Business

KB Financial earnings beat by $0.12, revenue topped estimates

Business

Signet Jewelers at Citi’s 2026 Global Consumer & Retail Conference: Strategic Resilience

Signet Jewelers at Citi’s 2026 Global Consumer & Retail Conference: Strategic Resilience

Business

PagSeguro Bets On Risky Credit, But The Stock Remains Attractive At 6x Earnings (PAGS)

Long-only investment, evaluating companies from an operational, buy-and-hold perspective.Quipus Capital does not focus on market-driven dynamics and future price action. Instead, our articles focus on operational aspects, understanding the long-term earnings power of companies, the competitive dynamics of the industries where they participate, and buying companies that we would like to hold independently of how the price moves in the future. Most QC calls will be holds, and that is by design. Only a very small fraction of companies should be a buy at any point in time. However, hold articles provide important information for future investors and a healthy dose of skepticism to a relatively bullish-biased market.Disclaimer: All of the author’s articles are written on an “as is” basis and without warranty. They represent the author’s opinion only and in no way constitute professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in any articles published.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PAGS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Why the price of oil matters more than you might think

A shock to oil supplies is rattling financial markets, driving up prices at the pump and raising fears of a bigger economic hit.

Business

LARRY KUDLOW: Hormuz will not stop history

For those wondering about the state of play for oil prices, gasoline, and stocks, here’s what President Trump said this afternoon: “I think the war is very complete, pretty much. They have no navy, no communications, they’ve got no Air Force.” And that America is “very far” ahead of his initial four-week to five-week estimated time frame.

Soon after the President’s statement, oil fell to $85 a barrel after topping $100 a barrel earlier in the day and stocks ended up rising more than 200 points.

And I have faith in him and his initial judgements, which have been superb. And I also have faith in the American people to stand behind Mr. Trump’s epic fury in order to change the course of history, and completely shift the international landscape and change the world’s balance of power in favor of America, the Western democracies, of course Israel, and our friends in the Middle East. I even saw a 52 percent favorable Rasmussen poll.

As I’ve said before, this is like the Berlin Wall coming down with President Reagan ending Soviet Communism. Or FDR ending fascism in World War II. And Mr. Trump ending ISIS in the first term, and now ending the barbaric terror state Iran, to finally conclude Iran’s 47-year forever war against America. A temporary blip in gasoline prices is a very small price to pay to achieve literally world-shattering results.

Fox News contributor Newt Gingrich discusses the Trump administration’s aggressive stance toward Iran amid Operation Epic Fury on ‘Kudlow.’

Mr. Trump is bending the arc of history toward freedom and prosperity. If you’re looking for economic impact estimates, there are a dime a dozen, and I wouldn’t put any confidence in any of them right now. Inflation, recession, stagflation.

I suppose it all depends on the duration of the war, which is unknowable, but it’s not going to be six months or twelve months or longer. Therefore, why bother to guesstimate?

We can say this factually, through the third quarter of 2025, according to OPEC, world oil production was 106.3 million barrels per day, more than world oil demand which was 105.5 million barrels per day.

If you take out a fifth of oil production because the Strait of Hormuz is not functioning, of course you have a dire Strait. But Mr. Trump is moving rapidly to reopen Hormuz with reinsurance guarantees and United States Navy protection. When? Probably a week or two, maybe less.

Iran will never stop this. And if they dare, it will make matters even more catastrophic for them. Hormuz will not stop history. Investors should look through this war and see the enormous prosperity that lies on the other side. And ordinary American working folks should celebrate the greatness of America.

Business

Micron Technology Will Hit Jackpot With This New Product (NASDAQ:MU)

