CryptoCurrency

Why It’s Not Too Late to Invest in Bitcoin

For years, Bitcoin skeptics have watched from the sidelines, waiting for a moment to join the ride, only to convince themselves that they’ve already missed the boat. However, the reality tells a different story. Not only is it not too late, but Bitcoin continues to prove itself as a superior investment option compared to traditional assets—whether you have $25 a week to spare or millions to allocate.

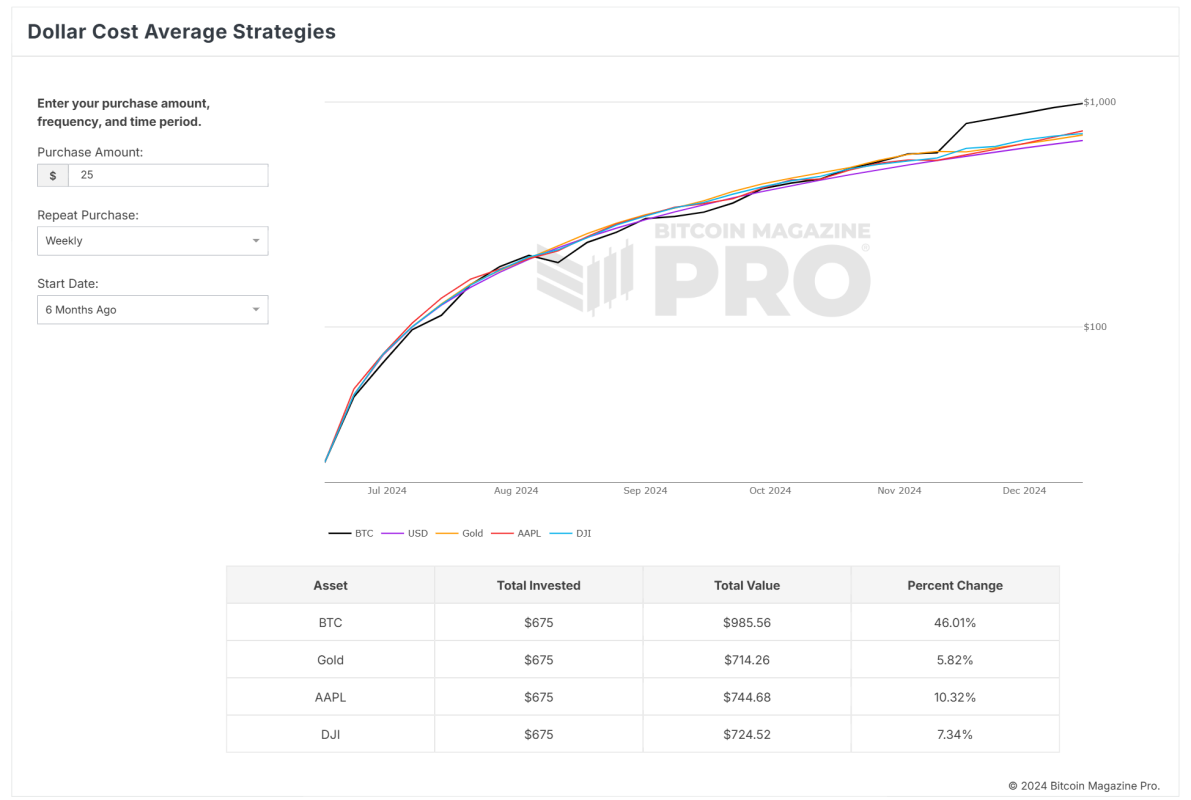

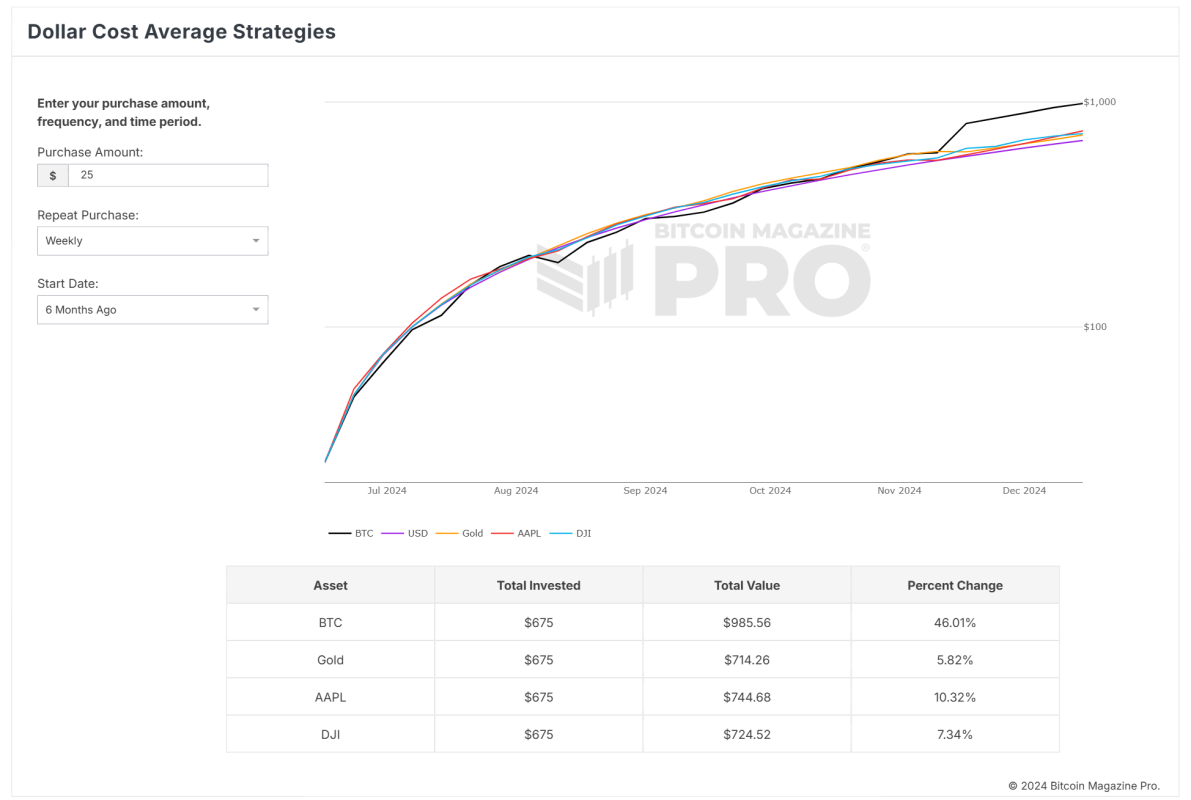

Bitcoin Magazine Pro has a free portfolio analysis tool, Dollar Cost Average (DCA) Strategies, which enables investors to measure Bitcoin’s performance against other leading assets like gold, the Dow Jones (DJI), and Apple (AAPL) stock. This powerful tool provides hard data to demonstrate how consistent, disciplined investing over time can lead to outsized returns, even with modest amounts.

What Is Bitcoin Dollar Cost Averaging?

Dollar cost averaging involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This strategy eliminates emotional decision-making and smooths out the effects of market volatility. By consistently buying Bitcoin over a defined period, investors benefit from market dips while building their portfolios over time.

Outperforming Traditional Assets Across Timeframes

Let’s break down the numbers using the DCA Strategies tool, starting with the last six months to emphasize recent performance::

- 6 Months:

Investing $25 weekly in Bitcoin would have turned $675 into $985.56, a 46.01% return. Meanwhile: Gold increased just 5.82%. Apple (AAPL) gained 10.32%. The Dow Jones (DJI) delivered a mere 7.34%. - 1 Year:

