Business

Gold prices set for biggest daily gain since 2008 after historic crash. Should you buy?

The sharp fall had pushed both metals into deeply oversold territory, setting the stage for a strong technical bounce. In global markets, spot gold rose sharply, recovering from Monday’s lows after slipping well below the $5,000 per ounce mark last week. Silver also surged strongly, bouncing back after recording its largest one-day fall on record on Friday, followed by further losses on Monday.

The sell-off last week was unusually severe. Gold had plunged nearly 10% in a single session, its steepest fall since 1983, while silver collapsed 27% in one day. Over the two trading sessions, gold fell more than 13% and silver nearly 34%, wiping out a large part of their recent gains and triggering margin calls across trading desks.

Tuesday’s recovery reflects renewed buying interest at lower levels and short covering after the sharp correction.

Jateen Trivedi, VP-Research Analyst (Commodity and Currency) at LKP Securities, said gold traded strongly positive as overseas prices surged sharply, triggering upside momentum in domestic markets as well. He said MCX gold rallied above Rs 1,51,000, gaining nearly Rs 8,000 intraday, driven by renewed safe-haven buying and short covering at lower levels.

Trivedi added that US non-farm payrolls and unemployment data later this week will be closely watched, as they remain critical inputs for the US Federal Reserve’s rate outlook and could add to volatility in bullion prices. From a technical perspective, he sees immediate support for gold near Rs 1,45,000, while resistance is placed around Rs 1,55,000.

Silver also saw a sharp rebound after last week’s unprecedented crash, with traders selectively rebuilding positions after the steep fall triggered forced selling and margin hikes.Hareesh V, head of commodity research at Geojit Investments, said gold and silver are showing early signs of stabilisation after last week’s historic sell-off. According to him, investors are reassessing whether the sharp fall was structural or simply an overshoot driven by short-term catalysts. He said the key drivers supporting bullion remain intact, suggesting the correction was largely technical rather than a shift in long-term fundamentals.

Hareesh cautioned that trading could remain choppy in the near term, as markets continue to digest the impact of margin hikes, a stronger US dollar and repositioning linked to developments around the US Federal Reserve leadership. He added that a sustained recovery may unfold gradually, but further liquidation risks would re-emerge only if prices break last week’s lows, which now act as important support levels.

Also read: The deal that changed Nifty playbook: India-US trade pact throws up over 70 winning stock ideas

Aamir Makda, commodity and currency analyst at Choice Broking, said gold has rebounded sharply from recent lows and is currently trading significantly higher. He noted that prices have recovered from key retracement levels, with immediate resistance seen near Rs 1,54,000. A breakout above this level could strengthen upside momentum and push prices towards higher resistance zones in the coming sessions.

On silver, Makda said prices have moved back above important technical levels, and a sustained breakout could lead to further gains ahead. He expects a moderately bullish trend for both gold and silver over the week, provided key support levels hold.

Despite the violent correction seen last week, analysts remain broadly constructive on the medium- to long-term outlook for precious metals. Many point out that even after the sharp fall, prices are broadly back to levels seen just a few weeks ago, underlining how stretched the rally had become before the correction.

Business

Lamborghini CEO Says EV Market for Luxury Cars Is ‘Close to Zero’

Lamborghini has canceled plans to launch its first fully electric vehicle, saying demand from wealthy buyers is almost nonexistent.

Chief Executive Stephan Winkelmann said the market for high-end electric supercars is “close to zero,” leading the brand to shelve its all-electric Lanzador project.

In an interview with The Sunday Times, Winkelmann explained that the company studied customer feedback, dealer input, and global data for more than a year before making the decision.

The Lanzador, first revealed in 2023 as a powerful “Ultra GT,” had been expected later this decade with a price near $300,000. That plan is now off the table, Fortune reported.

“The decision was made after over a year of continuous internal discussion, engaging with customers, dealers, market analysis, and global data,” Winkelmann said.

