CryptoCurrency

Trump’s ‘golden age’ begins without Bitcoin, but experts say big moves are coming

Despite not mentioning Bitcoin in Trump’s first speech, experts believe his administration will soon make crypto a priority.

A “golden age” without crypto

On Jan. 20, Donald Trump returned to the White House as the 47th President of the United States, delivering an inaugural address that promised a “golden age” for America.

His speech covered themes like unity, economic strength, and border control while addressing hot-button issues such as inflation, immigration, and energy production.

Yet, the crypto community noticed a glaring omission — there wasn’t a single mention of crypto or Bitcoin (BTC), despite the Trump family’s recent involvement in the crypto space.

On Jan. 17, Donald Trump announced his own meme coin, “Official Trump” (TRUMP), a bold, unexpected move. Not to be outdone, Melania Trump followed suit two days later with her own “Official Melania Meme” (MELANIA).

Both tokens caused an explosion of hype, with millions of traders diving headfirst into the frenzy. Despite early success, their value quickly plummeted, though they still retain hefty market caps in the billions.

Meanwhile, Bitcoin reached a euphoric milestone, climbing to a record high of $109,020 just hours before Trump’s swearing-in. However, the celebration was short-lived. As of Jan. 21, BTC’s price had pulled back to $103,000 levels, a nearly 5% drop.

Analysts attribute this slide to a combination of profit-taking by traders and market uncertainty sparked by Trump’s silence on crypto.

So, what has happened since Trump’s inauguration, and what can we expect in the days to come? Let’s find out.

A day of action, but not for crypto

When Trump returned to the White House, the crypto world held its breath. Whispers of executive orders that could alter the fate of the crypto industry had dominated pre-inauguration chatter.

Rumors swirled about initiatives to create a strategic Bitcoin reserve, establish a crypto advisory council, and even ban the creation of a central bank digital currency. Expectations soared. Day one felt like it could be a defining moment for the industry.

Instead, reality arrived with a dose of disappointment. Trump’s first day in office was packed with action—80 executive orders signed in rapid succession, overturning policies from the previous administration.

Federal workers were ordered back to the office, the U.S. pulled out of the Paris Agreement and the World Health Organization, and new federal regulations were put on hold. Even on Jan. 6, rioters saw federal charges against them dropped.

But for all the sweeping changes, crypto didn’t make the cut. Hopes of day-one clarity dissolved as the priorities lay elsewhere.

Yet, not all hope is lost. Eleanor Terrett, a journalist for Fox Business, recently hinted at big moves potentially still on the horizon.

In a tweet that sparked conversations across the digital finance world, she suggested that Trump might yet sign executive orders banning CBDCs and establishing a formal crypto council.

Her words align with those of Jeremy Allaire, CEO of Circle, the parent company behind USDC (USDC), who has also expressed optimism.

Allaire believes that Trump’s administration could soon ease restrictions on banks holding digital assets, including the repeal of the SEC’s Staff Accounting Bulletin 121 — a long-standing barrier for financial institutions interested in crypto.

While the crypto industry is eager for rapid progress, industry pioneers have urged patience. Binance founder CZ recently addressed this sentiment, tweeting, “Everyone expects everything to happen in one day. Good things take time.”

Glimmers of optimism amid the silence

As the crypto industry grapples with uncertainty, a notable announcement from Donald Trump Jr. on Jan. 20 caught attention.

Just hours after his father’s inauguration, Trump Jr. unveiled a series of strategic investments made by World Liberty Financial (WLFI), a DeFi project launched by the Trump family in 2024.

The allocations included $47 million each in Ethereum (ETH) and wrapped Bitcoin (wBTC), alongside $4.7 million each in Aave (AAVE), Chainlink (LINK), TRON (TRX), and Ethena (ENA), totaling over $120 million.

While policy clarity may lag, the Trump family is placing its bets on crypto’s future. Meanwhile, behind the scenes, Trump’s administration is also amending the regulatory era.

As former Securities and Exchange Commission Chief Gary Gensler officially resigned from his position on Jan. 20, Mark Uyeda, a well-known crypto advocate, stepped in as acting chair of the SEC.

Paul Atkins, a former SEC official and crypto supporter, has been nominated by Trump to permanently take over the role of SEC chair.

