Business

Mental health, substance abuse, and parenting: Here’s how employers plan to change their benefit spending in 2025

It’s all about taking care of caregivers this year. Read More

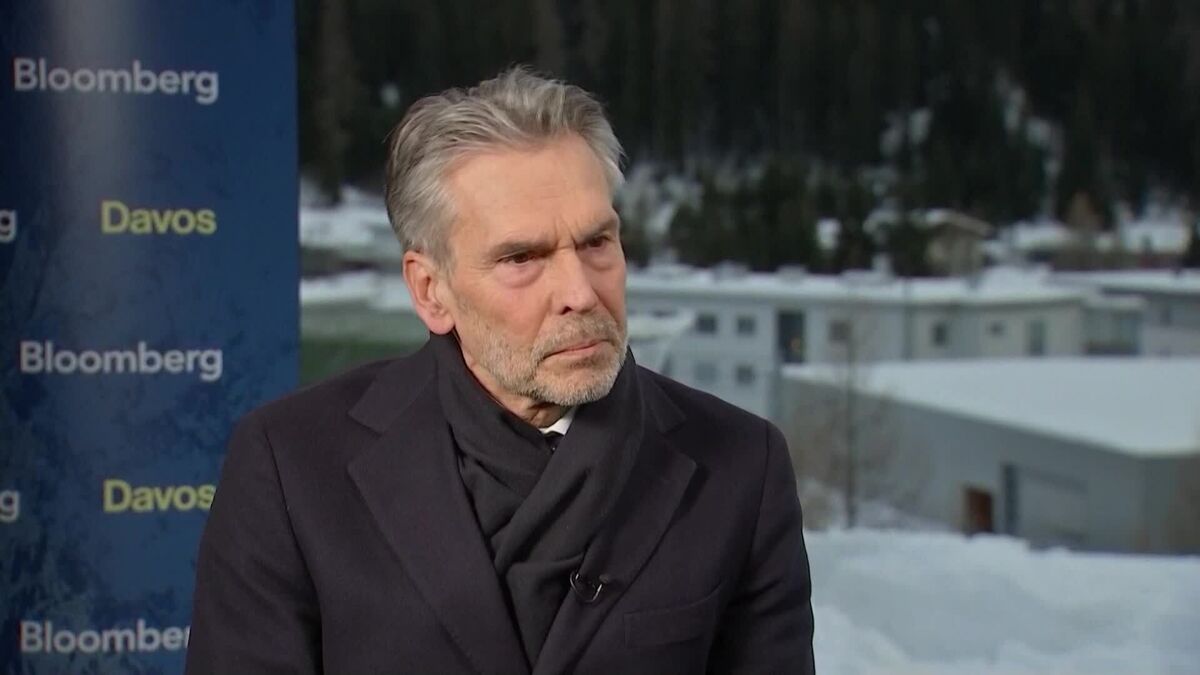

Business

Dutch PM Schoof: Transatlantic Relationship Key for Economy, Security

Dick Schoof, Prime Minister of the Netherlands, said it’s important that the security of Europe is “top of mind” for President Trump as well as for Europeans, as the transatlantic relationship is key both economically and for security. Schoof spoke to Bloomberg’s Chad Thomas in an interview at the World Economic Forum in Davos, where he also said he was looking closely at the potential impact of tariffs and discussed Ukraine and NATO. (Source: Bloomberg)

Technology

Google Fiber is coming to Las Vegas

Google Fiber’s next big expansion is underway in Las Vegas, Nevada. After first announcing the expansion last year, Google has confirmed that it has started construction in Las Vegas and Clark County where its fiber internet service will be available “later this year.”

GFiber, as it’s increasingly being branded, is currently available in select cities across 19 states, including California, North Carolina, Texas, Tennesee, and more. The company most recently lit up its services in Pocatello, Idaho; Logan, Utah; and Lakewood, Colorado, and it plans on bringing GFiber to Lawrence, Kansas as well. Like other fiber internet services, GFiber has symmetrical internet speeds, meaning the speeds for uploads and downloads are the same.

