CryptoCurrency

Which Is The Best ICO To Invest In 2025? Remtitix, Rexas Finance, Litechain AI Or WEPE?

In the search for the best Initial Coin Offering to invest in for 2025, many investors are pondering the potential of a promising ICO known as Remittix (RTX) alongside other ICOs like Rexas Finance, Litechain AI, and WEPE. Undoubtedly, Rexas Finance, Litechain AI, and WEPE all have their benefits and uniqueness, which have attracted a great deal of inflows to their respective presales.

However, experts still think Remittix stands out among them as it promises up to 100x gains during its presale and to tackle the complex problems often experienced in the online payment landscape. Learn about these ICOs and so find out why Remiitix is considered a more promising options

Analyzing Rexas Finance’s Success: What’s Driving Investor Interest?

Rexas Finance, is one of the new ICOs that is currently in the headlines. The token has risen to $42 million in its presale, with Stage 11 selling out quickly. The token, RXS, is now in Stage 12 at $0.20, up from $0.03 in Stage 1, reflecting strong investor confidence. The planned listing price is $0.25, with a launch on June 19, 2025.

One reason investors think Rexas Finance is viewed as one of the best cryptocurrency investments is due to its potential to transform the crypto landscape by linking real-world assets, like real estate and gold, to blockchain. With fractional ownership of these assets, investors can own shares of properties worldwide and earn passive income.

$12 Million Raised: Light Chain AI’s Presale a Massive Success

Like other new ICOs, Light Chain AI has captured the attention of crypto enthusiasts seeking significant gains. A key feature is its Artificial Intelligence Virtual Machine (AIVM), which enables efficient AI task execution on the blockchain. Unlike traditional systems, the AIVM evolves and develops through the collaboration of global developers.

Currently, you can buy LCAI tokens for $0.005625 each before the price increases to $0.006. So far, the project has raised over $12 million. You can purchase LCAI using Ethereum or USDT, and the platform allows you to connect your wallet to participate in the token presale.

WEPE Raises $54 Million: Is This the Next Meme Coin Sensation?

Inspired by the popular Pepe meme, Wall Street Pepe is a new cryptocurrency aimed at helping regular investors with trading tools and resources. While in its token presale, WEPE raised an impressive $54 million, indicating strong interest from its growing community.

As of now, 1 WEPE is priced at $0.0003665, with 25 days left until the presale concludes. While WEPE has made a promising start, its long-term success will depend on delivering on its commitments and maintaining community engagement.

Remittix (RTX) Dominates 2025 ICOs: $4.6 Million Raised, 100x Potential

As we assess the landscape of emerging ICOs for 2025, Remittix (RTX) stands strong alongside promising projects like WEPE, Litechain AI, and Rexas Finance. So, what’s drawing people to Remittix? Its innovative approach to converting cryptocurrencies into fiat effectively addresses the frustrations many users face with existing financial systems.

The project has garnered attention for its potential to simplify the remittance process, providing a much-needed service that can make financial transactions easier and more accessible. As we look toward the crypto landscape of 2025, it’s becoming increasingly clear that tokens with real, practical applications will hold significant value.

Moreover, the design and structure of Remittix further bolster investor confidence. The project features a locked liquidity pool, which helps maintain stability and minimizes the risk of sudden market dips. Transparent auditing practices also improve the project’s credibility, assuring backers that Remittix is not just another passing trend.

The ongoing Remittix token presale presents an exciting opportunity for early investors. With 72.93% of tokens for the current round already sold, the presale has raised an impressive $4.6 million, with 240 million tokens sold so far. Currently, the price of 1 $RTX is $0.0239, but it is being predicted to skyrocket possibly by 100x, just after it lists on exchanges.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Coins to watch for big gains

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Trump’s inauguration sparks crypto market frenzy, with Bitcoin surging to $106,000 and emerging tokens like Yeti Ouro poised for explosive growth.

President Trump’s inauguration has caused a big move in the crypto market. His inaugural speech didn’t mention crypto, but creating an SEC “crypto task force” under Acting Chairman Mark Uyeda was a big plus. This has pushed Bitcoin price to $106,000 this week, and the overall market looks promising.

Since we’re likely entering a bull market, it is natural that investors will be looking for the cryptocurrencies with the most potential for the highest returns. Two interesting choices this year are XRP and Yeti Ouro (YETIO).

XRP price: Limited upside

The popular XRP token is a cryptocurrency created by Ripple Labs for fast, low-cost international payments. Its adoption by financial institutions has cemented its position in the cross-border payment space. As of January 22, 2025, XRP price is at $3.19 on Coinmarketcap, a high of $3.23, and a low of $3.02.

