One of the most important changes in Samsung’s new phones is a simple one: when you long-press the side button on your phone, instead of activating Samsung’s own Bixby assistant by default, you’ll get Google Gemini.

Business

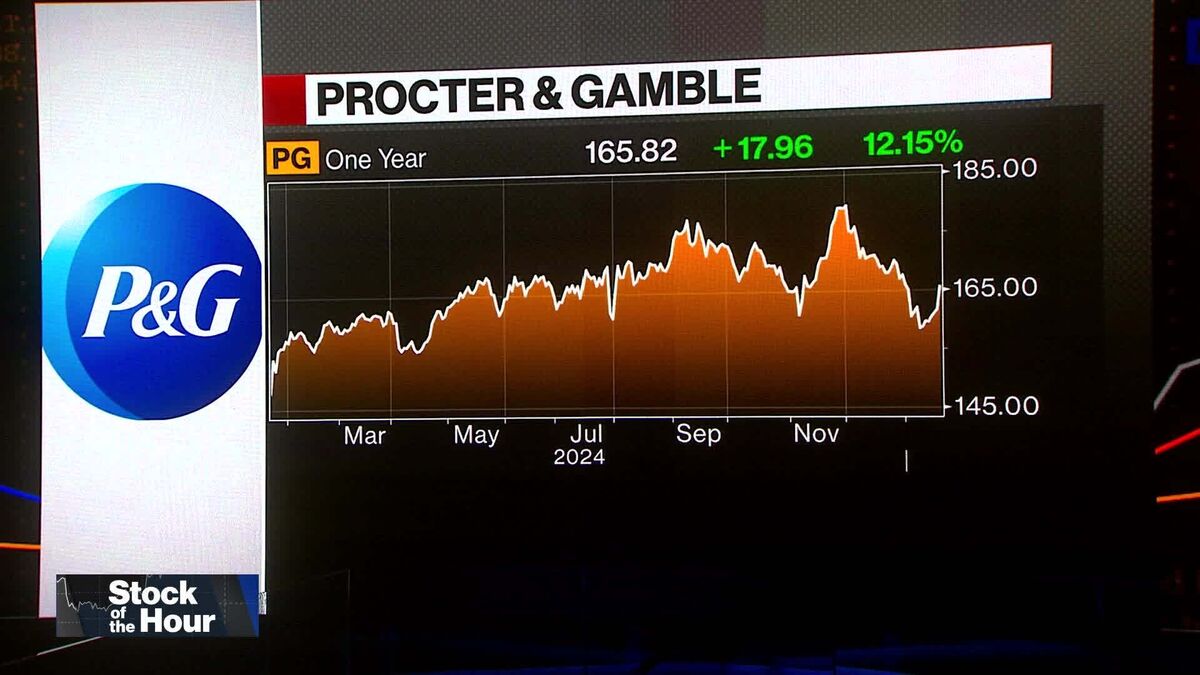

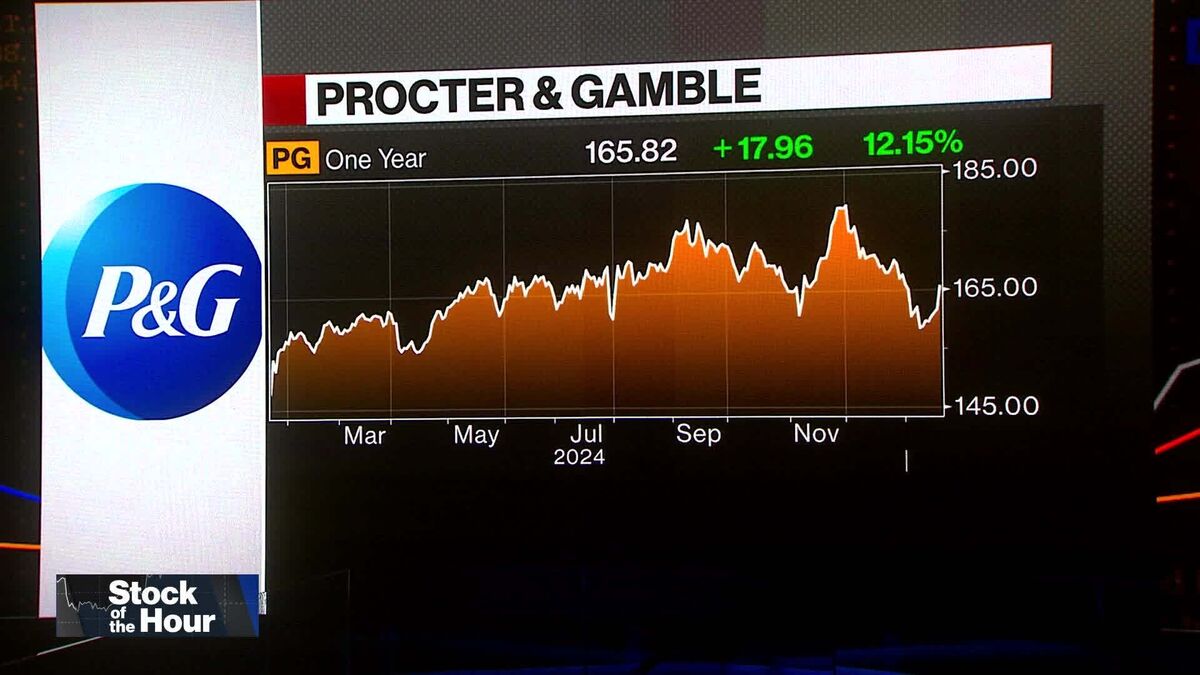

P&G Sales Jump Without Price Hikes

Procter & Gamble Co. organic sales surpassed estimates on higher volume, a change from earlier quarters where most of the company’s growth came from price hikes. Goldman Sachs Senior Consumer Analyst Bonnie Herzog speaks with Scarlet Fu on ‘Bloomberg: Markets.” (Source: Bloomberg)

Technology

A Samsung integration helps make Google’s Gemini the AI assistant to beat

This is probably a good thing. Bixby was never a very good virtual assistant — Samsung originally built it primarily as a way to more simply navigate device settings, not to get information from the internet. It has gotten better since and can now do standard assistant things like performing visual searches and setting timers, but it never managed to catch up to the likes of Alexa, Google Assistant, and now, even Siri. So, if you’re a Samsung user, this is good news! Your assistant is probably better now. (And if, for some unknown reason, you really do truly love Bixby, don’t worry: there’s still an app.)

The switch to Gemini is an even bigger deal for Google. Google was caught off guard a couple of years ago when ChatGPT launched but has caught up in a big way. According to recent reporting from The Wall Street Journal, CEO Sundar Pichai now believes Gemini has surpassed ChatGPT, and he wants Google to have 500 million users by the end of this year. It might just get there one Samsung phone at a time.

Gemini is now a front-and-center feature on the world’s most popular Android phones, and millions upon millions of people will likely start to use it more — or use it at all — now that it’s so accessible. For Google, which is essentially betting that Gemini is the future of every single one of its products, that brings a hugely important new set of users and interactions. All that data makes Gemini better, which makes it more useful, which makes it more popular. Which makes it better again.