On Wednesday, Google also confirmed that it’s piloting simplified, “lifestyle-based” plans in Alabama and Tennesee, which were first spotted last month. The new $70 / month Core 1 Gig, $100 / month Home 3 Gig, and $150 / month Edge 8 Gig plans replace the 1 Gig, 2 Gig, 5 Gig, and 8 Gig plans that GFiber widely offers.

These new plans are also launching in all of the locations where GFiber is currently available in Arizona and North Carolina, GFiber spokesperson Sunny Gettinger tells The Verge. They’re coming to most of GFiber’s remaining cities within the next month, too.

CryptoCurrency

Coinbase exec ‘identifies’ several Ross Ulbricht-linked wallets holding 430 Bitcoin

SSeveral wallets associated with Ross Ulbricht reportedly hold approximately 430 Bitcoin that were not confiscated by the U.S. government, according to a Coinbase executive.

Conor Grogan, Coinbase’s director of product strategy, claimed in a post on X on Jan. 22 that he identified dozens of wallets tied to the Silk Road founder. These wallets cumulatively hold about 430 Bitcoin (BTC), which have remained untouched for more than 13 years.

“I found ~430 BTC across dozens of wallets associated with Ross Ulbricht that were not confiscated by the USGovt and have been untouched for 13+ years. Back then these were probably dust wallets, now, collectively, they are worth about $47M,” Grogan noted.

Ulbricht left prison on Jan. 21, 2025, following a full and unconditional pardon from U.S. President Donald Trump. Keeping a campaign promise, Trump issued the pardon on his first full day in office after being sworn in on Jan. 20.

The U.S. government had seized 174,000 BTC from Silk Road in 2013. Ulbricht, arrested the same year, was sentenced in 2015 to two life sentences plus 40 years on charges including operating a criminal enterprise, drug distribution, and money laundering. Silk Road had used Bitcoin for transactions on its darknet marketplace.

While authorities shut down Silk Road and seized significant amounts of Bitcoin, wallets holding relatively small amounts at the time appear to have been overlooked. These wallets, now worth millions of dollars due to Bitcoin’s appreciation, remain untouched.

One such wallet holds 88.77 BTC, currently valued at over $9.4 million. Some of these wallets also contain airdropped assets, such as those from the 2017 Bitcoin Cash (BCH) hard fork.

Despite the substantial value of these wallets today, Grogan speculated that Ulbricht may not have access to the private keys. In response to concerns about publicizing this information, Grogan clarified:

“Not going to share the addresses but all of them are public (cited in trial docs or directly adjacent ) and tracked already by multiple sources.”

Business

JetBlue claims to be the first airline in history to start accepting Venmo payments for bookings

Struggling carrier embraces new revenue streams. Read More

Technology

Trump administration fires members of cybersecurity review board in “horribly shortsighted” decision

On Tuesday, a day after Donald Trump’s inauguration as the new U.S. president, the Department of Homeland Security told members of several advisory committees that they were effectively fired.

Among the committees impacted is the Cyber Security Review Board, or CSRB, according to sources familiar with the board who spoke to TechCrunch, as well as reporting by other news outlets. The CSRB was made up of both private sector and government cybersecurity experts.

One person familiar with the CSRB, who received the letter informing them that their membership in the CSRB was being terminated, criticized the decision.

“Shutting down all DHS advisory boards without consideration of the impact was horribly shortsighted,” the person, who asked to remain anonymous, told TechCrunch. “Stopping the CSRB review when China has ongoing cyber attacks into our critical infrastructure is a dangerous blunder. We need to learn from Salt Typhoon and protect ourselves better. The fact this isn’t a priority for Trump is telling.”

“You can’t stop what you don’t understand and the CSRB was arming us with understanding,” the person added.

The person was referring to the CSRB’s review of the devastating recent breaches at several telecoms in the U.S., allegedly carried out by Chinese government hackers.

Contact Us

Do you have more information about the Trump administration and its decisions and activities in the cybersecurity realm? From a non-work device, you can contact Lorenzo Franceschi-Bicchierai securely on Signal at +1 917 257 1382, or via Telegram and Keybase @lorenzofb, or email. You also can contact TechCrunch via SecureDrop.

CISA spokesperson Valerie Mongello referred TechCrunch’s request for comment to DHS, which did not respond to a request for comment.

“In alignment with the Department of Homeland Security’s (DHS) commitment to eliminating the misuse of resources and ensuring that DHS activities prioritize our national security, I am directing the termination of all current memberships on advisory committees within DHS, effective immediately,” read the letter sent to members of the CSRB.

Another person familiar with the matter pointed out that “it’s interesting that the rationale is ‘misuse of resources’ because all advisory board members get an excitingly rich salary of…$0.”

Katie Moussouris, a cybersecurity expert with more than two decades of experience, and a former member of the CSRB, told TechCrunch that “the people who serve as government advisors should be judged by skills and merit, not by political affiliation. I’m hopeful that these critical advisory board vacancies will be filled with the most qualified people without delay.”

The CSRB investigated the breach of U.S. government email systems provided by Microsoft, also allegedly carried out by Chinese government hackers. In March of last year, the committee published a report on the incident, which was widely lauded in the cybersecurity community.

Other DHS advisory committee members that are reportedly impacted by DHS’s decision are those dedicated to artificial intelligence, telecommunications, science and technology, and emergency preparedness.

CryptoCurrency

Top Dogecoin Price Predictions as DOGE Whales Go on a Buying Spree

TL;DR

- Analysts predict a bullish outlook for Dogecoin (DOGE), with potential price targets above $2, driven by bullish chart patterns and significant whale accumulation.

- The creation of Elon Musk’s Department of Government Efficiency (D.O.G.E.) has fueled speculation, with future endorsements potentially reflecting on the meme coin’s price performance.

DOGE’s Next Potential Targets

Dogecoin (DOGE) has experienced intense turbulence in the past week, with its valuation hovering between $0.33 and $0.43. It reached its local peak on January 18 (two days before Donald Trump’s inauguration), while currently, it trades at approximately $0.36 (per CoinGecko’s data).

Despite the significant volatility, many industry participants remain optimistic that DOGE could soon tap a new all-time high. X user Trader Tardigrade claimed that the asset has formed a bull flag on the 2-day chart, which could trigger a price explosion to as high as $2.

Prior to that, JAVON MARKS outlined an even more bullish prediction. They think DOGE has been “showing strength, and by historical performances, prices can be set for an over +432% gain from here.” The meme coin was trading at around $0.38 at the time of the forecast, and the potential increase would result in a valuation surpassing $2.

One major factor signaling that the OG meme coin could indeed witness a substantial rally in the short term is the whale activity. According to X user Ali Martinez, such large investors have purchased 590 million tokens (equaling more than $215 million) in the past 24 hours.

Consistent efforts in that field will reduce DOGE’s circulating supply and create upward pressure on the price (should demand stay the same or rise). In addition, the whales’ actions could encourage retail investors to follow suit and inject further capital into the ecosystem.

D.O.G.E. and DOGE

Another element signaling good days ahead for DOGE bulls is the establishment of the Elon Musk-led Department of Government Efficiency. The entity’s abbreviation is the same as that of the meme coin, while Tesla’s CEO is a huge proponent of the asset.

Earlier this week, Dogecoin’s value briefly skyrocketed by double digits after D.O.G.E. featured the token’s logo on its official website. It later removed it, but if Musk or the agency continues to endorse it, the price might rally again.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Business

Jamie Dimon on Trump’s tariffs: ‘Get over it’

JPMorgan Chase CEO Jamie Dimon said Wednesday that the looming tariffs that President Donald Trump is expected to slap on U.S. trading partners could be viewed positively.

Despite fears that the duties could spark a global trade war and reignite inflation domestically, the head of the largest U.S. bank by assets said they could protect American interests and bring trading partners back to the table for better deals for the country, if used correctly.

