CryptoCurrency

What Is Beamx Crypto – Coinlabz

BeamX Crypto is a digital currency that aims to offer enhanced privacy and efficiency features in the cryptocurrency space.

It distinguishes itself through innovative approaches to managing digital assets, potentially reshaping perspectives on financial transactions.

By prioritizing privacy and optimizing efficiency, BeamX Crypto seeks to carve out a niche in the evolving digital asset landscape.

Key Takeaways

- – BeamX Crypto is a cryptocurrency that prioritizes privacy features and transaction efficiency.

- – It integrates blockchain technology with Mimble Wimble to enhance privacy and accelerate transaction speeds.

- – BeamX targets industries such as healthcare, finance, and logistics, offering a more confidential and scalable model for transactions.

- – Analysts predict gradual growth for BeamX due to its focus on privacy, scalability, and secure transaction capabilities, making it an attractive investment option.

BeamX Crypto Launch

The introduction of BeamX Crypto represents a notable advancement in cryptocurrency technology. With a focus on enhanced privacy features and transaction capabilities, BeamX expands upon the existing framework of Beam to offer a more secure and efficient approach to digital transactions.

By leveraging blockchain technology and incorporating Mimble Wimble for increased privacy, BeamX aims to set a new standard in the crypto sphere. This iteration of Beam not only caters to individual users but also targets businesses in sectors such as healthcare, finance, and logistics.

BeamX Crypto’s launch indicates a shift towards a more confidential and scalable model for cryptocurrency transactions.

Prioritizing privacy, scalability, and usability, BeamX introduces fresh opportunities for secure digital transactions. Positioned as an innovative asset with distinct features and adaptability, BeamX Crypto is set to impact transaction processes across various industries.

BeamX Key Features

BeamX Crypto’s launch represents a notable advancement in cryptocurrency technology, offering key features that distinguish it within the digital transaction landscape. BMEX, an upgraded iteration of Beam, stands out for its emphasis on privacy and transaction efficiency. Leveraging blockchain technology with Mimble Wimble integration, BMEX ensures enhanced privacy features and accelerated transaction speeds.

This combination of privacy, scalability, and user-friendliness positions BMEX as a preferred option for secure and seamless transactions. Tailored for confidential transactions, BMEX can handle high transaction volumes, serving industries such as healthcare, finance, and logistics. Its distinctive features not only enhance security measures but also present promising investment prospects in the dynamic crypto market.

As BMEX garners recognition for its innovative approach, it emerges as a groundbreaking asset with the potential to reshape the digital economy. Delve into BMEX for a secure, efficient, and state-of-the-art experience in cryptocurrency transactions.

BeamX Crypto Current Price

The current price of BeamX Crypto is subject to fluctuations driven by market demand and supply dynamics.

Currently traded at $0.002318 is quite far off from its all-time high price achieved in February 2024 at $0.69.

Various factors, including market sentiment, trading volume, and overall market conditions, influence the value of BeamX. Observing the price of BeamX can offer insights into its performance and potential trends.

Numerous online platforms and exchanges display BeamX’s current price against other cryptocurrencies or fiat currencies, enabling users to track price movements and analyze market patterns. It’s important to recognize that cryptocurrency prices are highly volatile and can change rapidly.

Therefore, staying informed about the price of BeamX is crucial for individuals engaging with this digital asset. By remaining vigilant and observant of price fluctuations, one can navigate the dynamic landscape of BeamX with a well-informed perspective.

BeamX Price Predictions

Monitoring BeamX’s price fluctuations can offer valuable insights for decision-making, given its dynamic nature and potential trends. Analysts predict gradual growth for BeamX in the coming months, driven by its distinctive privacy features and versatility across various industries.

The increasing recognition and advanced technology of BeamX are likely to attract more investors, potentially influencing its price upwards. BeamX’s focus on privacy and scalability positions it for a favorable price trajectory, appealing to investors interested in long-term value.

Its adaptability across different sectors further enhances its potential for sustained growth and returns. In the ever-changing crypto market, BeamX’s secure and efficient transaction capabilities, along with its privacy-oriented design, could contribute to price stability and upward movement.

Should you Buy BeamX Crypto

When considering the potential of BMEX Crypto for your investment portfolio, it’s important to evaluate its features objectively. BMEX focuses on privacy enhancements, secure transactions, and scalability, making it appealing for both individual and business investors.

Its use of Mimble Wimble technology sets it apart, offering improved privacy and efficiency in transactions. With increasing recognition for its unique attributes and possible applications in various sectors, such as healthcare, finance, and logistics, BMEX is seen as a disruptive force in the digital economy.

The cryptocurrency’s emphasis on privacy and usability, along with its innovative approach, suggests that investing in BMEX could provide opportunities for portfolio growth and diversification.

Before making any decisions, it’s advisable to monitor market trends and assess whether BMEX aligns with your investment objectives.

Where to Buy BeamX Crypto

When looking to buy BMEX Crypto, it’s advisable to consider popular cryptocurrency exchanges that support its trading. Platforms such as Binance, KuCoin, and Hotbit facilitate the trading of BMEX against other cryptocurrencies or fiat currencies. These exchanges offer a user-friendly interface for purchasing and selling BMEX tokens, enabling participation in the growing market for this cryptocurrency.

