CryptoCurrency

What’s Behind Ripple’s (XRP) 5% Price Surge in Minutes?

TL:DR;

- Cryptocurrency prices tend to react positively to favorable news and developments coming from big names, especially if they are outside the industry.

- XRP’s case from the past hour or so was another confirmation of this narrative, as the asset jumped by 5% in the timeframe.

The news in question came from one of the most prominent US-based derivatives marketplaces, the Chicago Mercantile Exchange. Reports from SynopticCom indicated that the Illinois-based global giant had added two of the top 10 cryptocurrencies by market cap – XRP and SOL – to its 2025 agenda.

Moreover, the page reads that futures trading for both assets will begin on February 10 if the products receive the necessary regulatory green light.

@SynopticCom: CME just added XRP and SOL futures page to their staging subdomain. Page says XRP and SOL futures are going live on Feb 10 pending regulatory review. Looks like they are preparing for the official announcement. Brace for paradise.

As always, posted this first on… pic.twitter.com/Am6fzLyApd

— Summers (@SummersThings) January 22, 2025

Although the CME Group’s team is yet to make this announcement public, the report had an immediate impact on the prices of the underlying assets.

XRP, the third-largest cryptocurrency by market cap, had declined to $3.13 ahead of the news going live but jumped by about 5% within minutes to just over $3.28. It has retraced since then slightly, but it’s still 10% up in the past week and close to the 2018 all-time high of $3.4.

SOL, which has been on a roll since the Trump meme coin mania that started last Friday, went from under $255 to $270 within the same timeframe. Solana’s native token charted an all-time high during the weekend at over $290.

The post What’s Behind Ripple’s (XRP) 5% Price Surge in Minutes? appeared first on CryptoPotato.

CryptoCurrency

Shiba Inu whales rotate into PropiChain, bet on its AI edge

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Shiba Inu whales are rotating their profits into PropiChain, betting on its AI features and potential to rise.

Shiba Inu (SHIB) whales make strategic moves by cashing out and rotating profits into new opportunities. As a result, SHIB has experienced a 3.12% dip in the past 24 hours. This shift in focus indicates a growing interest in projects that promise higher returns.

PropiChain (PCHAIN) is catching investors’ attention due to its unique AI features. The project has raised $2 million during the presale, with its token selling at $0.01.

Shiba Inu sees 883% outflows

Shiba Inu experienced a massive 883% increase in outflows, with large investors pulling out over 460 billion SHIB. Between January 15 and 16, the total Shiba Inu outflows grew from 647 billion to 1.11 trillion SHIB. This large-scale movement has left investors worried about its future price movement.

The significant outflows were driven by big investors cashing out and adjusting their positions. Some investors sold out their Shiba Inu holdings to protect their gains. This pushed Shiba Inu to drop, denoting a 10.84% decrease in the past week.

Analysts believe Shiba Inu might have limited upside potential as new meme coins take the spotlight.

Whales bet on PropiChain and its AI features

Shiba Inu whales are betting big on PropiChain’s AI-driven altcoin. The project has raised $2 million during the presale and this is only scratching the surface as new investors join the fold.

At $0.01, PropiChain could be undervalued, making it a favorite among investors in the crypto space.

Its appeal comes from real estate tokenization and fractional ownership features. This will create new opportunities for PropiChain’s users, as many of them will be able to buy portions of properties. The true impact of this model is that it allows them to diversify their portfolios and earn passive income through rental income.

However, PropiChain’s AI features are its secret weapon. The platform will allow for predictive market analysis, helping users spot lucrative real estate investments and capitalize on them before anyone else.

With its automated valuation models, users will benefit from fair and accurate property appraisals. This will allow buyers and sellers to close real estate deals faster as the pricing is provided by AI algorithms.

Additionally, smart contracts will be used to automate transactions such as auto-leasing and lease renewals. This process handles transactions on behalf of landlords and tenants, improving efficiency and reducing costs.

PropiChain also incorporates the metaverse for virtual property viewing, allowing users to walk through properties in the digital space.

To maintain the safety of users and investors, PropiChain’s smart contracts have been rigorously audited by BlockAudit, a reputable Web3 security firm.

Shiba Inu and PCHAIN in 2025

While Shiba Inu has surged thanks to the hype around meme coins, PropiChain is counting on its AI features for a significant edge in 2025.

The new altcoin is also benefiting from bull market rotations, where smart money rotates their profits from established altcoins. With a growing community of investors, PropiChain could be the dark horse of this bull market.

Investors scoop the PCHAIN token

PCHAIN could currently be one of the most undervalued tokens in the market. At $0.01, PropiChain provides growth investors with a low entry for potentially massive gains.

