CryptoCurrency

Then They Fight You: Bitcoin and the United States’ Fiscal Crossroads

Introduction

Scholars dispute whether it was Mahatma Gandhi who first said, “First they ignore you, then they laugh at you, then they fight you, then you win.” What cannot be disputed is that advocates of bitcoin have adopted the aphorism as their own.

Bitcoiners commonly prophesize that at some point, bitcoin will replace the US dollar as the world’s predominant store of value.[1] Less frequently discussed is the essential question of exactly how such a transition might take place and what risks may lie along the path, especially if the issuers of fiat currency choose to fight back against challenges to their monetary monopolies.

Will the US government and other Western governments willingly adapt to an emerging bitcoin standard, or will they take restrictive measures to prevent the replacement of fiat currencies? If bitcoin does indeed surpass the dollar as the world’s most widely used medium of exchange, will a transition from the dollar to bitcoin be peaceful and benign, like the evolution from Blockbuster Video to Netflix? Or will it be violent and destructive, as with Weimar Germany and the Great Depression? Or somewhere in between?

These questions are not merely of theoretical interest. If bitcoin is to emerge from the potentially turbulent times ahead, the bitcoin community will need to contemplate exactly how to make it resilient to these future scenarios and how best to bring about the most peaceful and least disruptive transition toward an economy based once again upon sound money.

In particular, we must take into account the vulnerabilities of those whose incomes and wealth are below the rich-nation median—those who, at current and future bitcoin prices, may fail to save enough to protect themselves from the economic challenges to come. “Have fun staying poor,” some Bitcoiners retort to their skeptics on social media. But in a real economic crisis, the poor will not be having fun. The failure of fiat-based fiscal policy will inflict the most harm on those who most depend on government spending for their economic security. In democratic societies, populists across the political spectrum will have powerful incentives to harvest the resentment of the non-bitcoin-owning majority against bitcoin-owning elites.

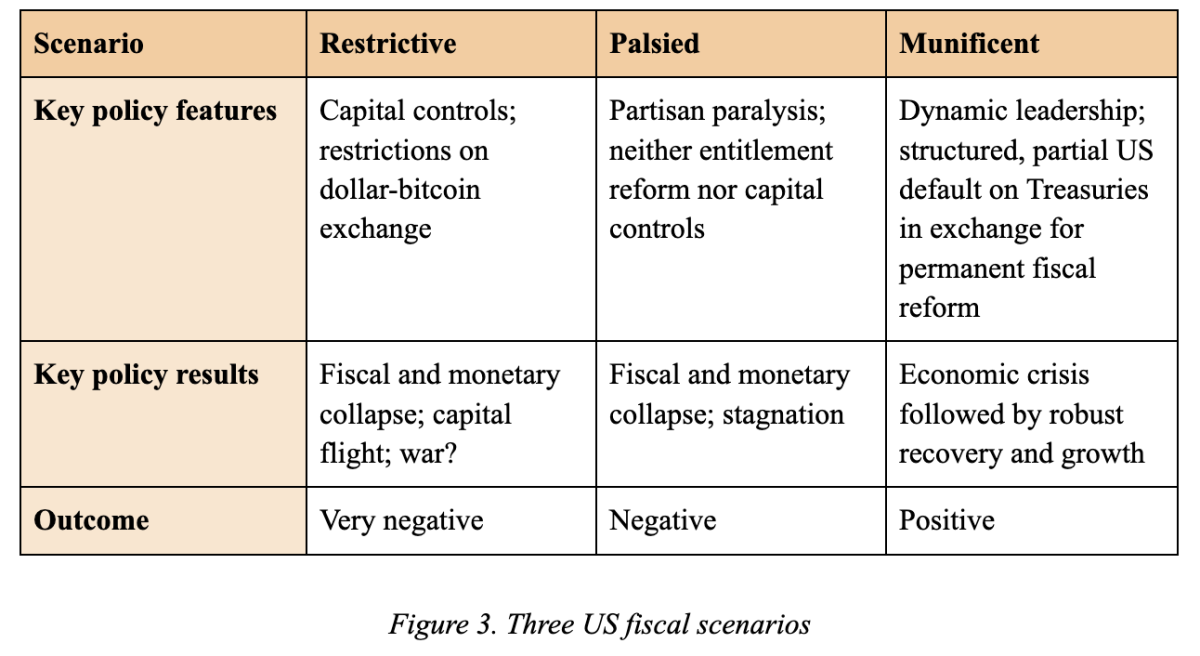

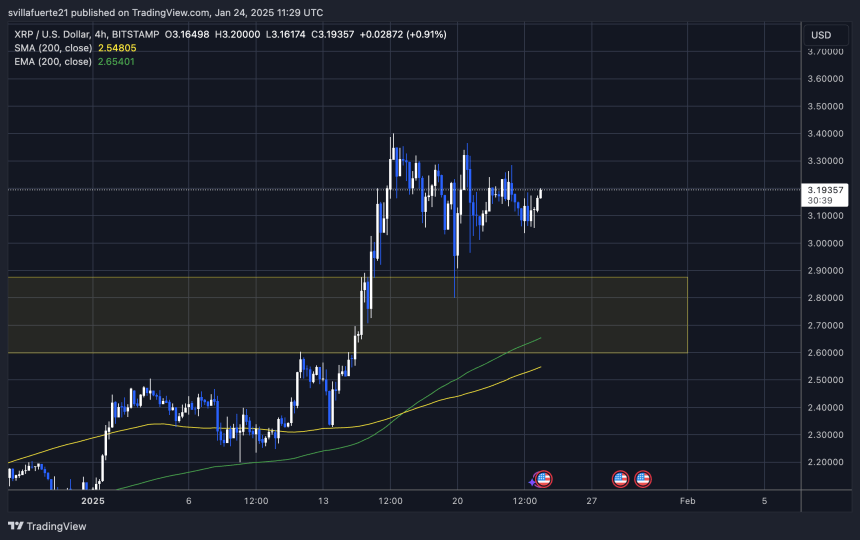

It is, of course, difficult to predict exactly how the US government will respond to a hypothetical fiscal and monetary collapse decades into the future. But it is possible to broadly group the potential scenarios in ways that are relatively negative, neutral, or positive for society as a whole. In this essay, I describe three such scenarios: A restrictive scenario, in which the US attempts to aggressively curtail economic liberties in an effort to suppress competition between the dollar and bitcoin; a palsied scenario, in which partisan, ideological, and special-interest conflicts paralyze the government and limit its ability to either improve America’s fiscal situation or prevent bitcoin’s rise; and a munificent scenario, in which the US assimilates bitcoin into its monetary system and returns to sound fiscal policy. I base these scenarios on the highly probable emergence of a fiscal and monetary crisis in the United States by 2044.

While these scenarios may also play out in other Western nations, I focus on the US here because the US dollar is today the world’s reserve currency, and the US government’s response to bitcoin is therefore of particular importance.

The Coming Fiscal and Monetary Crisis

We know enough about the fiscal trajectory of the United States to conclude that a major crisis is not merely possible but probable by 2044 if the federal government fails to change course. In 2024, for the first time in modern history, interest on the federal debt exceeded spending on national defense. The Congressional Budget Office (CBO)—the national legislature’s official, nonpartisan fiscal scorekeeper—predicts that by 2044, federal debt held by the public will be approximately $84 trillion, or 139 percent of gross domestic product. This represents an increase from $28 trillion, or 99 percent of GDP, in 2024.[2]

The CBO estimate makes several optimistic assumptions about the country’s fiscal situation in 2044. In its most recent projections, at the time of this publication, CBO assumes that the US economy will grow at a robust 3.6 percent per year in perpetuity, that the US government will still be able to borrow at a favorable 3.6 percent in 2044, and that Congress will not pass any laws to worsen the fiscal picture (as it did, for example, during the COVID-19 pandemic).[3]

The CBO understands that its projections are optimistic. In May 2024, it published an analysis of how several alternative economic scenarios would affect the debt-to-GDP ratio. One, in which interest rates increase annually by a rate of 5 basis points (0.05 percent) higher than the CBO’s baseline, would result in 2044 debt of $93 trillion, or 156 percent of GDP. Another scenario, in which federal tax revenue and spending rates as a share of GDP continue at historical levels (for example, as a result of the continuation of purportedly temporary tax breaks and spending programs), yields a 2044 debt of $118 trillion, or 203 percent of GDP.[4]

But combining multiple factors makes clear how truly dire the future has become. If we take the CBO’s higher interest rate scenario, in which interest rate growth is 5 basis points higher each year, and then layer onto that a gradual reduction in the GDP growth rate, such that nominal GDP growth in 2044 is 2.8 percent instead of 3.6 percent, the 2044 debt reaches $156 trillion, or 288 percent of GDP. By 2054, the debt would reach $441 trillion, or 635 percent of GDP (see figure 1).

View the original article to see embedded media.

Figure 1. US debt-to-GDP ratio: Alternative scenarios

Credit: Avik Roy, https://public.flourish.studio/visualisation/18398503/.

