CryptoCurrency

Solana (SOL) Price Expected to Reach $880-$1134; Trader Reveals Timeline

Riding a tide of bullish feelings like Bitcoin and Ethereum ETF approvals, a halving event, and even political occurrences like Trump’s triumph, Solana (SOL) has been on an amazing run through 2024. Solana’s growing ecosystem and technological developments have driven the Solana forecasts between $880 and $1134 per token. Although some may consider these forecasts too optimistic, Solana’s growing popularity and traction point to this milestone more as a matter of “when” than “if.”

Experts Weigh In: Could Solana reach $880-$1134?

Based on CoinMarketCap, Solana trades at over $239, up 1.54% daily. The Solana ecosystem is hopeful; many analysts see notable upward potential. Raoul Pal, CEO of Real Vision and Global Macro Investor, has set a “worst-case” target of $880 for Solana, with an optimistic projection of $1,200 in a peak market condition. Similarly, an analyst known as Crow has pointed to Solana’s historical performance—rising from $25 to $260 in 2023—as evidence of its capacity for exponential growth. Crow predicts Solana could surge from $125 to $890, driven by strong market momentum and historical price trends. Important changes inside the Solana ecosystem also support these positive projections. The widely awaited Firedancer upgrade should significantly improve the network’s scalability and performance, hence increasing Solana’s appeal to consumers and developers. Furthermore, speculations about a Solana Exchange-Traded Fund (ETF) are adding to the buzz. Though the ETF is still speculative, approval might pave the path for large institutional investments, increasing demand and price.

Solana’s acceptance is also flourishing in several spheres. From non-fungible tokens (NFTs) to distributed finance (DeFi), Solana continues to host increasing uses, hence supporting its reputation as a flexible and strong blockchain platform. Although Solana is likely to reach $880-$1134, this is expected to take time. Analysts say achieving these pricing expectations will depend critically on more general acceptance of DeFi and NFTs, the success of upgrades like Firedancer, and favorable market conditions. Assuming Solana keeps innovating and the market keeps track of growth, most forecasts show this milestone might be attained by 2040.

The Rising Star: Rexas Finance (RXS)

Although Solana’s long-term future seems bright, a new cryptocurrency called Rexas Finance (RXS) generates waves with its quick acceptance and innovative asset tokenizing method. This growing platform presents a novel viewpoint on blockchain applications by allowing users to tokenize and trade almost any real-world asset—from real estate and art to commodities and intellectual property. By choosing a community-driven presale instead of conventional venture capital financing, Rexas Finance has already drawn major investor interest. Originally priced at $0.03 in stage 1, launched on September 8, 2024, the token has surged to $0.125 in its ninth presale round. With 313,174,595 tokens sold, the presale has thus raised an amazing $23,647,109. Important benchmarks for Rexas Finance are a good Certik audit, which highlights the platform’s security dedication, and CoinMarketCap and CoinGecko listings. The platform’s innovative Millionaire Giveaway campaign, featuring a prize pool of one million RXS tokens, has further boosted its popularity.

Looking ahead, Rexas Finance intends to launch on significant exchanges in early 2025 at $0.20, exactly timed to coincide with the height of the next bull run. Driven by its actual use and increasing acceptance, analysts estimate the token might reach $20 by the end of 2025 and $100 by 2030. This is a shockingly 449,900% rise from its price; hence, it is a considerably more profitable investment than Solana’s expected 374.48% by 2040.

Why Rexas Finance Outshines Solana

Solana’s path to $880-$1,134 seems bright, but it’s a long-term play with an expected 2040 horizon. Rexas Finance provides better returns with faster rates. Its emphasis on the asset tokenization market—a sector with great future expansion—positioned it as a novel initiative. For individuals looking for high-growth prospects, Rexas Finance is quickly rising as a top choice. With practical use cases, an inventive ecosystem, and a demonstrated track record of investor interest, the platform is redefining asset management by democratizing access to typically illiquid assets through blockchain technology.

