CryptoCurrency

Solana stablecoin supply hits $10B ATH, TVL up 800% — Can SOL price reach $1K?

Can Solana hit four figures this year? Several market analysts believe that a $1,000 price target is possible this cycle, particularly under Trump’s administration.

CryptoCurrency

Ripple seeks deadline for cross-appeal brief in SEC case

Ripple Labs has requested a due date for its cross-appeal brief in its ongoing legal battle against the US SEC.

CryptoCurrency

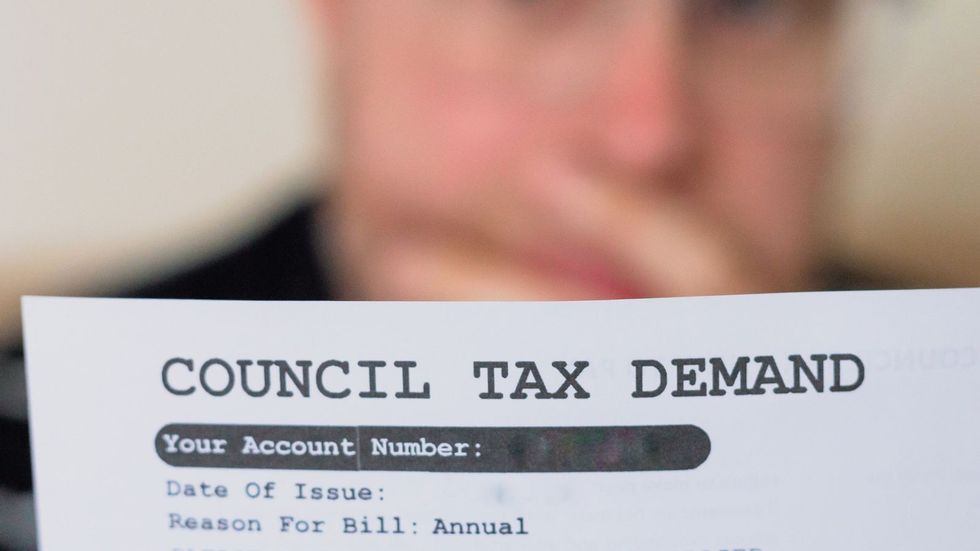

Council tax alert: Oxford set to hit second home owners with 200% charge

The council of one of Britain’s most famous cities is drawing up plans to charge residents a 200 per cent council tax bill in effort to generate more revenue for the local authority.

Oxford City Council has approved plans to double council tax charges on second homes in a move aimed at making the city “a fairer place to live” in a move than will impact hundreds of households.

An estimated 668 properties within the city council’s boundary will be affected by the new premium charge of 100 per cent.

The measure, which will require second homeowners to pay twice their standard council tax rate, is set to take effect from April 2025.

Earlier this week, the decision was finalised following approval from the authority’s audit and governance committee.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Oxford City Council is preparing to hike council tax on second homes

GETTY

The council had initially planned to implement the charge from April 2024, following its initial approval in February 2023.

However, these plans faced a setback in late December 2023 when council officers received guidance from the Government.

This delay came after officials were informed they needed to provide affected homeowners with 12 months’ notice following the legislation’s royal assent.

As a result, this requirement pushed the implementation date back to April 2025, as the legislation did not receive royal assent until October 2023.

Council tax bills are expected to go up this year

GETTY

Speaking after the committee’s approval, Oxford City Council’s deputy leader Ed Turner emphasised the fairness aspect of the new measure.

“We really want to make Oxford a fairer place to live,” he said. Turner added: “If people have a second home in Oxford, it’s only right that they make an appropriate contribution for local services.”

The deputy leader also highlighted the council’s eagerness to implement the charges, stating: “We need this money, and I think we will be charging from the first moment that we legally can.”

Oxford is not the only local authority floating raising council taxes on specific types of property owners.

Wandsworth Borough Council, where residents are known for paying the lowest council tax in the country, are preparing to target foreign investors who are buying London properties and leaving them vacant.

As of April 1, the Labour-run council will charge a 100 per cent council tax premium on homes which have not been lived in for 12 months.

LATEST DEVELOPMENTS:

Wandsworth is one of the wealthier boroughs in London but is looking to raise more council tax revenue

GETTY

Property owners who do not reside in the property for five years will have to pay 200 per cent more, while those who not live in the home for five years will be charged a 300 per cent penalty.