He added that the “acceptance curve” for electric vehicles among Lamborghini’s target clients was “close to zero” and flattening.

Investing heavily in a full battery-electric model, he warned, risked becoming an “expensive hobby” and would be financially irresponsible.

Lamborghini Shifts Focus to Plug-In Hybrids

Instead, Lamborghini will focus on plug-in hybrid electric vehicles, known as PHEVs.

“Plug-in hybrids offer the best of both worlds, combining the agility and low-rev boost of electric battery technology with the emotion and power output of an internal combustion engine,” Winkelmann said.

For now, the company plans to keep building traditional combustion-engine cars “for as long as possible.”

According to FoxBusiness, he said Lamborghini buyers want an emotional driving experience, something he believes electric cars currently struggle to provide. “EVs, in their current form, struggle to deliver this specific emotional connection,” he noted.

Lamborghini is owned by Volkswagen AG through its subsidiary Audi. It is not alone in rethinking electric strategies. Stellantis recently took a $26.5 billion charge after scaling back EV production.

General Motors recorded a $7 billion hit tied to changes in its EV plans. Ford Motor Company also announced major write-downs as it pivots toward hybrids and more affordable models.

Originally published on vcpost.com

Business

Decoded: The viral doomsday AI memo that roiled Wall Street

The founder of Citrini Research published “The 2028 Global Intelligence Crisis” on Sunday, outlining a hypothetical scenario in which accelerating AI adoption leads to widespread white-collar job losses, weaker consumption and mounting financial strain.

The essay describes a “deflationary cascade” in which AI doesn’t just augment workers, it replaces them so efficiently that it destabilises the broader economy.

In a market already jittery about rapid AI developments and heavily concentrated in tech stocks, the scenario struck a nerve. By Monday morning, the post had gone viral across trading desks.

What does the post say?

Citrini’s thesis imagines a near future in which rapidly improving AI agents hollow out software companies,displace white-collar workers, destabilise credit and housing markets, and inadvertently bankrupt the middle class.

It stresses that the scenario is a “thought exercise, not a prediction.” Still, its chain-reaction logic alarmed investors.

The post is written as a retrospective from 2028. In its version of events, AI first drives a surge in productivity and profits before job losses start to weigh on spending and credit.

Here are the key triggers from the post that spooked the market:

1) Death of the middleman

At the heart of Citrini’s thesis is a sharp leap in AI capability. It points to increasingly autonomous tools such as Anthropic’s Claude Code and OpenAI’s Codex as early signs of systems able to execute complex business tasks with minimal human input.

The impact would extend beyond software to travel booking, insurance, real estate commissions, and other industries built on transaction “friction.”

If such agents scale, they could undercut demand for platforms such as Monday.com, Zapier and Asana by allowing companies to manage workflows internally at lower cost. That, in turn, could push vendors like Oracle into sharper price competition.

Nor would it stop there. In Citrini’s framework, personal AI agents transact directly for consumers, bypassing intermediaries such as Uber and DoorDash. Payment networks, including Visa and Mastercard, could face pressure if transactions shift to lower-cost crypto rails.

The common thread: when machines optimise every transaction for efficiency, habitual app loyalty—a cornerstone of many digital business models–begins to erode.

2) Mass white-collar unemployment

Historically, technologies have created more jobs than they destroyed. Citrini argues AI could prove to be the exception.

“AI is now a general intelligence that improves at the very tasks humans would redeploy to. Displaced coders cannot simply move to ‘AI management’ because AI is already capable of that,” the report states.

In this scenario, layoffs in software and other white-collar sectors accelerate, and workers cannot easily transition into higher-value roles. Many shift into lower-paying or less stable jobs, putting pressure on wages and weakening consumer spending.

That softer demand then feeds back into corporate decisions. Instead of hiring, companies double down on automation to cut costs, reinforcing what Citrini describes as a cycle with no natural brake.

3) Financial spillovers

The report extends the shock into the private credit and housing sectors.