XRP’s utility in global transactions and its partnerships with financial institutions make it a stable choice for investors looking for stability. However, there is still some regulatory uncertainty, especially with the SEC’s scrutiny. The new crypto task force may bring clarity, but the timeline and outcome are unknown.

Predictions for XRP are through the roof. $33 is 1000% above the current XRP price, which is unlikely to happen in the short term. XRP is a stable investment with not much upside.

Yeti Ouro: High growth potential

Yeti Ouro, a new ERC-20 token on the Ethereum blockchain, combines meme virality with Play-to-Earn (P2E) gaming. Its main game, Yeti Go, allows players to earn YETIO tokens by racing in immersive gameplay built with Unreal Engine. This Meme & Play To Earn hybrid taps into the booming blockchain gaming market, projected to reach $65.7 billion by 2027.

Currently priced at $0.017 in Stage 2 of its presale, YETIO is a great entry point for early investors. The best time to invest in a cryptocurrency is during the early stages, especially after a presale, before the retail investors catch wind of any promising tokens. Early investors in Yetio Ouro have already seen a more than 40% ROI.

Once retail investors find out about a coin, it usually surges due to the high number of investors buying into the coin; the Trump memecoin is a good example.

Also, experts and analysts predict YETIO will reach $5 by the end of 2025, a 5000% gain. This is based on Yeti Ouro’s innovative concept, early adoption, and alignment with growing market trends. Yeti Ouro has validated its security stance with an audit from Solid Proof.

XRP vs. YETIO: Which one will grow more?

When it comes to returns, Yeti Ouro is the clear winner for exponential growth. It has a much lower market cap of only $13 million compared to XRP’s $183 billion, which is 14,077 times larger.

The combination of gaming and meme virality could attract a wide audience and will keep demand for YETIO tokens high.

XRP is an established cryptocurrency, but its growth is limited by market saturation and regulatory issues. In addition to this, due to XRP being a blue chip cryptocurrency with a huge market cap of over 183 billion, it would need a market cap of 2.013 trillion, which is close to the market cap of Bitcoin (2.09 Trillion), to see a 1000% return.

Conclusion

The cryptocurrency market post-Trump inauguration has many risks and opportunities. For those who want stability, XRP is a safe choice. However, it does not have the same growth potential as smaller, emerging coins that are attached to large and growing industries in the crypto space.

For those who want high-reward opportunities, Yeti Ouro is a great choice. Its P2E gaming and meme narratives work well with the growing market trends, and that makes it a risky but promising investment for those who want exponential returns.

For more information on Yeti Ouro, visit their website, X, Telegram, or Discord.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Bitcoin Realized Cap Hits $832B As $100K Inflows Begin To Slow

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

CryptoCurrency

Retail Demand for BTC Provides Firm Underpinning in Weaker Crypto Market

By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin and most major cryptocurrencies are weaker after Chicago Mercantile Exchange, a proxy for institutional activity, denied reports of listing futures tied to XRP and SOL. Traditional markets are also holding their breath for the expected Bank of Japan interest-rate increase on Friday.

Despite BTC’s continued range play above $100,000, retail demand remains robust. Glassnode’s shrimp-Crab cohort, which includes addresses holding up to 10 BTC, have absorbed 1.9 times the newly mined supply last month, totaling over 25,600 BTC. Meanwhile, long-term holders have slowed their spending and profit-taking activities, indicating a cautious, but firm, commitment to their investments.

Still, dropping below $100,000 might prove costly. According to Wintermute’s OTC trader Jake Ostrovskis, that would “frame Monday’s inauguration as a sell-the-news event and the narrative could switch pretty quickly.”

Reports suggest the number of whale wallets holding between 1 million and 10 million XRP has surged to an all-time high of 2,083, signaling increased accumulation and confidence in its future performance.

In the world of innovation, chatter around Bitcoin Synths is gaining traction on X. These synthetic assets allow users to benefit from bitcoin’s price movements without actually owning the cryptocurrency. Bitcoin Synths can be traded or used as collateral in lending protocols, avoiding the complexities associated with wrapped tokens and specialized bridges.

Ethereum layer-2 protocols are also making headlines with record transaction volumes, even as concerns about their capacity nearing limits persist.

On the macroeconomic front, recent data from the Labor Department shows that the “all tenant rent” index, an indicator of shelter inflation in the Consumer Price Index (CPI), rose at a slower pace last quarter. The data suggest that recent worries about inflation may be overdone and the Fed could pivot away from its hawkish forecast, which would be a positive sign for risk assets. Stay alert!

What to Watch

- Crypto

- Macro

- Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

- Initial Jobless Claims Est. 215K vs. Prev. 217K.