With a total investment of $1,325 in Bitcoin, your portfolio would now be worth $2,140.20, reflecting a 61.52% return. By comparison: Gold increased by 14.50%. Apple gained 22.80%. The Dow Jones grew by only 11.36%. - 2 Years:

A $25 weekly investment totaling $2,650 would now be valued at $7,145.42—a 169.64% return. Meanwhile: Gold rose by 26.56%. Apple grew by 36.22%. The Dow Jones delivered 21.13%. - 4 Years:

The long-term case is even stronger. A $5,250 investment would now be worth $14,877.77, representing an incredible 183.39% return. In the same period: Gold increased by 37.26%. Apple gained 54.05%. The Dow Jones grew 27.32%.

Across every timeframe, Bitcoin outpaces traditional assets, offering compelling returns even during short-term periods of six months to a year.

Why Timing the Market Doesn’t Matter

For investors hesitant about entering the market now, it’s important to understand that Bitcoin’s long-term performance speaks for itself. Historical data shows that adopting a DCA strategy minimizes the risk of market timing while amplifying returns over time. Even small, regular investments compound significantly when Bitcoin appreciates.

Moreover, Bitcoin is no longer seen as a speculative asset but as a reliable store of value in a volatile economic landscape. With institutional adoption, technological advancements, and increasing scarcity due to its fixed supply, Bitcoin’s long-term outlook remains overwhelmingly positive.

Why You’re Still Early

The global adoption of Bitcoin is still in its infancy. Despite its impressive performance, Bitcoin’s total market capitalization is small compared to traditional asset classes like gold or equities. This means there’s still significant room for growth as more individuals, institutions, and even governments recognize its utility and value.