Due to its promising AI features, PropiChain has raised $2 million in its ongoing token presale. This is considered a stepping stone as it has been listed on CoinMarketCap, opening up an avenue to attract more investors. The listing serves as a reminder the AI-driven altcoin is committed to transparency and growth.

For more information on PropiChain, visit their website or online community.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

CLS Global Admits to Wash Trading on Uniswap Following FBI Probe

Dubai-based crypto market maker CLS Global will plead guilty to charges related to wash trading on the decentralized exchange Uniswap.

Federal prosecutors in Boston announced Wednesday that the company will face market manipulation and wire fraud charges after falling victim to an FBI sting operation.

$428K Fine and U.S. Market Ban

As part of the plea agreement, the financial services firm will pay penalties and forfeited assets totaling over $428,000. The company will also be barred from offering services to U.S. investors and will be required to file annual compliance certifications.

A press release shows that CLS Global had been providing market-making services and other related offerings for crypto companies. The investigation specifically focused on its involvement with NexFundAI, a fake digital currency company set up by the FBI that had token trading on Uniswap.

The firm admitted that it had agreed to provide services for NexFundAI, which included wash trading to fraudulently generate trading volume and attract investors.

During several video conferences between July and August 2024, an employee explained that CLS used an algorithm for self-trading, buying, and selling from multiple wallets so that the activity was not visible and appeared organic. The worker revealed, “I know that it’s wash trading, and I know people might not be happy about it.”

The UAE-based firm then proceeded to buy and sell the token on Uniswap using its own wallets, creating fake trading volume to meet exchange listing requirements and bring in potential investors.

FBI Sting Operation

CLS Global is registered in the United Arab Emirates and has more than 50 employees based outside the U.S. It provided crypto-related services accessible to American investors, with the company’s official website listing partnerships with major centralized exchanges such as Binance, Bybit, KuCoin, Bitfinex, OKX, and Bitget.

The charges against it followed an undercover law enforcement operation targeting crypto “wash trading,” a practice where assets are bought and sold by the same party to create the illusion of market activity.

The company was one of three market makers investigated in the initiative, which also led to charges against several individuals involved in manipulating digital assets that were offered and sold as securities. This case marked the first set of criminal charges against financial services firms for market manipulation and wash trading in the industry.

Meanwhile, the Securities and Exchange Commission (SEC) also filed a related civil enforcement action against CLS Global, alleging violations of securities laws. The agency is seeking permanent injunctions, disgorgement of allegedly ill-gotten gains plus interest, and civil penalties, with any money seized from the crypto firm credited to the SEC resolution.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Ethereum Is Ready For The Next Big Move – Analyst Shares Bullish Target

Ethereum (ETH) has been underperforming in recent weeks, with its price action leaving investors disappointed following last week’s flash crash and heightened volatility. Despite initial hopes for a recovery, ETH has struggled to regain momentum, trending downward since mid-December. This lack of bullish movement has left investors eager for a surge that could break Ethereum out of its current slump.

Related Reading

Adding to the anticipation, top analyst Carl Runefelt recently shared a technical analysis suggesting that Ethereum may be preparing for its next significant move. According to Runefelt, ETH is forming a 4-hour symmetrical triangle, a pattern often associated with periods of consolidation before a breakout. While the direction of the breakout remains uncertain, the formation indicates that a decisive move could be on the horizon.

As Ethereum hovers near key levels, market participants are closely monitoring the triangle’s resolution. A breakout to the upside could reignite bullish sentiment, while a breakdown may signal continued struggles for the largest altcoin. With the broader crypto market showing signs of recovery, the coming days will be crucial for Ethereum to prove its resilience and reestablish its position as a leading performer in the space. All eyes are now on ETH’s next move.

Ethereum Consolidates Before A Move

Ethereum is currently in a short-term consolidation phase, trading between key demand and supply levels as the market grapples with uncertainty. While analysts are anticipating a major move, the direction remains unclear due to heightened volatility and mixed sentiment among investors. ETH’s price action reflects a market in wait-and-see mode, with traders closely monitoring key technical levels for signs of a breakout.

Top analyst Carl Runefelt recently shared his technical analysis on X, highlighting Ethereum’s preparation for its next significant move. According to Runefelt, ETH is forming a 4-hour symmetrical triangle, a pattern that often precedes a decisive breakout. He noted that this setup comes with both bullish and bearish scenarios, depending on the direction of the breakout.

