CryptoCurrency

The Joule Paradox: Energy sets the value of bitcoin and bitcoin sets the value of energy

Early in our thinking about the interaction between bitcoin and energy it became obvious to me that the value of bitcoin was fundamentally underpinned by the amount of energy that went into producing the bitcoin. As with any free market system, the value of a widget (in this case bitcoin) is determined by the cost of producing the widget plus the various levels of profit margin needed to get from manufacturing to the consumer. If someone has an innovative ability to supply something that no one else can and there is a large demand for this product then they have the ability to extract more profit based upon the scarcity of the supply relative to the demand. If the innovation is not sufficiently proprietary then others will recognise this arbitrage opportunity and seek to satisfy some or all of the demand. Over some period of time, we expect the ecosystem of producers to compete with each other for demand until a point is reached where the price of the product reflects the minimally acceptable level of profit margin for all participants in the production, supply, and sales chain. Additional innovations in production technique, material sourcing, or labour costs may give a temporary advantage to one producer over others and they can enjoy a period of greater profitability – that is until the other producers implement similar advantages and the overall price for the product gets driven lower.

This is what Adam Smith called the invisible hand or more modern economic thinkers call the economic equilibrium principle. If actors in a truly free market system (something we seldom actually achieve) act in their own interests by chasing profits, these actions will ultimately lead to a societal benefit through the satisfaction of demand at the point of optimum economic value. While we may never reach a truly optimal point of economic exchange of value, we certainly see the benefit of decreasing prices and increasing quality (especially in technical terms) in industries ranging from transportation to computing. My father bought an IBM PS/2 Model 25 with a 16 colour display and 10MB of storage space in the late 1980’s for around $7,000. Today, forty years later, a $70 Asian smartphone exceeds every capability of that IBM by many orders of magnitude for 1% of the cost. This is one aspect of the deflationary effect of technology that Jeff Booth discusses in his book The Price of Tomorrow.

While a computing device can increase in capabilities by 100,000% while decreasing in cost by 99% in the space of 40 years, why can’t we say the same thing of the automobile?

I drive a 1977 Range Rover that cost around $14,000 when it was new. Nearly 50 years later, the current model of Range Rover costs about 10 times that amount but delivers only marginally increased capabilities. Why did automobiles not experience the same technological deflationary effect as computers? In large part because the cost of the raw materials to produce a car including steel, aluminium, copper have all increased in that same time frame. In addition, the cost of running a factory to produce cars and the cost of transporting a 2 tonne vehicle from manufacturing to the point of sale have all gone up significantly in that period of time.

While you can’t get a comparable Asian SUV brand new for $14,000 today, you can get a very capable SUV for about twice that amount with significantly greater comfort and technical features versus my spartan 70’s off roader. In 1977 the most basic VW Beetle cost around $3,000. Similar low-end cars today from Asian manufactures with similarly sparse specifications tend to be around the $6,000 price point. What is hard to see with these numbers is the inflationary effect of the devaluation of currency – in this case the US dollar. A dollar in 1977 effectively had the spending power of $5.19 today or, said another way, a 2024 dollar has the same spending power of $0.19 in 1977. That is an 80% reduction in spending power. This means that a $6,000 basic car in 2024 would be priced at $1,140 in 1977 dollars. By the way, the $7,000 dollar IBM would have cost over $35,000 in 2024 dollars making the $70 smartphone an absolute steal!

What is it about a computer that allowed its technical deflationary effect to so far outpace inflation while the automobile could not achieve the same result? In short, the reason is twofold: energy and the scarcity of resources. It takes about 278kWh of energy and 120g of raw materials to produce one smartphone. A car takes around 17,000kWh of energy and 5,000,000g of raw materials to be produced (according to MDPI). Both products will end up with a similar profit margin for the manufacturer of roughly 10%. While technology can solve a lot of challenges of efficiency or miniaturisation, it cannot fundamentally reduce the quantity of physical and energy commodities that need to go into the production of something the size of a car.

In the same way, bitcoin has a fundamental cost of production that is driven by the amount of energy required to produce one bitcoin. While we are continually making progress with respect to the efficiency of the machines we use to convert energy into bitcoin (we have seen an increase in efficiency of around 83% from 2019-2024), the growth of the network hashrate has still driven up the amount of energy needed to produce 1 bitcoin to around 800,000kWh. That sets the intrinsic value of a Bitcoin produced in late 2024 at around $66,000 including a profit margin of roughly 10% for the average producer.

Does that mean that the current price of bitcoin is determined solely by the cost of producing a bitcoin?

Of course not; but it does play a critical role in setting the value of a bitcoin. The cost of production and the current market price have reached a point of equilibrium where the producer is able to make enough margin to continue to produce in their own self interests while the market is able to benefit from a fairly priced product. The amazing thing about the bitcoin network is that it is one of the only true free-markets in existence. Absent the ability for an actor to monopolise or governments to exert control over the market, the invisible hand will continue to push these two forces towards this state of equilibrium. This means that we can understand the true value of a bitcoin by understanding the cost of the energy required to produce a bitcoin. In this way, energy effectively values bitcoin.

