Business

My Biggest Concerns As We Enter 2026

Jacob Wackerhausen/iStock via Getty Images

Welcome to 2026

As always, the January Absolute Return Letter is about issues that are at the forefront of my mind – risks that keep me awake at night because they could have a profound impact on portfolio returns, should they come to fruition.

And, as always, I shall be the first to admit that the true sledgehammer – the one which could wipe out vast amounts of wealth – is likely to come out of the blue. Take for example COVID-19. Did anyone plan for the pandemic? Maybe when the reality started to sink in and large amounts of wealth had already been lost, but beforehand? Get my point? The biggest risks are almost always those we don’t even think about.

The three risks to follow – the ones I worry most about as we enter 2026 – will come in no particular order. I should stress that my colleagues don’t necessarily agree with me; they may, in fact, worry about something different. Also, you should be aware that this Absolute Return Letter is somewhat longer than usual (the January letters always are). It is impossible to cover a topic like this in 1,500 words. I hope you’ll understand. With those comments, let’s begin.

#1: US monetary policy

My concern is that Trump will replace Jerome Powell with an uber-dove, who will lower the policy rate purely for political reasons, and that this will lead to a significant steepening of the yield curve and, even worse, to a new spike in inflation.

Jerome Powell’s second term as the Chair of the Federal Reserve Bank began on the 23rd of May 2023. Therefore, his term is up on the 23rd May this year unless he is either reappointed or walks away prematurely. I would assign a very low probability to any of those outcomes; i.e., in all likelihood, a new Fed Chair will almost certainly take over in May.

Now, what does that mean? After the December cut, the Fed Funds target range is 3.50-3.75%, with the Effective Fed Funds Rate (EFFR) being 3.64%, as these lines are written. Trump has repeatedly said that the Fed should instantly lower the Fed Funds rate by a full percentage point and follow up with several more cuts (without being overly specific). For your information, the Fed Funds rate peaked at 5.25-5.50% in early 2024 before the current easing cycle began.

Trump’s wording suggests that he wants the EFFR to be cut by at least another 125 bps in addition to the 25 bps delivered in December, and that is why I expect Powell to be replaced by an uber-dove, somebody who is prepared to dance to Trump’s tunes. More recently, Trump has even stated that he won’t bring in a new Chair who won’t agree to take the EFFR down to 1%!

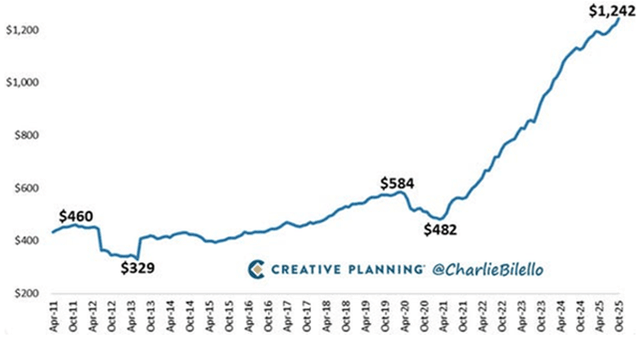

If you wonder what drives Trump, take a look at Exhibit 1 below. The US government is drowning in debt, and lower interest expenses would make it easier for him to deliver on his election promises.

Exhibit 1: Interest expense on US public debt outstanding

Source: Creative Planning

Trump is faced with at least two challenges, though. First and foremost, the Chair is only one of 12 voting members on the FOMC. Even if Trump can count on the support of a couple of other voting members (and he can), there is still a long way to a majority.

Secondly, Trump doesn’t control the yield curve, and bond investors could quite possibly react with much hostility to rate cuts that are not necessary. The average maturity of all outstanding US government debt is about six years. Should the yield curve steepen significantly in response to massive rate cuts, the whole exercise could actually end up being counterproductive.

