Business

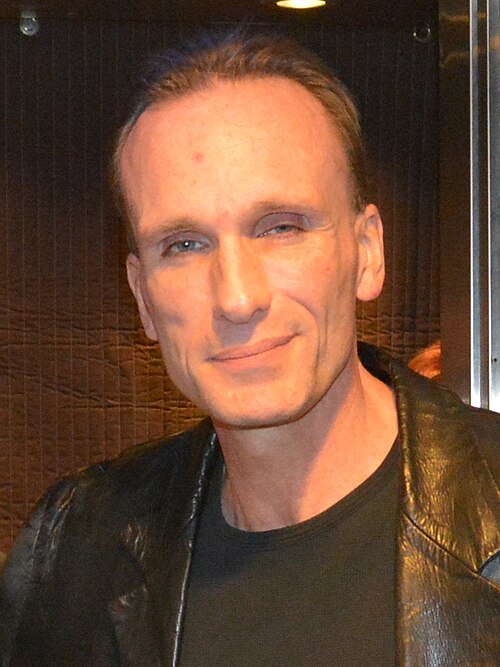

James Doyle, Managing Director of Endeavour Group

We sit down with James Doyle, Managing Director of Endeavour Group, a building safety consultancy and training provider supporting duty holders responsible for some of the UK’s most complex and high-risk buildings.

Based in the North West and operating nationally, Endeavour Group brings an evidence-led, engineering discipline to the built environment as regulatory scrutiny continues to increase.

With more than two decades of experience spanning offshore oil and gas, process safety and fire engineering, Doyle applies high-hazard industry methodologies to residential and commercial settings, helping organisations work through the requirements of the Building Safety Act with a clearer understanding of their responsibilities.

His team works with clients to strengthen building safety through intrusive assessments, safety case support and accredited training. As an approved ProQual training centre since 2018, the business delivers nationally recognised qualifications across fire safety, passive fire protection and health and safety, and is currently launching three new Fire Risk Assessment qualifications at Levels 3, 4 and 5.

Alongside its UK work, Endeavour has delivered UK-standard training internationally through remote delivery for several years. More recently, this has developed into direct conversations with overseas organisations, including engagement in Dubai, who are seeking to better understand how competence, evidence and decision making translate into live, occupied buildings.

In this interview, Doyle discusses the challenges duty holders face under the Building Safety Act, why evidential rigour matters, and the principles guiding decision making in a sector where the stakes are high.

What is the main problem you solve for your customers?

The single biggest issue our clients face is a lack of reliable information at a time when the expectations placed on duty holders have never been higher.

The Building Safety Act has transformed the regulatory landscape, yet many assessments across the UK are still carried out through visual surveys or templated reports that do not meet the level of evidence the legislation requires. That gap creates legal, financial and operational risk.

At Endeavour Group, our role is to give clients a clear picture. We carry out intrusive compartmentation surveys, fire risk assessments, building risk reviews, safety case reports, resident engagement support, remedial action planning and ongoing compliance management, all underpinned by photographic evidence, technical justification and structured reasoning. Every finding is linked back to fire strategy intent and the statutory definition of a relevant defect so there is no ambiguity about what the issue is or why it matters.

Through our partnership with Riskflag, we also support clients with a digital golden thread that organises their evidence, actions and decision making in an auditable way. When people work with us, they gain confidence and a route to compliance.

What made you start your business?

Endeavour Group began in 2018 after I moved from more than two decades working in offshore oil and gas, process safety and fire engineering. In high-hazard environments, assessment quality, intrusiveness and evidential strength are not optional. You learn very quickly that reassurance means nothing if it is not supported by facts.

When I stepped further into the built environment, I could see an increasing gap between what the legislation would ultimately demand and what was being delivered on the ground. Many reports were non-intrusive. Many conclusions were based on assumptions rather than evidence. Organisations responsible for buildings were making important decisions without the technical understanding to identify risk properly.

I created Endeavour because the sector needed a consultancy that applied engineering discipline, communicated clearly and delivered assessments that could stand up to legal and regulatory challenge. What began as a specialist consultancy has grown into a national capability supporting high-rise residential, supported living, student accommodation, retail, commercial, education and transport.

What are your brand values?

