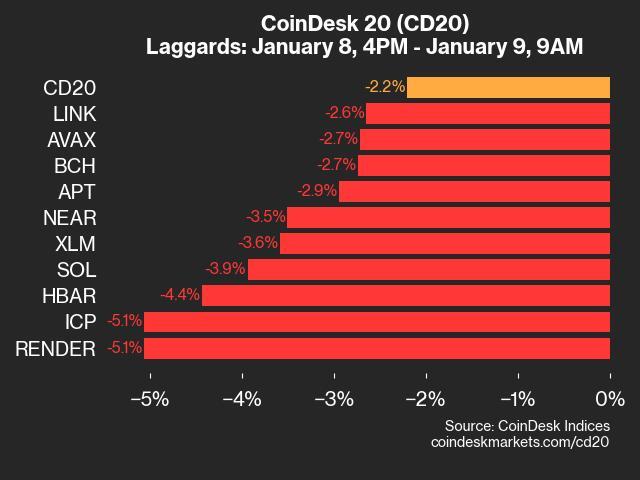

Solana is currently trading at $197, marking a 13% decline from the local high it achieved earlier this week. The broader cryptocurrency market is experiencing heightened indecision, with some fear creeping in as Bitcoin struggles to reclaim the pivotal $100,000 level. This hesitation has created ripple effects across altcoins, including Solana, which has seen its recent momentum stall.

Related Reading

Top analyst Jelle shared a technical analysis on X, highlighting that $SOL/BTC could be a key pair to monitor in the coming weeks. Jelle suggests that Solana’s performance against Bitcoin may provide critical insights into its potential trajectory. While Solana remains a market favorite due to its robust ecosystem and innovative developments, its ability to reclaim strength relative to BTC will likely influence investor sentiment.

As Solana continues to test key support levels, market participants are closely watching for signs of a breakout or further consolidation. The next few weeks could be decisive for Solana’s price action, setting the tone for its performance in the months ahead. Will Solana bounce back to reclaim its highs, or will market uncertainty push it lower? Investors are waiting for clear signals amid this period of flux.

Solana Enters A Crucial Phase

Solana is trading just above the critical $190 support level, a former supply zone that has flipped into demand. This level represents a key test for the asset as it seeks to solidify its bullish trajectory. Solana has been forming higher lows, a positive sign of strength, but it still needs to reclaim higher supply zones to confirm a sustained bullish trend.

Top analyst Jelle recently shared his insights on X, emphasizing the importance of monitoring the SOL/BTC pair in the coming weeks. He noted that Solana is entering what appears to be a bullish phase, but its performance against Bitcoin will be a critical factor in determining its future direction.

According to Jelle, Solana must reclaim the 0.0022 level against BTC to signal strength and confirm its bullish outlook. Should Solana fail to achieve this, Jelle indicated that he would consider reallocating some of his exposure back into Bitcoin.

Related Reading

The current market indecision, fueled by Bitcoin’s struggle to break above $100,000, has left many altcoins, including Solana, in a state of flux. A breakout above the 0.0022 level on the SOL/BTC chart would not only reinforce confidence in Solana’s bullish potential but also mark it as a strong contender in the ongoing market rally.

Testing Demand At Key Levels

Solana is currently trading at $196, navigating a critical demand zone between $193 and $200. This range serves as a key battleground for bulls and bears as Solana attempts to sustain its bullish trajectory. For bulls to regain control, the price must decisively break above the $200 level, invalidating bearish pressure and setting the stage for further gains.

To solidify its bullish structure, Solana needs to reclaim the $222 mark. Achieving this would establish a higher high, reinforcing confidence among investors and signaling the continuation of its upward trend. However, failure to push above $200 could leave the price vulnerable to further downside pressure.

Related Reading

On the flip side, losing the $193 support level would likely trigger a deeper correction. This could result in Solana entering a consolidation phase, where the price stabilizes before attempting another breakout. Such a scenario would likely extend market indecision as investors await clear signs of a sustained trend.

Featured image from Dall-E, chart from TradingView

+ There are no comments

Add yours