Business

Homebuyers gain leverage in these 3 metros as housing market slows

Check out what’s clicking on FoxBusiness.com.

Three of the nation’s largest housing markets are seeing a sharp rise in the number of homes for sale, giving buyers more choices even as the overall U.S. housing market shows signs of cooling.

In January, 46 of the country’s biggest metro areas had more homes on the market than they did a year earlier. Seattle saw the biggest increase, with inventory jumping 32.4%.

Charlotte, North Carolina, followed at 28.6%, while Washington, D.C., ranked third with a 26.8% rise, according to Realtor.com’s January 2026 Monthly Housing Market Trends Report.

In Seattle and Charlotte, much of the inventory growth is being driven by homes lingering on the market longer rather than a surge of new sellers, Realtor.com Senior Economist Jake Krimmel told FOX Business.

HOMEBUILDERS REPORTEDLY DEVELOPING “TRUMP HOMES” PROGRAM TO IMPROVE AFFORDABILITY

People gather at Kerry Park to see the Space Needle at dusk in Seattle June 21, 2025. (Juan Mabromata/AFP via Getty Images)

Homes in Seattle took about 15 days longer to sell than they did a year ago, while Charlotte homes remained on the market roughly 12 days longer.

“[Washington], D.C., is a little different, where stronger new listing growth seems tied to uncertainty over the local job outlook,” Krimmel told FOX Business.

Seattle’s expanding supply is also being influenced by layoffs in the tech sector, according to Michael Orbino, a managing broker at Compass.

“Several companies, including T-Mobile, Microsoft and Amazon, are repositioning their workforces,” Orbino said in a statement. “This is not a large part of the inventory but often puts buyers in pause mode, which has the effect of slowing down absorption, which increases inventory.”

JUST 17% OF VOTERS THINK NOW IS A GOOD TIME TO BUY A HOME AS AFFORDABILITY CONCERNS WEIGH: POLL

An aerial view of Charlotte, N.C. (iStock)

Several other metro areas also saw significant increases in homes for sale.

Louisville, Kentucky, was up 25.6%, while Las Vegas and Indianapolis each rose 25.4%. Baltimore saw inventory climb 24.1%, San Jose increased 23.3% and Cincinnati rose 21%, Realtor.com reported.

Regionally, the West posted the largest year-over-year inventory gain in January, up 12.2%. The Midwest followed at 10.3%, with the South close behind at 10.1%. The Northeast continued to lag, with inventory rising just 6.6%, according to the report.

COALITION WARNS TRUMP MORTGAGE CREDIT SHIFTS COULD SPARK ANOTHER 2008-STYLE CRASH

The U.S. Capitol in Washington, D.C., Jan. 26, 2026. (Mandel Ngan/AFP via Getty Images)

Nationally, housing inventory is up 10% from a year ago, but the pace of recovery is slowing. Year-over-year inventory growth has declined for nine consecutive months, and new listings rose just 0.7% compared with last year, Krimmel said.

January inventory remained more than 17% below 2017 to 2019 levels, according to Realtor.com.

CLICK HERE TO GET FOX BUSINESS ON THE GO

“Even though January is the slow season for housing, it’s an important moment to take stock,” Krimmel added. “The data and trends coming in right now will set the stage for how the market might behave once things pick up in the spring.”

