Business

Noah Holdings Stock: Deep Value With Structural Transformation (NYSE:NOAH)

I am an independent trader and analyst specializing in the micro-cap market. My strategy combines technical analysis with the CAN SLIM method, developed by William O’Neil, to identify high-growth, underanalyzed companies. I focus on financial trends, profit growth, and institutional capital accumulation to uncover stocks with significant upside potential. In addition to equities, I have experience in Forex trading, which has helped me better understand price movements, market volatility, and sentiment-driven trends. My research approach integrates both fundamental and technical analysis, allowing me to identify strong growth stocks before they gain widespread attention. Key indicators I prioritize include relative strength, trading volume shifts, and accelerating profit growth—all of which help pinpoint stocks with the highest potential. Writing for Seeking Alpha is an integral part of my investment process, enabling me to refine my strategies, test investment theses, and engage with the investor community. In my articles, I aim to deliver in-depth company analyses, focusing on stocks with strong growth trends, improving fundamentals, and technical setups that signal potential breakouts. Through structured research, I strive to enhance market understanding and provide actionable investment insights.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

GameStop Shares Rise Modestly in Early Trading, Trading Near $24.60 Amid Acquisition Speculation

GameStop Corp. shares edged higher in early Monday trading as retail investors and market watchers continued to parse ongoing speculation about CEO Ryan Cohen’s pursuit of a transformative acquisition, while the meme stock favorite approached its next earnings report later this month.

AFP / Frederic J. BROWN

GameStop (NYSE: GME) opened around $24.00 and ranged from a low of $23.93 to a high of $24.83, with shares trading near $24.54 to $24.66 in recent updates, up roughly 0.7% to 1.2% from Friday’s close of $24.37. Volume stood at approximately 3.7 million shares by mid-morning, below average but indicative of sustained interest in the specialty retailer.

The modest gain followed a 2.05% advance on Friday, when the stock closed at $24.37 after fluctuating between $23.62 and $24.39 on volume of nearly 6 million shares. GameStop’s performance has remained range-bound in early 2026, with the stock hovering between roughly $20 and $25 after peaking near $36 in late 2025 amid earlier meme-driven volatility.

Cohen, who has steered the company since becoming chairman and later CEO, has kept investors focused on strategic repositioning. In late January, he told CNBC that GameStop was eyeing a “very, very, very big” acquisition of a larger publicly traded consumer company, potentially leveraging its cash reserves — reported at about $8.8 billion in the most recent quarter — to execute a deal that could reshape the business into a broader conglomerate.

The acquisition rhetoric has fueled optimism among supporters who view Cohen’s vision as a path away from declining traditional video game retail toward diversified holdings with higher-margin opportunities. Analysts note that such a move could deploy excess cash productively, especially as core hardware and software sales have faced headwinds from digital distribution trends and store optimizations.

GameStop has already shown progress in shifting its mix. Recent quarters highlighted surging collectibles revenue — up over 50% year-over-year in some periods — alongside improved gross margins near 34.5%, driven by emphasis on pre-owned items, accessories and higher-margin categories. The company also raised liquidity through a convertible note offering, providing flexibility for investments or acquisitions despite ongoing revenue pressures.

Upcoming catalysts loom large. GameStop is scheduled to report fourth-quarter and full-year 2025 results on March 24, 2026, with a conference call the following day. Expectations center on continued margin resilience amid softer top-line trends, with attention on any updates regarding acquisition progress or balance-sheet deployment.

Short interest remains elevated at around 16% in recent data, keeping the door open for volatility if retail momentum builds. Michael Burry’s disclosed position in late January added to the narrative, though the investor tempered expectations for another massive short squeeze.

Broader challenges persist for the core business. Hardware and accessories sales declined sharply in prior periods, reflecting industry shifts toward streaming and digital downloads. Store closures and competition from online platforms continue to pressure physical retail, though Cohen’s focus on efficiency and strategic pivots has helped stabilize operations.

Wall Street remains cautious. Analyst consensus leans toward a “Sell” rating, with median price targets around $13.50 — well below current levels — reflecting skepticism about long-term profitability without a successful transformation. Some forecasts project modest upside to $31 by year-end under optimistic scenarios, but most emphasize execution risks in any major deal.