To acquire BMEX, one can create an account on one of these exchanges, deposit funds, locate BMEX in the trading pairs, and execute transactions efficiently.

It’s important to be aware of any specific requirements or trading pairs associated with BMEX on these platforms to ensure a smooth buying process. Factors like fees, security measures, and trading volume should be taken into consideration when selecting an exchange to buy BMEX Crypto.

Leveraging these reputable exchanges allows individuals to obtain BMEX tokens and explore potential investment opportunities in this privacy-focused and scalable cryptocurrency.

Frequently Asked Questions

Are Beam and Beamx the Same Coin?

No, Beam and BeamX are not the same coin. BeamX is an upgraded version of Beam, offering enhanced privacy and transactions. It is gaining attention in the crypto sphere, positioning itself as a revolutionary asset.

What Is the Difference Between Beam and Beamx?

The difference between Beam and BeamX lies in their privacy features and transaction capabilities. BeamX enhances privacy with Mimble Wimble and blockchain technology. It aims to provide secure, scalable, and efficient transactions, catering to various sectors.

What Chain Is Beamx?

BMEX operates on blockchain technology with a proof of work consensus mechanism. It leverages Mimble Wimble to enhance privacy and streamline transaction data.

Conclusion

BeamX Crypto is a digital currency that aims to provide enhanced privacy features and transaction efficiency. It’s positioned as a potential game-changer in the cryptocurrency space.

The platform is designed to offer users a secure and private way to conduct transactions. While the specifics of its technology and implementation may vary, BeamX Crypto emphasizes privacy as a key feature.

Investors interested in this digital currency should conduct thorough research and consider the potential risks and benefits before getting involved.

Other Cryptocurrencies you should check:

Velodrome Finance, Bad Idea AI, UNUS SED LEO, Trias Lab and DIMO Crypto.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Crypto fails as money and what needs to change

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In December 2024, the price of Bitcoin (BTC) passed $100,000 for the first time. This surge, driven by optimism over a pro-crypto US administration, marked a historic moment. Yet, despite the excitement, it also highlighted an ongoing problem—cryptocurrencies still aren’t ready for everyday use.

Bitcoin and other cryptocurrencies have become popular as investments, similar to stocks or as some experts call it—Bitcoin is the ‘digital gold.’ But when it comes to being used as real money, they fall short. High fees, slow transactions, and often overcomplicated systems keep crypto from being practical for most people. If the industry wants to see mass adoption, it needs to fix these problems and focus on making crypto easy to use and accessible to everyone.

Old blockchain systems are holding crypto back

When Bitcoin launched, its decentralized design was groundbreaking. It showed the world a new way to secure and transfer money without relying on banks that are prone to external factors such as inflation and geopolitical constraints. Yet, over a decade later, its original system is struggling to keep up.

Bitcoin’s block creation process, which happens every 10 minutes, limits how many transactions it can handle. During busy times, fees go up, and transactions take longer to confirm. This makes using Bitcoin for small, everyday payments inconvenient and expensive.

L2 solutions like the Lightning Network try to make Bitcoin faster and cheaper, but such solutions still depend on the same slow base layer. This means the core problem remains unsolved. As a result, Bitcoin is mostly used as a store of value or an investment rather than as a way to pay for everyday commodities. For crypto to be widely adopted, it needs to move beyond this basic limitation.

Crypto needs to scale for everyday use

If cryptocurrencies are to work as money for everyone, they need to scale up in a big way. Today’s leading flagships like Bitcoin and Ethereum (ETH) can’t handle the volume of transactions that a global payment system requires. Congestion and high fees make them impractical for daily use.

Traditional payment systems like Visa and Mastercard, on the other hand, process millions of transactions every day with ease. For crypto to compete, it must match or exceed this level of performance. Small improvements aren’t enough. The industry needs bold new designs for blockchains that can handle massive transaction volumes without breaking a sweat.

Without this kind of scalability, crypto will stay stuck as a niche tool – good for speculation but not for replacing traditional financial systems.

The case for hybrid models and stablecoins

One way forward might be through hybrid systems that combine crypto’s strengths with the stability of fiat money. Stablecoins, which are tied to fiat currencies like the US dollar, already show promise. They provide the speed and privacy of crypto while avoiding the price swings of coins like Bitcoin.

Stablecoins are gaining traction in countries where local currencies are unstable, offering people a safe and practical way to store and transfer value. However, they’re only part of the solution. The industry needs a seamless system that integrates stablecoins, traditional cryptocurrencies, and even digital fiat currencies.

Such a system would give users the flexibility to choose what works best for them while keeping the key benefits of decentralization, speed, and security.

Changing how people see crypto

Another big hurdle to crypto adoption is how people view it. Bitcoin is often called ‘digital gold,’ which makes people think of it as an investment to hold onto rather than spend. While this idea has helped Bitcoin grow in value, it has also hurt its potential to be fully integrated into everyday transactions for lesser commodities.