Right now, Google appears to be well ahead of its competitors in one important way: Gemini is the most capable virtual assistant on the market right now, and it’s not particularly close. It’s not that Gemini is specifically great; it’s just that it has more access to more information and more users than anyone else. This race is still in its early stages, and no AI product is very good yet — but Google knows better than anyone that if you can be everywhere, you can get good really fast. That worked so well with search that it got Google into antitrust trouble. This time, at least so far, it seems like Google’s going to have an even easier time taking over the market.

It’s not that Gemini is specifically great; it’s just that it has more access to more information and more users than anyone else

For years, there were three meaningful players in the virtual assistant space. Amazon’s Alexa, Google’s Assistant, and Apple’s Siri all offered similar features and were similarly accessible through speakers and phones and wearables. But now? The much-hyped, AI-first “Remarkable Alexa” is, by all accounts, massively delayed and massively underpowered. The latest versions of Siri shipped with a wackier animation and seemingly no new smarts or capabilities.

There are other ascendant AI assistants, of course. ChatGPT, Claude, Grok, and Copilot all have strong underlying models, and some share the same multimodal capabilities as Gemini. There are lots of good reasons to pick them or even something like Perplexity over Gemini. But they’re missing the most important thing: distribution. They’re apps you have to download, log in to, and open every time. Gemini is a button you can press — and that’s a big difference. There’s a reason OpenAI is reportedly working on everything from a web browser to a Jony Ive-designed ChatGPT gadget: the built-in options usually win.

The built-in options are also the ones that tend to have the best integration across the platform, which might be the whole ball game. Gemini can already change settings on your phone and, with new upgrades, can even do things across apps — grabbing information from your email and dumping it into a text message draft, just to name one example. Because of the way iOS and Android are architected, no other assistant has this kind of access — and again, there’s no indication that Siri’s ever going to be as good as it needs to be. If the future of assistants is this kind of agentic, using-your-apps-for-you behavior, Google’s inherent advantage might be insurmountable.