Solana is still a strong investment with a bright future, but its development path is gradual and constrained regarding possible returns. Conversely, Rexas Finance presents investors with a more profitable and timely possibility. Rexas Finance is a fascinating alternative for people wishing to optimize their investments in the cryptocurrency market since it offers significantly better gains thanks to its creative strategy, solid market fundamentals, and fast acceptance.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Trump Issues Crypto Executive Order to Pave U.S. Digital Assets Path: Reports

U.S. President Donald Trump has come through with an eagerly awaited executive order on crypto that directs his administration to establish friendly policies to put the industry on solid U.S. footing and work toward establishing a “digital asset stockpile.”

After years of courtroom combat with federal authorities, Trump’s order could allow the digital assets sector to move forward in the U.S. with a more welcoming framework set by the White House. Such orders are more of a beginning than an end in federal policy, but the pro-crypto president has taken that first step, Bloomberg reported Thursday.

When Trump had failed to issue it among his opening flurry of executive orders, crypto insiders grew increasingly tense about the new relationship he’s promised. But behind the scenes, leaders at the U.S. markets regulators — the Securities and Exchange Commission and Commodity Futures Trading Commission — were already prepping this week to move digital assets businesses out of the multi-year penalty box the previous agency officials kept them in.

CryptoCurrency

Top Cryptocurrency To Buy Right Now (Hint: It’s Not Bitcoin)

Bitcoin and large-cap crypto assets are caught in a state of uncertainty, as investors closely monitor both Donald Trump’s actions and the broader macroeconomic landscape.

While Bitcoin’s sustained trading above $100,000 is seen as a sign of strength, altcoins — particularly Ethereum — remain lackadaisical.

However, low-cap meme coins are showing little correlation with the broader market outlook and continue to create generational wealth. The Trump family coins — $TRUMP and $MELANIA — have driven the hype and FOMO to reach a fever pitch.

A new meme coin, Meme Index (MEMEX), has quickly established itself as a top cryptocurrency to buy right now. The project is building the first decentralized meme coin index fund, allowing investors to gain broader market exposure with just one coin.

Meme Index — The Smart Way To Invest In Meme Coins

The market has been eagerly anticipating the launch of an index fund-like investment model for meme coins.

There are simply too many high-upside meme tokens to invest in, particularly for retail investors. Due to the broader market bearishness, interested buyers can find promising assets like Moo Deng, Peanut The Squirrel and NEIRO in highly undervalued territory.

Meanwhile, new meme coins continue to launch. Inspired by Offical Trump’s success, the CEO of Vine Rus Yusopov launched his own meme coin, which has a $224 million market capitalization in just a day. Vine is one of TikTok’s biggest competitors and is rumoured to integrate with X.

However, it is highly improbable that small-scale investors can even find an asset like $VINE in time. Moreover, they either go all-in on one asset or are spread too thin across many, owing to the budget constraint.

Now, Meme Index’s meme coin baskets allow MEMEX holders to gain broader market exposure while spreading the risk. The project will soon launch 4 baskets, each with varying risk-reward ratios.

For instance, the Meme Titan Index is designed for safe players and features large-cap coins like Pepe and Dogecoin. On the contrary, the Meme Frenzy Index is designed for the degens and will include low-cap meme coins that could offer anywhere between 10x to 100x returns.

Meme Moonshot and Meme Midcap are the two other attractive options. Check out the project whitepaper for more of its salient features.

Noticeably, only MEMEX holders will be able to invest in the baskets. More importantly, they will get to vote on which tokens to be included in each basket. This would ensure every entry has strong community support and isn’t a scam.

Moreover, small-scale investors will finally benefit from projects like VINE, MOBY and UFD before they explode.

Considering its high upside potential, it is no surprise the Meme Index presale has raised nearly $3 million in short order, with many viewing it as one of the top cryptos to buy now

The Top Crypto To Buy Right Now?

Donald and Melania Trump’s meme coin launches have paved the way for major players to join the space. Just today, Barstool President Dave Portnoy released a video mulling about launching his own meme coin.

