CryptoCurrency

Vancouver City Council Passes Bitcoin Reserve Asset Motion

On December 11, Vancouver city councilors voted in favor of Mayor Ken Sim’s motion to make the city “Bitcoin-friendly” and authorize staff to look into holding cryptocurrency in reserve.

Mayor Ken Sim, who has been serving as mayor of Vancouver since 2022, said to CBC that he thinks investing in Bitcoin (BTC) is financially responsible in an era of inflation and market volatility and even agreed to donate $10,000 worth of BTC to the city from his personal holdings. City officials will now work to see if BTC can be incorporated into the city’s financial strategies and whether it can invest in cryptocurrency by converting a portion of Vancouver’s current financial reserve. The motion’s passing is in accordance with the city’s 2025 budget plan.

The motion, which was filed in November, stated that it would be “irresponsible” if the city did not evaluate the “merits” of incorporating BTC into its strategic assets, in order to stabilize the city’s financial standing. This would cover accepting taxes and fees in BTC. Capped at a supply of just 21 million coins, BTC has frequently been described as a digital version of gold, one that may serve as a store of value that shelters from inflationary pressures.

The mayor says he sought advice from the city’s auditor general before formulating his motion. Leading the way were several speakers, including experts such as Victoria Lemieux, head of the Blockchain research cluster at the University of British Columbia, for whom support for the council’s decision was a no-brainer. However, there have been concerns over the environmental footprint of BTC mining, as well as the volatility of cryptocurrency, making it a questionable option for city financial reserves. Lemieux also said, “Mining BTC would take a lot of energy” to CBC.

Can Bitcoin be used as a reserve asset in Vancouver?

The Bank of Canada’s Currency Act prevents cities from being able to send BTC as payment for local expenditures or even hold it as a reserve because they are confined to investments which do not come with financial risk. It goes on to explain that the only legal currency is physical money such as notes and coins, made and issued by the Bank of Canada or the Royal Canadian Mint. Crypto is considered a commodity and not money under Canadian law, according to the Canada Revenue Agency.

However, Section 27.1 of the Bank of Canada Act permits the Bank to create a special reserve fund to absorb unrealized valuation losses resulting from movements in the fair value of the Bank’s investment portfolio. Although this provision does not directly address cryptocurrencies, it creates leeway regarding the assets the Bank of Canada could evaluate. While legislative changes would be required, Vancouver’s motion signals a potential shift toward integrating BTC into official financial portfolios. The motion, therefore, could indicate a readiness for Vancouver to contest the current status quo.

CryptoCurrency

XRP at $10, Ethereum at $6k, Catzilla exploding to $1

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto markets heat up with bold forecasts for XRP, Ethereum, and newcomer Catzilla, sparking investor interest.

Cryptocurrency enthusiasts are buzzing with excitement as the market shows signs of a promising bull run. Analysts are making bold predictions about potential price leaps for well-known digital assets like XRP, Ethereum, and the intriguing newcomer, Catzilla. These forecasts have sparked interest, as investors look to capitalize on the next big movements in the crypto world.