Those who are second home owners, who have furnished their property despite it not being their primary residence, will be hit with a double council tax bill.

Under previous tax rules, a property in Wandsworth needed to be empty for two years before being hit with a 100 per cent council tax rate.

GB News has contacted Oxford City Council for comment.

CryptoCurrency

Fineqia launches world’s first DeFi yield Cardano ETN

Fineqia AG, the European subsidiary of digital assets and investment firm Fineqia International, has unveiled the first-ever exchange-traded note that deploys Cardano assets for yield bearing in decentralized finance.

The Fineqia FTSE Cardano Enhanced Yield ETN, which went live on the Vienna Stock Exchange on Jan.24, will allow investors to tap into opportunities around Cardano (ADA) price appreciation while still earning yield regardless of the underlying asset’s price movement.

ETNs are debt instruments that collateralize an exchange-traded product’s underlying asset, including crypto. The Cardano ETN, which trades under the ticker YADA, provides access to yield by deploying ADA across yield-bearing DeFi protocols.

The global DeFi market currently holds over $155 billion in total value locked across various protocols. According to DeFiLlama, the TVL peaked at $207 billion during the last bull market. Meanwhile, research platform Statista estimates that the global DeFi ecosystem could see its revenue grow to $542 billion by 2025.

Fineqia’s offering is a collaboration with FTSE Russell, a subsidiary of the London Stock Exchange, which will serve as the ETN’s index provider.

The launch of the Cardano ETN follows Fineqia AG’s base prospectus approval from the Liechtenstein Financial Market Authority. Approval from the FMA allows the company to issue crypto-backed exchange-traded notes across the European Union.

YADA adds to the growing crypto ETN market in the EU, with a third of the 139 products listed on the Vienna Stock Exchange. Increased adoption of digital assets as investment vehicles has led to the availability of over 220 crypto ETPs globally. These products currently account for more than $216 billion in assets under management.

Among these ETPs are U.S. spot Bitcoin ETFs, which have recorded over $121 billion in AUM since their debut in January 2024. Experts attribute the positive market sentiment to Trump’s victory and assumption of office.

Spot Bitcoin ETFs have seen over $4.2 billion in net inflows year-to-date, reflecting the broader optimism surrounding the market.

CryptoCurrency

Crypto Czar Classifies NFTs and Meme Coins as Collectibles

David Sacks has introduced a new perspective on non-fungible tokens (NFTs) and meme coins, describing them as a distinct class of digital assets.

In an interview with Fox Business, the AI and crypto czar spoke on the growing complexity of classifying digital assets, categorizing the two as collectibles.

Digital Asset Classification

“When you talk about digital assets, it could mean many things… you’re talking about a vast area of innovation,” Sacks stated in the interview. He explained that virtual assets cover a broad spectrum, including securities and commodities, placing NFTs and meme coins in the collectible category.

This classification could influence the way the two are perceived, shifting the focus from their volatility to their potential as items of cultural and commemorative significance. Sacks elaborated on this idea, comparing such assets to traditional memorabilia.

Speaking on the Solana-based Official Trump (TRUMP) meme coin, he said:

“I think the Trump coin is a collectible. It’s like a baseball card or a stamp. People buy it because they want to commemorate something.”

However, he clarified that his statements should not be interpreted as a regulatory position.

NFT and Meme Coin Legitimacy Debate

The legitimacy of non-fungible tokens and meme coins is still a hot topic. Last August, NFT marketplace OpenSea received a Wells notice from the SEC over claims that such assets on its platform might be regarded as unregistered securities. In December, the gaming-focused NFT project Cyberkongz was sent a similar warning from the regulator.

This debate has intensified with the recent launches of the official TRUMP and MELANIA meme coins. Senator Elizabeth Warren, a crypto skeptic, has urged federal regulators and the Office of Government Ethics to investigate the TRUMP meme coin. In a January 22 letter, she alleged it had enriched the President and provided a means for crypto funds to flow to him.

At a recent press briefing, Trump downplayed the situation by saying he did not know whether he had benefited financially from the project and claimed to have no knowledge of the coin’s value.

The introduction of these tokens also caused some constitutional compliance concerns, with Zack Guzman from Coinage noting that while the emoluments clause prohibits presidents from profiting from their office, meme coins challenge these existing rules.