Many software firms have been financed by private-credit lenders based on assumptions of steady long-term revenue. If AI undermines those assumptions, defaults could surge. Asset managers such as Hellman & Friedman and Permira, cited in the report, could face pressure if software-backed loans sour.

At the same time, laid-off white-collar workers struggle to service mortgages, triggering housing stress. Combined credit tightening and falling consumer confidence could amplify the downturn.

Citrini ultimately sketches a late-2027 crash that wipes out 57% of the S&P 500.

4) The paradox of “ghost GDP”

Citrini flags what it sees as a growing imbalance: the economy looks healthy on paper, but many households are under strain.

In one scenario, large AI companies continue to post strong profits and productivity gains. Given their heavyweight in stock indices and overall output, headline GDP and market indicators remain resilient.

The problem, the firm argues, is that machines don’t spend. They don’t buy homes, cars or everyday services.

The result is what Citrini calls “ghost GDP” – economic output that shows up in the data but doesn’t filter through to the wider population.

That gap between rising corporate profits and squeezed household finances, the firm warns, could heighten social and political tensions, with anger directed less at Wall Street and more at Silicon Valley.

How did markets react?

Investors were already uneasy about AI disruption. The Substack post sharpened those fears.

US software stocks led the slide. Shares of Datadog, CrowdStrike and Zscaler fell sharply, while International Business Machines suffered its worst one-day drop in decades. Private-equity groups KKR and Blackstone, both cited in the report, also declined.

The broader selloff, which coincided with renewed trade-policy uncertainty in Washington, pushed the Dow Jones Industrial Average down 1.7%, or 822 points, on Monday.

Shares of DoorDash fell about 7% after the note called it a “poster child” for businesses that monetise friction between buyers and sellers. In the scenario, AI agents enable customers and drivers to transact more directly, squeezing margins. On social media, co-founder Andy Fang said the rise of “agentic commerce” would force the company to adapt. “The ground is shifting underneath our feet,” he wrote.

“So far this year, the stock market has been discounting a scenario in which AI is our Frankenstein monster,” said Ed Yardeni of Yardeni Research. His base case is less dire: “We continue to believe that AI is augmenting workers’ productivity rather than making them extinct.”

Also read: IT stock crash wipes out Rs 1.2 lakh crore for LIC & mutual funds in bloodbath not seen since 2008

After the selloff, van Geelen said the report was a scenario, not a forecast. Speaking to Bloomberg, he described it as an attempt to “start a conversation” about a world in which human intelligence is no longer the scarcest resource.

Whether that future materialises is unclear. But the episode shows how quickly AI enthusiasm can turn into market anxiety.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

UiPath (PATH) Stock Trades Near $10.10 Amid Agentic AI Push, Eyes Q4 Fiscal 2026 Results on March 11

UiPath Inc.’s stock has shown resilience in late February 2026, closing at $10.10 on February 24 after a 0.69% decline, as the robotic process automation leader leverages its agentic AI advancements and partnerships to counter broader software sector pressures and position for growth in enterprise automation.

As of February 24, 2026, UiPath (NYSE: PATH) traded in a session range of $9.92 to $10.43 with volume of about 32 million shares. The shares have recovered modestly from recent lows but remain down significantly year-to-date in 2026, reflecting volatility in the automation and AI software space. The 52-week range spans a low near $9.38 to a high of $19.84, with the stock trading at a forward P/S ratio around 3.5 and a forward P/E below 15—levels some analysts view as attractive given the company’s pivot to agentic AI orchestration.

The recent performance follows UiPath’s emphasis on agentic AI, where autonomous agents handle complex workflows beyond traditional RPA bots. On February 23, 2026, UiPath joined the Agentic AI Foundation as a Gold Member, gaining influence in working groups on governance, security, and observability to help shape open standards for interoperable AI agents. This move complements earlier initiatives, including a partnership with OpenAI to integrate frontier models into enterprise workflows via a ChatGPT connector and launches of agentic solutions for healthcare administrative bottlenecks.

