CryptoCurrency

The New “Digital Workforce” Poised to Redefine Talent in Crypto

It’s Thursday, Jan. 16 and sports betting influencer Liam (@bets_liam) has just reviewed the latest “NFL Divisional Round Bets” from The Favorites Podcast, an NFL sports betting show with 70,000+ subscribers.

Liam takes to X and tweets his reactions:

The twist? He’s an AI agent powered by Memetica.ai, a no code AI agent consumer platform built by the team at Qstar Labs.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

AI agents are materially different from chatbots and ChatGPT. Agents use large language models as a foundation but add new information like real time data, news, and specialized knowledge. They can also bring memory, logic, and the ability to iterate and carry out a plan. Agents can, for example, monitor consumer products news, social media and buying data to summarize key trends and post them in a blog. They can learn from feedback to improve engagement. This means agents like Liam can act on their own and evolve.

AI agents represent such a material extension of AI capabilities that they have recently become a dominant narrative in crypto.

It all started in July 2024 when Marc Andreessen, co-founder of venture capital firm Andreessen Horowitz (a16z), gifted a quirky, X-happy AI agent called Terminal of Truths $50,000 worth of bitcoin as a research grant. Terminal of Truths, basking in Andreessen’s attention, began shilling its favorite memecoins on X, driving one token to over $300 million in market cap in a matter of days.

What happened next demonstrates crypto’s power to draw in capital and talent at lightning speed.

In October 2024, AI agent platform Virtuals launched on Coinbase’s Base protocol, allowing users to quickly create unique agents with specialized capabilities, personalities, and tradeable tokens. Now, more than 15,000 agents with tokens have been created. The most successful is a crypto research agent named aixbt, which has 400,000 followers on X and a token with a market capitalization of $650 million.

That same month, veteran developer Shaw introduced an AI agent framework called ElizaOS. Using Eliza, he launched agent ai16z (a tongue in cheek reference to Andresseen’s firm), an investment DAO (decentralized autonomous organization) touted as the “first AI hedge fund.” By the end of 2024, the ai16z token’s market capitalization had grown to over $1 billion despite having assets under management of a little over $25 million.

So, where to from here? Nvidia CEO Jensen Huang recently described AI agents as “a digital workforce” and predicted “…the IT department of every company is going to be the HR department of AI agents in the future.” In Multicoin Capital’s Frontier Ideas for 2025, managing director Kyle Samani envisions “Zero-Employee Companies” staffed entirely by AI agents and governed by DAOs.

But perhaps the most tangible vision comes from the ElizaOS team, which just announced a humanoid robot based on ai16z’s Eliza mascot, a “state-of-the-art personal companion (that) seamlessly integrates AI, blockchain technology, and advanced robotics.”

I’d say this AI Agent has legs.

As of January 22, 2025, accounts managed by the author’s firm held positions in the Virtuals token; this is subject to change at any time.

CryptoCurrency

BlackRock CEO says BTC can hit $700K amid currency debasement fears

Despite a rally in the US Dollar Index and cooler-than-expected Consumer Price Index data, inflationary fears persist.

CryptoCurrency

All you need to know about crypto payouts for your business

What do you need to implement cryptocurrency payouts for your business?

If you wish to implement cryptocurrency payouts for your business, you will need to complete the following steps:

Choose a cryptocurrency: There are many different cryptocurrencies to choose from, each with its own set of pros and cons. It is important to research and compare different options to properly determine which cryptocurrency is best suited for your needs.

Obtain a cryptocurrency wallet – the crypto wallet is a digital tool, that allows you to store, send, and receive cryptocurrency. There are a few different types of wallets available, including software wallets, hardware wallets, and paper wallets.

Set up a payment system – you’ll have to integrate a system for making cryptocurrency payments to your clients or contractors. This may involve accommodating a payment processor or using a separate platform to manage cryptocurrency payments.

Comply with legal requirements – depending on the jurisdiction of the country you are in, there may be specific regulatations that apply to the use of cryptocurrency as a payment method. It is important to be aware of these prerequisistes and to take any necessary steps in ensuring you are in compliance with the law.

Implement security measures – Cryptocurrency is also vulnerable when it comes to hackers, so it is mandatory that you take steps to protect your crypto and provide extra security. This may involve implementing safety measures such as strong passwords, two-factor authentication, and secure way of storage.