- Jan. 23, 10:00 a.m.: The National Association of Realtors releases December 2024 U.S. Existing Home Sales report.

- Existing Home Sales Est. 4.16M vs. Prev. 4.15M.

- Existing Home Sales MoM Prev. 4.8%.

- Jan. 23, 4:30 p.m.: The Fed releases the H.4.1 report, the central bank balance sheet, for the week ended Jan. 22.

- Total Reserves Prev. $6.83T.

- Jan. 23, 6:30 p.m.: Japan’s Ministry of Internal Affairs and Communications releases December 2024’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. 0.6%.

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.7%.

- Inflation Rate YoY Prev. 2.9%.

- Jan. 23, 10:00 p.m.: The Bank of Japan (BoJ) releases Statement on Monetary Policy.

- Interest Rate Decision Est. 0.5% vs. Prev. 0.25%.

- Jan. 23, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 18.

Token Events

- Governance votes & calls

- Morpho DAO is discussing reducing incentives by 30% across all networks and assets.

- Yearn DAO is discussing funding and endorsing a subDAO called Bearn to focus on building and launching products on Berachain.

- Frax DAO is discussing a $5 million investment in World Liberty Financial (WLFI), the crypto project backed by the family of U.S. President Donald Trump.

- Jan. 23: Livepeer (LPT) is hosting a Core Dev call.

- Jan. 24: Arbitrum BoLD’s activation vote deadline. BoLD allows anyone to participate in validation and defend against malicious claims to an Arbitrum chain’s state.

- Jan. 24: Hedera (HBAR) is hosting a community call at 11 a.m.

- Unlocks

- Jan. 31: Optimism (OP) to unlock 2.32% of circulating supply worth $52.9 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Token Launches

- Jan. 23: Sky (SKY) is being listed on Bitget.

- Jan. 23: Animecoin (ANIME) is launching, with claims starting at 8 a.m. The token will be listed on multiple exchanges including Binance, OKX and KuCoin.

Conferences:

Token Talk

By Francisco Rodrigues

- Azuki, a non-fungible token (NFT) collection, is introducing its Animecoin (ANIME) today on Ethereum and Arbitrum. The token was announced on Jan. 13.

- An airdrop will encompass Azuki NFT holders, Hyperliquid HYPE stakes, some Arbitrum ecosystem participants and Kaito yappers.

- It will also include certain anime communities and BNB token holders who, between Jan. 17 and Jan. 20, subscribed to Simple Earn with their tokens on Binance.

- The debut builds on a growing trend of NFT collections launching their own tokens, a trend that started in 2021 when Bored Ape Yacht Club (BAYC) launched ApeCoin.

- Other examples include DeGods’ DUST and Pudgy Penguins’ PENGU tokens, which have a $1.6 billion market capitalization.

- Other signs indicate the NFT market is heating up, with Nansen recently pointing out that a Crypto Punk was sold for 170 ETH (around $540,000) while an Azuki was sold for 165 ETH. The Azuki NFT had been bought a month before for 105 ETH.

Derivatives Positioning

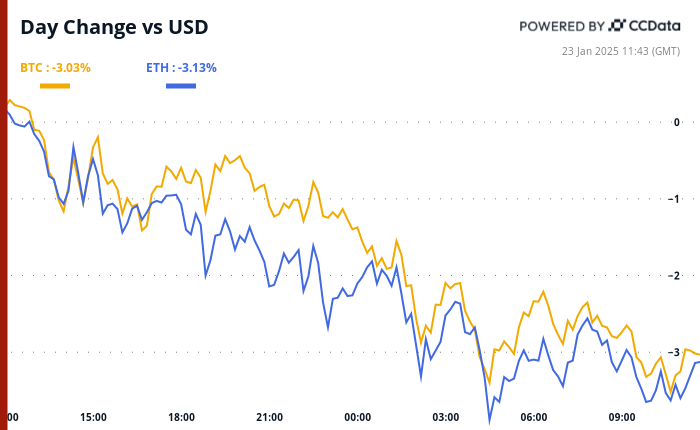

- The cumulative volume delta indicator reveals that major cryptocurrencies, with the exception of TON, have experienced net selling pressure in the perpetual futures markets over the past 24 hours.

- Block flows on Deribit and Paradigm featured long positions in short-dated BTC puts at $100K, $95K and $70K. An entity bought ETH put at $2.9K.

- Front-end BTC and ETH calls now traded at par with puts.

