Chief executives of London-listed companies should be able to be paid like “top-rate footballers” without facing a backlash, according to billionaire financier Lord Michael Spencer.

The founder of brokerage ICAP, part of which was sold to Tullett Prebon, said the UK needed to tackle the “political hot potato” of executive pay if it was to attract the best executives to run some of the largest companies listed on the London Stock Exchange.

“We don’t mind paying our footballers, top-rate footballers, extraordinary amounts of money,” Spencer, a former Treasurer of the UK Conservative party, told the Financial Times. “Somehow that’s considered perfectly acceptable. But if the CEO of BP or HSBC earns £20mn a year, materially less than their peer group in America, everyone jumps up and down saying this is an outrage.”

Spencer said pay was one of the reasons why the UK was lagging behind other markets such as the US. Ashtead, the construction equipment rental group, on Tuesday became the latest FTSE 100 group to say it would move its primary listing from London. Companies, including Paddy Power owner Flutter and building materials group CRH, have also chosen to shift their primary listings to the US.

Chief executives such as Laxman Narasimhan, the former boss of Reckitt Benckiser, and Keith Barr, who ran InterContinental Hotels Group, have left the UK in favour of the US, while Smith & Nephew’s former boss, Namal Nawana, left after the London-listed company could not meet his pay demands. Dame Julia Hoggett, chief executive of the LSE, argued last year that UK executives should be paid more if the country wanted to retain talent and prevent companies from moving overseas.

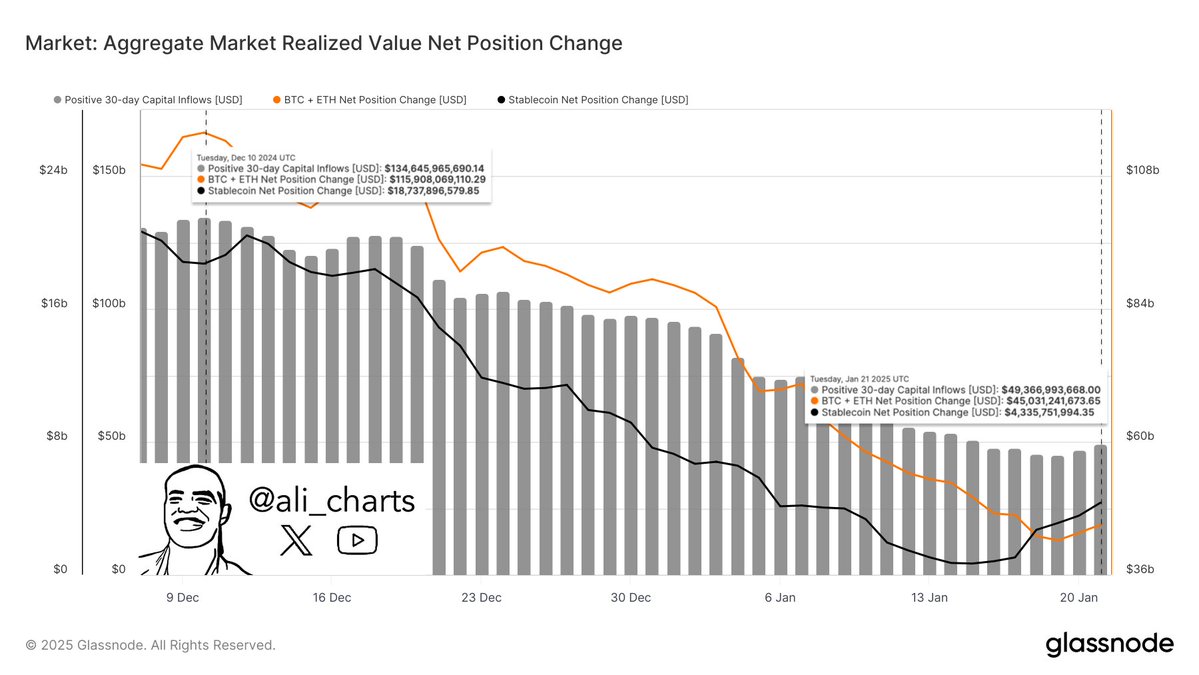

The median FTSE 100 chief executive pay amounted to £4.1mn last year, while bosses of S&P 500 companies in the US were paid a median of $16mn. AstraZeneca’s Pascal Soriot, who stands to earn as much as £18.7mn this financial year, is the best paid CEO on the FTSE 100. However, 36 per cent of shareholders voted against his pay award.

Meanwhile, the average annual salary of Premier League football players is about £2.1mn, according to FT research. The best-paid — including Manchester City’s Kevin De Bruyne and Erling Haaland — are estimated by football data agency Capology to earn about £20mn a year in on-field salary. This does not take into account their ability to earn more through lucrative sponsorship deals.

“The US celebrates the fact that great chief executives earn large amounts of money. They want their chief executives to be paid like football stars,” said Spencer.

But the financier, who has returned to working in the City as chair of asset manager Nutshell, pointed to other changes he said were needed to galvanise the UK’s capital markets.

“A simple starting point is that the UK stock market is the only major market in the world that still charges stamp duty on transactions,” he said, referring to the 0.5 per cent levy on buying London-listed shares.

“What you have therefore created with stamp duty is a market place that is less liquid and therefore ratings of shares will be lower in that market,” he said. “Why would any proper company therefore list in London?

“Any big company — a Klarna, or Arm, or Revolut — the government went rushing around saying we’re going to get them to list in London. But not one of those will list in London [ . . .] with the UK’s current structure.” He said this problem was “one that the politicians and Treasury refuse to face up to.”

There have been attempts by the current and former governments to boost the competitiveness of the UK’s capital markets, including an overhaul of listings rules.

A Treasury spokesperson said: “Recent IPOs and listing announcements by high-growth companies like Raspberry Pi and Canal+ demonstrate confidence in our capital markets and there is more we can do to attract exciting businesses to the UK.”

Spencer became chair of Nutshell earlier this month, having increased his equity stake in the business from 25 per cent to about 40 per cent. The fund, which is run by Mark Ellis, uses algorithms to profit from daily fluctuations in price.

Additional reporting by Josh Noble in London

You must be logged in to post a comment Login