Google is practically spoiled for places to put Gemini

Meanwhile, Google is practically spoiled for places to put Gemini. The company recently announced that all paying Workspace customers will get Gemini access. You can access Gemini with one click from your Gmail inbox or summon it with one keystroke in Docs. And the underlying tech is even more pervasive. You can use Gemini to find stuff on YouTube and in Drive, and practically every time you search, a Gemini-powered AI Overview appears at the top of your results. “Today, all seven of our products and platforms with more than two billion monthly users use Gemini models,” Pichai said on Google’s earnings call last fall. (Fun fact: the word “gemini” appears 29 times in that earnings call transcript, only three fewer than “search.”)

When it comes to how people actually encounter and interact with these models, though, the phone is still the AI device of choice. And that’s where Google has maybe its largest advantage. “Gemini’s deep integration is improving Android,” Pichai said on that earnings call. “For example, Gemini Live lets you have free-flowing conversations with Gemini; people love it.” For now, smartphones are the most compelling AI devices, and Google can integrate its systems unlike any other. Apple, scrambling to play catch-up with the iPhone, had to launch an awkward handoff with ChatGPT just so Siri could answer more questions.

All of these assistants, including Gemini, still have lots of limitations. They lie; they misunderstand; they lack the necessary integrations to do even some of the basic things Alexa and Assistant have been able to do for years. The Gemini models still occasionally do ridiculous, deal-breaking things like tell people to eat rocks and generate diverse founding fathers. But if you believe the AI era is coming, or is maybe even here, then there is nothing more important right now than getting your AI platform in front of users. People are developing new habits, learning new systems, developing new relationships with their virtual assistants. The more entrenched we become, the less likely we will be to dump our AI friend for another one.

ChatGPT had the first-mover advantage and captured the world’s imagination by showing just how compelling an AI chatbot could be. But Google has the distribution. It can put its sparkly icon in front of practically the entire population of the internet every single day, across a huge range of products, and get the kind of data and feedback it needs to eventually do this well. Even as it fights in court over how powerful its default status made it in search, Google is executing the same playbook with AI. And it’s working again.

CryptoCurrency

Bitcoin price probably ‘chops’ in $100K–$110K range until FOMC meeting

Analysts believe US interest rates will not change, but Bitcoin price could benefit if the Federal Reserve mentions quantitative easing at the next FOMC.

Business

Australia Exchange Pays Clients Compensation After System Outage

ASX Ltd. Chief Executive Officer Helen Lofthouse said last month’s settlement system failure was a one-off and the firm has taken steps to stop it happening again, as technology at Australia’s leading exchange faces ongoing scrutiny.

Technology

Some shareholders of a16z-backed Divvy Homes may not see a dime from $1B sale

The $1 billion acquisition of rent-to-own startup Divvy Homes, which was announced Wednesday, is expected to leave some shareholders without a payout, according to sources familiar with the deal.

The terms — and Divvy’s journey from buzzy startup to acquisition target — reflects the rollercoaster ride the proptech industry has endured over the past decade.

The San Francisco-based startup, founded in 2016, had raised more than $700 million in debt and equity from well-known investors such as Tiger Global Management, GGV Capital, and Andreessen Horowitz (a16z), among others. By 2021, the company was valued at $2.3 billion.

And while the Brookfield Properties purchase of Divvy for $1 billion was at half of its peak valuation, the acquisition could still be considered a win in an industry that has had a string of shutdowns and bankruptcies.

However, it’s a loss for some shareholders, according to a letter from Divvy CEO and co-founder Adena Hefets, which was viewed by TechCrunch.

“If the transaction closes, Divvy will sell substantially all of its assets, namely its home portfolio and brand, to Brookfield for approximately $1 billion. However, after repaying its outstanding indebtedness, transaction costs, and liquidation preference to preferred shareholders, we unfortunately estimate that neither common shareholders nor holders of the Series FF preferred stock will receive any consideration,” according to the letter, which was sent to shareholders, former employees, and “Divvy supporters.”

FF preferred stock, also known as Founders Preferred Stock, is a type of stock that is issued to founders of a company. The law firm Cooley defines the shares as being issued to founders “at the time of incorporation in order to facilitate sales of stock by founders in connection with future equity financings.”

TechCrunch has reached out to Hefets and Divvy Homes for comment and will update the article with any response.