Market Movements:

- BTC is down 4.1 % from 4 p.m. ET Wednesday to $102,020 (24hrs: -2.71%)

- ETH is down 3.85% at $3,206.18 (24hrs: -2.83%)

- CoinDesk 20 is down 3.61% to 3,799.21 (24hrs: -3.58%)

- CESR Composite Ether Staking Rate is down 15 bps to 3.15%

- BTC funding rate is at -0.0019% (-2.08% annualized) on OKX

- DXY is unchanged at 108.25

- Gold is down 0.35% at $2,761.10/oz

- Silver is down 0.73% to $30.57/oz

- Nikkei 225 closed up 0.79% at 39,958.87

- Hang Seng closed down 0.4% at 19,700.56

- FTSE is unchanged at 8,538.7

- Euro Stoxx 50 is unchangedat 5203.6

- DJIA closed +0.3% to 44,156.73

- S&P 500 closed +0.61% at 6,086.37

- Nasdaq closed +1.28% at 20,009.34

- S&P/TSX Composite Index closed +0.12% at 25,311.5

- S&P 40 Latin America closed +1.21% at 2,297.32

- U.S. 10-year Treasury is up 3 bps at 4.59%

- E-mini S&P 500 futures are down 0.19% to 6,109.00

- E-mini Nasdaq-100 futures are down 0.56% to 21,876.75

- E-mini Dow Jones Industrial Average Index futures are unchaged at 44,384.00

Bitcoin Stats:

- BTC Dominance: 58.59

- Ethereum to bitcoin ratio: 0.031

- Hashrate (seven-day moving average): 781 EH/s

- Hashprice (spot): $58.9

- Total Fees: 8.5 BTC/ $876,410

- CME Futures Open Interest: 188,396 BTC

- BTC priced in gold: 37.1 oz

- BTC vs gold market cap: 10.56%

Technical Analysis

- BTC’s retreat from Monday’s high is teasing a formation of a double top bearish reversal pattern.

- A move below the horizontal line would confirm the pattern, potentially bringing more chart-led sellers to the market.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $377.31 (-3.03%), down 1.89% at $370.19 in pre-market.

- Coinbase Global (COIN): closed at $295.85 (+0.56%), down 2.59% at $288.18 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$32.81 (+4.99%)

- MARA Holdings (MARA): closed at $19.69 (+0.66%), down 2.54% at $19.19 in pre-market.

- Riot Platforms (RIOT): closed at $13.14 (+3.14%), down 1.75% at $12.91 in pre-market.

- Core Scientific (CORZ): closed at $15.97 (+4.58%%), down 1.63% at $15.71 in pre-market.

- CleanSpark (CLSK): closed at $11.14 (+1.64%), down 2.51% at $10.86 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.53 (+2.24%), up 2.58% at $28.27 in pre-market.

- Semler Scientific (SMLR): closed at $62.11 (-4.36%), up 2% at $64.90 in pre-market.

- Exodus Movement (EXOD): closed at $41.00 (+2.5%), down 2.07% at $40.15 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: $248.7 million

- Cumulative net flows: $39.23 billion

- Total BTC holdings ~ 1.161 million.

Spot ETH ETFs

- Daily net flow: $70.7 million

- Cumulative net flows: $2.81 billion

- Total ETH holdings ~ 3.648 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows a spike in the number of active addresses on Solana.

- Addresses holding USDC led the growth as TRUMP token frenzy gripped the market over the weekend.

While You Were Sleeping

In the Ether

CryptoCurrency

New AI Agent TEA Revolutionizes On-Chain Activity

Vaduz, Liechtenstein, January 23rd, 2025, Chainwire

Griffin AI has introduced the Transaction Execution Agent (TEA), an AI-powered solution designed to simplify Ethereum-based transaction management, which is now available for beta testing. As decentralized finance (DeFi) evolves, the need for intuitive and efficient tools continues to grow. TEA addresses this by identifying users’ on-chain requirements—such as wallet queries, asset swaps, and transaction status checks—and preparing actions for seamless user approval.

Redefining blockchain interactions with AI

Complex blockchain interfaces often deter newcomers and slow down even experienced users. Griffin AI’s Transaction Execution Agent (TEA) allows users to interact in everyday language. It identifies user intent, pulls relevant on-chain data, and then presents easy-to-approve transaction proposals for tasks like sending tokens, monitoring balances, or swapping assets. By streamlining these workflows into a simple conversation rather than multiple separate apps, TEA ensures a more confident and secure on-chain experience.

Introducing Griffin AI’s Transaction Execution Agent (TEA)

TEA bridges blockchain protocols and everyday usability by offering a conversational interface: users ask the AI in natural language to perform tasks like “send 0.5 ETH to my friend” or “swap tokens on Uniswap.” TEA interprets these requests, checks the necessary data (balances, gas fees, contract addresses), and then prepares the appropriate transaction steps for user confirmation. By focusing on actionable tasks, TEA streamlines on-chain engagement, making it more accessible to both newcomers and experienced users alike.