In this scenario of higher interest rate payments and lower economic growth, in 2044 the US government would pay $6.9 trillion in interest payments, representing nearly half of all federal tax revenue. But just as we cannot assume that economic growth will remain high over the next two decades, we cannot assume that the demand for US government debt will remain steady. At a certain point, the US will run out of other people’s money. Credit Suisse estimates that in 2022 there was $454 trillion of household wealth in the world, defined as the value of financial assets and real estate assets, net of debt.[5] Not all of that wealth is available to lend to the United States. Indeed, the share of US Treasury securities held by foreign and international investors has steadily declined since the 2008 financial crisis.[6] At the same time that demand for Treasuries is proportionally declining, the supply of Treasuries is steadily increasing (see figure 2).[7]

View the original article to see embedded media.

Figure 2. Ownership of US Treasuries

Credit: Avik Roy, https://public.flourish.studio/visualisation/7641395/.

In an unregulated bond market, this decline in demand paired with an increase in supply should lead to lower bond prices, signifying higher interest rates. The Federal Reserve, however, has intervened in the Treasury market to ensure that interest rates remain lower than they otherwise would. The Fed does this by printing new US dollars out of thin air and using them to buy the Treasury bonds that the broader market declines to purchase.[8] In effect, the Fed has decided that monetary inflation (that is, rapidly increasing the quantity of US dollars in circulation) is a more acceptable outcome than allowing interest rates to rise as the nation’s creditworthiness decreases.

This situation is not sustainable. Economist Paul Winfree, using a methodology developed by researchers at the International Monetary Fund,[9] estimates that “the federal government will begin running out of fiscal space, or its capacity to take on additional debt to deal with adverse events, within the next 15 years”—that is, by 2039. He further notes that “interest rates and potential [GDP] growth are the most important factors” that would affect his projections.[10]

For the purposes of our exercise, let us assume that the US will experience a fiscal and monetary failure by 2044—that is, a major economic crisis featuring a combination of rising interest rates (brought about by the lack of market interest in buying Treasuries) and high consumer price inflation (brought about by rapid monetary inflation). Over this twenty-year period, let us also imagine that bitcoin gradually increases in value, such that the liquidity of bitcoin, measured by its total market capitalization, is competitive with that of US Treasuries. Competitive liquidity is important because it means that large institutions, such as governments and multinational banks, can buy bitcoin at scale without excessively disrupting its price. Based on the behavior of conventional financial markets, I estimate that bitcoin will reach a state of competitive liquidity with Treasuries when its market capitalization equals roughly one-fifth of federal debt held by the public. Based on my $156 trillion estimate of federal debt in 2044, this amounts to approximately $31 trillion of bitcoin market cap, representing a price of $1.5 million per bitcoin—roughly twenty times the peak price of bitcoin reached in the first half of 2024.

This is far from an unrealistic scenario. Bitcoin appreciated by a comparable multiple from August 2017 to April 2021, a period of less than four years.[11] Bitcoin has appreciated by similar multiples on many other occasions previously.[12] And if anything, my projections of the growth of US federal debt are conservative. Let us, then, further imagine that by 2044, bitcoin is a well-understood, mainstream asset. A young man who turned eighteen in 2008 will celebrate his fifty-fourth birthday in 2044. By 2044, more than half of the US population will have coexisted with bitcoin for their entire adult lives. A robust ecosystem of financial products, including lending and borrowing, will by then likely have been well established atop the bitcoin base layer. Finally, let us speculate that in this scenario, inflation has reached 50 percent per annum. (This is somewhere between the over-100 percent inflation rates of Argentina and Turkey in 2023 and the nearly 15 percent inflation experienced by the US in 1980.)

In 2044, under these conditions, the US government will be in crisis. The rapid depreciation in the value of the dollar will have led to a sudden drop in demand for Treasury bonds, and there will not be an obvious way out. If Congress engages in extreme fiscal austerity—for example, by cutting spending on welfare and entitlement programs—its members will likely be thrown out of office. If the Federal Reserve raises interest rates enough to retain investor demand—say, above 30 percent—financial markets will crash, along with the credit-fueled economy, much as they did in 1929. But if the Fed allows inflation to rise even further, it will only accelerate the exit from Treasuries and the US dollar.

Under these circumstances, how might the US government respond? And how might it treat bitcoin? In what follows, I consider three scenarios. First, I contemplate a restrictive scenario, in which the US attempts to use coercive measures to prevent the use of bitcoin as a competitor to the dollar. Second, I discuss a palsied scenario, in which political divisions and economic weakness paralyze the US government, preventing it from taking meaningful steps for or against bitcoin. Finally, I consider a munificent scenario, in which the US eventually ties the value of the dollar to bitcoin, restoring the nation’s fiscal and monetary soundness. (See figure 3.)

Figure 3. Three US fiscal scenarios

1. The Restrictive Scenario

Throughout history, the most common response of government to a weakening currency has been to force its citizens to use and hold that currency instead of sounder alternatives, a phenomenon called financial repression. Governments also commonly deploy other economic restrictions, such as price controls, capital controls, and confiscatory taxation to maintain unsound fiscal and monetary policies.[13] It is possible—even probable—that the United States will respond similarly to the crisis to come.

Price Controls

In AD 301, the Roman Emperor Diocletian issued his Edictum de Pretiis Rerum Venalium—the Edict Concerning the Sale Price of Goods—which sought to address inflation caused by the long-running debasement of the Roman currency, the denarius, over a five-hundred-year period. Diocletian’s edict imposed price caps on over 1,200 goods and services.[14] These included wages, food, clothing, and shipping rates. Diocletian blamed rising prices not on the Roman Empire’s extravagant spending but on “unprincipled and licentious persons [who] think greed has a certain sort of obligation . . . in ripping up the fortunes of all.”[15]

Actions of this sort echo throughout history until the modern day. In 1971, US President Richard Nixon responded to the imminent collapse of US gold reserves by unilaterally destroying the dollar’s peg to one-thirty-fifth of an ounce of gold and by ordering a ninety-day freeze on “all prices and wages throughout the United States.”[16] Nixon, like Diocletian and so many other rulers in between, did not blame his government’s fiscal or monetary policies for his country’s predicament but rather the “international money speculators” who “have been waging an all-out war on the American dollar.”[17]

Even mainstream economists have convincingly shown that price controls on goods and services do not work.[18] This is because producers cease production if they are forced to sell their goods and services at a loss, which leads to shortages. But price controls remain a constant temptation for politicians since many consumers believe that price controls will protect them from inflation (at least in the short term). Since 2008, the Federal Reserve has imposed an increasingly aggressive set of controls on what economic historian James Grant calls “the most important price in capital markets”—that is, the price of money as reflected by interest rates.[19] As explained above, the Federal Reserve can effectively control interest rates on Treasury securities by acting as the dominant buyer and seller of those securities on the open market. (When bond prices rise because of more buying than selling, the interest rates implied by their prices decline, and vice versa.) The interest rates used by financial institutions and consumers, in turn, are heavily influenced by the interest rates on Treasury bonds, bills, and notes. Prior to the 2008 financial crisis, the Fed used this power narrowly, on a subset of short-term Treasury securities. But afterward, under Chairman Ben Bernanke, the Fed became far more aggressive in using its power to control interest rates throughout the economy.[20]

Capital Controls

Price controls are only one tool used by governments to control monetary crises. Another is capital controls, which hamper the exchange of a local currency for another currency or reserve asset.

In 1933, during the Great Depression, President Franklin Delano Roosevelt (popularly known as FDR) deployed a First World War–era statute to prohibit Americans from fleeing the dollar for gold. His Executive Order 6102 prohibited Americans from holding gold coin, gold bullion, and gold certificates and required people to surrender their gold to the US government in exchange for $20.67 per troy ounce.[21] Nine months later, Congress devalued the dollar by changing the price of a troy ounce to $35.00, effectively forcing Americans to accept an immediate 41 percent devaluation of their savings while preventing them from escaping that devaluation by using a superior store of value.[22]

Capital controls are far from a historical relic. Argentina has historically prohibited its citizens from exchanging more than $200 worth of Argentine pesos for dollars per month, ostensibly to slow the decline of the value of the peso.[23] China imposes strict capital controls on its citizens—essentially requiring government approval for any exchange of foreign currency—to prevent capital from leaving China for other jurisdictions.[24]

Increasingly, mainstream economists see these modern examples of capital controls as a success. The International Monetary Fund, born out of the 1944 Bretton Woods Agreement, had long expressed opposition to capital controls, largely at the behest of the United States, which benefits from global use of the US dollar. But in 2022, the International Monetary Fund revised its “institutional view” of capital controls, declaring them an appropriate tool for “managing . . . risks in a way that preserves macroeconomic and financial stability.”[25]

In my restrictive 2044 scenario, the US uses capital controls to prevent Americans from fleeing the dollar for bitcoin. The federal government could achieve this in several ways:

- Announcing a purportedly temporary, but ultimately permanent, suspension of the exchange of dollars for bitcoin and forcing the conversion of all bitcoin assets held in cryptocurrency exchanges into dollars at a fixed exchange rate. (Based on my predicted market price at which bitcoin’s liquidity is competitive with Treasuries, that would be approximately $1.5 million per bitcoin, but there is no guarantee that a forced conversion would occur at market rates.)

