Business

FPIs trim bearish bets, but no rush to buy yet

The Long-Short Ratio – number of traders betting on a rise in prices (long positions) to those betting on a fall (short)-of foreign portfolio investors‘ Nifty futures position stood at 19.4% on Friday, as against 7.5% seen exactly a month ago. Though the measure has fallen from 22.1% on Wednesday following the sell-off in the wake of the renewed AI-related concerns, showing foreigners have increased their bearish positions again, analysts are not concluding anything yet. The ratio made a lifetime low of 5.98% on September 30.

“FIIs have been on a bit of a rollercoaster lately,” said Vipin Kumar, AVP- derivatives and technical research at Globe Capital Market.

Agencies

AgenciesCHANGE IN MOOD Dip in FII Long-Short Ratio suggests ‘smart money’ is hedging its wagers as global worries over AI-driven volatility linger

Kumar said that after a brief period of optimism fuelled by the India-US trade statement, the Long-Short Ratio of FPIs’ Nifty positions is retreating once more, fuelled by a sharp sell-off in US tech, driven by growing anxieties over AI disruption.

“The recent dip in the FII Long-Short Ratio suggests that the ‘smart money’ is hedging its bets.”

After the announcement of the framework for the US-India trade deal earlier this month, bullish bets increased to 16-17% of total bets from only 11% a day ago.

However, the IT sell-off on Thursday and Friday soured some sentiment. The Nifty ended 1.3% lower at 25,471 on Friday, while the Nifty IT index fell 8.2% during the past week. Akshay Bhagwat, SVP- derivatives research at JM Financial Services, said that since budget day, foreign investors have covered their short bets and also bought index futures, roughly to the tune of Rs 9,400 crore till date.

“However, Nifty has lost its momentum lately, and the Long-Short Ratio has cooled off, back below 20% on profit booking of long bets,” he said.

NO BIG MOVES

After Friday’s decline, Nifty is expected to hold above the 24,850-25,000 zone, said Chandan Taparia, head of technical and derivatives research at Motilal Oswal Financial Services. “While the market has struggled to sustain momentum, it continues to form a higher base despite the STT hike, a weaker rupee, and geopolitical tensions,” he said. Taparia expects Nifty to oscillate between the budget-day lows of 24,500 and the highs of 26,300 seen after the US-India trade deal.

Kumar said that the cooling off of the Long-Short Ratio indicates any immediate upside for domestic markets remains capped as global headwinds outweigh local catalysts. “The short-term technical structure for the Nifty has shifted to a negative bias. Following the recent weakness, the index appears to be gravitating toward a price gap created during the February 3 rally, and the key support zone is placed around 25,200-25,000 spot levels,” he said.

Business

Eagle Materials stock downgraded by JPMorgan on wallboard demand concerns

Eagle Materials stock downgraded by JPMorgan on wallboard demand concerns

Business

Midcaps offer attractive opportunities amid volatility: Gautam Duggad

Commodity-Led Earnings Boost

Commenting on the theme, Gautam Duggad from Motilal Oswal said, “Metals and oil & gas gave an additional kicker, but even ex-commodities, earnings growth stood at 12%. This is the sixth consecutive quarter of high earnings growth, increasing from 10% to 16% over the period. Out of 27 sectors, 19 delivered double-digit growth, which is encouraging.”

“Strong earnings came from auto, capital goods, NBFCs, and PSU banks. Lending NBFCs grew nearly 30%, non-lending 35%, and PSU banks delivered 18% growth versus an expected 5-6%. Even IT and retail showed healthy growth.”

He also highlighted a smallcap recovery: “Smallcaps posted close to 30% growth after five quarters of zero or negative numbers. Midcaps ex-commodities grew 20%, slowing the pace of earnings cuts significantly.”

Market Sentiment and Valuation Concerns

Duggad noted: “India has underperformed in dollar terms over the last 15-18 months. Largecaps are fairly valued, but midcaps and smallcaps still need selectivity—midcap index trades at 28 times, smallcap at 24 times. Volatility arises from trade deals, IT, and AI disruption, but fiscal and monetary steps by the government and RBI are now reflecting in earnings, particularly in auto and consumer staples.”

IT Disruption and Uncertain Valuations

On IT valuations, Duggad said: “We upgraded IT in November, yet Infosys dropped 15-17% shortly after. It has now retraced to around 1300. Short-term levels remain uncertain.”Narrow Nifty Contributions Mask Broader Strength

Discussing Nifty earnings, he added: “Financials, consumer, and IT account for 60% of Nifty profits. With these sectors growing only 3-10%, headline Nifty growth of 7-8% is concentrated in few stocks. Broader coverage shows 16% growth, highlighting strong opportunities in mid- and smallcaps. This is truly a stock-picker’s market.”