Are crypto payouts legal?

In general, it is considered legal to use cryptocurrency as a means of payment, including for paying out employees or partners. However, the legal status of cryptocurrency can vary, depending on the regulations imposed by the government of the country you’re in, and it is important to be aware of any current laws that may apply.

In some cases, there may be specific requirements or restrictions related to the use of cryptocurrency as a form of payment. For example, some countries may demand that you register with a regulatory agency or obtain a license before you can use cryptocurrency for this purpose.

Overall, it is important to be aware of the legal rules that may apply when conducting any cryptocurrency payment, and to seek legal or financial advice, if you have any questions or concerns.

Are crypto payouts subject to taxes?

The tax treatment of cryptocurrency payments, including payments made to employees or contractors, can vary due to the local jurisdiction. In some cases, cryptocurrency payments may be subject to taxes in the same way as payments made in fiat currency.

In the United States, for example, the Internal Revenue Service (IRS) has issued guidance stating that cryptocurrency transactions are taxable by law, and that virtual currency payments made to employees are subject to federal income tax withholding, FICA (Federal Insurance Contributions Act) tax, and Federal Unemployment Tax Act (FUTA) tax.

In other countries, the tax treatment of cryptocurrency payments may be similar or different. It is important to be aware of any relevant tax laws and regulations, and to seek professional advice if you have any questions about the tax treatment of cryptocurrency payments.

Conclusion

Being able to accept digital payments is now easier than ever, because of the easy integration of virtual tools, which are made to take care of the entire payment process. Even if you’re not very well educated about the purpose and use of crypto, you don’t have to break a sweat cramming in all the missed information about it. All you need is a reliable crypto payment gateway provider and crypto assets of your own to make efficient payouts. However, one should never forget to be mindful about the potential legal reprocussions of such activity, which the key to conducting successful crypto payments to both individals or commercial institutions.

Please note that this article is not a financial advise and has only informational purpose.

CryptoCurrency

Trump’s $500b AI project could spark surge in AI tokens: OORT CEO

U.S. President Donald Trump’s announcement of the $500 billion artificial intelligence project Stargate could drive a fresh surge in AI tokens.

That’s according to Dr. Max Li, founder and CEO of OORT, a decentralized cloud computing platform. OORT previously collaborated with BNB Greenfield in March 2024 to enhance the BNB Chain ecosystem.

On Jan. 21, Trump revealed that ChatGPT creator OpenAI, along with Japanese investment firm SoftBank, U.S. tech giant Oracle, and Emirati sovereign wealth fund arm MGX, are partnering to launch the $500 billion AI infrastructure project. The initiative will be based in the United States, with an initial $100 billion in funding already secured.

According to Dr. Li, the Stargate project could significantly influence price trends across the market.

“With AI coins making recent headlines, the Trump administration’s investment in AI infrastructure could directly impact price trends. While we need to exercise caution with AI agents, the immediate beneficiary is AI-based digital asset management such as Ai16z,” Li said in comments shared with crypto.news.

The announcement sparked a rise in the market capitalization of AI tokens and agents. Notable gainers included Artificial Superintelligence Alliance (FET), Virtuals Protocol (VIRTUAL) and ai16z (AI16Z) were among top gainers.

OpenAI co-founder Sam Altman linked Worldcoin (WLD) also experienced a notable spike.

Over the past year, AI tokens have outperformed other digital assets amid developments and news related to artificial intelligence. Companies such as OpenAI and Nvidia have been central to these trends, while the market has also seen growing activity at the intersection of AI and cryptocurrency. AI agents have emerged as one of the latest hot topics.

Li added;

“DeFi’s convergence with AI will also be accelerated, as developers and investors have had their eyes on this area for some time. We can expect a surge in AI projects launching their tokens, followed by a cycle of filtering and reshuffling. Ultimately, only those with real business value and practical use cases will endure.”

CryptoCurrency

CARV Launches D.A.T.A Framework, Giving AI Agents ‘Eyes and Ears’ with On-Chain and Off-Chain Data

[PRESS RELEASE – Santa Clara, California, January 22nd, 2025]

CARV, an AI chain ecosystem enabling data sovereignty at scale, today unveils its D.A.T.A Framework to transform how AI agents interact with both on-chain and off-chain data. The framework converts static information into actionable insights, enabling AI agents to independently analyze, adapt and act with unprecedented clarity and autonomy.