For crypto to succeed as money, this perception needs to change. People should see it as a tool for everyday transactions, whether they’re buying coffee or sending money abroad. This requires not just better technology but also better communication and transparency from the industry. The message should be clear—crypto is simple, reliable, and ready to use in the real world.

The path ahead

We should, of course, consider that the industry keeps focusing on speculation and addressing crypto as a stock market while playing around with price gains, in that case, the industry and crypto will fail to reach their full potential and remain as a niche tool. But if the priorities were to shift into practical solutions, crypto could truly become the money of the future.

The road ahead isn’t easy, but the goal is worth it. Crypto doesn’t just need new technology—it needs a new mindset. The question isn’t whether crypto can change the world. The question is whether we’re ready to make it happen.

CryptoCurrency

Nibiru EVM (Nibiru V2) Codebase Finalized Following Rigorous Security Audits

[PRESS RELEASE – Tortola, British Virgin Islands, January 23rd, 2025]

Nibiru, a secure and high-performance blockchain, has reached successful code completion for its upcoming Nibiru EVM (Nibiru V2) upgrade.

“This milestone marks a key step in the evolution of Nibiru. Smoothly launching an initiative like this is about doing small things right to make a big difference. Nibiru places a heavy emphasis on security for users and their digital assets. The audits and resulting mitigation changes help ensure that the new generation of apps on Nibiru will deploy in a secure and efficient environment, stated Unique Divine, Co-founder of Nibiru and CEO of Nibi, Inc.”

These security audits of Nibiru focused on the core L1 logic. The team started with a consultative security audit in October 2024 by Zenith, where Code4rena assembled a curated team of auditors tailored to the project’s specific codebase and needs. After addressing potential security findings from this audit, the team sponsored a competitive Code4rena audit in November 2024. This second audit expanded its scope to include Nibiru’s Ethereum JSON-RPC, in addition to the core L1 and the Nibiru EVM.

What is Nibiru EVM (Nibiru V2)?

The Nibiru EVM Upgrade, also called Nibiru V2, is a “purely additive” enhancement to Nibiru that makes it an EVM-equivalent execution engine. This allows Ethereum-based application development teams to more easily build on Nibiru and take advantage of widely used tools like MetaMask and Coinbase Wallet.

The team’s Jan 2025 Ecosystem Update also mentions the launch of several products on top of Nibiru V2, including a Uniswap V3 deployment by Oku, Astrovault’s cross-chain value capture DEX, tokenized private credit and T-bills, and Bridged USDC.

Nibiru Lagrange Point: A Glimpse into the Future

Building upon the progress of the Nibiru EVM upgrade, Nibiru is unveiling the initial stages of its ambitious “Nibiru Lagrange Point” roadmap. This roadmap outlines a series of innovative advancements designed to further enhance the scalability, decentralization, and user experience on Nibiru.

Nibiru Lagrange Point combines:

- FunToken Mechanism, a unification of EVM and non-EVM tokens that don’t rely on third-party bridges

- Pipeline-Aware Reordered Execution (PARE) for higher throughput

- Optimized validator dynamics in NibiruBFT, including Boneh–Lynn–Shacham (BLS) Signatures and novel grouping algorithms to reduce overhead and speed up block times.

- Mempool Lanes for orderly transaction flow

These design innovations are meant to “address bottlenecks across every layer of the stack, paving the way for advanced DeFi, real-world assets (RWAs), AI-driven bots, and high-traffic cultural projects—all running seamlessly on a single platform”, according to Harvey Liu, Research Engineer at Nibi, Inc.

About Nibiru

Nibiru is a high-performance MultiVM blockchain that achieves fast finality, a block time of less than 1.8 seconds, and robust security. Backed by $20.5 million in funding from NGC Ventures, HashKey Capital, Kraken Ventures, and Tribe Capital, Nibiru enables developers to build and deploy smart contract applications interoperable across multiple virtual machines, such as the Ethereum Virtual Machine (EVM) and WebAssembly (Wasm).

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bitcoin’s (BTC) Outlook is Bullish, Prices Expected to Remain Elevated: Deutsche Bank

The outlook for bitcoin (BTC), the world’s largest cryptocurrency, is positive, and its price is expected to remain elevated in 2025, German lender Deutsche Bank (DB) said in a report Wednesday.

A more favorable regulatory and political backdrop in the U.S., growing institutional adoption, and looser Federal Reserve monetary policy, are all expected to support the cryptocurrency’s price, the report said.

The Trump administration’s support for crypto means the market’s current bull run should continue, and ongoing presidential backing is key for the “continuation of crypto’s golden era,” analyst Marion Laboure wrote.

While President Trump didn’t sign any crypto-related executive orders on his first day in office, the announcement that the Securities and Exchange Commission’s (SEC) will develop a regulatory framework for digital assets is a first step towards an overhaul of the industry, the report said.

The appointment of Paul Atkins as SEC chair is also indicative of a “shift towards an innovation-friendly approach,” Deutsche Bank noted.

