Business

Furniture retailers face existential threat

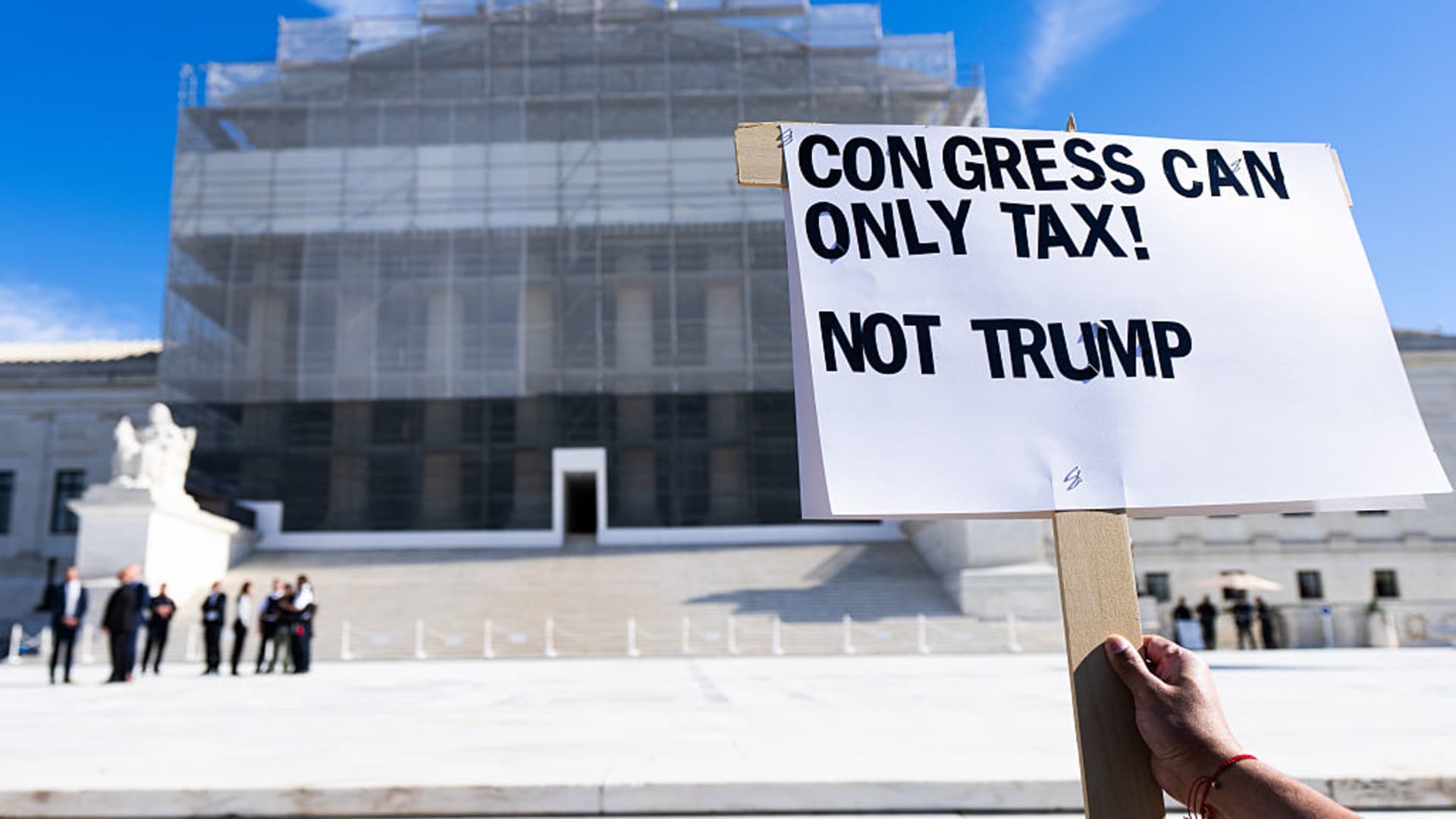

President Donald Trump’s so-called “reciprocal tariffs” could be struck down by the U.S. Supreme Court as soon as this week. Regardless of the ruling, there’s little comfort to be found for the furniture industry.