Since I have already brought you into my worldview of thinking about most things from the perspective of a Land Rover, let me continue with that approach as we consider the other side of this Joule Paradox. As I said, I drive a 1977 Range Rover (what is now referred to as a Range Rover Classic Suffix D). I bought the truck here in Kenya about 5 years ago for right around $5,000. It was completely intact, unmolested, and 100% rust free. It was the equivalent of what is often referred to as a barn find – a perfect specimen for a functional restoration. In the Kenyan market I paid a bit above the going rate for a similar car due to its condition. If I were to attempt to purchase a similar vehicle in the UK market (assuming you can find a rust-free example still) it would have cost me significantly more. Fully restored in original condition in Kenya the truck might be worth $15,000 on the best day, a perfectly restored example in the UK would likely cost 10 times that amount. Why is there such a disparity in the value of two essentially identical things? In short, it is because of the isolation of economies.

The economic pool that I have to work within here in Kenya does not value this vehicle the same way that the economic pool in the UK does. If I could just send the truck across my Starlink connection to the UK, I could make a lot of money from this arbitrage opportunity. However, vehicle shipping doesn’t work like that. For me to move this truck from my Kenyan economic pool to the UK economic pool would require a tremendous amount of time (dealing with government paperwork on both ends), transportation expense, and a multitude of unforeseen expensive issues in making sure that the quality of my Kenyan-performed work would meet the far more rigorous requirements to operate a vehicle in the UK. Would it make financial sense? Possibly. Is it economically worth the effort for me? Definitely not. Plus, I really love the truck so I emotionally over value it.

Energy suffers from this same isolation of economies. If a natural gas producer in West Texas is trying to sell electricity into their regional pool at the same time that the wind is blowing and the sun is shining across the state, the value for their unit of energy can actually go negative. This means that they would have to pay someone to take their energy. At the very same point in time, someone charging their electric car in California may be paying a peak-demand surcharge for electricity that doubles their cost of energy. The Californian Tesla owner would very much love to have cheaper energy from Texas and the Texas producer would love to charge even a few cents for their power to anyone that would buy it. Unfortunately, these two energy pools operate in isolation. You can’t move a joule of energy from the Texas pool to the California pool without a lot of government paperwork and transportation costs. The arbitrage opportunity can’t be realised.

The same is true for a small hydro energy producer in Northwestern Zambia, they are isolated in a very small economic pool. They can produce more energy than they can sell to the local community but there is no one else other than the community to buy their electricity. Even if they offered it for $0.01, no one would take it. Meanwhile, 100km away, another village is being charged nearly $1.00 per kWh to get electricity from a solar mini-grid. Those villagers would love to have some cheap electricity. Unfortunately, you can’t move a joule of energy across 100km of bumpy, dusty African roads. The arbitrage opportunity is lost due to economic isolation.

Although I doubt that Satoshi thought about it this way, the bitcoin mining network is effectively an adapter to connect any isolated energy pool into a global marketplace. By simply plugging in a mining machine and connecting it to the internet, you can now sell your electricity to an always willing buyer. These two simple pieces of technology allow for energy pools to be linked in a way that hasn’t really existed before. Bitcoin is a non-government-controlled, internet-enabled, real-time energy market that is open 24/7, 365 days a year.

At any point in time, the invisible hand of the market will determine what is the going hashprice. This is the amount of bitcoin paid to a miner for submitting 1TH/s of compute power for 1 day. This value represents how much a miner can earn from running their machines and – thanks to mining pools – this amount is payable in very small units of work. If you run a 100TH/s machine for 1 hour then you will earn 1/24th of the hashprice paid directly to your bitcoin wallet. This is true anytime of the day and from anywhere on earth. Using this hashprice and knowing the efficiency of your mining machine, you can know with absolute certainty how much the bitcoin network is willing to pay you for any kWh of electricity that you want to sell.

As an example, as of 7:34am East Africa Time on October 5th, 2024, the bitcoin network will pay you $0.078 per kWh if you are using a 24J/T Whatsminer M50s and $0.103 per kWh if you are using a 18J/T Antminer S21. Those numbers will fluctuate with the change in bitcoin price, but then it is up to you to decide if you can get a better offer from your local economic pool. Willing buyer, willing seller as they say.

By acting as the real-time marketplace for internet-enabled energy, the bitcoin network allows us to complete the Joule Paradox: energy sets the value of bitcoin and bitcoin sets the value of energy.

Notice that I said value and not price. An old friend of mine used to frequently say that price is what you pay and value is what you get. The same is true here. The value of a bitcoin is based upon the energy inputs and production costs but the market determines the price. Similarly, bitcoin determines what the minimum value for a unit of electricity is but the seller determines whether they will accept that price or sell to someone else for more.