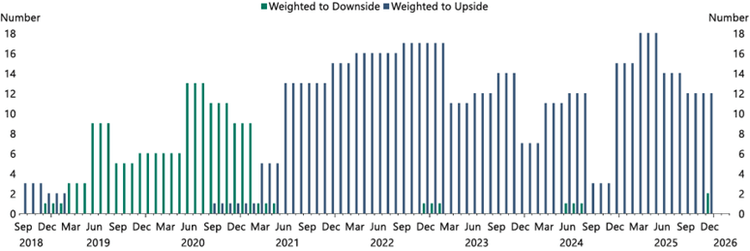

One final point on this concern. Anecdotal evidence suggests that, in the FOMC, the members see plenty of upside risks to their inflation forecasts (Exhibit 2). Therefore, the new Chair may struggle to gather sufficient support to repeatedly cut rates. Having said that, it remains a key concern of mine, given Trump’s determination to have lower rates.

Exhibit 2: Number of FOMC members who think the risk to inflation is high/low

Source: Apollo Global Management

#2: The AI bubble

My concern is that the AI bubble will finally burst, and that the selloff will turn out to be far more widespread than anticipated (similar to the dotcom bust in 2000).

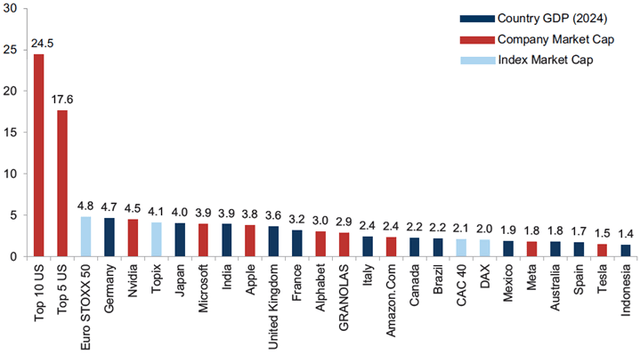

As you can see in Exhibit 3 below, the combined value of the ten largest US stocks, when measured by market cap, now exceeds the GDP of Germany, Japan, India, UK, France, Italy and Canada put together! The ‘sinners’ here are, not surprisingly, US mega cap stocks, mostly the hyperscalers, but the rally in those have had a noticeable effect on other US equities as well.

Exhibit 3: Company market cap (red) & country GDP (dark blue) in US$ trillion

Notes: Country GDPs as of 2024. Market prices as of 8 October 2025. (Source: Goldman Sachs Global Investment Research)

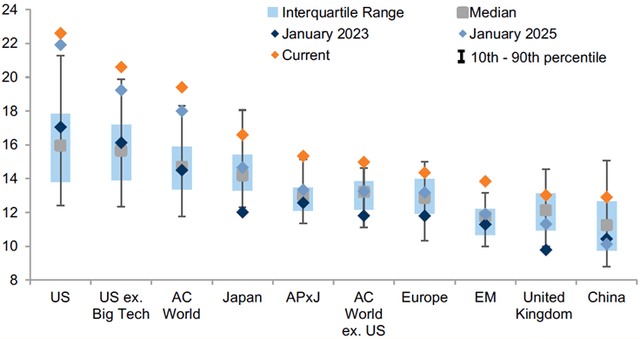

Let’s move to Exhibit 4 straightaway. As you can see, even ex. Big Tech, US equities are now much more expensive than equities elsewhere. Adding to that worry, as you can also see, even if equities are less expensive elsewhere, with only a couple of exemptions (UK and China), equities in most countries are now trading near historical highs.

This suggests to me that, if an AI-related selloff in the US were to materialise, equities in the rest of the world won’t offer the protection many expect them to. Equities elsewhere may fall less than US equities, but they will most likely still fall.

