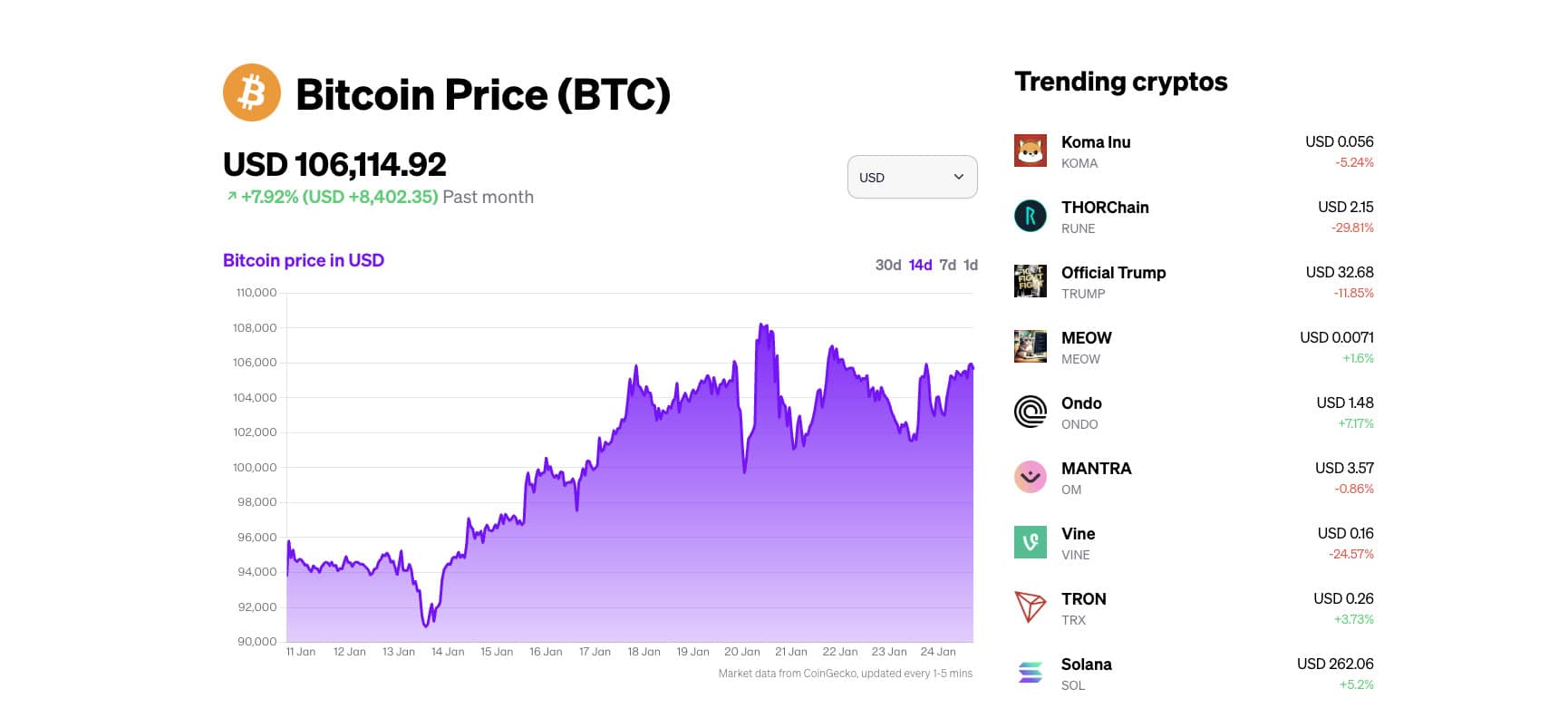

The market is showing signs of recovery in the third week of January after enduring a sharp downturn in late December, triggered by the Federal Reserve’s hawkish stance.

Key events, including the CPI report, the FOMC meeting on January 29, and the impact of Trump’s inauguration on January 20, could heavily influence Bitcoin’s trajectory and push it forward.

New projects like PlutoChain ($PLUTO) may also draw attention. With advanced Layer-2 solutions and faster transaction capabilities, PlutoChain could address some of Bitcoin’s current limitations and activate new functionalities.