Over at the Commodity Futures Trading Commission, Caroline Pham has assumed the role of acting chair, bringing with her a reputation for thoughtful consideration of blockchain technologies.

The CFTC could become a leading federal watchdog for crypto, with early legislative efforts positioning the agency to oversee crypto spot markets for widely traded tokens.

While it’s unclear whether Pham will be Trump’s top pick for the full-time role, her name is consistently mentioned on shortlists for the position.

Notably, in 2023, Pham pitched a pilot program for crypto oversight, citing her proactive stance toward digital asset regulation.

Even the FDIC, a key player in past controversies like “Operation Choke Point 2.0,” is undergoing change, with Chair Marty Gruenberg stepping down just before Trump’s inauguration.

The coming days for crypto under Trump’s second term remain uncertain but intriguing. While his administration’s silence on day one left many feeling deflated, the signs of movement are there.

Good days ahead?

The Trump administration’s second term has begun with more questions than answers for the crypto industry. While there has been no immediate executive order addressing digital assets, experts urge patience.

Richard Galvin, co-founder of hedge fund DACM, noted that “it’s premature to draw strong conclusions from the absence of an immediate executive order,” reflecting the administration’s wide range of competing priorities.

Hints of progress behind the scenes have also added to the optimism. David Bailey of Bitcoin Magazine suggested that “our EOs are among the first 200,” though he acknowledged uncertainty about which specific measures might make the cut.

If these executive orders address issues like a regulatory framework or even hint at a crypto council or a strategic reserve, they could provide a much-needed boost to the market’s confidence.

Bitcoin’s recent performance has further fueled anticipation. In just one week, its price surged from $88,000 to $108,000, achieving a new all-time high.

Analysts like Michaël van de Poppe stressed that maintaining support above $100,000 is crucial for continued upward momentum.

However, he also warned that failure to hold this level could lead to a pullback. Meanwhile, a weaker U.S. dollar and falling yields have bolstered altcoins.

Further ahead, the path for crypto under Trump’s administration remains uncertain but filled with potential. Executive orders could emerge as a defining moment, providing clarity on key issues. However, the absence of immediate action doesn’t raise alarm.

Bitcoin’s ability to maintain its recent gains, the broader market’s reaction to potential policy shifts, and the macroeconomic backdrop will all play critical roles in shaping what’s next.

CryptoCurrency

Ross Ulbricht Is Free — Now Let's Fight For The Samourai Devs

Yesterday, President Trump signed a full pardon for Silk Road founder Ross Ulbricht. This was a tremendous victory for the Bitcoin (and Libertarian) movement.

It proved with some time, effort and political coordination, the Bitcoin network state, to borrow a term from Balaji Srinivasan, can facilitate real and important change via the highest levels of power at the nation-state level.

While we should surely take a moment to celebrate, we should also keep in mind others in the Bitcoin and broader crypto space are currently facing unfair sentencing and we should be acting on their behalf. These others include the developers of Samourai Wallet, who are currently wrongfully being charged with operating an unlicensed money transmitting business.

In this case, not only is the freedom of the developers involved at stake but our ability to use the privacy tools they’ve created.

Now we have to do #freesamorai to ensure noncustodial wallets remain legal! https://t.co/Jq1UDbe9dl

— Matt Corallo (@TheBlueMatt) January 22, 2025

And so this time around, let us right wrongs before they result in unfair sentencing, like we saw with Ross.

To do this, you can donate to the Peer-to-Peer Rights Fund to help fund the defense for the Samourai case (and others like it). We have to do our part to stop regulatory overreach and to protect the freedom of those who have helped to further enable our own via the tools they’ve created.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CryptoCurrency

Turning $600 into $50,600 By Q3 2025: Here Are the 4 Tokens to Do It

Investors seem to persistently be drawn to the rapid evolution and change in the cryptocurrency market. Over time, four tokens exemplified by Rexas Finance (RXS), MANTRA (OM), Cardano (ADA), and Ripple (XRP) showcase the best likelihood to amass considerable returns from relatively small investments before the year 2025 wraps up. The unique offerings of each token make them worth serious consideration for investors.