“By providing intuitive, conversational interface, we’re stripping away the barriers that have made DeFi complex and inaccessible for so many users,” said Oliver Feldmeier, CEO of Griffin AI. “This is about empowering individuals to engage confidently with blockchain technology, no matter their level of experience.”

Key features of Griffin AI’s TEA include

- Conversational, language-based interface

Users can tell TEA in everyday language exactly what they need, whether it’s sending tokens or checking balances. If critical information is missing or unclear, TEA will prompt the user for clarification. By interpreting these natural-language inputs and confirming any ambiguities, TEA helps users avoid manual errors and confusing interfaces.

- Seamless transaction sending

TEA identifies when users want to send tokens, pulls essential details (recipient address, token balance, gas fee estimates), and constructs a transaction. This reduces the chance of human error, allowing users to confirm with one click in their connected wallet.

- Easy-to-execute swaps

When users need to swap tokens, TEA fetches relevant liquidity pools (e.g., Uniswap) and calculates pricing details. It then prepares the transaction steps, ensuring everything is set before prompting the user for final approval.

- Wallet & network integration

The agent connects with a range of Ethereum wallets – MetaMask, Browser Wallet, Trust Wallet, WalletConnect, Ledger, and more – automatically detecting balances and transaction histories. TEA is already compatible with Ethereum mainnet, Base, Arbitrum, OP Mainnet, and Polygon.

- Real-time network data

TEA continuously checks exchange rates, gas fees, and network status, helping users stay aware of real-time blockchain conditions. With this information at hand, TEA can generate accurate transaction proposals without requiring manual research.

- Transaction tracking and notifications

TEA monitors the status of each operation, sending automated updates as transactions confirm or if issues arise. This eliminates the guesswork associated with blockchain explorers, making it easier to stay informed about the progress of on-chain activity.

- Secure operations and smart validations

Before any action is executed, TEA presents a transaction proposal that users can review in detail. This proposal is checked against on-chain data to detect potential discrepancies, and only after the user manually approves in their wallet is the transaction submitted—maintaining maximum security and control.

A foundation for modular AI development

While an advanced tool for users, TEA also serves as a cornerstone for developers by offering adaptable frameworks for diverse on-chain tasks. Its design enables further customizations to expand functionality and improve accessibility as part of a range of modular agents in the Griffin AI Playground.

“Although we focused on simplifying the DeFi experience for human users with TEA’s current release, these same capabilities lay the groundwork for truly autonomous agents,” added CEO Oliver Feldmeier. “We’re teaching them how to navigate on-chain data and initiate transactions, opening the door to a future where these agents can operate without human oversight.”

Available now in open beta

Griffin AI Playground offers early access to TEA and other cutting-edge agents. With over 230,000 active users, the platform enables users to explore and test AI-driven solutions in a collaborative environment. During this open beta phase, participants are advised to limit transactions to smaller sums for testing purposes. Feedback is encouraged to refine TEA for its full launch.

According to Oliver Feldmeier, “This is just the beginning. We plan to extend TEA’s capabilities to support yield generation, staking, and bridging assets across multiple networks. Ultimately shaping TEA into a go-to toolkit for DeFi users as well as agent developers.”

About Griffin AI

Griffin AI specializes in integrating artificial intelligence with blockchain technology, creating an innovative platform for the deployment, use, and monetization of decentralized AI agents. Serving individual developers, non-technical creators, and large organizations alike, Griffin AI provides essential tools for the development and monetization of autonomous AI agents within a blockchain environment. Griffin AI is committed to leading the transformation of the DeFi AI landscape through its robust and innovative solutions.

ContactFounderOliver FeldmeierGriffin AIhello@griffinai.io

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

How Bitcoin investors can avoid tax fraud

Bitcoin investors must navigate a complex tax landscape, including understanding taxable vs. non-taxable transactions, key regulations by jurisdiction and ways to stay compliant.

CryptoCurrency

Sainsbury’s to cut 3,000 jobs and shut in-store cafes

Sainsbury’s has announced it will cut more than 3,000 jobs and plans to shut its remaining in-store cafes as part of a major overhaul.

The headcount reduction represents about two per cent of the company’s current 148,000-strong workforce.

It will see about 20 per cent of senior management roles cut at the supermarket giant as part of plans to focus on fewer, bigger roles and to simplify its head office and management teams.

The retailer also said it had decided to close its remaining 61 Sainsbury’s Cafes, subject to consultation.

The majority of Sainsbury’s shoppers do not use the cafes regularly, whereas in-store food halls and concessions have grown in popularity, it said.