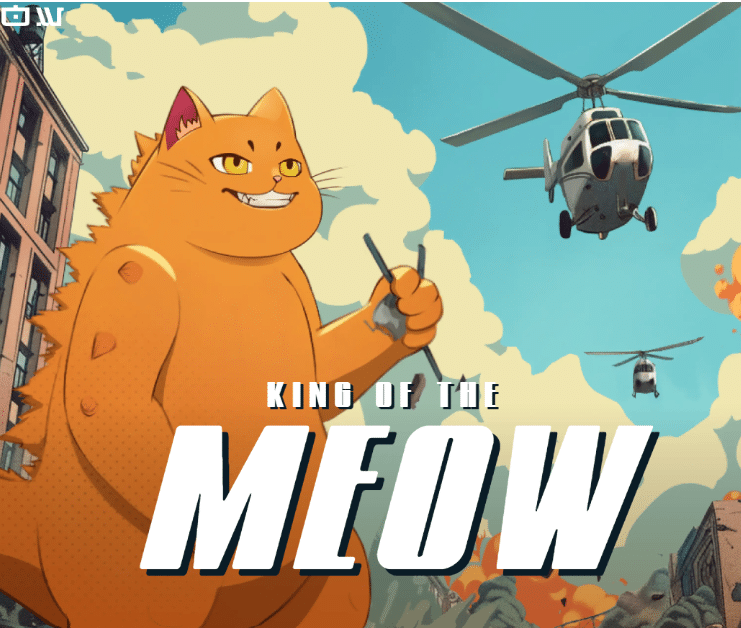

Catzilla unleashed: The meme coin movement people have been waiting for

When financial freedom feels like a distant dream, along comes Catzilla — the meme coin that doesn’t just promise gains but delivers them with the flair of a legendary feline warrior. Fueled by meme culture and designed for exponential growth, this isn’t just another meme coin. This is a call to arms for crypto warriors everywhere.

14 stages of glory: Where the brave reap rewards

Catzilla’s presale isn’t just a launch; it’s a journey through 14 stages of evolution where the CATZILLA token gains momentum and value. Early adopters can enjoy up to 700% returns as they level up their holdings with each stage. Every step forward is a leap toward financial triumph — an opportunity to transform ambition into real profits.

But tread carefully, crypto adventurers — the clock is ticking. Only those bold enough to act now will grab their share of Catzilla’s unstoppable rise.

Cats vs. dogs: The meow money takeover

For years, dog-themed coins have ruled the meme coin scene, but the cats are clawing their way to the top. With recent feline sensations like MEW and Popcat proving their worth, the stage is set for a cat-led revolution:

- MEW: Climbed into the top 15 meme coins with an impressive 103.7% growth in three months.

- Popcat: Pounced into action with a jaw-dropping 157.44% surge, cementing its dominance.

But these success stories are only the beginning. As Catzilla prepares to make its grand debut, it’s clear that the crypto meme kingdom is shifting — and it’s cats that are poised to reign supreme.

Rewrite the crypto playbook with Catzilla

Catzilla isn’t just here to disrupt; it’s here to obliterate the outdated rules of the game. With each presale stage, it smashes through the barriers holding back ambitious investors, creating a new paradigm where warriors of the crypto world rise to claim their rewards.

The time to act is now. The clock is ticking, and Catzilla’s presale won’t wait for the hesitant. Be among the fearless few who seize this opportunity to transform their portfolios.

This is more than a meme coin — this is a movement. Join the Catzilla movement, and watch as it wreaks havoc on the market and delivers chaos-fueled gains to those brave enough to believe.

XRP eyes new heights as crypto bull run looms

XRP is showing promising signs, with its current price range between $2.39 and $3.46. The coin has seen a month-on-month increase of over 35%, hinting at positive momentum. Supported by a 6-month surge of around 408%, XRP could be gearing up for another breakthrough. Its nearest resistance is just shy of $4. If it breaks this, it could aim for the second resistance near $5, signaling potential gains of over 40% from the current upper range. Watch the support levels at $1.83 to stay cautious, but the overall trend seems poised for upward movement. The crypto market awaits another bull run, and XRP might lead the charge.

Ethereum’s path to breakthrough: Will ETH prices surge?

Ethereum is currently trading between $2918 and $3516. Recent trends show a downward movement, with a 1-week decline of over 7%. The 10-day and 100-day moving averages are slightly above $3200. These suggest that Ethereum is struggling to gain momentum. The RSI at 39 indicates a market that’s not overbought, which leaves room for potential growth.

If Ethereum can push past $3819, we could see a move toward $4417. This would mean a rise of about 25% if achieved. For now, support around $2624 provides some stability against further losses. The market mood hints at volatility, with signs of a potential rebound as part of an anticipated global crypto bull run.