“If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it,” Dimon told CNBC’s Andrew Ross Sorkin during an interview at the World Economic Forum in Davos, Switzerland. “National security trumps a little bit more inflation.”

Since taking office, Trump has been saber-rattling on tariffs, threatening Monday to impose levies on Mexico and Canada, then expanding the scope Tuesday to China and the European Union. The president told reporters that the EU is treating the U.S. “very, very badly” due to its large annual trade surplus. The U.S. last year ran a $214 billion deficit with the EU through November 2024.

Among the considerations are a 10% tariff on China and 25% on Canada and Mexico as the U.S. looks forward to a review on the tri-party agreement Trump negotiated during his first term. The U.S.-Mexico-Canada Agreement is up for review in July 2026.

Dimon did not get into the details of Trump’s plans, but said it depends on how the duties are implemented. Trump has indicated the tariffs could take effect Feb. 1.

“I look at tariffs, they’re an economic tool, That’s it,” Dimon said. “They’re an economic weapon, depending on how you use it, why you use it, stuff like that. Tariffs are inflationary and not inflationary.”

Trump leveled broad-based tariffs during his first term, during which inflation ran below 2.5% each year. Despite the looming tariff threat, the U.S. dollar has drifted lower this week.

“Tariffs can change the dollar, but the most important thing is growth,” Dimon said.

Dimon wasn’t the only big Wall Street CEO to speak of tariffs in a positive light.

Goldman Sachs CEO David Solomon, also speaking to CNBC from Davos, said business leaders have been preparing for shifts in policy, including on trade issues.

“I think it turns into a rebalancing of certain trade agreements over time. I think that rebalancing can be constructive for U.S. growth if it’s handled right,” Solomon said. “The question is, how quickly, how thoughtfully. Some of this is negotiating tactics for things over than simply trade.”

“Used appropriately, it can be constructive,” he added. “This is going to unfold over the course of the year, and we have to watch it closely.”

Technology

UK Pledges Public Sector AI Overhaul

The U.K. government has unveiled a set of digitisation plans within the public sector to save £45 billion each year in productivity. The headline announcement is “Humphrey,” a set of AI tools to speed up policy-making activities.

Most Humphrey tools summarise government data, including debates, meetings, policies, laws, and responses to consultations, so civil servants can search through it more quickly when making decisions. Before this, the collation of consultation responses was outsourced to contractors, costing the taxpayer £100,000 a pop.

Another plan is to establish a new team within the Department for Science, Technology, and Innovation that will be in charge of identifying how tech can be used to improve the efficiency of public services. Current systems result in the U.K. tax authority taking 100,000 phone calls daily and the driving licence agency processing 45,000 physical letters, making response times unnecessarily long.

This team will start by developing solutions to help people with disabilities or long-term illnesses more quickly access the services they need, such as financial support or healthcare. The tech will connect the relevant government departments or local authorities so individuals don’t have to be passed between up to 40 of them in a series of phone calls.

Other initiatives, announced on Jan. 21, include:

A full roadmap of these plans on how the government will renew its £23 billion a year tech spend will come in the summer.

SEE: UK Trails Behind Europe in Technical Skills Proficiency

UK public services are plagued by legacy technology

European companies tend to specialise in mature technologies, meaning the region is often seen as technologically behind, particularly compared to the U.S. The U.K. is a top culprit, particularly in critical national infrastructure, which is difficult and expensive to update without downtime.

SEE: 99% of UK Businesses Faced Cyber Attacks in the Last Year

A government report published this week found that nearly half of public services, such as those offered by the NHS and local councils, cannot be accessed online. For example, registering a death must be done in person and, businesses must place a newspaper advert when they want to buy a lorry.

The report found that a quarter of all digital systems used by the central government are outdated, leading to high maintenance costs and a heightened risk of cyber attacks. NHS England alone saw 123 critical service outages last year, leading to missed appointments and disruptions relating to staff being forced to use paper-based systems.

Cybercrime disruption can have even more severe consequences. In June, a ransomware attack on pathology company Synnovis led to months of NHS disruption and, according to Bloomberg. This resulted in harm to dozens of patients, with long-term or permanent damage in at least two cases.

Government is dedicated to making the UK an AI leader, reaping economic growth

This announcement comes just a few days after the government’s “AI Opportunities Action Plan,” outlining the 50 ways it will build out the AI sector and turn the U.K. into a “world leader.” The strategy involves boosting public computing capacity twentyfold, creating a training data library, and building AI hubs in deindustrialised areas.

Last year, the U.K. signed an agreement committing to explore how AI can improve public services and boost economic growth, along with the other Group of Seven nations.

SEE: UK Government Announces £32m of AI Projects

Science Secretary Peter Kyle said in a press release: “We will use technology to bear down hard to the nonsensical approach the public sector takes to sharing information and working together to help the people it serves. We will also end delays businesses face when they are applying for licenses or permits, when they just want to get on with the task in hand – growth.”

A “Digital Commercial Centre of Excellence” will also be forged as part of the overhaul, which will look at how public sector firms can invest in U.K. tech startups and scaleups, simultaneously boosting their efficiency and creating jobs.

CryptoCurrency

Final Day for Flockerz Presale After Securing $12.5M – Could it Skyrocket 100x after Listing?

Ever since Donald Trump’s appointment as US President, the crypto market has been making merry. Bitcoin crossed the $100,000 mark and made a high of $109,000. As of now, the OG crypto coin is 550% from the cycle lows in November 2002, when it plummeted to $15,500.

Well, Bitcoin could potentially climb to $1M by the end of 2025. No, we’re not joking!

During the 2015-2018 cycle, the coin was also up by almost the same percentage as it is now in the current cycle. And during the 2018-2022 cycle, the price was up by 1,300% during the same stage.

Now, if we take cues from the 2015-2018 cycle, Bitcoin can end up 1,110% higher from its lows by the end of March 2025. The price is expected to peak around October, when it may stand at 11,000% higher at around $1.7M.

With Bitcoin’s potential rally comes a near-certainty that the rest of the crypto industry (meme coins included) will follow suit. And that’s where Flockerz shines through, as this Vote-to-Earn project aims to innovate the industry with its community-centric approach.

Trump Administration to Bitcoin and Crypto Industry?

If you need another perspective, consider the Trump effect. Donald Trump is expected to be the most pro-crypto president the US has ever seen. He has promised several legal reforms to strengthen the crypto market.

During his first term, when he was not all that pro-crypto, Bitcoin gained 20x. And now, when the winds have changed, investors only expect a 10x move from Bitcoin to reach $1M, as reported by Coindesk.

Just days before his swearing-in ceremony, Trump launched his own meme coin, $TRUMP.

It quickly became the 18th largest cryptocurrency in the world when it hit a market cap of $15B at a price of around $75. Similarly, the first lady, Melania Trump also followed suit and launched $MELANIA.

Although these coins brought in decent returns for investors, the SEC is not too impressed and may ring in several regulatory restrictions.

The launch of individual-based cryptocurrencies opens the door for manipulation and scams and can dent the investor’s belief in the crypto markets.

As per SEC, popular meme coins like these can ‘blur the lines between celebrity, politics, and finance’ and lead to a lot of volatility and fraud.

There have already been signs of that. As per Bubblemaps, 90% of the $MELANIA token supply was found to be in a single wallet. The official website of the meme coin claims that only 35% of the tokens have been made available to the token team.

Since political meme coins can be a grey area for both regulators and investors, we recommend investing in people-driven coins like Flockerz ($FLOCK) – one of the hottest presales this January.

Last Few Hours of the $FLOCK Presale

$FLOCK is a unique V2E meme coin that allows token holders to participate in the decision-making process. Investors can vote on aspects such as token burns, governance plans, expansion ideas, and new features.

This puts the power in the hands of people who actually care about the coin, and not a single entity. Moving forward, this can set an important precedent in the meme coin industry. Investors may prefer projects with V2E structures in place.

This community-driven coin has amassed close to 31K followers on X and has a strong presence on Telegram as well.

This innovative V2E concept has helped $FLOCK raise $12.5M in presale funding. At the time of writing this, less than 2 hours remain before the presale ends. You can get one $FLOCK for $0.0066883.

To do that, visit the official Flockerz presale website, connect your wallet, and purchase the number of $FLOCK you need. You can do so with a bank card, $ETH, $USDT, or $BNB.

The coin will then move towards listing and is expected to skyrocket to 100x post that within a few months. Experts expect listing gains of at least 10x on launch. The project has reserved 10% of its total token supply for listing to prevent extreme volatility.

Traders have also shown increased interest lately, buying over $44K $FLOCK in the last three days.

The presale is inches away from closing, and this is definitely your last chance to join the $FLOCK mania.

However, crypto assets are subject to market risks and it is wise to do your own research before putting in your hard-earned money. This article isn’t a substitute for professional financial advice.

Business

Tariffs have a long history in the US – two charts tell that story | Money News

There’s a chart that’s been doing the rounds in recent weeks – American businessman Marc Andreessen tweeted it, and then it was reposted by Donald Trump himself.

The chart is pretty simple: it shows the proportion of American federal government revenues coming from tariffs, going all the way back to the early days of American independence.

And to glance at, it tells a compelling story. For nearly all of the 19th century, tariffs imposed on goods imported into America provided more than half the government’s revenues.

The president’s interpretation was as follows: “The tariffs, and tariffs alone, created this vast wealth for our country. Then we switched over to income tax. We were never so wealthy as during this period. Tariffs will pay off our debt and, MAKE AMERICA WEALTHY AGAIN!”

Money blog: New tax rises now ‘a good bet’ for 2025

The first half of his post is quite true. America’s federal economy was largely built on revenues from tariffs. When Alexander Hamilton was designing much of the federal infrastructure, not to mention paying the debts from the War of Independence, he chose to fund it with tariffs and duties on goods imported to the country.

Revenue wasn’t the only reason for the tariffs. They were there, too, to protect the country’s nascent industries. But those tariffs were the main source of income for a long time. What changed? Well, from the late 19th century onwards, the size of the American state expanded. Paying for the Civil War was expensive; funding a growing welfare state and national infrastructure in the following decades likewise.

But tariffs can only go so far. There is only so high one can lift these fees before they begin to stifle activity, making goods so expensive to import that domestic consumers face economic damage. That brings us back to the data in the chart approvingly cited by the president.

Take the same numbers and divide them by GDP – the total size of the US economy – another way of skinning it (indeed, the way you’d normally look at long-run historical figures like this). Now everything looks somewhat different. You can see that at no point in American history – even in those early days when tariffs were far higher than today and a far more important source of revenues – did the total amount they raised exceed 6% of gross domestic product. This is not accidental.

It was because tariffs couldn’t raise enough to finance the Federal administration that successive administrations began to collect other taxes on American citizens rather than imports, starting with excise taxes and income taxes in the Civil War. Those taxes, collected by the Internal Revenue Service, ballooned in the following decades – as did the size of the state.

Today the American federal budget is orders of magnitude bigger than two centuries ago (albeit still much smaller than those you find in Europe). The new administration has made it an explicit policy to cut back on waste, led in part by Elon Musk and his DOGE (the Department of Government Efficiency, whose name was seemingly chosen in order to fulfil Mr Musk’s ambition to turn everything into a meme). But there are limits to how far one can cut: a superpower with a large military, vast infrastructure networks such as road and rail, not to mention public health and education systems, does not come for free.

Even so, raising revenue is just one purpose of tariffs. They can also be used as a negotiating tool with other countries (indeed, this might well be their main function in the hands of Mr Trump). They can be used to protect domestic industries against competition.

Whatever the purpose, after decades of relatively free trade around much of the world – most notably America itself – we are living now in an era where tariffs are back. And this story has only just begun.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login