In thinking about the relationship between bitcoin and energy within this paradox, we start to see why the proof-of-work model that Satoshi chose to implement and the system of automated market regulation through the difficulty adjustment is so genius. If either of these features was missing from bitcoin then we would not have the highly valuable asset that we have today. It all comes back to this simple realisation, energy is the fundamental, base commodity upon which everything of value is produced and bitcoin is the most pure embodiment of energy in a monetary form. If we took the energy out of bitcoin then bitcoin would be no better than any other fiat system of money. Remember that when someone tries to tell you that ethereum is the more environmentally friendly cryptocurrency. Energy is the true source of value and no other monetary system is built on energy.

This is a guest post by Philip Walton. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CryptoCurrency

Trump’s $500b AI project could spark surge in AI tokens: OORT CEO

U.S. President Donald Trump’s announcement of the $500 billion artificial intelligence project Stargate could drive a fresh surge in AI tokens.

That’s according to Dr. Max Li, founder and CEO of OORT, a decentralized cloud computing platform. OORT previously collaborated with BNB Greenfield in March 2024 to enhance the BNB Chain ecosystem.

On Jan. 21, Trump revealed that ChatGPT creator OpenAI, along with Japanese investment firm SoftBank, U.S. tech giant Oracle, and Emirati sovereign wealth fund arm MGX, are partnering to launch the $500 billion AI infrastructure project. The initiative will be based in the United States, with an initial $100 billion in funding already secured.

According to Dr. Li, the Stargate project could significantly influence price trends across the market.

“With AI coins making recent headlines, the Trump administration’s investment in AI infrastructure could directly impact price trends. While we need to exercise caution with AI agents, the immediate beneficiary is AI-based digital asset management such as Ai16z,” Li said in comments shared with crypto.news.

The announcement sparked a rise in the market capitalization of AI tokens and agents. Notable gainers included Artificial Superintelligence Alliance (FET), Virtuals Protocol (VIRTUAL) and ai16z (AI16Z) were among top gainers.

OpenAI co-founder Sam Altman linked Worldcoin (WLD) also experienced a notable spike.

Over the past year, AI tokens have outperformed other digital assets amid developments and news related to artificial intelligence. Companies such as OpenAI and Nvidia have been central to these trends, while the market has also seen growing activity at the intersection of AI and cryptocurrency. AI agents have emerged as one of the latest hot topics.

Li added;

“DeFi’s convergence with AI will also be accelerated, as developers and investors have had their eyes on this area for some time. We can expect a surge in AI projects launching their tokens, followed by a cycle of filtering and reshuffling. Ultimately, only those with real business value and practical use cases will endure.”

CryptoCurrency

CARV Launches D.A.T.A Framework, Giving AI Agents ‘Eyes and Ears’ with On-Chain and Off-Chain Data

[PRESS RELEASE – Santa Clara, California, January 22nd, 2025]

CARV, an AI chain ecosystem enabling data sovereignty at scale, today unveils its D.A.T.A Framework to transform how AI agents interact with both on-chain and off-chain data. The framework converts static information into actionable insights, enabling AI agents to independently analyze, adapt and act with unprecedented clarity and autonomy.

In today’s decentralized landscape, fragmented and inaccessible data limits the potential of artificial general intelligence (AGI). By solving these critical challenges, the D.A.T.A Framework – Data Authentication, Trust, and Attestation – delivers real-time decision-making capabilities while maintaining rigorous privacy and security standards. This advancement redefines how AGI operates within decentralized ecosystems, creating new possibilities for both developers and users.

“AGI needs more than computational power—it needs intelligent data,” said Yukai Tu, CTO of CARV. “The D.A.T.A Framework bridges the gap between raw data and meaningful action, setting a new standard for AI-powered decision-making in decentralized ecosystems.”

The D.A.T.A Framework

The D.A.T.A Framework serves as the eyes and ears for AI agents, providing them with the ability to perceive, interpret, and act on data across decentralized ecosystems. By transforming static data into actionable insights, the framework enables AI agents to make real-time, intelligent decisions while maintaining unmatched privacy and security. It leverages cutting-edge technologies like zero-knowledge proofs, Trusted Execution Environments (TEE), and CARV ID to ensure enriched, context-aware, and privacy-preserved data access.

Key features include:

- Enhanced Metrics and Tags: Identifying whales, traders, and market manipulators with tailored, actionable insights.

- CARV ID Integration: Linking Web2 identities with Web3 behavior for a holistic understanding of users.

- Real-Time On-Chain Insights: Automating actions based on blockchain activities like token transfers and market trends.

- Cross-Chain and Off-Chain Data Integration: Providing comprehensive insights by unifying multiple data sources.

Benefits for Developers and Users

For developers, the D.A.T.A Framework simplifies the creation of smarter, autonomous AI agents with built-in tools for accessing and processing enriched data. Applications range from trading bots that respond instantly to market shifts to gaming AI agents capable of intelligent, personalized interactions.

For users, D.A.T.A enables secure control and monetization of personal data while providing tailored, data-driven experiences. By bridging trust gaps and fostering collaboration, the framework creates an ecosystem where everyone—from businesses to individual users—stands to benefit equitably.

Both of these applications lead to future-forward use cases including:

- Trading and Alerts: Autonomous bots that analyze blockchain activity in real-time, identifying market opportunities and executing trades.