With the Markets in Crypto-Assets (MiCA) regulation coming into force in the EU in December, the European crypto market now enjoys increased legitimacy and security, the report added.

More clarity about the potential establishment of a U.S. bitcoin reserve could be forthcoming in the first quarter, the bank said.

Read more: Bitcoin No Longer a Niche Investment as Institutional Adoption Takes Off: WisdomTree

CryptoCurrency

BitMEX Launches Chinese New Year Competition: Win a 188,888 USDT Prize Pool

Mahe, Seychelles, January 23rd, 2025, Chainwire

BitMEX, the OG crypto derivatives exchange, today launched the Slither to Success Trading Competition to kick off the Lunar New Year. Participants can compete for a share of 188,888 USDT.

The competition will run from 23 January 2025 at 11:00 AM (UTC) to 16 February 2025 at 11:59 PM (UTC). Users can participate in the competition anytime during the campaign period.

Rewards will be distributed across three leaderboards:

- Highest Trading Volume: 70% of the total prize pool will be shared by the Top 50 Traders ranked by trading volume

- Highest PnL: 15% of the total prize pool will be shared by the Top 50 Traders ranked by PnL

- Highest ROI%: 15% of the total prize pool will be shared by the Top 50 Traders ranked by ROI%

Traders can compete for the highest trading volume, PnL, or ROI%, with each trader eligible to win rewards across all three leaderboards.

Bottom traders will also stand to benefit, with an opportunity for a 1,000 USDT bonus available to the bottom 5 traders with the highest loss in PnL.

To participate in the Slither to Success Trading Competition, new customers must be fully verified on BitMEX. For full details and registration, users can visit here.

About BitMEX

BitMEX is the OG crypto derivatives exchange, providing professional crypto traders with a platform that caters to their needs through low latency, deep crypto native liquidity, and unmatched reliability.

Since its founding, no cryptocurrency has been lost through intrusion or hacking, allowing BitMEX users to trade safely in the knowledge that their funds are secure. So too that they have access to the products and tools they require to be profitable.

BitMEX was also one of the first exchanges to publish their on-chain Proof of Reserves and Proof of Liabilities data. The exchange continues to publish this data twice a week – providing assurance that they safely store and segregate the funds they are entrusted with.

For more information on BitMEX, users can visit the BitMEX Blog or www.bitmex.com, and follow Telegram, Twitter, Discord, and its online communities. For further inquiries, users may contact press@bitmex.com.

ContactBitMEX PressBitMEXpress@bitmex.com

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Upbit, Bithumb compensate users after service outages during martial law

Upbit and Bithumb will compensate investors $2.5 million after service outages caused by a surge in crypto activity during South Korea’s martial law declaration.

CryptoCurrency

Calls for DOUBLE-DIGIT tax rises up to 35% as local authorities struggle to hit Labour targets

Britons are warned that their council tax bills could rise by at least 10 per cent as local authorities call for double-digit increases to meet Labour’s targets.

These figures far exceed the normal 4.99 per cent cap, with local authorities grappling with mounting financial pressures.

Eight councils are seeking dramatic double-digit increases of up to 35.7 per cent.

Households in areas from Yorkshire to Birmingham, London and the South face the prospect of inflation-busting rises that could take effect from April 1, 2025.

The proposed increases come amid rising pressure, with housing high on Labour’s agenda and the party setting an ambitious target of 1.5 million new homes over the course of this Government.

Burnham-on-Sea and Highbridge have already approved a staggering 35.7 per cent rise, while The Royal Borough of Windsor and Maidenhead is proposing a 25 per cent increase.

Bradford Council is pursuing a potential 14.99 per cent increase. For struggling residents, the Council has promised additional support measures, though details will only be confirmed once the Government approves the final increase level.

In Burnham-on-Sea and Highbridge, councillors have approved a 35.7 per cent rise

GETTY

Birmingham is also plotting a 10 per cent hike amid ongoing service challenges.

Other authorities seeking double-digit rises include Hampshire pushing for a 15 per cent increase, Carmarthenshire and Cheshire East wanting 10 per cent, and Newham in London at 10 per cent.

The unprecedented wave of proposed increases comes as councils struggle to maintain essential services and manage mounting financial difficulties.

In Burnham-on-Sea and Highbridge, councillors have approved a 35.7 per cent rise, increasing Band D properties from £143.41 to £194.62 per year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The council cited Somerset Council’s financial emergency as forcing them to take on additional costs, including highway maintenance, CCTV, and public facilities.

Bradford Council is awaiting Government response on their proposed 14.99 per cent increase, with council leader Susan Hinchcliffe writing to request permission for various options between 9.99 per cent and 14.99 per cent.

Birmingham City Council’s proposed 10 per cent increase comes as the authority faces significant financial challenges and service disruptions.

Their financial crisis has deepened, with plans to cut £153million from its public services despite being embroiled in an ongoing ‘rat tax’ row as well as a bin crew strike that has affected local services a bin crew strike that has affected local services.

LATEST DEVELOPMENTS:

The authority’s financial situation has reached a critical point, with the council now officially classified as bankrupt.