Business

Schools project to understand impact of poverty

A six-month listening exercise has taken place, giving support and advice to parents.

Business

Christmas Island's Swell Lodge bought by WA business duo

The new owners of a luxury retreat on Christmas Island are bullish on the remote province’s tourism potential as uncertainty surrounds the island’s major employers.

Business

Kim Kardashian Files Trademarks for ‘NOR11’ Clothing and Jewelry Line

At just 12 years old, North West, the eldest daughter of Kim Kardashian and Kanye West, is reportedly stepping into the fashion industry with her own clothing and jewelry brand. According to exclusive reports published by The U.S. Sun and echoed across outlets including Daily Mail, Reality Tea and Yahoo, Kardashian has filed multiple trademark applications for the brand name “NOR11,” signaling the preteen’s entry into entrepreneurship.

The move positions North as the latest family member to pursue a fashion venture, following her mother’s Skims empire and her father’s Yeezy legacy. While no official launch date, collection details or release has been confirmed by the family or representatives, the trademark filings mark a concrete step toward commercialization. Kardashian, often referred to as a “momager” in media coverage, is believed to be overseeing the business aspects.

Trademark Filings and Brand Name Origins The U.S. Sun exclusively revealed that Kim Kardashian submitted three trademark applications for “NOR11” across key categories. These cover clothing and accessories such as dresses, shoes, hats, stockings and outerwear; watches and jewelry including bracelets, necklaces, earrings and rings; and bags like handbags, wallets and cosmetic cases.

The name “NOR11” cleverly combines the start of North’s first name with “11,” which sources suggest references her age when the idea began gaining traction in the Kardashian household. North turned 12 in June 2025, making the “11” a nod to her pre-teen brainstorming phase. The filings indicate a full lifestyle label rather than a limited capsule, encompassing apparel, accessories and jewelry.

As of February 16, 2026, the trademarks remain in the application stage with the United States Patent and Trademark Office. No opposition or approval status has been publicly updated, but the filings alone have sparked widespread speculation about an imminent rollout.

North’s Fashion Journey So Far North West has long shown a keen interest in style, often appearing in high-fashion looks alongside her mother. From early runway cameos—like her 2018 L.O.L. Surprise Fashion Show debut at age 5—to more recent bold statements, she has built a reputation as a trendsetter.

In 2023, at age 10, North landed her first solo magazine cover with i-D magazine, where she expressed ambitions to own both Yeezy and Skims one day and become a business owner. In a subsequent Interview magazine feature, she told her mother she planned to start her own clothing line called “North West.” These early comments foreshadowed the current developments.

Her style evolution accelerated in 2025–2026. She debuted electric blue hair in braids, bridge piercings, blackened teeth with diamond grills, and maximalist outfits blending streetwear and luxury. Recent sightings include a Valentine’s Day 2026 shopping spree at Alexander Wang in Manhattan with friends, where designer Alexander Wang gifted her a studded leather bag. North sported colorful wigs and alt-fashion pieces, drawing attention for her fearless aesthetic.

Social media amplified her visibility: North joined Instagram in December 2025 under her own account, posting restrained teasers including images with “NOR11” elements and cryptic captions like “🔜,” hinting at upcoming projects. She also appeared in Skims holiday campaigns in late 2025, modeling festive loungewear with blue braids.

Family Support and Business Backing Kim Kardashian’s involvement underscores the family’s entrepreneurial ethos. Kardashian has built Skims into a billion-dollar brand focused on shapewear and apparel, while navigating trademark disputes and expansions. Her experience likely guides North’s venture, protecting the brand name early and structuring it for growth.

Kanye West’s influence appears in North’s reported style inspirations; she has cited her father as a key fashion muse over her mother in past interviews. The family’s combined legacy—high-fashion red carpets, business acumen and social media savvy—provides a strong foundation.

Critics note the unusual timing for a 12-year-old to launch a commercial brand, raising questions about child labor laws, creative control and long-term impact. However, supporters highlight North’s demonstrated passion and the Kardashian-Jenner history of early career starts (e.g., Kylie Jenner’s cosmetics line).

Potential Collection and Market Impact While specifics remain under wraps, “NOR11” could target tween and young teen demographics with edgy, inclusive apparel and jewelry. Expect influences from streetwear, luxury basics and bold accessories, mirroring North’s personal style—think oversized pieces, custom graphics, piercings-inspired details and sustainable elements to align with modern youth trends.

The brand would enter a competitive tween/young adult market dominated by Shein, Zara Kids and emerging Gen Z labels. North’s built-in audience—millions following her parents’ social channels and her own growing presence—could drive rapid visibility. Collaborations or limited drops might tie into Skims or other family ventures.

As of mid-February 2026, no launch timeline has surfaced beyond the trademark activity. Industry observers speculate a soft rollout later in 2026 or early 2027, possibly with pop-up events, online exclusives or celebrity endorsements.