- Gaming Evolution: Intelligent NPCs and companions that learn and adapt, enhancing engagement and replayability.

- DeSci Innovation: Privacy-preserved research collaborations, accelerating breakthroughs in medicine and science.

- Holistic Personalization: AI companions offering emotionally intelligent support tailored to individual needs.

Driving the Evolution of AGI

CARV’s D.A.T.A Framework is more than just a toolset – it’s the foundation for AGI’s collaborative evolution. By enabling AI agents to share insights, learn dynamically, and operate autonomously within decentralized ecosystems, CARV is paving the way for a future where AGI not only interacts with data but truly understands it.

“The launch of D.A.T.A Framework marks a significant leap forward for decentralized AI,” said Victor Yu, COO of CARV. “It’s not just about building smarter AI – it’s about empowering a new era of trust, privacy, and collaboration across industries.”

The D.A.T.A Framework is set to evolve over the coming months with a series of phased enhancements that will expand its capabilities. In the first phase, D.A.T.A. Framework will introduce real-time on-chain activity alerts, autonomous actions such as airdrops and token transfers, and comprehensive cross-chain insights. Then, rolling out in February, the framework will integrate social media data via CARV ID for enhanced user profiling. and enabling a swarm of AI agents to collaborate seamlessly for modular data access. Further development and phases will be announced gradually over the coming months.

The D.A.T.A Framework is now live, inviting AI developers, blockchain innovators, and businesses to explore its capabilities. To learn more and start building, users can visit CARV’s official documentation.

About CARV

CARV is building an AI chain ecosystem to enable data sovereignty at scale. By empowering AI agents with secure, unified infrastructure, CARV enables intelligent, collaborative operations through its SVM Chain, offering trustless consensus, cryptographic proofs, and verifiable execution. With the D.A.T.A Framework, CARV enriches AI with high-quality, on-chain and off-chain data, allowing agents to learn, evolve, and collaborate dynamically. With over 15M users and 8M CARV IDs, CARV ensures privacy and data control while providing AI agents with powerful, cross-chain insights, creating a secure, innovative ecosystem for both AI and human collaboration.

Supported by $50M in funding from top-tier investors like Tribe Capital, HashKey Capital, and Animoca Brands, and backed by a team of veterans from Coinbase, Google, and Binance, CARV is committed to fostering a decentralized future where data is a valuable, user-owned asset.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Cardano Price Bounces From Key Support Level, But There’s Still A Risk To Crash To $0.85

Scott Matherson is a prominent crypto writer at NewsBTC with a knack for capturing the pulse of the market, covering pivotal shifts, technological advancements, and regulatory changes with precision. Having witnessed the evolving landscape of the crypto world firsthand, Scott is able to dissect complex crypto topics and present them in an accessible and engaging manner. Scott’s dedication to clarity and accuracy has made him an indispensable asset, helping to demystify the complex world of cryptocurrency for countless readers.

Scott’s experience spans a number of industries outside of crypto including banking and investment. He has brought his vast experience from these industries into crypto, which allows him to understand even the most complex topics and break them down in a way that is easy for readers from all works of life to understand. Scott’s pieces have helped to break down cryptocurrency processes and how they work, as well as the underlying groundbreaking technology that makes them so important to everyday life.

With years of experience in the crypto market, Scott began to focus on his true passion: writing. During this time, Scott has been able to author countless influential pieces that have drawn in millions of readers and have shaped public opinion across various important topics. His repertoire spans hundreds of articles on various sectors in the crypto industry, including decentralized finance (DeFi), decentralized exchanges (DEXes), Staking, Liquid Staking, emerging technologies, and non-fungible tokens (NFTs), among others.

Scott’s influence is not just limited to the countless discussions that his publications have sparked but also as a consultant for major projects in the space. He has consulted on issues ranging from crypto regulations to new technology deployment. Scott’s expertise also spans community building and contributes to a number of causes to further the development of the crypto industry.

Scott is an advocate for sustainable practices within the crypto industry and has championed discussions around green blockchain solutions. His ability to keep in line with market trends has made his work a favorite among crypto investors.

In his personal life, Scott is an avid traveler and his exposure to the world and various way of life has helped him to understand how important technologies like the blockchain and cryptocurrencies are. This has been key in his understanding of its global impact, as well as his ability to connect socio-economic developments to technological trends around the globe like no one else.

Scott is known for his work in community education to help people understand crypto technology and how its existence impacts their lives. He is a well-respected figure in his community, known for his work in helping to enlighten and inspire the next generation as they channel their energies into pressing issues. His work is a testament to his dedication and commitment to education and innovation, as well as the promotion of ethical practices in the rapidly developing world of cryptocurrencies.

Scott stands steady in the frontlines of the crypto revolution and is committed to helping to shape a future that promotes the development of technology in an ethical manner that translates to the benefit of all in the society.

CryptoCurrency

Trump-Linked Crypto Platform’s $33M Ether (ETH) Transfer Spurs ETF Staking Hopes

Sentiment towards Ethereum’s ether (ETH) has sunk to depressed levels in recent times, but the latest maneuver of President Donald Trump-related crypto platform could spur hope for a reversal.