Despite Bitcoin’s impressive track record of outperforming gold in terms of returns, its market capitalization at the time of writing stands at only 10.82% of gold’s market cap. This highlights significant growth potential; at current market prices, Bitcoin would need to increase 9.24 times to reach parity with gold, translating to a projected price of $934,541 per BTC.

This price target is in line with recent Bitcoin forecasts, including Eric Trump’s confident projection that Bitcoin’s price will reach $1 million.

With tools like Bitcoin Magazine Pro’s DCA Strategies, anyone can explore how small, regular investments can create exponential growth over time. Whether your starting point is $25 per week or $2,500, the data proves one thing: it’s never too late to start investing in Bitcoin.

A Tool for Every Investor

The DCA Strategies tool available on Bitcoin Magazine Pro allows you to customize your investment parameters, including purchase amounts, frequencies, and start dates. This flexibility empowers investors to create tailored strategies that align with their financial goals and time horizons.

The tool also provides comparative analysis against other assets, so you can clearly see how Bitcoin outperforms over time. This isn’t just a theoretical exercise—it’s actionable insight for anyone serious about building long-term wealth.

Conclusion: The Time to Act Is Now

For those sitting on the fence, thinking they’ve missed their chance, the data is clear: Bitcoin is not only a viable investment—it’s the best-performing asset of the decade. With a DCA strategy, even the most cautious investor can start small and reap the rewards of long-term growth.

It’s time to stop watching from the sidelines. Use Bitcoin Magazine Pro’s Dollar Cost Average Strategies tool to craft your investment approach today. If history repeats itself—and there’s every reason to believe it will—Bitcoin’s future is brighter than ever.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CryptoCurrency

Ivanka Trump Slams Fake Crypto Coin Exploiting Her Name

From Trump to Melania, we now have the Ivanka Trump coin. The crypto industry is going full-throttle on Trump mania, but at least one family member isn’t happy with the latest development, particularly the release of the $IVANKA coin.

Related Reading

In a post on Twitter/X, Ivanka Trump blasted the news of the new crypto project, calling it a “fake crypto coin” currently being promoted without her consent. The presidential daughter stated that she’s not connected with the project and is currently working with her legal team over the unauthorized use of her name in marketing the crypto.

This isn’t the first time a Trump-themed coin became available in the market. Just days before taking office, Trump advertised a meme coin, followed by the launch of the $MELANIA coin.

Ivanka Publicly Denies Any Link With $IVANKA Crypto Project

On Thursday, the presidential daughter publicly denied any links to a new crypto meme coin that’s marketed under her name. In a Twitter/X post that has generated over 1.2 million impressions, Ivanka issued a strong warning and reminder to consumers against this suspicious crypto project.

It has come to my attention that a fake crypto coin called “Ivanka Trump” or “$IVANKA” is being promoted without my consent or approval.

To be clear: I have no involvement with this coin. This fake coin risks deceiving consumers and defrauding them of their hard-earned money,…

— Ivanka Trump (@IvankaTrump) January 23, 2025

Ivanka shared that she had no connection with the project and criticized the developers for using her likeness and name without approval, calling it a violation of her rights. She added that her legal team is taking this issue seriously and plans to sue over misuse of identity.

The presidential daughter added that the crypto project is not just unacceptable but also deceptive and exploitative. Ivanka and her husband, Jared Kushner, held important positions in the first Trump administration. However, the couple seems to enjoy their time on the sidelines.

Controversy Swirls Around The New Coin Releases

Trump-themed meme coins are some of the most popularly traded tokens in the market today. However, their release and marketing were controversial. On January 17th, US President Donald Trump launched the Official Trump token on the Solana blockchain. Then, after two days, the First Lady also announced her coin, the “Melania Coin”, supported by the Solana blockchain.

President Trump used Truth Social to announce his crypto coin, encouraging the community to join the celebration and the special Trump Community. Days after its launch, the Trump token hit an all-time high of $75, pushing the project’s market cap to $15 billion.

However, the enthusiasm on Trump’s coin immediately fizzled, trading at the $37 level, reflecting a 50% drop. Also, the Melania meme coin suffered the same fate, plunging by 80%, and it’s now trading at $2.8.

Related Reading

Trump Continues Pro-Crypto Stance

Before the November elections, Trump indicated his intention to support Bitcoin and crypto projects. He promised a favorable crypto environment and outlined specific plans, including replacing SEC Chair Gary Gensler and supporting a Bitcoin reserve.

On January 23rd, Trump issued his first crypto regulation, banning the creation and issuance of the Central Bank Digital Currency (CBDC).