- Barring businesses under US jurisdiction from holding bitcoin on their balance sheets and from accepting bitcoin as payment.

- Liquidating bitcoin exchange-traded funds (ETFs) by forcing them to convert their holdings to US dollars at a fixed exchange rate.

- Requiring bitcoin custodians to sell their bitcoin to the US government at a fixed exchange rate.

- Requiring those who self-custody their bitcoin to sell it to the government at a fixed exchange rate.

- Introducing a central bank digital currency to fully surveil all US dollar transactions and ensure that none are used to purchase bitcoin.

The US government would be unlikely to execute all of these strategies successfully. In particular, the US will be unable to force all those who self-custody bitcoin to surrender their private keys. But many law-abiding citizens would likely comply with such a directive. This would be a pyrrhic victory for the government, however: The imposition of capital controls would lead to a further decline in confidence in the US dollar, and the cost to the US government of purchasing all the bitcoin custodied by American citizens and residents could exceed $10 trillion, further weakening the US fiscal situation. Nonetheless, the government in the restrictive scenario will have concluded that these are the least bad options.

Confiscatory Taxation

The US government could also use tax policy to restrict the utility of bitcoin and thereby curtail its adoption.

In a world where one bitcoin equals $1.5 million, many of the wealthiest people in the United States will be early bitcoin adopters. Technology entrepreneur Balaji Srinivasan has estimated that at a price of $1 million per bitcoin, the number of bitcoin billionaires will begin to exceed the number of fiat billionaires.[26] This does not imply, however, that the distribution of wealth among bitcoin owners would be more equal than the distribution of wealth among owners of fiat currency today.

Fewer than 2 percent of all bitcoin addresses contain more than one bitcoin, and fewer than 0.3 percent contain more than ten bitcoin. Addresses within that top 0.3 percent own more than 82 percent of all the bitcoin in existence.[27] (See figure 4.) Given that many individuals control multiple wallets, and even allowing for the fact that some of the largest bitcoin addresses belong to cryptocurrency exchanges, these figures likely underestimate the amount of bitcoin wealth concentration. They compare unfavorably to US fiat wealth distribution; in 2019, the top 1 percent held merely 34 percent of all fiat-denominated wealth in the United States.[28]

If bitcoin ownership remains similarly distributed in 2044, those left behind by this monetary revolution—including disenfranchised elites from the previous era—will not go down quietly. Many will decry bitcoin wealth inequality as driven by anti-American speculators and seek to enact policies that restrict the economic power of bitcoin owners.

View the original article to see embedded media.

Figure 4. Distribution of bitcoin ownership

Credit: Avik Roy, https://public.flourish.studio/visualisation/18651414/.

In 2021, rumors circulated that Treasury Secretary Janet Yellen had proposed to President Joe Biden the institution of an 80 percent tax on cryptocurrency capital gains, a steep increase from the current top long-term capital gains tax rate of 23.8 percent.[29] In 2022, President Biden, building on a proposal by Massachusetts Senator Elizabeth Warren, suggested taxing unrealized capital gains—that is, on-paper increases in the value of assets that the holder has not yet sold.[30] This would be an unprecedented move since it would require people to pay taxes on earnings they have not yet realized.

It has long been argued that taxing unrealized capital gains would violate the US Constitution because unrealized gains do not meet the legal definition of income, and Article I of the Constitution requires that non-income taxes must be levied in proportion to states’ respective populations.[31] A recent case before the Supreme Court, Moore v. United States, gave the court the opportunity to make clear its position on the question; it declined to do so.[32] As a result, it remains eminently possible that a future Congress, supported by a future Supreme Court, will assent to the taxing of unrealized capital gains, and cryptocurrency gains specifically.

Moreover, a presidential administration that does not like the constitutional interpretations of an existing Supreme Court could simply pack the court to ensure more favorable rulings. The FDR administration threatened to do precisely that during the 1930s. The conservative Supreme Court of that era had routinely ruled that FDR’s economically interventionist policies violated the Constitution. In 1937, Roosevelt responded by threatening to appoint six new justices to the Supreme Court in addition to the existing nine. While he was ultimately forced to withdraw his court-packing proposal, the Supreme Court was sufficiently intimidated and began approving New Deal legislation at a rapid pace thereafter.[33]

A unique feature of US tax policy is that US citizens who live abroad are still required to pay US income and capital gains taxes, along with the taxes they pay in the country of their residence. (In all other advanced economies, expatriates only pay taxes once, based on where they live. For example, a French national living and working in Belgium pays Belgian tax rates, not French tax rates, whereas an American in Belgium pays both Belgian and US taxes.) This creates a perverse incentive for Americans living abroad to renounce their US citizenship. Every year, a few thousand Americans do so. However, they must first seek approval from a US embassy on foreign soil and pay taxes on all unrealized capital gains. In a restrictive scenario, in which the US Treasury is starved for revenue, it is easy to imagine the government suspending the ability of Americans to renounce their citizenship, ensuring that expatriates’ income remains taxable regardless of where they live.

Right-Wing Financial Restrictions

While many of the restrictive policies described above have been proposed by politicians affiliated with the Democratic Party, Republican Party officials and representatives in 2044 may be just as willing to amplify populist resentment of the bitcoin elite. The United States is already home to a vocal movement of both American and European intellectuals building a new ideology broadly known as national conservatism, in which the suppression of individual rights is acceptable in the name of the national interest.[34] For example, some national conservatives advocate monetary and tax policies that protect the US dollar against bitcoin, even at the expense of individual property rights.[35]

The USA PATRIOT Act was passed by overwhelming bipartisan congressional majorities weeks after the terrorist attacks of September 11, 2001. It was signed into law by Republican President George W. Bush and included numerous provisions designed to combat the financing of international terrorism and criminal activity, especially by strengthening anti-money-laundering and know-your-customer rules, as well as reporting requirements for foreign bank account holders.[36]

The PATRIOT Act may have helped reduce the risk of terrorism against the US, but it has achieved this at a significant cost to economic freedom, especially for American expatriates and others who use non-US bank accounts for personal or business reasons. Just as FDR used a law from the First World War to confiscate Americans’ gold holdings, in 2044 a restrictive government of either party will find many of the PATRIOT Act’s tools useful to clamp down on bitcoin ownership and usage.

The End of America’s Exorbitant Privilege

Bitcoin is remarkably resilient in its design; its decentralized network will likely continue to function well despite restrictive measures adopted by governments against its use. Today, for instance, a considerable amount of bitcoin trading volume and mining activity occurs in China, despite that country’s prohibition of it, because of the use of virtual private networks (VPNs) and other tools that disguise a user’s geographic location.[37]

If we assume that half of the world’s bitcoin is owned by Americans and further assume that 80 percent of American bitcoin is held by early adopters and other large holders, it is likely that most of that 80 percent is already protected against confiscation through self-custody and offshore contingency planning. Capital controls and restrictions could collapse institutional bitcoin trading volume in the US, but most of this volume would likely move to decentralized exchanges or to jurisdictions outside of the US with less restrictive policies.

A fiscal failure of the US in 2044 will be necessarily accompanied by a reduction in US military power because such power is predicated on enormous levels of deficit-financed defense spending. Hence, the US government will not be as capable in 2044 as it is today of imposing its economic will on other countries. Smaller nations, such as Singapore and El Salvador, could choose to welcome the bitcoin-based capital that the US turns away.[38] The mass departure of bitcoin-based wealth from the US would, of course, make America poorer and further reduce the ability of the US government to fund its spending obligations.

Furthermore, US restriction of bitcoin’s utility will not be enough to convince foreign investors that US Treasuries are worth holding. The main way the US government could make investing in US bonds more attractive would be for the Federal Reserve to dramatically raise interest rates because higher interest rates equate to higher yields on Treasury securities. But this would in turn raise the cost of financing the federal debt, accelerating the US fiscal crisis.

Eventually, foreign investors may require the US to denominate its bonds in bitcoin, or in a foreign currency backed by bitcoin, as a precondition for further investment. This momentous change would end what former French Finance Minister and President Valéry Giscard d’Estaing famously called America’s privilège exorbitant: Its long-standing ability to borrow in its own currency, which has enabled the US to decrease the value of its debts by decreasing the value of the dollar.[39]

If and when US bonds are denominated in bitcoin, the United States will be forced to borrow money the way other countries do: In a currency not of its own making. Under a bitcoin standard, future devaluations of the US dollar would increase, rather than decrease, the value of America’s obligations to its creditors. America’s creditors—holders of US government bonds—would then be in a position to demand various austerity measures, such as requiring that the US close its budget deficits through a combination of large tax increases and spending cuts to Medicare, Social Security, national defense, and other federal programs.