Business

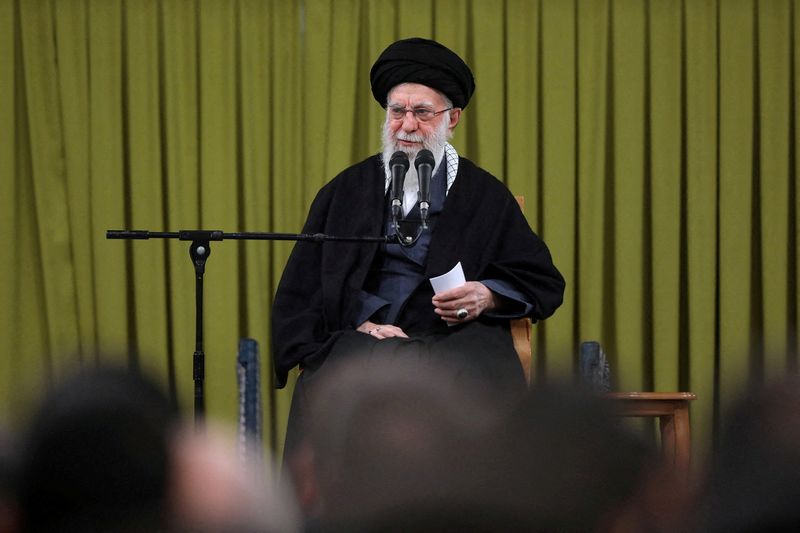

Trump says Iran’s Khamenei is dead

Trump says Iran’s Khamenei is dead

Business

APEX Tech Acquisition completes $112 million IPO on NYSE

APEX Tech Acquisition completes $112 million IPO on NYSE

Business

Kyiv says Russia accepted US plan for Ukraine security guarantees

Kyiv says Russia accepted US plan for Ukraine security guarantees

Business

Veradigm earnings matched, revenue was in line with estimates

Veradigm earnings matched, revenue was in line with estimates

Business

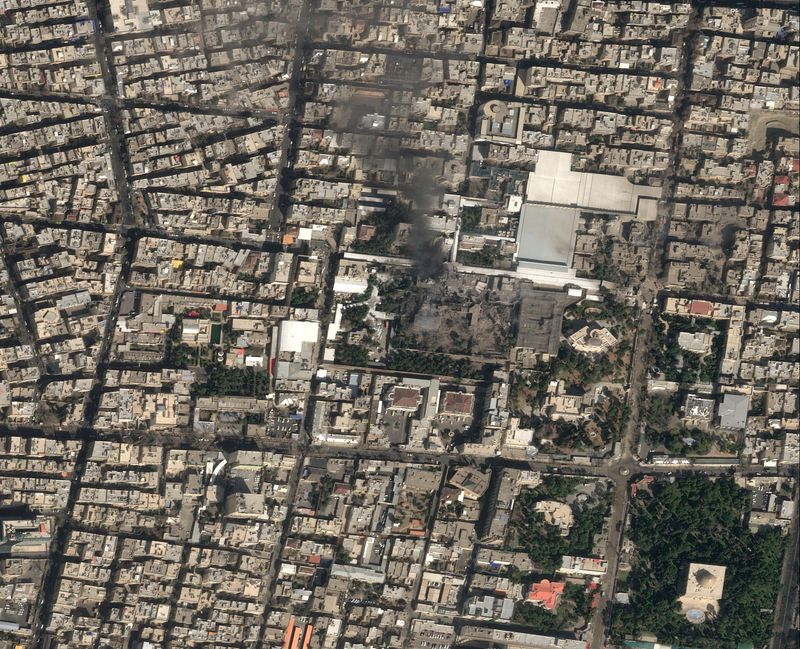

Iran’s Supreme Leader Ali Khamenei killed, senior Israeli official says

Iran’s Supreme Leader Ali Khamenei killed, senior Israeli official says

Business

Iran Escalation Triggers Risk-Off Move To USD And Gold, Oil, Defense And Aerospace Win

Dhierin-Perkash Bechai is an aerospace, defense and airline analyst.

Dhierin runs the investing group The Aerospace Forum, whose goal is to discover investment opportunities in the aerospace, defense and airline industry. With a background in aerospace engineering, he provides analysis of a complex industry with significant growth prospects, and offers context to developments as they occur, describing how they might affect investment theses. His investing ideas are driven by data informed analysis. The investing group also provides direct access to data analytics monitors.

Learn more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Residents protest as authorities burn cash left on ground by Bolivian plane crash

Residents protest as authorities burn cash left on ground by Bolivian plane crash

Business

Mexican authorities return body of cartel boss ’El Mencho’ to relatives

Mexican authorities return body of cartel boss ’El Mencho’ to relatives

Business

Berkshire CEO Abel seeks to reassure shareholders after taking baton from Buffett

Berkshire CEO Abel seeks to reassure shareholders after taking baton from Buffett

Business

Israel’s Netanyahu says there are signs that Iranian supreme leader Khamenei ’is no longer’

Israel’s Netanyahu says there are signs that Iranian supreme leader Khamenei ’is no longer’

-

Politics7 days ago

Politics7 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World5 days ago

Crypto World5 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports17 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 hours ago

NewsBeat5 hours agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat10 hours ago

NewsBeat10 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat4 days ago

NewsBeat4 days agoPolice latest as search for missing woman enters day nine