Exhibit 4: 12-month forward P/E multiples for MSCI regions

Notes: STOXX 600 for Europe; S&P 500 for USA. Data from January 2003 to November 2025. (Source: Goldman Sachs Global Investment Research)

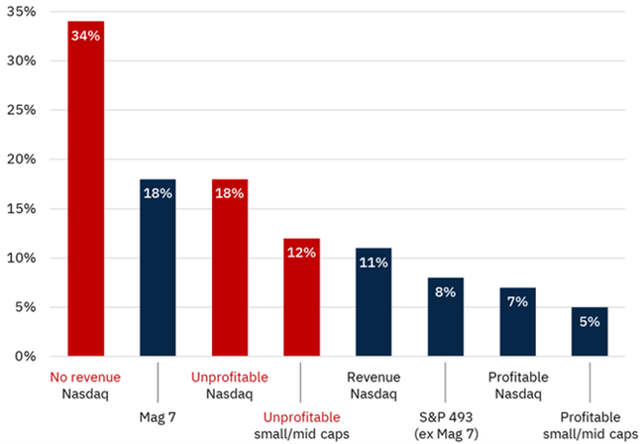

One last point on this concern: Supporters of the AI bull story argue that, yes, those stocks are indeed rather expensive, but an outstanding earnings outlook justifies it. My counterargument to that is embedded in Exhibit 5 (see below). As you can see, the stocks that have done the best in 2025 are companies with no revenues, followed by unprofitable Nasdaq stocks. Investing in those types of stocks is not only an indication of hyped investor behaviour; it is indeed a very convincing one.

Exhibit 5: Price returns on US equities, 2025 to 30 September

Source: Creative Planning

#3: Climate change

My concern is that our political leaders will take (even more) control of the political agenda on climate change, and that this will lead to a mix of irrational government policies.

Climate change sceptics will argue that political leaders have already taken control and have done immense damage to the economy in the process. My concern is that the damage has hardly started yet; things can in fact get a lot worse. As the average temperature continues to rise, so will the damage to the economy. And, as the impact on the economy worsens, angst amongst our political leaders will grow and drive them to make decisions that make little sense.

Let me give you an example: In a recent interview with Danmarks Radio (the Danish BBC-lookalike), a Danish politician uttered the following words (and I paraphrase): “Danish households pay far too much for their electricity. We need to generate more cheap energy from wind and solar.”

If it was only that simple, but wind and solar are two energy forms that are broadly misunderstood. They are not cheap at all; they are in fact amongst the most expensive energy forms available today. On top of that, they are unreliable, as the wind doesn’t always blow and the sun doesn’t always shine.

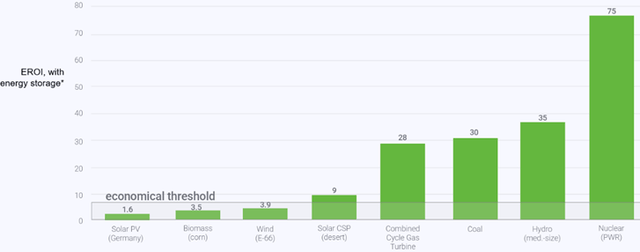

I have, in the past, written extensively about the concept of EROI and shall not repeat myself (too much); however, EROI (Energy Return On Investment) is a crucial metric which is important to understand, and most politicians clearly don’t. It measures how much energy you get out from an energy source compared to the energy spent to extracting, processing and delivering it.

An EROI of 8:1 means that you generate eight units of energy for every one unit of energy invested, and 8:1 happens to be the breakeven point; the point where the energy source in question begins to make economic sense.

Exhibit 6 compares the lifetime electricity output of different energy sources to the energy needed to create and run them 24/7, which is precisely how EROI is defined. Take a long look at the chart, and then ask yourself the question: Are our political leaders on the right track?

Exhibit 6: EROI of various energy sources

Source: enCore Energy

Don’t get me wrong. I am fully aware that the environmental impact needs to be taken into account as well. However, these two energy forms are not nearly as clean, environmentally speaking, as we are led to believe.

The bottom line

As we enter 2026, I think the risks facing equity investors are above average but not (yet) at extreme levels. The last major, global panic attack happened in early 2020, when it dawned on investors how serious COVID-19 was. Back in 2008, as the Global Financial Crisis unfolded, there was even more blood in the streets.

