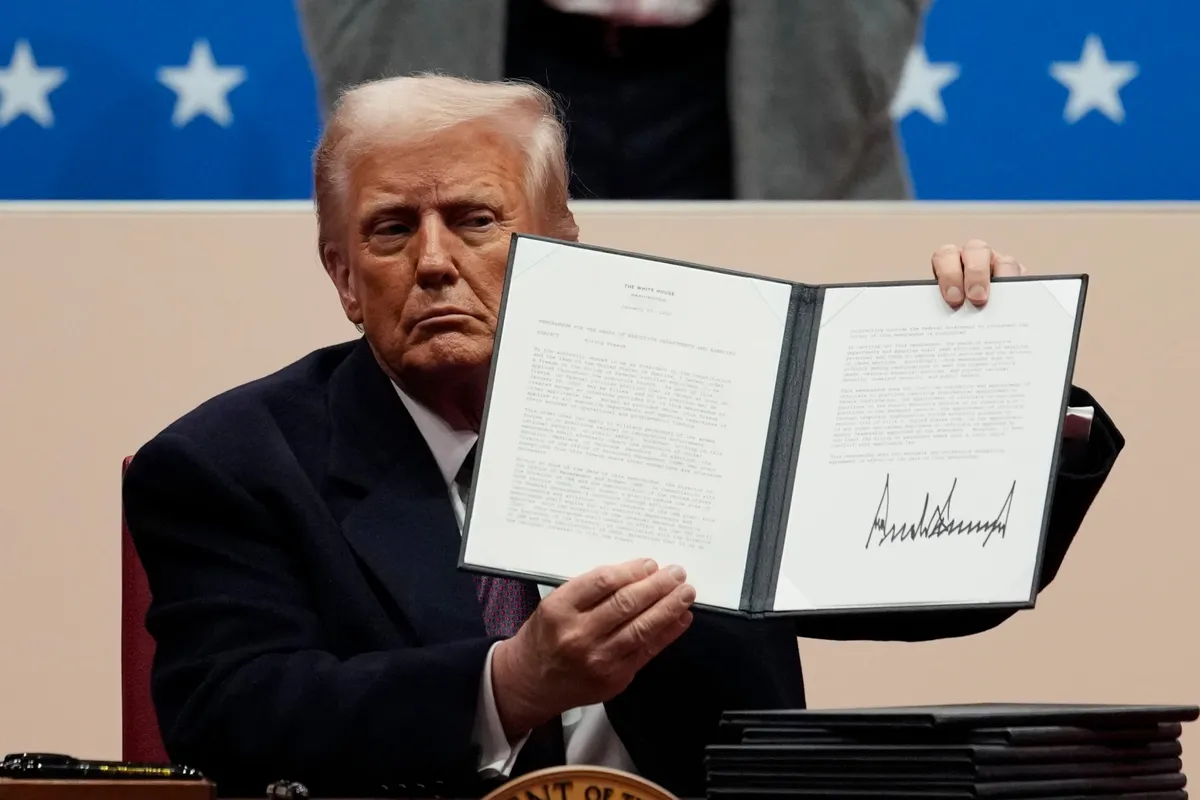

Donald Trump imposed no new trade tariffs on the first day of his second term, as feared by markets, but the US president did lay out the official blueprint for an “America First Trade Policy”.

A presidential memo called on federal agencies to remediate “unfair trade practices” and identify “currency manipulators”. Trade pacts with China, Canada, Mexico and all other partners were placed under review.

The message: the Trump administration was ready to use all means to re-engineer trade flows to its advantage. Here are five takeaways from the opening salvos of Trump’s trade agenda.

Firm pledges for ‘tariffs sooner rather than later’

Trump mentioned tariffs just three times in his inaugural address, calming investors and trade partners who had been warned to expect “day one” levies. But he did outline plans to set up an External Revenue Service to collect tariffs, indicating serious plans to increase revenues from trade.

Josh Lipsky, a senior director at the Atlantic Council think-tank, said tariff decisions are likely to be delayed, but not abandoned. “The president was worried about the market reaction on Tuesday and he didn’t want it to mar his first day.”

The president’s “America First” memo provided a framework for the new agenda, announcing a series of reviews into unfair trade practices, the reasons for US trade deficits and whether competitors are manipulating currencies and unfairly taxing US business.