Featured image from Tobias Hase/Picture Alliance/Getty Images, chart from TradingView

CryptoCurrency

U.S. Congressional Republicans in Hot Pursuit of Biden-Era’s Crypto Debanking

An investigation in the U.S. House of Representatives and a hearing in the Senate will examine whether financial regulators during the administration of former President Joe Biden deliberately cut off crypto industry leaders and others from the banking system in an inappropriate use of authority.

“Debanking is un-American — every legal business deserves to be treated the same regardless of their political beliefs,” said Senate Banking Committee Chair Tim Scott, a South Carolina Republican who took over the gavel earlier this month and has scheduled a February 5 hearing on debanking. “Unfortunately, under Operation Chokepoint 2.0, Biden regulators abused their power and forced financial institutions to cut off services to digital asset firms, political figures, and conservative-aligned businesses and individuals.”

Operation Chokepoint 2.0 is the name Republican lawmakers and the digital assets industry have been using for the systemic severing of crypto insiders from U.S. banks, in reference to an earlier era’s Operation Chokepoint — a government-sanctioned effort to reduce risk in banking by encouraging the lenders to back away from legal but otherwise risky businesses.

Delving into the struggle of crypto executives and businesses to maintain banking relationships, the House Oversight Committee is “investigating whether this debanking practice originates from the financial institutions themselves or from either implicit or explicit pressure from government regulators,” according to a letter the committee chairman, Representative James Comer, sent on Friday to founders and CEOs of several crypto companies and organizations, including Coinbase, Lightswap and Uniswap Labs.

The challenge of pinning the lack of banking options entirely on the government is that some financial institutions may have made decisions based on their own risk appetites or business plans that deliberately steered clear of crypto interests. And banking regulators such as the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency were public in their guidance that regulated banks seeking to do crypto business would face restrictions and additional scrutiny from the agencies.

However, a Coinbase pursuit of private FDIC communications with banks demonstrated that the agency directed them to stop pursuing digital assets services until the regulator had specific rules in place, which it wasn’t developing.

“We are grateful to assist in the thorough investigation of this pernicious practice,” said Kristin Smith, CEO of the Blockchain Association, which also received the House committee’s letter probing the trend.

Meanwhile, congressional Democrats have been focusing their own investigation requests on President Donald Trump’s recently launched meme coin, $TRUMP. He’s been accused of using the presidency to rack up billions of dollars, and they cite the token as a potential risk for dangerous conflicts of interest.

CryptoCurrency

The Cynics and Idealists of Bitcoin

There is something to the stereotype of naive dreamers and idealists, or cold hard realists and cynics. Stereotypes don’t just come into being baselessly, there is a kernel of truth to them, otherwise they would not have spread virally as an idea in the first place. But they, as well as the worldviews they espouse, are also exaggerated beyond that kernel.

Bitcoin is currently stuck in a game of tug of war between the naive idealists and the jaded cynics.

On one hand, the idealists argue that we already won. We don’t have to do anything, Bitcoin is magically guaranteed success. It’s already going to take over the world, everyone is going to own it, it is the best store of value ever. That’s all it needs to win and succeed. No improvements needed.

On the other hand, the cynics argue that we’ve lost, or are going to. That short of a total overhaul changing Bitcoin drastically, there is no way Bitcoin can succeed in the world. It will become captured and useless. “Who knows where to start?” is the response to asking for what improvements are needed.

Both of these extremes dominating the public dialogue sweeps attention away from two important things, the reality of what can already be done with what we have, and how substantially that reality can be expanded with even very small and simple improvements.

As things stand right now, Bitcoin to have any degree of censorship resistance and privacy for a big portion of the world would depend on custodians. The best we can do in that regard is lots of small and local chaumian ecash mints, but to run an ecash mint requires running a Lightning node.

Lightning is complicated, and screwing up and losing the most recent channel state can lose all of your money. The design allows your counterparty to steal all of your funds if you try to use an old channel state after updating it. CTV + CSFS would give us LN-Symmetry, a type of Lightning channel giving a new way for channels to work. Instead of using an old state allowing the other party to take all your money, LN-Symmetry channels would allow them to just “cut through” all the intermediary states and spend your old state into the most recent one on-chain, ensuring everyone gets the correct amount of money.

That one small change (and that is by no means all CTV + CSFS enables) would radically change the landscape of who would be capable and willing to run a local ecash mint. The risk of losing everyone’s money through incompetence would almost disappear.

This one small new functionality would heavily improve Bitcoin’s odds of staying private and censorship resistant. Does it scale self custody to the whole world? No. Does it drastically improve Bitcoin’s value despite store of value maximalists’ claim improvement isn’t needed or possible? Absolutely.