Meanwhile, billionaire investor Mark Cuban previously dismissed the Trump project as a gamble, suggesting it could harm the crypto industry’s reputation, especially if proper regulations were not in place. Similarly, former Coinbase CTO Balaji Srinivasan described such tokens as speculative assets, famously calling them a “zero-sum lottery.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

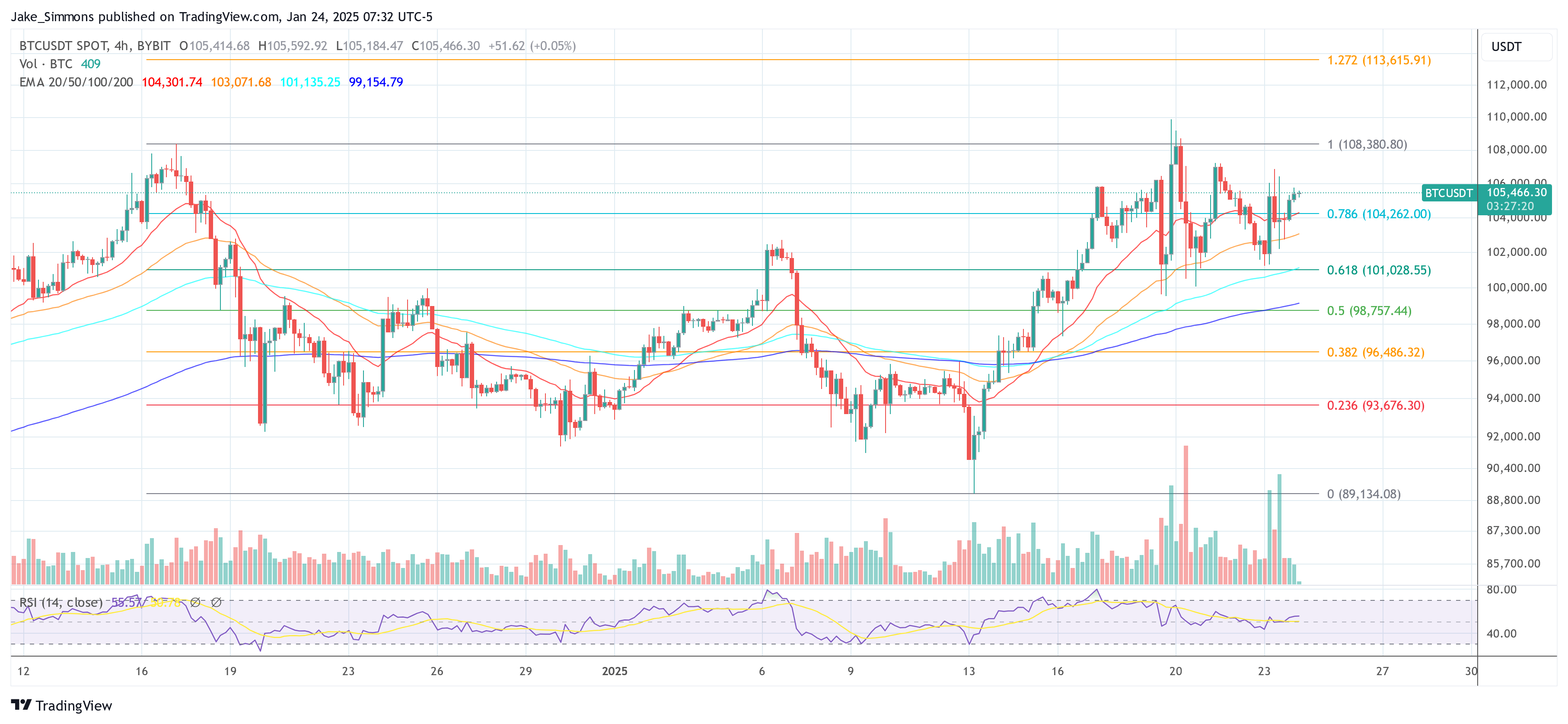

Bigger Bitcoin Price Catalyst Than The US BTC Reserve

The US Securities and Exchange Commission (SEC) announced on Thursday, January 23, the rescission of Staff Accounting Bulletin (SAB) No. 121, a directive that had imposed stringent accounting requirements on crypto custody for US banks and financial institutions. The move, encapsulated in the newly issued SAB 122, is poised to serve as a more substantial catalyst for Bitcoin’s price dynamics than the anticipated US Bitcoin Reserve (SBR), according to several industry experts.

