Business

Laughing Water Capital Q4 2025 Letter

AlexSecret/iStock via Getty Images

Dear Partners,

In the fourth quarter, Laughing Water Capital (“LWC”) returned approximately 6.8%, bringing full year returns after all fees and expenses to approximately 3.9%. 1 In contrast, the SP500TR (SP500) and R2000 (RTY) returned approximately 2.7% and 2.2% in the quarter, and finished the year up 17.9% and 12.8% respectively. As always individual results may vary, so please check your individual statements for the most accurate reading of your performance.

As a reminder, one trip around the sun tells us very little . I referenced this truism last year when we outperformed the indexes by a wide margin, and it is still true this year when our performance was lackluster versus the indexes. What really matters is cumulative performance over longer periods of time, where the twists and turns that come with a portfolio that is volatile by design are smoothed out a bit. In that regard we remain well positioned as since inception our portfolio has cumulatively returned approximately 400%, vs ~332% for the SP500TR and ~175% for our most relevant benchmark, the R2000.

For us, 2025 was similar to most years; we had some winners, we had some losers, and we had some stocks that went basically nowhere. To be fair, our losers were more costly than they should have been, and our big winners were not initially sized as large as they could have or should have been. Our overall performance reflects these two elements.

This is of course frustrating, but it does not shake my core beliefs. I still believe that focusing on off-the-beaten-path investments in good businesses, led by good people, during times of near-term uncertainty or transition that can be fixed given enough time can provide outsized returns over time. As long as we don’t overpay, this approach puts us in position to benefit from the dual forces of earnings power improvement and multiple expansion as our management partners move past their near-term challenges and market perception improves.

However, I also acknowledge that it is difficult to remain focused on our approach when the beaten path is paved by artificial intelligence, chips, and data centers. It is human nature to love a “clean story,” even though historically investing against a positive backdrop has often led to disappointment. These days for the masses believing that AI and related industries will change the world is about as clean as it gets… as long as you don’t spend any time worrying about “ how? ” or “ at what cost? ” or “ who will the winners be? ”.

I am not calling a bubble in these matters, but I am comfortable saying there is a fair bit of enthusiasm. By contrast, over shorter periods we are more likely to have the crowd question our sanity than we are to benefit from the madness of crowds. While our headline returns failed to excite vs. the indexes, with few exceptions the fundamental performance of our businesses was good in 2025, and I believe it will improve further in 2026. At some point, fundamentals will matter. For this reason, almost the entirety of my and my family’s capital remains invested right next to yours. Our interests are aligned.

Where Are We Now? The Factors of Life

♪♪♪ You take the good, you take the bad, you take them both,and there you have, the facts of life. the facts of life ♪♪♪

Admittedly, our lead vs. the SP500TR has narrowed quite a bit in recent years. Ultimately, our success will depend on my ability to pick individual stocks that outperform, so I cannot blame the environment entirely for this narrowing. However, the environment is at least worth being aware of.

A few facts of note:

- 2025 was the third year in a row that less than a third of the SP500 beat the index . ii

- The SP500 has outperformed the equal weight SP500 by 34% over the past 3 years, eclipsing the prior 3 year gap of 32% from 1997-1999.

- 2025 was the 5 th year in a row of large cap outperformance, which ties 1994-1998 for the longest streak of large cap outperformance.

- Additionally, profitable members of the R2000 were up 8.3% on the year, while unprofitable members of the R2000 were up 34.4% on the year . iii

The above stats are reflective of the “factors” that have been driving the market in recent years. Namely, larger size, growth, and momentum have been driving the market – and I would argue reinforcing each other as well.

From 40,000 feet this makes sense to me. Larger businesses have a cost of capital advantage and scale advantages. Growth is most often associated with tech, and we have been witnessing the greatest companies the world has ever known display winner-take-most economics. Momentum, or the idea that stocks that are going up continue to go up regardless of valuation, has benefited from persistent trends through tech and AI. All of the above also benefit from passive investing ETFs, which have been taking massive share from active strategies, and by rule allocating more money to larger, more expensive stocks than they do to smaller cheaper stocks.

