Looking to cement Wyoming’s position at the forefront of Bitcoin innovation, freshman Representative Jacob Wasserburger (@jacob4wyoming) has introduced the “State Funds-Investment in Bitcoin Act” (HB0201), a bill aimed at creating a Bitcoin Strategic Reserve for the state. Following the footsteps of groundbreaking Bitcoin legislation previously passed in Wyoming, this bill seeks to secure the state’s financial future while paving the way for broader national adoption.

Wyoming: A Tradition of Innovation

“Wyoming has always been a pioneer—from women’s suffrage, to the first national park; from the invention of the LLC, to the frontier of digital assets,” Wasserburger remarked when introducing the bill. “HB0201 ensures that Wyoming remains the leading state for legislative innovation in Bitcoin, while providing our citizens with the long-term benefits of sound money and financial sovereignty.”

HB0201 would allow the allocation of a portion of Wyoming’s state funds into Bitcoin as part of a diversified investment strategy. By doing so, the state aims to capitalize on Bitcoin’s long-term appreciation potential while promoting its principles of decentralization and monetary resilience. The initiative aligns with Wyoming’s established reputation as the most Bitcoin-friendly jurisdiction in the United States, a legacy cultivated by laws such as the Wyoming Special Purpose Depository Institution (SPDI) framework, and includes more than two dozen other laws and regulations passed or promulgated since 2018.

National Collaboration: Supporting Senator Lummis and President-elect Trump

Representative Wasserburger’s ambitions extend beyond Wyoming. The freshman legislator emphasized the importance of supporting efforts by Wyoming Senator Cynthia Lummis and President-elect Donald Trump to establish a United States Strategic Bitcoin Reserve.

“As a proud supporter of Senator Lummis and President-elect Trump’s efforts, I believe Wyoming can play a vital role in this national initiative,” Wasserburger stated. “Building a strategic Bitcoin reserve isn’t just about securing financial strength—it’s about ensuring that both Wyoming and America remain leaders on the global stage.”

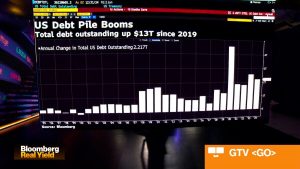

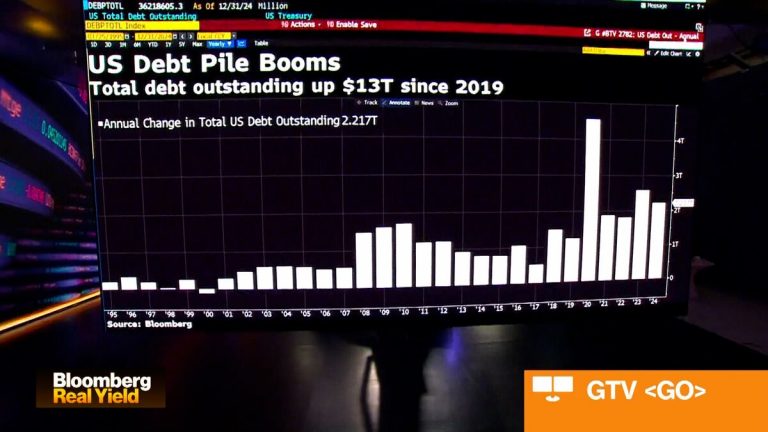

This collaboration underscores the growing recognition of Bitcoin as a geopolitical asset. Advocates argue that holding Bitcoin as a reserve asset could hedge against inflation, protect against economic instability, and strengthen the United States’ position in an increasingly digital global economy.

The Economic Case for a Bitcoin Strategic Reserve

At the heart of HB0201 lies an economic argument as compelling as it is revolutionary. Bitcoin, often described as “digital gold,” has demonstrated remarkable resilience and growth over the past decade. For Wyoming, a state that has consistently championed financial independence and innovation, the potential upside of Bitcoin aligns with its long-term vision.

“We can’t afford to sit on the sidelines while other states, like Texas, Pennsylvania, North Dakota, New Hampshire and others move forward with their own Bitcoin reserve bills,” said Wasserburger. “Passing HB0201 quickly ensures that Wyoming remains the leader among the states, setting the standard for financial innovation and sovereignty. With many other states likely to follow suit, now is the time to solidify our position as the trailblazer in the digital economy and ensure Wyoming stays ahead of the pack.”

“Wyoming’s economic future depends on embracing innovation while staying true to our principles of individual liberty and financial independence,” said Wasserburger. “Investing in Bitcoin is not just smart policy—it’s Wyoming’s way of saying we’re ready for the future.”

In a time when states are grappling with economic uncertainty and inflationary pressures, Bitcoin’s fixed supply and decentralized nature offer a stark contrast to traditional financial systems. By adopting HB0201, Wyoming positions itself as a leader not just in Bitcoin regulation, but in integrating Bitcoin into the financial apparatus of state governance.

This is a guest post by Colin Crossman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

+ There are no comments

Add yours