Bitcoiners need to stop focusing solely on the extremes and poles when it comes to possibility in this space, there is a wide open field mostly unexplored between them. If we really want to know our odds of success, the limits of what we actually can and can’t do with Bitcoin, then we need to explore that field.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CryptoCurrency

This Ripple (XRP) Rival Has Gone Viral In The Past Week Surging Past $5.8M Raised In Its ICO's First Month

Ripple (XRP) is currently trading at $3.08 and has experienced a slight decline of 5% over the past 24 hours. Despite its established presence in the cross-border payments sector, Ripple (XRP) is encountering fresh challenges from emerging competitors. Remittix (RTX) in particular is stealing some of Ripple’s spotlight away with a modern offering in the global payments space. This powerful PayFi solution promises to address long standing issues in this lucrative market, as it gears up to dominate PayFi in 2025. So what key features are drawing so many to Remittix (RTX)?

Ripple (XRP) Price Declines Following Mid January Surge

Ripple (XRP) has been wobbling significantly in January, having risen by 40% in just a few days but ending the week up by a net 2.47%. Based on on-chain analytics, Ripple has a market capitalization of about $181.2 billion and a circulating supply of 57,564,441,898 XRP tokens. The Relative Strength Index (RSI) sits at 52 suggesting a neutral market sentiment. The Moving Average Convergence Divergence (MACD) points at a possible consolidation phase without clear momentum in either direction. It appears that Ripple’s most recent surge has come to an end but what’s next is unclear for the moment.

Remittix Disrupts the PayFi Space

Remittix is leveling up the cross-border payments market. The hefty fees and transaction times that come with traditional payment systems have long bothered both individuals and businesses. Now, Remittix wants to end those problems for good.

Through the platform, users can change more than 40 cryptocurrencies to fiat currency and transfer funds worldwide. Transactions are completed within 24 hours and flat-rate pricing eliminates hidden fees typical of legacy systems.

Another key draw for businesses is the Remittix Pay API, which enables companies to accept cryptocurrency payments while seamlessly settling in fiat currencies. With support for over 30 fiat currencies and 50 cryptocurrency pairs, this API simplifies financial operations for organizations operating across borders.

Remittix (RTX) is also designed with privacy and security in mind. Transactions are processed as standard bank transfers, concealing their cryptocurrency origins and making the platform accessible for both seasoned blockchain users and newcomers. This approach ensures that businesses and individuals can integrate digital assets into their workflows without unnecessary complexity.

Remittix is also focused on advancing financial inclusion. By offering its solutions 24/7 without reliance on traditional banking infrastructure, Remittix provides vital access to underbanked populations. This initiative helps bridge the gap in global finance, empowering users who might otherwise be excluded from the modern economy.

Remitix Presale Continues To Boom, Surpassing $5.8 Million

Remittix is soaring in presale, having raised over $5.8 million already with tokens priced at $0.0297. Analysts are forecasting an 800% price surge during the presale with even more substantial growth expected post-launch. As it continues to disrupt the PayFi space, Remittixis becoming one of the most promising crypto projects for 2025.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Ripple seeks deadline for cross-appeal brief in SEC case

Ripple Labs has requested a due date for its cross-appeal brief in its ongoing legal battle against the US SEC.

CryptoCurrency

Council tax alert: Oxford set to hit second home owners with 200% charge

The council of one of Britain’s most famous cities is drawing up plans to charge residents a 200 per cent council tax bill in effort to generate more revenue for the local authority.

Oxford City Council has approved plans to double council tax charges on second homes in a move aimed at making the city “a fairer place to live” in a move than will impact hundreds of households.

An estimated 668 properties within the city council’s boundary will be affected by the new premium charge of 100 per cent.

The measure, which will require second homeowners to pay twice their standard council tax rate, is set to take effect from April 2025.

Earlier this week, the decision was finalised following approval from the authority’s audit and governance committee.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Oxford City Council is preparing to hike council tax on second homes

GETTY

The council had initially planned to implement the charge from April 2024, following its initial approval in February 2023.

However, these plans faced a setback in late December 2023 when council officers received guidance from the Government.

This delay came after officials were informed they needed to provide affected homeowners with 12 months’ notice following the legislation’s royal assent.

As a result, this requirement pushed the implementation date back to April 2025, as the legislation did not receive royal assent until October 2023.

Council tax bills are expected to go up this year

GETTY

Speaking after the committee’s approval, Oxford City Council’s deputy leader Ed Turner emphasised the fairness aspect of the new measure.

“We really want to make Oxford a fairer place to live,” he said. Turner added: “If people have a second home in Oxford, it’s only right that they make an appropriate contribution for local services.”

The deputy leader also highlighted the council’s eagerness to implement the charges, stating: “We need this money, and I think we will be charging from the first moment that we legally can.”