The Royal Borough of Windsor and Maidenhead’s proposed 25 per cent rise would represent one of the largest increases among English councils.

The average council tax for a Band D property in England currently stands at £1,668 per year, approximately £169 monthly. A 25 per cent increase, as proposed in some areas, could add £42.25 to monthly bills, bringing the total to £211.25. Higher band properties would face even steeper increases under the proposed changes.

All councils seeking to exceed the standard 4.99 per cent cap must obtain special permission from the Ministry of Housing and Local Communities. This process typically requires a local referendum alongside the formal Government application.

Bradford Council leader Susan Hinchcliffe acknowledged the impact on residents, stating: “We realise that no one wants to see an increase in council tax when other bills are also rising. That’s why, if approved, we’d put in place a fund to support the least well-off.”

Last year town halls warned they may not meet the Government’s house-building targets unless council tax is raised by 10 per cent

GETTY

Last year town halls warned they may not meet the Government’s house-building targets unless council tax is raised by 10 per cent. Around 84 per cent of district councils can’t afford enough planning officers to support Labour’s pledge of 1.5 million new homes over the next five years, according to research.

The District Council Network (DCN) called on Chancellor Rachel Reeves to provide additional funding for planning departments in her upcoming Budget and allow council tax hikes of up to 10 per cent, double the current limit.

Richard Wright, DCN’s planning and growth spokesman, emphasized that underfunded planning departments risk subpar developments.

He said: “If the Government’s house-building revolution is to succeed, we need a step change in the recruitment and retention of planners.”

He warned that without proper resources, housing could be built in undesirable locations, undermining long-term success.

CryptoCurrency

Coins to watch for big gains

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Trump’s inauguration sparks crypto market frenzy, with Bitcoin surging to $106,000 and emerging tokens like Yeti Ouro poised for explosive growth.

President Trump’s inauguration has caused a big move in the crypto market. His inaugural speech didn’t mention crypto, but creating an SEC “crypto task force” under Acting Chairman Mark Uyeda was a big plus. This has pushed Bitcoin price to $106,000 this week, and the overall market looks promising.

Since we’re likely entering a bull market, it is natural that investors will be looking for the cryptocurrencies with the most potential for the highest returns. Two interesting choices this year are XRP and Yeti Ouro (YETIO).

XRP price: Limited upside

The popular XRP token is a cryptocurrency created by Ripple Labs for fast, low-cost international payments. Its adoption by financial institutions has cemented its position in the cross-border payment space. As of January 22, 2025, XRP price is at $3.19 on Coinmarketcap, a high of $3.23, and a low of $3.02.

XRP’s utility in global transactions and its partnerships with financial institutions make it a stable choice for investors looking for stability. However, there is still some regulatory uncertainty, especially with the SEC’s scrutiny. The new crypto task force may bring clarity, but the timeline and outcome are unknown.

Predictions for XRP are through the roof. $33 is 1000% above the current XRP price, which is unlikely to happen in the short term. XRP is a stable investment with not much upside.

Yeti Ouro: High growth potential

Yeti Ouro, a new ERC-20 token on the Ethereum blockchain, combines meme virality with Play-to-Earn (P2E) gaming. Its main game, Yeti Go, allows players to earn YETIO tokens by racing in immersive gameplay built with Unreal Engine. This Meme & Play To Earn hybrid taps into the booming blockchain gaming market, projected to reach $65.7 billion by 2027.

Currently priced at $0.017 in Stage 2 of its presale, YETIO is a great entry point for early investors. The best time to invest in a cryptocurrency is during the early stages, especially after a presale, before the retail investors catch wind of any promising tokens. Early investors in Yetio Ouro have already seen a more than 40% ROI.

Once retail investors find out about a coin, it usually surges due to the high number of investors buying into the coin; the Trump memecoin is a good example.

Also, experts and analysts predict YETIO will reach $5 by the end of 2025, a 5000% gain. This is based on Yeti Ouro’s innovative concept, early adoption, and alignment with growing market trends. Yeti Ouro has validated its security stance with an audit from Solid Proof.

XRP vs. YETIO: Which one will grow more?

When it comes to returns, Yeti Ouro is the clear winner for exponential growth. It has a much lower market cap of only $13 million compared to XRP’s $183 billion, which is 14,077 times larger.

The combination of gaming and meme virality could attract a wide audience and will keep demand for YETIO tokens high.

XRP is an established cryptocurrency, but its growth is limited by market saturation and regulatory issues. In addition to this, due to XRP being a blue chip cryptocurrency with a huge market cap of over 183 billion, it would need a market cap of 2.013 trillion, which is close to the market cap of Bitcoin (2.09 Trillion), to see a 1000% return.

Conclusion

The cryptocurrency market post-Trump inauguration has many risks and opportunities. For those who want stability, XRP is a safe choice. However, it does not have the same growth potential as smaller, emerging coins that are attached to large and growing industries in the crypto space.

For those who want high-reward opportunities, Yeti Ouro is a great choice. Its P2E gaming and meme narratives work well with the growing market trends, and that makes it a risky but promising investment for those who want exponential returns.