If ETH breaks above the triangle, the bullish target is set around $3,900, signaling the potential start of a new bullish phase. Conversely, a breakdown below the triangle would point to a bearish target near $2,720, indicating further downside. Runefelt emphasized the importance of monitoring this pattern as it unfolds, as the outcome could set the tone for Ethereum’s next trend.

Related Reading

With market sentiment still uncertain and volatility remaining high, Ethereum’s symmetrical triangle offers a clear framework for traders. Whether the breakout is upward or downward, it will likely mark the beginning of a significant move, shaping Ethereum’s trajectory in the weeks to come. For now, investors are keeping a close eye on this critical technical formation.

Volatility Driving The Market

Ethereum is currently trading at $3,317, navigating a market dominated by massive volatility. This heightened price action has become the primary force driving speculation and uncertainty among traders. As Ethereum struggles to stabilize, holding above critical support levels is essential to maintaining a bullish structure and avoiding further downside.

The $3,300 level has emerged as a key area of support that bulls need to defend to sustain momentum. If ETH can hold this mark and push above the $3,550 resistance with strength, it could solidify a bullish outlook and potentially lead to a stronger recovery. Breaking this level would also signal renewed confidence among investors, opening the door to a more sustained upward trend.

However, the market’s uncertainty also carries the risk of a deeper correction. Losing the $3,000 psychological level could trigger additional selling pressure, leading to a dramatic drop and testing lower support zones. Such a move would challenge ETH’s resilience and likely extend its consolidation phase.

Related Reading

As the market waits for clearer signals, Ethereum’s ability to hold above key levels will be closely watched. The coming days are critical for determining whether ETH can maintain its structure or face further volatility and downside pressure.

Featured image from Dall-E, chart from TradingView.

CryptoCurrency

Prices Rise After Report of Leaked CME Futures Addition

Payments-focused cryptocurrency XRP and world’s most-used blockchain Solana (SOL) prices spiked on Wednesday afternoon, after report that the Chicago Mercantile Exchange (CME) is adding futures contracts of both.

According to a post on X, CME have posted the futures page for XRP and SOL in their “staging subdomain.”

A screenshot of the website shows that the regulated futures could start trading on Feb. 10 pending regulatory approval. The website was not accessible at the time of publication. CoinDesk reached out to CME for comments.

“We’ve seen a slew of ETF filings for SOL and XRP futures ETFs. Typically these would use CME or CBOE futures but we don’t have any yet,” Bloomberg Intelligence ETF analyst James Seyffart told CoinDesk. “I would expect CME to list those futures in the next month assuming those issuers know something we don’t.”

XRP and SOL jumped as much as 3% in the minutes after the post started circulating on social media, TradingView data showed.

UPDATE (Jan. 22, 10:09 UTC): Adds comments from Bloomberg ETF analyst.