Oxford is not the only local authority floating raising council taxes on specific types of property owners.

Wandsworth Borough Council, where residents are known for paying the lowest council tax in the country, are preparing to target foreign investors who are buying London properties and leaving them vacant.

As of April 1, the Labour-run council will charge a 100 per cent council tax premium on homes which have not been lived in for 12 months.

LATEST DEVELOPMENTS:

Wandsworth is one of the wealthier boroughs in London but is looking to raise more council tax revenue

GETTY

Property owners who do not reside in the property for five years will have to pay 200 per cent more, while those who not live in the home for five years will be charged a 300 per cent penalty.

Those who are second home owners, who have furnished their property despite it not being their primary residence, will be hit with a double council tax bill.

Under previous tax rules, a property in Wandsworth needed to be empty for two years before being hit with a 100 per cent council tax rate.

GB News has contacted Oxford City Council for comment.

CryptoCurrency

Fineqia launches world’s first DeFi yield Cardano ETN

Fineqia AG, the European subsidiary of digital assets and investment firm Fineqia International, has unveiled the first-ever exchange-traded note that deploys Cardano assets for yield bearing in decentralized finance.

The Fineqia FTSE Cardano Enhanced Yield ETN, which went live on the Vienna Stock Exchange on Jan.24, will allow investors to tap into opportunities around Cardano (ADA) price appreciation while still earning yield regardless of the underlying asset’s price movement.

ETNs are debt instruments that collateralize an exchange-traded product’s underlying asset, including crypto. The Cardano ETN, which trades under the ticker YADA, provides access to yield by deploying ADA across yield-bearing DeFi protocols.

The global DeFi market currently holds over $155 billion in total value locked across various protocols. According to DeFiLlama, the TVL peaked at $207 billion during the last bull market. Meanwhile, research platform Statista estimates that the global DeFi ecosystem could see its revenue grow to $542 billion by 2025.

Fineqia’s offering is a collaboration with FTSE Russell, a subsidiary of the London Stock Exchange, which will serve as the ETN’s index provider.

The launch of the Cardano ETN follows Fineqia AG’s base prospectus approval from the Liechtenstein Financial Market Authority. Approval from the FMA allows the company to issue crypto-backed exchange-traded notes across the European Union.

YADA adds to the growing crypto ETN market in the EU, with a third of the 139 products listed on the Vienna Stock Exchange. Increased adoption of digital assets as investment vehicles has led to the availability of over 220 crypto ETPs globally. These products currently account for more than $216 billion in assets under management.

Among these ETPs are U.S. spot Bitcoin ETFs, which have recorded over $121 billion in AUM since their debut in January 2024. Experts attribute the positive market sentiment to Trump’s victory and assumption of office.

Spot Bitcoin ETFs have seen over $4.2 billion in net inflows year-to-date, reflecting the broader optimism surrounding the market.

CryptoCurrency

Crypto Czar Classifies NFTs and Meme Coins as Collectibles

David Sacks has introduced a new perspective on non-fungible tokens (NFTs) and meme coins, describing them as a distinct class of digital assets.

In an interview with Fox Business, the AI and crypto czar spoke on the growing complexity of classifying digital assets, categorizing the two as collectibles.

Digital Asset Classification

“When you talk about digital assets, it could mean many things… you’re talking about a vast area of innovation,” Sacks stated in the interview. He explained that virtual assets cover a broad spectrum, including securities and commodities, placing NFTs and meme coins in the collectible category.

This classification could influence the way the two are perceived, shifting the focus from their volatility to their potential as items of cultural and commemorative significance. Sacks elaborated on this idea, comparing such assets to traditional memorabilia.

Speaking on the Solana-based Official Trump (TRUMP) meme coin, he said:

“I think the Trump coin is a collectible. It’s like a baseball card or a stamp. People buy it because they want to commemorate something.”

However, he clarified that his statements should not be interpreted as a regulatory position.

NFT and Meme Coin Legitimacy Debate

The legitimacy of non-fungible tokens and meme coins is still a hot topic. Last August, NFT marketplace OpenSea received a Wells notice from the SEC over claims that such assets on its platform might be regarded as unregistered securities. In December, the gaming-focused NFT project Cyberkongz was sent a similar warning from the regulator.

This debate has intensified with the recent launches of the official TRUMP and MELANIA meme coins. Senator Elizabeth Warren, a crypto skeptic, has urged federal regulators and the Office of Government Ethics to investigate the TRUMP meme coin. In a January 22 letter, she alleged it had enriched the President and provided a means for crypto funds to flow to him.

At a recent press briefing, Trump downplayed the situation by saying he did not know whether he had benefited financially from the project and claimed to have no knowledge of the coin’s value.

