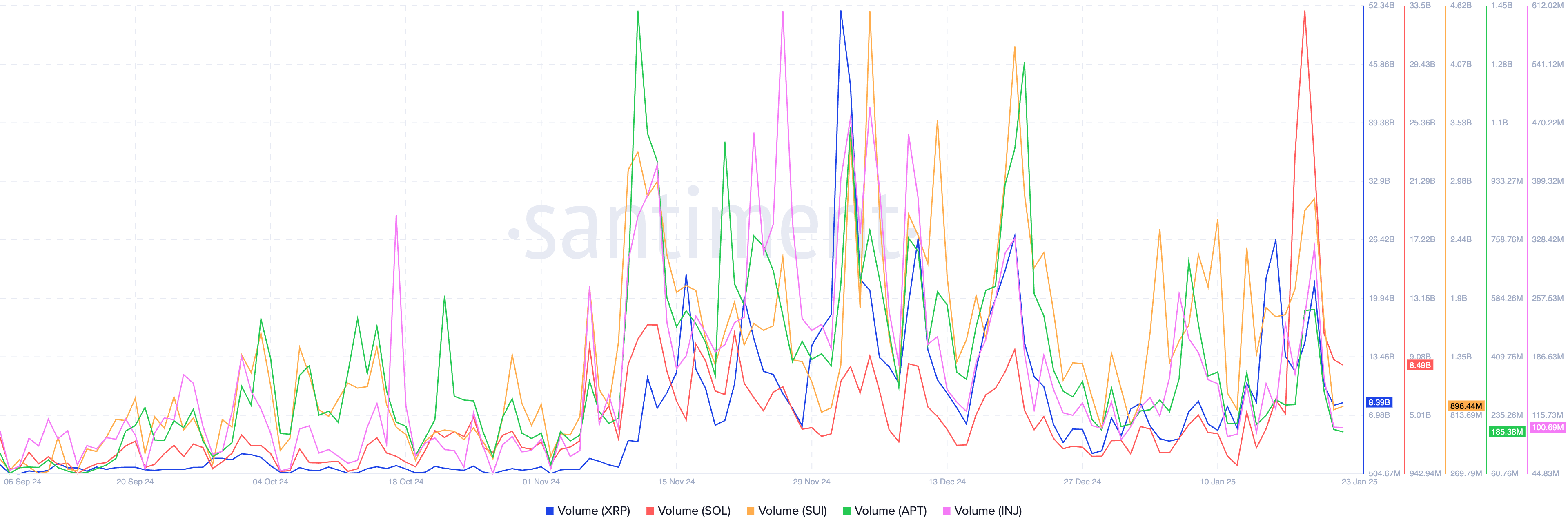

Santiment data shows that the total open interest in USD in the top 5 made in USA tokens noted considerable spikes in January, closer to the inauguration. Even as OI drops from its highest level in assets, it is above the 2024 average, supporting a bullish thesis for the tokens.

Similarly, volume in the top 5 made in USA tokens recorded a spike earlier in January, since then volume remains above the average levels.

Solana is holding on to double-digit gains for the last seven days while other cryptocurrencies in the top 5 struggle, alongside Bitcoin, on Thursday.

Ruslan Lienkha, chief of markets at YouHodler told Crypto.news:

“We may see an accelerated pace of cryptocurrency ETF approvals. However, the more significant development lies in the potential establishment of a comprehensive legal framework for the cryptocurrency industry in the U.S. This could lead to the full recognition of cryptocurrencies as a distinct asset class. Previously, attempts were made to classify cryptocurrencies under existing asset categories, such as securities or commodities, which did not fully capture their unique characteristics.”

Tim Ogilvie, Global head of institutional at Kraken, said that:

“Bitcoin’s bullish momentum still has room to grow, as indicated by the relative strength index (RSI), which currently sits at 65. Generally, an RSI above 70 is considered overbought.

Solana (SOL) hit an all-time high of $260 this week. However, technical analysis suggests that it is now in overbought territory, with an RSI around 75. While there may still be bullish momentum, this could also signal caution for short-term traders. They will be watching to see if SOL can close above $260 to confirm renewed bullish momentum.”

