Business

MF Tracker: Can this 3 and 5 year top performer PSU fund extend its winning streak?

Launched in July 2010, the fund is not given any rating by Morningstar and Value Research. For this fund, according to Value Research, each category must have a minimum of 10 funds for it to be rated, which is not the case for the PSU category as there are five funds. As per Morningstar, this category is a non rateable category fund.

Also Read | Will secondary market SGB maturity returns now be taxed? Budget 2026 has changed the rules

Based on the trailing returns, the fund has outperformed its category average in the last three and five years whereas in the last 10 years, it failed to outperform its benchmark. As in the last three years and five years, the fund gave 32.14% and 28.74% respectively, the category average was 30.60% and 27.94% respectively. Since its inception, the fund has delivered a CAGR of 8.35%. Note, the data for the benchmark BSE PSU TRI was not available to compare the performance of the fund.

On the basis of daily rolling returns, the fund has delivered a CAGR of 15.23% in the last five years, 8.27% in the last seven years, and 7.79% in the last 10 years.

A monthly SIP made in the fund since its inception would have been Rs 59.25 lakh with an XIRR of 13.67%. A lump sum investment of Rs 1 lakh made in the fund since its inception would have been Rs 3.48 lakh with a CAGR of 8.34%.

How does the fund house decode the performance?

PSU stocks have been strong performers, both on an absolute basis and relative to the broader market post 2020, due to an earnings revival and valuation re rating and this tailwind clearly aided our fund’s performance, Rohit Shimpi, Fund Manager, SBI PSU Fund shared with ETMutualFunds.Top contributors for the fund over the last five years have been our holdings in PSU banks and financial institutions, industrials including defence, utilities including electric utilities, energy and metals. These stocks were aided by improvement in asset quality of PSU banks, growth in defence and power, and a positive commodity cycle impacting metals.

Our fund’s strategy has not changed significantly over time, however in mid 2024, we did feel that certain pockets within PSUs were seeing exuberance, and we realigned the portfolio towards large cap stocks within the PSU space. Overall, while being highly stock specific, we remain more positive on large cap stocks within the PSU space at this point in time, Shimpi further said.

What experts say on SBI PSU Fund

According to an expert, with the fund comfortably outperforming its category average, this strong performance marks a sharp improvement over its long term historical returns and reflects the powerful rally seen in public sector stocks in recent years.

Abhishek Bhilwaria, BhilwariaMF (AMFI registered MFD), shared with ETMutualFunds that the primary drivers of this performance have been favourable macroeconomic conditions for PSUs and focused portfolio positioning. The government led reforms, balance sheet clean ups in public sector banks, higher capital expenditure and policy support for infrastructure, defence and energy companies have significantly improved earnings visibility across the sector.

“In addition, the fund has maintained high exposure to core PSU segments such as financial services, energy and power, which have been among the biggest beneficiaries of the economic cycle.”

He further said that the fund has also benefited from a concentrated portfolio approach, with its top holdings accounting for over half of its assets and stocks such as State Bank of India, Bharat Electronics and NTPC have delivered strong returns and played a major role in boosting overall fund performance, and a measured allocation to mid cap PSUs further enhanced returns during periods of market momentum.

Also Read | Silver & gold ETFs rally up to 9% as bullion boom continues. Should you invest now?

As per the last available portfolio data, the top 10 stock holding of the fund is SBI with an allocation of 17.80%, followed by NTPC of around 7.70%, and Bank of Maharashtra with an allocation of 3.65%.

Based on the sectoral allocation, the fund holds 30.05% in banks, 13.49% in power, and 13.33% in crude oil. Around 12.32% is allocated to capital goods, 8.53% to gas transmission, and 6.30% to mining.

So has the fund benefited more from stock selection or sector trends? Bhilwaria said that the SBI PSU Fund has benefited more from broad sector trends, with stock selection acting as a differentiating factor rather than the primary driver and the re rating of the PSU sector as a whole has been the foundation of the fund’s strong returns.

“Improved asset quality in PSU banks, sustained government spending on infrastructure and defence, and renewed investor confidence in public sector enterprises lifted the entire category. This is evident from the fact that average PSU funds have also delivered strong multi year returns, indicating that the rally was sector wide.”

However, SBI PSU Fund’s ability to consistently rank at the top of the category stems from its concentrated exposure to high conviction names and its willingness to take calculated bets across market capitalisations. By overweighting leaders such as SBI and Bharat Electronics and maintaining exposure to select mid cap PSUs, the fund was able to capture incremental gains over peers.

The fund holds 97.12% in equity, 0.08% in debt, and 2.80% in others. Based on market capitalisation, the fund holds 68.95% in large caps, 21.21% in mid caps, 2.89% in others, and 6.96% in small caps.