Furniture importers are facing steep, and in some cases stacking, import duties after the industry was hit with higher tariffs on items such as couches, kitchen cabinets and vanities last fall under section 232 of the Trade Expansion Act.

While Trump’s country-specific “liberation day” tariffs imposed under the International Emergency Economic Powers Act and announced in April are under review by the nation’s highest court, the duties specific to furniture importers, of around 25%, are not.

Compounding the issue is a constant thread of uncertainty plaguing the industry, said Peter Theran, CEO of the Home Furnishings Association, the trade group representing furniture retailers.

The 25% duty on certain furniture imports was supposed to rise to 50% in January, but at the end of December, that plan was pushed back to 2027. Its also become common over the past year for Trump to threaten new tariffs on various imports that never end up getting enacted.

“This is a very, very difficult time to manage your business,” said Theran. “The No. 1 driver of the difficulty of managing your business is unpredictability and an inability to make alternative plans and invest in those plans, because you don’t know what tomorrow will be.”

Rising distress

Tariffs and the uncertainty they’ve brought are the latest blow to the furniture industry, which has been struggling for the past four years and was under pressure well before Trump’s trade war.

During the Covid-19 pandemic, when people were stuck at home and flush with cash, many Americans took the opportunity to refresh their spaces and buy new furniture and decor. Then, low interest rates brought a surge in demand for new homes, which served as a catalyst for furniture buying.

The result was outsized growth across the home goods industry and boom times for furniture.

But as inflation and interest rates began to creep up in 2022, the sector started to sputter, and it later declined for the first time in at least seven years, according to data from Euromonitor.

By the time tariffs came around, home sales had slowed and some furniture companies were already struggling to keep operations afloat and couldn’t manage the sudden increase in fixed costs.

American Signature Furniture, the parent company behind Value City Furniture, declared bankruptcy late last year after nearly 80 years in business. It began liquidation sales at its 89 remaining stores last month.

In a court filing, the company said the aftermath of the Covid pandemic, subsequent shifts in consumer spending and rising costs led to a 27% decline in sales between 2023 and 2025. Net operating losses ballooned from $18 million to $70 million during the same time period, it said.

By the end of 2024, the company was facing “significant liquidity constraints,” which were then “further exacerbated and accelerated by the introduction of new tariff policies,” the company said in the filing.

Over the last year, at least 10 other furniture businesses have declared bankruptcy, with some liquidating and ceasing operations altogether, according to a CNBC review of federal bankruptcy filings.

Most of the companies are smaller businesses, which have been hit harder by tariffs because they have fewer resources than their larger competitors.

“The smaller players are definitely the ones that will be the hardest hit because they don’t necessarily have deep pockets, they don’t have the economies of scale, they don’t have the huge sourcing teams that can suddenly look to pivot the destination or the origin of the products,” said Neil Saunders, retail analyst and managing director at GlobalData. “So they are under a lot of pressure, and we probably will see more failures in that independent space.”

Joseph Cozza, whose small furniture business East Coast Innovators supplies retailers such as Macy’s and Raymour & Flanigan, told CNBC he was forced to raise prices between 15% and 18% to offset higher tariff costs, leading to a slide in demand over the holidays.

For now, Cozza said he can keep his business running but is hoping for an interest rate cut, a jolt to the housing market and larger-than-expected tax returns to spur sales.

“I’m praying for that,” he said.

If not, he might have to move his business from Philadelphia to North Carolina, where operating costs are lower, he said.

“I have a nice company with nice employees, and I pay them all a really good wage, and I’m being penalized,” said Cozza. “I’m being penalized for what I do, and I just don’t think that’s fair.”

Market share grab

The advent of tariffs has created a market grab opportunity for larger businesses, which are better equipped than smaller businesses to weather policy changes and keep prices lower.