Bitcoin Price Prediction – Trump’s Inauguration Could Start Another Major BTC Rally Going Into February 2025

Currently, Bitcoin (BTC) is trading at approximately $103,900, with a 1.05% decrease from the previous close.

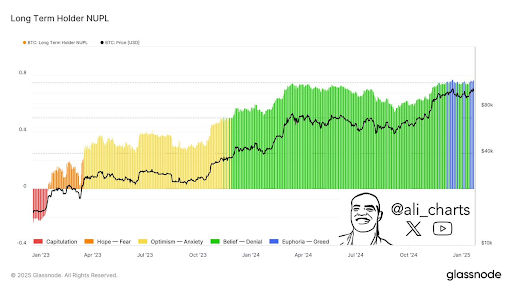

The Relative Strength Index (RSI) for Bitcoin is currently at 65.045, suggesting that the asset is approaching overbought conditions.

In terms of moving averages, Bitcoin’s 50-day Simple Moving Average (SMA) stands at $99,416.28, while the 200-day SMA is at $96,330.46. The 50-day SMA is above the 200-day SMA, which shows a bullish trend.

Resistance levels to monitor include the psychological barrier at $100,000 and the important $106,000 level.

Bitcoin’s price has surged back to $100,000 after dipping to around $90,000 earlier this month, with rumors that Trump’s actions could disrupt the market once again.

The upcoming CPI report remains a major event, with positive inflation data potentially driving Bitcoin’s price higher.

Other factors, such as the resurgence of institutional investors, increased stablecoin minting, and renewed inflows into spot Bitcoin ETFs, could provide additional support.

Major crypto firms, including Ripple, Coinbase, Kraken, Robinhood, and Circle, have collectively contributed over $10 million to Trump’s inaugural fund.

Executives are gathering in Washington as the president-elect prepares to take office, with speculation mounting over executive orders set to change crypto policy.

Trump, known for his pro-crypto stance, is expected to issue directives on January 20, one of which could potentially ignite a Bitcoin price boom.

Galaxy Digital’s CEO has made a bold prediction, suggesting Bitcoin could soar to $500,000 if a reserve system is implemented.

At the same time, Crypto Rover says that his prediction is $280,000 after Trump’s inauguration.

Meanwhile, analyst VirtualBacon forecasts Bitcoin reaching $200,000 by year’s end, citing factors such as increased Federal Reserve liquidity, pro-crypto policies, rising ETF inflows, and the possibility of an altcoin season fueling the surge.

Is PlutoChain’s Hybrid Layer-2 Approach the Key to Activating BTC’s Full Potential in 2025?

PlutoChain ($PLUTO) is a powerful Layer-2 solution designed to potentially improve Bitcoin’s functionality for DeFi, NFTs, and advanced blockchain applications.

Bitcoin’s network often struggles with slow transactions, high fees, and congestion – but this might come to an end soon.

PlutoChain may resolve these challenges by creating a hybrid Layer-2 network to reduce traffic, cut costs, and boost scalability.

With block times of just 2 seconds—compared to Bitcoin’s 10-minute intervals—PlutoChain could bring faster, more efficient smart contract execution while maintaining the trusted Bitcoin infrastructure.

EVM compatibility is also a feature and it might enable developers to port Ethereum-based projects to PlutoChain seamlessly.

This could unlock new opportunities for DeFi, NFTs, and AI applications, expanding Bitcoin’s use beyond being merely a store of value.

In the testnet phase, PlutoChain processed 43,200 transactions in a single day without congestion, showcasing its potential for real-world applications.

Security remains a priority for PlutoChain. The platform has undergone audits by SolidProof, QuillAudits, and Assure DeFi.

Ongoing code reviews, stress tests, and adherence to international standards ensure reliability. Additionally, PlutoChain fosters community engagement and transparency by allowing users to vote on upgrades, partnerships, and features via its official Discord channel.

The Bottom Line

As Trump’s inauguration approaches, optimism surrounding Bitcoin’s future is growing. Speculation about rising institutional interest and potential regulatory changes could drive the crypto leader to new heights in the coming months.

Meanwhile, PlutoChain ($PLUTO) might play a pivotal role in addressing Bitcoin’s long-standing challenges.

The potential mainnet launch is coming soon, so it might be a good idea to keep an eye on PlutoChain and see whether it could gain traction.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Source link

You must be logged in to post a comment Login