I’ve been going back and forth about if I want to launch my own meme coin #DDTG pic.twitter.com/KdEdXgdvJT

— Dave Portnoy (@stoolpresidente) January 23, 2025

Against such a backdrop, Meme Index’s investment model could prove to be a game-changer for whales and small-scale retailers alike.

Smart money investors are already impressed with the project’s uniqueness, innovation and community governance model, with many calling it the next 100x crypto.

Despite its ambitious goals, MEMEX is highly undervalued and is still in the early stages of its presale. Interested buyers can invest in the meme coin today with just a few clicks and take a major step towards diversifying their portfolio.

Check out Meme Index’s X and Telegram accounts for the latest updates.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

BlackRock CEO wants SEC to ‘rapidly approve’ tokenization of bonds, stocks: What it means for crypto

BlackRock CEO Larry Fink said he’s “a huge believer in crypto” and urged the SEC to “rapidly approve” asset tokenization. Is this a net positive for the crypto sector?

CryptoCurrency

Here’s why Bitcoin and most altcoins are falling

Bitcoin and most altcoins have fallen this week even after Donald Trump’s inauguration to become the most crypto-friendly president in the US.

Bitcoin (BTC) price dropped to $101,000 on January 23rd, while popular meme coins like ai16z, Fartcoin, and Official Trump fell by over 20%. Other top laggards were coins like Lido DAO, Jupiter, Virtuals Protocol, and Hyperliquid.

There are four possible reasons for the ongoing crypto retreat. First, economists expect the Bank of Japan to hike interest rates by 0.25% on Friday. This would bring the official cash rate to 0.50%, the highest level since 2008.

The last BoJ rate hike occurred in August last year, leading to a sharp decline in cryptocurrencies and other assets. This was due to the unwinding of the Japanese yen carry trade. As such, another BoJ rate hike may trigger another drop, albeit at a smaller size.

Second, in line with this, Bitcoin and altcoins fell as traders waited for next week’s Federal Reserve interest rate decision. A hawkish tone may also lead to more weakness in the crypto industry since it would push government bond yields higher.

Third, they have dropped because Donald Trump has not mentioned crypto since his inauguration. He has also not signed any executive order on cryptocurrency. This explains why the odds of him creating a strategic Bitcoin reserve have dropped to 40% on Polymarket.

The coins also dropped because of the popular practice of buying an asset ahead of a major event and then selling it when it occurs.