Conclusion

While XRP and ETH may show less short-term potential, Catzilla emerges as the ultimate meme coin hero aiming to bring financial freedom to everyone. With a 700% ROI during its presale, triple utility features, and a mission to unite enthusiasts, acquiring CATZILLA tokens offers a chance to join the fight against crypto villains.

To learn more about Catzilla, visit the website, X, Telegram chat.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

TORN Enjoys Uptick After Court Overturns Tornado Cash Sanctions

TORN, the native token of beleaguered crypto mixer Tornado Cash, enjoyed a brief renaissance over the last two days following news that a court had overturned sanctions imposed on the platform by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC).

Initially trading around the $9.50 level on January 22, the token skyrocketed 140% to break beyond $25 as speculators reacted to the news. At press time, the asset has lost some value and is down to $17.

Victory for Tornado Cash

Tornado Cash’s legal woes started in August 2022 when OFAC designated it as a sanctioned entity, claiming the Lazarus Group, a criminal organization linked to the North Korean regime, had used the platform to launder stolen cryptocurrencies worth more than $455 million.

Subsequently, one of its developers, Alex Pertsev, was arrested in The Netherlands, charged with money laundering, found guilty, and sentenced to five years in prison.

The mixer’s co-founder, Roman Storm, was also arrested in August 2023 and charged with conspiracy to commit money laundering and operating an unlicensed money-transmitting business. With his trial scheduled for April 14, 2025, he has publicly defended himself, claiming he is being prosecuted for writing open-source code.

However, following the judgment against Tornado Cash, six individuals led by crypto advocate Joseph van Loon sued the U.S. Treasury, OFAC, then-Secretary Janet Yellen, and OFAC Director Andrea Gacki, accusing them of overreach.

Loon and his fellow plaintiffs argued that there were no grounds for sanctioning the crypto mixer because it was software rather than a person or entity. Their view was supported by an appellate court in November 2024. It ruled that the immutable nature of the service’s smart contracts meant it could not be defined as “property,” a concept in the International Emergency Economic Powers Act (IEEPA) that OFAC had used to justify its sanctioning of Tornado Cash.

According to the court, the lines of codes making up the smart contracts could not be subjected to ownership or control since they operated autonomously without human intervention, thus falling outside the purview of the IEEPA.

The latest determination upholds the November judgment, which the government agencies had sought to be reheard. However, it does not impact the criminal case against Storm and fellow co-founder Roman Semenov, who remains at large.

Market Reacts

While the value of the TORN token skyrocketed in the aftermath of the court’s decision, it has since cooled down, going from a high of $25.28, per data from CoinGecko to $17.00.

However, its current price is still 122% higher than a week ago and an 88% improvement over 30 days. The coin has a market capitalization north of $68 million, and its recent performance puts it vastly ahead of the broader crypto market, which is up a mere 1.8%.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

RUNE Dives 30% as Bitcoin, Ether Based Services Paused

Shaurya Malwa

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CryptoCurrency

Vitalik Regains Leadership In Ethereum Foundation, Meanwhile Yeti Ouro Could Explode To $20 In 2025

Ethereum is once again making headlines as co-founder Vitalik Buterin states that going forward, he will unilaterally head the Ethereum Foundation (EF) and will choose its leadership until sufficient measures are put in place. Some members of the community argue that there is no sufficient activity in the EF, but Buterin does not accept any movement in the direction of lobbying or centralization. Aside from these institutional changes, fresh ERC-20 projects like Yeti Ouro (YETIO) are poised to leverage the renewed enthusiasm of Ethereum.

Ethereum Overhaul Gains Traction: Focus Shifts To Creating Value

The restructuring of Ethereum leadership is proceeding at full pace with, Vitalik Buterin stating in an X post that the Foundation’s aims include increasing internal technical capabilities, supporting innovation in a decentralized way, and refraining from active political lobbying. Buterin’s stance is strongly supported by Ki Young Ju, CEO of CryptoQuant, who claims that, although Ethereum may be under heavy pressure in the short term, the focus of the network should be on building real value instead of shallow financial captures.