Rexas Finance (RXS): Pioneering Real-World Asset Tokenization

Making things accessible to the masses is at the heart of Rexas Finance, as seen in the tokenization of real estate through blockchain. By enabling users to buy lower percentage shares of traditionally expensive assets, Rexas Finance undoubtedly stands out. Their emphasis on the platform’s security, transparency, and accessibility is unmatched. Thanks to the success of the Rexas Finance presale, over $41.5 million has been raised alongside 424 million tokens sold. As stage 11 sold out before the schedule, stage 12, owing to the result of votes by the community, has been introduced. It is currently set for $0.200, with the token set to list at $0.25 on June 19, 2025. Experts anticipate RXS climbing to $5 by Q3 2025. Investor confidence has increased due to its community-driven marketing strategies and approach to tokenizing real-world assets. This is evident from the $1 million giveaway, in which 20 winners receive $50,000 worth of RXS tokens each.

MANTRA (OM): Making Waves in the Market

Mantra has invested heavily in expanding its platform, which provides users with a comprehensive list of decentralized finance services. It trades at $3.76 while holding a market capitalization of $3.61 billion. This firm has positioned itself as essential for any DeFi user. With a shift from traditional finance to innovative DeFi solutions, analysts predict a bullish market across the capital. Focusing on community initiatives is promising. By 2025, MANTRA is projected to trade within the $12 to $15 range. Even reaching a whopping $20 is plausible during the bullish run. The projection remains clear due to strong polymers in other DeFi projects alongside steady adoption. From an investment standpoint, adopting MANTRA simplifies risks while strengthening returns. OM solves issues through an appealing, low-risk, and unique governance model while increasing community incorporation.

Cardano (ADA): A Sustainable Blockchain with Great Capabilities

Investment and retailer trust is shifting towards ADA because it has become one of crypto’s most innovative and secure blockchains due to AI-driven resources and scalability functionality. Currently, it stands at $1.06 with a $37.31 billion market cap. This signals trust and attention from all major players in the financial market. In the past few months, whales have accumulated over 30 million tokens, making big bets on Cardano. Veteran trader Peter Brandt asserts that ADA has bottomed, signaling the start of a grand bull market. Analysts forecast that in 2025, ADA will reach the $5 mark, with strong potential to increase if key sectors like smart contracts and decentralized applications become more widely adopted. In an era where sustainability is gaining significant attention, Cardano stands out due to its relative energy consumption while providing an advanced level of performance. For long-term investors, there is potential to harness the power of this blockchain with ADA.

Ripple (XRP): Leader in Cross-Border Payment Technology

The XRP token is often portrayed as an efficient and cost-effective transaction method worldwide. Valued at $3.17 and with a market cap of $182 billion, XRP is gaining momentum. Analysts believe Ripple may strengthen its relations with other players in the industry, ensure regulatory compliance, and set indicators that the price of XRP will soar to $10. Ripple pioneered building blockchain payment networks and other existing infrastructures, which paved the way for the XRP token to break international boundaries into the mainstream economy. Ripple’s consolidation with legal entities further increased investor confidence in trading, and now, the technology allows for cheap transactions around the globe.

Conclusion

Investing $600 in these tokens guarantees a strong base encompassing Rexas Finance, MANTRA, Cardano, and Ripple. Together, these companies pave the way for a smart way to spend across the many specialties of asset tokenization, cross-border payment, and blockchain technology that reduces carbon emissions and innovation in DeFi. Each token is excellently positioned to ensure that these evolving trends pay off in transformative ways that ripple across the economy. Of these, Rexas Finance is a leader in innovative tokenizing of real-world assets, which is set to boom. With strong community support, successful presale results, and a clear roadmap, RXS is poised to become the best investment for those looking to transform small amounts of money into significant wealth.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

How to find new memecoins before they go viral

Discover practical strategies to spot new memecoins before they go viral, including tracking launch platforms, analyzing social media trends and leveraging blockchain tools for early opportunities.

CryptoCurrency

HMRC to overhaul ‘scandalous system’ which has overtaxed thousands of pensioners by £1.37bn

HMRC is set to overhaul its “scandalous” tax system that has overcharged pensioners by £1.3billion since 2015.

The move comes after years of campaigning and frustration from savers who’ve had to fight for refunds.