A substantial decline in America’s ability to fund its military would have profound geopolitical implications. A century ago, when the United States eclipsed the United Kingdom as the world’s leading power, the transition was relatively benign. We have no assurances that a future transition will work the same way. Historically, multipolar environments with competing great powers are frequently recipes for world wars.[40]

2. The Palsied Scenario

In medicine, a palsy is a form of paralysis accompanied by involuntary tremors. This term accurately describes my second scenario, in which the macroeconomic tremors accompanying bitcoin’s rise are paired in the US with partisan polarization, bureaucratic conflict, and diminishing American power. In the palsied scenario, the US is unable to act aggressively against bitcoin, but neither is it able to get its fiscal house in order.

Today, partisan polarization in the US is at a modern high.[41] Republicans and Democrats are increasingly sorted by cultural factors: Republicans are disproportionately rural, high school–educated, and white; Democrats are more urban, college-educated, and nonwhite. Independents, who now make up a plurality of the electorate, are forced to choose among the candidates selected for general elections by Republican and Democratic base voters in partisan primaries.[42]

While we can hope that these trends reverse over time, there are reasons to believe they will not. Among other factors, the accelerating development of software capabilities that manipulate behavior at scale, including artificial intelligence—for all of their promise—brings substantial risks in the political sphere. The potential for deepfakes and other forms of mass deception could reduce trust in political parties, elections, and government institutions while further fragmenting the US political environment into smaller subcultural communities. The cumulative effect of this fragmentation may be the inability to achieve consensus on most issues, let alone controversial ones such as reducing federal entitlement spending.

In the palsied scenario, the US government is unable in 2044 to enact most of the restrictive measures described in the previous section. For example, paralysis could prevent Congress and the Federal Reserve from developing a central bank digital currency because of adamant opposition from activists but especially from depository banking institutions, who correctly view such a currency as a mortal threat to their business models. (A retail central bank digital currency obviates the need for individuals and businesses to deposit their money at banks because they could instead hold accounts directly at the Federal Reserve.)[43]

Similarly, in the palsied scenario, Congress would be unable in 2044 to enact confiscatory taxes against bitcoin holders and the wealthy more broadly. Congress would fail to enact these policies for the same reasons it has failed to date: Concerns about such taxes’ constitutionality; opposition from powerful economic interests; and recognition that direct attacks on bitcoin-based capital will drive that capital offshore to the detriment of the United States.

The palsied scenario is no libertarian utopia, however. In such a scenario, the federal government would retain the ability to regulate centralized exchanges, ETFs, and other financial services that facilitate the conversion of US dollars to bitcoin. If a majority of US-held bitcoin becomes owned through ETFs, the federal regulatory agencies would maintain the ability to limit the conversion of bitcoin ETF securities into actual bitcoin, heavily restricting the movement of capital out of US-controlled products.

Most importantly, however, partisan paralysis means that Congress will be unable to solve America’s fiscal crisis. Congress will lack the votes for entitlement reform or other spending cuts. And by 2044, federal spending will continue to increase at such a rapid clip that no amount of tax revenue will be able to keep pace.

Under the palsied scenario, Americans who hold bitcoin will be better able to protect their savings from government intrusion than under the restrictive scenario. They will not have to flee the country to own bitcoin, for example. This suggests that a significant proportion of the bitcoin community—both individuals and entrepreneurs—will remain in the United States and likely emerge as an economically powerful constituency. But the institutional environment in which they live and work will be frozen in dysfunction. Anti-bitcoin policy makers and pro-bitcoin political donors may end up in a stalemate.

As in the restrictive scenario, in the palsied scenario the failure of the dollar-denominated Treasury bond market could force the United States to eventually get its fiscal house in order. In both cases, creditors may very well demand that the Treasury Department issue debt securities that are collateralized by hard assets. By 2044, bitcoin will have over three decades of validation as a preeminent store of value, and the American bitcoin community will be well positioned to help the US adapt to its new circumstances.

3. The Munificent Scenario

The munificent scenario is both the least intuitive and the most optimistic scenario for America in 2044. In the munificent scenario, US policy makers respond to the fiscal and monetary crisis of 2044 by actively moving to remain ahead of events, instead of being compelled to react to forces ostensibly outside of their control.

The munificent scenario involves the US doing in 2044 something similar to what El Salvador did in 2019 or Argentina did in 2023 when those countries elected Nayib Bukele and Javier Milei to their presidencies, respectively. Though Bukele and Milei are different leaders with somewhat differing philosophies, they have both explicitly expressed support for bitcoin, with Bukele establishing bitcoin as legal tender in El Salvador[44] and Milei pledging to replace the Argentine peso with the dollar[45] while legalizing bitcoin.[46] Milei has also used his presidential authority to significantly reduce Argentine public expenditures in inflation-adjusted terms, thereby achieving a primary budget surplus.[47]

Imagine that in November 2044, the US elects a dynamic, pro-bitcoin president who pledges to adopt bitcoin as legal tender alongside the dollar (à la Bukele) and works with Treasury bondholders to reduce the US debt burden (à la Milei). One could imagine a grand fiscal bargain in which Treasury bondholders accept a one-time, partial default in exchange for Medicare and Social Security reform and an agreement to back the US dollar with bitcoin going forward, at a peg of sixty-seven satoshis to the dollar (that is, $1.5 million per bitcoin). Bondholders will likely be glad to accept a partial default in exchange for significant reforms that put the US on a sustainable fiscal and monetary footing for the future.

Such reforms need not punish the elderly and other vulnerable populations. A growing body of research suggests that fiscal solvency need not be at odds with social welfare. For example, the Foundation for Research on Equal Opportunity published a health care reform plan that was introduced by Arkansas Rep. Bruce Westerman and Indiana Sen. Mike Braun in 2020 as the Fair Care Act. The plan would reduce the deficit by over $10 trillion in a thirty-year period and make the health care system fiscally solvent while achieving universal coverage.[48] The bill achieves this in two primary ways: First, it means-tests health care subsidies so that taxpayers are only funding the cost of care for the poor and the middle class, not the wealthy. Second, it reduces the cost of subsidizing health care by incentivizing competition and innovation. In these ways, the proposal increases the economic security of lower-income Americans while also increasing the fiscal sustainability of the federal government.

Similarly, the US could reform Social Security by transitioning the Social Security trust fund from Treasury bonds to bitcoin (or bitcoin-denominated Treasury bonds).[49] Such an idea is less practical in the era of high volatility that has characterized bitcoin’s early history, but by 2044 the bitcoin-dollar exchange rate is likely to be more stable. The post-ETF maturation of bitcoin trading, as large financial institutions introduce traditional hedging practices to the asset, has significantly reduced bitcoin’s dollar-denominated price volatility. Soon, bitcoin’s price volatility may resemble that of a stable asset such as gold. By collateralizing Social Security with bitcoin, the US could ensure that Social Security lives up to its name, providing actual economic security to American retirees in their golden years.

The munificent scenario has additional benefits. The US government, by directly aligning itself with bitcoin’s monetary principles, could help make the twenty-first century another American one. It is highly unlikely that America’s primary geopolitical rival, China, will legalize a currency such as bitcoin that it cannot control. America’s culture of entrepreneurship, married with sound money, could lead to an unprecedented era of economic growth and prosperity for the United States. But this would require US leaders to place the nation’s long-term interests ahead of short-term political temptations.

The Satoshi Papers is now available for pre-order in the Bitcoin Magazine Store.

[1] A widely held view among academic economists is that for something to be considered money, it must serve as a store of value, a medium of exchange, and a unit of account. These features of money are not binary, but rather reside on a continuum; some forms of money are better stores of value, and others might be more widely used in trade and commerce. Bitcoin’s emergence as the premier store of value is the most significant development because this is what fiat currencies do most poorly. See Friedrich Hayek, Denationalisation of Money, 2nd ed. (London: Profile Books, 1977), 56–57.

[2] Congressional Budget Office, “The Long-Term Budget Outlook: 2024 to 2054,” March 20, 2024, https://www.cbo.gov/publication/59711.

[3] Congressional Budget Office, “Long-Term Economic Projections,” March 2024, https://www.cbo.gov/system/files/2024-03/57054-2024-03-LTBO-econ.xlsx.

[4] Congressional Budget Office, “The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget,” May 21, 2024, https://www.cbo.gov/publication/60169.

[5] Credit Suisse AG, “Credit Suisse Global Wealth Report 2023,” accessed June 16, 2024, https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html.

[6] Avik Roy, “Bitcoin and the U.S. Fiscal Reckoning,” National Affairs, Fall 2021. https://nationalaffairs.com/publications/detail/bitcoin-and-the-us-fiscal-reckoning.

[7] Federal Reserve Bank of St. Louis, “Federal Debt Held by Federal Reserve Banks,” accessed June 16, 2024, https://fred.stlouisfed.org/graph/?g=jwFo.

[8] Lowell R. Ricketts, “Quantitative Easing Explained,” Federal Reserve Bank of St. Louis, accessed June 16, 2024, https://files.stlouisfed.org/files/htdocs/pageone-economics/uploads/newsletter/2011/201104.pdf.