Should one focus on this sector now post Budget 2026?

Bhilwaria said that following the Union Budget 2026, the outlook for PSU funds has turned more cautious in the near term. PSU bank stocks corrected sharply after the budget due to the absence of fresh capital infusion announcements and profit booking after a strong pre budget rally and this highlights the sensitivity of PSU stocks to policy signals and market expectations.

“That said, the longer term structural story remains intact. The government’s continued emphasis on capital expenditure, particularly in power, defence, railways and infrastructure, supports earnings growth for several PSU companies. As a result, PSU funds may still offer opportunities, but a selective and disciplined approach is essential rather than aggressive lump sum allocations.”

And lastly, given their very high risk profile, sectoral and thematic funds such as PSU funds should form only a small part of an investor’s portfolio. Most experts recommend limiting exposure to a single sector fund to around 10% of the overall portfolio.

He further said that these funds should be treated as satellite investments, while the core portfolio remains anchored in diversified equity funds and investors whose PSU allocation has increased significantly due to past rallies may also consider rebalancing to manage risk.

Also Read | NFO Insight: Does Kotak Services Fund offer access to India’s core growth engine?

Key risk ratios and investment style

The PE and PBV ratio of this fund were recorded at 19.66 times and 3.12 times respectively whereas the dividend yield ratio was recorded at 2.39% as of December 2025.

ETMutualFunds analysed the other key ratios of the fund over a three year period. Based on the last three years, the scheme has offered a Treynor ratio of 2.15 and an alpha of 0.18. The Sortino ratio of the scheme was recorded at 0.82. The return due to net selectivity was recorded at 0.12 and return due to improper diversification was recorded at 0.05 in the last three years.

The investment style of the fund is to invest in growth oriented stocks across large cap market capitalisations.

Others in PSU basket

Apart from SBI PSU Fund, there are three other actively managed funds in the category which have completed three years of existence in the industry. Invesco India PSU Equity Fund gave 31.74%, Aditya Birla SL PSU Equity Fund gave 29.49%, and ICICI Prudential PSU Equity Fund gave 29.03% in the last three years.

Post seeing strong performance by these funds, what is the outlook of these funds? The expert said that the outlook for the PSU sector in early 2026 is one of selective long term opportunity combined with near term volatility. Fundamentally, many PSUs are in a stronger position than in previous cycles, with healthier balance sheets, improved governance and steady cash flows and several companies continue to offer attractive dividend yields and benefit from government backed order visibility.

“However, market sentiment has become more discerning. Much of the valuation re rating seen over the past few years is already priced in, particularly in PSU banks. Budget related uncertainty, evolving governance reforms and ambitious disinvestment targets have added to short term fluctuations. As a result, broad based sector rallies may be limited going forward.”

He further said that for PSU funds, this suggests a phase of consolidation rather than runaway gains. Performance is likely to be driven by stock specific fundamentals rather than pure sector momentum. Investors should approach PSU funds with a medium to long term horizon, an ability to tolerate volatility and a clear understanding that returns may be uneven, and a selective and measured exposure remains the most prudent strategy in the current environment.

One should always consider risk appetite, investment horizon, and goals before making any investment decisions.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

If you have any mutual fund queries, message ET Mutual Funds on Facebook or Twitter. We will get it answered by our panel of experts. Do share your questions at ETMFqueries@timesinternet.in along with your age, risk profile, and Twitter handle.

Business

Asia-Pacific Investment in Australia Hits Record Highs in 2025

Asian investment into Australia reached a series of record-breaking milestones in 2025, with Japan, Korea, Singapore, and Malaysia reshaping bilateral economic ties through landmark deals and strategic capital deployment, even as global macroeconomic headwinds tested investor confidence across the region.

Key takeaways

- Japan’s M&A market surged 83.9% to US$218.5 billion in 2025, marking the third consecutive year of record Japanese investment into Australia.

- Korea’s POSCO sealed a landmark A$1.2 billion lithium deal while Hanwha cemented its defence presence through a 19.9% stake in Austal, signalling Asia’s deepening strategic ties with Australia.

- Critical minerals, defence, real estate, and renewables are set to dominate Asia-Pacific deal flow into Australia throughout 2026.

These are the central findings of MinterEllison’s 2026 Asia Report: Year in Review, the fifth annual edition of the firm’s flagship Asia practice publication tracking cross-border deal activity, regulatory shifts, and sector-by-sector investment trends across Australia’s key Asian partner economies.

Japan: Unprecedented M&A and Historic Leadership

Japan’s M&A market reached unprecedented levels in 2025, recording 3,472 transactions valued at a combined US$218.5 billion, an extraordinary 83.9% surge compared to 2024.