For more information on Yeti Ouro, visit their website, X, Telegram, or Discord.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Bitcoin Realized Cap Hits $832B As $100K Inflows Begin To Slow

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

CryptoCurrency

Retail Demand for BTC Provides Firm Underpinning in Weaker Crypto Market

By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin and most major cryptocurrencies are weaker after Chicago Mercantile Exchange, a proxy for institutional activity, denied reports of listing futures tied to XRP and SOL. Traditional markets are also holding their breath for the expected Bank of Japan interest-rate increase on Friday.

Despite BTC’s continued range play above $100,000, retail demand remains robust. Glassnode’s shrimp-Crab cohort, which includes addresses holding up to 10 BTC, have absorbed 1.9 times the newly mined supply last month, totaling over 25,600 BTC. Meanwhile, long-term holders have slowed their spending and profit-taking activities, indicating a cautious, but firm, commitment to their investments.

Still, dropping below $100,000 might prove costly. According to Wintermute’s OTC trader Jake Ostrovskis, that would “frame Monday’s inauguration as a sell-the-news event and the narrative could switch pretty quickly.”

Reports suggest the number of whale wallets holding between 1 million and 10 million XRP has surged to an all-time high of 2,083, signaling increased accumulation and confidence in its future performance.

In the world of innovation, chatter around Bitcoin Synths is gaining traction on X. These synthetic assets allow users to benefit from bitcoin’s price movements without actually owning the cryptocurrency. Bitcoin Synths can be traded or used as collateral in lending protocols, avoiding the complexities associated with wrapped tokens and specialized bridges.

Ethereum layer-2 protocols are also making headlines with record transaction volumes, even as concerns about their capacity nearing limits persist.

On the macroeconomic front, recent data from the Labor Department shows that the “all tenant rent” index, an indicator of shelter inflation in the Consumer Price Index (CPI), rose at a slower pace last quarter. The data suggest that recent worries about inflation may be overdone and the Fed could pivot away from its hawkish forecast, which would be a positive sign for risk assets. Stay alert!

What to Watch

- Crypto

- Macro

- Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

- Initial Jobless Claims Est. 215K vs. Prev. 217K.

- Jan. 23, 10:00 a.m.: The National Association of Realtors releases December 2024 U.S. Existing Home Sales report.

- Existing Home Sales Est. 4.16M vs. Prev. 4.15M.

- Existing Home Sales MoM Prev. 4.8%.

- Jan. 23, 4:30 p.m.: The Fed releases the H.4.1 report, the central bank balance sheet, for the week ended Jan. 22.

- Total Reserves Prev. $6.83T.

- Jan. 23, 6:30 p.m.: Japan’s Ministry of Internal Affairs and Communications releases December 2024’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. 0.6%.

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.7%.

- Inflation Rate YoY Prev. 2.9%.

- Jan. 23, 10:00 p.m.: The Bank of Japan (BoJ) releases Statement on Monetary Policy.

- Interest Rate Decision Est. 0.5% vs. Prev. 0.25%.

- Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

Token Events

- Governance votes & calls

- Morpho DAO is discussing reducing incentives by 30% across all networks and assets.

- Yearn DAO is discussing funding and endorsing a subDAO called Bearn to focus on building and launching products on Berachain.

- Frax DAO is discussing a $5 million investment in World Liberty Financial (WLFI), the crypto project backed by the family of U.S. President Donald Trump.

- Jan. 23: Livepeer (LPT) is hosting a Core Dev call.

- Jan. 24: Arbitrum BoLD’s activation vote deadline. BoLD allows anyone to participate in validation and defend against malicious claims to an Arbitrum chain’s state.

- Jan. 24: Hedera (HBAR) is hosting a community call at 11 a.m.

- Unlocks

- Jan. 31: Optimism (OP) to unlock 2.32% of circulating supply worth $52.9 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Token Launches

- Jan. 23: Sky (SKY) is being listed on Bitget.

- Jan. 23: Animecoin (ANIME) is launching, with claims starting at 8 a.m. The token will be listed on multiple exchanges including Binance, OKX and KuCoin.

Conferences:

Token Talk

By Francisco Rodrigues

- Azuki, a non-fungible token (NFT) collection, is introducing its Animecoin (ANIME) today on Ethereum and Arbitrum. The token was announced on Jan. 13.

- An airdrop will encompass Azuki NFT holders, Hyperliquid HYPE stakes, some Arbitrum ecosystem participants and Kaito yappers.

- It will also include certain anime communities and BNB token holders who, between Jan. 17 and Jan. 20, subscribed to Simple Earn with their tokens on Binance.

- The debut builds on a growing trend of NFT collections launching their own tokens, a trend that started in 2021 when Bored Ape Yacht Club (BAYC) launched ApeCoin.

- Other examples include DeGods’ DUST and Pudgy Penguins’ PENGU tokens, which have a $1.6 billion market capitalization.

- Other signs indicate the NFT market is heating up, with Nansen recently pointing out that a Crypto Punk was sold for 170 ETH (around $540,000) while an Azuki was sold for 165 ETH. The Azuki NFT had been bought a month before for 105 ETH.