[9] Atish R. Ghosh et al., “Fiscal Fatigue, Fiscal Space and Debt Sustainability in Advanced Economies,” Economic Journal 123, no. 566 (February 2013): F4–F30, https://onlinelibrary.wiley.com/doi/full/10.1111/ecoj.12010.

[10] Paul Winfree, “The Looming Debt Spiral: Analyzing the Erosion of U.S. Fiscal Space,” March 5, 2024, https://epicforamerica.org/wp-content/uploads/2024/03/Fiscal-Space-March-2024.pdf.

[11] Coinmarketcap.com, “Bitcoin Price Today,” accessed June 16, 2024, https://coinmarketcap.com/currencies/bitcoin/.

[12] Coinmarketcap.com, “Bitcoin Price Today.”

[13] Ray Dalio, Principles for Navigating Big Debt Crises (Westport, CT: Bridgewater, 2018).

[14] When the denarius was introduced circa 211 BC, it contained around 4.5 grams of silver. In AD 64, the Roman Emperor Nero reduced the amount of silver to 3.5 grams. By the time of Diocletian’s reign, there was almost no silver left in the denarius, and the currency was abolished. For further reading on hyperinflation in ancient Rome, see H. J. Haskell, The New Deal in Old Rome: How Government in the Ancient World Tried to Deal With Modern Problems (New York: Alfred A. Knopf, 1947).

[15] Antony Kropff, “An English Translation of the Edict on Maximum Prices, Also Known as the Price Edict of Diocletian,” April 27, 2016, https://kark.uib.no/antikk/dias/priceedict.pdf.

[16] Richard M. Nixon, “Address to the Nation Outlining a New Economic Policy,” August 15, 1971, https://www.presidency.ucsb.edu/documents/address-the-nation-outlining-new-economic-policy-the-challenge-peace.

[17] Richard M. Nixon, “Address to the Nation.”

[18] Vernon Smith and Arlington Williams, “On Nonbinding Price Controls in a Competitive Market,” American Economic Review 71: 467–74.

[19] Swen Lorenz, “3 Lessons I Learned From Jim Grant, the Wall Street Cult Hero,” accessed July 5, 2024, https://www.undervalued-shares.com/weekly-dispatches/3-lessons-i-learned-from-jim-grant-the-wall-street-cult-hero/.

[20] Avik Roy, “Bitcoin and the U.S. Fiscal Reckoning,” National Affairs, Fall 2021.

[21] US Congress, “The Gold Standard Act of 1900,” accessed June 16, 2024, https://www2.econ.iastate.edu/classes/econ355/choi/1900mar14.html.

[22] Gary Richardson, Alejandro Komai, and Michael Gou, “Gold Reserve Act of 1934,” accessed June 16, 2024, https://www.federalreservehistory.org/essays/gold-reserve-act.

[23] Fitch Ratings, “Overview of Argentine Capital Controls (History and Recent Impact on Corporates),” April 6, 2021, https://www.fitchratings.com/research/corporate-finance/overview-of-argentine-capital-controls-history-recent-impact-on-corporates-06-04-2021.

[24] Robert Kahn, “The Case for Chinese Capital Controls,” Council on Foreign Relations, February 2016, https://www.cfr.org/sites/default/files/pdf/2016/02/February%202016%20GEM.pdf.

[25] International Monetary Fund, “Executive Board Concludes the Review of the Institutional View on the Liberalization and Management of Capital Flows,” press release, March 30, 2022. https://www.imf.org/en/News/Articles/2022/03/30/pr2297-executive-board-concludes-the-review-of-the-institutional-view-on-capital-flows.

[26] Balaji Srinivasan, “The Billionaire Flippening,” February 5, 2021, https://balajis.com/p/the-billionaire-flippening.

[27] “Bitcoin Rich List,” accessed July 7, 2024, https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html.

[28] Congressional Budget Office, “Trends in the Distribution of Family Wealth, 1989 to 2019,” September 27, 2022, https://www.cbo.gov/publication/57598.

[29] William White, “80% Crypto Capital Gains Tax? 15 Things We Know About the Rumors,” Yahoo! Finance, April 23, 2021, https://finance.yahoo.com/news/80-crypto-capital-gains-tax-153027836.html#.

[30] Garrett Watson and Erica York, “Proposed Minimum Tax on Billionaire Capital Gains Takes Tax Code in Wrong Direction,” Tax Foundation, March 30, 2022, https://taxfoundation.org/blog/biden-billionaire-tax-unrealized-capital-gains/.

[31] Steven Calabresi, “Taxes on Wealth and on Unrealized Capital Gains Are Unconstitutional,” Reason, October 11, 2023, https://reason.com/volokh/2023/10/11/taxes-on-wealth-and-on-unrealized-capital-gains-are-unconstitutional/.

[32] Wall Street Journal Editorial Board, “A Supreme Court Mistake on Wealth Taxes,” The Wall Street Journal, June 20, 2024, https://www.wsj.com/articles/moore-v-u-s-supreme-court-mandatory-repatriation-tax-brett-kavanaugh-amy-coney-barrett-23d99510.

[33] Charles Lipson, “Packing the Court, Then and Now,” Discourse, April 21, 2021, https://www.discoursemagazine.com/p/packing-the-court-then-and-now.

[34] Avik Roy, “Freedom Conservatism Is Different, and That Matters,” National Review, July 18, 2023, https://www.nationalreview.com/2023/07/freedom-conservatism-is-different-and-that-matters/.

[35] Peter Ryan, “Is Bitcoin ‘America First’?” The American Conservative, February 13, 2024, https://www.theamericanconservative.com/is-bitcoin-america-first/.

[36] USA PATRIOT Act of 2001, Congress.gov, accessed June 16, 2024, https://www.congress.gov/107/plaws/publ56/PLAW-107publ56.htm.

[37] Ryan Browne, “Bitcoin Production Roars Back in China Despite Beijing’s Ban on Crypto Mining,” CNBC.com, May 18, 2022, https://www.cnbc.com/2022/05/18/china-is-second-biggest-bitcoin-mining-hub-as-miners-go-underground.html.

[38] Some bitcoin-based wealth may be denominated in fiat currencies, such as equity stakes in digital-asset exchanges such as Coinbase and bitcoin-mining companies such as Marathon Digital Holdings.

[39] Barry Eichengreen, Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System (Oxford: Oxford University Press, 2011).

[40] Donald Kagan, On the Origins of War: And the Preservation of Peace (New York: Anchor, 1996).

[41] Ezra Klein, Why We’re Polarized (New York: Simon & Schuster, 2020).

[42] Nick Troiano, The Primary Solution: Rescuing Our Democracy from the Fringes (New York: Simon & Schuster, 2024).

[43] Avik Roy, “There’s No Such Thing as an ‘American-Style’ Central Bank Digital Currency,” Forbes, April 12, 2023, https://www.forbes.com/sites/theapothecary/2023/04/12/theres-no-such-thing-as-an-american-style-central-bank-digital-currency/.

[44] Avik Roy, “El Salvador Enacts Bitcoin Law, Ushering In New Era Of Global Monetary Inclusion,” Forbes, June 9, 2021, https://www.forbes.com/sites/theapothecary/2021/06/09/el-salvador-enacts-bitcoin-law-ushering-in-new-era-of-global-monetary-inclusion/.

[45] Ryan Dubé and Santiago Pérez, “Argentina’s New President Wants to Adopt the U.S. Dollar as the National Currency,” The Wall Street Journal, November 20, 2023, https://www.wsj.com/world/americas/argentinas-new-president-wants-to-adopt-the-u-s-dollar-as-national-currency-86da3444.

[46] On Twitter/X, Milei’s foreign minister and economic adviser Diana Mondino (@DianaMondino, December 21, 2023) declared, “We ratify and confirm that in Argentina contracts can be agreed in Bitcoin.”

[47] “The spending cuts that allowed Milei to turn around Argentina’s economy,” Buenos Aires Times, April 23, 2024, https://www.batimes.com.ar/news/economy/the-expenses-cut-by-milei-to-achieve-a-fiscal-surplus.phtml.

[48] Avik Roy, “The Fair Care Act of 2020: Market-Based Universal Coverage,” Foundation for Research on Equal Opportunity, October 12, 2020, https://freopp.org/the-fair-care-act-of-2020-market-based-universal-coverage-cc4caa4125ae.

[49] Under 2024 forecasts, the Social Security Trust Fund will be fully depleted by 2033. I assume, for the purposes of my scenario analysis, that Congress finds a short-term solution before then that postpones Social Security’s reckoning past 2044.

CryptoCurrency

CoinShares Seeks Approval For Spot Litecoin And XRP ETF In Latest Market Move

Ronaldo is an experienced crypto enthusiast dedicated to the nascent and ever-evolving industry. With over five years of extensive research and unwavering dedication, he has cultivated a profound interest in the world of cryptocurrencies.