The majority of Sainsbury’s shoppers do not use the cafes regularly,

Getty Images

Simon Roberts, Sainsbury’s chief executive, said the supermarket was facing a “particularly challenging cost environment” as it moves forward with its company strategy.

He said: “As we accelerate into year two and beyond of our strategy, we are facing into a particularly challenging cost environment which means we have had to make tough choices about where we can afford to invest and where we need to do things differently to make our business more efficient and effective.

“The decisions we are announcing today are essential to ensure we continue to drive forward our momentum but have also meant some difficult choices impacting our dedicated colleagues in a number of parts of our business.

“We’ll be doing everything we can to support anyone impacted by today’s announcements.”

CryptoCurrency

LOVELY INU Price Projections: Forecasts and Analysis

Amidst the dynamic landscape of cryptocurrency investments, the allure of Lovely Inu as a utility and decentralized meme token has sparked the interest of many discerning investors.

By scrutinizing price forecasts for various timeframes, from near-future projections to the intriguing possibilities stretching far into 2030, a deeper understanding of the potential movements of Lovely Inu emerges.

Factors driving these forecasts, the nuances of market dynamics, and essential investment considerations all play pivotal roles in unraveling the future trajectory of this digital asset.

Short-term Price Predictions

When considering Lovely Inu‘s short-term price predictions, it is essential to analyze the projected value fluctuations within specific timeframes.

In September, Lovely Inu is anticipated to range between $0.00000005429 and $0.00000005635.

Moving into October, the predicted range widens slightly to $0.00000005532 – $0.00000006049, showcasing potential growth.

November’s forecast suggests a further increase, with values projected between $0.00000005946 and $0.00000006152.

However, December introduces a potential dip, with estimates ranging from $0.00000004136 to $0.00000004912.

Looking ahead to January, the price is expected to recover, fluctuating between $0.00000004653 and $0.00000006204.

These short-term predictions indicate a mix of fluctuations, offering opportunities for both traders and investors to strategize accordingly.

Long-term Price Forecasts

In evaluating the long-term trajectory of Lovely Inu, the expected price movements over several years reveal a promising outlook for potential growth and market performance.

Moving into 2025 and 2026, the price is expected to continue rising, with projections ranging from $0.000001784 to $0.000003878 and $0.000002714 to $0.000003490, respectively.

The forecasts suggest a positive market sentiment towards Lovely Inu, indicating a bullish momentum that could potentially benefit long-term investors seeking growth opportunities in the cryptocurrency space.

Price Prediction FAQs

Within the realm of Lovely Inu price predictions, investors often seek clarity on various aspects to make informed decisions .

The likelihood of Lovely Inu crashing to zero is deemed unlikely, but the recommendation for investment depends on individual risk tolerance levels. Analysts project a potential rise in the future, indicating bullish momentum for the Lovely Inu token.

These FAQs aim to provide investors with essential insights to navigate the volatile cryptocurrency market and assess the potential of Lovely Inu as a long-term investment option.

Market Cap and Volume Analysis

Analyzing the market cap and volume of Lovely Inu provides crucial insights into the token’s performance and investor activity. With a current market cap of $3,877,500, Lovely Inu’s position in the market is relatively stable.

This could suggest that Lovely Inu may not be actively traded compared to other tokens in the market. Investors should consider this aspect when evaluating the token for investment purposes.

Monitoring changes in market cap and volume over time can help in identifying trends and predicting potential price movements in Lovely Inu. It is essential to assess these metrics alongside other factors to make informed investment decisions.

Investment Insights

With due consideration to the market dynamics, investors are urged to assess Lovely Inu’s potential for long-term growth before making any investment decisions.

Evaluating the token’s utility, community support, development roadmap, and overall market conditions can provide valuable insights into its future performance.

While short-term price predictions offer some guidance, focusing on the token’s fundamentals and long-term potential may be more beneficial for strategic investment decisions. It is essential for investors to conduct thorough research, diversify their portfolios, and stay informed about any updates or developments related to Lovely Inu.

Conclusion

In conclusion, Lovely Inu’s price forecasts and insights provide valuable information for cryptocurrency investors looking to understand its potential trajectory.

By analyzing short-term and long-term predictions, addressing common queries, and exploring market cap and volume analysis, investors can make informed decisions about this utility and decentralized meme token.

Understanding the factors influencing Lovely Inu’s price movements is essential for navigating the risks and opportunities associated with this dynamic digital asset.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

How to Discover New Cryptocurrencies to Invest In

Key Considerations Before Investing

Before getting into new cryptocurrencies, consider these questions:

- Where does cryptocurrency fit into the bigger picture of your portfolio?