UiPath’s latest quarterly results, for fiscal Q3 2026 ended October 31, 2025, reported December 3, 2025, showed revenue of $411.11 million—up 15.9% year-over-year—and EPS of $0.16, beating estimates of $0.15. Annualized recurring revenue reached $1.782 billion, growing 11%, with dollar-based net retention at 107%. The quarter marked UiPath’s first GAAP operating income of $13 million, highlighting improving profitability amid investments in AI-enhanced automation.

Management highlighted alliances with Microsoft, Amazon, Salesforce, and others to expand reach and scalability. Recent recognitions include inclusion in G2’s 2026 Best Software Awards across five categories, underscoring strong user adoption. The company also acquired WorkFusion to bolster capabilities in healthcare AI and other verticals.

Analysts remain divided but generally constructive on the long-term outlook. Consensus among 13-17 firms rates PATH a Hold to Moderate Buy, with average 12-month price targets around $15.62 to $15.77—implying 54-56% upside from current levels. High targets reach $19, while lows sit at $10-$14. RBC Capital recently lowered its target to $14 from $17 on February 23, 2026, maintaining Sector Perform amid software sector concerns and investor sentiment, though earlier adjustments reflected optimism around AI positioning.

Institutional interest persists, with Vanguard Group increasing its stake by 4.9% in Q3 2025, adding over 2.25 million shares to hold nearly 48 million—about 9% ownership valued around $641 million. This supports views of undervaluation, with some models suggesting PATH trades 38% below fair value estimates around $16.19.

Challenges include competition in RPA and AI automation from players like ServiceNow, as well as cautious enterprise spending in some segments. The software sector faces divergence in 2026, with AI leaders potentially gaining while others lag. UiPath’s forward guidance and ARR trends will be key in proving sustained momentum.

The next major catalyst arrives March 11, 2026, when UiPath reports fiscal Q4 and full-year 2026 results after market close, followed by a 5:00 p.m. ET conference call. Consensus expects EPS around $0.20-$0.25 and revenue near $465 million, up about 10% year-over-year. Investors will scrutinize ARR growth, margin expansion, agentic AI adoption metrics, and full-year guidance amid the platform’s evolution.

UiPath, a pioneer in RPA now transitioning to comprehensive agentic automation, benefits from its end-to-end platform and enterprise focus. With AI agents poised as a major 2026 trend for workflow orchestration, the company’s scale, partnerships, and improving profitability position it to capture demand in digital transformation. While near-term volatility persists from sector dynamics, the low valuation and AI tailwinds offer potential for recovery if execution continues.

As the March earnings approach, UiPath’s ability to demonstrate accelerating growth in agentic solutions and sustained enterprise traction will determine whether the current levels prove a buying opportunity or reflect ongoing caution in automation software.

Business

Bitmine Immersion Technologies (BMNR) Stock Trades Near $19.44 Amid Massive Ethereum Treasury Growth

Bitmine Immersion Technologies Inc. shares have experienced sharp swings in February 2026, closing at $19.44 on February 24 after rising 1.14%, as the Ethereum-focused treasury company continues aggressive accumulation of ETH tokens, reporting holdings of 4.423 million ETH and total crypto, cash, and “moonshot” assets reaching $9.6 billion.

As of February 24, 2026, Bitmine Immersion (NYSE American: BMNR) traded in a session range of $18.65 to $19.60 with volume exceeding 30 million shares. The stock has declined roughly 5-6% over the past week but remains significantly higher over longer periods, with a 52-week range from $3.20 to $161.00 reflecting extreme volatility tied to Ethereum price movements and the company’s concentrated treasury strategy. Market capitalization stands around $8.74 billion.