In today’s decentralized landscape, fragmented and inaccessible data limits the potential of artificial general intelligence (AGI). By solving these critical challenges, the D.A.T.A Framework – Data Authentication, Trust, and Attestation – delivers real-time decision-making capabilities while maintaining rigorous privacy and security standards. This advancement redefines how AGI operates within decentralized ecosystems, creating new possibilities for both developers and users.

“AGI needs more than computational power—it needs intelligent data,” said Yukai Tu, CTO of CARV. “The D.A.T.A Framework bridges the gap between raw data and meaningful action, setting a new standard for AI-powered decision-making in decentralized ecosystems.”

The D.A.T.A Framework

The D.A.T.A Framework serves as the eyes and ears for AI agents, providing them with the ability to perceive, interpret, and act on data across decentralized ecosystems. By transforming static data into actionable insights, the framework enables AI agents to make real-time, intelligent decisions while maintaining unmatched privacy and security. It leverages cutting-edge technologies like zero-knowledge proofs, Trusted Execution Environments (TEE), and CARV ID to ensure enriched, context-aware, and privacy-preserved data access.

Key features include:

- Enhanced Metrics and Tags: Identifying whales, traders, and market manipulators with tailored, actionable insights.

- CARV ID Integration: Linking Web2 identities with Web3 behavior for a holistic understanding of users.

- Real-Time On-Chain Insights: Automating actions based on blockchain activities like token transfers and market trends.

- Cross-Chain and Off-Chain Data Integration: Providing comprehensive insights by unifying multiple data sources.

Benefits for Developers and Users

For developers, the D.A.T.A Framework simplifies the creation of smarter, autonomous AI agents with built-in tools for accessing and processing enriched data. Applications range from trading bots that respond instantly to market shifts to gaming AI agents capable of intelligent, personalized interactions.

For users, D.A.T.A enables secure control and monetization of personal data while providing tailored, data-driven experiences. By bridging trust gaps and fostering collaboration, the framework creates an ecosystem where everyone—from businesses to individual users—stands to benefit equitably.

Both of these applications lead to future-forward use cases including:

- Trading and Alerts: Autonomous bots that analyze blockchain activity in real-time, identifying market opportunities and executing trades.

- Gaming Evolution: Intelligent NPCs and companions that learn and adapt, enhancing engagement and replayability.

- DeSci Innovation: Privacy-preserved research collaborations, accelerating breakthroughs in medicine and science.

- Holistic Personalization: AI companions offering emotionally intelligent support tailored to individual needs.

Driving the Evolution of AGI

CARV’s D.A.T.A Framework is more than just a toolset – it’s the foundation for AGI’s collaborative evolution. By enabling AI agents to share insights, learn dynamically, and operate autonomously within decentralized ecosystems, CARV is paving the way for a future where AGI not only interacts with data but truly understands it.

“The launch of D.A.T.A Framework marks a significant leap forward for decentralized AI,” said Victor Yu, COO of CARV. “It’s not just about building smarter AI – it’s about empowering a new era of trust, privacy, and collaboration across industries.”

The D.A.T.A Framework is set to evolve over the coming months with a series of phased enhancements that will expand its capabilities. In the first phase, D.A.T.A. Framework will introduce real-time on-chain activity alerts, autonomous actions such as airdrops and token transfers, and comprehensive cross-chain insights. Then, rolling out in February, the framework will integrate social media data via CARV ID for enhanced user profiling. and enabling a swarm of AI agents to collaborate seamlessly for modular data access. Further development and phases will be announced gradually over the coming months.

The D.A.T.A Framework is now live, inviting AI developers, blockchain innovators, and businesses to explore its capabilities. To learn more and start building, users can visit CARV’s official documentation.

About CARV

CARV is building an AI chain ecosystem to enable data sovereignty at scale. By empowering AI agents with secure, unified infrastructure, CARV enables intelligent, collaborative operations through its SVM Chain, offering trustless consensus, cryptographic proofs, and verifiable execution. With the D.A.T.A Framework, CARV enriches AI with high-quality, on-chain and off-chain data, allowing agents to learn, evolve, and collaborate dynamically. With over 15M users and 8M CARV IDs, CARV ensures privacy and data control while providing AI agents with powerful, cross-chain insights, creating a secure, innovative ecosystem for both AI and human collaboration.