Read More: Solana Bull Bets Big on SOL Rallying to $400

CryptoCurrency

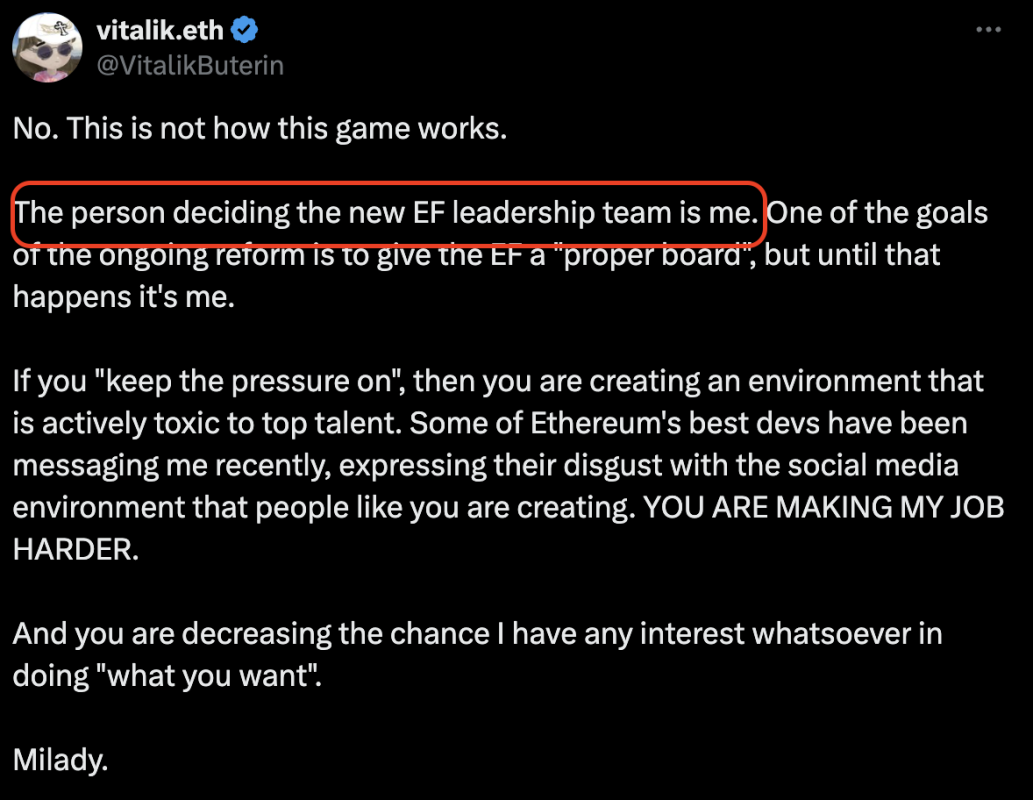

Ethereum's Looming Collapse Is A Lesson In Blockchain Integrity

In the world of decentralized networks, the battle lines are drawn not just between different blockchains but within the communities they spawn. Bitcoin, having weathered its own civil war, has emerged stronger, proving its resilience and commitment to the principles of decentralization, freedom, and Truth. Ethereum, on the other hand, is currently embroiled in internal strife, revealing a stark contrast in community ethos and leadership philosophy.

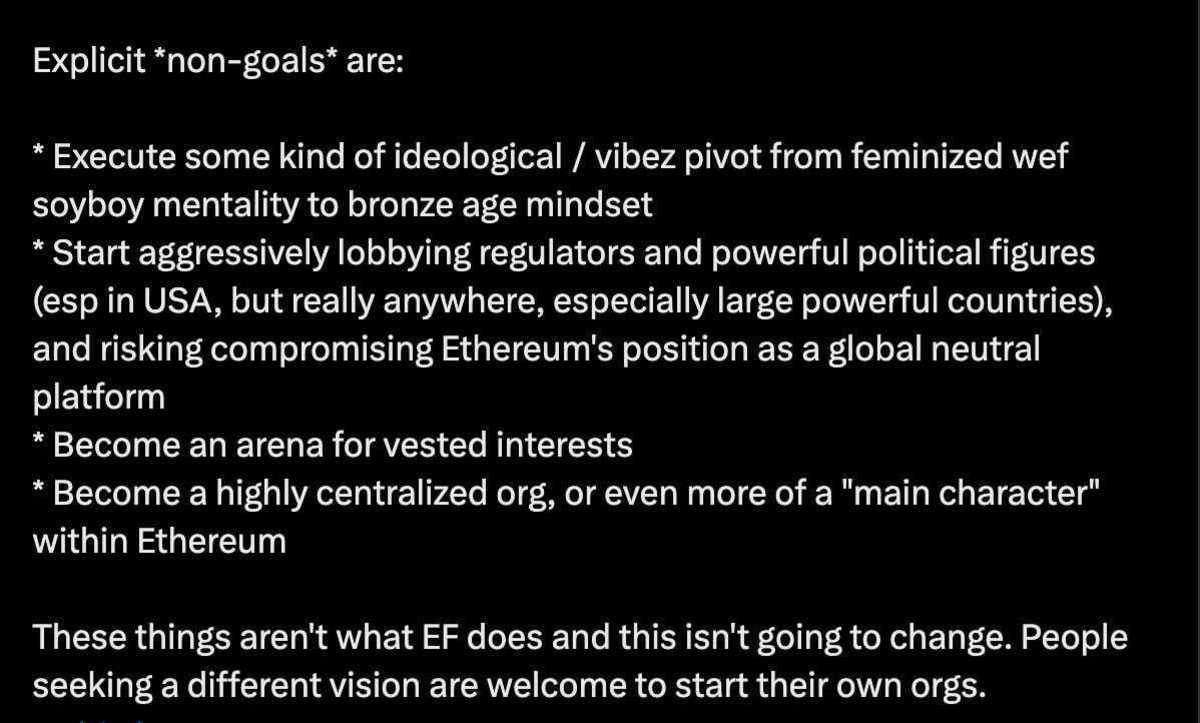

Vitalik Buterin’s recent tweets concerning the Ethereum Foundation drama are a testament to this. They expose a community that seems to prioritize PERCEPTION over substance, a hallmark of the bureaucratic and “woke” culture that has infiltrated society at large. Ethereum’s approach, under Buterin’s guidance, reflects a refusal to adopt the “bronze age mindset” that has been pivotal in Bitcoin’s success. This mentality, often derided as “toxic maximalism” by outsiders (the term “maximalism” was coined by Vitalik himself, by the way), champions unapologetic truths and a fierce defense of core values like decentralization and security.