Over the last year, some large and publicly traded furniture companies have actually been growing profits and sales despite higher costs from tariffs.

During Ikea’s fiscal 2025, it was able to keep prices relatively steady and revenue about flat compared with 2024, it said in a news release. It did report higher operating expenses but attributed the increase to an acquisition it made in the Baltics, not tariffs.

RH, Williams-Sonoma and Wayfair have all grown sales and margins even as they faced higher import costs.

In the nine months ended Nov. 1, RH saw sales grow almost 10% as margins expanded. At Williams-Sonoma, sales grew about 4% in the 39 weeks ended Nov. 2 while operating margins grew slightly. Wayfair, which reported fourth-quarter results on Thursday, saw revenue grow 5.1% in fiscal 2025 as gross margin stayed steady and operating expenses fell.

Wall Street has yet to see the full impact of furniture-specific tariffs on these companies because most of them last reported results right around the time the tariffs were enacted.

But they already faced a wide array of duties throughout 2025. Most U.S. furniture imports come from China and from Vietnam and other parts of southeast Asia, which have seen a range of higher tariffs before furniture-specific levies were introduced. At one point, imports from China were tariffed as high as 145%, while Vietnam faced tariffs of around 20%.

Most of those country-specific duties have come under review by the Supreme Court. At the heart of the case is whether Trump had the legal authority to impose what he calls reciprocal tariffs, which critics say infringes on the power of Congress to tax.

Any ruling the court makes is poised to bring even more uncertainty to the industry.

If the justices rule against the duties, there will be questions over how they will be refunded and whether the administration will come up with new ways to implement tariffs. If the justices rule in Trump’s favor, there will be questions over whether tariffs could get even higher.

“A CEO of one of the largest furniture retailers in the country said to me, ‘Even if tariff strategy ended up with the worst possible outcome for my business, I would then create a plan, invest in that plan, execute under that plan and create the best outcome that’s available,’” said Theran of the Home Furnishings Association.

“No one can do that,” he said. “No one can invest in a plan now, because the tariff strategy has not stabilized. It keeps changing, and the looming Supreme Court decision almost certainly will cause change after that decision is rendered.”

Business

HIVE Digital: A Re-Rating Waiting To Happen (NASDAQ:HIVE)

I started out as a crypto investor a decade ago and remain deeply active in the crypto space. I cover Bitcoin miners, digital asset treasuries, and crypto ETFs majorly, but I also seek alpha in tech equities, especially in emerging sectors like quantum computing and orbital intelligence. I have initiated coverage as a first analyst here on Seeking Alpha to cover names like SealSQ (LAES), Rezolve AI (RZLV), among others, with Buy ratings. Several of these tickers have delivered double to triple digit returns since initial coverage. I try to go beyond surface level metrics and headline numbers. I focus on fundamentals, capital allocation, momentum, market structure, and management execution. And most of all, your comments matter. Even the critical comments are very much welcome, as they improve my work and sharpens the analysis. I value thoughtful disagreements. I look forward to learning and compounding together in the market. Best, Mandela

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HIVE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

US trade deficit hits fresh high despite Trump's tariffs

The US bought more goods than it sold in 2025 as the White House attempts to reverse the flow.

Business

A Yale Professor’s Investment Formula Says You Need More Stocks. See How It Works.

Are you invested too much in stocks or not enough? There is a new way to answer that question.

Yale University finance professor James Choi recently developed a formula that recommends an asset allocation based in part on your age, income, savings and risk tolerance. The formula is drawn from a paper he co-authored last year and was adapted for The Wall Street Journal.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Orphaned Baby Macaque Punch-kun Goes Viral at Japanese Zoo

A six-month-old Japanese macaque named Punch-kun has captured hearts worldwide after videos and photos of him carrying a large stuffed orangutan toy everywhere went viral on social media. The baby monkey, abandoned by his mother shortly after birth, treats the plush as a surrogate parent, providing comfort as he adjusts to life with other primates at Ichikawa City Zoo in Chiba Prefecture, near Tokyo.