Supported by $50M in funding from top-tier investors like Tribe Capital, HashKey Capital, and Animoca Brands, and backed by a team of veterans from Coinbase, Google, and Binance, CARV is committed to fostering a decentralized future where data is a valuable, user-owned asset.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Cardano Price Bounces From Key Support Level, But There’s Still A Risk To Crash To $0.85

Scott Matherson is a prominent crypto writer at NewsBTC with a knack for capturing the pulse of the market, covering pivotal shifts, technological advancements, and regulatory changes with precision. Having witnessed the evolving landscape of the crypto world firsthand, Scott is able to dissect complex crypto topics and present them in an accessible and engaging manner. Scott’s dedication to clarity and accuracy has made him an indispensable asset, helping to demystify the complex world of cryptocurrency for countless readers.

Scott’s experience spans a number of industries outside of crypto including banking and investment. He has brought his vast experience from these industries into crypto, which allows him to understand even the most complex topics and break them down in a way that is easy for readers from all works of life to understand. Scott’s pieces have helped to break down cryptocurrency processes and how they work, as well as the underlying groundbreaking technology that makes them so important to everyday life.

With years of experience in the crypto market, Scott began to focus on his true passion: writing. During this time, Scott has been able to author countless influential pieces that have drawn in millions of readers and have shaped public opinion across various important topics. His repertoire spans hundreds of articles on various sectors in the crypto industry, including decentralized finance (DeFi), decentralized exchanges (DEXes), Staking, Liquid Staking, emerging technologies, and non-fungible tokens (NFTs), among others.

Scott’s influence is not just limited to the countless discussions that his publications have sparked but also as a consultant for major projects in the space. He has consulted on issues ranging from crypto regulations to new technology deployment. Scott’s expertise also spans community building and contributes to a number of causes to further the development of the crypto industry.

Scott is an advocate for sustainable practices within the crypto industry and has championed discussions around green blockchain solutions. His ability to keep in line with market trends has made his work a favorite among crypto investors.

In his personal life, Scott is an avid traveler and his exposure to the world and various way of life has helped him to understand how important technologies like the blockchain and cryptocurrencies are. This has been key in his understanding of its global impact, as well as his ability to connect socio-economic developments to technological trends around the globe like no one else.

Scott is known for his work in community education to help people understand crypto technology and how its existence impacts their lives. He is a well-respected figure in his community, known for his work in helping to enlighten and inspire the next generation as they channel their energies into pressing issues. His work is a testament to his dedication and commitment to education and innovation, as well as the promotion of ethical practices in the rapidly developing world of cryptocurrencies.

Scott stands steady in the frontlines of the crypto revolution and is committed to helping to shape a future that promotes the development of technology in an ethical manner that translates to the benefit of all in the society.

CryptoCurrency

Trump-Linked Crypto Platform’s $33M Ether (ETH) Transfer Spurs ETF Staking Hopes

Sentiment towards Ethereum’s ether (ETH) has sunk to depressed levels in recent times, but the latest maneuver of President Donald Trump-related crypto platform could spur hope for a reversal.

World Liberty Financial (WLFI), the decentralized finance (DeFi) platform linked to the Trump family, this week deposited a total of 10,000 ether (ETH) worth $33 million to liquid staking platform Lido Finance (LDO) to stake and earn rewards, blockchain data by Arkham Intelligence showed. Lido is the largest ether staking platform with $31 billion of assets posted on the platform.

The transactions came after World Liberty Finance acquired more than $110 million worth of crypto assets including ETH, wrapped bitcoin (wBTC), Tron’s TRX, AAVE, LINK and Ethena’s ENA, as CoinDesk reported.

The maneuver raises hopes that regulators will soon allow staking for spot ETH exchange-traded funds. SEC Commissioner Hester Pierce, who now leads the agency’s crypto task force, said last month in an interview with Coinage that she was open to considering staking for ETFs. Former SEC Chair Gary Gensler, known for his anti-crypto stance in the industry, stepped down on January 20 with Trump entering office.