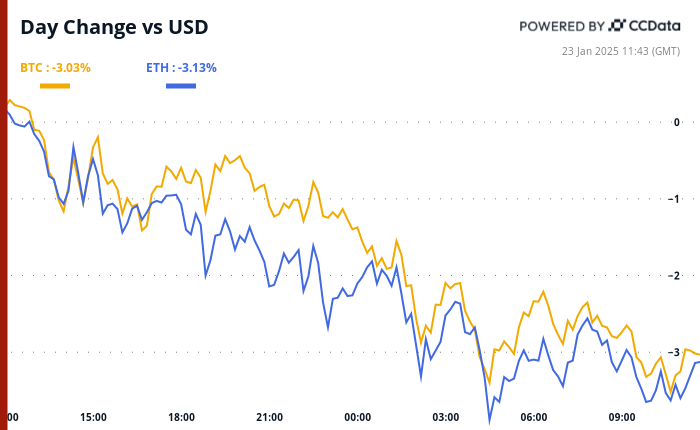

Derivatives Positioning

- The cumulative volume delta indicator reveals that major cryptocurrencies, with the exception of TON, have experienced net selling pressure in the perpetual futures markets over the past 24 hours.

- Block flows on Deribit and Paradigm featured long positions in short-dated BTC puts at $100K, $95K and $70K. An entity bought ETH put at $2.9K.

- Front-end BTC and ETH calls now traded at par with puts.

Market Movements:

- BTC is down 4.1 % from 4 p.m. ET Wednesday to $102,020 (24hrs: -2.71%)

- ETH is down 3.85% at $3,206.18 (24hrs: -2.83%)

- CoinDesk 20 is down 3.61% to 3,799.21 (24hrs: -3.58%)

- CESR Composite Ether Staking Rate is down 15 bps to 3.15%

- BTC funding rate is at -0.0019% (-2.08% annualized) on OKX

- DXY is unchanged at 108.25

- Gold is down 0.35% at $2,761.10/oz

- Silver is down 0.73% to $30.57/oz

- Nikkei 225 closed up 0.79% at 39,958.87

- Hang Seng closed down 0.4% at 19,700.56

- FTSE is unchanged at 8,538.7

- Euro Stoxx 50 is unchangedat 5203.6

- DJIA closed +0.3% to 44,156.73

- S&P 500 closed +0.61% at 6,086.37

- Nasdaq closed +1.28% at 20,009.34

- S&P/TSX Composite Index closed +0.12% at 25,311.5

- S&P 40 Latin America closed +1.21% at 2,297.32

- U.S. 10-year Treasury is up 3 bps at 4.59%

- E-mini S&P 500 futures are down 0.19% to 6,109.00

- E-mini Nasdaq-100 futures are down 0.56% to 21,876.75

- E-mini Dow Jones Industrial Average Index futures are unchaged at 44,384.00

Bitcoin Stats:

- BTC Dominance: 58.59

- Ethereum to bitcoin ratio: 0.031

- Hashrate (seven-day moving average): 781 EH/s

- Hashprice (spot): $58.9

- Total Fees: 8.5 BTC/ $876,410

- CME Futures Open Interest: 188,396 BTC

- BTC priced in gold: 37.1 oz

- BTC vs gold market cap: 10.56%

Technical Analysis

- BTC’s retreat from Monday’s high is teasing a formation of a double top bearish reversal pattern.

- A move below the horizontal line would confirm the pattern, potentially bringing more chart-led sellers to the market.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $377.31 (-3.03%), down 1.89% at $370.19 in pre-market.

- Coinbase Global (COIN): closed at $295.85 (+0.56%), down 2.59% at $288.18 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$32.81 (+4.99%)

- MARA Holdings (MARA): closed at $19.69 (+0.66%), down 2.54% at $19.19 in pre-market.

- Riot Platforms (RIOT): closed at $13.14 (+3.14%), down 1.75% at $12.91 in pre-market.

- Core Scientific (CORZ): closed at $15.97 (+4.58%%), down 1.63% at $15.71 in pre-market.

- CleanSpark (CLSK): closed at $11.14 (+1.64%), down 2.51% at $10.86 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.53 (+2.24%), up 2.58% at $28.27 in pre-market.

- Semler Scientific (SMLR): closed at $62.11 (-4.36%), up 2% at $64.90 in pre-market.

- Exodus Movement (EXOD): closed at $41.00 (+2.5%), down 2.07% at $40.15 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: $248.7 million

- Cumulative net flows: $39.23 billion

- Total BTC holdings ~ 1.161 million.

Spot ETH ETFs

- Daily net flow: $70.7 million

- Cumulative net flows: $2.81 billion

- Total ETH holdings ~ 3.648 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows a spike in the number of active addresses on Solana.

- Addresses holding USDC led the growth as TRUMP token frenzy gripped the market over the weekend.