The issue dates back to when Pension Freedoms were introduced in April 2015, allowing people with Defined Contribution pensions to withdraw their savings in chunks instead of locking it into a fixed income for life.

Unfortunately, HMRC applied “emergency tax codes” to these withdrawals, often resulting in pensioners being taxed far more than necessary.

As a result, over 470,000 people have had to claim refunds, totalling an eye-watering £1.37billion. In the past three months alone, nearly £50million has been repaid to more than 14,000 individuals.

HMRC has now given an update to the “scandalous system” in their ‘Pension Schemes Newsletter’, in an article called ‘helping customers get on the right pension pay faster”.

As a result, over 470,000 people have had to claim refunds, totaling an eye-watering £1.37 billion

GETTY

Steve Webb, partner at pension consultants LCP, has campaigned for change on the system for 10 years.

He said: “It is great news that at long last HMRC has listened to the voices of ordinary taxpayers and changed this scandalous system. For too long, hundreds of thousands of people have been overtaxed and had to jump through hoops to claim back their own money.”

HMRC has committed to replacing these outdated emergency tax codes with regular tax codes. This will ensure the correct amount of tax is deducted automatically in real-time.

This change promises to reduce the need for complicated year-end reconciliations and form-filling, especially for those making multiple withdrawals in a single year.

It’s a long-awaited win for pensioners, promising less hassle and more peace of mind when accessing their hard-earned savings.

Jon Greer, head of retirement policy at Quilter said: “HMRC’s latest figures reveal that pension tax overpayment refunds remain a significant issue, with over 14,600 repayment claims processed between October and December 2024, amounting to £49,514,458.

“This equates to an average refund of £3,390 per person. While these figures highlight an ongoing problem, HMRC’s plans to streamline tax coding from April 2025 are a welcome step towards reducing the administrative burden on savers and minimising overpayments in the first place.

“That said, the broader challenges of pension withdrawals persist. Many individuals are still accessing their pension savings to manage financial pressures.

“Such decisions, made in haste, could lead to unintended tax consequences and potentially compromise long-term financial plans.”

LATEST DEVELOPMENTS:

Greer warned that although HMRC’s planned reforms to update tax codes automatically for new pension withdrawals are a positive step, it’s unclear if they will fully fix the system’s issues.

The HMRC article said: “From April 2025 we are improving how tax code information is used for those people who are new to receiving a private pension, so they pay the right amount of tax from the outset.

“We will automatically update the tax code for customers who are on a temporary tax code and would benefit from being on a cumulative code — this means they’ll avoid an overpayment or underpayment at the end of the year.

“There is no need to contact HMRC and once a tax code has been changed we’ll inform customers by letter or digitally if they’ve signed up for paperless in the HMRC app or online.”

Webb explained this new system should mean that far more people are quickly moved on to the correct tax code and no longer end up with an overpayment of tax.

He added: “The tax system is complex enough as it is, and this change should hopefully reduce the complications which pension savers face when they try to access their hard-earned cash.”

Retirees are advised to seek professional financial advice to make tax-efficient withdrawals and avoid overpaying.

Until the reforms are fully in place, Greer explained there’s still a risk of overpayment and a complicated claims process to get money back.

He concluded: “While HMRC’s efforts are a good start, much more needs to be done to create a smoother system for savers.”

CryptoCurrency

KIBHO COIN: Paving the Way for the Future of Cryptocurrency

In an era where digital currencies are redefining the landscape of financial transactions, KIBHO COIN emerges as a notable contender with a distinct approach to enhancing transactional efficiency and stability.

By anchoring its value to gold reserves and operating as an ERC20 token on the Ethereum blockchain, KIBHO COIN, or KBC, showcases a strategic positioning aimed at providing a streamlined and cost-effective payment alternative.

The implications of this unique digital asset on the future of currency systems are not to be overlooked, presenting a compelling narrative that hints at potential transformations in the realm of financial transactions.

Market Cap and Volume Analysis

In analyzing the market cap and volume of KIBHO COIN (KBC), it is evident that the current market cap stands at $78,971. This data indicates the total value of KIBHO COIN in circulation at the present moment, showcasing investor interest and market activity.

The market cap serves as a key metric for assessing the overall size and health of the cryptocurrency within the broader market.