This is also what is driving the plan to create a “proper board” for the Foundation, which Buterin hopes will improve cooperation with wallet providers, L2s, and application developers. On the other hand, the promised additional Pectra upgrade that is claimed to introduce major speed and efficiency improvements points to the fact that Ethereum’s roadmap is still very much innovation focused.

Ethereum News: ETH Technical Outlook

Ethereum price continues to be above $3,100 on Coinmarketcap, having defended the support at $3,216 several times, all of which is happening despite the leadership tussles within the organization. Analysts observe a new emerging inverted head-and-shoulders pattern, which could push Ethereum price above $3,550, with the next critical area of concern around $4,100.

Yeti Ouro: Meme Appeal Meets Real Utility

Ever since Ethereum has changed its direction, the users of Ethereum ecosystem have focused on Yeti Ouro’s ability to infuse meme coin culture with actual P2E offerings. This “Hot New Utility Meme Coin” is employing a 5% burn of tokens out of the total supply of 1 billion while setting aside some tokens for the community, which helps in making the tokens scarce over time.

One thing that has investors attracted to Yeti Ouro presale is its successful audit by SolidProof. This extensive auditing has built trust among the investors as it confirms its smart contracts, and general infrastructure of the project.

Possible Growth Of 1,000 Times

Some analysts suggest that Yeti Ouro could rise as high as $20 in 2025. This bold projection hinges on the continued growth of presales selling more than 131 million tokens. Such presale momentum shows its ability to attract significant inflows. Early investors have already experienced a rise in price. With the impending reveal of Yeti Go; a mindless racing game on unreal engine which incorporates PvP alongside in-game tokens, the project is gaining more traction.

The end product aims to deliver high end gameplay features:

-

Destructive PvP Racing: Users can shove people off of platforms, use power-ups, and even immerse themselves fully with advanced audio such as Spatial Audio and Dolby Atmos.

-

Staking and Marketplace: Players can stake YETIO and buy powerful assets.

-

It’s AAA: The environment has gone through a polished, ever evolving design. The game is processed through an iterative design that just finished its second revision.

The dev recently released a video showcasing glimpses of the level 1 map of Yeti Go game.

A report from Research and Markets indicates that the P2E gaming market currently standing at $8.5 billion is predicted to grow over $300 billion by 2030 which represents a Yeti Ouro phenomenon which empowers its P2E projects with disclosure.

Conclusion

If ETH begins to surge and the blockchain gaming market continues inflating, Yeti Ouro will make a $20 price claim which will remain unrestricted on how fast strong crypto projects can grow in a shifting market.

Yeti Ouro’s presale success will lead to bigger price rallies in the upcoming weeks, making it a prime investment. Early investors in YETIO, especially during its presale phase will see significant returns, as it will likely top presale charts.

Join The Yeti Ouro Community

Website: https://yetiouro.io/

X (Formally Twitter): https://x.com/yetiouro

Telegram: https://t.me/yetiouroofficial

Discord:https://discord.gg/YtUsEZ2Zr

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Semler Scientific to raise $75M to fund Bitcoin buys as paper gains near $30M

Semler Scientific is planning to raise $75 million through a private offering of convertible senior notes, which will help fund further Bitcoin purchases.

CryptoCurrency

Bitcoin ETFs face slowdown as Trump’s crypto executive order falls short on BTC-specific strategic reserve

Inflows into spot Bitcoin ETFs in the U.S. remained sluggish on Jan. 23 as President Donald Trump’s efforts to form a working group on digital assets under an executive order failed to meet market expectations.

According to data from SoSoValue, the 12 spot Bitcoin ETFs recorded $188.65 million in net inflows on Thursday, marking their fourth consecutive day of declining inflows since the beginning of the week, when they recorded over $1 billion in inflows.