Regional panic attacks also occur from time to time, although they may not affect equities everywhere. The sovereign debt crisis in the eurozone in 2010-12 caused by Greece is a classic example of a regional crisis.

Equities always react negatively to such incidents but sometimes more so than others. They are particularly sensitive when equity valuations are rich, and equities – particularly US equities – are indeed richly valued at present. Let me briefly describe the different stages leading to the eventual equity collapse, as I have experienced them:

Stage 1 is also what I call the bubble stage. At this stage, the party atmosphere in the equity market is high. Investors are not yet seriously concerned about equity valuations, and even modestly positive earnings surprises are richly rewarded by investors, as long as the company in question operates in a ‘hot’ industry. The few who raise their voice in concern are branded perma-bears.

Stage 2 is when the first signs of more widespread concern begin to appear. In my own vocabulary, this stage is called the yellow flag stage. Excessively high P/E values are common at this stage. Even companies with negative earnings often trade at absurd valuations; however, many companies which report disappointing numbers are punished, sometimes severely so.

Stage 3 is the red flag stage. Professional investors, who have so far participated, can now smell a rat, but equity markets continue to go up, driven primarily by retail investors. Two themes dominate at this stage:

- so-called story stocks dominate, and that is whether their earnings are positive or negative; and

- for companies making a profit, it is no longer enough to live up to expectations. Earnings must exceed them for the stock price not to react negatively.

Adding to the growing absence of professional investors, another indicator has proven to be a solid indicator of an imminent collapse, namely the crumbling of the IPO market. Many planned IPOs are cancelled and of those that aren’t, many do not perform that well. One could even argue that a very rich IPO calendar is an even earlier sign of a pending collapse, as the problems almost always begin with an overload of IPOs, followed by the crumbling of the IPO market.

Stage 4 is the final stage in this cycle – the equity market collapses at this stage. Now, equity markets never collapse ‘just’ because equities are expensive; a catalyst shall be required, and it is impossible to predict what that catalyst will be. You never know ex-ante. Having said that, experience has taught me that the more expensive equities are, the less serious a catalyst shall be required for the market to collapse.

Now, to the important question. As we enter 2026, where are we in this cycle? We have definitely passed stage 1. Although I see elements of stage 3 in today’s market behaviour, neither have (most) professional investors departed yet, nor does the performance of the average IPO suggest a collapse is imminent. In other words, I believe we are late stage 2.

I still invest in equities, but I favour a cautious approach. We delivered about +30% net to our investors in 2025 and did so despite taking a lot of equity risk out of our portfolio early in the year. I don’t expect +30% in 2026, but I expect to outperform the MSCI World index by overweighting RoW equities relative to US equities and by allocating a fair bit to commodities and commodity-linked equities in lieu of vanilla equities.

Gold was a big winner for us in 2025, and I don’t think that party is over yet, but we have regularly trimmed our allocation to gold and will continue to do so, as it is not behaving like the risk-off assets we expected it to be when we first invested.

Adding it all up

In summary, my three biggest calls for 2026 are:

- index-linked bonds to outperform nominal bonds;

- RoW equities to outperform US equities; and

- commodities to outperform equities.

#1 is the consequence of the first concern referred to above, i.e. that President Trump may replace Jerome Powell with an uber-dove, which could have an unpleasant impact on inflation.

#2 is a result of my second concern, i.e., that the AI bubble may burst. It is almost a given that equity markets will be affected worldwide should the bubble burst in the US, but I think the negative impact will be bigger in the US, given how expensive US equities are (see Exhibit 4 again).

Finally, #3 is a function of the intense focus on climate change. As the average temperature continues to rise, so will (most) governments’ desire to go green, and that will raise demand for many commodities, particularly green metals.

In the distant background, a small but growing minority continues to argue that Net Zero will never happen, and that could very well turn out to be correct. However, these critics miss the point if they, on that basis, conclude that investing in green opportunities is yesterday’s story. It isn’t, as long as there is a political commitment to go greener. If that support fades, as it has done in the US, it will be time to change strategy.

By Niels Clemen Jensen

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.