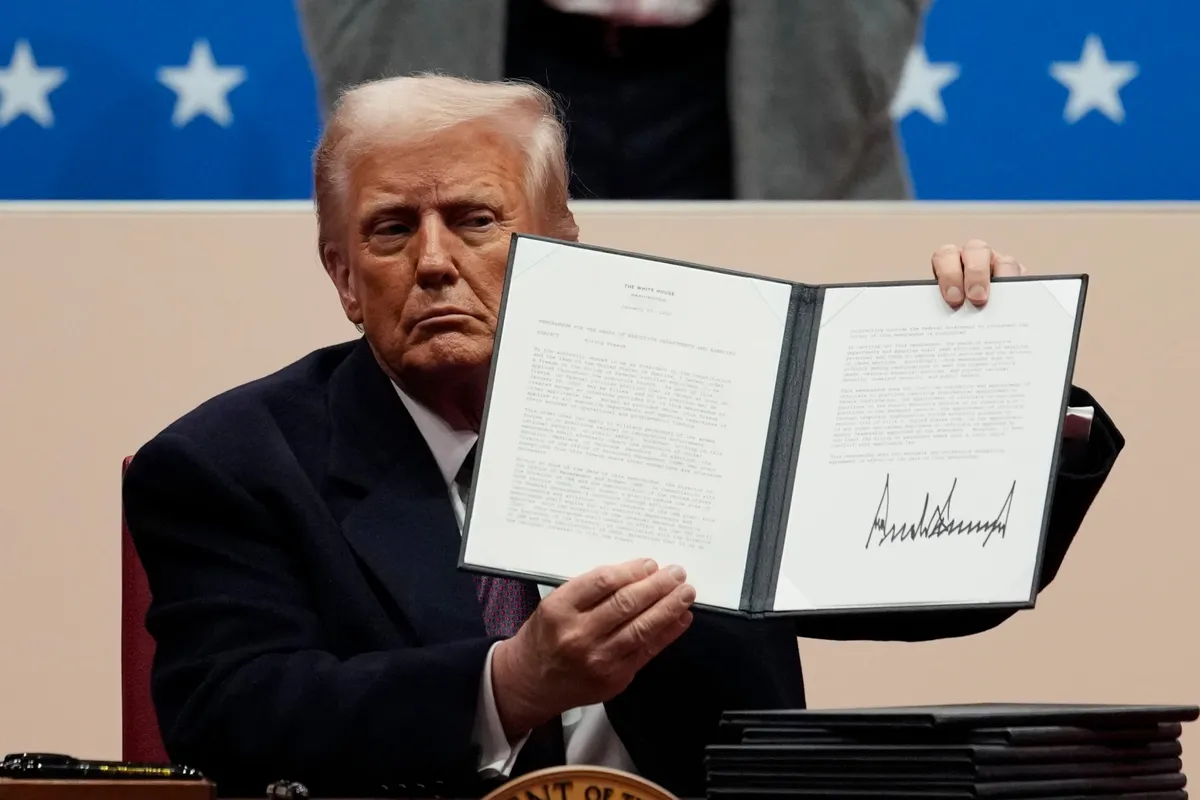

The renminbi weakened and Chinese stocks fell after US President Donald Trump said he could impose a 10 per cent tariff against China from next month.

The CSI 300 index of Shanghai- and Shenzhen-listed companies was down 1 per cent by Wednesday afternoon. Hong Kong’s Hang Seng index retreated 1.8 per cent, led lower by the mainland Chinese companies listed in the territory.

The offshore renminbi, which trades free of the limits imposed by Chinese financial authorities, weakened by 0.3 per cent on Wednesday to 7.29 a dollar.

The dollar strengthened by 0.15 per cent against a basket of currencies including the pound and the yen. The price of gold also rose to an 11-week high of $2,758.

China had largely avoided direct attention from Trump during his whirlwind first day in office, in which he suggested levying 25 per cent tariffs on the US’s largest trading partners Canada and Mexico, leading traders to slash bets on a resumption of the trade war started in his first term.

Trump said the 10 per cent tariff was being considered to punish China for the flow of the opiate fentanyl to Mexico and Canada. The US has accused China of sending the chemicals used to make fentanyl to Mexico where cartels use them to manufacture the drug.

It was a repetition of a threat the new president had made during his campaign.

Traders widely expect the US dollar to continue to strengthen against the currencies of major trading partners, including China, as higher tariffs and lower interest rates in China weigh on the renminbi.

Some 27 per cent of fund managers polled in a Bank of America survey said “long US dollar” was the most crowded trade in January.

Stocks in the rest of Asia were broadly up on Wednesday. Korea’s Kospi index was up 1.3 per cent and Japan’s broad Topix rose 0.9 per cent. Taiwan’s benchmark index advanced 1 per cent while India’s Sensex was up 0.2 per cent.

During the presidential campaign, Trump also threatened to impose a separate 60 per cent levy on Chinese imports.

You must be logged in to post a comment Login