The introduction of these tokens also caused some constitutional compliance concerns, with Zack Guzman from Coinage noting that while the emoluments clause prohibits presidents from profiting from their office, meme coins challenge these existing rules.

Meanwhile, billionaire investor Mark Cuban previously dismissed the Trump project as a gamble, suggesting it could harm the crypto industry’s reputation, especially if proper regulations were not in place. Similarly, former Coinbase CTO Balaji Srinivasan described such tokens as speculative assets, famously calling them a “zero-sum lottery.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bigger Bitcoin Price Catalyst Than The US BTC Reserve

The US Securities and Exchange Commission (SEC) announced on Thursday, January 23, the rescission of Staff Accounting Bulletin (SAB) No. 121, a directive that had imposed stringent accounting requirements on crypto custody for US banks and financial institutions. The move, encapsulated in the newly issued SAB 122, is poised to serve as a more substantial catalyst for Bitcoin’s price dynamics than the anticipated US Bitcoin Reserve (SBR), according to several industry experts.

Implications For Bitcoin

Originally enacted in 2022, SAB 121 mandated that banks classify customer-held cryptocurrencies as liabilities on their balance sheets. This classification significantly increased the operational costs and complexities for financial institutions, effectively deterring them from offering crypto-related services. Thus, the requirement acted as a barrier, limiting the integration of Bitcoin and other cryptocurrencies into mainstream banking operations.

Related Reading

The withdrawal of SAB 121 through SAB 122 effectively removes this accounting impediment. SEC Commissioner Hester Peirce lauded the decision on social media, stating, “Bye, bye SAB 121! It’s not been fun: http://SEC.gov | Staff Accounting Bulletin No. 122.”

The Bitcoin community has responded favorably to the SEC’s decision. Andrew Parish, founder of x3, emphasized the significance of SAB 122 on X, asserting, “Rescinding of SAB 121 is a bigger catalyst for Bitcoin than the SBR. Bookmark this post.” Similarly, Fred Krueger, founder of Troop, highlighted the broader market implications, noting, “SAB 122 is extremely good for Bitcoin. More significant than the Bitcoin Reserve, which is also coming. Now watch the Banks start accumulating.”

Vijay Boyapati, an Ex-Google engineer and the author of The Bullish Case for Bitcoin, further elaborated on the transformative potential of the SEC’s action, stating, “It really is hard to emphasize how huge a sea change we’re witnessing. We went from the worst conceivable anti-Bitcoin, anti-innovation, anti-growth, anti-business administration to the most friendly Bitcoin administration you could hope for. This is 100% not priced in.”

Related Reading

Michael Saylor, Executive Chairman of MicroStrategy, succinctly captured the market sentiment with his tweet: “SAB 121 has been rescinded, allowing banks to custody Bitcoin. 🚀” This aligns with Saylor’s previously outlined tgree catalysts for Bitcoin reaching $1 million per coin, where the facilitation of traditional bank custody stood as last open m factor.

The regulatory easing is expected to catalyze increased institutional participation in the BTC and crypto market. Brian Moynihan, CEO of Bank of America—the second-largest US bank by assets—addressed the potential for broader crypto adoption during an interview with CNBC’s Andrew Ross Sorkin at the World Economic Forum in Davos, Switzerland. Moynihan stated, “If the rules come in and make it a real thing that you can actually do business with, you’ll find that the banking system will come in hard on the transactional side of it.”

This statement aligns with the SEC’s latest directive, indicating that banks are now more likely to develop and offer crypto services, including custody solutions, which were previously constrained under SAB 121. The removal of these regulatory hurdles is anticipated to enhance the liquidity and accessibility of Bitcoin, potentially driving a new wave of demand similar to the spot ETFs in January last year.