GameStop’s market capitalization sits near $11 billion, supported by a loyal retail base and Cohen’s track record from Chewy. The stock’s 52-week range spans $19.93 to $35.81, with the current price in the middle of that band after a choppy start to 2026.

Investor sentiment ties closely to Cohen’s commentary. In recent posts and interviews, he has critiqued traditional corporate structures while positioning GameStop for bold moves. A long-term performance award granted to Cohen in January — contingent on stockholder approval at a special meeting expected in March or April — aligns incentives around significant value creation.

As trading unfolds Monday, GameStop reflects the ongoing tug-of-war between meme-stock enthusiasm and fundamental realities in a maturing gaming industry. The company’s cash position provides optionality, but success hinges on deploying it effectively amid competitive and economic uncertainties.

Looking ahead, the March earnings release and any acquisition developments could serve as pivotal moments. For now, shares trade with cautious optimism, buoyed by Cohen’s ambitions yet tempered by retail sector headwinds.

GameStop’s evolution under Cohen continues to captivate markets, blending legacy retail with potential for reinvention through strategic acquisitions and operational focus.

Business

Ford recalls 1.74 million vehicles over rearview display issue

Check out what’s clicking on FoxBusiness.com.

Ford is recalling nearly 1.74 million vehicles in the U.S. due to software problems that can affect rearview camera displays, according to notices published this week by the National Highway Traffic Safety Administration (NHTSA).

One recall covers 849,310 2021–2026 Ford Broncos and 2021–2024 Ford Edges, which may experience overheating in its Accessory Protocol Interface Module (APIM). The issue can cause the rearview camera image not to appear when the vehicle is in reverse.

“A rear-view camera that does not display an image while in reverse gear can reduce the driver’s view of what is behind the vehicle, increasing the risk of a crash,” the NHTSA alert warned.

A separate recall impacts 889,950 vehicles, including 2020-2022 Ford Escapes, 2020-2022 Lincoln Corsairs, 2020-2024 Lincoln Aviators and 2020-2024 Ford Explorers.

FORD IN DEEP WATER AFTER SWEEPING RECALLS HIT EVERY MODEL SINCE 2020 – WITH ONE EXCEPTION

Ford Explorers from 2020-2024, as well as other models from Ford and Lincoln are the subjects of two new recalls related to rear display problems. (Fatih Aktas/Anadolu via Getty Images / Getty Images)

“On the affected vehicles, it may be possible to have the SYNC screen image on the center display flipped or inverted immediately after an ignition cycle,” a recall report from the NHTSA says. “This may result in the image displayed being inverted or flipped, this includes all buttons. While in reverse the rearview camera image, buttons, and camera guidelines may also be inverted or flipped.”

According to the NHTSA report, Ford said that they are not aware of any related crashes or injuries connected to the issue.

FORD BUILDS ONE-OF-A-KIND EXPLORER FOR POPE LEO XIV

Ford Broncos from 2021–2026 are among a list of vehicles subject to new recalls having to do with issues impacting rear displays. (Josh Lefkowitz/Getty Images / Getty Images)

For Bronco and Edge owners, Ford is offering a free software update to the APIM. Notification letters are scheduled to be mailed at the end of the month, and repairs can be completed at dealerships or through over-the-air updates.

A remedy for the second group of vehicles is still under development. Interim letters notifying owners of the safety risks will be sent in the coming months.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Drivers can check their vehicle identification number (VIN) on the NHTSA website or Ford’s recall lookup tool for more information, or contact Ford customer service at 1-866-436-7332.

Ford recalls over rearview camera issues are a continuation of prior recall alerts. A past recall for older Ford vehicles was issued last October for 1.4 million vehicles.

Business

Natural Gas (NG1:COM) Rebounds Toward $3.5 As Qatar LNG Shutdown Tightens Global Supply

Traders Union is a leading financial portal dedicated to empowering traders and investors with essential information to maximize their success in the financial markets. Its mission is to create a trusted platform where users can easily access comprehensive details about the top brokerage firms offering the most favorable and seamless trading conditions.

Founded in 2010, Traders Union was built on the idea of providing thorough and unbiased reviews of international forex brokers, along with high-quality content covering global trading and investment trends.