Implications For Bitcoin

Originally enacted in 2022, SAB 121 mandated that banks classify customer-held cryptocurrencies as liabilities on their balance sheets. This classification significantly increased the operational costs and complexities for financial institutions, effectively deterring them from offering crypto-related services. Thus, the requirement acted as a barrier, limiting the integration of Bitcoin and other cryptocurrencies into mainstream banking operations.

Related Reading

The withdrawal of SAB 121 through SAB 122 effectively removes this accounting impediment. SEC Commissioner Hester Peirce lauded the decision on social media, stating, “Bye, bye SAB 121! It’s not been fun: http://SEC.gov | Staff Accounting Bulletin No. 122.”

The Bitcoin community has responded favorably to the SEC’s decision. Andrew Parish, founder of x3, emphasized the significance of SAB 122 on X, asserting, “Rescinding of SAB 121 is a bigger catalyst for Bitcoin than the SBR. Bookmark this post.” Similarly, Fred Krueger, founder of Troop, highlighted the broader market implications, noting, “SAB 122 is extremely good for Bitcoin. More significant than the Bitcoin Reserve, which is also coming. Now watch the Banks start accumulating.”

Vijay Boyapati, an Ex-Google engineer and the author of The Bullish Case for Bitcoin, further elaborated on the transformative potential of the SEC’s action, stating, “It really is hard to emphasize how huge a sea change we’re witnessing. We went from the worst conceivable anti-Bitcoin, anti-innovation, anti-growth, anti-business administration to the most friendly Bitcoin administration you could hope for. This is 100% not priced in.”

Related Reading

Michael Saylor, Executive Chairman of MicroStrategy, succinctly captured the market sentiment with his tweet: “SAB 121 has been rescinded, allowing banks to custody Bitcoin. 🚀” This aligns with Saylor’s previously outlined tgree catalysts for Bitcoin reaching $1 million per coin, where the facilitation of traditional bank custody stood as last open m factor.

The regulatory easing is expected to catalyze increased institutional participation in the BTC and crypto market. Brian Moynihan, CEO of Bank of America—the second-largest US bank by assets—addressed the potential for broader crypto adoption during an interview with CNBC’s Andrew Ross Sorkin at the World Economic Forum in Davos, Switzerland. Moynihan stated, “If the rules come in and make it a real thing that you can actually do business with, you’ll find that the banking system will come in hard on the transactional side of it.”

This statement aligns with the SEC’s latest directive, indicating that banks are now more likely to develop and offer crypto services, including custody solutions, which were previously constrained under SAB 121. The removal of these regulatory hurdles is anticipated to enhance the liquidity and accessibility of Bitcoin, potentially driving a new wave of demand similar to the spot ETFs in January last year.

At press time, BTC traded at $105,466.

Featured image created with DALL.E, chart from TradingView.com

CryptoCurrency

Best of the Week: It’s All Happening!

It was a big week for crypto following the inauguration of Donald Trump to a second term Monday.

The White House issued an executive order on digital assets, calling for a friendly approach to crypto across the administration and the creation of a “digital asset stockpile” (which may, or may not be, a Bitcoin Strategic Reserve). Regulatory editors Nik De and Jesse Hamilton were all over the news, as usual.

The SEC withdrew a controversial crypto accounting rule, started a crypto taskforce headed by Hester Peirce (aka “Crypto Mom”), and named crypto-friendly Commissioner Mark Uyeda as acting chair.

Senator Cynthia Lummis, arguably crypto’s most loyal friend in Congress, was named to head the Senate Banking Committee’s new digital assets panel, Hamilton also reported.

We dissected the fallout from the (very) controversial memecoins dropped by the Trump family on the eve of Monday’s swearing in. CoinDesk’s Shaurya Malwa reported that 60 Solana Whales made off with at least $10 million each (many others gained a lot less). Reporting from Tom Carreras on Monday showed that the paper wealth generated by these surprise tokens was, frankly, staggering, even absurd.

Still the memecoins were a great success, encouraging filings for memecoin ETFs, Helene Braun reported. Helene also broke the story about how CME leaked information about XRP and SOL futures ETFs by mistake, which sank those tokens and weighed on the broader market.