The latest catalyst came February 23, 2026, when Bitmine announced its ETH position reached 4,422,659 tokens valued at approximately $1,958 per ETH (based on CoinMarketCap data), representing 3.66% of Ethereum’s 120.7 million circulating supply. The company added 51,162 ETH in the prior week—valued at roughly $98-100 million—during what Executive Chairman Tom Lee described as a “mini crypto winter” for the asset. Staked ETH totaled 3,040,483 tokens, generating annualized staking revenues of $171 million at a recent 2.89% seven-day yield, outperforming the Composite Ethereum Staking Rate of 2.81%.

Bitmine highlighted its position as the world’s largest Ethereum staking operation, with 69% of holdings already staked. The company reiterated progress on its Made-in-America Validator Network (MAVAN), a proprietary staking infrastructure set for deployment in early calendar 2026 (Q1). MAVAN aims to provide secure, best-in-class staking for Bitmine’s assets, working with three providers in the interim. Lee emphasized the “alchemy of 5%” philosophy—targeting 5% of ETH supply—now over 73% achieved in seven months.

The treasury update included $691 million in cash and strategic “moonshot” investments, such as a $200 million stake in Beast Industries, alongside minor holdings like 193 BTC. Average daily trading volume of about $700 million ranks BMNR as the 165th most traded U.S. stock, underscoring high visibility despite concentration risks.

The aggressive ETH accumulation has drawn attention amid Ethereum’s price weakness, with the token sliding to levels near $1,958 from 2025 highs. Bitmine’s average cost basis—estimated near $4,000 per token in prior disclosures—has led to substantial paper losses, ballooning to over $8 billion in some analyses as ETH declined. Yet management views current prices as a “perfect bottom” and continues buying, framing it as a long-term institutional strategy leveraging staking yields and DeFi mechanisms.

Recent institutional moves bolster confidence. BlackRock increased its stake significantly in prior periods, and inflows from firms like Sumitomo Mitsui Trust Group and Envestnet Asset Management have supported liquidity. However, leadership changes—including the January 2026 separation of President Erik Nelson with a $605,000 payout—have raised questions about execution during the treasury buildout.

Analyst coverage remains limited but mixed, with some highlighting BMNR’s role as a leveraged ETH play rather than a traditional tech or mining stock. The company’s shift from immersion-cooled Bitcoin mining to an Ethereum treasury focus has reduced self-mining exposure while deferring new site buildouts. No recent quarterly earnings details alter the narrative, with the last reported figures showing ongoing losses (trailing EPS around -$0.93) amid treasury volatility.

The next updates will likely focus on MAVAN launch progress in Q1 2026 and further ETH purchases or staking metrics. Consensus lacks a unified price target due to sparse coverage, but sentiment ties closely to Ethereum’s trajectory—potential rallies could drive BMNR higher, while prolonged weakness might exacerbate losses.

Bitmine Immersion Technologies positions itself as the leading Ethereum treasury for institutional and public market investors, capitalizing on native protocol yields and infrastructure like MAVAN. Its scale—controlling over 3.6% of ETH supply—offers unique exposure but introduces concentration risk in a volatile asset class. As the company advances its staking platform and continues accumulation, BMNR remains a high-beta proxy for Ethereum believers amid the broader crypto market’s fluctuations.

Investors monitoring the stock eye Ethereum fundamentals, including network activity highs and staking economics, as key drivers. With trading volume elevated and institutional stakes growing, Bitmine’s path in 2026 will hinge on executing MAVAN and navigating crypto cycles effectively.

Business

What is happening to gas and electricity prices?

Typical household bills will fall by 7% when the new energy cap takes effect on 1 April 2026.