BlackRock’s IBIT attracted the lion’s share of inflows, totaling $154.6 million, leading Bitcoin ETFs in inflows for the fifth consecutive day while Bitwise’s BITB followed with inflows of $42.15 million.

More modest inflows that contributed to the positive momentum came from Invesco Galaxy’s BTCO, Grayscale’s mini Bitcoin Trust, Fidelity’s FBTC and ARK 21Shares’ ARKB which logged inflows of $12.38 million, $11.9 million, $9.16 million and $8.35 million respectively.

Grayscale’s GBTC, which stood out as the only outlier on the day, recorded $49.94 million in outflows, offsetting some of the inflows from the other ETFs. The remaining five BTC ETFs saw zero inflows.

The total daily trading volume for Bitcoin investment vehicles reached $9.59 billion on Jan. 23, marking the second-highest level ever recorded, just behind the $10.39 billion peak seen on March 5.

Notably, the dip in inflows to Bitcoin ETFs coincided with a shift in Bitcoin’s price momentum after President Donald Trump signed an executive order on Thursday that is aimed at establishing a working group focused on digital assets that fell short of expectations.

While the order set out to advise the White House on digital asset policy and evaluate the creation of a government-held digital asset stockpile—comprising cryptocurrencies seized during investigations—it stopped short of establishing a dedicated strategic Bitcoin reserve, a move many crypto advocates had been hoping for.

Initially, Bitcoin responded positively to the announcement, climbing as much as 2.7% to reach $106,732. However, after the full details of the executive order were released, sentiment shifted, and the largest cryptocurrency by market value dropped nearly 4%, hitting $102,517. Since then, Bitcoin (BTC) has shown signs of recovery, gaining 2.1% to trade at $104,991 per coin.

CryptoCurrency

US Bitcoin Reserve ‘Pretty Much Confirmed’

Sen. Cynthia Lummis (R-WY) chairs the US Senate panel on crypto assets. She has promised some big changes in government policy for the sector.

A Bitcoin sovereign wealth fund Republicans are calling a “strategic national reserve” is only one of Lummis’ promises for blockchain. But markets are thrilling with bullish activity on that prospect alone.

Over the weekend, Bitcoin whales were insatiable in their accumulation.

After Republicans retook control of Congress following November’s election, the US Senate Banking Committee opened its first subcommittee panel on cryptocurrencies Thursday.

Binance Founder: Strategic Bitcoin Reserve Alert!

US Strategic Bitcoin Reserve, pretty much confirmed.

Crypto moving at crypto speed again. https://t.co/8qWlt65ARE

— CZ BNB (@cz_binance) January 23, 2025

The idea of a national Bitcoin reserve is so popular at the moment among US policymakers that several states are considering establishing state reserves.

Congress Convenes First Subcommittee on Crypto

The Senate Banking digital asset subcommittee will:

✔️ Pass legislation promoting responsible innovation and consumer protection

✔️ Eradicate Operation Chokepoint 2.0

✔️ Make America the bitcoin and digital asset capital of the world— Senator Cynthia Lummis (@SenLummis) January 23, 2025

The new Senate subcommittee on digital assets has a host of issues to tackle with normalizing US government policy over blockchain. In an X post on Thursday afternoon, Sen. Lummis promised a three-point crypto agenda in 2025:

- Pass legislation promoting responsible innovation and consumer protection

- Eradicate Operation Chokepoint 2.0

- Make America the bitcoin and digital asset capital of the world

Popular crypto markets analyst Crypto Beast replied, “we’re going much higher.” The strategic Bitcoin reserve has backing from President Trump, according to recent reports and the fact that he signed the documents.

In addition, it has a strong group of pro-crypto delegates to Congress in the new subcommittee. That includes Sen. Ruben Gallego (D-AZ), who received strong backing from the pro-crypto Fairshake PAC.

Plus, there’s Sen. Bernie Moreno (R-OH), a freshman senator who prevailed in the ballot count over the Banking Committee’s previous chair, Sen. Sherrod Brown (D-OH).