Traders Union saves time and effort by making the process of selecting a reliable broker hassle-free. With the Traders Union Broker Rating, users have all the data needed to make well-informed decisions, eliminating the need for endless research and review reading.

Business

Red Cat Holdings: Poised For Explosive Growth As Military Drone Contracts Accelerate

Red Cat Holdings: Poised For Explosive Growth As Military Drone Contracts Accelerate

Business

BJ's Restaurants: Another Pizookie Dip Worth Buying

BJ's Restaurants: Another Pizookie Dip Worth Buying

Business

Two right-wing politicians lead in Peru’s presidential race, but most are undecided, poll says

Two right-wing politicians lead in Peru’s presidential race, but most are undecided, poll says

Business

Netflix (NFLX) Shares Dip Amid Analyst Downgrade, Trading Around $98 on Volatile Session

Netflix Inc. shares declined modestly in intraday trading Monday as investors digested a fresh analyst downgrade amid ongoing shifts in the streaming giant’s strategic priorities, including a pivot toward organic growth and artificial intelligence integration following the abandonment of a potential blockbuster acquisition.

Netflix’s stock (NASDAQ: NFLX) opened at approximately $97.69 and ranged between a low of $96.58 and a high of $98.94, with shares changing hands at around $97.58 to $97.96 in recent updates, down roughly 1.2% to 1.5% from the previous close of $99.02. Volume exceeded 23 million shares in early afternoon trading, below the average but reflecting continued interest in the entertainment sector leader.

The pullback follows a period of volatility for the Los Gatos, California-based company. Netflix stock has navigated a choppy path in early 2026, with a notable surge in late February that contributed to a 15.3% monthly gain, according to S&P Global Market Intelligence data. That rally was fueled in part by relief from the company’s decision to walk away from pursuing a deal for Warner Bros. Discovery assets, a move that investors viewed as preserving financial discipline rather than risking overextension in a competitive media landscape.

Analysts have highlighted the strategic repositioning. Netflix is channeling resources into core streaming operations, with commitments to approximately $20 billion in content investment this year, while exploring AI-driven tools to enhance filmmaking efficiency. The company recently acquired InterPositive, an AI filmmaking startup, signaling deeper integration of technology in content production. This shift emphasizes organic subscriber growth, advertising revenue expansion — projected to double in 2026 compared to the prior year — and free cash flow generation, with some forecasts pointing to around $11 billion by year-end.

However, not all views are uniformly positive. Wells Fargo downgraded Netflix shares, citing concerns over elevated content spending and signs of decelerating revenue momentum. The note contributed to selling pressure, though broader market sentiment remains mixed. Consensus analyst price targets hover around $113 to $116, implying potential upside from current levels, with some optimistic calls reaching higher.

Netflix’s fundamentals continue to reflect its dominance in streaming. Trailing price-to-earnings ratio stands near 39, with forward estimates at about 31. Market capitalization approximates $418 billion, underscoring its scale in the entertainment industry. The stock’s 52-week range spans $75.01 to $134.12, with the current price sitting well below last summer’s peak but above the yearly low.

Recent performance has been influenced by broader industry dynamics. Streaming competition remains fierce, with rivals including Disney+, Amazon Prime Video and others vying for subscriber attention. Netflix’s ad-supported tier has gained traction, helping offset slower paid subscriber additions in some regions. The company has also benefited from hits in its original programming slate and live events, bolstering viewer engagement.

Looking ahead, investors are monitoring Netflix’s path to sustained profitability and cash flow amid macroeconomic uncertainties, including interest rate environments and consumer spending patterns. The company’s emphasis on balance-sheet strength — opting for internal growth over large-scale mergers — has resonated with some Wall Street firms, such as JPMorgan, which resumed coverage with an Overweight rating and a $120 target post the Warner Bros. deal exit.

Netflix executives have expressed confidence in long-term opportunities, particularly in advertising and international expansion. Revenue growth guidance for 2026 has been characterized as robust in some quarters, with expectations around 13% to 15% in certain scenarios, though operating margins may face pressure from content outlays.