For us, competence, clarity and integrity are not marketing terms. They are the foundations of how we work.

Competence means having the technical depth to interpret fire strategy, identify relevant defects, challenge assumptions and build evidence that supports decisive action. Clarity means presenting findings in a way that duty holders, residents and regulators can understand without ambiguity. Integrity means reporting what the evidence shows rather than what people hope to hear.

These values guide how we approach every survey, every safety case and every piece of advice we give.

Do your values define your decision making process?

Yes, completely. We always ask ourselves: would this stand up to regulatory, legal or third-party scrutiny? If the answer is no, we refine it.

Through years of working with the regulator we understand their role in asking the ‘what if’ question, and we ensure that our reports comprehensively satisfy this requirement with appropriate mitigation. We test our findings and their failure modes adapted from offshore safety case methodology, which ensures every conclusion is traced back to justification.

The same standard applies to our training centre, where evidential discipline underpins everything we deliver.

Is team culture integral to your business?

It is essential. Our team is our strength.

The work we do spans high-rise residential, student living, supported living, care environments, commercial and educational settings. Each brings its own challenges, and our ability to deliver depends on a culture built on openness, technical curiosity and shared accountability.

That collaborative approach also supports our international conversations, where the emphasis is on sharing experience and understanding how similar challenges are managed in different operating environments.

In terms of your messaging, do you communicate clearly with your audience?

Clarity is central to everything we do. Building safety is technical, but communication should not be.

Our reports explain the issue, the evidence, the risk and the action required in straightforward language. We avoid jargon and prioritise giving duty holders information they can use immediately. The same approach shapes our training, where real-world examples help learners understand how legislation applies in practice.

What is your attitude to competitors?

There are organisations in the sector that deliver excellent work, but there is still significant variation in standards.

We regularly see surveys that lack intrusive inspection or fail to link findings back to the definition of a relevant defect. These reports may reassure people in the moment, but they do not provide the level of evidence required under the Act.

What we do is driven by quality, not comparison. We know our methodology is robust because our evidence has already changed outcomes, including cases where developers have accepted responsibility for defects once they reviewed our findings. Strong evidence drives accountability.

What advice would you give to anyone starting a business?

Focus on building deep expertise and do not compromise your standards. Consistency, honesty and high-quality work are far more valuable than volume.

Surround yourself with people who share your approach and invest in their development. If you concentrate on doing things properly, reputation and growth will follow naturally.

What three things do you hope to have in place within the next twelve months?

First, the full launch of our Building Safety Masterclass to help duty holders understand relevant defects, liability pathways and evidential requirements under the Act.

Secondly, increasing the portfolio of higher-risk buildings being managed and achieving successful Building Assessment Certificate approvals.

And third, continuing to explore international conversations, including recent engagement in Dubai, where organisations operating complex, occupied buildings are asking similar questions around competence, accountability and how UK-standard training and assessment translate into real-world decision making.

Business

Super Micro Computer: Margins May Expand This Year (Rating Upgrade)

Super Micro Computer: Margins May Expand This Year (Rating Upgrade)

Business

Walmart (WMT) Q4 2026 earnings

Walmart said on Thursday that holiday-quarter sales rose nearly 6% and its quarterly earnings and revenue surpassed Wall Street’s expectations as gains in e-commerce, advertising and its third-party marketplace boosted its business.

For the full current fiscal year, Walmart said it expects net sales to increase by 3.5% to 4.5% and adjusted earnings per share to range from $2.75 to $2.85. That earnings outlook fell short of Wall Street’s expectations of $2.96 per share, according to LSEG.

In an interview with CNBC, Chief Financial Officer John David Rainey said speedy deliveries from stores are helping Walmart attract more shoppers, particularly those with higher incomes.

“Our ability to serve customers at the scale that we have, combined with the speed that we now have, is really translating into continued market share gains,” he said.

He said the company’s market share gains cut across all incomes, but were larger among upper-income households. For example, with fashion, a category that grew by a mid-single digit percentage in the fourth quarter, almost all of that increase came from households with an annual income over $100,000, he said.

In the coming months, Rainey said he expects price increases from inflation and President Donald Trump‘s tariff hikes to ease. Food inflation at Walmart in the fourth quarter was just above 1%, while it was slightly higher for general merchandise, he said.