Bitcoin’s price had a somewhat unexpected reaction to the aforementioned news. The asset started to lose value after the document’s signing and dropped to $102,400 before it recovered some ground to nearly $105,000 now.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

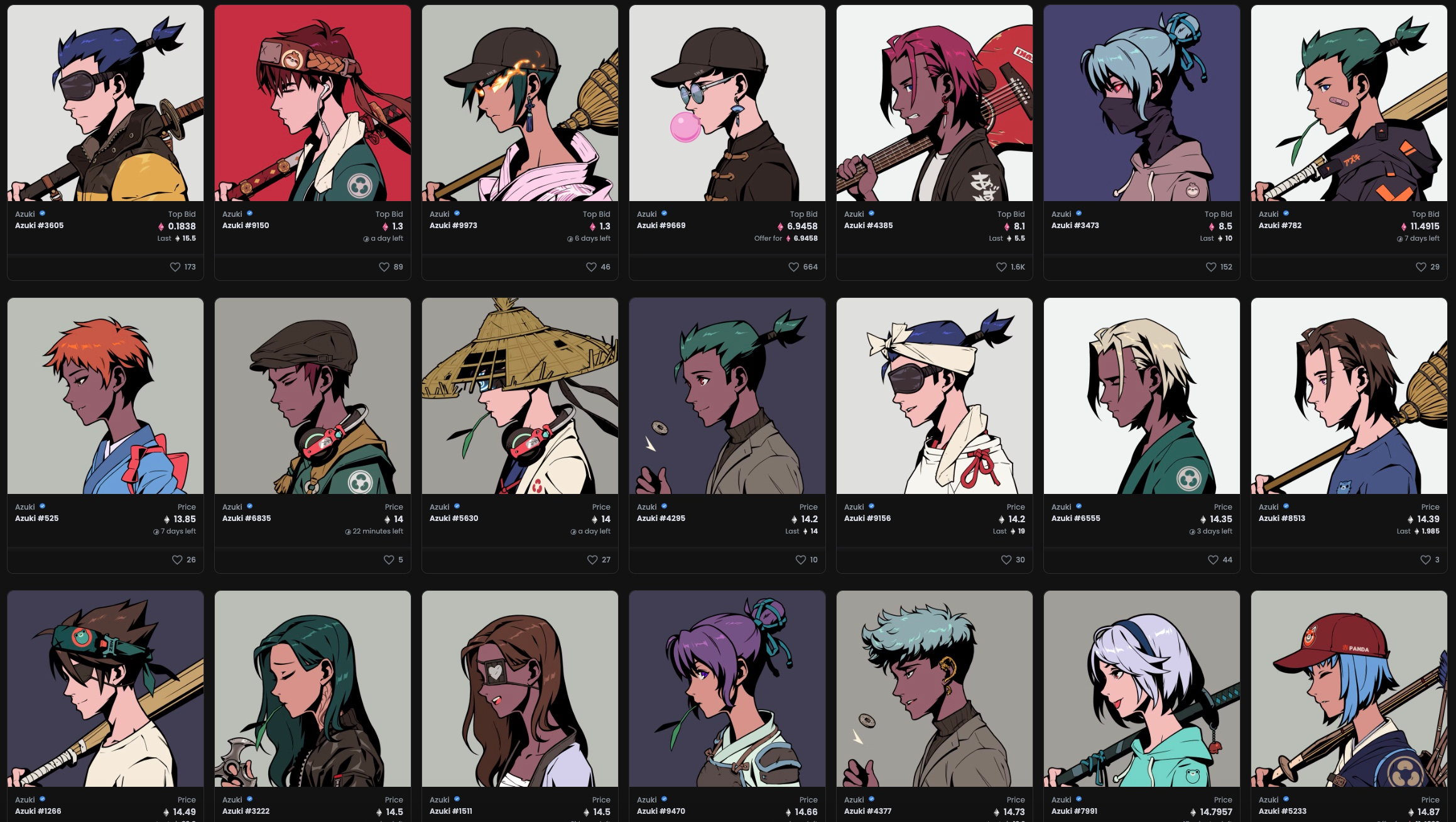

Azuki Airdrops Animecoin, Debuts at $1.2B FDV

Animecoin, the governance token tied to non-fungible token (NFT) project Azuki, has debuted at a fully diluted value (FDV) of $1.2 billion with tokens trading at $0.12 on HyperLiquid.