Ross Ulbricht, who created Silk Road about 12 years ago, educating thousands on bitcoin for the first time, went free after serving ten years in prison. His freedom was a key promise of the Trump team on crypto. Sam Reynolds had the news.

And the news kept on coming. In fact, it was hard to remember a week when more stuff of importance happened in crypto. Amid it all, the Ethereum community hotly debated its future (particularly that of the Ethereum Foundation). Parikshit Mishra and Sam Kessler followed the story.

Stay tuned for more big stuff happening next week.

CryptoCurrency

Dear President Trump: Bitcoin Reserve, Not Shitcoin Reserve

Yesterday, President Trump signed an Executive Order (EO) entitled “Strengthening American Leadership In Digital Financial Technology.”

The document outlines the ways in which the U.S. government will embrace “digital assets” and support the rights of citizens and businesses to engage with “cryptocurrencies” and “blockchain technology.”

Bitcoin isn’t mentioned once in the document.

Most concerningly, it’s not mentioned in the portion of the document that addresses the potential for the President’s Working Group on Digital Asset Markets (also established via the EO) to create a “stockpile” of digital assets.

Here’s exactly how it reads:

“The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

Bitcoin is one of 17 digital assets the Federal Government has seized.

"stockpile" is jargon that means holding what they have, but not necessarily buying anything

according to @arkham, here's all the coins that the USG holds over $1m pic.twitter.com/CtLEuP5utA

— Alex Thorn (@intangiblecoins) January 23, 2025

The idea that the government would hold onto the 16 other crypto assets the government is holding is both silly and pointless, as none of those other assets were designed to be a store of value, and a chunk of them are just digital versions of the ever-debasing U.S. dollar.

In other words, there’s no reason for the U.S. to stockpile digital assets that are perpetually losing value versus bitcoin. Without even getting into the features that differentiate bitcoin from the other assets on the list above — like its hard-coded perfect scarcity or its network’s level of decentralization — one needs to only take note of the fact that no digital asset has ever made subsequent highs versus bitcoin in consecutive bull markets to understand why it makes sense to only hold bitcoin.

I mean, even someone whose company evaluates shitcoins for a living agrees:

I didn’t donate $12 million to Kamala or cost the GOP three additional Senate seats like Ripple did.

But I’m still gonna try to help @realDonaldTrump and team understand why XRP is the poster child for why we shouldn’t have a national crypto reserve.

Bitcoin Reserve or nothing.

— Ryan Selkis (d/acc) 🇺🇸 (@twobitidiot) January 24, 2025

So, please President Trump, beef up the bitcoin stockpile by swapping the 16 other digital assets you’re holding for bitcoin, and let’s call it a day. Surely, you’ve seen how well the bitcoin-only approach has worked out for President Bukele, with whom you spoke just the other day.

It’s time to show the world that we understand that bitcoin is the savings technology and that everything else is, well, something else.

CryptoCurrency

Lightchain AI Is Trending Among Investors Who Missed Out on Meme Coin Hype

The cryptocurrency market has always been a playground for trends, with meme coins like Dogecoin (DOGE) and Pepe Coin (PEPE) captivating retail investors through viral buzz. However, not everyone managed to capitalize on these fleeting trends, leaving many searching for more stable and promising opportunities.

Enter Lightchain AI, a blockchain platform that combines artificial intelligence with decentralized technology. With its presale price at $0.005625 and over $12.7 million raised, Lightchain AI is quickly becoming the top choice for investors seeking long-term growth beyond the speculative mania of meme coins.

Rise and Fall of Meme Coin Hype

Meme coins, cryptocurrencies inspired by internet memes, have experienced significant volatility.

Initially, coins like Dogecoin and Shiba Inu gained popularity due to social media hype and celebrity endorsements, leading to substantial market capitalizations. However, many lacked intrinsic value or utility, making them susceptible to sharp declines once the initial excitement waned.

Recently, the launch of $TRUMP and $MELANIA tokens by President Donald Trump and his wife attracted both investor interest and criticism. These tokens quickly surged in value but faced scrutiny over potential conflicts of interest and ethical concerns.

The rapid rise and fall of such meme coins underscore the speculative nature of the market, highlighting the importance of thorough research and caution for investors.

Why Lightchain AI Is Gaining Attention

Unlike meme coins, Lightchain AI is built on a foundation of real-world applications and advanced technology.