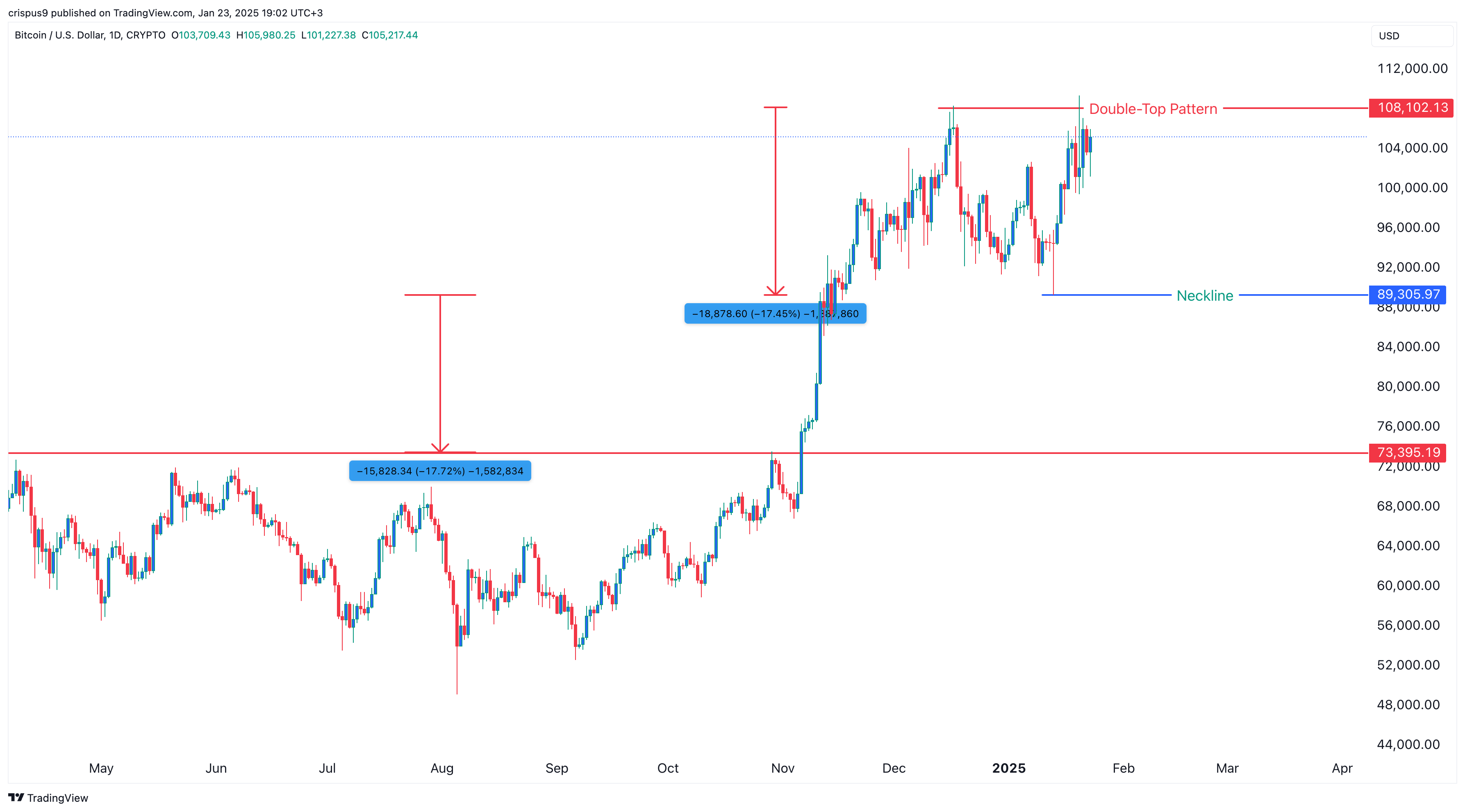

Risks of a Bitcoin price double top

Bitcoin has also formed the risky double-top chart pattern at $108,100.This pattern is made up of two peaks and a neckline and is usually a bearish reversal sign. The neckline in this case is at $89,305. By measuring the distance between the double-top and the neckline, the potential target for the coin is about $74,000.

Therefore, Bitcoin will remain on edge as long as it is below that double-top pattern. This will, in turn, affect other altcoins that often move in the same direction as Bitcoin.

Moving above the double-top point at $108,100 will invalidate the bearish view and point to more gains, potentially to the psychological level at $110,000.

CryptoCurrency

Boba Network Integrates Nucleus to Expand Cross-Chain Functionality and Ecosystem Accessibility

[PRESS RELEASE – San Francisco, United States, January 22nd, 2025]

Boba Network has announced the integration of Nucleus, a protocol designed for blockchain networks. This collaboration enables users bridging ETH, Liquidity Staking Tokens (LSTs), or Liquidity Reward Tokens (LRTs) to the Boba Network to engage with Ethereum mainnet functionalities while accessing various DeFi protocols, gaming platforms, and NFT marketplaces

The partnership aligns with Boba Network’s focus on scalability and user-focused development. The integration of Nucleus expands Boba Network’s ecosystem offerings, highlighting advancements in cross-chain functionality and composable infrastructure.

Enhancing Results Through Cohesion

- ETH, LSTs, or LRTs bridged to Boba Network are integrated into the network’s system, facilitating seamless interaction with decentralized applications. This approach aims to optimize user engagement without additional complexity.

- This version removes promotional language and references to financial benefits, focusing solely on functionality.

- Frictionless Cross-Chain Operations

- Secure interchain messaging protocols connect Ethereum Mainnet and Boba Network, enabling efficient yield aggregation. The flow of assets and rewards benefits from streamlined coordination between chains.

- Composable Infrastructure

- Smart contracts empower cross-chain deposits, withdrawals, and liquidity management. This allows developers to build robust decentralized applications that incorporate Nucleus’s functionality without added complexity.