The total supply of the token is set at 10 billion, and holders of the Azuki NFT can claim the airdrop.

Users reported that the official airdrop claims website suffered downtime moments after it went live.

CryptoCurrency

This Under $0.25 Crypto May Crush Shiba Inu and Pepe Coin in 2025

The rapidly changing crypto market has a new under-$0.25 token gaining attention as a potential disruptor, set to surpass Shiba Inu and Pepe coin by 2025. Lightchain AI, now in its presale stage at $0.005625 per token, has already secured $12.7 million in funding, reflecting strong support from investors.

By merging blockchain technology with artificial intelligence, Lightchain AI introduces innovative solutions that move beyond the speculative nature of meme coins. With its forward-thinking strategy and advanced capabilities, it’s positioned for significant growth in the years ahead.

Why Shiba Inu and Pepe Coin Could Face Challenges in 2025

In 2025, Shiba Inu (SHIB) and Pepe Coin (PEPE) may encounter several challenges impacting their growth. A significant concern is their vast token supplies, which can hinder substantial price appreciation. Despite community-driven token burn initiatives, reducing the circulating supply to a level that meaningfully affects price remains a formidable task.

Additionally, the meme coin market is becoming increasingly saturated, intensifying competition and making it difficult for individual tokens to maintain investor interest. The speculative nature of these coins, often lacking intrinsic utility, subjects them to heightened volatility and susceptibility to market sentiment shifts.

Moreover, the evolving regulatory landscape poses potential risks, as increased scrutiny could lead to restrictions or decreased investor confidence in meme-based cryptocurrencies. These factors collectively suggest that SHIB and PEPE may face significant hurdles in sustaining their growth trajectories in 2025.

How Lightchain AI Plans to Stand Out

Lightchain AI stands out by combining innovative technology with a sustainable ecosystem supported by thoughtful tokenomics and advanced solutions. Its total token supply of 10 billion LCAI is strategically allocated; 40% for presale, 28.5% for staking rewards to incentivize network participation, 15% for liquidity to ensure smooth transactions, and the remainder for marketing, treasury, and team incentives. This distribution ensures ecosystem growth while rewarding both early adopters and long-term contributors.

The platform’s low-latency architecture enhances performance, enabling real-time execution of tasks, even during high network demand. To address risks like scalability and resource constraints, Lightchain AI employs mitigation strategies, including sharding for parallel processing and dynamic resource allocation. These robust features position Lightchain AI as a leader in blockchain innovation.

Rise of Lightchain AI in 2025

Lightchain AI is poised to dominate 2025 with its groundbreaking approach to blockchain and AI integration. By combining innovative tokenomics and advanced technology, Lightchain AI offers unique solutions that set it apart from traditional cryptocurrencies.

Its focus on scalability, security, and real-world applications positions it as a leader in the evolving crypto landscape. With growing investor interest and strong presale momentum, Lightchain AI is set to redefine the future of blockchain innovation.

Its potential for widespread adoption and practical use cases make it a strong contender to surpass meme coins like SHIB and PEPE in the coming years. As more industries embrace blockchain technology, Lightchain AI is well-positioned to capitalize on this growing market and solidify its place as a top crypto player. Invest in Lightchain AI today and be part of the next generation of blockchain revolution.

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Ether set for ‘potential tactical breakout’ after SEC kills SAB 121

A crypto analyst says ETH is signaling a potential “low-risk, high-reward opportunity” after the Securities and Exchange Commission killed a controversial accounting rule.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login