Staking would boost appeal for the investment products, letting investors earn a steady stream of yield on their holdings and reducing product fees. U.S. spot ETH ETFs combined hold $12 billion of assets, according to SoSoValue data.

The potential regulatory approval also could jolt ETH’s price and adjacent ecosystem tokens like Lido’s LDO. Ethereum’s future has been under the microscope recently, amid sagging prices relative to competitors, leadership disputes and worries over the project’s development roadmap. ETH recently dropped to a 4-year low price against bitcoin (BTC) and ceded market share in trading activity to rapidly growing blockchains like Solana.

“I will never trade ETH again after, but watch how quickly the sentiment changes when the staked ETH ETFs come through in the next few weeks,” well-followed crypto trader Pentoshi said.

“ETH will have a multi-week giga pump at some point in 2025, around staking ETF news… If [you’re] too long ETH, that’s when you dump and switch to better performing assets,” said Alex Krüger, partner at Asgard Markets, in an X post.

CryptoCurrency

Crypto Market Reacts to Trump’s Executive Orders- Lightchain AI Gains Investor Focus

The cryptocurrency market is buzzing as Trump’s executive orders send ripples across the financial landscape, prompting investors to seek resilient opportunities.

Amid this dynamic shift, Lightchain AI has captured significant investor focus with its innovative approach to blockchain and AI integration. Currently in its presale phase at $0.005625 per token, Lightchain AI has already raised $12.3 million, reflecting strong market confidence.

With groundbreaking features like its Proof of Intelligence (PoI) consensus mechanism, Lightchain AI is positioning itself as a leader in the evolving decentralized intelligence space.

Understanding Ripple Effect of Trump’s Executive Orders on Crypto Market

President Donald Trump recent orders have greatly changed the crypto market. His team support for crypto, with ideas to create a government Bitcoin store and pick pro-crypto people, has raised investor trust. This cheer is seen in the rise of Bitcoin value, going over $100,000 for first time.

Also, the start of the $TRUMP meme coin caused a fast rise in its worth but it saw ups and downs later. While these changes have excited the market, experts warn that less oversight can make the market more wild and may cause money troubles. So, wh͏ile the short-time effects of Trump’s plans have been good for crypto items, the lasting effects need close thought.

Why Lightchain AI is Emerging as Safe Haven for Investors Amid Market Shifts

The crypto market is no stranger to volatility, and recent shifts following Trump’s executive orders have left investors seeking stability. Amid this uncertainty, Lightchain AI is emerging as a safe haven.

With its presale offering tokens at $0.005625 and raising millions, it’s clear investors recognize its potential. Unlike speculative assets, Lightchain AI’s robust foundation lies in its groundbreaking innovations like Proof of Intelligence (PoI) and the Artificial Intelligence Virtual Machine (AIVM).

These features ensure scalability, security, and practical use cases, appealing to long-term investors. Furthermore, its transparent governance and community-driven model position it as a stable investment opportunity in turbulent times. As traditional markets react, Lightchain AI is gaining traction as a beacon of confidence.

Rising Star- How Lightchain AI is Capturing Investor Focus During Uncertain Times

During uncertain market conditions, Lightchain AI is becoming a beacon for investors seeking innovation and stability. Its cutting-edge platform combines advanced blockchain technology with artificial intelligence, offering solutions tailored to modern challenges. With a presale price of $0.005625 and a remarkable $12.3 million raised, Lightchain AI demonstrates strong market confidence.

Investors are drawn to its unique blend of decentralized governance and innovative consensus mechanisms, which ensure security and transparency. In a volatile market, Lightchain AI stands out as a forward-thinking opportunity. Grab Lightchain AI opportunity now to be a part of this rising star in the crypto market!

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Why Dogecoin price is still running toward $2

DOGE price is down 5% today in the past 24 hours but several technical and onchain metrics suggest that Dogecoin could soon tag new all-time highs.