“It seems to be a little bit more of a normalized price environment,” he said. “I think we have, largely as a retail industry, absorbed or seen the brunt of the impact from tariffs.”

While that comment is welcome news to many U.S. shoppers who buy at the country’s largest grocer, it may be too early to say what pricing trends at the retailer mean for the rest of the economy. Though Walmart is viewed as a key barometer for the wider retail industry, it traditionally has had more power than its competitors to keep prices low in part because of its scale.

Here is what the big-box retailer reported for the fiscal fourth quarter compared with Wall Street’s estimates, according to a survey of analysts by LSEG:

- Earnings per share: 74 cents adjusted vs. 73 cents expected

- Revenue: $190.66 billion vs. $190.43 billion expected

Shares of Walmart were slightly positive early on Thursday, after falling in premarket trading.

Yet as of Wednesday’s close, shares of the company have climbed about 22% over the past year and about 14% so far this year. That’s outpaced the S&P 500′s 12% gains over the past year and less than 1% gains year to date.

Walmart’s results Thursday also show an inflection point in the industry. For the first time, Amazon topped Walmart as the largest retailer by annual revenue, as the company posted $716.9 billion in sales for its most recent fiscal year compared with $713.2 billion for Walmart.

The companies aren’t an exact comparison, as Amazon gets a sizeable piece of its revenue from cloud computing and other tech services. Yet it underscores the competition between the two rivals, particularly as Walmart follows a similar playbook by growing revenue streams outside of brick-and-mortar retail, like from ads and its marketplace.

In the three-month period that ended Jan. 31, Walmart’s net income decreased to $4.24 billion, or 53 cents per share, compared to $5.25 billion, or 65 cents per share, in the year-ago period.

Excluding one-time items like investment gains and losses, legal settlements and business reorganization, Walmart’s adjusted earnings per share were 74 cents.

Revenue rose from $180.55 billion in the year-ago quarter.

Comparable sales jumped 4.6% for Walmart’s U.S. business and 4% for Sam’s Club in the fourth quarter, excluding fuel, compared with the year-ago period. The industry metric, also called same-store sales, includes sales from stores and clubs open for at least a year.

Walmart’s e-commerce sales in the U.S. rose 27% compared with the year-ago period, fueled by store-fulfilled pickup and delivery of online orders,, along with the retailer’s third-party marketplace. That marked the company’s 15th straight quarter of double-digit digital gains. Global e-commerce sales increased 24% year over year.

For the company’s U.S. business, e-commerce accounted for 23% of sales – a record high for Walmart. The digital growth in the quarter included an approximately 50% gain in store-fulfilled deliveries and a roughly 41% increase in sales from Walmart Connect, its advertising business, the company said.

While Walmart is gaining ground, its growth is not evenly distributed across income groups.

In the interview with CNBC, Rainey said the company does “see some pressure on the lowest income cohort.” He said Walmart has tracked year-over-year spending trends by income group. Like in the prior quarter, he said it saw that spending among the highest earners compared to lower-income groups “had gapped out a little bit.”

The trend he described reflects what some economists have called the “K-shaped economy.”

Walmart’s quarterly report marked the first under its new CEO John Furner. Furner, the former Walmart U.S. CEO and a more than three-decade company veteran, succeeded Doug McMillon as Walmart’s top executive on Feb. 1.

Investors largely expect Furner to focus on similar priorities as his predecessor McMillon, such as increasing Walmart’s online business, attracting more customers across incomes and ramping up higher-margin businesses like its third-party marketplace and advertising.

Along with getting a new CEO, Walmart has hit other milestones lately. Its stock switched to the tech-heavy Nasdaq in December and its market value hit $1 trillion earlier this month.

Along with its results Thursday, Walmart also announced a new $30 billion share repurchase authorization, replacing a $20 billion buyback program approved in 2022.

As of Wednesday’s close, shares of the company have climbed about 22% over the past year and about 14% so far this year. That’s outpaced the S&P 500′s 12% gains over the past year and less than 1% gains year to date.

Business

Walmart sales rise 5.6% as online reaches record 23% share

Walmart CEO Doug McMillan joins ‘Mornings with Maria’ to discuss his retirement, inflation pressures, tariffs, AI-driven growth and the future of America’s largest retailer.