Again, for the most part I understand these dynamics.

Where it breaks down for me is at the individual business level. As stated above, core to my investment philosophy is the idea that if we can invest in good businesses, led by good people, when earnings power is obscured by temporary problems or a business transition, we will ultimately be rewarded as long as we don’t overpay going in, assuming our management partners execute to a reasonable degree. Said more simply, if we don’t overpay and earnings power goes up, we should be rewarded. I consider this view to be infallible, but quite frankly it is entirely at odds with how the market seems to work these days.

Take for example our investment in Lifecore Biomedical, our CDMO that puts injectable drugs into syringes and vials. I have written about this investment extensively in the past, but in brief, Lifecore has excess capacity in a market where there is a global shortage of capacity, demand is growing, and new supply cannot be quickly or effectively built because of a limited supply chain and regulatory barriers. Additionally, customers shop on quality control above all else, and new facilities cannot demonstrate a long track record of effective quality control. It is nearly impossible to imagine scenarios where Lifecore does not fill their existing capacity absent completely destroying their ~40 year record of quality control, and incremental business is very sticky and comes with high margins. A new management team has been racking up customer wins and taking out costs. Private market value multiples suggest considerable upside for the stock, and a I believe a past sale process received low ball bids near the current stock price, suggesting downside protection is real.

In sum, what I see with Lifecore is a business with real competitive advantages that is executing at a very high level, where the stock has solid downside protection, earnings power is obviously growing, and the upside is tied to measurable cash flow and private market value in the not-too-distant future.

In contrast, here is what the market sees in Lifecore. A simple factor analysis suggests that Lifecore should underperform the market due to its small size. It should underperform when Quality is in favor. It should underperform when Value is in favor. And it should underperform when Growth is in favor.

Nowhere in this factor analysis is there room for a cleaned up balance sheet, multiple new large customer wins, contractually guaranteed step ups in revenue by a large customer, an FDA pipeline that can be probability weighted into new business, a U.S. president that is forcing international pharmaceutical companies to move production to the U.S., a large competitor that is bleeding customers due to quality control issues, or a management team that is executing on every dimension.

The only positive factor scores Lifecore receives are momentum and volatility, which in my mind are more reflective of the market thinking of LFCR as a flashing light on a screen rather than an actual business. Our bet with Lifecore – and all of our investments – is that the actual business is going to matter at some point. With Lifecore – and any business for that matter – if earnings power per share moves significantly higher over a reasonable period of time, I fail to see how we will not be rewarded assuming we did not overpay at the outset.

There is an argument that I should not be as “factor” agnostic as I have been traditionally. Despite my belief that our approach is rooted in infallible logic, it is clearly out of step with the facts of life in today’s market. Opportunity cost is real, so I am actively exploring this argument, and if I can find ways to improve my process without deviating from the core, I will embrace them.

That being said, with few exceptions our businesses and our management partners are doing what I expect of them, and I remain confident that we will be rewarded with time. As always, patience will be the key.

Top 5 Investments

LifeCore Biomedical (LFCR)

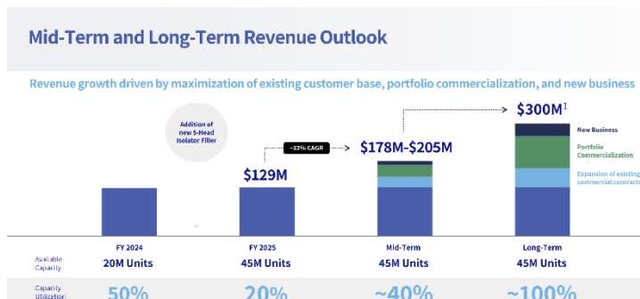

LifeCore, also discussed above, appreciated ~10% on the year despite fantastic execution toward the only thing that matters: increasing capacity utilization. Importantly for us, it seems as if the necessary elements of earnings power improvement and a re-rating are already in place. On slide 11 of the company’s investor presentation , the company lays out a bridge for how they expect to fill their capacity in the years to come. This slide was first presented at the company’s Investor Day in November of 2024, and has not yet been updated. In this bridge, the “New Business” piece for the Mid-Term and Long-Term are approximately $11M and $34M respectively. The $34M of Long-Term new business represents approximately 11% of total capacity.

However, on the company’s Q3’25 earnings call, when commenting on a business win from a commercial tech transfer from a large multinational pharmaceutical company, management indicated that they expect that this new customer will be a top 5 customer, and use “material capacity within the facility… between 5% and 10%.” In mid-December, the company announced another commercial tech transfer from a different large multinational pharmaceutical company, which was also described as a potential “top 5 customer.” Further, back in August the company announced they won a late-stage GLP-1 product, which they indicated could/should be commercialized by 2029-2030. This product could also conceivably be a top 5 customer.

In sum, these customer wins should allow LifeCore to blow their previous “new business” estimates out of the water, even before considering that they have several other additional wins under their belt.

Additionally, the company’s EBITDA margin target of 25% seems extremely conservative. For starters, for Q4’25 they guided to 23% margins at the midpoint, and they are only operating at around 20% capacity utilization. They further indicated they will be taking additional cost out of the business, and pro forma for that cost they could be at 25% margins this quarter. Lastly, I have spoken with industry consultants who have toured the facilities, and consensus is that this should be at least a low 30s percent margin business, which is industry standard.

Looking forward, I expect management will continue to announce customer wins as industry conditions are experiencing what are likely a once in a lifetime lollapalooza effect. Ordinarily, CDMO business is very sticky because for a pharmaceutical company to switch the manufacturer of their drug, they have to go through FDA approval at the new facility. However, at present this dynamic is out the window for much of the industry.

First, Trump’s tariff talk has sent a clear message to international pharma companies: they must bring production to the U.S. or face the consequences. This talk is being backed up by action on the ground. Namely, in the past FDA site inspections overseas were typically scheduled in advance. These days they are happening un-announced, which ramps up the pressure on international manufacturers. Second, a large domestic player owned by Novo Holdings (formerly Catalent (CTLT)) has had major quality and compliance issues ranging from equipment failures to pest infestations. This has led the FDA to issue a warning letter to the facility that causes all products manufactured there to be considered adulterated. As such, products manufactured there are unmarketable, and FDA trials tied to the facility are on hold. Customers have no choice but to consider moving away from this Novo facility. These two factors have led CEO Paul Josephs to comment that the current opportunity set is the richest he has seen in his 30 year career.

Admittedly the sales cycle here is long, and the time between customer win and revenue dollars is also long. This is unattractive to a market that seems to only care about near term factors. However, I believe Lifecore is well on their way to $100M in EBITDA versus a current enterprise value of ~$400M. A 16x multiple would be conservative here, so I think we will be well rewarded by focusing on the real-world developments at the business rather than the factors.

Liquidia Corp (LQDA)

Liquidia was first introduced anonymously in the YE’24 letter to LPs . At the time, the company was a pre-approval biopharmaceutical company that was mired in patent lawsuits filed by an incumbent (United Therapeutics (UTHR) – UTHR) that was seeking to defend their market position versus an upstart that seems to have a superior product. Since that time, Liquidia’s drug – Yutrephia – has been approved for treatment of pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD). Early sales of Yutrephia have crushed expectations as patients – and prescribers – seem to prefer Yutrephia vs. the incumbent due to superior delivery and tolerability. Between appreciation and adding to the position as the company reached important milestones, LQDA has grown into a top position.

Liquidia has won many patent battles vs. United Therapeutics already, but the war is not yet won. United Therapeutics has a $22B market cap, and much of that is at risk due to Liquidia’s advances. They are thus well incentivized to keep fighting. As such, the patent lawsuits continue to linger, with a resolution of the latest round expected any day. My reading of the materials and discussions with attorneys lead me to believe that the odds for success are heavily tilted in Liquidia’s favor. Importantly however, at this point the remaining questions are almost entirely tied only to the use of Yutrephia to treat PH-ILD. In other words, it seems that Liquidia will be able to continue to sell Yutrephia in some form regardless of the outcome of the still pending patent conflict.

If they lose on the patent front, it is possible they will have to pay a royalty to United Therapeutics, or that the indications for which Yutrephia can be prescribed could be limited to only PAH. These would of course be negative developments, and the stock would likely take a near-term hit, but ultimately an adverse outcome should not be catastrophic given the growing size of the end market, the share they are taking, doctor ability to prescribe off label, and other future indications. Additional value should come from Liquidia’s L606 product, which is still in development.

If they win the patent battle, in my view the stock could easily double or triple as they continue to penetrate the market. We thus have a situation where the downside seems reasonably well protected, and the upside could be substantial over the next 1-2 years. I think the reality of this situation is more important than any factors.

NextNav Inc (NN)

NextNav is our wireless spectrum / terrestrial backup to GPS investment. Shares were more or less flat for the year, which of course did not help our performance. The factors here are completely unattractive, and completely irrelevant. The only things that will matter for the success of the investment are getting FCC approval for NextNav’s plan, and what the re-purposed spectrum would be worth.

On the approval front, the relevant background is that in 2017 Senator Ted Cruz, now Chairman of the Senate Committee on Commerce, Science, & Transportation that oversees the Federal Communications Commission (FCC), first called for a terrestrial backup to GPS. Next Congress passed the National Timing Resilience and Security Act of 2018, which explicitly calls for a terrestrial , wireless, wide-area backup system to GPS. In 2020 President Trump issued an Executive Order calling for a non-satellite-based alternative to the positioning, timing, and navigation that is provided by GPS. However, none of these initiatives have advanced, largely due to a lack of funding and political will. In fact, no real progress was made toward this goal until April of 2024 when NextNav submitted a proposal for rulemaking to the FCC that would enable a terrestrial GPS-complement and backup system to be stood up on the back of 5G mobile spectrum. Notably, NextNav’s plan requires zero government funding. The FCC next published a Notice of Inquiry (NOI) in March of 2025 that focuses on identifying a backup to GPS, while mentioning NextNav by name.

NextNav’s proposal asks that the 900 MHz spectrum band – where NextNav already has spectrum – be repurposed from Location and Monitoring Service to allow for 5G. To be clear, there are other groups with different plans, but each of them seems to fall short of NextNav’s plan in one way or another. Importantly, this is not a winner take all situation. The goal is to create a “system of systems” to act as backup GPS, which means there can be multiple winners. Unlike alternative plans, NextNav’s plan also frees up valuable low-band spectrum for consumers. Freeing up spectrum is another stated policy goal of Trump, Ted Cruz, FCC Chairman Brendan Carr, and Secretary of Commerce Howard Lutnick, who oversees the National Telecommunications and Information Administration (NTIA), which is effectively the Federal equivalent of the civilian FCC.

The relevant context is that China and Russia have terrestrial backups to GPS, and the U.S. does not. China and Russia also have satellite killing missiles, which means they can destroy U.S. GPS, but the U.S. cannot destroy their GPS. Deploying a terrestrial backup to GPS is thus a national security issue that has bi-partisan support, and NexNav is the only group that has submitted a concrete plan to reach this goal. If you think the U.S. approving a record $11B arms deal for Taiwan as happened in December might antagonize China, then the importance of a terrestrial GPS backup rises. If you think the U.S. capturing Maduro from Venezuela and cutting off Chinese access to Venezuelan oil matters, then the importance of a terrestrial GPS backup rises. If you think Trump calling for a $1.5T defense budget is indicative of a militaristic stance, then the importance of a terrestrial GPS backup rises.

In my view, the case for approving NextNav’s plan is straight forward; of the available options their plan is quickest to market, cheapest, most robust, covers the widest geography, and is least disruptive to mobile phone makers. Further, NextNav’s technical-engineering studies show that 5G signals can co-exist with incumbent users of 902-928 MHz spectrum. However, there is significant opposition to the plan from these incumbents. This opposition primarily falls into 3 buckets: licensed toll operators (EZ Pass, Sun Pass, etc.), Federal users (Lutnick has been clear he wants to reduce Federal spectrum squatting), and unlicensed part 15 devices (RFID, certain security sensors, garage door openers, etc.), each of which claim that allowing 5G transmissions into the band will harm their existing operations.

NextNav and the opposition have both submitted hundreds of pages of technical studies and opinions in support of their respective opinions. I have spent significant time understanding both sides of the argument, and am not dissuaded from the investment. Importantly, NextNav is only asking for use of 902-907 MHz and 918-928 MHz and is happy to co-exist in that range, meaning that 11 MHz from 907-918 would be unchanged for incumbents, and they could still operate in the rest of the band as well. The physics and filtering here is complex. However, there are some commonsense elements at play as well.

It should be noted that toll operators primarily operate in the middle part of the band already, and most part 15 devices are center tuned to 915 MHz, meaning they are most effective where NextNav does not want to operate. Perhaps more importantly, in the E.U. and China the equivalent to part 15 devices operate in much smaller bands. For example, for Uhf Rfid, which is used for inventory tracking, the E.U. allocates 3 MHz of spectrum, while China allocates 5 MHz. It is not clear to me why the U.S. needs 26 MHz for Uhf Rfid when much much smaller slices work abroad.

Additionally, mobile phone traffic peaks at predictable times. Namely, the primary peak is between 7:00 and 10:00 PM, and the secondary peak is between 12:00 and 1:00 PM. In other words, 5G signals are most active when people are at home on their couch or eating lunch. Demand for much of the part 15 ecosystem is inversely correlated to these times; there is less inventory tracking happening when warehouse workers are eating lunch or on their couch. In a gross oversimplification, it is also worth noting that the incumbent devices in question are designed to operate under high interference conditions, and 5G is also designed to dynamically move away from interference.

The FCC operates under a “serve the public interest” doctrine, which is pretty close to a “highest and best use” doctrine, and it seems difficult to argue that reserving 26 MHz for a situation where 5 MHz suffices in real world conditions abroad meets this standard. All of the relevant political figures here have made it clear they are proponents of market forces. To me, this suggests that the FCC could grant NextNav’s proposal for 5G which would also allow Part 15 makers continued access to all of 902-928 MHz. Realistically, it could take 18-36 months for 5G to go live, during which time if Part 15 makers were concerned about interference from NextNav they would limit all new devices to only the 11 MHz where NextNav 5G would not operate. Importantly, much of the Part 15 device ecosystem turns over extremely quickly (like one time use RFID tags), and a sizeable part of the entire Part 15 fleet would be turned over before 5G even went live in the 902-907 / 918-928 MHz bands.

In any case, NextNav has been attempting to work collaboratively with the opposition for almost 2 years now to find a solution that works for everyone, but for the most part the opposition has not come to the table. As such, the next logical step here would be a Notice of Proposed Rule Making (NPRM) from the FCC which would effectively force all parties to the table. It is impossible to know the exact timing of when that might happen, but as recently as mid-December FCC Chairman Brendan Carr testified in front of the Senate Commerce Committee:

[…] we have been taking actions at the FCC to look at standing up either complementary, or alternative, or secondary ways of getting that precision, navigation and timing information that today is displayed by GPS. So we are going to look at potentially next steps and trying to invigorate that work.

The simple fact that the FCC allowed NextNav to file their proposal means that they clearly do not hate the idea. The fact that the FCC followed with an NOI that mentions NextNav by name suggests that they are favorably predisposed to the idea. The big risk at this point is that the FCC just lets the proposal gather dust for years, but the quote above suggests that that risk is de minimis. In fact, in my view this quote suggests that the NPRM is more of a “when” than an “if”, and if the above-mentioned U.S. military moves that are seemingly hostile toward China have any signal value, then I suspect that “when” is “soon.”

Soon is of course difficult to quantify, but scuttlebutt suggests that any delay is not because of the opposition, but rather due to staffing constraints at the FCC bumping into an ambitious agenda , complicated by digging out of the government shutdown. I suspect that in the months to come NN stock will be volatile as it trades on meaningless factors, options hedging around obvious potential action dates, and fears that any delay to an NPRM is due to the opposition convincing the FCC that NextNav’s plan is flawed. Again, I believe this is a “when” not an “if”, and the “when” is simply constrained by available manpower at the FCC.

I suggest looking past the factors and volatility, and toward what the result of the NPRM might be. In the best case, NextNav would be granted clean use of 15 MHz of low band spectrum. AT&T (T)’s recent purchase of low band spectrum from EchoStar (SATS) suggests NextNav’s spectrum could be worth somewhere around $60 per share. There could be upside to that number as well. Public comments from bankers involved in that transaction indicate that the transaction happened on an accelerated timeline, which likely prevented some bidders from fully participating . iv Additionally, AT&T’s FCC filing related to the transaction indicates they purchased the spectrum to alleviate congestion in their low band portfolio. As of Q3’25 AT&T had 119M subscribers, while Verizon (VZ) had 146M, and T-

Mobile had 140M. Prior to the transaction AT&T had slightly more low band spectrum than Verizon and about the same as T-Mobile (TMUS). The simple math suggests that if AT&T’s smaller subscriber base was causing congestion, then T-Mobile and Verizon are likely dealing with congestion as well; they need more low band. Additionally, if satellite operators that are attempting to roll out direct to mobile like Starlink decide they need low band spectrum to penetrate through tree cover or indoors, then look out above . After all, it only takes 2 seriously interested parties in an auction of a scarce asset to exceed upper estimates of valuation.

The downside is admittedly difficult to quantify, but it is important to recognize that given some combination of both overt and apparent support for NextNav by all of the relevant decision makers, it seems likely that NextNav will at least get something . That might mean geographic carveouts, it might mean claw backs of windfall gains, it might mean paying incumbents to go away, or it might mean power restrictions on the spectrum. All of these potential items could detract from ultimate value. However, game theory is important here. If the goal of Trump, Cruz, Carr and Lutnick is to roll out a backup to the GPS system, they have to incentivize the mobile network operators (MNOs) to roll it out. The MNOs are only incentivized to roll out this spectrum if it is attractive to them for 5G use. Carve outs, power restrictions, and other ancillary costs make the spectrum less attractive, which then hinders deployment. The FCC is thus incentivized to be generous to NextNav.

My main worry here is that my analysis is rooted in logic, which does not always jibe with politics. That being said, in matters of national security politics typically take a back seat to the common good. During time of rising belligerence, national security typically trumps all. No pun intended.

Secure Waste Infrastructure (SES:CA, SECYF)

Secure is our waste management business that operates primarily alongside the oil fields in Western Canada, which was first introduced in our H1’25 letter . This is a stable business whose cash flows are largely tied to oil production, which does not swing violently as oil drilling can. The accounting here is wonky as part of the business is a pass-through pipeline, which hides the fact that economic EBITDA margins are north of 30%, while those relying on a quantitative screen would incorrectly conclude that margins are closer to 4%. In my view, the connection to oil and misleading accounting helps to explain the mis-pricing, although the fact that solid waste companies currently trade at their biggest discount to the S&P in over ten years likely also contributes.

Importantly for us however, management is determined to take advantage of their low share price, and have been voracious buyers of their own stock. Additionally, management has several high ROIC growth projects available to them, and they are deploying capital. The combination of steady cash flows, a shrinking float, organic growth, and reinvestment opportunities is powerful and I expect Secure will reward us over the years to come even without multiple expansion. However, given the stability of Secure’s cash flows and management’s seeming dedication to share repurchases, I think a re-rating is likely. Waste peers typically trade at mid to high teens multiples of EBITDA, while SECURE trades around 10x while converting more EBITDA to cash than peers.

Zooming in a bit, since the U.S. capture of Maduro from Venezuela, the market has taken the view that the return of Venezuelan oil to international markets would be bad for Canadian oil. This may prove to be correct, but at this time all indications are that Venezuela will need billions of dollars of investment to reinvigorate their oil business, and that of course will require a stable military-political situation, which remains far from guaranteed. President Trump also seems hell bent on lowering oil prices going into the mid-term elections. The longer-term thesis here is that eventually the market will recognize that Secure deserves a higher multiple because it is not as cyclical as one would initially assume. As a reminder, when Secure was forced to sell a representative sample of their assets to Waste Connections (WCN) in early 2024, Waste Connections (WCN)’ CEO commented:

We looked back over a 5-year period during diligence of the assets we would be acquiring. And crude moved – Western Canadian crude moved from a high of about $80 a barrel to around $32. So that’s a pretty significant swing and revenue changed 8% peak to trough and EBITDA changed 12% from peak to trough.

However, I would not argue that we are at the point where Secure gets credit for its relative stability, and I would expect that shares will decline if oil craters. Importantly though, I would also expect that Secure management would do what they have done in the past at times when the share price declined, and aggressively buy back stock. The near-term mark to market on this sequence of events might be painful for the stock, but any impact on Secure’s cash flow should be muted. Ultimately the cure for low prices is low prices, and zooming back out, the more shares that Secure can repurchase at low prices, the better our long-term returns will be. I think optimizing for the long term is the right path.

Vistry Group PLC (BVHMF)

Vistry is our U.K. asset light “Partnerships” homebuilder. This is a recession resilient business that is actively repurchasing stock. The stock returned ~12% on the year, as unfortunately Vistry spent much of the last 12 months crawling out of the doghouse after being punished for accounting misstatements attached to the run-off of its legacy traditional Housebuilding business. The fact that funding for low-income housing in the U.K. was also in need of a refresh during this period did not help either, nor did the fact that the entire U.K. housing sector is trading at depressed levels.

However, to repeat what I wrote in our Q3’25 letter : the U.K. has recently announced a new ten year, £39B funding program that dwarfs the previous program in both size and duration. Management recently announced they expect to grow EBIT in the high teens in H2’25, more than 20% in 2026, and that “the real step-up” will come in 2027 as the recently announced funding flows through the market. This trajectory seems to match comments from the U.K. Housing Secretary, who recently stated “We are doubling down on our plans to unleash one of the biggest eras of building in our country’s history and we are backing the builders all the way. ” v Further, Vistry CEO Greg Fitzgerald seems to be a believer as he has purchased ~£1M of stock in the open market this year. Despite all this, Vistry shares still trade at ~4.5x 2026 EBIT, while transaction comps indicate a low double-digit multiple would be more appropriate.Vistry continues to repurchase shares every day, eventually the stink of the past accounting problems will wash off, and it seems clear that the business should meaningfully accelerate over the next 12-18 months. Shares could double from here and still trade below where they were trading prior to the accounting problems, and there should still be significant upside from there as the business executes in the years to come.

Also of Note:

PAR Technology Corp (PAR)

PAR is our restaurant software company, and was a meaningful detractor on our performance, as shares were down ~50% on the year. There was some normal fluctuation in the business due to customers’ implementation timelines that did not go our way, but PAR’s biggest problem seems to be that they are a software company in a world that believes AI and “vibe coding” will destroy legacy software. This belief caused multiples to come down dramatically across the sector. The other mortal sin committed by PAR was choosing to think long term about their business in a market that seems to only care about “hitting the numbers”. In brief, management elected to delay some expected revenue so that they could divert resources toward winning new business from a tier 1 operator.

On the former point, I think this view is shortsighted. PAR is not just software – it is years of customer relationships and ecosystem integrations that can’t be replicated through code alone. PAR’s customers have enterprise level decision making processes in place. Nobody responsible for hundreds or thousands of restaurants will switch to a vibe-coded upstart on a whim. On the latter point, while management has not fully confirmed that they have won a tier 1 operator, they have indicated that they have moved past the RFP stage and into the development phase, while commenting “we’re generally in a market where the press release comes out quite a bit after we’ve won a deal.” vi In other words, it seems as if PAR’s decision to delay some revenue to win a big new customer will be rewarded, but the stock market doesn’t seem to think so. I believe that with time the market’s view will more closely match my own.

Thryv Inc (THRY)

I have exited our position in long-time holding THRY. While we made some money along the way with some well-timed sales at significantly higher prices than where I sold our last shares, Thryv was a significant detractor for 2025, and likely belongs in the mistake pile. The original thesis was that Thryv’s declining but cash gushing Yellow Pages business obfuscated a fast-growing small business software business. This software was not necessarily dominant versus competitors, but I believed Thryv had a competitive advantage in terms of distribution. This was because Thryv had a captive audience in the form of its Yellow Pages customers, while competitors were dependent on cold-calls and Google key words. Combined with tailwinds from aging baby boomers who are retiring and leaving their businesses in the hands of the next generation that is more apt to upgrade their software stack, I believed Thryv was well positioned for success.

However, there was a clear timing element: the distribution advantage is finite. My fear at this point is that a combination of a broad decline in software multiples, a poorly executed acquisition, and poor management communication have led to a complete evaporation of the market’s faith in management and the business, and the stock is now significantly lower than it was five years ago when the business came public. We are business owners first, but there are times when the realities of the stock market – and the implied opportunity costs – should not be ignored. As I see it, the timeline for Thryv to lever their distribution advantage into scale and product advantages is shrinking, it is very difficult to win back the market’s trust when management credibility is impaired, sustained negative stock performance weighs on employee morale, and the technical setup of every shareholder over a 5 year period being underwater likely will require a multi-year digestion period so I have moved on.

New Investments

The factorization of the market and “win now” mentality of market participants has led to some wild swings on seemingly mundane earnings developments. I have made 3 new small investments, that are best left undisclosed at this time as I hope at least 2 of them will turn into larger investments in the months to come. Please stay tuned.

Administrative Notes

The team at Spicer Jeffries is hard at work on our 2025 audit and K1s. As in years past, I suspect their work will be done well in advance of tax day. On a net basis, we ended the year in a realized loss position so I would expect taxes to be minimal to non-existent. However, it is up to Spicer to allocate gains and losses across the partnership, so I can make no guarantees.

Looking Forward

As always, I don’t have any great insights into what will happen next with the stock market, and I suggest you view anyone who claims to know the answer with suspicion. This is true at the macro-economic level, as well as the factor level. What I can say on the macro level is that it seems increasingly clear that Trump and co. intend to run the economy as hot as they can in to mid-term elections. Thus far it seems as if inflation is in check, but the unintended consequences of the government’s actions are of course unknowable at this point.

More important for us is that I feel very good about developments at our individual businesses. At the start of this letter I mentioned the winners and losers last year, but several of our largest positions did very little in 2025, despite clear fundamental improvement to their business. History has shown that regardless of market factors and other day to day market noise, eventually fundamental performance matters. I suspect we will enjoy a catch-up period at some point. Additionally, I continue to believe that eventually the market pendulum will swing away from size, growth, and momentum and back toward areas that are more reflective of our portfolio. Even if the pendulum does not swing, at some point the growing earnings power of our businesses should reward us with time.

Please let me know if you have any questions,

Matthew Sweeney

Managing Partner

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.