Business

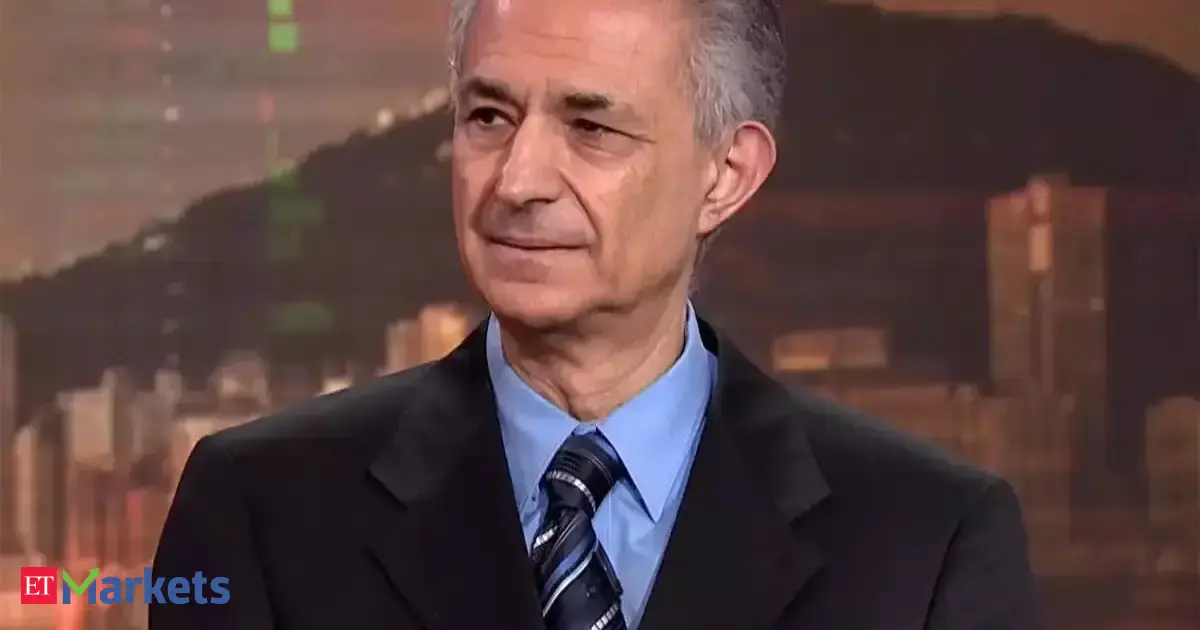

Fed faces tough crossroads of weak growth and sticky inflation: Andrew Freris

When asked how much of a rate cut he expects next year, Freris declined to offer specific projections. “I avoid… making suggestions as to what the Fed may or may not do,” he said, emphasising only that a cut is likely, but for unwelcome reasons. He stressed that policy easing will depend entirely on how inflation behaves and, from his perspective, inflation is not easing meaningfully at all.

On whether markets have already priced in an 80% chance of a Fed cut, Freris delivered one of his strongest remarks. “In my 56 years in the market, I have never seen markets pricing in anything. This is complete nonsense,” he said. According to him, the idea that markets respond predictably to expected policy moves is flawed. If the Fed cuts rates in December, he expects markets to react negatively because such a move would confirm an economic slowdown and signal weaker corporate earnings. “Either way it would have been bad news,” he remarked, explaining that a rate hike would indicate worsening inflation while a cut would highlight weakening growth.

Freris also reiterated his investment stance. “Keep out of US stocks, full stop,” he advised, urging investors instead to focus on Asia and the European Union—regions he says have significantly outperformed the S&P 500 this year. He pointed out that indices across the Eurozone, South Korea, Taiwan, China and even Hong Kong have delivered stronger returns, arguing that U.S. markets have not been the safe bet many expected. If investors had loaded up on the S&P at the beginning of the year, he said, they would have underperformed several international markets that surprisingly beat expectations.