Boba Network as a Foundation for Innovation

Boba Network’s advanced capabilities support Nucleus’s goal of integrating core functionalities into blockchain ecosystems.

- HybridCompute™

- Off-chain data computation at scale lowers costs and boosts performance for yield-bearing protocols.

- Account Abstraction

- Simplified user interactions reduce onboarding barriers and enhance overall accessibility.

- Low Transaction Costs

- Lower fees support high-volume user participation and provide a cost-effective environment for dApp developers.

This synergy bolsters ecosystem capabilities, drives the adoption of decentralized technology, and sets the stage for new market opportunities.

Aligning with Nucleus’s Mission

By deploying on Boba Network, Nucleus aims to integrate core functionality across multiple crypto networks. This approach supports ecosystem participation by leveraging Boba Network’s features, including speed, cost-efficiency, and access to a range of decentralized applications.

What the Integration Brings

- For Users: Convenient access to a variety of applications within the Boba Network ecosystem.

- For Developers: Tools and resources for integrating advanced features into decentralized applications to support innovative product development.

- For Ecosystems: Increased network activity supported by integrated functionalities, contributing to the ongoing development of blockchain technology.

Setting a New Standard for Blockchain Networks

The collaboration between Nucleus and Boba Network aims to integrate advanced network functionalities as a core feature rather than an additional option. This integration seeks to enhance the accessibility and utility of blockchain technology, supporting broader adoption and facilitating advancements in decentralized finance and related fields.

Users can learn more about Nucleus on Boba Network and experience how this integration is redefining blockchain networks.

About Nucleus

Nucleus is a protocol designed to integrate core functionalities at the foundational layer of blockchain ecosystems. By streamlining cross-chain operations and providing developers with tools for integrating advanced features, Nucleus aims to enhance how users interact with Web3 technologies.

About Boba Network

Boba Network is a multichain Layer 2 solution designed for scalability, low transaction costs, and enhanced developer capabilities. Through innovations such as HybridCompute™ and account abstraction, Boba Network supports diverse dApps spanning DeFi, gaming, and NFTs, aiming to bring the next wave of users into the blockchain space.

Website: https://boba.network

Twitter: @bobanetwork

LinkedIn: https://www.linkedin.com/company/bobanetwork/

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Here’s Why $96,000-$111,000 Is Most Important

Although Bitcoin price action is still holding above the $100,000 price level, the past 24 hours have been highlighted by a 2.5% decline. According to liquidation data from Coinglass, this decline has seen $65.47 million worth of positions liquidated, with the majority ($54.10 million) being long positions.

Crypto analyst Kevin (Kev_Capital_TA) noted a significant range between $96,000 and $111,000, calling it the most pivotal zone on Bitcoin’s liquidation heatmap. This zone could determine the market’s next trajectory after months of back and forth movement trading between this range.

Bitcoin’s Liquidity Heatmap Highlights Key Levels

According to Kevin’s analysis, which he posted on social media platform X, large liquidity blocks dominate the range between $96,000 and $111,000, which has created an important zone for Bitcoin traders to keep an eye on.

Related Reading

Liquidity heatmaps visualize areas where buy and sell orders accumulate, often serving as potential reversal or breakout points. The presence of significant liquidity in this range suggests that the market could experience heightened volatility once Bitcoin approaches these levels, and inexperienced investors could be caught up in the price action.

The liquidity blocks within this range are highlighted in green in the Bitcoin price chart below. These green zones are high-activity zones that act as a magnet for price action. Notably, the largest liquidity cluster lies near $109,700, slightly above Bitcoin’s current all-time high of $108,786, achieved just three days ago. This proximity to this all-time high means that Bitcoin could undergo another strong price action once it reaches this level. There are many market participants with buy and sell orders here around $109,700.

Bitcoin Needs To Break Above its Prolonged Sideways Trading

Kevin also pointed out Bitcoin’s extended period of sideways trading, which has tested the patience of many investors. He noted that Bitcoin traded sideways for eight months at the end of 2024, followed by a brief surge in price, only to return to another three-month period of low volatility.

