WPP has “looked at” switching its primary listing to New York, according to chief executive Mark Read, who will pursue opportunities to take advantage of a “resurgence” in the US as Donald Trump re-enters the White House.

Read told the Financial Times this was the year for the London-listed advertising network to start delivering on its push into AI, revenue growth and — despite his worries over the health of the UK stock market — its share price.

“We have to drive topline growth to drive the share price — I’m very focused on that,” Read said in an interview at his office on London’s Southbank, as he outlined plans for up to $100mn in additional AI investment to drive both creativity and productivity across its agencies.

“As a leadership team, we have a plan. We know what we need to do. And 2025 is the year about execution, and particularly execution in AI.”

Read said WPP had looked at moving its primary listing to the US, adding: “It’s something we keep a watching eye on.” While it has no plans to do so at the moment, he pointed out that “other CEOs who have moved their listing to the US have found a positive experience”.

The market is closely watching Read’s next moves, with talk among corporate advisers and industry rivals about pressure mounting on the chief executive after the arrival of former BT boss Philip Jansen as chair three weeks ago.

WPP shares have fallen by a tenth in the past month, and are now about a third lower than when Read took over in 2018. The share price of its French rival Publicis has almost doubled in the same period.

Meanwhile WPP’s two largest US rivals — Omnicom and IPG — last month unveiled merger plans to create a single, New York-based advertising heavyweight.

Read said that while major deals along the lines of Omnicom-IPG were “obviously something we consider”, he would not have pursued such a tie-up. “We’d be better off investing in what we have than going through a major consolidation,” he said.

He also viewed the merger as an opportunity, suggesting WPP’s own period of restructuring pointed to disruption ahead for his US rivals. “I’ve got the battle scars of integrating businesses over the past six years,” said Read, pointing to the challenges of bringing together companies spanning multiple advertising and PR agencies.

“There’ll be three big players in our industry. None of us are massively different in size and scale from the others,” he said. And while scale tended to be positive for media buying and planning activities, he added, it was “not entirely clear to me that scale and creativity are two words that always go together”.

Read has faced criticism from some staff over a policy announced last week to bring people back to the office four days a week. But he said: “Ogilvy in New York is one of our best-performing agencies. It’s packed — busy and vibrant — you can feel the energy. And I’m sure those things are linked.”

Read said the US, where it has about 38 per cent of its business, would be the main area for growth for WPP, including M&A plans focused on data and technology services to give it a bigger presence in the world’s largest advertising market.

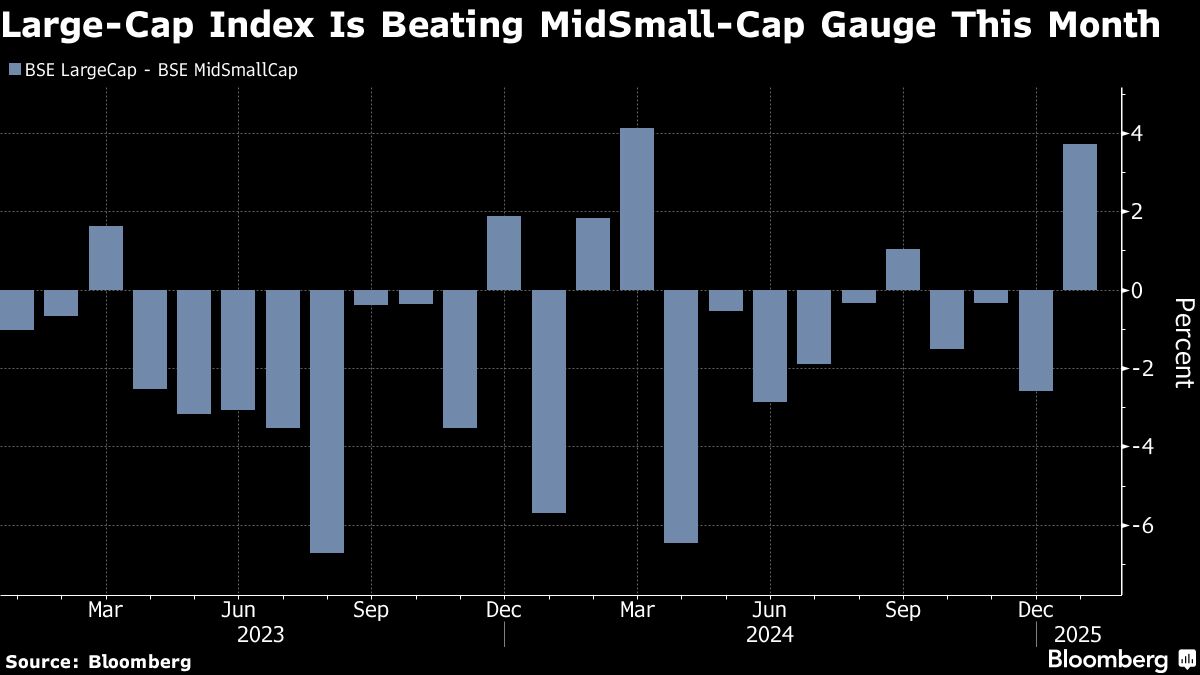

“With the Trump presidency, there’s a resurgence in business confidence in the US,” he observed, noting the “sense of ambition and growth in the US” that also translated into how well their companies fared on the stock market.

The UK government needed to “get to the bottom” of how to provide the flow of capital that the FTSE 100 required, he said, noting how the valuation discount for companies quoted in London was now “the biggest it’s been in history”.

“It’s driving M&A and a reduction in the number of listed companies,” he added.

This posed a challenge, he said, for the UK as a whole. “We have to get closer: WPP as a company to the US and the UK as a country to the US.”

WPP counts some of the largest US tech companies as clients — including winning Amazon’s media business outside the Americas last year — but has been hit by a slowdown in spending on advertising in the sector. Even so, he said that “in the long run, those companies are going to be changing the world”.

He also noted how Trump had in a short space of time brought cultural change in corporate America: “The most striking example of the changes at Meta over the last six weeks. They can see the way the wind is blowing.”

Advertisers were also returning to X, the social media site owned by Trump’s ally Elon Musk. “The change in content moderation [at] Meta — more closely aligned with X — probably helps that as well,” he said.

Looking ahead, he said he was hopeful that this year will deliver improvement in revenues, with plans to spend between £50mn and £100mn more than in 2024 on an AI platform that is being rolled out across the group’s 100,000 workers.

“We’ve got a lot of great new business opportunities,” Read said. “We’re very confident where we are with our investments in AI, and I think we’re going to see a better year in 2025 than we did in 2024.”

.

.  MARKS (@JavonTM1)

MARKS (@JavonTM1)

You must be logged in to post a comment Login