Toxicity, in this context, becomes a virtue. It favors those willing to speak uncomfortable truths and maintain the integrity of the blockchain’s original vision. Choosing the path of bureaucratic, HR-friendly discussions leads to a landscape where managing perceptions overshadows achieving actual results. Ethereum’s current predicament is not just a long time coming but perhaps a necessary wake-up call for those who have strayed from the path of what blockchain technology was meant to achieve.

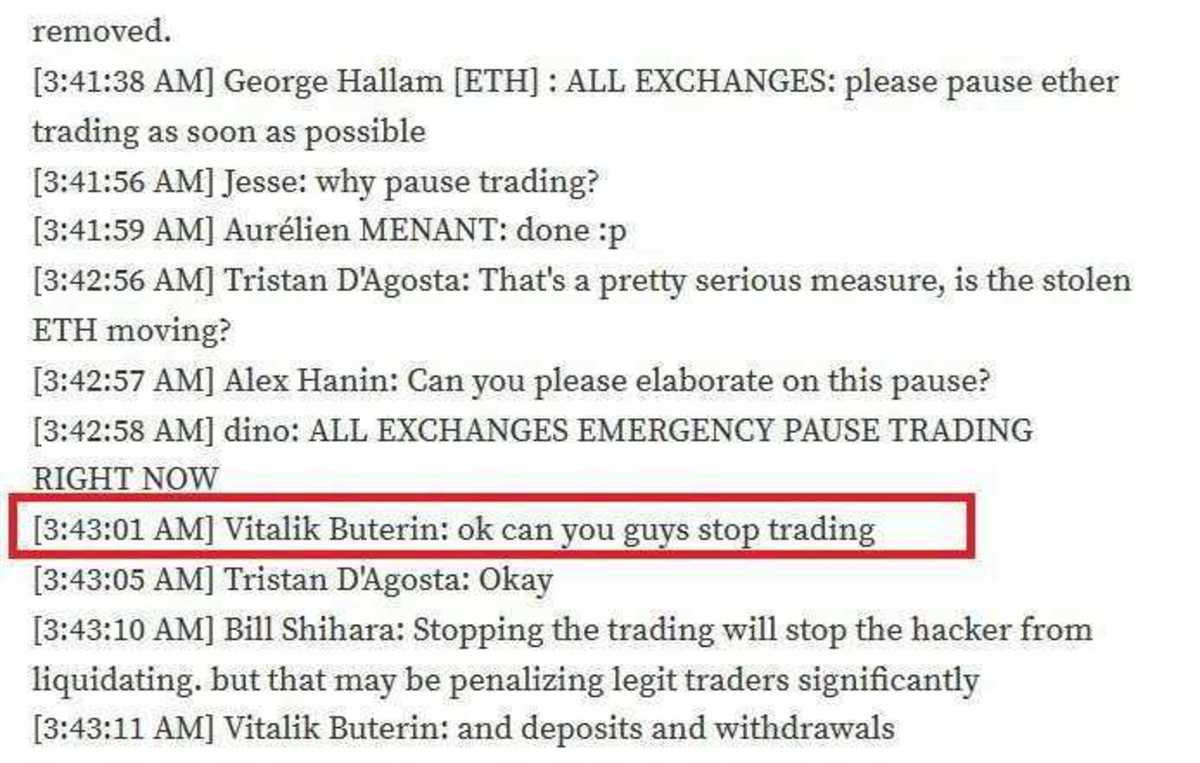

In contrast, Ethereum’s current turmoil showcases a leadership that is cracking under pressure, revealing Buterin’s true colors – not for the first time.

Bitcoin, unlike Ethereum, does not have a Foundation, and this is by design. Does this make our governance process a hundred times harder? Absolutely, and that’s precisely the point. Even though I might not always agree with the criticism leveled at Bitcoin Core, I recognize the value in knowing they can be replaced at any given moment. The Ethereum Foundation has always been a magnet for centralized control, and the power vacuum its collapse would leave will sow chaos. Bitcoin’s governance might be organized chaos, but Ethereum is now facing a spell of unorganized chaos that could further tarnish its reputation. I’d love to see Vitalik return to Bitcoin; he’s undeniably intelligent. Yet, his current role as the “man in control” is exactly why Bitcoin avoids having a public figurehead. The plebs, the node runners – are in control, and that’s the better way.

The “.ETH” community’s apparent lack of commitment to these foundational blockchain principles suggests a future where Ethereum might not just suffer greatly from its civil war but could also lose its relevance.