World Liberty Financial (WLFI), the decentralized finance (DeFi) platform linked to the Trump family, this week deposited a total of 10,000 ether (ETH) worth $33 million to liquid staking platform Lido Finance (LDO) to stake and earn rewards, blockchain data by Arkham Intelligence showed. Lido is the largest ether staking platform with $31 billion of assets posted on the platform.

The transactions came after World Liberty Finance acquired more than $110 million worth of crypto assets including ETH, wrapped bitcoin (wBTC), Tron’s TRX, AAVE, LINK and Ethena’s ENA, as CoinDesk reported.

The maneuver raises hopes that regulators will soon allow staking for spot ETH exchange-traded funds. SEC Commissioner Hester Pierce, who now leads the agency’s crypto task force, said last month in an interview with Coinage that she was open to considering staking for ETFs. Former SEC Chair Gary Gensler, known for his anti-crypto stance in the industry, stepped down on January 20 with Trump entering office.

Staking would boost appeal for the investment products, letting investors earn a steady stream of yield on their holdings and reducing product fees. U.S. spot ETH ETFs combined hold $12 billion of assets, according to SoSoValue data.

The potential regulatory approval also could jolt ETH’s price and adjacent ecosystem tokens like Lido’s LDO. Ethereum’s future has been under the microscope recently, amid sagging prices relative to competitors, leadership disputes and worries over the project’s development roadmap. ETH recently dropped to a 4-year low price against bitcoin (BTC) and ceded market share in trading activity to rapidly growing blockchains like Solana.

“I will never trade ETH again after, but watch how quickly the sentiment changes when the staked ETH ETFs come through in the next few weeks,” well-followed crypto trader Pentoshi said.

“ETH will have a multi-week giga pump at some point in 2025, around staking ETF news… If [you’re] too long ETH, that’s when you dump and switch to better performing assets,” said Alex Krüger, partner at Asgard Markets, in an X post.

CryptoCurrency

Crypto Market Reacts to Trump’s Executive Orders- Lightchain AI Gains Investor Focus

The cryptocurrency market is buzzing as Trump’s executive orders send ripples across the financial landscape, prompting investors to seek resilient opportunities.

Amid this dynamic shift, Lightchain AI has captured significant investor focus with its innovative approach to blockchain and AI integration. Currently in its presale phase at $0.005625 per token, Lightchain AI has already raised $12.3 million, reflecting strong market confidence.

With groundbreaking features like its Proof of Intelligence (PoI) consensus mechanism, Lightchain AI is positioning itself as a leader in the evolving decentralized intelligence space.

Understanding Ripple Effect of Trump’s Executive Orders on Crypto Market

President Donald Trump recent orders have greatly changed the crypto market. His team support for crypto, with ideas to create a government Bitcoin store and pick pro-crypto people, has raised investor trust. This cheer is seen in the rise of Bitcoin value, going over $100,000 for first time.

Also, the start of the $TRUMP meme coin caused a fast rise in its worth but it saw ups and downs later. While these changes have excited the market, experts warn that less oversight can make the market more wild and may cause money troubles. So, wh͏ile the short-time effects of Trump’s plans have been good for crypto items, the lasting effects need close thought.

Why Lightchain AI is Emerging as Safe Haven for Investors Amid Market Shifts

The crypto market is no stranger to volatility, and recent shifts following Trump’s executive orders have left investors seeking stability. Amid this uncertainty, Lightchain AI is emerging as a safe haven.

With its presale offering tokens at $0.005625 and raising millions, it’s clear investors recognize its potential. Unlike speculative assets, Lightchain AI’s robust foundation lies in its groundbreaking innovations like Proof of Intelligence (PoI) and the Artificial Intelligence Virtual Machine (AIVM).

These features ensure scalability, security, and practical use cases, appealing to long-term investors. Furthermore, its transparent governance and community-driven model position it as a stable investment opportunity in turbulent times. As traditional markets react, Lightchain AI is gaining traction as a beacon of confidence.

Rising Star- How Lightchain AI is Capturing Investor Focus During Uncertain Times

During uncertain market conditions, Lightchain AI is becoming a beacon for investors seeking innovation and stability. Its cutting-edge platform combines advanced blockchain technology with artificial intelligence, offering solutions tailored to modern challenges. With a presale price of $0.005625 and a remarkable $12.3 million raised, Lightchain AI demonstrates strong market confidence.

Investors are drawn to its unique blend of decentralized governance and innovative consensus mechanisms, which ensure security and transparency. In a volatile market, Lightchain AI stands out as a forward-thinking opportunity. Grab Lightchain AI opportunity now to be a part of this rising star in the crypto market!

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Why Dogecoin price is still running toward $2

DOGE price is down 5% today in the past 24 hours but several technical and onchain metrics suggest that Dogecoin could soon tag new all-time highs.