As of March 9, 2026, with U.S. markets active, Netflix shares reflect a cautious tone amid these developments. The stock’s movement underscores the challenges and opportunities facing legacy media players in an evolving digital landscape, where technology integration and disciplined capital allocation increasingly define success.

The day’s trading activity highlights ongoing investor scrutiny of Netflix’s ability to balance aggressive content investment with profitability goals. While the downgrade added near-term pressure, the company’s market position, subscriber base and innovation efforts continue to support a generally constructive outlook among many analysts.

Business

Q Mixers debuts sparkling mixers

-(1).webp?t=1773065938)

The mixers are intended as additions to cocktails, mocktails or enjoyed as a standalone beverage.

Business

10 Essential Facts About Jennifer Runyon: Remembering the 'Ghostbusters' Star Who Passed at 65

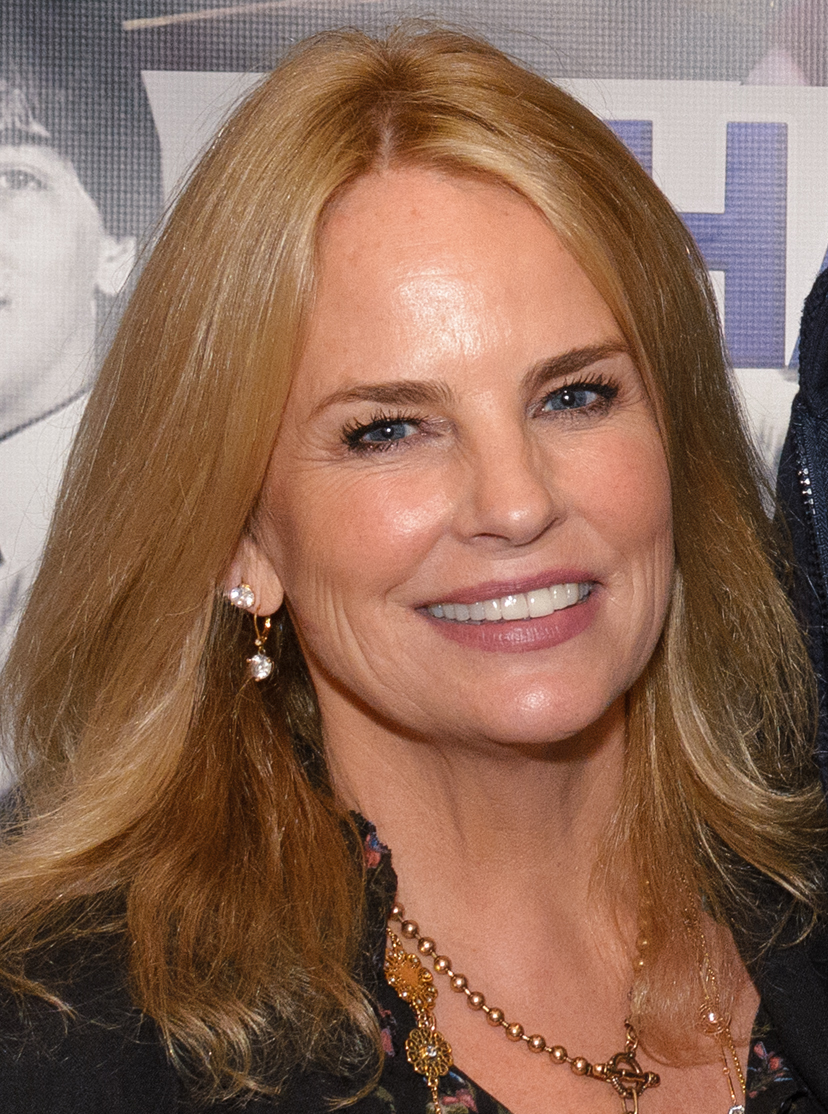

Jennifer Runyon, the beloved actress whose sunny presence brightened 1980s screens in Ghostbusters, Charles in Charge and A Very Brady Christmas, died March 6, 2026, at age 65 after a six-month battle with cancer.

Business

Poland stocks lower at close of trade; WIG30 down 0.25%

Poland stocks lower at close of trade; WIG30 down 0.25%

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

News Videos6 hours ago

News Videos6 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World2 hours ago

Crypto World2 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech4 hours ago

Tech4 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death