Walmart posted solid fourth-quarter results Thursday as shoppers continued prioritizing value and convenience, helping push online sales to a record share of the retailer’s business.

The company reported fiscal fourth-quarter revenue of $190.7 billion, up 5.6% from a year earlier. U.S. comparable sales rose 4.6%, driven by a 2.6% increase in transactions and a 2% increase in the average amount shoppers spent per visit.

Grocery prices were up just 0.6% from a year earlier, with some categories – including eggs and dairy – seeing price declines.

AMAZON PHARMACY TO EXPAND SAME-DAY PRESCRIPTION DELIVERY TO 4,500 US CITIES

The company reported fiscal fourth-quarter revenue of $190.7 billion. (Gabby Jones/Getty Images)

Global e-commerce sales climbed 24% in the quarter, including a 27% increase in the U.S., where online now accounts for 23% of total sales — the highest level in company history.

Growth was fueled in part by roughly 50% growth in store-fulfilled delivery, as Walmart expanded faster-delivery options that now reach the vast majority of U.S. households within hours.

Walmart’s profits grew faster than overall sales in the quarter. (Joe Raedle/Getty Images)

The retailer said it continued to gain market share across income tiers, including higher-income households – a sign that its pricing and convenience strategy is resonating beyond budget-conscious shoppers.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WMT | WALMART INC. | 126.62 | -2.23 | -1.73% |

CHINESE-MADE TEETHING TOYS SOLD ON AMAZON RECALLED OVER FATAL CHOKING RISK

Profits grew faster than overall sales in the quarter. Adjusted operating income rose about 10%, compared with roughly 5% sales growth. The gains were driven by higher-margin businesses, including advertising and membership programs. Advertising revenue climbed 37% globally, including 41% growth for Walmart Connect in the U.S., while membership fee income increased more than 15%. Together, advertising and membership fees accounted for nearly one-third of operating income in the quarter.

Walmart expects sales to rise 3.5% to 4.5% in the full current fiscal year. (Brian Kaiser/Bloomberg via Getty Images)

Inventory growth remained below the pace of sales growth, reflecting continued supply chain discipline.

Looking ahead, Walmart expects sales to rise 3.5% to 4.5% in the full current fiscal year, with operating profit projected to increase 6% to 8%.

CLICK HERE TO GET FOX BUSINESS ON THE GO

The results suggest U.S. consumers remain resilient, even as they stay value-focused, while Walmart’s investments in digital services, faster delivery and higher-margin revenue streams continue to strengthen its competitive position.

Business

Inside PepsiCo’s innovation strategy

Fiber, hydration and whole grains identified as keys to new product growth.

Business

Integer Hld earnings beat by $0.06, revenue topped estimates

Integer Hld earnings beat by $0.06, revenue topped estimates

Business

Amentum to relocate headquarters to Reston, Virginia in 2027

Amentum to relocate headquarters to Reston, Virginia in 2027

Business

FX Market Awaits North American Leadership

Dilok Klaisataporn/iStock via Getty Images

The North American market took the dollar (DXY) lower on Tuesday, and there was little follow-through selling. Yesterday, the dollar was bid in North America, and rather than resist, European more than Asia-Pacific operators have extended the greenback’s

Business

‘Pulp Fiction’ Actor Peter Greene Died From Accidental Gunshot Wound

Veteran character actor Peter Greene, best known for his chilling portrayal of the sadistic pawn shop owner Zed in Quentin Tarantino’s 1994 masterpiece Pulp Fiction, died from an accidental self-inflicted gunshot wound, the New York City Office of Chief Medical Examiner confirmed Wednesday.

The medical examiner ruled Greene’s cause of death as a “gunshot wound of left axilla with injury of brachial artery,” classifying the manner as accidental. The axilla refers to the armpit, and the brachial artery is the major blood vessel supplying the upper arm, elbow, forearm and hand. The injury led to extensive, fatal bleeding.

Greene, 60, was found dead Dec. 12, 2025, inside his Lower East Side apartment in Manhattan following a wellness check prompted by a neighbor who reported music playing continuously overnight. Authorities discovered the scene with no signs of foul play at the time. The actor had been scheduled for surgery that same day to remove a benign tumor near his lung.