Punch was born in July 2025 but rejected by his mother days later, a behavior sometimes seen in macaques under stress or due to health issues. In the wild, such rejection often proves fatal for infants. Zoo staff intervened immediately, hand-rearing and bottle-feeding Punch to ensure his survival. As he grew, keepers noticed signs of anxiety and loneliness typical in orphaned primates who lack maternal bonding and physical contact.

To help ease his distress, caretakers introduced soft blankets and toys around one week old. Punch quickly formed a strong attachment to an oversized orange plush orangutan, reportedly purchased from IKEA. He clings to it while sleeping, carries it on his back like a real infant macaque would ride with its mother, presses his face into it when scared and rarely lets it out of reach. Zoo officials have dubbed the toy his “plushie mom” or surrogate mother.

“The stuffed animal was a surrogate mother,” zoo representative Mr. Shikano told media outlets. Staff were surprised by the depth of the bond but recognized it as a healthy coping mechanism during his hand-rearing phase.

Videos shared on platforms like Instagram, X (formerly Twitter) and YouTube show Punch dragging the toy through his enclosure, snuggling with it during naps and even bringing it along as he explores. One clip depicts him running back to the plush when overwhelmed, melting viewers with its poignant display of need for security.

The footage exploded online in mid-February 2026, amassing millions of views and shares. Comments flooded in with empathy: “This broke my heart but also healed it,” one user posted. Others called Punch “the bravest little guy” and rooted for his recovery. The story drew comparisons to other viral animal tales of resilience and companionship.

By February 15, the zoo reported unprecedented crowds, with long lines forming at entrance gates. Officials issued an apology for delays, thanking visitors while urging patience. “We would like to express our sincere gratitude to everyone who visited us today,” the zoo posted on X.

Punch’s integration into the troop has progressed gradually. Introduced to other macaques in mid-January, he has begun deeper interactions, though challenges remain. Some troop members have been less welcoming, leading to occasional retreats to his toy for reassurance. Recent updates from the zoo indicate steady improvement: “Punch is gradually deepening his interactions with the troop of monkeys,” a February 6 post noted. He still carries the plush but ventures farther while maintaining it nearby.

Zoo staff monitor his development closely, providing enrichment and socialization opportunities. Japanese macaques typically form strong social bonds early, so Punch’s progress marks a positive step toward full group membership.

The viral phenomenon has spotlighted animal welfare issues, with some advocates questioning zoo environments. PETA and others criticized the “concrete pit” setting, arguing sanctuaries offer better natural space and bonds. The zoo emphasizes its conservation and educational role, with Punch’s story highlighting hand-rearing successes in captive care.

Punch’s IKEA orangutan has sparked interest in similar toys, with online searches surging and some retailers noting stock interest. Social media users jokingly suggested “buy it before it sells out,” turning the plush into an unexpected symbol of comfort.

As Punch continues growing—now about seven months old—his story resonates as one of adaptation and unexpected friendship. Zoo visitors flock not just for the cute factor but to witness a tiny survivor finding solace amid hardship.

Ichikawa City Zoo, a smaller facility focused on local wildlife and education, has seen a welcome boost in attendance. Officials hope the attention raises awareness about primate care and the emotional needs of young animals.

For now, Punch-kun remains a beacon of cuteness and resilience, his stuffed companion a touching reminder that even in loneliness, comfort can come from the simplest sources.

Business

NBA embraces content creators, tries to protect live sports rights

The future of the NBA’s media strategy was taking shape at this year’s All-Star weekend.

The fanfare has always been about showcasing the league’s best players. But this year, the event was as much about the league’s partnership with content creators as it was on-the-court talent.

More than 200 global creators took part in the events Thursday through Sunday, facilitated by the league. It showed the NBA appears more than happy to partner with content creators rather than limit their game access to wall off the value of live rights – where the league makes most of its money. The NBA’s new 11-year, $77 billion media rights deal began this season with deals with Comcast’s NBCUniversal, Disney and Amazon.