Welcome to Cash Flow Venue, where dividends do the heavy lifting! Blending my financial chops with the timeless wisdom of value investing (and love for steady income), I’ve built a rock-solid pillar in my financial foundation through dividend investing. I believe it’s one of the most accessible paths to achieving financial freedom, and I’m excited to share my insights with you. I’m a finance professional with deep experience in M&A and business valuation. What does that mean in practice? I’ve evaluated countless businesses and played key roles in sell-side and buy-side transactions, guiding clients through the complexities of buying and selling companies. In my day-to-day work, I dive into financial modelling, conduct commercial and financial due diligence to assess a company’s health, negotiate deal terms, and, of course, attend way too many meetings 🙂 My focus spans sectors like tech, real estate, software, finance, and consumer staples – industries I’ve spent years advising and now invest in personally. Today, they make up the core of my portfolio and coverage on this platform. My motivation for writing on Seeking Alpha comes from a desire to not only deepen my own knowledge but also to share value with others who are on a similar path. Dividend investing has played a key role in my financial journey, and I believe it’s one of the most straightforward and accessible ways for anyone to work towards financial freedom. By sharing my insights and experiences, I hope to demystify the process, making it more approachable for those looking to build long-term wealth. Ultimately, my goal is to help facilitate OUR journey to financial freedom, learning and growing together as we navigate the world of dividend investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, AMD, NVDA, AMZN, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Fed monitors Iran conflict impact on inflation as oil prices surge

Former JP Morgan Chase chief economist Anthony Chan breaks down the run up in oil prices on ‘Varney & Co.’

Federal Reserve policymakers are monitoring the conflict with Iran for its potential impact on inflation and consumer prices, as energy prices have jumped since the outbreak of hostilities.

Oil prices briefly surged over $100 a barrel amid fears of supply disruptions caused by the conflict with Iran, which threatens to stem the flow of oil from the Persian Gulf through the Strait of Hormuz.

Gasoline prices at the pump have also risen for consumers since the outset of the conflict, which could push inflation data higher and complicate potential interest rate cuts by Federal Reserve policymakers.

New York Fed President John Williams said last week that while there is uncertainty over the impact of the war on the U.S. economy and inflation, past instances in which oil prices surged didn’t lead to a fundamental shift in the outlook.

AMID IRAN WAR, PRESIDENT TRUMP SUGGESTS SHORT-TERM OIL PRICE SPIKE IS ‘SMALL PRICE TO PAY’ FOR PEACE

New York Fed President John Williams said the central bank will have to wait and see how the Iran war will impact energy prices and inflation. (Al Drago/Bloomberg via Getty Images)

“Nobody can be sure how long this will last or the broader implications… Past experience has shown that movements in oil prices that we’ve seen so far don’t fundamentally shift the economy, but we’ll wait and see,” Williams told reporters after a conference hosted by America’s Credit Unions.

He noted that the war with Iran is “one of those developments that can hit both of our mandated goals in a kind of opposing way in the short term – raise inflation and maybe slow global growth,” but added that the transmission through financial markets had been “reasonably muted.”

Williams added that interest rate cuts will “eventually” be warranted if inflation eases in line with his expectations.

GAS PRICES SURGE AS IRAN CONFLICT RATTLES GLOBAL OIL MARKETS, PUSHING US CRUDE ABOVE $90

Minneapolis Fed President Neel Kashkari said the Middle East conflict has caused him to question his forecast for one interest rate cut this year. (Victor J. Blue/Bloomberg via Getty Images)

Minneapolis Fed President Neel Kashkari said at an event hosted by Bloomberg last week that “it’s just too soon to know what imprint this has on inflation and for how long.”

Kashkari also told Bloomberg that he’s now less confident about his original forecast for one interest rate cut this year, saying that “with the geopolitical events, we need to get a lot more data in.”

Boston Fed President Susan Collins said in the text of a speech to be delivered Friday that “I do not see an urgency for additional policy adjustments” and intends to take a “patient, deliberate approach as appropriate” as she considers her outlook for inflation, jobs and rate cuts.

US WEIGHS ASKING CHINA TO CURB RUSSIAN, IRANIAN OIL PURCHASES

Boston Fed President Susan Collins said the Middle East hostilities are a source of considerable uncertainty for the economic outlook. (Vanessa Leroy/Bloomberg via Getty Images)

“My baseline features a still-uncertain inflation picture, with continued upside risks,” Collins said, adding that “this, combined with recent evidence suggesting a relatively stable labor market, in my view argues for maintaining policy rates at their current, mildly restrictive levels for some time.”

Collins added that in her outlook, “considerable economic uncertainty remains, exacerbated by recent geopolitical developments like the hostilities in the Middle East.”

The Fed’s monetary policy panel, the Federal Open Market Committee (FOMC), will hold its next meeting to determine interest rate policy on March 17-18.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The market expects the FOMC will leave interest rates unchanged at their current target range of 3.5% to 3.75%, with the CME FedWatch tool showing a 97.4% of no cut in March.