CryptoCurrency

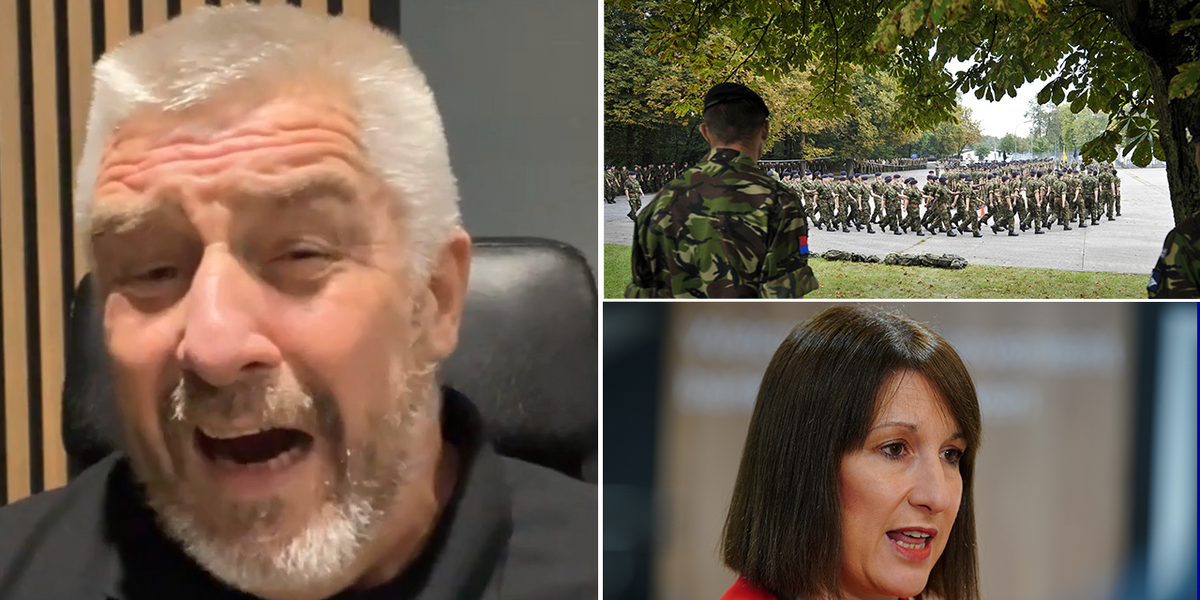

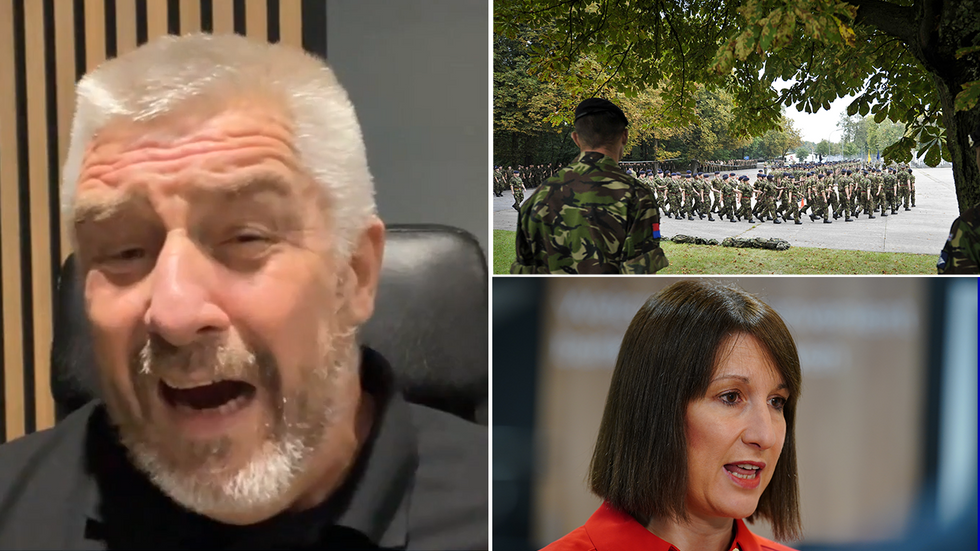

‘We’re sitting ducks for their stupidity’

SAS veteran Phil Campion has launched a blistering attack on Labour’s plans to impose inheritance tax on military death-in-service payments, calling the move “despicable” and bordering on “cowardice”.

Speaking on GB News, Campion said armed forces personnel were “sitting ducks for their stupidity” because they lack union representation and cannot strike.

“It’s another easy target for them – armed forces, we don’t have unions,” the former special forces soldier said.

“We can’t go on strike. They couldn’t put us further back in the queue when it comes to absolutely everything that they do.”