In the Crypto Regulatory Affairs newsletter, experts at Elliptic said:

“On January 20, US President Donald Trump was sworn into office for his second term in office, a moment the cryptoasset industry has been awaiting with high expectations. Prior to his inauguration, recent news reports had indicated that President Trump – who campaigned on a promise to make the US a leader in cryptoasset innovation – planned to issue executive orders upon taking office that would declare crypto to be a national strategic priority, appoint a crypto czar and establish a crypto council to effect policy changes, and repeal a controversial accounting rule on crypto established by the Securities and Exchange Commission (SEC), known as Staff Accounting Bulletin (SAB) 121.

However, in his first twenty four hours in office, President Trump did not sign any executive order pertaining to crypto.”

Crypto traders and experts maintain optimism of positive action within the first 100 days of Trump’s return to office.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CryptoCurrency

Here Аre the Latest Developments

TL;DR

- Pi Network developers have set the Open Network launch condition at 15 million KYC-verified users, with over 9 million already migrated, but some users continue to face verification challenges.

- The project’s popularity remains strong, especially in Asia, with millions of users and a large social media following that surpasses established crypto entities like Ripple.

What’s New?

Pi Network is one of the most controversial and yet most popular cryptocurrency projects. It claims to allow people to mine digital assets directly from their smartphones with minimal energy consumption. Despite being around for almost six years, Pi Network has yet to introduce its native token and open mainnet.

Many community members have been frustrated by the lack of clarity surrounding the exact launch of those developments. However, Pi Network’s team has continuously assured these milestones are on the horizon.

Not long ago, the developers said the first major target was the launch of the Open Network. They said it will go live if 15 million users pass necessary Know-Your-Customer (KYC) verifications and migrate to the mainnet (known as the Grace Period) before the end of this month.

At the beginning of January, Pi Network claimed the project has been making “excellent progress,” with over 9 million successful migrations. Prior to that, the team maintained that 14 million people had completed the verification procedures.

Despite the claimed progress, some users complained they had experienced issues when trying to abide by the rules. To ease their efforts, Pi Network recently advised them to “either spend Pi to update their name or appeal to resubmit their KYC application.”

“Pioneers who have rejected KYC applications due to differences in their Pi account name and their real name in ID documents can now either spend Pi to update their name or appeal to resubmit their KYC application. Complete this action today if needed,” the full guidance reads.

Towards the end of last year, the team issued another advice to struggling users. Specifically, it urged people who can’t complete KYC procedures for some reason to join a dedicated Telegram chat “where there will be mods to answer your questions.”

How Popular is Pi Network?

As mentioned above, the controversy surrounding the project has not stopped it from increasing its popularity in the past few years. Its user base has been particularly on the rise in Asia, in countries like South Korea, China, Vietnam, Japan, Singapore, and others.

Last month, Wu Blockchain revealed that the number of Pi Network users in South Korea reached 1.34 million, which is more than the domestic client base of well-known crypto exchanges like Binance and Coinbase.

Meanwhile, the official X account of the project has more than 3.5 million followers. In comparison, established cryptocurrency entities such as Ripple, for instance, have fewer subscribers.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

TRUMP Token Tops XRP In Trading Volume Despite Sharp Decline

A surprising twist within the crypto market has seen TRUMP token trading volume surpass XRP, with a massive price correction. This behavior of the market in a very unpredictable manner points to the fact that the crypto space is quite unpredictable and that speculative tokens often see tremendous trading activity swings, even as their prices plummet. The trading volume surge by the TRUMP token is more interesting in this scenario of high volatility and uncertainty.

Related Reading

Speculation Fuels TRUMP Token’s Rally

Despite its sharp decline in price (down 16% in the last 24 hours), the TRUMP token managed to outdo XRP in trading volume. The rally in trading activity in TRUMP’s token has piqued the interest of the entire cryptocurrency community, with speculation pointing towards a very strong reaction of traders to the token, probably fueled by its political branding or hype around its speculative nature.

Donald Trump, the 47th president of the United States, launched the meme coin Official Trump (TRUMP), which is based in Solana, over the weekend. Its price immediately reached highs close to $80, indicating that it was a huge success at launch.

At the time of writing, TRUMP was trading at $35.69, with a 24-hour trading volume surpassing XRP’s. In particular, according to CoinMarketCap data, the meme coin has experienced $8.7 billion in trade activity, compared to XRP’s $8.3 billion.