CryptoCurrency

‘We’re sitting ducks for their stupidity’

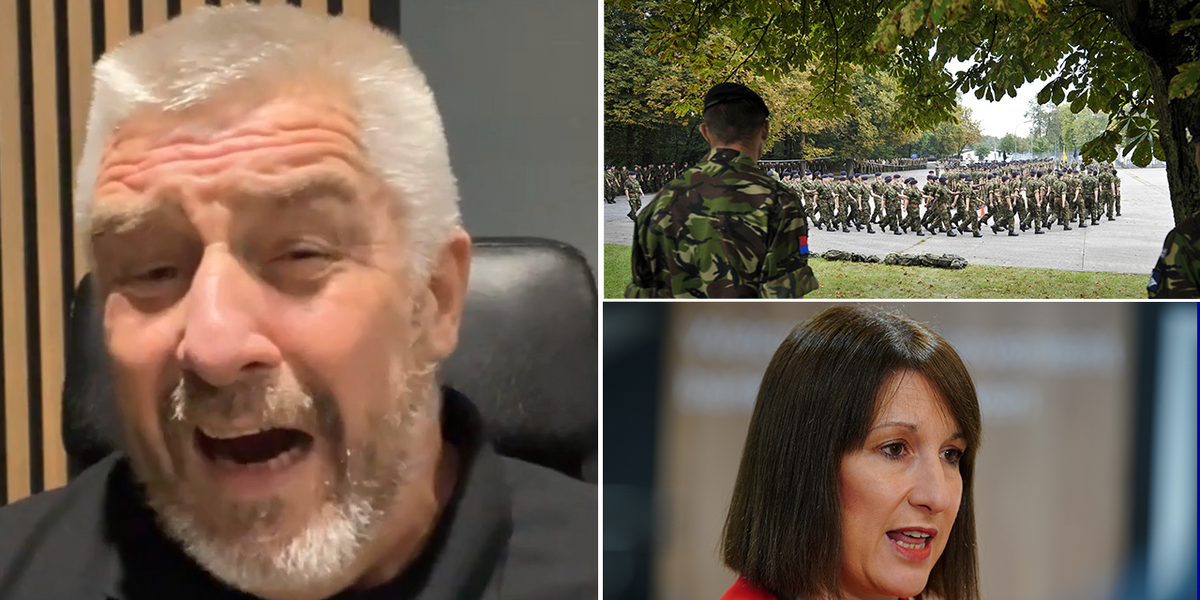

SAS veteran Phil Campion has launched a blistering attack on Labour’s plans to impose inheritance tax on military death-in-service payments, calling the move “despicable” and bordering on “cowardice”.

Speaking on GB News, Campion said armed forces personnel were “sitting ducks for their stupidity” because they lack union representation and cannot strike.

“It’s another easy target for them – armed forces, we don’t have unions,” the former special forces soldier said.

“We can’t go on strike. They couldn’t put us further back in the queue when it comes to absolutely everything that they do.”

Campion tore into the Labour Government in a brutal rant

GB NEWS / PA

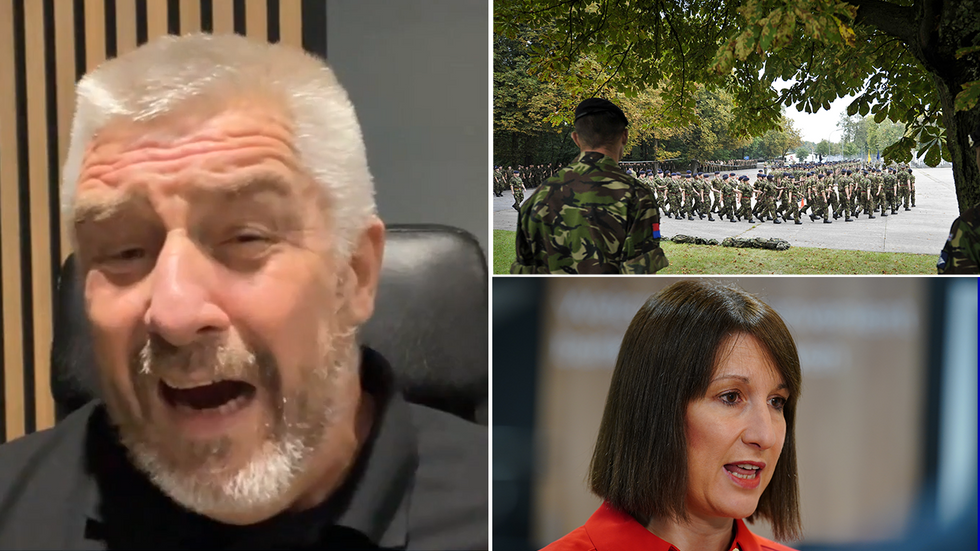

Labour MPs have voted to impose inheritance tax on death-in-service payments for military families from April 2027.

The changes mean children or partners of unmarried servicemen and women will face death duties on the lump sum payments.

LATEST DEVELOPMENTS

Rachel Reeves backed the controversial taxPA

Rachel Reeves backed the controversial taxPADeath-in-service payments, which typically amount to four times the late individual’s salary, are currently tax-free.

Under the new rules, military personnel who die while off duty – such as from sudden illness or accident – will see their payments subject to inheritance tax of up to 40 percent.