Sanae Takaichi became Japan’s first female Prime Minister, signalling a decisive pivot toward economic growth and a commitment to lifting defence spending to 2% of GDP.

Japanese investment in Australia reached record levels for the third consecutive year, with real estate, energy security, and data centres emerging as priority sectors. The landmark A$55 billion Mogami-class frigate contract further cemented defence collaboration as a key pillar of the bilateral relationship heading into 2026.

Korea: Lithium Billions and a Expanding Defence Presence

Korea delivered one of the year’s most consequential bilateral transactions. POSCO Holdings committed A$1.2 billion into Mineral Resources’ lithium assets, securing a 30% interest and long-term access to spodumene concentrate from Tier-1 assets at Wodgina and Mt Marion.

Meanwhile, Australia-Korea cross-border investment volumes grew 20% year-on-year in the first three quarters of 2025. On the defence front, Hanwha’s stake in Austal Limited was approved at 19.9%, positioning the Korean conglomerate as Austal’s largest single shareholder and reflecting deepening strategic industrial ties between the two nations.

China: Record Trade Surplus, Subdued M&A

China’s domestic economy showed signs of stabilisation in 2025, posting a record US$1.189 trillion trade surplus while accelerating overseas manufacturing investment across Southeast Asia.

Inbound M&A from Chinese companies into Australia remained subdued, as FIRB approval challenges continued to constrain deal activity.

Australia charted an independent China strategy under its re-elected government, prioritising trade while maintaining security commitments. MinterEllison anticipates 2026 deal flow will emerge primarily through minority equity interests, joint ventures, and licensing agreements in sectors including EVs, mining, biotech, and fintech.

Singapore and Malaysia: Capital, Infrastructure, and Renewables

Singapore delivered political certainty following Prime Minister Lawrence Wong’s landslide election victory, though overall M&A activity softened amid US-driven global headwinds.

Capital markets reform initiatives deployed approximately S$3.95 billion to local asset managers, while IPO fundraising reached its highest level since 2019 at S$2.54 billion. Australian real estate remains a key deployment target for Singapore-based capital in 2026.

Malaysia rounded out a strong year for Southeast Asian investment into Australia, backed by solid GDP growth of 4.7 to 5.0%. Sime Darby Property acquired the largest Melbourne CBD development site in five years, while Gamuda Berhad secured infrastructure contracts exceeding RM8 billion and entered Tasmania’s renewable energy market. Fortescue’s green hydrogen collaboration in Sarawak highlighted the growing maturity of bilateral clean energy ties.

The 2026 Asia Report presents a region demonstrating strategic purpose despite a volatile global backdrop. Critical minerals, defence, real estate, and renewables are expected to drive deal activity across all five markets in the year ahead, reinforcing Australia’s position as a preferred destination for Asian capital.

Other People are Reading

Business

SpaceX Readies Confidential IPO Filing. What That Means.

SpaceX Readies Confidential IPO Filing. What That Means.

Business

Stocks’ Season of Discontent Could Linger Well Past Winter. Plus, Picks Among BDCs.

Stocks’ Season of Discontent Could Linger Well Past Winter. Plus, Picks Among BDCs.

Business

AI Gave Investors a Glimpse of the Future This Month. And They Sold Their Stocks.

Investors have been betting for years that artificial intelligence would change everything. They got some proof of it this month—and then they started selling.

The S&P 500 and the Nasdaq fell in February, each suffering its worst month since tariff turmoil started to crop up in markets last spring. Among the hardest-hit: software businesses, tech companies and the financial firms invested in, or threatened by, the rapid evolution of AI technology.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Global gas markets face their biggest shock since 2022 on Iran conflict

Global gas markets face their biggest shock since 2022 on Iran conflict

Business

Afghanistan fires at Pakistani jets over Kabul as conflict intensifies

Afghanistan fires at Pakistani jets over Kabul as conflict intensifies

Business

Trump warns Iran of unprecedented force if it retaliates

Trump warns Iran of unprecedented force if it retaliates

Business

Paramount Is Officially Buying Warner Bros. Why the Stock Soared.

Paramount Is Officially Buying Warner Bros. Why the Stock Soared.