Ronaldo’s journey began with a spark of curiosity, which soon transformed into a deep passion for understanding the intricacies of this groundbreaking technology.

Driven by an insatiable thirst for knowledge, Ronaldo has delved into the depths of the crypto space, exploring its various facets, from blockchain fundamentals to market trends and investment strategies. His tireless exploration and commitment to staying up-to-date with the latest developments have granted him a unique perspective on the industry.

One of Ronaldo’s defining areas of expertise lies in technical analysis. He firmly believes that studying charts and deciphering price movements provides valuable insights into the market. Ronaldo recognizes that patterns exist within the chaos of crypto charts, and by utilizing technical analysis tools and indicators, he can unlock hidden opportunities and make informed investment decisions. His dedication to mastering this analytical approach has allowed him to navigate the volatile crypto market with confidence and precision.

Ronaldo’s commitment to his craft goes beyond personal gain. He is passionate about sharing his knowledge and insights with others, empowering them to make well-informed decisions in the crypto space. Ronaldo’s writing is a testament to his dedication, providing readers with meaningful analysis and up-to-date news. He strives to offer a comprehensive understanding of the crypto industry, helping readers navigate its complexities and seize opportunities.

Outside of the crypto realm, Ronaldo enjoys indulging in other passions. As an avid sports fan, he finds joy in watching exhilarating sporting events, witnessing the triumphs and challenges of athletes pushing their limits. Furthermore, His passion for languages extends beyond mere communication; he aspires to master German, French, Italian, and Portuguese, in addition to his native Spanish. Recognizing the value of linguistic proficiency, Ronaldo aims to enhance his work prospects, personal relationships, and overall growth.

However, Ronaldo’s aspirations extend far beyond language acquisition. He believes that the future of the crypto industry holds immense potential as a groundbreaking force in history. With unwavering conviction, he envisions a world where cryptocurrencies unlock financial freedom for all and become catalysts for societal development and growth. Ronaldo is determined to prepare himself for this transformative era, ensuring he is well-equipped to navigate the crypto landscape.

Ronaldo also recognizes the importance of maintaining a healthy body and mind, regularly hitting the gym to stay physically fit. He immerses himself in books and podcasts that inspire him to become the best version of himself, constantly seeking new ways to expand his horizons and knowledge.

With a genuine desire to become the best version of himself, Ronaldo is committed to continuous improvement. He sets personal goals, embraces challenges, and seeks opportunities for growth and self-reflection. Ultimately, combining his passion for cryptocurrencies, dedication to learning, and commitment to personal development, Ronaldo aims to go hand-in-hand with the exciting new era that the emerging crypto technology is bringing to the world and societies.

CryptoCurrency

Next Stop for DePIN: Taco Bell

The DePIN revolution is coming to a fast food franchise near you. The movement that started with Helium and has spread to numerous categories, including mapping and car data, this year is now spreading to hospitality. The initiative shows how quickly DePINs — or decentralized networks of physical infrastructure — are becoming mainstream.

The fast food and hospitality industry, often associated with consistency and efficiency, is quietly upgrading as decentralized technologies make their way into the mainstream. The adoption of DePIN by major franchises like Taco Bell and KFC signals a shift in how these businesses operate and engage with technology.

At the core of this transformation is the integration of DePIN devices — sensors, routers, and other physical infrastructure — powered by blockchain and token-based incentives. These networks enable businesses to contribute to shared ecosystems while gaining real-time operational insights and being rewarded for their participation. It’s a forward-thinking approach that combines cutting-edge technology with the practical needs of fast-food and hospitality businesses, paving the way for greater efficiency, sustainability and customer satisfaction.

With DePIN, the industry is embracing a strategic evolution — one that reflects the growing potential of decentralized technologies to enhance traditional models while creating new opportunities for growth.

For franchisees, the potential benefits of DePIN are significant. By integrating DePIN devices into their operations, they can unlock a wealth of opportunities:

- Enhanced operational efficiency: DePIN devices, such as air quality sensors from Ambient Network, can provide real-time data on environmental conditions. This information can be used to optimize HVAC systems, improve indoor air quality, and reduce energy consumption.

- Increased customer satisfaction: By leveraging DePIN-powered solutions, franchises can offer a more personalized and convenient customer experience. For instance, indoor cell site deployments from Helium Mobile or XNET can provide reliable connectivity, while blockchain-based supply chain management can ensure product quality and freshness.

A case study: the power of collaboration

A prime example of DePIN’s impact on the franchise industry is the partnership between major fast-food chains and Ambient Network, the largest decentralized air quality network on Solana. By deploying air quality sensors across hundreds of stores, from coast to coast, these franchises are not only improving air quality for their customers but also contributing to a cleaner environment. Moreover, they are generating valuable data insights that can be used to optimize operations and reduce costs.

“With the growing maturity of tokens and decentralized technologies, we’re seeing a shift in how we can use these assets within our stores and properties,” explains Pushpak Patel, Founding Principal at CMG Companies, one of the largest operators of KFC, Taco Bell, Sonic, Little Caesars, Rent-A-Center, and Ace Hardware franchises in the US.

“By installing 1,000 DePIN devices from Ambient Network, we’re enhancing our ability to gather operational insights across our locations. Having air quality sensors installed doesn’t just provide real-time conditions, both outdoor and indoor — it also enables us to participate in demand-response programs. And with the strategic density of our locations, we can help unlock greater coverage for the network, which in turn generates additional data insights. This is a game-changer.”

Franchisees may partner with third parties to deploy and manage the infrastructure, or they can manage the devices in-house to improve operational efficiency with the devices and potentially generate an excellent return on investment. With Helium, these deployer participants are seeing ROI from a few dollars to tens of dollars per day based on factors like location, miner density and network demand.

Parami Investors, one of the largest deployers of Helium and Ambient devices in North America, has also been bullish on DePIN opportunities for franchise locations. We are clearly seeing greater adoption by retailers and hospitality providers to adopt and deploy decentralized solutions such as Helium and Ambient. Ambient is now deployed across highly dense commercial shopping and dining centers like the Japanese Village Plaza in Los Angeles’ Little Tokyo district, hotels like the Best Western in Las Vegas and fast food chains like Taco Bell, KFC and Five Guys. Revolutions start on the street with franchisees pushing the envelope for wider corporate adoption.

The road ahead

As DePIN technology continues to mature, we can expect to see even more innovative applications in the franchise industry. From decentralized energy grids like Powerledger and community-powered solar from Glow, to blockchain-based loyalty programs from Hang, the possibilities are endless.

For fast food retailers and franchisees, deploying DePIN devices is not just a technological trend — it’s an investment in a more efficient, profitable, and sustainable future. From generating passive income to collecting valuable data and optimizing operations, the benefits are clear. As the technology continues to evolve, franchisees and other small businesses will find even more ways to leverage DePIN devices to improve both the customer experience and their bottom line.

Decentralized solutions are building an ecosystem that benefits everyone, driving participation through incentives. And DePIN devices are a key part of that vision. By embracing these new technologies, franchisees are setting themselves up for long-term success, ensuring that they remain competitive in an ever-changing market.

CryptoCurrency

Can Trump Meme Coin Beat Solana in 2025? Experts Back DTX Exchange as Next 10,000% Listing

Trump’s meme coin (TRUMP) has been making waves, with some wondering if it could outperform established giants like Solana (SOL) in 2025. While this SOL-based asset surges in popularity, DTX Exchange (DTX) is stealing the spotlight as the true underdog with massive potential.

Experts are already backing DTX Exchange as the next big listing, with predictions of an incredible 10,000% rally very soon. With its innovative hybrid trading model, DTX offers something truly unique, drawing attention from savvy investors looking for the next game-changing platform. Keep reading to learn more!

Solana (SOL) Soars as Trump Meme Coin (TRUMP) Takes Center Stage

Solana’s native token, SOL, skyrocketed over the last weekend, breaching the $290 price level following the launch of a meme coin tied to President Donald Trump. Dubbed the Official Trump coin (TRUMP) and launched on the Solana blockchain, this meme coin now has a $7 billion market cap, making it one of the largest on the network.

Notably, Solana shines as a cheaper and faster alternative to Ethereum. It hosts popular meme coins, DeFi platforms, and gaming projects. With ETF proposals for SOL piling up, the Solana price trajectory looks promising.

Trump’s Latest Meme Coin Delivered a 1,000% Surge

The Official Trump coin burst onto the scene late Friday. The launch was announced on President Trump’s X and Truth Social accounts during the Crypto Ball, a celebration of his White House return hosted by crypto leaders in Washington, D.C.

Launching at $6.24, the coin skyrocketed 1,000+% to $75.35 within 24 hours, according to CoinMarketCap. Designed as a symbol of support for Trump’s ideals, it comes with a disclaimer that it’s not intended as an investment or security.

With 200 million coins initially available — set to grow to 1 billion over three years — just 10% is public, while 80% is reserved for creators and Trump’s CIC Digital affiliate.