The NBA is betting its future has space for both a growing creator base and the traditional game viewing experience that has fueled its revenue growth.

“The NBA has a long history of collaborating with talented creators who share our commitment to bringing the excitement of our games and events to fans around the world,” NBA Senior Vice President of Social and Digital Content Bob Carney said in a statement. “We’re thrilled to join forces with more creators than ever at NBA All-Star, providing opportunities for them to be active participants across virtually every event and deliver engaging content that showcases this marquee NBA event to different audiences.”

A few months ago, NBA Commissioner Adam Silver called the NBA “a highlights-based sport” and pointed fans to Instagram, TikTok, X and YouTube for league content. Silver has decided it’s worth partnering with creators to keep Generation Z and Generation Alpha interested in the NBA as those age groups move away from watching full games the way their parents did.

Embracing social media is a risky play for Silver, given the vast majority of the league’s revenue comes from the value of live games. The NBA’s big media deal has led to soaring team valuations. The average value of an NBA franchise is now $5.52 billion, 18% more than a year ago.

Still, Silver may have little choice. Unlike the NFL, NBA regular season games don’t have huge audiences. This season, NBA regular season games have averaged about 2 million viewers across ESPN, NBC and Amazon Prime Video, according to Nielsen data. That compares with an average TV audience of 18.7 million for a regular season NFL game in the most recent season.

A 2023 survey from marketing firm InMobi found 61% of Gen Z respondents, or those aged 18 to 24 at the time of the survey, named user-generated content as their favorite form of media.

Bridging the gap between content creation and live rights may be inventing a new form of alternative broadcasting, where kids can watch games along with their favorite YouTuber. A Harris Poll survey earlier this year found 37% of surveyed Gen Z-ers said they would watch a creator‑led co‑stream during a regular season game across pro sports. Seventy percent said they’re likely to watch their favorite creator’s feed if that person is co‑streaming a sporting event.

“As time goes on, I could see in a couple of years, there’s 30 different ways to watch the Super Bowl or something like that,” said sports content creator Jesse Riedel, known as Jesser on YouTube, in an interview. “I think in the future, instead of one broadcast, there’s gonna be so many versions of a broadcast.”

Riedel has more than 37 million YouTube subscribers. He co-founded a media and lifestyle company, Bucketsquad, which has annual revenue in the “solid” tens of millions, according to the company’s president, Zach Miller.

Riedel noted the NBA is a cleaner fit for content creation than the NFL because fans tend to focus more on players and less on teams. Riedel features many star players in his videos, helping him to draw large viewership.

“I feel like the NFL audience I have is more die hard for their teams, but the NBA, I think, in particular, is more like player driven,” Riedel said.

The rise of NBA content creation is not the only factor changing the league’s media future. Silver also spoke this weekend about how artificial intelligence will likely change the NBA viewing experience.

“One area in particular that I think is worth addressing is impact on the fan experience. One of the things we’re beginning to see already is how we’re going to, more than personalize, almost hyper-personalize our telecasts,” said Silver in an All-Star weekend press conference. “Many of you have probably experimented with this already, but in essence, you’ll be able to hear the game in any dialect, any language, you’ll be able to hear a hardcore Xs and Os commentary, maybe one that’s more comedic if that’s what you’re interested in, or a novice explaining each foul and the rules as it goes along.”

NBA Commissioner Adam Silver addresses the media following the Board of Governors meetings on Sept. 10, 2025 at the St. Regis Hotel in New York City.

David Dow | National Basketball Association | Getty Images

There’s inherent risk with hyper-personalizing the game. Sports is one of the last collective experiences in American society – and certainly on television. This has led to skyrocketing media rights and the high cost of associated advertising.

Perhaps having many broadcasts and AI experiences will boost interest, and targeted advertising rates will continue to spike as companies seize the opportunity to attach hyper-specific commercials to personalized content.

But breaking down broadcasts into many different pieces may also deteriorate the main reason why live rights are so valuable – as a way to target millions of people all at once.