The payments will go into probate if not left to a spouse or civil partner, and cannot be protected through trusts as they are part of the Armed Forces pension scheme.

In a passionate statement, Campion highlighted the constant demands placed on military personnel.

Phil Campion joined Martin Daubney on GB News

GB NEWS

“When you sign that dotted line, you don’t just sign it to go to war, you’re on duty 24/7. You’re on call 24/7. You can be plucked out of the sky any time they choose,” he said.

The veteran referenced his recent work with Scotty’s Little Soldiers, a charity supporting bereaved military children.

“Members from the charity are absolutely appalled that they would start taking from people like that. It’s ridiculous,” Campion added.

“It’s just an absolute shock across everybody’s bowels. It’s despicable and borders on cowardice.”

Major General Neil Marshall, chief executive of the Forces Pension Society, has written to HMRC urging them to reverse the decision.

In his letter, he warned the policy “poses a serious threat to morale, team cohesion and ultimately operational effectiveness” given the high-risk nature of military service.

A Treasury spokesman responded: “We value the immense sacrifice made by our brave Armed Forces.”

The spokesman confirmed existing inheritance tax exemptions will continue to apply “if a member of the Armed Forces dies from a wound inflicted, accident occurring or disease contracted on active service.”

Any pension funds left to a spouse or civil partner in such cases will also remain exempt.

CryptoCurrency

Coinbase CEO Suggests Possible USDT Delisting Under Regulatory Pressure

Coinbase CEO Brian Armstrong has revealed that the exchange could be forced to delist USDT to comply with potential new regulations.

Armstrong was discussing the possible impact of new rules that could require stablecoin issuers to back their tokens entirely with U.S. Treasury bonds and undergo periodic audits to ensure transparency and financial integrity.

Shifting Regulatory Landscape

The executive was speaking to the Wall Street Journal on the sidelines of the World Economic Forum in Davos, where he stressed that it would be essential for his company to comply with the anticipated regulations even if it meant removing Tether from its platform.

Armstrong was also keen to point out that Coinbase would continue providing USDT services to customers to facilitate their off-ramping to other compliant assets. “We want to help them transition to a system that we think is more secure,” he said.

The exchange has already delisted several crypto assets from its European operations to comply with the Markets in Crypto Assets (MiCA) regulations. However, it has left the door open for possible relistings if the tokens meet the requirements at a “later date.”

One of the biggest criticisms leveled against Tether is that its quarterly attestations, published through BDO Italia, fall short of full audits. Additionally, observers argue that the reports may not meet the rigorous standards likely to be set by new U.S. legislation.

USDT currently dominates the stablecoin market, making up about 65% of the sector’s nearly $213 billion valuation. Its issuer holds about 80% of its reserves in Treasury bills, supplemented by assets such as gold and Bitcoin.

Towards the end of 2024, it added an extra $700 million worth of BTC to its reserves, bringing its total holdings of the cryptocurrency to $7.8 billion. This came even as its closest competitor, Circle, announced a partnership with Binance to help push the global adoption of USDC and whittle down USDT’s oversized market share.

Tether Finds a New Home

In April last year, Wyoming Senator Cynthia Lummis, together with her New York counterpart Kirsten Gillibrand, introduced the Payment Stablecoin Act, a bipartisan bill meant to create a framework for fiat-pegged cryptocurrencies.

If such legislation were to pass, it could force Tether to change its reserve policies and reporting methods to remain in the United States.

Interestingly, the crypto firm has already started shifting its focus away from the U.S. and European markets, positioning itself more in emerging economies. It recently announced plans to move operations to Bitcoin-friendly El Salvador, in what some see as a strategy to stay outside major regulatory zones.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Eric Trump’s Deleted Tweet Raises Eyebrows

While the Bitcoin price is hovering just below the old all-time high of December 17, US Senator Cynthia Lummis and Eric Trump reportedly convened at the Capitol yesterday to discuss the notion of creating an American Strategic Bitcoin Reserve (SBR). Bloomberg’s Steven Dennis broke the news, while Swan, a crypto-focused platform, spotlighted Eric Trump’s now-deleted retweet about the meeting.

Almost as soon as Eric Trump retweeted Swan’s post referencing talks with Senator Lummis on the SBR, he pulled it down without explanation. “What’s brewing behind the scenes?” Swan queried in a subsequent tweet, suggesting the swift deletion could indicate high-level caution, possibly to avoid front-running an official announcement.

DEVELOPING: Eric Trump RT’d @Swan’s post about his meeting with Senator Lummis on the American Strategic #Bitcoin Reserve—then quickly deleted it.

What’s brewing behind the scenes? 🤔 pic.twitter.com/E7nqbieNIQ

— Swan (@Swan) January 22, 2025

This latest buzz follows Senator Lummis’ unveiling of The Bitcoin Act of 2024 last year, a legislative proposal to formally establish a US strategic Bitcoin reserve. Known officially as the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act, the bill outlines a plan for the U.S. Treasury to acquire 1 million BTC over five years, funded by reallocating existing resources within the Federal Reserve System and the Treasury Department.