Business

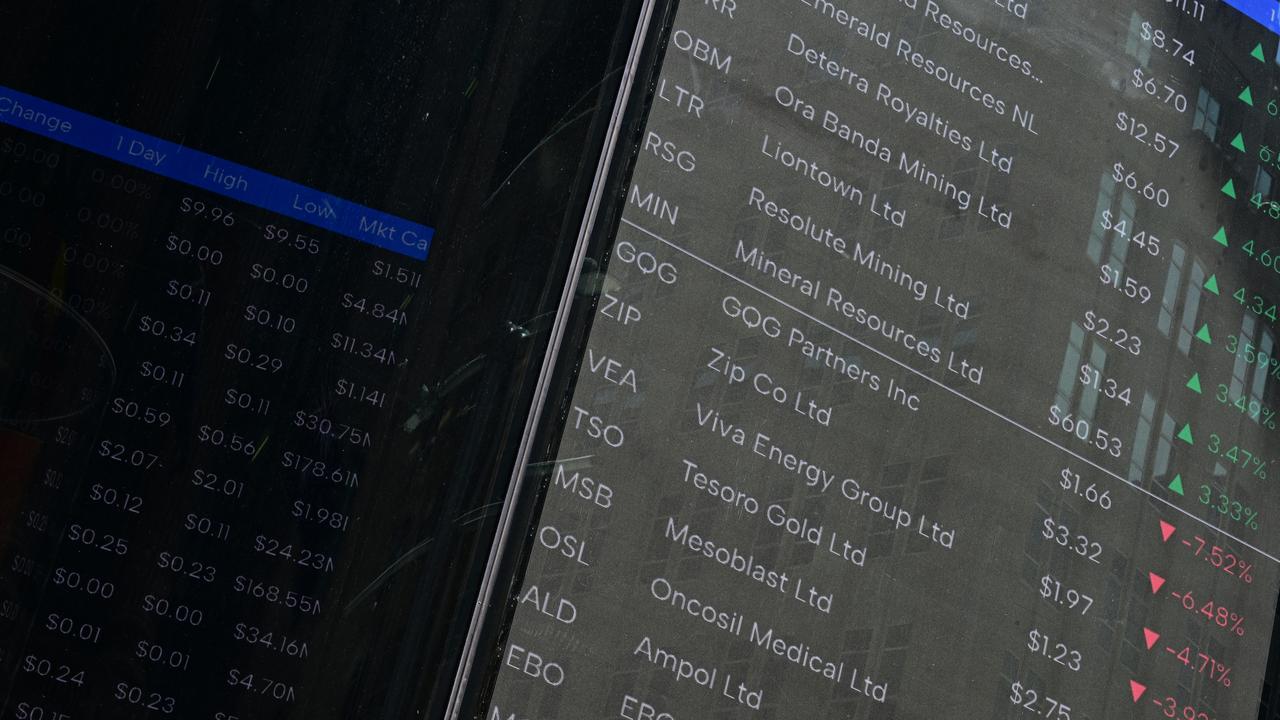

Aussie shares top records as results support mega moves

Australia’s share market has broken multiple records as earnings season delivers more outsized company-level moves for bigger players, while mining stocks remain hot assets.

Business

City of Perth council to vote on $280k bill for governance issues

City of Perth councillors are set to vote on spending $280,000 to implement workplace recommendations tonight, continuing a meeting that ran for more than four hours on Tuesday.

Business

At Close of Business podcast February 25 2026

Elisha Newell talks to Mark Pownall about WA’s biggest and most profitable private businesses.

Business

Exclusive | Jane Street Accused of Insider Trading That Helped Collapse Terraform

The administrator winding down Do Kwon’s Terraform Labs has sued Jane Street, alleging that the high-speed trading giant engaged in insider trading to profit unlawfully from and ultimately hasten the crypto empire’s collapse.

Todd Snyder, the plan administrator appointed by a bankruptcy court, is seeking damages from Jane Street, its co-founder Robert Granieri, and employees Bryce Pratt and Michael Huang.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Workday shares slide amid underwhelming subscription revenue forecast

Workday shares slide amid underwhelming subscription revenue forecast

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World1 day ago

Crypto World1 day agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World7 days ago

Crypto World7 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech17 hours ago

Tech17 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat12 hours ago

NewsBeat12 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week