Hundreds of thousands of pensioners on a low income are missing out on vital support which can be worth over £3,900 each year, plus the top six benefits it comes with.

As well as extra cash each month, they could also get multiple other forms of support including help with council tax and up to £300 in Winter Fuel Payments this winter.

Pension Credit is intended to help people who have reached state pension age and are on a low income with their daily living costs.

It’s estimated up to 880,000 eligible households are not claiming Pension Credit, with over £1.7billion going unclaimed.

The benefit tops up the person’s income to a minimum of £201.05 per week for single pensioners and £306.85 for couples. A person who has a disability or caring responsibilities may get more.

Research from Royal London shows that 79 per cent of pensioners surveyed believe they are good with money.

Although the belief, over 40 per cent haven’t yet checked if they qualify for Pension Credit this year, despite it acting as a gateway to additional benefits, including reduced council tax and help with NHS costs.

Research reveals six additional benefits that many pensioners don’t realise they could access through Pension Credit

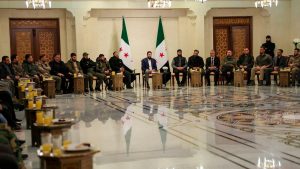

GETTY

As part of its Take The Credit campaign, Royal London is partnering with Pocket Power to offer pensioners a free phone call, offering a bill-switching service, helping them save on their household bills and wider costs and support with PensionCredit applications.

On average, a Pocket Power call saves each person £250, which could provide critical support this winter.

The easiest way to check if one can qualify for Pension Credit is to use one of the free online calculators. Once this has been confirmed Britons can apply via the website, post or phone.

Research reveals six additional benefits that many pensioners don’t realise they could access through Pension Credit.

- The least known benefit is a discount on Royal Mail redirection services when moving house, with 93 per cent unaware of this perk.

- Help with rent costs through Housing Benefit is unknown to 57 per cent of pensioners.

- Nearly half are unaware of additional help with NHS dental treatment, glasses and transport costs.

- Around 43 per cent don’t know about potential Council Tax Discount assistance.

- A free TV licence for those aged 75 or older is unknown to 41 per cent of eligible pensioners.

- Finally, 32 per cent are unaware they could get help with energy bills through the Winter Fuel Payment.

The top six schemes, offers or discounts pensioners use to support their finances:

- Bus passes are the most widely claimed benefit, used by 76 per cent of pensioners

- Free eye tests, prescriptions and dental care follow closely behind, with 66 per cent of pensioners accessing these healthcare benefits

- Shop discounts, such as those offered by Iceland for over 60s, are used by 22 per cent of pensioners

- National Rail senior railcards are claimed by 21 per cent of retirees

- Senior membership rates at attractions like the National Trust are utilised by 16 per cent

- The Warm Home Discount, offering £150 off electricity bills, is accessed by 15 per cent of pensioners.

Sarah Pennells, consumer finance specialist at Royal London, said: “It’s great to see pensioners are savvy on so many levels, with many taking steps such as changing energy providers to limit their outgoings.

“However, there is still a significant gap in awareness around Pension Credit and the other benefits that claiming it entitles people to.”

She emphasised that approximately three-quarters of a million pensioners are missing vital financial support.

She added: “Our research shows there is still a sense of embarrassment associated with applying for benefits when there should be absolutely no shame in accepting help.”

She encouraged pensioners to use free online calculators to check their eligibility.

Verity Kick at Oak Tree Mobility warns: “Winter can be tough, especially for our elderly loved ones. Cold days mean higher heating bills and the health issues that are linked to cold weather can make winter particularly difficult and expensive for the elderly.”

Eligible pensioners must have qualified for pension credit for at least one day between 16-22 September 2024 to receive the Winter Fuel Payment.

![90 Day Fiance: Before The 90 Days – Tigerlily and Adnan Make a Baby – Recap [S07E17]](https://wordupnews.com/wp-content/uploads/2024/12/90-day-fiance-tigerlily-taylor-6524-300x169.jpg)

![90 Day Fiance: Before The 90 Days – Tigerlily and Adnan Make a Baby – Recap [S07E17]](https://wordupnews.com/wp-content/uploads/2024/12/90-day-fiance-tigerlily-taylor-6524-768x432.jpg)

+ There are no comments

Add yours