Business

NYC real estate pros warn against Mayor Mamdani’s 9.5% property tax hike ultimatum

Fox 5’s ‘Good Day New York’ co-host Rosanna Scotto joins ‘Varney & Co.’ to break down Mamdani’s proposed property tax hike and what it could mean for New York homeowners, renters and small businesses.

New York City’s democratic socialist Mayor Zohran Mamdani has issued an ultimatum to Albany: tax the ultra-wealthy or face a “last resort” 9.5% property tax hike to plug a $5.4 billion deficit.

While Mamdani claims he’s protecting the working class, real estate insiders say the plan is a math-defying disaster that will drive up rents and accelerate the flight of taxpayers to low-tax states like Florida and Texas.

“Even the discussion of a 9.5% hike is enough to influence buyer behavior and cause irritations in the market,” Douglas Elliman’s Ben Jacobs told Fox News Digital. “Some buyers have considered Nassau, Westchester, Long Island, and even Florida or Texas as alternatives because they just don’t agree with [NYC] politics.”

“The mention of a 9.5% hike can pause decision-making, especially for those weighing options in the suburbs or out-of-state markets. We’re already seeing clients seriously evaluate alternatives in Nassau, Westchester and beyond, factoring taxes heavily into affordability calculations,” Michelle Griffith of Douglas Elliman also told Fox News Digital. “In some negotiations, this ‘Mamdani Effect’ is tangible, slowing deals or prompting buyers to consider properties outside NYC.”

WALL STREET CASH FUELS HAMPTONS HOUSING BOOM TO RECORD MEDIAN PRICE AMID TIGHT INVENTORY

Earlier this week, Mamdani issued a preliminary fiscal year 2027 budget that includes a property tax hike, a prospect he has described as a “last resort.”

New York City Mayor Zohran Mamdani held a press conference in Coney Island on Feb. 15, 2026. (Getty Images)

“Today, I’m releasing the City’s preliminary budget. After years of fiscal mismanagement, we’re staring at a $5.4 billion budget gap — and two paths. One: Albany can raise taxes on the ultra-wealthy and the most profitable corporations and address the fiscal imbalance between our city and state. The other, a last resort: balance the budget on the backs of working people using the only tools at the City’s disposal,” Mamdani said in a Tuesday post on X.

“Faced with no other choice, the city would have to exercise the only revenue lever fully within our own control. We would have to raise property taxes. We would also be forced to raid our reserves,” Mamdani additionally said during remarks Tuesday. “This would effectively be a tax on working and middle class New Yorkers, who have a median income of $122,000.”

Both agents warn that taxing high earners could trigger a further exodus of wealth, shrinking the tax base and eventually leaving middle-class families “holding the bag.”

New York City Mayor Zohran Mamdani called for the state to increase taxes on corporations and the wealthy to help address city’s budget deficit Tuesday, warning that the alternative option will be for the city to raise property taxes.

“Higher corporate and wealth taxes can trigger a chain reaction,” Jacobs said. “Reduced investment and relocation of high earners shrink the city’s tax base, which often indirectly affects middle-class households. Even if they aren’t the direct target, over time these economic ripples can influence affordability, property values and access to services.”

“In many cases, property tax increases are eventually absorbed by tenants, particularly in rent-stabilized or market-rate units where landlords factor operating costs into pricing,” Griffith added. “While the Mayor’s promise of ‘rent stability’ is admirable, history shows that higher property taxes can translate into incremental rent increases fairly quickly, sometimes within a year. Working families may end up feeling the impact, even if it’s not immediate.”

Jacobs’ and Griffith’s respective clients allegedly also see the risks with Mamdani’s economic proposals.

The average cost of rent in New York City is $3,454 per month, according to latest Zillow data. (Getty Images)

“Many of my clients view a flat rate hike on a system they already consider inequitable as a Band-Aid solution. Buyers and sellers alike would likely welcome a complete reassessment overhaul that reflects true property values and promotes fairness,” Griffith explained. “Temporary spikes tend to create uncertainty in the market, whereas a transparent and balanced approach would stabilize it long-term.”