DTX Exchange (DTX): A New Innovative Project Set To Revolutionize The Way You Trade

DTX Exchange enters the crypto scene as a game-changing trading platform. Designed to redefine the DeFi landscape, DTX lets you trade a wide array of assets, including cryptocurrencies, stocks, bonds, ETFs, and forex pairs.

It’s no wonder experts believe this viral altcoin has what it takes to dominate the 2025 bull cycle. Let’s dive into other features that make DTX Exchange a standout:

-

Diverse Asset Range: Unlike platforms focused solely on crypto, DTX Exchange opens the door to multiple investment opportunities, giving traders unmatched flexibility.

-

Unbeatable Speed: Powered by the VulcanX blockchain, DTX Exchange delivers jaw-dropping speeds of 200,000 transactions per second (TPS), outpacing Solana’s 600 TPS. Faster trades mean better entries, exits, and higher profit potential.

-

Passive Income Opportunities: The platform unlocks passive income streams that allow users to grow wealth effortlessly through its exclusive DTX RWA (Real World Assets) segment.

-

Phoenix Wallet: Managing your assets has never been easier. The Phoenix Wallet supports over 120,000 assets and provides a secure, all-in-one solution for tracking and storing investments.

Why DTX Exchange (DTX) Is The Perfect Altcoin for 2025

DTX Exchange has already captured investors’ interests thanks to its fair launch system. Unlike other projects dominated by whales and VCs who manipulate prices, DTX is backed by a growing and enthusiastic community of investors. This ensures transparency, equality, and price stability.

Adding to this fairness, DTX’s incremental cliff pricing model steadily increases token value over time, making it one of the most reliable investments in DeFi today. Right now, DTX Exchange is in its eighth presale stage and has raised over $12.5M so far.

Its tokens are priced at $0.16 each with a potential listing price of $0.20. Early adopters have enjoyed over 700% gains and are looking forward to the 10,000% projected by experts when it lists on top-tier exchanges.

Final Verdict

While TRUMP and Solana made a recent splash in the crypto market, it’s clear that DTX Exchange is a must-have altcoin in 2025. With its innovative hybrid trading model and massive growth potential, experts are backing DTX Exchange as the next 10,000% listing, ready to take the crypto world by storm.

If you’re looking for the next big thing in crypto, all eyes should be on DTX Exchange — it’s setting the stage for a future that’s nothing short of explosive.

Learn more about DTX Exchange here:

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Oversight committee Republicans launch debanking investigation

While Democrats are calling for an investigation into Donald Trump’s potential conflicts of interest on crypto, House Republicans said they would explore debanking claims.

CryptoCurrency

Raydium targets $10, CATZILLA steals spotlight with high growth potential

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CATZILLA is stealing the spotlight from Raydium’s $10 target with its high growth potential.

While Raydium sets its sights on a notable target, the real buzz centers around CATZILLA. This emerging contender has investors talking about its potential to surge by high values.

CATZILLA: The meme coin redefining success

CATZILLA is generating a seismic buzz in the crypto world with its growth potential. This emerging meme coin is more than just a flashy newcomer — it’s a bold, community-driven project poised to challenge crypto norms and deliver massive returns.

CATZILLA’s mission is to confront greed, expose scammers, and create a fairer crypto ecosystem. With a rebellious spirit and a fierce drive for innovation, its rallying investors, meme enthusiasts, and DeFi advocates to join its mission of decentralized financial empowerment.

CATZILLA isn’t just another fleeting meme coin. It’s designed with longevity and value at its core, offering early investors an incredible 88% presale discount. Starting at $0.0002, its 14-stage presale gradually increases prices, ensuring those who act early benefit the most.

Triple utility power:

- Governance – Empowering the community to shape CATZILLA’s future.

- Incentives – Rewarding active engagement and contributions.

- Staking – Offering opportunities for passive income by holding and staking CATZILLA tokens.

By blending humor, financial opportunity, and a transparent roadmap, CATZILLA is turning heads as a serious contender in the meme coin arena.

CATZILLA’s strength lies in its passionate community and commitment to inclusivity. It’s a platform where creativity meets innovation, uniting seasoned investors and meme fans in a collective pursuit of financial freedom.

Whether for the laughs, the gains, or the mission, CATZILLA promises a fresh approach to crypto — a space where collaboration thrives and possibilities are endless.

Interested investors can join the CATZILLA movement via presale.

Raydium eyes further growth

Raydium’s recent surge is catching eyes as its price maintains between $5.79 and $8.67. With a 6-month climb of over 227%, the potential for more growth is compelling. The nearest resistance sits at $9.57, signaling a pivotal point. If broken, the path to the second resistance at $13.07 opens, hinting at more than a 50% gain from current levels.

The RSI at 43.34 suggests room to run before overbought levels. The MACD’s positive nature bolsters this bullish sentiment. Recent 1-week and 1-month gains of over 39% and 54% respectively reflect growing momentum. As traders eye these levels, Raydium’s future looks promising in what could be shaping up to be an altcoin season.

Conclusion

While coins like RAY show limited short-term potential, Catzilla stands out as a meme coin aiming to bring financial freedom. With a 700% ROI potential during its presale — starting at $0.0002 and rising to $0.0016 over 14 stages — it offers governance features, rewards for loyalty, and staking options. Catzilla looks to unite enthusiasts to challenge toxic systems and reach new heights.

For more information on Catzilla, visit their website, X, or Telegram News.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Ethereum Achieves 17x Scaling with Layer 2, but Challenges Persist, Says Buterin

Layer 2 protocols have played a critical role in scaling the Ethereum network. The blockchain’s co-founder Vitalik Buterin noted that Layer 2s in 2025 represents a significant evolution from their experimental beginnings in 2019, having achieved certain decentralization milestones, secured billions of dollars in value, and scaled Ethereum’s transaction capacity by 17-fold, all while simultaneously lowering fees.

However, Buterin stated that challenges remain, particularly around scaling and heterogeneity.

Blob Space and Interoperability Challenges

In his latest blog post, Buterin pointed out that Ethereum’s current blob space – a resource for storing and processing data on the blockchain – barely meets the demands of today’s Layer 2s and their use cases. As such, this limitation could hinder the platform’s ability to accommodate future growth.

Additionally, the heterogeneity of Layer 2s creates challenges when it comes to interoperability, composability, and user experience.

While Ethereum’s initial vision for scaling involved a shard-based system of homogenous blockchains, Buterin noted that Layer 2s have instead evolved into a fragmented ecosystem of chains created by different actors, each with different standards and infrastructure requirements.

To address these challenges, the Ethereum co-founder outlined several key steps. On the Layer 1 side, Ethereum must accelerate scaling blobs and expand the Ethereum Virtual Machine (EVM) and gas limits to handle activities such as proofs, large-scale DeFi, deposits, withdrawals, and mass exit scenarios.

On the Layer 2 front, he stressed the need for improved security, ensuring guarantees such as censorship resistance, light client verifiability, and the absence of trusted parties. Interoperability across Layer 2s and wallets must also be prioritized to enable easy interactions across chains through standardized addresses, message-passing protocols, bridges, and efficient cross-chain payments.

For users, Ethereum should feel like a unified ecosystem rather than a collection of disparate chains, Buterin added.

Strengthening ETH as a Triple-Point Asset

Buterin also stated that Ethereum’s future as a strong triple-point asset – functioning as a store of value, medium of exchange, and unit of account – requires a “multi-pronged” strategy to maximize the value of ETH.

The first step is to cement ETH as the primary asset across the combined Layer 1 and Layer 2 Ethereum economy. This includes prioritizing ETH, the main collateral for decentralized applications and financial ecosystems.

Next comes incentivizing Layer 2s to allocate a portion of their fees toward the broader Ethereum ecosystem, which could generate sustainable funding. This may involve burning part of the fees, staking them, or channeling proceeds into public goods for the Ethereum network.