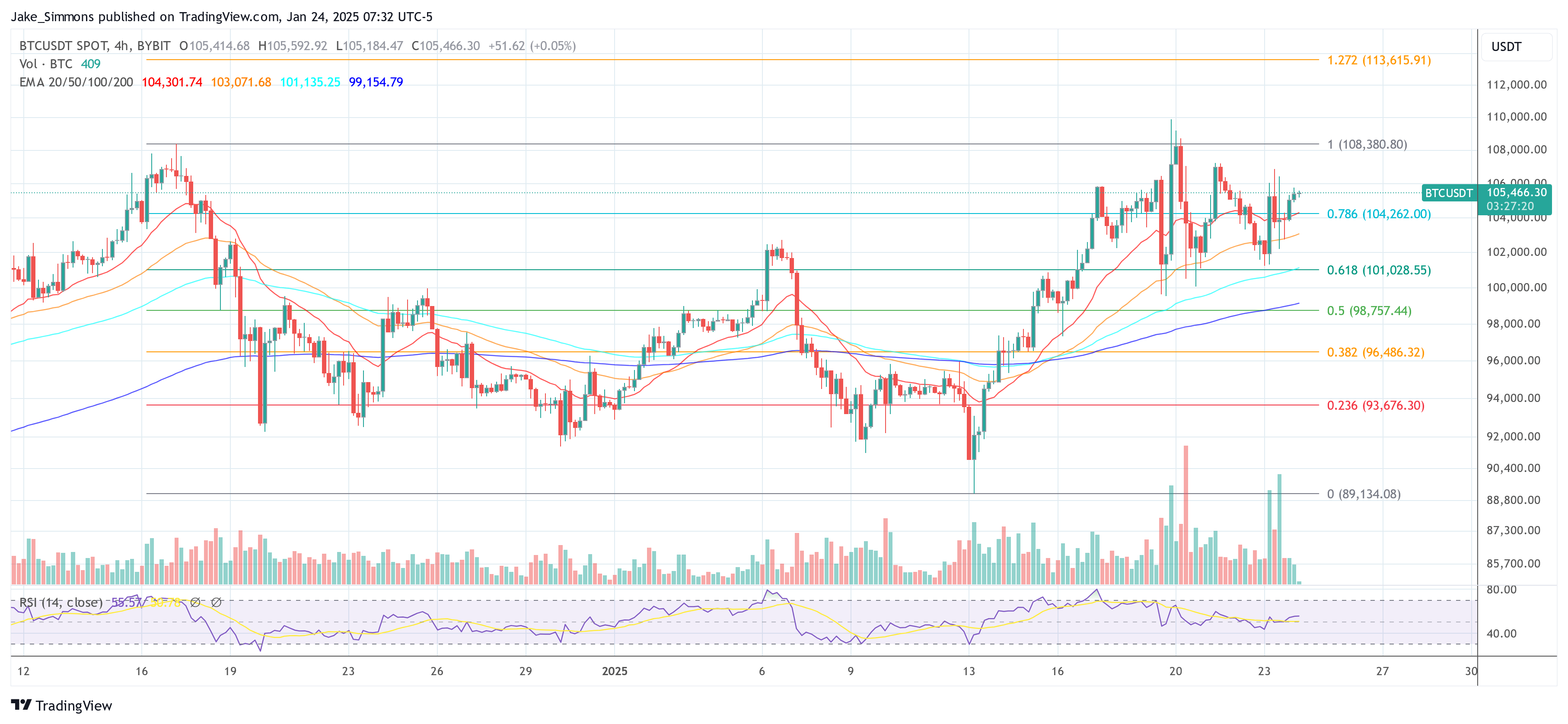

At press time, BTC traded at $105,466.

Featured image created with DALL.E, chart from TradingView.com

CryptoCurrency

Best of the Week: It’s All Happening!

It was a big week for crypto following the inauguration of Donald Trump to a second term Monday.

The White House issued an executive order on digital assets, calling for a friendly approach to crypto across the administration and the creation of a “digital asset stockpile” (which may, or may not be, a Bitcoin Strategic Reserve). Regulatory editors Nik De and Jesse Hamilton were all over the news, as usual.

The SEC withdrew a controversial crypto accounting rule, started a crypto taskforce headed by Hester Peirce (aka “Crypto Mom”), and named crypto-friendly Commissioner Mark Uyeda as acting chair.

Senator Cynthia Lummis, arguably crypto’s most loyal friend in Congress, was named to head the Senate Banking Committee’s new digital assets panel, Hamilton also reported.

We dissected the fallout from the (very) controversial memecoins dropped by the Trump family on the eve of Monday’s swearing in. CoinDesk’s Shaurya Malwa reported that 60 Solana Whales made off with at least $10 million each (many others gained a lot less). Reporting from Tom Carreras on Monday showed that the paper wealth generated by these surprise tokens was, frankly, staggering, even absurd.

Still the memecoins were a great success, encouraging filings for memecoin ETFs, Helene Braun reported. Helene also broke the story about how CME leaked information about XRP and SOL futures ETFs by mistake, which sank those tokens and weighed on the broader market.

Ross Ulbricht, who created Silk Road about 12 years ago, educating thousands on bitcoin for the first time, went free after serving ten years in prison. His freedom was a key promise of the Trump team on crypto. Sam Reynolds had the news.

And the news kept on coming. In fact, it was hard to remember a week when more stuff of importance happened in crypto. Amid it all, the Ethereum community hotly debated its future (particularly that of the Ethereum Foundation). Parikshit Mishra and Sam Kessler followed the story.

Stay tuned for more big stuff happening next week.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login