Reuters contributed to this report.

Business

Acadia Healthcare Company, Inc. (ACHC) Presents at Leerink Global Healthcare Conference 2026 Transcript

Benjamin Mayo

Leerink Partners LLC, Research Division

I thought it would be maybe helpful to start since Todd is relatively new to the organization joining in a time of change and you’ve been at other places in your career. I wanted to hear kind of observations around some of the strengths and weaknesses that you’ve identified within either the company operations, the finance functions. And maybe we’ll just start there.

Todd Young

Chief Financial Officer

Sure. Yes. I joined Acadia 4 months ago, right at the end of October. So still new, getting used to being on the services side of health care grew up on the product side, including at Acadia Pharma, which has created a little confusion as I joined Acadia Healthcare.

Overall, the company is in a really good spot from a market positioning standpoint. The demand for our services continue to grow, and we’ve got a nice diversified business across both the acute inpatient, specialty inpatient, residential as well as the outpatient business with our opioid replacement therapy, what we call CTC. So I think all of those give us a really good spot to drive growth from.

Overall, I mean, the organization is very pleased that Debbie Osteen is back as CEO. Debbie joined us back in mid-January. And so her history in the industry and her proven track record of operating facilities is really something that’s breathed fresh life into the employee base and

Business

BofA cuts Nu Holdings stock price target on higher costs

BofA cuts Nu Holdings stock price target on higher costs

Business

Genius Group Limited (GNS) Q4 2025 Earnings Call Prepared Remarks Transcript

Roger James Hamilton

Founder, CEO & Director

Good morning, and welcome to the Genius Group Investor Call. I am Roger James Hamilton, the Founder and CEO of Genius Group. And I’m joined today by our CFO, Gaurav Dama. We also have Shah Hamza here, who is operating our slides. And Shah, if you want to just share the slides, we’ll make sure everyone can see these as we go. And we’re going to get started.

So first of all, today, we’re presenting our 2025 full year results alongside our plans for 2026. We’ll be walking through our 3 business units: Genius School, Genius Academy and Genius Resorts and also our Genius City development, our Bitcoin Treasury strategy, current legal cases, our share count and our guidance for the year ahead.

So moving on to the next slide. Before we begin, I’d like to remind everyone that this call contains forward-looking statements as defined under the Private Securities Litigation Reform Act of 1995. These are subject to risks and uncertainties that could cause actual results to differ materially from those stated. And for a full discussion, please see our most recent filings with the SEC.

We undertake no obligation to update any forward-looking statement to reflect events occurring after this call. And during the call, we will also reference non-IFRS financial measures, including adjusted EBITDA and pro forma revenues. Reconciliations to the most directly comparable IFRS measures are in the press release and slide deck, which we are also issuing this morning. Both documents are available on our Investor Relations website at irgeniusgroup.net, where you can also access our Form 20-F, which we are also presenting today for

Business

President Trump says oil price surge ‘small price to pay’ for peace

A ‘Barron’s Roundtable’ panel analyzes the Iran conflict, its impact on crude prices and shipping through the Strait of Hormuz.