“A flat hike on a system already misaligned with true property values risks exacerbating inequity,” Jacobs said.

Real estate is a game of certainty, and Mamdani’s proposal has created the opposite as the agents look ahead to the future of NYC’s market.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business correspondent Lydia Hu details NYC Mayor Zohran Mamdani’s call for tax hikes on wealthy New Yorkers and more on ‘Varney & Co.’

“Buyers and sellers are focused on long-term affordability and predictability. Without clear guidance on taxes and assessments, the market slows and buyers proceed with caution, which is especially true for middle-class families,” Jacobs said.

“Ultimately, buyers want predictability. When policy proposals create uncertainty, whether on taxes, rent or regulations, it directly impacts the market. People are not just looking at the sticker price of a property,” Griffith said. “Stability and transparency in tax and assessment policies are key to keeping NYC’s middle-class families confident in making big housing decisions.”

Fox News Digital reached out to Mamdani’s office for comment but did not receive a response by the time of publication.

FOX Business’ Alex Nitzberg contributed to this report.

Business

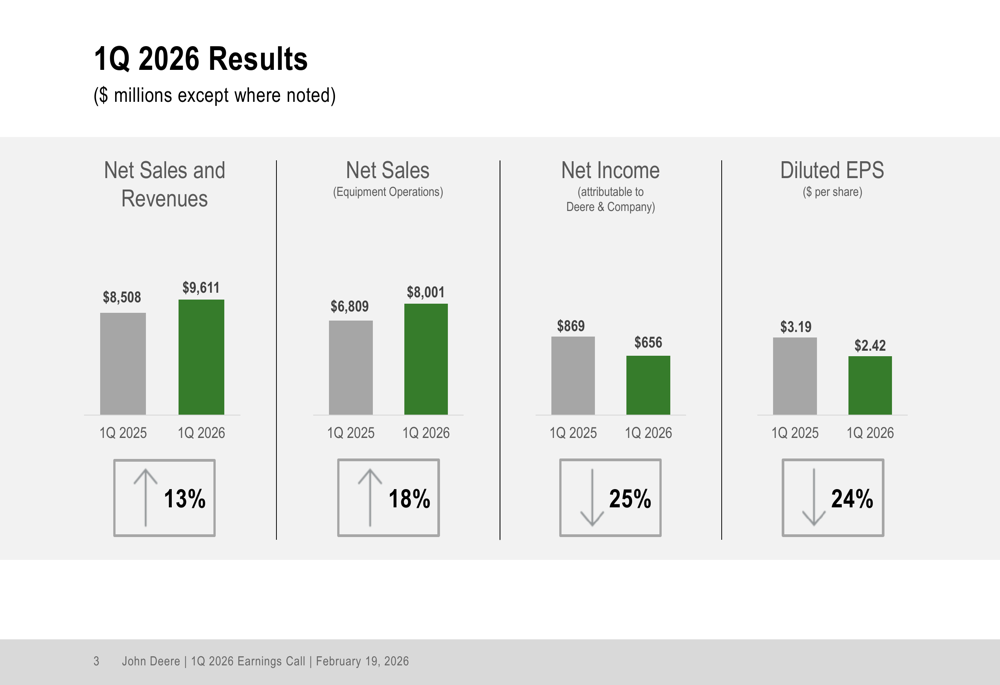

Deere Q1 2026 slides: Strong revenue growth despite profit headwinds

Deere Q1 2026 slides: Strong revenue growth despite profit headwinds

Business

Earnings call transcript: Teekay Tankers beats Q4 2025 estimates with strong EPS and revenue

Earnings call transcript: Teekay Tankers beats Q4 2025 estimates with strong EPS and revenue

Business

United Airlines MileagePlus update: Fewer rewards for non-cardholders

No United Airlines credit card? Soon you’ll earn fewer miles than other travelers.

United is overhauling its MileagePlus frequent flyer program to reward travelers with more miles and lower redemption rates, including for some of its long-haul business-class seats — if they have one of the airline’s credit cards. It’s the latest move by an airline to reward its highest-spending customers.