- Is cryptocurrency a good long-term investment?

- Should you invest in Initial Coin Offerings?

- Is it worth investing in NFTs?

- What is DeFi, and are there investment opportunities there?

The crypto market is confusing. Scams and a lack of standardized valuation criteria send investors running for cover. Adding cryptocurrencies to a portfolio, however, can add diversity and high growth potential.

Where to Find New Cryptocurrencies

You can explore various platforms and tools to discover emerging cryptocurrencies:

Cryptocurrency Exchanges

Platforms like Binance, Coinbase, Crypto.com, and Kraken are great starting points. Most major exchanges list new coins as they launch. Some exchanges, like Coinbase, require an account to access detailed information about new cryptocurrencies.

Data Aggregators

Data aggregators provide up-to-date crypto information:

- CoinMarketCap: Lists new coins along with prices, market caps, and trading volumes.

- CoinGecko: Offers similar features to help you analyze coins.

Social Media

Social platforms provide real-time updates on crypto trends:

- X (formerly Twitter): Follow developers and projects for updates on new coins.

- Telegram: Join crypto-related groups for direct communication with project teams.

- Discord: Many projects maintain servers for announcements and discussions.

Specialized Tools

Use tools to analyze and verify cryptocurrencies:

- KryptView: Research tokens by name or address.

- TokenSniffer: Provides audits of coins, highlighting potential risks.

- BSCCheck: Examines tokens on the Binance Smart Chain.

Websites

Explore reputable websites for crypto news and insights:

- Trading View

- Top ICO List

- DEX Screener

Decentralized Finance (DeFi) Platforms

DeFi platforms like Uniswap, Aave, and Maker allow users to engage in peer-to-peer transactions, lending, and borrowing. Many have native tokens that power their ecosystems.

NFT Marketplaces

NFTs are digital ownership of assets. New NFTs are listed on platforms such as OpenSea and Rarible. Specialized marketplaces like NBA TopShot sell to niche audiences.

Initial Coin Offerings (ICOs)

ICOs raise funds for new projects. While fewer exist today due to stricter regulations, some opportunities remain. Always check if the ICO is registered with regulatory agencies.

Exchange-Traded Funds (ETFs)

ETFs offer indirect exposure to cryptocurrencies. For instance, the Bitcoin Spot ETFs approved in 2024 allow investors to purchase shares in funds that hold cryptocurrencies.

Evaluating New Cryptocurrencies

Once you identify potential investments, analyze them carefully. Here are some factors to consider:

Use Cases

What purpose does cryptocurrency serve? Coins with strong use cases, like Ethereum (ETH) for smart contracts, often have higher potential.

Market Metrics

Review these key metrics:

- Price: Current value per coin.

- Market Cap: Total value of all circulating coins.

- Trading Volume: Amount traded in the last 24 hours.

Community and Social Sentiment

A strong community often supports a coin’s growth. Check forums, social media, and project updates to gauge sentiment.

Regulations and Legal Status

Ensure the cryptocurrency complies with local laws. Avoid coins involved in legal disputes or regulatory issues.

Whitepapers

A project’s whitepaper explains its purpose and technology. Analyze its clarity and feasibility.

Tools for Analysis

Here’s a quick comparison of popular tools:

|

Tool |

Function |

Key Features |

|

CoinMarketCap |

Tracks new cryptocurrencies |

Prices, market cap, trading volumes |

|

TokenSniffer |

Analyzes token legitimacy |

Contract audits, risk flags, holder analysis |

|

KryptView |

Provides token research |

Holder data, transaction details |

|

Trading View |

Offers technical analysis tools |

Charts, price trends |

Common Red Flags

Watch out for these warning signs to avoid scams:

- Exaggerated Promises: Claims of guaranteed returns.

- Lack of Transparency: Incomplete or vague whitepapers.

- High Concentration: Large token supplies held by few wallets.

- Unverified Contracts: Missing or unverified contract details.

Staying Informed

The crypto market changes rapidly. To stay ahead, regularly monitor:

- New listings on exchanges.

- Social media updates from project teams.

- Trends in DeFi platforms and NFT marketplaces.

Investing in new cryptocurrencies can be exciting and profitable. Use reliable sources, conduct thorough research, and stay vigilant against scams. By following this guide, you can explore opportunities while minimizing risks. Happy investing!

CryptoCurrency

CZ criticizes AI chat bots for being ‘lazy,’ how does CZ feel about AI in crypto?

Changpeng ‘CZ’ Zhao comments on how ‘lazy’ AI chat bots are in a recent X post, despite his eagerness in exploring AI technology in blockchains.