Broader Implications North West’s reported fashion career launch reflects evolving celebrity offspring dynamics: from passive exposure to active participation in family businesses. It also highlights the Kardashian brand’s intergenerational strategy, positioning the next generation as entrepreneurs.

Whether “NOR11” becomes a full empire or a creative outlet remains to be seen. For now, the trademark filings confirm North is following her parents’ path—blending fashion, fame and business at an extraordinarily young age.

Business

Never mind cod, it's tilapia and chips please

Two fish and chip shops in Fenland are trying lesser known varieties of fish as cod prices soar.

Business

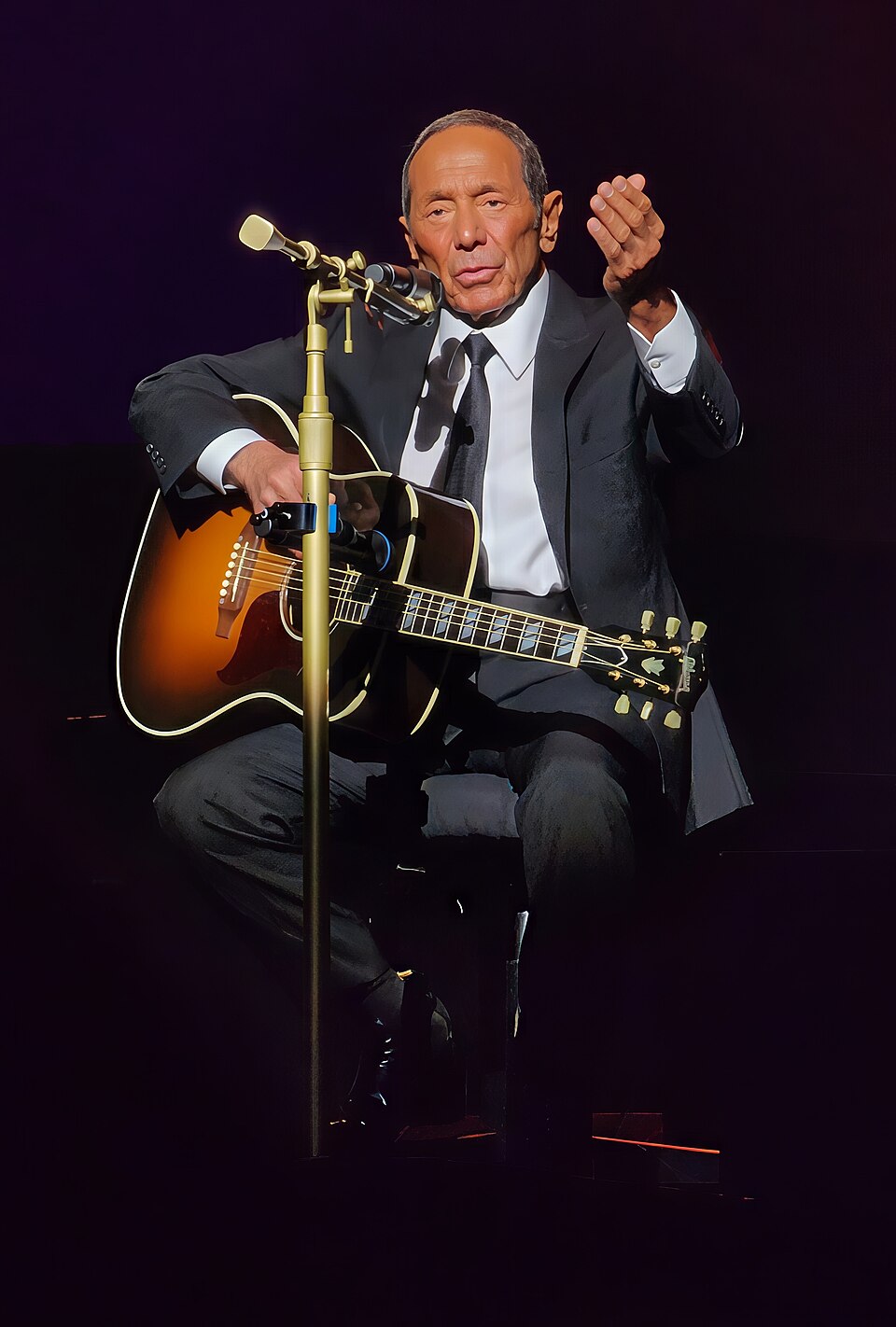

‘Inspirations of Life and Love’ Out Now

Legendary singer-songwriter Paul Anka, the enduring voice behind timeless hits like “My Way” and “Put Your Head on My Shoulder,” released his 30th studio album, Inspirations of Life and Love, on February 13, 2026, via Green Hill Music/Sun Label Group. The lushly orchestrated collection arrived perfectly timed for Valentine’s Day weekend, blending nine new original songs with two beloved classics to celebrate seven decades of his influential career.