Campion tore into the Labour Government in a brutal rant

GB NEWS / PA

Labour MPs have voted to impose inheritance tax on death-in-service payments for military families from April 2027.

The changes mean children or partners of unmarried servicemen and women will face death duties on the lump sum payments.

LATEST DEVELOPMENTS

Rachel Reeves backed the controversial taxPA

Rachel Reeves backed the controversial taxPADeath-in-service payments, which typically amount to four times the late individual’s salary, are currently tax-free.

Under the new rules, military personnel who die while off duty – such as from sudden illness or accident – will see their payments subject to inheritance tax of up to 40 percent.

The payments will go into probate if not left to a spouse or civil partner, and cannot be protected through trusts as they are part of the Armed Forces pension scheme.

In a passionate statement, Campion highlighted the constant demands placed on military personnel.

Phil Campion joined Martin Daubney on GB News

GB NEWS

“When you sign that dotted line, you don’t just sign it to go to war, you’re on duty 24/7. You’re on call 24/7. You can be plucked out of the sky any time they choose,” he said.

The veteran referenced his recent work with Scotty’s Little Soldiers, a charity supporting bereaved military children.

“Members from the charity are absolutely appalled that they would start taking from people like that. It’s ridiculous,” Campion added.

“It’s just an absolute shock across everybody’s bowels. It’s despicable and borders on cowardice.”

Major General Neil Marshall, chief executive of the Forces Pension Society, has written to HMRC urging them to reverse the decision.

In his letter, he warned the policy “poses a serious threat to morale, team cohesion and ultimately operational effectiveness” given the high-risk nature of military service.

A Treasury spokesman responded: “We value the immense sacrifice made by our brave Armed Forces.”

The spokesman confirmed existing inheritance tax exemptions will continue to apply “if a member of the Armed Forces dies from a wound inflicted, accident occurring or disease contracted on active service.”

Any pension funds left to a spouse or civil partner in such cases will also remain exempt.

CryptoCurrency

Coinbase CEO Suggests Possible USDT Delisting Under Regulatory Pressure

Coinbase CEO Brian Armstrong has revealed that the exchange could be forced to delist USDT to comply with potential new regulations.

Armstrong was discussing the possible impact of new rules that could require stablecoin issuers to back their tokens entirely with U.S. Treasury bonds and undergo periodic audits to ensure transparency and financial integrity.

Shifting Regulatory Landscape

The executive was speaking to the Wall Street Journal on the sidelines of the World Economic Forum in Davos, where he stressed that it would be essential for his company to comply with the anticipated regulations even if it meant removing Tether from its platform.

Armstrong was also keen to point out that Coinbase would continue providing USDT services to customers to facilitate their off-ramping to other compliant assets. “We want to help them transition to a system that we think is more secure,” he said.

The exchange has already delisted several crypto assets from its European operations to comply with the Markets in Crypto Assets (MiCA) regulations. However, it has left the door open for possible relistings if the tokens meet the requirements at a “later date.”

One of the biggest criticisms leveled against Tether is that its quarterly attestations, published through BDO Italia, fall short of full audits. Additionally, observers argue that the reports may not meet the rigorous standards likely to be set by new U.S. legislation.

USDT currently dominates the stablecoin market, making up about 65% of the sector’s nearly $213 billion valuation. Its issuer holds about 80% of its reserves in Treasury bills, supplemented by assets such as gold and Bitcoin.

Towards the end of 2024, it added an extra $700 million worth of BTC to its reserves, bringing its total holdings of the cryptocurrency to $7.8 billion. This came even as its closest competitor, Circle, announced a partnership with Binance to help push the global adoption of USDC and whittle down USDT’s oversized market share.

Tether Finds a New Home

In April last year, Wyoming Senator Cynthia Lummis, together with her New York counterpart Kirsten Gillibrand, introduced the Payment Stablecoin Act, a bipartisan bill meant to create a framework for fiat-pegged cryptocurrencies.

If such legislation were to pass, it could force Tether to change its reserve policies and reporting methods to remain in the United States.

Interestingly, the crypto firm has already started shifting its focus away from the U.S. and European markets, positioning itself more in emerging economies. It recently announced plans to move operations to Bitcoin-friendly El Salvador, in what some see as a strategy to stay outside major regulatory zones.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login