Additionally, the trading volume highlights the level of liquidity and the extent of trading occurring within a specified period, offering insights into market dynamics and potential price fluctuations.

Short-term Price Forecast Insights

With a focus on near-term market movements, a comprehensive analysis of KIBHO COIN’s short-term price forecast reveals potential fluctuations based on current trends and external factors. The projected price range for September spans from $0.005758 to $0.005978.

Moving into October, the forecast indicates a range of $0.005868 to $0.006416. November shows a potential price range between $0.006307 and $0.006526. However, December may see a slight dip, with a predicted range of $0.004387 to $0.005210.

Looking ahead to January, the estimates suggest a range of $0.004936 to $0.006581. These predictions are subject to market dynamics and investor sentiment, which could influence KIBHO COIN’s short-term price movements.

Long-term Price Predictions and Trends

Continuing the analysis beyond short-term projections, the focus shifts towards evaluating the long-term price predictions and trends for KIBHO COIN.

Long-term forecasts suggest a gradual upward trajectory for KIBHO COIN, with projected prices ranging from $0.08226 to $0.1974 in 2024, $0.1514 to $0.3290 in 2025, and further increases expected in subsequent years.

These predictions indicate a potential growth trend for KIBHO COIN, with values varying based on market conditions and adoption rates. Investors looking for sustained returns may find KIBHO COIN an intriguing option, considering the projected price appreciation over the coming years.

Factors Influencing KIBHO COIN’s Value

Evaluating the underlying factors that shape the value of KIBHO COIN provides crucial insights for investors seeking to understand its market dynamics.

The value of KIBHO COIN is influenced by various factors such as market demand, the token’s utility, the stability of the backing assets (in this case, gold), technological advancements, regulatory developments, and overall market sentiment towards cryptocurrencies.

Market demand plays a significant role in determining the value of KIBHO COIN, as increased interest and adoption can drive up prices.

Additionally, the utility of KIBHO COIN in facilitating smoother and cheaper transactions backed by gold adds intrinsic value to the token.

Future Implications of KIBHO COIN

Looking ahead, the evolving landscape of digital currencies presents promising opportunities for the future impact of KIBHO COIN.

As the world increasingly adopts digital forms of payment, KIBHO COIN’s unique proposition of being backed by gold could solidify its position as a stable and reliable alternative to traditional cryptocurrencies.

The potential for increased adoption by investors seeking a secure store of value and a medium of exchange could drive the demand for KIBHO COIN, further enhancing its value and utility in the digital currency market.

Additionally, the transparency and security provided by blockchain technology, on which KIBHO COIN is built, could attract more users looking for efficient and trustworthy transactions.

Conclusion

KIBHO COIN’s innovative approach of being asset-backed by gold reserves has garnered attention in the cryptocurrency market.

As market dynamics continue to evolve, KIBHO COIN’s ability to offer a stable and efficient payment solution could position it as a key player in shaping the future of digital currency transactions.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Elon Musk Considers Pardon for Roger Ver After Ulbricht Clemency

Ulbricht’s pardon sparked widespread celebration and reignited discussions about Roger Ver, a controversial figure in the cryptocurrency world. Ver, an early Bitcoin Cash advocate, faces allegations of owing $48 million in taxes linked to his expatriation process. He denies the charges, claiming he relied on expert advice and was unfairly treated during legal proceedings.

Critics believe that his case represents a host of issues including violations of attorney-client privilege, concealing evidence, and more. His supporters call the situation a “miscarriage of justice.” Ray Youssef, an executive at a crypto platform, was one of the first known public crypto supporters to call for Ver’s release.

In response to the growing campaign, Musk said he would look into Ver’s case. He also drew attention to what supporters see as government overreach. They believe a pardon would uphold principles of privacy and due process, mirroring arguments made in Ulbricht’s defense.

This development has intensified debates on the balance between individual rights and state authority in the crypto space. Musk’s involvement adds weight to calls for clemency, fueling hopes for a resolution.

CryptoCurrency

Is Ethereum’s Weak Performance a Reason to Worry or an Opportunity in Disguise? (Santiment)

The current bull market has seen top alternative cryptocurrencies, except Ethereum, shine, and now, ETH holders are becoming frustrated. Market sentiment signals extreme negativity among the Ethereum community, and the crypto project’s slumping market cap growth is not helping matters.

Compared to other assets like Ripple (XRP) and Solana (SOL), whose market capitalizations have grown by 36.9% and 32.2% in the past month, ETH has been struggling and even recorded a 4.7% decline.

Factors Driving ETH Underperformance

A new report by the market intelligence platform Santiment analyzed factors driving Ethereum’s underperformance.

According to the analysis, the crypto community has been criticizing Buterin for periodically selling off large amounts of ETH. Although the Ethereum co-founder has explained severally that those sales were executed to fund personal expenses or support projects related to the blockchain, community members see them as a sign that he may not be confident in the network’s future.

On several occasions, Buterin’s ETH sales have triggered multi-week-long sell-offs among traders amid heightened concerns about Ethereum’s future and decentralization. Some market participants insist that Buterin, a few big players, and the Ethereum Foundation have too much control over the network because of their large ETH holdings.

These players include Coinbase, Binance, and Lido Finance, and their influence has raised centralization concerns among users. Additionally, users are worried about Ethereum following government rules in some cases, such as blocking transactions to the crypto mixer Tornado Cash.

A Good Sign?

From a more technological perspective, some analysts believe Ethereum’s underperformance could also be linked to its decision to go modular. Modularization in this context refers to Ethereum splitting its responsibilities across smaller, specialized projects called layer-2 solutions.

While going modular could have a positive impact on Ethereum in the long term, ETH is struggling currently because these layer-2 solutions are taking away some of the attention and investment that used to go to the cryptocurrency. One illustration of this issue is the ETH supply spiking significantly after the Dencun upgrade because transaction fees declined, and less ETH got burned.

Regardless of these factors, Santiment believes that the extremely negative social side of Ethereum is a good sign for the short-term future of ETH because the market often moves in the opposite direction from general investor sentiment. So, ETH could finally break past the $4,000 range in the coming weeks if retail traders remain bearish and sell off their coins to long-term holders and key stakeholders out of frustration.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Expert Bullish On Cardano: Forecasts Explosive Rally To $3 Once This Resistance Is Broken

Cardano (ADA) has struggled to maintain the bullish momentum it experienced in recent weeks, with its price still trailing approximately 67% below its all-time high of $3.09, reached during the 2021 bull run.

Despite this significant gap, analysts believe that the potential for a robust price recovery exists in the coming weeks and months ahead of the new year.

Cardano Consolidates Above Key Moving Averages, Poised For Breakout

Trend Rider, a prominent analyst on the social media platform X (formerly Twitter), provided insights on Cardano’s current price action, noting that the price dipped below the parabolic line, indicating a cooling-off period, which occurred just above the $1 mark last week.

However, he emphasized that the Cardano price is consolidating above its moving averages, suggesting it is preparing for a potential breakout while “shaking out weaker hands.”

Trend Rider further anticipates a resumption of bullish momentum soon, forecasting that once the Cardano price breaks through the $1.25 resistance level, it could rapidly surge toward the $3 mark, inching closer to its previous record peak.

Adding to the optimistic outlook, analyst Ali Martinez pointed out that after experiencing a 44% correction, Cardano began its second leg up during the week of February 1, 2021.

Given that ADA has already undergone a 43% correction recently, the analyst suggests that the next upward movement for ADA could be just two to three weeks away, with a target of $6 in sight.

Analysts Identify Key Support And Price Targets

Another analyst, AV Sebastian, also weighed in, suggesting that the price recent dip may be over, and that the Cardano price is poised to break out of a triangular pattern. He highlighted the last two candles as particularly bullish and expects a significant rally in the coming days.

In analyzing short-term price actions, several analysts noted that ADA is exhibiting a “very bullish market structure” on the daily timeframe. On the chart is observed a double bottom formation leading to a breakout and a V-shaped recovery along a descending channel.

It is further believed that a retest of the key support zone at $1.3886 appears inevitable for ADA’s price in the near-term, which would then lead to price uptrend with a main target of $1.7748.

Further support zones have also been identified, with the $0.824 level being crucial to watch early in 2025. Holding this support could unlock significant upside potential, and analysts are eyeing May 2025 as a key timeframe for achieving targets.