Third, while rollups offer opportunities for Layer 1 to capture value through MEV, it’s important to maintain flexibility, recognizing that not all rollups can adopt this model due to different application requirements. Finally, Ethereum could explore raising the blob count as a potential revenue stream.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

XRP Forms A Bullish Pattern In 4-Hour Chart – Analyst Expects $4.20 After Breakout

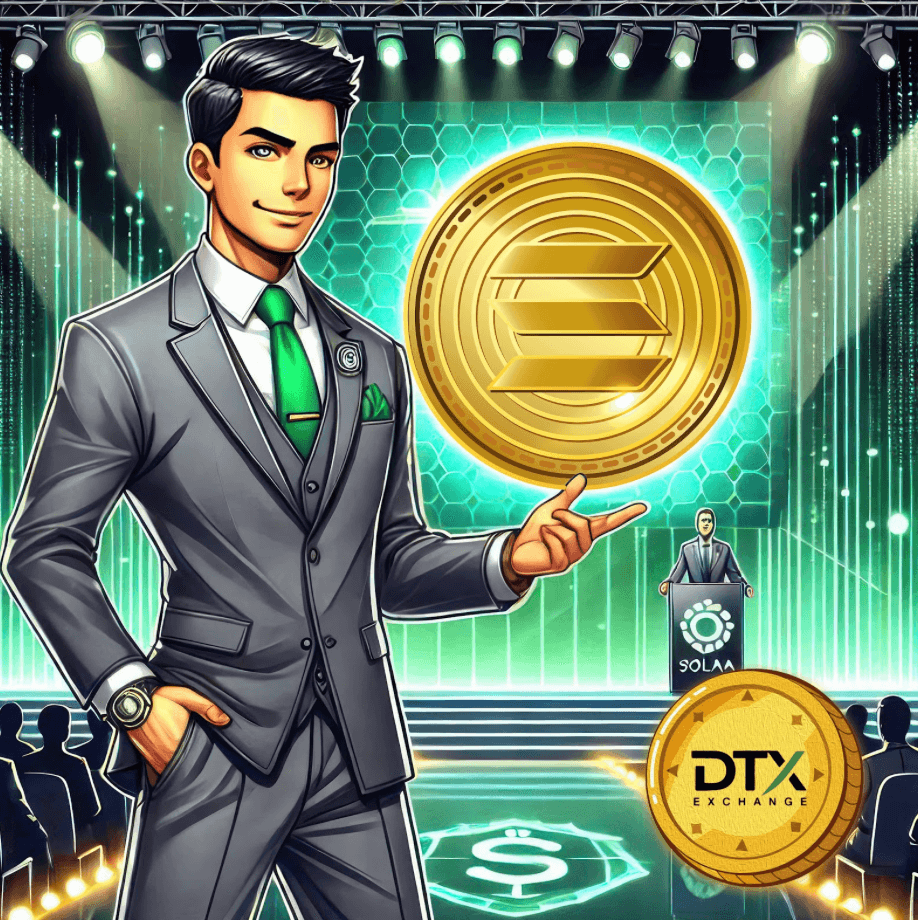

XRP is currently at a critical juncture, trading at a key level after breaking its all-time high just eight days ago. Despite the market’s inherent volatility, price action remains robust, fueling optimism among investors and analysts. As the broader crypto market enters a bullish phase, XRP is gaining attention as a potential leader in the next major rally.

Related Reading

Market sentiment is growing increasingly positive, with analysts predicting a massive move into price discovery. Among them, crypto expert Carl Runefelt has shared an intriguing technical analysis on X, highlighting a bullish setup for XRP. According to Runefelt, the price is forming a bullish pennant pattern on the 4-hour timeframe, a classic indicator of potential upward continuation. This pattern suggests that XRP is consolidating before a significant breakout, which could propel the price into uncharted territory.

As excitement builds, investors are watching closely to see whether XRP can sustain its momentum and capitalize on the bullish market environment. A breakout from the bullish pennant could confirm XRP’s trajectory toward new milestones, reinforcing its position as one of the market’s most dynamic assets.

XRP About To Enter Price Discovery

XRP is on the verge of entering price discovery as the broader crypto market signals a bullish rally. Following a strong pump in early November, XRP’s price action has remained resilient, fueling optimism for substantial gains in the months ahead. As the market flirts with a decisive phase, XRP continues to stand out as a top contender for life-changing returns for investors and traders.

Renowned crypto analyst Carl Runefelt has shared an insightful technical analysis on X, highlighting a bullish setup for XRP. According to Runefelt, the price is forming a bullish pennant pattern on the 4-hour timeframe, a classic indicator of potential upward continuation. Based on this setup, Runefelt has set a price target of $4.20 in the coming weeks, aligning with broader expectations of a market-wide rally.

The bullish pennant suggests that XRP is consolidating before its next major move. If the pattern holds, the breakout could propel XRP into uncharted territory, confirming its position as a leading asset in this market cycle.

Related Reading

As the market gears up for a potentially explosive phase, XRP is well-positioned to capitalize on the momentum. With its strong price action and favorable technical setup, XRP has the potential to deliver significant returns. Investors and traders are closely watching as XRP prepares for its next move, with anticipation building for what could be a pivotal rally.

Price Testing Critical Levels

XRP is currently trading at $3.19, following a massive surge above its previous all-time high last week. The recent price action highlights XRP’s strength as it continues to attract investor interest during this bullish phase. However, the asset has entered a brief consolidation phase, which could signal preparation for its next move.

For bulls to maintain momentum and sustain the uptrend, reclaiming the $3.25 resistance level is critical. Breaking above this mark would likely reignite buying pressure and pave the way for another push toward new all-time highs. Achieving this would reinforce the bullish structure and solidify XRP’s position as one of the market’s top-performing assets.

Conversely, holding above the $3.05 support level is equally important to confirm the ongoing trend. This level has become a key line of defense, and a breakdown below it could signal weakness, potentially leading to a deeper correction and testing lower demand zones.

Related Reading

As XRP consolidates, investors are closely monitoring these crucial levels. A breakout above $3.25 or a strong defense of $3.05 will provide clearer direction for XRP’s next move. The coming days will be pivotal in determining whether XRP can sustain its bullish momentum or face temporary headwinds.

Featured image from Dall-E, chart from TradingView

CryptoCurrency

It’s Easier Than You Think to Build With AI and Web3

Remember those middle-school writing prompts: Describe your favorite cookie.

Your teacher told you to write it as if to an alien, a being who had never encountered a cookie before, which meant touching on each sense – sight, sound, smell, touch, taste. You might not have realized it then, but describing something in a way that allows people to get a clear picture is actually quite hard.

Let me try to describe Matheus Pagani, founder and CEO of Venture Miner. Matheus is a male with light caramel skin and dark brown hair. Even though his hair is cut close, you can tell it’s curly. He’s got a thick dark brown, almost black beard, which connects to a mustache. His eyes are dark brown behind thin wire glasses. His bottom lip sticks out a little further from his top lip, giving him a look of assurance, but not arrogance.

Picturing him yet? How confident are you?

Oh yeah, and he’s Brazilian.

Got it?

Let’s see what Matheus Pagani actually looks like.

Is this what you had come up with in your head from my description? Doubt it. Whenever I told you he was Brazilian, did you accessorize him in bright colors and a feathered headdress? Something like this?

If so, check your bias, but also you’re thinking like an AI. That was what ChatGPT came up with from the prompt “some Brazilians having fun.” Pagani showed this and other examples spit out by our generative AI (Italians have fun by sitting around long tables with multiple generations eating pizza) during the AI2Web3 Bootcamp in NYC in early December.

The bootcamp, run by Pagani and Build City, brought together 59 participants across all skill levels to learn how the two buzziest (and often misunderstood) technologies can be brought together to create useful products and services. Pagani used a version of the middle-school assignment to explain how and why AI made the significant leaps that have kept us all excited and on edge over the past few years. Before there was largely only text data being used to train AIs, and as the exercise highlights, that only goes so far. But mix text information with visual data, and you get a fuller picture.

And understanding this, getting hands on with both AI and blockchain technology to understand its core components is what the bootcamp was all about. For Pagani, these skills are going to be relevant for nearly all people – engineers, tech users, journalists, artists, doctors – real soon.

“We want to join brilliant minds from all backgrounds to come and work with AI and Web3, since the junction of their multiple perspectives can uncover new use cases that we would never envision just with a specialized Web3 or AI mindset alone,” Pagani said. “Nowadays we have tools to easily enable any non-technical enthusiasts to build practically functional applications and systems just with “plain English,” so what matters is bringing passionate people interested in solving problems together with the proper education. When you have this combination, you just need to light the match and watch it burn.”

Mind-Boggling Building

What makes the intersection of these two technologies so exciting is just how much you can build in such a short amount of time without really any prior technical experience.

Not only will AI source whole codebases with the right prompt, but the crypto industry is also building tools to help make developing at the intersection of both more intuitive and accessible.

For instance, Coinbase, who sponsored the bootcamp, launched AgentKit in November. The framework allows developers to build AI agents with their own crypto wallets, enabling the agents to interact autonomously with blockchain networks. This could be used to build a squad of agents that can monitor the markets and execute trades automatically based on predefined rules and guardrails.

“One day, we’ll have AI agents own their own cars and operate their own taxi service that gets paid by customers in crypto and then uses that crypto to purchase repairs,” Lincoln Murr, associate product manager at Coinbase, told the attendees.

Coinbase currently has a grants program ongoing for building with AgentKit. “What you build doesn’t have to be useful; we have a bias towards cool stuff,” Murr told the bootcamp, hoping to inspire projects and applications that no one has yet thought of.

Ora Network also has an interesting model for developers looking to build AI-enabled Web3 applications or vice versa. The network allows developers to utilize current large language models, including Meta’s Llama3 and Stable Diffusion, but it also enables developers to build their own models and offer a so-called initial model offering (IMO) to crowdfund its continued development.

“It’s kind of winner-takes-all right now in AI, but with this model, we’re allowing the crowdfunding of AI building and training, so people can have a share of the models, which is empowering if we think these models will run society in a decade,” Alec James, partnerships and growth lead at Ora, said during the bootcamp. “If that’s the case, we’ll want that development distributed.”