Related Reading

Since then, however, the strong bullish momentum has yet to repeat itself. Although long-term holders may still be in profit, short-term traders are feeling the most strain from the lack of any substantial upward price action.

The first step in repeating bullish momentum would be to break above the upper end of the liquidation zone at $110,000.

If Bitcoin breaches this range, it could trigger a significant rally or sell-off depending on the prevailing sentiment and trading activity within the zone.

However, the lack of liquidity beyond these levels also poses risks, especially below the lower end of the zone. The thinner orders means there isn’t enough hold up liquidity to reject a price breakdown.

At the time of writing, Bitcoin is trading at $102,200, down by 2.8% in the past 24 hours.

Featured image from Unsplash, chart from Tradingview.com

CryptoCurrency

DOGE and TRUMP ETFs May be Coming But Should Institutional Investor Trade Them?

It took institutions over a decade to take bitcoin (BTC) seriously as an investment vehicle, even though well-known financial pioneers had embraced the largest cryptocurrency on the market years earlier.

But not even one year after the launch of the spot bitcoin exchange-traded funds (ETFs) which saw adoption from pension funds, hedge funds and even universities, one issuer is taking it a step further.

The latest filings with the Securities and Exchange Commission aim to bring meme coin ETFs — such as those tracking dogecoin (DOGE) or U.S. President Donald Trump’s Trump coin (TRUMP) — to the market.

This isn’t just a bold move because DOGE and TRUMP are far less established and legitimate tokens, especially in Wall Street’s eyes, but meme coins provide no actual utility, unlike bitcoin or Ethereum’s ether (ETH). Their value simply comes from how much people believe it is worth making the launch of an ETF tracking the coins an ethical debate.

“Opinions vary greatly on the value of meme coins. I fail to see their long-term value, but others have different opinions,” said James Angel, faculty affiliate at Georgetown University’s McDonough’s Psaros Center for Financial Markets and Policy. “However, a sponsor of an ETF based on meme coins needs to be very careful in the marketing of the ETF. It would be highly unethical to market such an ETF as a prudent investment vehicle.”

Steve McClurg, former CEO of Valkyrie and founder Canary Capital, a hedge fund that has applied for several non-meme coin crypto ETFs, said he is personally not a fan of memecoin ETFs and that while the firm considered filing an application, it ultimately decided not to.

“I don’t know how you can be a fiduciary who runs an ETF knowing that the basis of your underlying [asset] is meant and designed to go to zero,” he said. Although meme coins aren’t technically designed to go to zero, they are highly susceptible to collapsing once the hype around them dies down.

Nevertheless, he believes that memecoin ETFs will eventually be approved. The former SEC under Chair Gary Gensler, who resigned on Monday after Trump became President, has so far approved several spot bitcoin and Ethereum ETFs but refused to acknowledge a potential Solana (SOL) ETF, for which several issuers had filed initial documents.

More than 30 other applications are still pending, three of them being tied to memecoins.

“It’s very hard for the SEC where the President chooses the commissioners to deny a meme coin put out by the President,” he said.

Meme coins have long divided the crypto community. Some find them fun to trade, as they can quickly bring in a large profit through so-called pump-and-dumps, but others find them troubling, especially when issued by the country’s president.

“Call me old fashioned but I think presidents should focus on running the country and not launching scam tokens,” said Nic Carter, crypto influencer and venture capitalist, in a post on X. Carter has been a vocal Trump supporter.

Carter believes that there are multiple conflicts of interest when presidents start or run a business, let alone launch a cryptocurrency or DeFi protocol that they set policy for. Newly inaugurated President Donald Trump last year introduced a crypto lending platform called World Liberty Financial.

CryptoCurrency

Missed DOGE’s Early Days? Remittix Could Be the Next Explosive Crypto Investment of 2025

Following its conception in 2013 Dogecoin ambled along slowly, not seeing much activity for several years. That changed in 2021, when Dogecoin started rising. At first slowly, then all at once. Dogecoin jumped to lofty heights in no time at all, rising by 60,000% in a mere 2 months. Dogecoin glory days are long gone, many savvy investors have been eyeing a new project that could see similar explosive growth: Remittix.