The irony here is palpable; while Ethereum struggles, other platforms like Solana stand to gain.

But it seems like those making this migration do not learn from their mistakes. They recognize the ugly side of Ethereum and Vitalik, but instead of seeking the true axioms of a good network, they move to an even more centralized alternative.

However, this shift is likely temporary. The so-called “On-Chain refugees” fleeing the chaos of Ethereum will eventually find their way back to Bitcoin, the original and only cryptocurrency that has consistently delivered on its promises without the drama. They need one more rug pull on the Solana side before they finally end their journey, like all of us – Bitcoin only.

This drama within Ethereum has been brewing for years, and while it might be late in coming, it’s not soon enough for Humanity. The time wasted building upon what some might argue is a fundamentally flawed system could have been better spent advancing technologies that genuinely uphold the ideals of decentralization and freedom.

As Ethereum continues to navigate its internal conflicts, it serves as a cautionary tale. It underscores the importance of a community that values Truth over narrative, freedom over control, and decentralization over centralized decision-making. Bitcoin emerging stronger from its civil war wasn’t just about survival; it was about proving the soundness of its principles. Ethereum’s ongoing struggle might just be the catalyst needed for the blockchain community to return to those roots, recognizing that in the realm of digital currencies, only those built on genuine, unyielding principles will stand the test of time.

Bonus Take – PLEASE make this happen Nic: https://x.com/nic__carter/status/1881029931011903772

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Articles Guillaume writes in particular may discuss topics or companies that are part of his firm’s investment portfolio (UTXO Management). The views expressed are solely his own and do not represent the opinions of his employer or its affiliates. He’s receiving no financial compensation for these takes. Readers should not consider this content as financial advice or an endorsement of any particular company or investment. Always do your own research before making financial decisions.

CryptoCurrency

Ethereum whales add $1B in ETH — Is the accumulation trend hinting at a $5K ETH price?

Numerous cohorts of Ethereum addresses added over 330,000 ETH in the last two weeks. Is this a sign that a $5,000 ETH price is in the making?

CryptoCurrency

Universal Credit update: DWP to overhaul benefit payment this year

The Department for Work and Pensions (DWP) has announced three significant changes to Universal Credit as part of a £240million package aimed at shifting focus from welfare to work.

The changes, outlined in the Get Britain Working White Paper, will affect millions of benefit claimants across the UK. Work and Pensions Secretary Liz Kendall said: “We promised change, and that is what we will deliver.

“For too long, millions of people have been denied opportunities to work and build a better life, and too many children are growing up in poverty, harming their life chances and our country’s future.”

The new measures will improve how the department detects and prevents fraud and error, ensuring support is targeted where needed most. The DWP expects these changes to save £7.6billion by 2029/30.

These reforms are part of the Labour Government’s broader strategy to increase employment opportunities and reduce poverty nationwide. Benefits will increase by 1.7 per cent from April 2025, worth an average of £12.50 per month for families on Universal Credit.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Massive changes are coming to Universal Credit

GETTY / PA

However, due to Universal Credit being paid monthly in arrears based on assessment periods, some claimants may not see the increase until June 2025. The new monthly standard allowance rates will see single people under 25 receive £316.98, while those 25 or over will get £400.14.

Joint claimants under 25 will receive £497.55 per month, with couples where one or both are 25 or over getting £628.10. The Secretary of State’s annual review has also confirmed a 4.1 per cent increase to the basic and new state pensions under the triple lock.

This means those in the full rate of the new state pension will see an increase of over £470 per year. Bank holiday payment dates may be affected, with benefits usually paid on the working day before if the regular payment date falls on a holiday.

A new Fair Repayment Rate will be introduced, reducing Universal Credit deductions from 25 per cent to 15 per cent of the standard allowance from April 2025. This change will benefit 1.2 million of the poorest households by an average of £420 a year.

Britons are being urged to calculate how much they could be entitled to from the DWP

GETTY

These deductions cover various debts impacting households, including energy bills, water bills, council tax, rent arrears, service charges, child maintenance and court fines.

Third-party deductions will be set at five per cent of the Universal Credit standard allowance, ranging from £15.85 for single people under 25 to £31.41 for joint claimants aged 25 or over.

Minimum deductions for rent and service charges will be reduced to 15 per cent of the Universal Credit standard allowance, down from the current level of 20 per cent.

The Government is also investing £1billion to extend the Household Support Fund in England by a full year and maintain Discretionary Housing Payments in England and Wales.

This additional funding aims to help struggling families and pensioners facing the greatest financial hardship. The DWP will continue moving claimants to Universal Credit throughout this year, with all managed migration notices expected to be sent by December 2025.