Business

Cardinal found with phone during secret conclave to elect Pope Leo, book says

Cardinal found with phone during secret conclave to elect Pope Leo, book says

Business

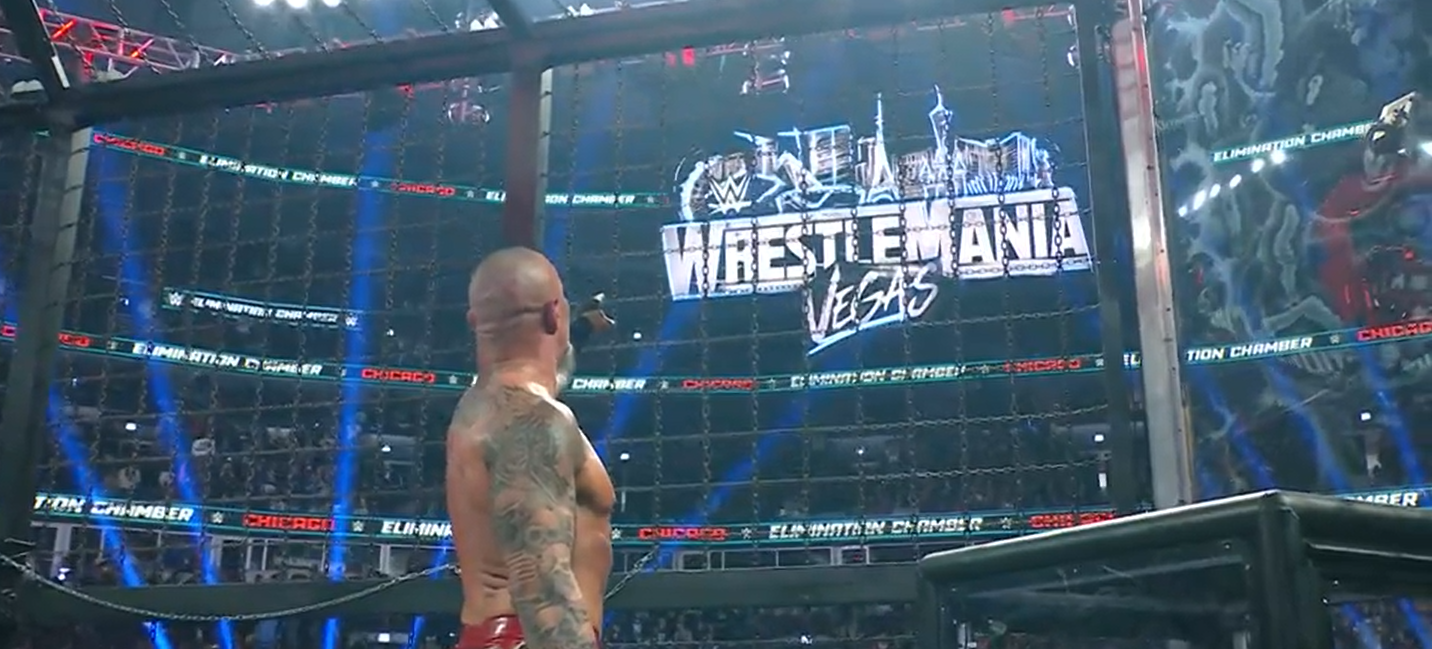

Randy Orton Wins Elimination Chamber, Becomes Number One Contender for Undisputed WWE Title

Randy Orton has won the Men’s Elimination Chamber match, which means that he will go against Drew McIntyre for the WWE Undisputed Championship at WrestleMania 42.

To win the match and become number one contender, Orton bested Cody Rhodes, LA Knight, Logan Paul, Trick Williams, and Je’Von Evans.

Randy Orton Wins Elimination Chamber

Orton pinned Rhodes to win the match after McIntyre interfered. McIntyre first attacked Rhodes, but Orton eventually hit him with the RKO.

Rhodes retaliated against McIntyre and hit him with the Cross Rhodes. However, Orton took the opportunity to take out Rhodes with the RKO to pick up the win.

Orton’s 2026 win is his second Elimination Chamber win overall. His first won the Elimination Chamber in 2014 when he successfully defended his WWE World Heavyweight Championship against Cesaro, Christian, Daniel Bryan, John Cena, and Sheamus.

Seth Rollins Returns

The Men’s Elimination Chamber match also marked the return of Seth Rollins, who was revealed to be the masked man who has been attacked The Vision for the past couple of weeks.

Rollins cost Paul the match, hitting him with The Stomp before Rhodes went for the pin.

Prior to his elimination, Paul himself eliminated Williams, Evans, and Knight.

Originally published on sportsworldnews.com

-

Politics7 days ago

Politics7 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics6 days ago

Politics6 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World5 days ago

Crypto World5 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports1 day ago

The Vikings Need a Duck

-

Business7 days ago

Business7 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech5 days ago

Tech5 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat14 hours ago

NewsBeat14 hours agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Business7 days ago

Business7 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat19 hours ago

NewsBeat19 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 hours ago

Tech3 hours agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Tech7 days ago

Tech7 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat10 hours ago

NewsBeat10 hours agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source