This powerful PayFi project is tackling real world problems in the lucrative cross border payments space, leading analysts to project massive price increases in the coming months.

So how is Dogecoin (DOGE) doing now and how far could Remittix (RTX) go in 2025?

Dogecoin (DOGE) Posts 20.13% Monthly Gain

Dogecoin is living in a different era now, down 49.74% from its ATH all those years ago. Dogecoin (DOGE) entered 2025 on thin ice after huge swings but overall has come out on top with a 20.15% gain in the last month. Technical analysis shows Dogecoin (DOGE) making a bullish reversal pattern referred to as a rounding bottom. Despite this, some investors are diversifying into emerging utility-focused projects like Remittix as they seek more stable returns over the long term.

Remittix Redefines the Global Payment Space

Remittix will make global payments simple, this lucrative market is worth $190 trillion today and set to rise to $290 trillion by 2030. Remittix’s advanced PayFi system is connecting cryptocurrencies with traditional FIAT systems helping it to rapidly become one of the fastest growing crypto’s of 2025.

Remittix (RTX) enables users to convert over 40 cryptocurrencies into fiat and send funds directly to bank accounts across the globe. And unlike legacy payment systems that are typically bloated with fees and take an age to process payments, Remittix (RTX) offers flat-rate pricing and speedy transactions. Its transparency and affordability let it shine above the rest in a highly competitive financial sector.

One of Remittix’s (RTX) key features is its powerful Remittix Pay API. This tool lets businesses accept cryptocurrency payments and settle them in fiat to their bank account of choice. This gives freelancers and merchants more flexibility, letting them manage over 40 fiat currencies and 50 + cryptocurrency pairs.

A multi-currency wallet on the platform is another draw, allowing users to manage multiple fiat and crypto assets from one account. This makes the platform ideal for freelancers, global businesses and digital nomads who deal frequently with international transactions.

Remittix Flies Past $5.2 Million In Presale

Remittix (RTX) is excelling in its presale, with tokens available at a ripe price of just $0.0282. As utility-focused projects gain prominence in the crypto space, Remittix stands out for solving real-world problems. Analysts project a significant price increase of 800% by the presale’s end. Positioned to dominate the lucrative cross-border payments market, Remittix is a project not to overlook in 2025.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Blockstream launches two Bitcoin investment funds

Institutional demand for high-yield Bitcoin funds is growing following the successful launch of BTC ETFs.

CryptoCurrency

Circle launches Paymaster to allow users pay gas fees with USDC

Stablecoin issuer Circle has introduced a new feature called Circle Paymaster, enabling users to pay gas fees using the USDC stablecoin.

The USDC (USDC) issuer said in an announcement that the on-chain utility solution Circle Paymaster was now live on Arbitrum and Base, two leading Ethereum (ETH) layer-2 solutions.

With this product, users on the L2s can now use USDC rather than ETH when paying for transaction fees.

In the crypto market, blockchain users need transaction fees often paid via a chain’s native token. This gas fees requirement has typically meant users must hold tokens such as Ether and others on-chain, with transaction failures likely when one has no funds to cover gas fees.

Paymaster removes this challenge by allowing users to pay with USDC, removing the need for one to have the required native token. The feature is permissionless and composable, which means developers can work with any wallet compatible with the ERC-4337 token standard.

Circle’s launch of Paymaster adds to the company’s Gas Station offering.

While Paymaster users utilize their USDC to pay for gas fees, Gas Station allows developers to pay for gas costs for users. Developers who sign up for the Gas Station feature offer a gasless experience for users across their decentralized applications.

Gas Station works with Circle’s programmable wallets and requires developers to create a Circle Console account.

Circle will expand access to Paymaster beyond Arbitrum and Base in coming months, with additional networks including Ethereum, Solana and Polygon PoS.

Transaction charges across Paymaster will be 10% of gas fees per transaction. However, Circle is waiving this charge until June 30, 2025 to incentivize adoption.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login