LATEST DEVELOPMENTS:

Changes are coming to Universal Credit

PA

The complete transition from legacy benefits to Universal Credit is scheduled to finish by March 2026. This migration affects claimants currently receiving Working Tax Credit, Child Tax Credit, Income Support, Income-based Jobseeker’s Allowance, Income-related Employment and Support Allowance and Housing Benefit.

Money expert Fiona Peake from Ocean Finance advises: “Universal Credit and other benefits will see updates, with new rules around work requirements. Keep track of any changes to your entitlements.

“The Government’s online benefits calculator is worth checking regularly, as you might become eligible for additional support.

“Consider using budgeting apps or speaking with a financial adviser to create a personalised action plan. The most important thing is not to bury your head in the sand – stay informed and take action early.”

CryptoCurrency

Crypto gurus pick 1 to hold

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto experts narrow down the best altcoin to hold from Sui, Toncoin, Stellar, and the rising star, Remittix.

Choosing the right altcoin is crucial for making significant gains. With hundreds of options available, it can be difficult to choose. This is where experts come in. These experts have been buzzing about four major players Sui, Toncoin, Stellar, and Remittix.

Remittix is gaining much attention because of its vision of bridging the gap between crypto and fiat with ease and transparency. Still in its presale phase, Remittix has raised close to $4.8 million, with experts predicting a 100x surge.

What makes Remittix stand out

Remittix is differentiating itself in a competitive market by emphasizing practical utility. The platform wants to transform the management of cross-border payments.

This is what makes it unique:

- Fiat-to-crypto simple conversion: Convert more than 40 altcoins into fiat instantly and transfer the funds straight to any bank account in the globe.

- Clear fees: No guesswork, no hidden fees. What is sent is exactly what the receiver gets.

- For businesses and freelancers: Businesses will have complete control by accepting cryptocurrency payments and settling in fiat thanks to the “Remittix Pay” API.

- Privacy: Cryptocurrency can be sent via Remittix without disclosing where it came from.

Because of these features, Remittix is positioned as more than an altcoin. It is a useful tool for those wishing to combine the advantages of cryptocurrency with the comforts of regular banking.

Comparing Sui, Toncoin, and Stellar

Sui

Sui is a scalable Layer-1 blockchain that has gained popularity for its developer-friendly ecosystem. Because of its own programming language, Move, it has become popular for DeFi applications.

Toncoin

Toncoin serves as the foundation for the Telegram Open Networks. It’s a fantastic ecosystem for decentralized apps, payments and communications. However, Toncoin’s growth potential is closely linked with Telegram’s performance.

Stellar

Stellar has been in business for years and is well-known for its cross-border payment solutions. It has cemented its position in the cryptocurrency market through its collaborations with financial institutions.

Why Remittix wins

Although each of the three tokens has advantages, Remittix looks to offer a higher degree of transparency and ease of conversion. Remittix has also passed through a smart contract audit to guarantee its security and transparency. The cryptocurrency is expected to develop rapidly after its debut, with intentions to list on Uniswap and large centralized exchanges.

Conclusion

Although Sui, Toncoin, and Stellar provide intriguing opportunities, Remittix stands out.

Its features could solve problems that other cryptocurrencies ignore and its presale updates demonstrate its growth trajectory. Remittix seeks to provide something special for both novice and experienced cryptocurrency investors: maximum profits with the least amount of hassle.

For more information on Remittix, visit their website or socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

CoinDesk Launches Free Registration

Dear CoinDesk Community,

Starting today, some readers will be asked to register for a free account to continue accessing our content.

This change is part of a pilot program to help us better understand the needs of our audience and ensure that we are delivering content that is relevant and tailored to your interests. Registration is quick, free, and we promise to keep your personal information safe.

This trial marks an important first step in understanding what users enjoy on the site and sets the stage for offering exciting new features. This includes advanced data tools, in-depth reports, protocol deep-dives, and investigative content, bringing together the best reporting and analysis CoinDesk has to offer.

If you’re prompted to register, we hope you’ll take a moment to join us. By doing so, you’re helping shape the future of CoinDesk and ensuring we continue to provide the very best coverage of the digital assets industry as it enters an expansive new phase.

Thank you for your ongoing support. We’ll keep you updated on our progress and share more about what’s ahead in the coming months.