The changes mark the biggest shake-up to the lucrative program in more than a decade, when United began rewarding customers for how much they spent — not just how far they flew.

United Chief Commercial Officer Andrew Nocella told CNBC in an interview that the airline has been working on the changes for about 18 months and that the carrier is aiming to reward its most loyal customers.

The shift also comes as United tries to stand out in an ever more competitive landscape for travel and rewards credit cards. That space also includes American Express’ Platinum, Capital One‘s Venture X and Chase’s Sapphire Reserve cards.

United Airlines planes are taxiing to takeoff from San Francisco International Airport.

Tayfun Coskun | Anadolu | Getty Images

“In the credit card space in general, a lot’s changed over the last five to 10 years in terms of the number of travel credit cards that are out there,” Nocella said. “What I’m thinking about as we make these changes for United is to make sure that if you hold the credit card, you put it top of wallet, and then if you don’t hold the credit card, there’s a reason to get the credit card that seems incredibly compelling if you’d like to fly United Airlines and if you’d like to have that … trip to Tahiti or to Rome or wherever we may be able to take you.”

The changes take effect April 2. United is planning to show the discounted award flights on its website “so customers can see exactly how much having a United card could save them on their travel,” the airline said.

United’s loyalty program update is part of a trend among airlines to reward frequent flyer program members depending on how much they spend. About a decade ago, the major carriers tweaked their loyalty programs to reward customers for dollars spent over miles traveled.

Airlines also encourage customers to sign up for their credit cards by offering perks like no fees for checked bags and earlier boarding.

What’s changing with United MileagePlus

United MileagePlus primary cardholders will get more miles per dollar spent on United flights compared with customers without a card, and higher rates than they do currently. Their earning goes up, too, when they actually use that card to purchase the ticket.

Meanwhile, customers without the card will earn less than they do today.

For example, a traveler without a co-branded United Airlines credit card will get three miles per dollar spent on a ticket, down from the current five miles. Under the new structure, a cardholder could earn six miles, and more if they use the card to buy it. Those with elite MileagePlus status earn miles at a higher rate, too.

United debit cardholders will also receive more miles, once they spend $10,000, United said.

Redemption rate discounts for cardholders

United will also now allow customers with one of its credit cards to redeem their miles for flights at a discount of at least 10% compared with those without the card.

The carrier said that, as an example, an economy-class award ticket that was 15,000 miles will go for 13,500 without elite Premier status. United said it’s setting aside special discounted inventory of award tickets for cardholders, including for top-tier Polaris seats.

Perks for elites

Those with elite MileagePlus Premier status will get deeper discounts and better miles redemption. Elites with a card get at least 15% off mileage tickets.

United said its a seat in a long-haul business class Polaris cabin that is going for 200,000 miles would be 170,000 miles if the cardmember has elite Premier status. United added the lowest priced “Saver Award” seats for Polaris would be accesible to MileagePlus members with a United card, seats that were previously just available to high-tier elites.

Their earning rates also increase if they have both the credit card and status. MileagePlus 1K, the highest tier before Global Services, will get 17 miles for each dollar spent when they use their United Club credit card.

What’s happening to basic economy flyers?

United Airlines travelers who don’t have the credit card won’t receive miles for basic economy tickets. American Airlines last year similarly said it would no longer allow travelers in that class to earn miles, following an earlier move by Delta Air Lines. There’s an exemption, however, for holders of United’s elite Premier status, who can still earn miles in basic economy.

What about business travelers?

Business travelers often have to book with company credit cards under corporate travel policies. But United said that individuals who personally hold a United credit or debit card will still get more miles than an employee who doesn’t.

Business

Hamilton Lane stock hits 52-week low at 111.83 USD

Hamilton Lane stock hits 52-week low at 111.83 USD

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports13 hours ago

Sports13 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment19 hours ago

Entertainment19 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World22 hours ago

Crypto World22 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show