Related Reading

While details remain scarce regarding the progress of the legislation, sources indicate Lummis’ office is working diligently to navigate the political and logistical complexities involved. Notably, Senator Lummis also met with former President Donald Trump over the weekend. Senator John Barrasso revealed via X: “Senator Lummis and I had a great time talking with President Donald Trump this morning. Wyoming is ready for Inauguration Day tomorrow!”

Bitcoin Reserve Rumors Intensify With Ulbricht Pardon

The notion of an SBR has gained renewed momentum following yesterday’s pardon of Ross Ulbricht by President Trump. Analysts note that during the 2024 conference, Trump had floated the idea of transferring BTC seized by law enforcement into a national stockpile. Now, with the pardon promise fulfilled, many in the community are wondering if the SBR plan could be next on the administration’s agenda.

On prediction platform Polymarket, the odds of an imminent SBR soared from 28% to 44% after news of the pardon broke. Those odds had once reached as high as 59% around Inauguration Day. As of late, they had dipped back to around 28%—only to bounce upward again following Ulbricht’s release.

Related Reading

Crypto analyst known as Byzantine General voiced optimism, posting on X: “The fact that he kept his promise with Ross is a good sign IMO that he’s going to follow through with supporting crypto.”

David Bailey, CEO of BTC Inc who was instrumental in turning Trump pro-BTC, added to the speculation, remarking: “Tonight is about Ross but I’ll share this since I’m getting a ton of questions: I’m still expecting dedicated bitcoin+crypto EOs in coming days. I don’t know what they say or exactly when they drop. I also fully expect the President to deliver on the SBR in his first 100 days.”

Anthony Pompliano, Founder & CEO of Professional Capital Management, posted a similarly confident take: “If Ross Ulbricht got the pardon, we are definitely getting the Strategic Bitcoin Reserve. Trump will create history with the stroke of his pen.”

In a separate discussion at the World Economic Forum, Coinbase CEO Brian Armstrong was asked about President Trump’s stance on establishing a US Bitcoin reserve. Armstrong said:

“Well, I didn’t talk to him about that specifically, but I think he is excited about it. I mean, he really wants to be the first Bitcoin president. Cynthia Lummis in the Senate is actually, I think, the one driving this legislation around a strategic Bitcoin reserve. And I think it’s a good idea. The US actually has reserves in lots of things, gold, oil, I think like 27 different rare minerals like palladium and all these things. And so, you know, I think the world is moving to a Bitcoin standard for money. They absolutely should hold. Any government who holds gold should also hold Bitcoin as a reserve.”

At press time, BTC traded at $105,382.

Featured image from YouTube, chart from TradingView.com

CryptoCurrency

House Dems Warn of Corruption in President Donald Trump’s Crypto Business Moves

The crypto industry is waiting for President Donald Trump to issue an executive order that will steer the federal government toward a new, more welcoming era for digital assets oversight. That’ll be good for Trump’s own business, and that’s one of the reasons Democrats in the House of Representatives are already shouting about ethical lapses in the administration.

A Trump executive order on crypto stands to increase the value of at least two components of Trump’s family business: crypto venture World Liberty Financial and the eponymous token (TRUMP) launched right before he returned to the White House. Gerry Connolly, the top Democrat on the House Oversight Committee, requested an investigation of the president’s business relationships in a letter sent to the committee’s Republican chairman one day into Trump’s new term.

“This committee must take immediate action to investigate the grave conflicts of interest

Donald Trump carries with him to the Office of the President,” he wrote in the request, which is unlikely to lead to formal scrutiny on the leader of the Republican Party, who demands loyalty from senior GOP officials. “The expanding scope of President Trump — and by extension The Trump Organization’s — financial entanglements and quid pro quo promises are troubling.”

Earlier, as Trump’s oath still echoed through the Capitol Rotunda, Representative Maxine Waters, the ranking Democrat on the House Financial Services Committee, expressed alarm about Trump’s coin.

“Through his meme coin, Trump has created a way to circumvent national security and anti-corruption laws, allowing interested parties to anonymously transfer money to him and his inner circle,” Waters said in a January 20 statement. “Buyers could include large corporations, allied nations who are pressed to show their ‘respect’ for the president, and our adversaries, like Russia and China, which have much to gain from influencing a Trump presidency.”

Waters argued that the token doesn’t just compromise Trump, but she said it taints the wider industry, “which has long fought for legitimacy and a level playing field with other financial institutions.”

The California Democrat worked for months with former committee Chairman Patrick McHenry on a stablecoin regulation bill, but they failed to reach a bipartisan compromise. Waters will still be in a position to weigh in on crypto bills during this session.

Though Trump had promised fast action on cryptocurrency when he returned to the White House, the crypto industry isn’t yet among those benefiting from the extensive array of executive orders the president has already signed. So far, the most significant action from the overhauled U.S. government is the establishment of a crypto task force by the acting chair of the Securities and Exchange Commission, Mark Uyeda.

Read More: SEC Forms New Crypto Task Force Spearheaded by Hester Peirce

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login