When the concept of cryptocurrency was introduced back in 2009 – when the first Bitcoin whitepaper was released by the anonymous creator, Satoshi Nakamoto – its unique selling point was that it was different. By that we mean, the idea of a decentralised, peer-to-peer digital currency that could operate independently was revolutionary for the financial market.

Trading crypto, too, was a different experience compared to trading on traditional Forex platforms. Unlike Forex markets, which are heavily regulated and rely on central authorities like banks or brokers, cryptocurrency transactions are recorded on blockchain, a distributed ledger that is transparent and independent of any governing body, introducing a whole new dynamic for traders.

While this is still true today, however, as the cryptocurrency market has evolved, significant similarities between both markets have come to light. In 2025, crypto traders can learn a lot from traditional Forex platforms, with both markets having merged in terms of accessibility, tools, and strategies. Whether it’s through Forex trading apps or crypto trading platforms, traders now have access to similar features that enable them to execute trades efficiently and strategically, and if you look closely, the way in which they do so is not so different.

Learning to Manage Risk

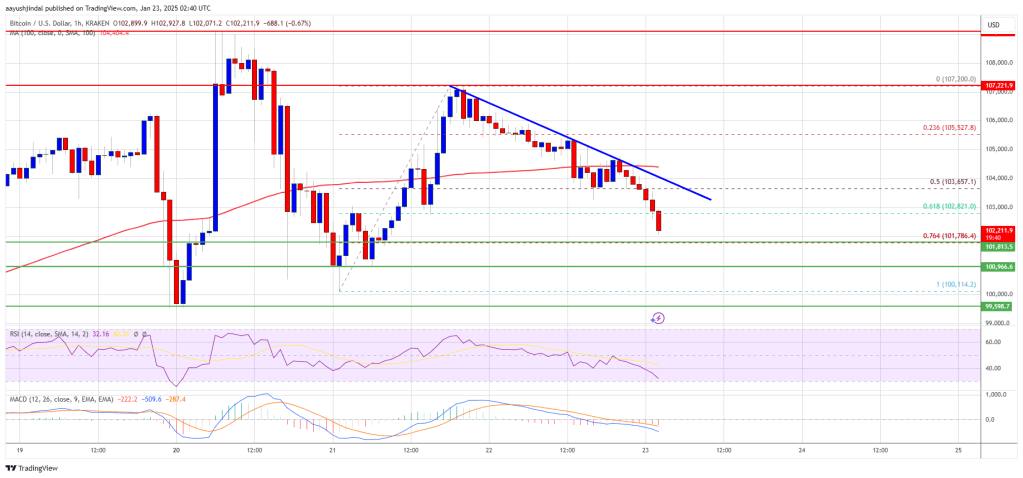

Everyone knows that the cryptocurrency market is volatile. One day, the price of Bitcoincould be reaching a high of $106,000, the next it could have dropped down to $95,000. As a result, entering the crypto market is a risk in itself, but there are ways to mitigate that risk and ensure it never becomes too damaging.

Forex traders have long used risk management strategies to protect their capital, with stop-loss orders, take-profit orders, and position sizing being common risk management tools that can be found on Forex platforms. By setting a stop-loss at a predetermined price, traders can limit potential losses if the market moves against them. Similarly, setting take-profit orders allows traders to lock in profits when the market reaches a specific level.

These are standard practices in the traditional Forex market, and they can be beneficial practices in the crypto market too. For investors buying BTC, ETH, or any other altcoin, adopting risk management strategies can work to mitigate the high volatility and unpredictable nature of what is a very unpredictable market.

Learning to Trade Responsibly

Another thing that crypto traders can learn from traditional Forex platforms is the ability to trade responsibly. In Forex trading, emotional control and maintaining discipline are critical factors for long-term success. Provided an investor utilises a trusted, regulated platform, they should not only be receiving access to the financial market, but information and guidance on how to safely navigate that access.

To give an example, on the Exness app – one of the up-and-coming platforms for both Forex and crypto traders alike – investors can access a wide range of educational resources, including guidelines on trading psychology, discipline, and emotional control. For those asking: “is Exness legit?”, this is one of the key signifiers that a platform is committed to helping traders succeed, and it’s also must-have information in both a Forex and crypto context.

As an investor, it can be very easy to let emotions get the better of you. The fast-paced nature of both Forex and crypto markets often triggers impulsive decisions based on a range of factors, and this emotional response can easily lead to overtrading, chasing losses, or taking unnecessary risks that ultimately erode profits. Through digesting the tips and guidelines of platforms like Exness, however, it’s possible to learn how to mitigate these symptoms and make informed, strategic decisions based on fact rather than emotion.

Learning to Manage

Whether you’re a new investor in crypto or Forex – or both – you’ll learn very quickly that you are your own manager. You can follow all the necessary guidelines and steps, but ultimately, you are in charge of your portfolio, and it’s up to you to manage it effectively. One of the reasons Forex trading has become more accessible in recent years, however, is because the platforms are specifically designed to support this level of personal responsibility, offering tools and features that enable traders to take full control of their investments.

As mentioned before, this includes risk management tools, but also real time access to market data. On a Forex platform, you can track live price movements, monitor currency pair fluctuations, and follow global economic events that are bound to affect market behaviour. You can also utilise automated trading options, such as bots or algorithms that program the platform to execute trades for you based on specific criteria – helping you stick to your plan without getting swayed by emotional impulses.

In terms of the crypto market, it is these kinds of tools that you can learn from and utilise when managing your crypto portfolio. In both markets, of course, diversification is crucial in mitigating risk, but especially in the crypto-verse, this makes it harder to keep control in a volatile space and remain aware of everything going on. To succeed, it is crucial to take advantage of platforms offering this level of help, working to keep you on top of your game and flourishing, no matter where the market swings.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Source link

You must be logged in to post a comment Login