The revelation came more than two months after his death, as the medical examiner completed autopsy and toxicology reviews. No additional details about the circumstances—such as how the firearm was handled—have been released publicly.

Greene’s manager, Gregg Edwards, announced the initial news of his passing in December, describing him as a “talented actor” whose work left a lasting impact. Tributes from colleagues and fans highlighted his intense screen presence and versatility in villainous roles.

Born Peter Green on May 10, 1965, in Montclair, New Jersey, he adopted the professional name Peter Greene to avoid confusion with another actor. He began his career in the late 1980s and early 1990s, appearing in independent films before breaking through with memorable supporting parts.

His role as Zed in Pulp Fiction—the menacing figure who, alongside accomplice Maynard, subjects Butch Coolidge (Bruce Willis) and Marsellus Wallace (Ving Rhames) to horrific ordeals—became one of the film’s most iconic and disturbing sequences. The performance cemented Greene’s reputation for portraying dangerous, unpredictable characters.

That same year, he played the villainous Dorian Tyrell in The Mask opposite Jim Carrey, a role that showcased his ability to blend menace with dark humor. Other notable credits include The Usual Suspects (1995), where he appeared as a key figure in the ensemble crime drama; Cleaner (2007) with Samuel L. Jackson; and television episodes of The Blacklist, Hawaii Five-0 and Law & Order.

Greene’s career spanned more than three decades, with over 80 film and TV credits. He often gravitated toward gritty, independent projects and was praised for his commitment to authentic, intense performances.

Friends and industry insiders described Greene as private yet generous, with a deep passion for acting. He maintained a low public profile in recent years, focusing on select roles and personal health matters.

The accidental nature of his death has prompted renewed discussions about firearm safety, even in private settings. Accidental shootings remain a leading cause of preventable gun-related fatalities in the United States, according to public health data.

No public memorial service details have been announced. Greene is survived by family members, though they have not issued statements following the cause-of-death ruling.

His work continues to resonate with audiences. Pulp Fiction, celebrating its 30th anniversary in 2024, remains a cultural touchstone, and Greene’s Zed is frequently cited in discussions of Tarantino’s most unforgettable antagonists.

Fans have taken to social media to share clips and memories. One post read, “Peter Greene’s Zed still gives me chills—RIP to a true scene-stealer.” Others expressed shock at the tragic circumstances.

As Hollywood mourns another loss from the 1990s era, Greene’s legacy endures through his powerful on-screen moments. Colleagues remember him as a dedicated professional whose intensity elevated every project.

The medical examiner’s findings close the investigation into his death, providing clarity after months of speculation. Authorities emphasized that the ruling underscores the importance of safe firearm handling.

Peter Greene’s contributions to cinema, particularly in defining memorable villains, ensure his place in film history.

Business

Wayfair Beats Earnings Estimates. Why the Stock Is Falling.

Wayfair Beats Earnings Estimates. Why the Stock Is Falling.

Business

Gamblizard’s perspective on how the UK gambling regulations will affect player loyalty programs.

In the past five years, the UK gambling sector has faced its sharpest regulatory shift in a generation. The Gambling Commission has tightened rules on affordability checks, marketing practices and bonus structures.

The 2023 White Paper signalled a deeper reset. Consumer protection now sits at the centre of policy thinking. Operators must justify not only products, but also player retention strategies.

Loyalty programmes have entered the spotlight. Regulators question point systems, tier rewards and personalised offers. Critics argue such schemes may encourage sustained spending. The Commission has already restricted certain bonus features. More limits may follow, especially where transparency is weak.

Gamblizard.com views this shift as structural rather than temporary. From its industry analysis, loyalty mechanics will not disappear. They will, however, be redesigned under stricter compliance standards. Data use, reward thresholds and communication practices will require closer scrutiny. In this climate, retention cannot rely on volume-based perks alone. It must align with responsible gambling duties and measurable consumer safeguards.

Regulatory pressure on loyalty mechanics

Recent reforms place loyalty structures under direct pressure. Affordability checks now demand deeper income verification. Operators must assess spending against financial markers. This affects tier progression and reward eligibility. A points ladder tied to higher deposits now carries compliance risk. Bonus incentives face tighter examination. The Commission has already limited mixed-product offers. Wagering conditions attract particular scrutiny. Complex mechanics may be viewed as misleading. Clear language is no longer optional.