At the time of writing, ADA was trading at $1.14, up 1.13% for the 24-hour period.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

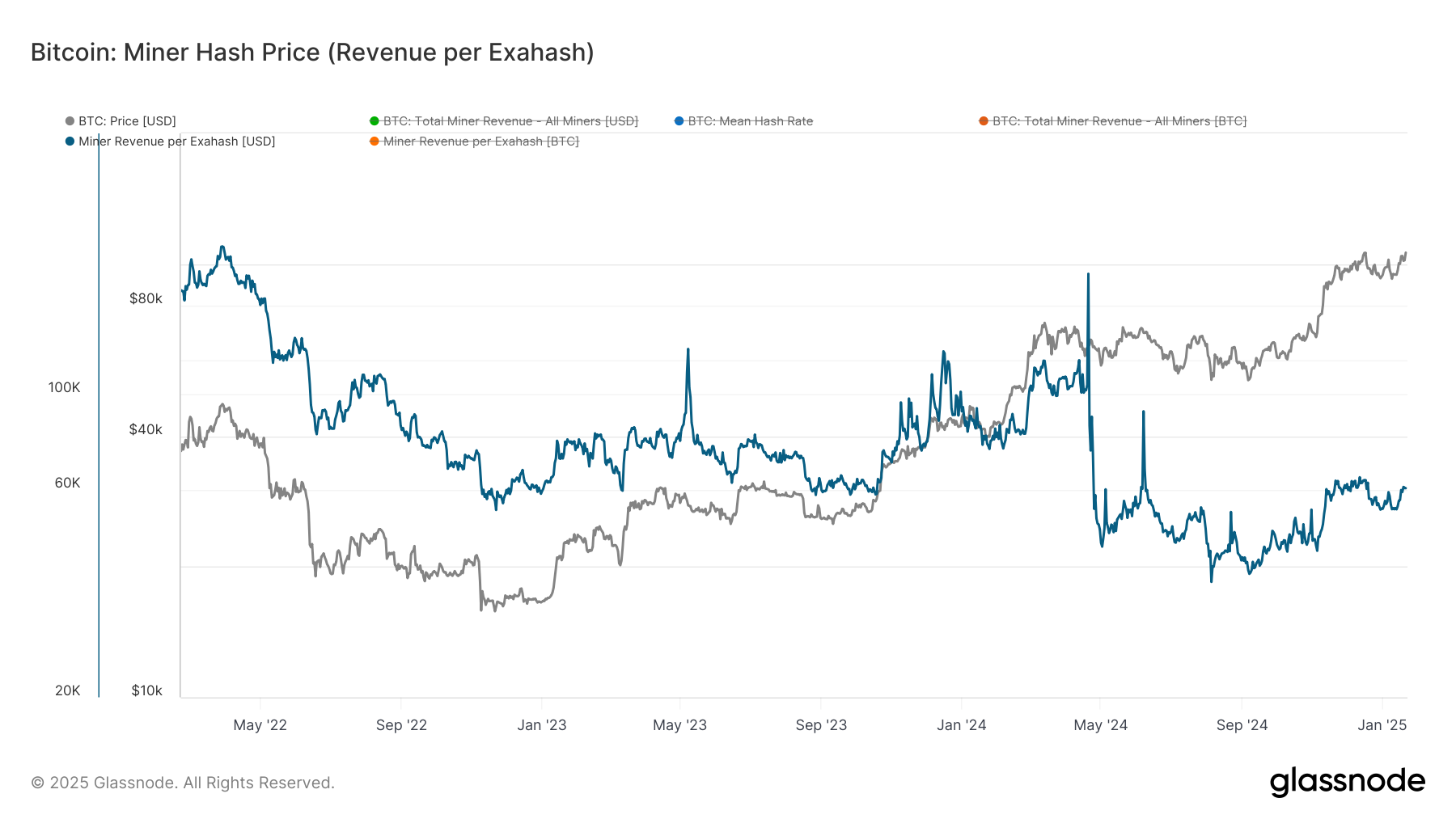

BTC Hashprice Hits its Highest Level for Over a Month

Hashprice, a metric coined by Luxor that gauges mining profitability, estimates the daily income of miners relative to their estimated contribution to the Bitcoin network’s hash power. In other words, it is the expected value miners can expect from 1 TH/s of hashing power per day.