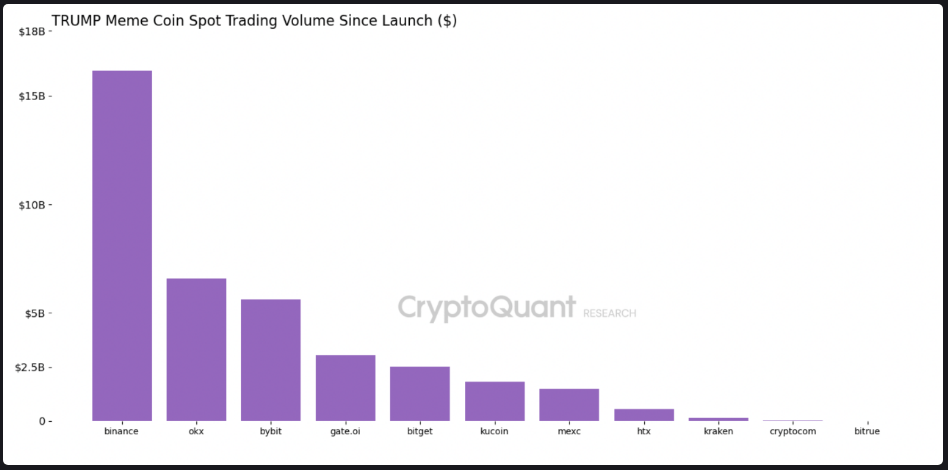

Since its inception on January 17, TRUMP has experienced an incredible $38 billion in trade activity, according to CryptoQuant data released on Wednesday. Notably, big sell-offs as momentum cools are probably the cause of the recent price’s sustained high trading volume.

According to Dexscreener data, sale volume has recently surpassed buy volume.

Meanwhile, XRP keeps growing steadily, while holding the number one spot of the top-ranked digital assets on the market. A short-term jump in trading volumes of the TRUMP token indicated a new shift in interest into tokens that bring more volatility and rewarding trading dynamics.

XRP Standing Strong

Although the TRUMP token managed to take a trading volume lead over XRP temporarily, it’s not easily replaced in the long run because of its years-long presence in the market. XRP, being an old cryptocurrency, has attracted followers and institutional investment and, thus, is relatively stable in the market.

Related Reading

The TRUMP token is, on the other hand, a recently introduced and relatively speculative asset whose trading volume peak may prove transitory and reliant on the whim of speculative traders rather than being based on sustainable investment.

The contrast between the two tokens—one propelled by excitement and the other by solid fundamentals—illuminates the divergent forces at work in the cryptocurrency market. Although XRP may be more resilient, the TRUMP coin is presently experiencing a brief period of excitement and even controversy, which highlights the market’s unpredictable nature and the factors that influence trading activity.

Featured image from Gearbest, chart from TradingView

CryptoCurrency

Absence of Trump Crypto Order Amps Industry Tension as He Fails to Mention in Speech

The crypto industry is desperate to see crypto action from U.S. President Donald Trump, now a few days into his new presidency, but there hasn’t yet been a confirmation from the White House that an executive order is pending.

It’s not entirely off of Trump’s radar, though, because he did mention the crypto industry in his address on Thursday to the World Economic Forum, saying that an increase in domestic oil and gas production will secure U.S. manufacturing dominance and make it “the world capital of artificial intelligence and crypto.”

Still, he spent much more of the speech talking about U.S. AI commitments and didn’t mention digital assets again.

The sector will likely be watching closely at 2:30 p.m. Eastern on Thursday, when Trump is again scheduled to sign executive orders. The White House has already issued an extensive array of such orders. While they don’t carry the weight of law, such directives can steer the federal government’s priorities.

Trump is also scheduled to speak with crypto-friendly El Salvador President Nayib Bukele at 3:30 p.m., news which sparked another rally in Bitcoin’s price.

In other corners of the federal government, the Senate Banking Committee established its first digital assets subcommittee on Thursday, with Wyoming Republican Cynthia Lummis running it alongside other crypto-friendly lawmakers. And the Securities and Exchange Commission, newly led by Republican Mark Uyeda, announced a crypto task force this week.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login