Trump also sharpened his rhetoric and repeated threats to apply 25 per cent tariffs on Canadian and Mexican imports, despite the countries’ free trade pact. When asked about the prospect of imposing universal tariffs on anybody doing business with the US, the president said: “We may. But we’re not ready for that yet.”

“The experience of the first term is to expect tariffs sooner rather than later,” Lipsky warned, adding that the administration did not yet have a full economic team in place and wanted to establish solid legal bases for any moves.

Focusing on the neighbours first

Trump appears to be prioritising actions on the US’s nearest trading partners, saying he was preparing tariffs on Canada and Mexico to be applied as soon as February 1.

Trump had no qualms in hitting US allies in his first term, invoking national security concerns to put tariffs on steel and aluminium imports. But by going so publicly for Canada, analysts say he is signalling that no country is safe from the self-declared “tariff man”.

Trump’s trade memo ordered a review of trade ties with Canada and Mexico by April 1 (a later date from Trump’s tariff warning, which the president did not explain). Preparations would then begin for a comprehensive review of the USMCA trade deal in July 2026.

One priority highlighted in the trade memo is Trump’s determination to cut “unlawful migration and fentanyl flows”, particularly from Mexico and Canada.

Many supply chains for US manufacturers, particularly carmakers, rely on operations in all three countries and those businesses could put pressure on Trump to rescind his threats.

On Tuesday Canadian Prime Minister Justin Trudeau said his country was taking Trump’s proposals “seriously” and would respond if tariffs were imposed, while Mexico’s President Claudia Sheinbaum said it would focus on the “decrees rather than the discourse”.

A systematic overhaul, including towards China

Other parts of the president’s policy cover the means to enable a comprehensive shift in Washington’s dealings with its trade partners.

“I am not expecting tweaks on the margins,” said Kelly Ann Shaw, a partner at law firm Hogan Lovells and a former Trump trade adviser. “But rather a review of the entire panoply of trade and economic tools that results in significant action.”

The broad range of initiatives kick-started by the memo include a probe into currency manipulation. Trump has previously accused China of undervaluing the renminbi to boost the value of its exports.

The president also directed his trade representative, Jamieson Greer, to review US trade deals, including the limited one struck during the first Trump administration that was intended to boost exports to China.

Several sections of the memo direct various US economic officials to probe the US’s economic relations with China more broadly, including a review of existing tariffs on Chinese goods.

Greer has also been asked to identify possible new deals with significant market access for “American workers, farmers, ranchers, service providers and other businesses”, indicating that the second Trump administration may be open to forging new trade agreements.

“This is a pretty huge deal. It makes me think at some point there is going to be a trade bill in Congress,” said Everett Eissenstat, a partner at Washington law firm Squire Patton Boggs. “Once trade bills start moving they tend to be very significant and the statutes don’t change that often.”

Weaponising trade to achieve different ends

Trump has linked tariffs to other policy goals, beyond reducing trade deficits.

He has promised duties on EU products unless the bloc’s members buy more American oil and gas. Trump on Monday also suggested that tariffs on China could hinge on a deal over TikTok’s ownership. He said he would apply levies on Chinese imports of up to 100 per cent if Beijing failed to agree on a deal to sell at least 50 per cent of the app to a US company.

Anahita Thoms, head of international trade for law firm Baker McKenzie in Germany, said Trump was using tariff threats to maximise his leverage.

“I do not think he is bluffing but he is using it as a negotiating tool,” she said. Now “each country will know what concession it will have to make to be on good terms”.

The threats risked collateral damage. “Tariffs would be inflationary,” said Thoms, adding Trump would not “want to do something that has a negative impact on inflation”.

‘Global’ tariffs and global implications

US imports from countries such as Vietnam and Mexico picked up in Trump’s first term. This reflected the trend of Chinese manufacturers seeking to bypass US tariffs by exporting to America via third countries.

Trump’s trade team have realised this. His memo calls on Greer to consider additional tariff modifications to address “circumvention through third countries”.

The memo asks officials to look at whether a “global supplemental tariff” could be used to remedy the “large and persistent” annual US trade deficit. That indicates that something similar to the universal tariff promised by Trump on the campaign trail might still emerge.

His threats could also stimulate other countries to increase trade with each other. Just since December, the EU has clinched agreements with the Mercosur group of South American countries and Mexico while restarting talks with Malaysia after more than a decade.

Speaking to the Financial Times, Malaysian Prime Minister Anwar Ibrahim said the global trading system would survive the “initial shock” of Trump’s trade barriers.

You must be logged in to post a comment Login