Transparency rules are expanding. Terms must be prominent and intelligible. Hidden triggers or unclear expiry dates invite sanctions. In short, loyalty design must now sit within a framework shaped by consumer protection rather than pure retention logic.

Why loyalty schemes face greater scrutiny

Regulators argue that loyalty schemes can intensify play. Points, tiers and status labels may create pressure to sustain spending. Behavioural research suggests that near-miss rewards reinforce repetition. Policy makers note this dynamic with caution.

Duty of care now carries heavier weight. Operators must identify harm indicators earlier. A loyalty upgrade cannot override affordability concerns. Compliance teams are expected to intervene, even at commercial cost. Oversight has therefore moved from peripheral audit to board-level accountability.

Key regulatory shifts operators must monitor

The regulatory climate is evolving in stages. Some measures are already active. Others remain under consultation. Together they reshape loyalty architecture.

- Enhanced affordability checks now require earlier triggers and documented reviews.

- Mandatory transparency standards demand clearer reward terms and visible conditions.

- Caps on certain incentives may limit deposit-linked promotions.

- Data monitoring obligations require active tracking of spending patterns and risk markers.

For operators, the challenge lies in integration. Compliance cannot sit apart from marketing strategy. Loyalty mechanics must be designed with audit trails in mind. Regulators increasingly expect evidence, not assurances.

Gamblizard analysis of business impact

Gamblizard’s assessment is pragmatic. The tightening regime alters loyalty economics at their core. High-tier VIP segments, once central to margin strategy, now carry heavier oversight and thinner returns. Enhanced checks slow onboarding and raise intervention rates. In some cases, account restrictions reduce lifetime value. Compliance costs are also rising. Operators must invest in monitoring systems, staff training and audit documentation. Manual reviews of high spenders demand senior input. Technology budgets are shifting from acquisition tools to risk analytics.

Gamblizard notes a gradual shift from deposit-linked perks toward value-based retention. Operators are exploring models that reward consistency, safe play indicators and verified affordability. The focus moves from short-term revenue spikes to longer-term account stability within regulatory limits.

From high rollers to broader retention models

Gamblizard identifies a structural pivot already under way. The VIP-centric model, built on high spend concentration, now attracts disproportionate regulatory exposure. Operators are recalibrating towards retention frameworks that distribute value more evenly and reduce compliance volatility. The emphasis shifts from elite tiers to sustainable cohorts with verified affordability profiles.

Below are the principal directions shaping this transition:

- Lower-risk segmentation

Broader mid-tier cohorts offer steadier margins and fewer intervention triggers. Risk-adjusted lifetime value replaces pure revenue concentration. - Behaviour-based rewards

Progression linked to responsible play markers, session stability and affordability verification rather than deposit spikes. - Non-monetary benefits

Priority service access, product previews and informational tools that carry limited regulatory friction. - Structured gamification within compliance limits

Transparent mechanics, capped thresholds and clearly defined eligibility rules aligned with consumer protection standards.

This recalibration signals commercial adaptation, not retreat. Loyalty remains viable, but its architecture now mirrors regulatory priorities rather than legacy VIP economics.

The future of loyalty programmes in the UK market

Loyalty programmes in the UK are unlikely to disappear. They will, however, be redesigned around regulatory tolerance rather than promotional ambition. Future models will favour clarity over complexity. Reward structures will be simpler. Terms will be visible and written in plain language. Transparency may itself become a competitive marker, signalling operational discipline to both regulators and customers.

Gamblizard expects a gradual shift towards responsible engagement metrics. Retention will be measured through stability, verified affordability and lower intervention rates. Profitability will depend on controlled growth rather than aggressive tier escalation. The balance between margin and compliance will shape boardroom strategy for years.

Advanced analytics will support this transition. Real-time risk scoring can flag irregular spend patterns within minutes. Predictive behavioural analysis may identify early harm indicators. Automated affordability triggers can pause rewards pending review. CRM systems will still personalise offers, yet within predefined compliance boundaries and documented audit trails.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports10 hours ago

Sports10 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment16 hours ago

Entertainment16 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World19 hours ago

Crypto World19 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show