While You Were Sleeping

In the Ether

CryptoCurrency

New AI Agent TEA Revolutionizes On-Chain Activity

Vaduz, Liechtenstein, January 23rd, 2025, Chainwire

Griffin AI has introduced the Transaction Execution Agent (TEA), an AI-powered solution designed to simplify Ethereum-based transaction management, which is now available for beta testing. As decentralized finance (DeFi) evolves, the need for intuitive and efficient tools continues to grow. TEA addresses this by identifying users’ on-chain requirements—such as wallet queries, asset swaps, and transaction status checks—and preparing actions for seamless user approval.

Redefining blockchain interactions with AI

Complex blockchain interfaces often deter newcomers and slow down even experienced users. Griffin AI’s Transaction Execution Agent (TEA) allows users to interact in everyday language. It identifies user intent, pulls relevant on-chain data, and then presents easy-to-approve transaction proposals for tasks like sending tokens, monitoring balances, or swapping assets. By streamlining these workflows into a simple conversation rather than multiple separate apps, TEA ensures a more confident and secure on-chain experience.

Introducing Griffin AI’s Transaction Execution Agent (TEA)

TEA bridges blockchain protocols and everyday usability by offering a conversational interface: users ask the AI in natural language to perform tasks like “send 0.5 ETH to my friend” or “swap tokens on Uniswap.” TEA interprets these requests, checks the necessary data (balances, gas fees, contract addresses), and then prepares the appropriate transaction steps for user confirmation. By focusing on actionable tasks, TEA streamlines on-chain engagement, making it more accessible to both newcomers and experienced users alike.

“By providing intuitive, conversational interface, we’re stripping away the barriers that have made DeFi complex and inaccessible for so many users,” said Oliver Feldmeier, CEO of Griffin AI. “This is about empowering individuals to engage confidently with blockchain technology, no matter their level of experience.”

Key features of Griffin AI’s TEA include

- Conversational, language-based interface

Users can tell TEA in everyday language exactly what they need, whether it’s sending tokens or checking balances. If critical information is missing or unclear, TEA will prompt the user for clarification. By interpreting these natural-language inputs and confirming any ambiguities, TEA helps users avoid manual errors and confusing interfaces.

- Seamless transaction sending

TEA identifies when users want to send tokens, pulls essential details (recipient address, token balance, gas fee estimates), and constructs a transaction. This reduces the chance of human error, allowing users to confirm with one click in their connected wallet.

- Easy-to-execute swaps

When users need to swap tokens, TEA fetches relevant liquidity pools (e.g., Uniswap) and calculates pricing details. It then prepares the transaction steps, ensuring everything is set before prompting the user for final approval.

- Wallet & network integration

The agent connects with a range of Ethereum wallets – MetaMask, Browser Wallet, Trust Wallet, WalletConnect, Ledger, and more – automatically detecting balances and transaction histories. TEA is already compatible with Ethereum mainnet, Base, Arbitrum, OP Mainnet, and Polygon.

- Real-time network data

TEA continuously checks exchange rates, gas fees, and network status, helping users stay aware of real-time blockchain conditions. With this information at hand, TEA can generate accurate transaction proposals without requiring manual research.

- Transaction tracking and notifications

TEA monitors the status of each operation, sending automated updates as transactions confirm or if issues arise. This eliminates the guesswork associated with blockchain explorers, making it easier to stay informed about the progress of on-chain activity.

- Secure operations and smart validations

Before any action is executed, TEA presents a transaction proposal that users can review in detail. This proposal is checked against on-chain data to detect potential discrepancies, and only after the user manually approves in their wallet is the transaction submitted—maintaining maximum security and control.

A foundation for modular AI development

While an advanced tool for users, TEA also serves as a cornerstone for developers by offering adaptable frameworks for diverse on-chain tasks. Its design enables further customizations to expand functionality and improve accessibility as part of a range of modular agents in the Griffin AI Playground.

“Although we focused on simplifying the DeFi experience for human users with TEA’s current release, these same capabilities lay the groundwork for truly autonomous agents,” added CEO Oliver Feldmeier. “We’re teaching them how to navigate on-chain data and initiate transactions, opening the door to a future where these agents can operate without human oversight.”

Available now in open beta

Griffin AI Playground offers early access to TEA and other cutting-edge agents. With over 230,000 active users, the platform enables users to explore and test AI-driven solutions in a collaborative environment. During this open beta phase, participants are advised to limit transactions to smaller sums for testing purposes. Feedback is encouraged to refine TEA for its full launch.

According to Oliver Feldmeier, “This is just the beginning. We plan to extend TEA’s capabilities to support yield generation, staking, and bridging assets across multiple networks. Ultimately shaping TEA into a go-to toolkit for DeFi users as well as agent developers.”

About Griffin AI

Griffin AI specializes in integrating artificial intelligence with blockchain technology, creating an innovative platform for the deployment, use, and monetization of decentralized AI agents. Serving individual developers, non-technical creators, and large organizations alike, Griffin AI provides essential tools for the development and monetization of autonomous AI agents within a blockchain environment. Griffin AI is committed to leading the transformation of the DeFi AI landscape through its robust and innovative solutions.

ContactFounderOliver FeldmeierGriffin AIhello@griffinai.io

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login