Best regards,

Team CoinDesk

CryptoCurrency

Making Waves in Tampa Bay: Bitcoin Bay Foundation Joins the Gasparilla Parade of Pirates

The sounds of cannons and cheers fill the air as Tampa Bay’s famous Gasparilla Parade of Pirates begins, drawing a crowd of over 600,000 people. Among the colorful floats and pirate-themed fun, one float stands out— The world’s first Bitcoin Pirate ship proudly flying the Bitcoin Bay Foundation flag. For the first time ever, Bitcoin is part of this historic event, and Bitcoin Bay is once again making history.

As parade-goers stop by Bitcoin Bay’s tent along the parade route, they’re welcomed with food, drinks, and an invitation to learn more about this mission-driven organization. But how did Bitcoin Bay get here? How did a small group of Bitcoin fans grow into an organization big enough to earn a spot in Tampa’s biggest celebration?

Growing a Bitcoin Economy in Tampa Bay

Bitcoin Bay’s journey started in October 2021 when one of our founders, @bennyhodl, hosted the first Bitdevs meetup. It began with just a few people talking about Bitcoin outside a local restaurant, but it soon grew into something much bigger. We had a vision: to make Bitcoin Bay the go-to place for everything Bitcoin in Tampa Bay. We wanted to create a local economy powered by Bitcoin, where people could connect, learn, and spend their bitcoin.

With a clear mission and a committed team, Bitcoin Bay quickly gained steam. Weekly meetups turned into a strong network where newcomers, developers, and business owners could connect, learn, and share ideas. Bitcoin Bay became more than just a meetup; we were a resource for Bitcoin knowledge and support in the region.

The 2023 Miami Bitcoin Conference was a watershed moment for The Bay. Competing in the first Bitcoin Games against grassroots meetup groups from across the country, Bitcoin Bay won the grand prize of 1 BTC. But instead of keeping the entire prize, we chose to share half of it with other Bitcoin meetups in a follow up competition.

At the time, we had no idea what the ripple effects of this would be. We’ve since consulted with and inspired other groups to take on similar missions. Denver Bitdevs, one of the recipients, has even opened their own Bitcoin community hub called “The Space.” By sharing our prize, we showed that Bitcoin Bay is here not only for our own growth but to support Bitcoin communities everywhere.

By the end of 2023, we became the world’s first Bitcoin-only meetup to receive 501(c)(3) nonprofit status. This recognition helped us grow even more and allowed us to reach more people in the Tampa Bay area.

Building a Strong, Supportive Community

Since the beginning, Bitcoin Bay has made a real impact across Tampa Bay. Our members support each other’s businesses, like HVAC services, estate planning, and even local beef suppliers. Our ethos of Community, Prosperity, and Resilience guides us as we build a connected network where people can rely on each other.

One of our proudest achievements was hosting the Sound Money Soiree, our first charity gala attended by 120 people, including business leaders, Bitcoiners, and community leaders. Together, we raised nearly $30,000 to support our mission. This money has gone toward expanding our outreach and growing our community, helping us make a bigger impact in Tampa Bay.

Education is a major part of Bitcoin Bay’s mission. Through partnerships with the University of Tampa and the University of South Florida, we’re bringing Bitcoin education to students. We provide guest lectures, internships, and this summer, we’re hosting our first Bitcoin summer camps. By investing in the next generation, we’re making sure Bitcoin’s potential continues to grow in Tampa Bay.

Our community’s resilience was tested when hurricanes Helene and Milton struck. Bitcoin Bay members quickly came together to help. Volunteers formed cleanup teams to clear debris, while others helped coordinate food, water, and gas for those in need. This showed that Bitcoin Bay’s mission to build a strong, resilient community is more than just words—it’s a way of life.

Looking Ahead: The Journey Continues

As Bitcoin Bay’s Pirate float sails down the Gasparilla Parade route, it’s more than a celebration—it’s a statement. We are here to build, educate, and empower. This float represents a year of hard work, resilience, and community spirit, and it marks the beginning of our next chapter.

“We’re excited to bring Bitcoin to the Gasparilla Parade and share our mission with Tampa Bay,” says President Wesley Schlemmer. “Bitcoin Bay is more than an organization; it’s a movement shaping the future of our local community and beyond.”

To learn more about the Bitcoin Bay Foundation, Gasparilla event details, and how you can get involved in their community efforts, please visit:

* Website: bitcoinbay.foundation

* Twitter: @bitcoinbaytpa

* Nostr: npub1tampasjf5z0rllvrh8nlqckrjtzzj9590uljzeuu6ymsr8hq9pjsrw0ynt

* Email: Wesley@bitcoinbay.foundation

Together, we’re building a better future with Bitcoin. We invite all Bitcoiners to join us on this exciting journey and make history with us!

This is a guest post by Bitcoin Bay Foundation. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login