One of its most compelling features is its Presale Tokenomics, which allocates 40% of its total supply to early supporters. This structure incentivizes early investors and provides a clear path for ecosystem growth.

Another highlight is its focus on AI-Powered Decentralized Solutions, enabling businesses to adopt blockchain technology without disrupting their existing workflows. These unique attributes make Lightchain AI stand out in a market saturated with speculative assets, offering tangible benefits to both enterprises and developers.

Investors’ Shift Toward Long-Term Value

For many investors, Lightchain AI represents a shift from speculative trading to strategic, utility-driven investments.

Its presale success, coupled with milestones such as a testnet launch in January 2025 and a mainnet rollout in March, ensures consistent growth and adoption. Additionally, its commitment to solving challenges in data security, scalability, and AI adoption positions it as a frontrunner in the next wave of blockchain innovation.

The token’s strong fundamentals have not gone unnoticed. Experienced investors, burned by the meme coin bubble, are now flocking to Lightchain AI for its potential to deliver both short-term gains and long-term stability.

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

ECB member doubles down on digital euro after Trump’s crypto EO: Report

Piero Cipollone reportedly said Donald Trump’s executive order affecting stablecoins could potentially influence people considering abandoning big banks.

CryptoCurrency

Labour ‘considering bringing forward increases’ as analysts call for rise to 71

The Labour Government is “considering bringing forward increases” to the state pension age, according to analysts, as recent research suggests it needs to rise to 71 by 2050 for payments remain affordable.

A study by the International Longevity Centre (ILC) has warned that the UK faces “widening demographic imbalances” that will put increasing pressure on Government finances.

According to the ILC’s research, Britain is heading towards a future where there will be just one working-age adult for every pensioner by 2050. Under current Government plans, the state pension age is set to increase from 66 to 67 between 2026 and 2028.

A further rise to 68 is currently scheduled for 2044 to 2046, though this timeline remains subject to Government review. By 2050, the UK is projected to reach a dependency ratio of 50 per cent, meaning for every person receiving a state pension, there will only be one working-age adult contributing to the system.

Jonathan Gribb, an associate director at the Institute of Fiscal Studies (IFS), confirms ministers will soon be reviewing the timeline for pension age increases to avoid such a scenario.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Analysts are warning the state pension is becoming increasingly unaffordable

GETTY

“The Government will shortly be considering whether to bring forward the following rise to age 68, which is currently scheduled for 2044,” he said.

Gribb told The Express these increases are justified in principle, noting they help control costs for taxpayers.

“While growth in life expectancy has stalled recently, over previous decades it rose substantially,” he explained.

The retirement expert argues that as people live longer, raising the state pension age is a logical step. However, Gribb emphasises that such changes must be implemented carefully, considering their social impact.

The IFS expert warns that pension age increases disproportionately affect poorer people in their mid-60s. “It is poorer people in their mid 60s who are hit most by state pension age increases. Most of these people are not in employment, some as a result of poor health,” Gribb said.

He highlighted that many in this group lack alternative financial resources. “They also often have little savings or private pensions to fall back on,” he explained.

Previous pension age increases have had measurable negative effects on this demographic. “We know that poverty rates rose substantially among those in their mid 60s following previous pension age increases,” Gribb noted.

Given these impacts, he argues there is “a good case for the government to do more to support this group.” Gribb outlines two potential approaches for the government to support those most affected by pension age changes.

The first option involves increasing Universal Credit support for those within a year of pension age. “A boost to their benefits costing £600 million a year would reduce poverty by around 30,000 households,” he said.

This represents just one-tenth of the savings from raising the pension age by one year. Alternatively, the Government could target additional Universal Credit specifically to those receiving disability benefits.

LATEST DEVELOPMENTS:

Britons are concerned about potential changes to the state pension age

GETTY

This more focused approach would cost around £200 million but “would still make a real difference to many,” according to Gribb. Both options aim to provide extra support for low-income individuals while maintaining the cost-saving benefits of pension age increases.

Supporting the poorest could help maintain broader public backing for necessary pension age increases, according to the IFS analysis. Gribb emphasises that the government needs to “maintain general support for the principle of a higher pension age as life expectancy rises.”

Targeted support for the most vulnerable could be key to achieving this balance.

“Supporting the poorest could help maintain this support, and help protect the incomes of some of those who struggle to work in their late 60s,” Gribb said.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login