According to Glassnode, hashprice is hovering above $62 PH/s, around the highest level since mid-December.

What’s driving the increase in hashprice? Well bitcoin (BTC) has surged to well over $100,000, a 56% increase in three months and has given the miners some relief. The network has also seen a slight increase in miner fees of late, roughly 12 BTC per day, the highest amount for over a month, partly driven by the network’s inscription activity.

Due to the halving in April 2024, where the mining rewards get cut in half, the hashprice had dropped from around $115 PH/s.

As a result of the halving, miners struggled in share price appreciation on average last year; while mining revenue for much of 2024 was below the rolling 365-simple moving average (SMA). Only since November has it reclaimed this moving average, which is a historically bullish signal.

While the hash rate, the computational power in order to mine on a proof-of-work blockchain, recently hit all-time highs, as a result sent the network difficulty to all-time highs, which eats into mining profitability, as it becomes harder for miners to receive rewards.

European head of research at Bitwise, Andre Dragosch, told CoinDesk exclusively about miners being in a healthier position than last year.

“We have recently seen a decline in network hash rate since the all-time highs in early January. Meanwhile, the price of bitcoin has increased, and the overall transaction count has picked up again. This has led to a recovery in hash price, which should technically incentivize miners to continue ramping up their hash rate”.

Dragosch says, “overall, bitcoin miners appear to be well capitalized judging by the continued increase in bitcoin miner holdings since the beginning of the year which implies that miners are selling less than they are mining on a daily basis”.

CryptoCurrency

Donald and Melania Trump’s Meme Coins Decline from Peak Highs as Lightchain AI Gathers Momentum

The crypto market has witnessed a surge in celebrity-driven meme coins, including those tied to Donald and Melania Trump. However, the hype around these coins appears to be fading as investors turn their attention to more utility-focused projects.

One such standout is Lightchain AI, a blockchain project that has already raised $12.3 million during its presale, with a token price of $0.005625. This innovative platform is making waves for its ability to address critical blockchain inefficiencies, drawing interest from investors seeking long-term growth.

Trump Meme Coins – From Hype to Market Decline

Donald Trump’s start of the $TRUMP meme coin on January 17, 2025 has caused much talk in the crypto world. At first, the coin’s worth shot up, hitting a market size of about $7.8 billion. But this quick rise was soon followed by ups and downs; as of January 21, 2025, $TRUMP is trading near $38 which shows a drop of 49% from its highest point.

Critics say that the coin has no real money value. It mostly works as a guess item. There are also worries about possible unfair deals since the Trump Organization holds 80% of the coin’s part.

Also, the next start of Melania Trump’s $MELANIA coin has added to market chaos. These changes show the risky kind of ͏meme coins and point out the dangers for buyers. People in the market should be careful, because the future path of $TRUMP and like things is not clear.

Lightchain AI Utility-Driven Alternative for Smart Investors

The backbone of Lightchain AI is designed to tackle the challenges of tomorrow with unmatched efficiency and innovation

At its core lies the Artificial Intelligence Virtual Machine (AIVM), a dedicated layer built specifically for AI tasks such as model training and inference, seamlessly integrated into the blockchain for peak performance.

Complementing this is the revolutionary Proof of Intelligence (PoI), a unique consensus mechanism that not only secures the network but also incentivizes nodes to perform valuable AI computations.

To ensure scalability, Lightchain AI incorporates advanced technologies like sharding and Layer 2 solutions, enabling it to handle high-speed, high-throughput AI tasks effortlessly. This robust infrastructure positions Lightchain AI as a powerful, utility-driven solution for future-facing smart investors.

From Noise to Innovation Future of Crypto

The fall of Donald and Melania Trump’s meme coins highlights a hard lesson for the crypto world: hype alone won’t last.

Enter Lightchain AI—a utility-driven project that’s turning heads and redefining what blockchain technology can do. This isn’t just another fleeting trend; it’s a movement toward real innovation and lasting impact.

For investors hungry for sustainable growth and meaningful returns, Lightchain AI is leading the charge. With an impressive presale performance and groundbreaking features, it’s primed to shape the next wave of blockchain advancements. Ready to join the future?

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login