The album, available on streaming platforms, CD, vinyl and in Dolby Atmos, follows Anka’s announcement in October 2025 and lead single “Anytime” drop. As of February 16, 2026, it has garnered early praise for its romantic themes, rich arrangements and Anka’s still-vibrant vocals at age 84.

Announcement and Build-Up Anka first teased the project on his official website and social media in mid-October 2025, describing it as a heartfelt reflection on love and life’s milestones. “It’s been an absolute joy to write and record these songs,” he posted on Facebook and Instagram. The lead track “Anytime” served as an instant grat, with a visualizer emphasizing its classic crooner style.

Pre-save campaigns on Spotify and other platforms built anticipation, with the album listed as arriving February 13. Rock Cellar Magazine previewed it in November 2025 as a celebration of Anka’s longevity, noting the inclusion of fresh material alongside re-recordings.

Album Details and Tracklist Inspirations of Life and Love runs approximately 43 minutes across 11 tracks. The record features Anka’s signature orchestral production, focusing on themes of romance, reflection and enduring emotion—ideal for the holiday release.

Key tracks include:

- “Anytime” (lead single, a new romantic ballad)

- “I Just Can’t Wait”

- “(All Of A Sudden) My Heart Sings”

- “That’s Life” (classic re-recording)

- “I Believe” (another nod to his catalog)

- “The Last Time I Saw You”

The album mixes original compositions with refreshed hits, showcasing Anka’s continued songwriting prowess. Green Hill Music highlighted the “lush orchestration” and “masterful” performances, positioning it as a mature, heartfelt addition to his discography of over 130 albums.

Media Coverage and Promotions The release coincided with high-profile interviews. CBS Sunday Morning aired a segment on February 15, 2026, where correspondent Lee Cowan profiled Anka’s 70-year career. Anka discussed adapting to industry changes, from teen idol days to writing for Frank Sinatra and embracing modern shifts like AI in music. He performed a spontaneous song about the show and emphasized discipline—daily olive oil with lemon, rigorous routine—to maintain his voice.

Deadline published an exclusive Q&A on February 13, where Anka reflected on Sinatra collaborations, Hollywood evolution and advice for creatives amid disruption. He expressed no immediate retirement plans, teasing his A Man and His Music Tour resuming March 4, 2026.

An HBO Max documentary, Paul Anka: His Way, streams alongside the album, chronicling his journey from 1957 teen sensation to enduring icon.

Reception and Cultural Impact Early listener reactions on social media and streaming platforms praise the album’s warmth and timeless appeal. Anka posted on Instagram February 14: “Happy Valentine’s Day, everybody 🌹 Let my new album be your soundtrack today.” Fans echoed sentiments, calling it a “perfect love collection” and lauding his enduring relevance.

Critics note the release reaffirms Anka’s status as one of pop music’s most consistent figures, with a Hot 100 presence across seven decades. The Valentine’s timing enhances its romantic draw, potentially boosting streams and sales in the holiday period.

Tour and Future Plans Anka’s A Man and His Music Tour resumes in March 2026, bringing the new material to live audiences. No retirement hints surfaced in recent interviews; he remains active, writing, recording and performing.

Inspirations of Life and Love arrives as a poignant milestone for Anka, blending nostalgia with fresh creativity. Available now on all platforms, it invites listeners to celebrate love through the lens of a music legend who shows no signs of slowing down.

Business

Uruguay will push ahead with pivot away from dollar debt, says Finance Minister

Uruguay will push ahead with pivot away from dollar debt, says Finance Minister

Business

Morning Bid: Japan’s economy could do with some Fire Horse energy

Morning Bid: Japan’s economy could do with some Fire Horse energy

Business

XP Inc.: Clearly Shifting Its Advisory Strategy, And Trades At 10/12x Earnings (XP)

Long-only investment, evaluating companies from an operational, buy-and-hold perspective.Quipus Capital does not focus on market-driven dynamics and future price action. Instead, our articles focus on operational aspects, understanding the long-term earnings power of companies, the competitive dynamics of the industries where they participate, and buying companies that we would like to hold independently of how the price moves in the future. Most QC calls will be holds, and that is by design. Only a very small fraction of companies should be a buy at any point in time. However, hold articles provide important information for future investors and a healthy dose of skepticism to a relatively bullish-biased market.Disclaimer: All of the author’s articles are written on an “as is” basis and without warranty. They represent the author’s opinion only and in no way constitute professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in any articles published.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat14 hours ago

NewsBeat14 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat16 hours ago

NewsBeat16 hours agoMan dies after entering floodwater during police pursuit

-

Politics5 days ago

Politics5 days agoWhy was a dog-humping paedo treated like a saint?