Business

No beef with the US, but local is best

News that US beef now has official access to Australian supermarket shelves has sparked questions among households and retailers.

For consumers facing rising grocery bills, the idea of imported beef driving down prices might seem attractive. However, a closer look at how beef is produced, processed and priced in Australia and the US shows that imported US beef is highly unlikely to reduce the cost of retail beef in Australia.

In most cases it will remain more expensive than locally produced options and be confined to niche markets rather than everyday purchases such as mince and barbecue steaks.

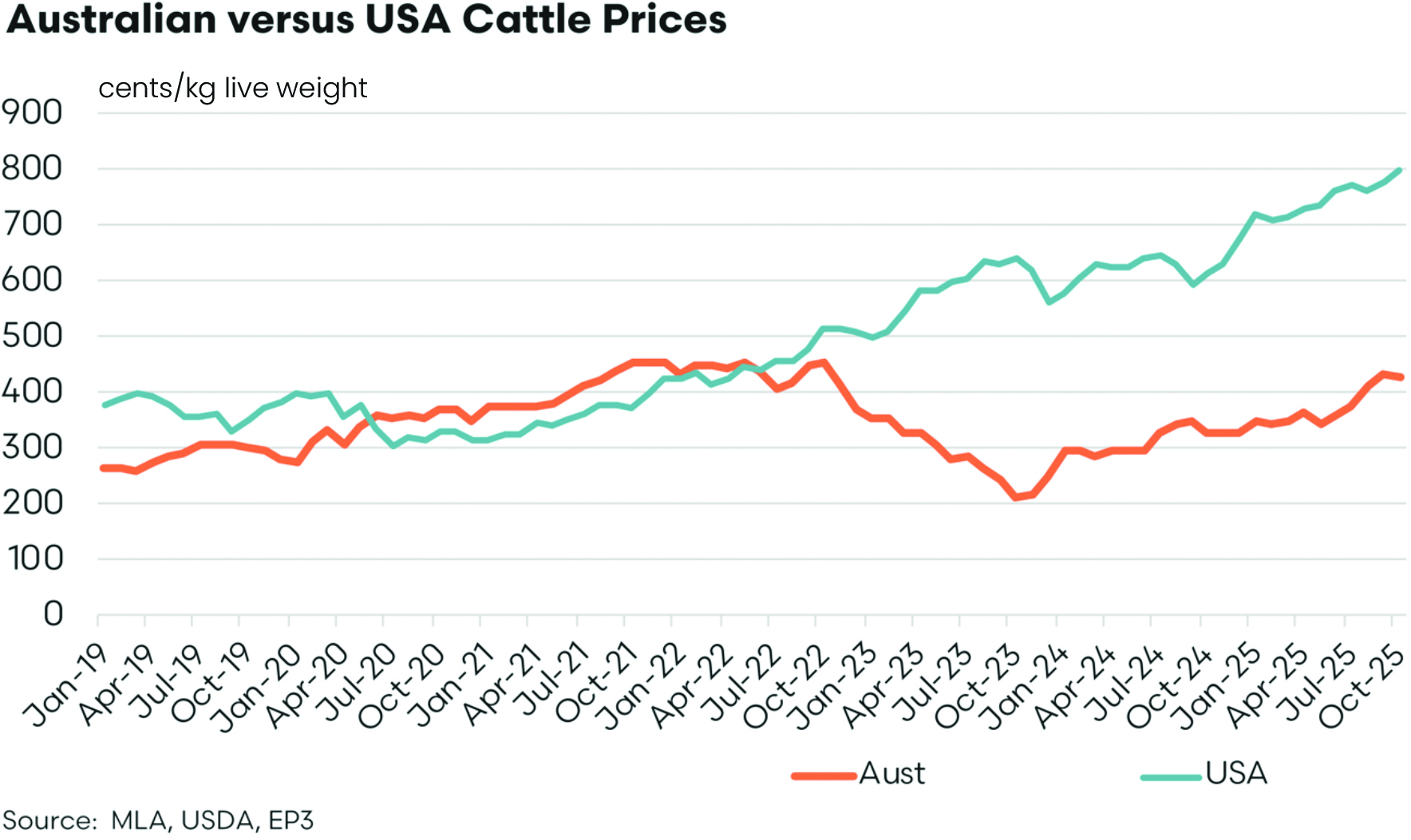

At the core of the issue is the cost of cattle. Australian-finished heavy steers are currently trading at around 430 cents per kilogram live weight, helped by improved seasonal conditions and steady domestic supply.

In the US, comparable animals are trading much higher, closer to 800c/ kg live weight.

This matters for Australian consumers because the price of beef in the supermarket starts with the cost of the animal on farm.

If US beef processors are paying nearly 50 per cent more for cattle, there is no realistic pathway for US beef to arrive in Australia and sell for less than the local product.

That difference in farmgate prices translates directly into higher processing and wholesale costs.

In the US, lean 90CL beef trim (90 per cent lean meat, 10 per cent fat), which is used to make lean mince and hamburgers, sells for about $US4.05 per pound.

Converted at an exchange rate of 0.655 to a metric measure, that comes to around $13.70 per kilogram in Australian currency.

In Australia, processors producing the same lean trim are working with much cheaper livestock, and local wholesale prices generally sit in the $10 to $12 per kilogram range.

By the time US trim is boxed, frozen, shipped, insured, inspected, cleared through customs, stored and distributed, the cost climbs higher still. No importer can absorb those additional expenses and still place US beef on Australian supermarket shelves at a price below local beef.

The price gap becomes even more obvious at the retail counter. In Australia, lean beef mince with around 10 per cent fat content typically retails for between $18 and $22/kg at major supermarkets.

In the US, the same 10 per cent fat mince is commonly priced between $US6.50 and $US10 per pound. Once converted into Australian dollars, this equates to between $22 and $34/kg.

In other words, US mince is already more expensive on American shelves than Australian mince is locally. The idea that it could be shipped halfway across the world, repackaged and then sold for less than Australian mince is not commercially realistic.

For retail consumers, this means the arrival of US beef does not translate to cheaper sausages, burger mince, stir-fry strips or barbecue chops.

Instead, any US beef that appears on Australian retail shelves will most likely be in premium or specialist categories. Cuts such as USDA prime or choice ribeye steaks, grain-fed briskets for low-and-slow barbecue, short ribs or branded gourmet burger blends might attract a small group of enthusiasts who are willing to pay extra for a distinctive American flavour or style. These products are not where the majority of Australian households spend their weekly meat budget, and they are not priced to compete with everyday Australian beef.

Some might ask whether increased imports could at least put downward pressure on prices indirectly by boosting competition. Again, this is unlikely. Australian beef remains cheaper from paddock to plate. Local producers have lower livestock costs, shorter transport distances and efficient processing systems.

Domestic retailers are already sourcing their beef from a well-established supply chain that keeps costs relatively contained. US imports would enter that system at a higher cost base, not a lower one, making it impossible for them to act as a price-cutting force across the broader market.

For Australian families browsing the meat aisle, the reassurance is clear. The price of their weekly beef mince or steak is driven by Australian conditions, not American imports. Rainfall, feed costs, herd numbers and domestic demand have far more influence on the price of beef than anything arriving on a shipping container from the US.

The Australian beef supply chain remains competitive and efficient, and US beef is not arriving to undercut it.

The limited competitiveness of US beef imports should also reassure retailers. Butchers and supermarkets will continue to rely on domestic producers for the vast majority of their beef offering, as it remains the most economical and reliable source. For consumers, the best value will still come from fresh, locally sourced beef.

• Matt Dalgleish is co-founder and director of Episode 3 (EP3)