In a recent post, Changpeng ‘CZ’ Zhao shared his thoughts on artificial intelligence-powered chat bots. The Binance co-founder called them lazy, for only being able to tell him things that he already knew. Instead of educating him on information he does not know.

“The problem with AI Chatbots is that, often, I don’t know what I don’t know. I don’t know what to ask. It would be good if it could just tell me things I should know. So lazy,” wrote CZ in his post.

Many users in the comments section seemed to agree with him, noting how more often than not, AI technology is only as good as the human that controls it.

“True, AI needs human guidance to be truly effective. That’s why I combine AI analysis with human experience and market sentiment from CT. Best of both worlds for better trading decisions,” said one trader in X.

“You can ask exactly that and the Chatbot will ask the question for to to himself,” said another user.

Although the former Binance CEO did not specify which AI chat bot he used, many users began recommending different AI projects to him.

CZ’s relationship with AI technology

After his release from prison in September last year, the former Binance lead has been vocal in his desire to explore AI technology, specifically its uses in the blockchain.

In November, CZ said that artificial-intelligence tagging could be used on-chain, as a way to accelerate the crypto payment process and eliminate unnecessary bias commonly found within human-operated systems.

“AI tagging (or AI data in general) is well fitted to be done on-chain. Harness low cost labor globally without geographic bias, (micro) pay them in crypto instantly,” said CZ.

However, he believes that more tools integrating AI technology need to be built before any real progress can be made.

Even back in April 2024, CZ had reportedly been in ongoing discussions with OpenAI CEO Sam Altman as he began to take an interest in AI-focused investments.

In a previous interview, Columbia University computer science professor Ronghui Gu said that Zhao and Altman both “believe that A.I. is going to help a lot in actualizing the development of technology and human knowledge.”

AI technology has only just begun its descent into the crypto sphere. In December, an analysis from Syncracy Capital showed that AI-integrated crypto projects only made up 1% of the crypto market cap. However, the firm expects a 10-fold leap as more AI platforms start appearing.

CryptoCurrency

A Potential Game-Changer for Solana (SOL)

TL;DR

- The SEC’s pending decision on Grayscale’s Solana ETF, due today, could have a major impact on the underlying token.

- The Chicago Mercantile Exchange’s plan to launch SOL and XRP futures on February 10 has already influenced the performance of the assets. The products (if they go live) may attract more institutional investors and positively influence both tokens in the long term.

The Potential Catalyst

Solana (SOL) has been among the top-performing cryptocurrencies in the last week, with its price soaring by over 20% for that timeframe. It reached a new all-time high of more than $285 on January 19, while currently, it trades just south of $250.

One important factor suggesting that the bull run may prevail is Grayscale’s intention to convert its Solana Trust Fund into an exchange-traded fund (ETF). The agency responsible for approving such filings in the US is the Securities and Exchange Commission (SEC). Its initial decision deadline for Grayscale’s investment vehicle is set for today (January 23).

The recent shifts in the Commission’s leadership have caused some industry participants to speculate that the aforementioned ETF could receive the necessary green light. Up until January 20, the SEC was led by Gary Gensler, who was known as an enemy of the cryptocurrency industry. However, he stepped down on the day of Donald Trump’s inauguration, with the pro-crypto Mark Uyeda succeeding him at the helm.

Other well-known companies that have filed to launch SOL ETFs on American soil include VanEck, 21Shares, Bitwise, and Canary Capital. The SEC has until January 25 to give its nod or deny those applications.

It is important to note that the watchdog has the authority to extend its review period beyond the initial deadlines. This was a common policy during Gensler’s reign, and we have yet to see whether the agency will keep this practice after the changes at the top.

Nearly a year ago, the SEC approved a wave of spot Bitcoin ETFs for trade in the United States. The companies behind the funds included popular names such as BlackRock, Grayscale, Bitwise, Wisdom Tree, and others. The price of the primary cryptocurrency plunged after the announcement, but a few weeks later, it started pumping substantially.

This might serve as a warning to investors that the potential launch of a spot Solana ETF in America could be generally beneficial for the valuation of the underlying asset but may also lead to enhanced volatility and a move to the downside in the short term.

The Additional Bullish Element

Another factor that could positively impact Solana’s price is the supposed plan of the Chicago Mercantile Exchange to introduce SOL and XRP futures. The financial derivatives exchange is looking to do so on February 10.

The news had an immediate impact on the prices of both assets. SOL pumped to as high as $270, whereas XRP briefly jumped to $3.28.

The contracts (if approved) will allow people to speculate on the future price of the aforementioned assets without actually owning them. They may attract an additional number of investors into the Solana and Ripple ecosystems, possibly having a positive influence on the prices of their native tokens.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login