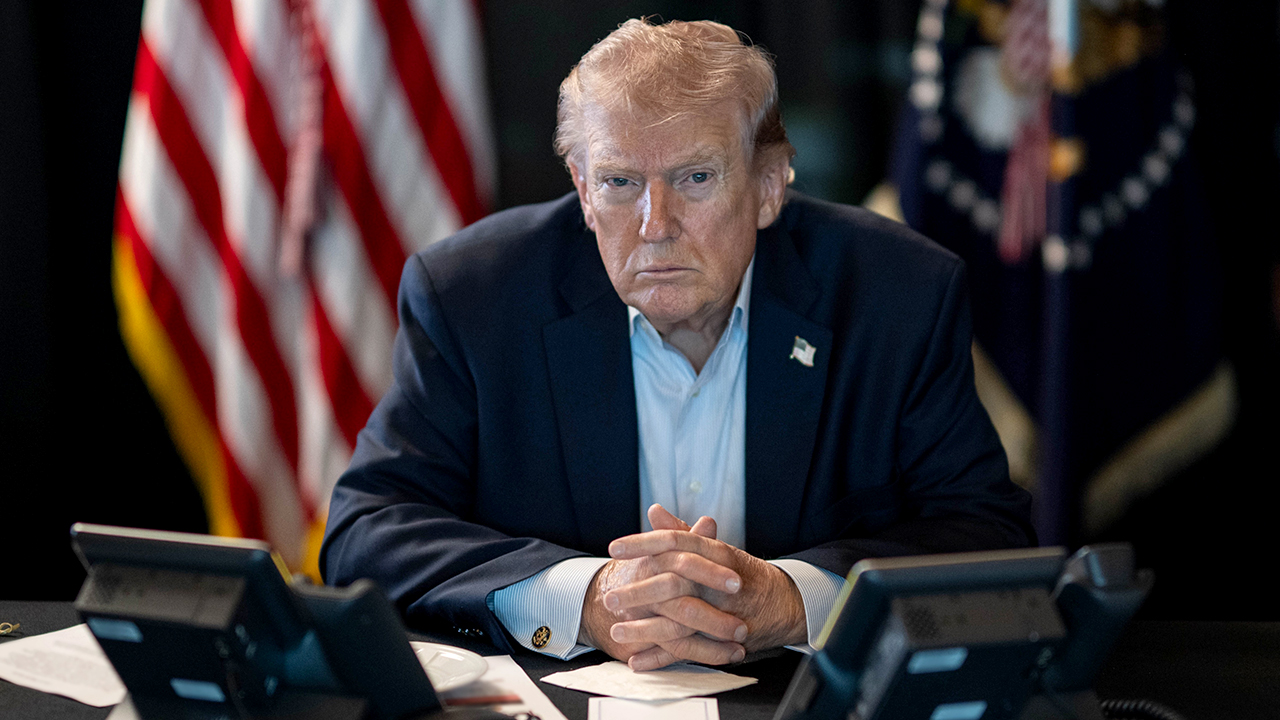

As gas prices surge while the U.S. wages war against Iran, President Donald Trump suggested in a Sunday Truth Social post that the short-term rise is a “small price” for peace.

“Short term oil prices, which will drop rapidly when the destruction of the Iran nuclear threat is over, is a very small price to pay for U.S.A., and World, Safety and Peace. ONLY FOOLS WOULD THINK DIFFERENTLY!” the president declared in the post.

Americans have been facing rising gas prices at home as the U.S. attacks the Islamic nation..

CRUDE OIL PRICES EXCEED $100 A BARREL AS WAR IN IRAN DISRUPTS PRODUCTION, SHIPPING

President Donald Trump monitors military operations during Operation Epic Fury against Iran on March 2, 2026. (The White House via X Account/Anadolu via Getty Images)

The AAA national average price for a gallon of regular gas is $3.478 as of Monday, significantly higher than average one week ago of $2.997.

Rep. Thomas Massie, R-Ky., highlighted rising fuel prices amid the war in a Sunday post on X, and said that “waging war costs American taxpayers about $1 billion per day,” asserting, “This isn’t America First.”

Rep. Thomas Massie questions Attorney General Pam Bondi during a House Judiciary Committee hearing in Washington, D.C., on Feb. 11, 2026. (Nathan Posner/Anadolu via Getty Images)

Trump, an outspoken critic of Massie, is backing challenger Ed Gallrein in the Republican primary in Massie’s congressional district.

Senate Minority Leader Chuck Schumer, D-N.Y., has called for the president to tap the Strategic Petroleum Reserve to help tackle the price surge.

TRAVEL IS ABOUT TO GET MORE EXPENSIVE AS IRAN CONFLICT SPARKS JET FUEL CRUNCH

Senate Minority Leader Charles Schumer speaks to the media at the U.S. Capitol on March 3, 2026. (Anna Moneymaker/Getty Images)

TRAVEL IS ABOUT TO GET MORE EXPENSIVE AS IRAN CONFLICT SPARKS JET FUEL CRUNCH

“The Strategic Petroleum Reserve exists for moments exactly like this,” Schumer said in a statement. “When wars and global crises disrupt energy markets, the United States has the ability to act, but President Trump and his administration are refusing to do so. Trump should release oil from the SPR now to stabilize markets, bring prices down, and stop the price shock that American families are already feeling thanks to his reckless war.”

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos10 hours ago

News Videos10 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World7 hours ago

Crypto World7 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech8 hours ago

Tech8 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business3 hours ago

Business3 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs