Business

Leveraging BI to Analyze and Benchmark Consumer Markets in ASEAN, Highlighting Indonesia

Indonesia’s size influences ASEAN consumer expansion, but early benchmarking at the regional level reduces risks, prevents flawed assumptions, and ensures better market entry decisions.

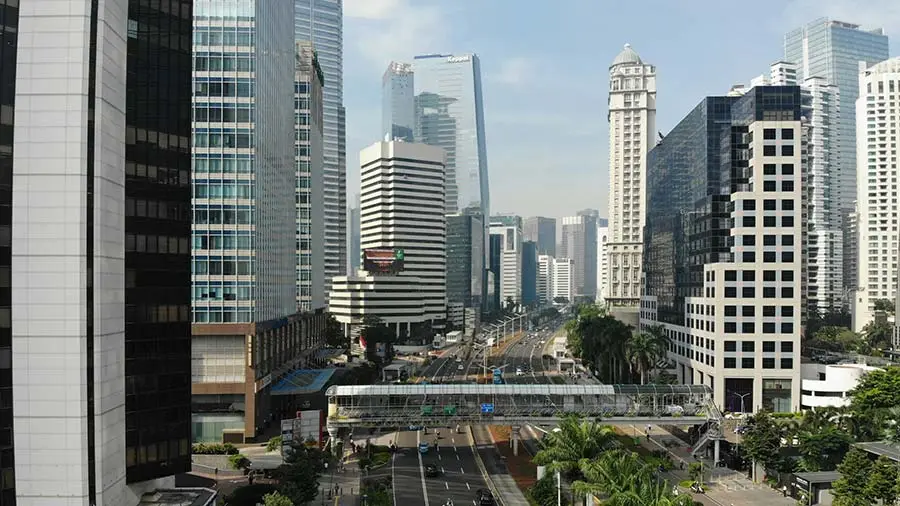

Indonesia’s Role in ASEAN’s Consumer Market

Indonesia is central to ASEAN’s consumer landscape, representing the largest population and consumption levels in the region. It accounts for nearly one-third of ASEAN household spending and is often viewed as the default entry point for market expansion. However, this assumption can pose risks, as relying solely on Indonesia’s size may lead to overlooking nuanced market differences and potential pitfalls in strategy.

Indonesia’s diverse demographics, regional disparities, and evolving consumer preferences require businesses to adopt a tailored approach rather than a one-size-fits-all strategy. Companies must invest in understanding local market dynamics, cultural nuances, and economic conditions to effectively tap into its vast potential. Additionally, while Indonesia offers significant opportunities, businesses should also consider the broader ASEAN market to diversify risks and capitalize on growth in other emerging economies within the region.

The Importance of Business Intelligence in Market Entry

Business Intelligence (BI) is essential for making informed decisions across ASEAN markets. At this level, BI helps benchmark consumer markets before companies commit to a single country. While Indonesia frequently features in such analyses, its size doesn’t negate the need for rigorous benchmarking. Misjudging the market based on assumptions can significantly increase the costs and risks associated with expansion.

Early Benchmarking to Avoid Market Mistakes

Many failed regional expansion efforts stem from late-stage market selection, where initial assumptions about demand, pricing, and channels become entrenched. Conducting ASEAN-level benchmarking early ensures companies understand regional variations, particularly in Indonesia’s diverse consumer segments. This approach helps prevent overconfidence based on size alone and promotes more precise, data-driven market entry strategies.

Read the original article : Using BI to Benchmark Consumer Markets in ASEAN with a Focus on Indonesia