Another source told TechCrunch that equity holders “got zero’d” so “founders, employees and VCs” will get “nothing” from the sale. The identity of the source, who asked to remain anonymous, has been verified by TechCrunch.

Divvy operated a rent-to-own model in which it worked with renters who wanted to become homeowners by buying the home they wanted and renting it back to them for three years while they built “the savings needed to own it themselves,” it said.

The company ran into some hiccups when mortgage interest rates began to surge in 2022, leading it to conduct three known rounds of layoffs in a year’s time. Divvy’s last known funding occurred in August 2021 — a $200 million Series D funding led by Tiger Global Management and Caffeinated Capital. The Series D round was announced just six months after a $110 million Series C.

Hefets also shared in the letter the “decision to sell wasn’t easy” and “came after a thorough review of Divvy’s strategic alternatives … and with significant deliberation around our options.”

She said the move followed “years of fighting difficult market conditions, including rising interest rates, and making as many cost cuts as possible.”

As the company looked into what lay ahead in 2025, it decided the best way forward was to sell its “portfolio of homes now and return as much capital as possible to shareholders.”

“With almost a decade of pouring myself into this company, and believing in this mission, this was not the ending I had hoped for…While I am not proud of the financial outcome, I am proud of the impact we had on our customers’ lives,” Hefets added.

Want more fintech news in your inbox? Sign up for TechCrunch Fintech here.

Want to reach out with a tip? Email me at maryann@techcrunch.com or send me a message on Signal at 408.204.3036. You can also send a note to the whole TechCrunch crew at tips@techcrunch.com. For more secure communications, click here to contact us, which includes SecureDrop and links to encrypted messaging apps.

CryptoCurrency

Cardano and XRP investors get in early on new wallet technology

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cardano (ADA) and XRP investors are buzzing about 1Fuel’s wallet technology, looking to get in early.

Cardano (ADA) and Ripple (XRP) are widely known for their blockchain solutions, and achieved more fame when they announced plans to collaborate. But lately, their investors have been more interested in 1Fuel (OFT), especially since its new wallet technology might transform the DeFi landscape.

This DeFi wallet is important to 1Fuel’s ecosystem, offering cross-chain transaction capability and privacy tools. With the 1Fuel presale quickly progressing, there has been a lot of excitement surrounding the public listing.

Cardano and Ripple plan collaborative projects

Recently, the founder of Cardano, Charles Hoskinson, and the CEO of Ripple, Brad Garlinghouse, announced that they have been discussing collaborations. Once this news broke out, the value of the two altcoins increased in a week. Cardano‘s price increased by 1.14% while XRP rose by 20.68%, further attracting investor interest.

This potential collaboration has caused investors to rank ADA and XRP among the best altcoins. With their rising in value, these tokens can be easily managed on wallets like MetaMask and Trust Wallet.

New wallet technology piques widespread interest

1Fuel has emerged with a new wallet technology which is attracting a lot of attention, especially from ADA and XRP whales. This technology is expected to transform the DeFi space, driving 1Fuel’s value as one of the best altcoins.

One of the best parts of this wallet is cross-chain transactions and one-click technology. This is a major advantage over platforms like MetaMask and Trust Wallet, which require multiple wallets and tokens for cross-chain swaps. With only the 1Fuel token, investors can freely send altcoins from one blockchain to another.

1Fuel is also fitted with highly advanced financial tools that make it easy to manage digital assets. These include crypto debit and credit cards, peer-to-peer (P2P) exchange, disposable wallets, and AI-driven features. With all of these, 1Fuel could be a top DEX wallet, especially as it features an inbuilt privacy mixer and cold storage. These are privacy features that are usually lacking in well-known platforms like MetaMask and Trust Wallet.

1Fuel presale sees fast progress

The 1Fuel presale has been moving at an impressive pace, which is a sign of the widespread investor interest and confidence. In just a week, stage 1 achieved 100% completion while stage 2 had a similar progress. Now it is in stage 3 and over 30% complete, selling over 146 million tokens and raising $1.4 million.

Investors can buy the token at $0.017 in stage 3. Analysts predict that 1Fuel could rise by 100x in 2025, and investors are highly anticipating long-term growth.

1Fuel’s launch

Investors are looking forward to 1Fuel’s public listing in Q2 2025. Supported by a robust DeFi ecosystem, 1Fuel could change how digital assets are managed. The exchange technology is offering an edge over widely known blockchain systems like Cardano and Ripple.

To find out more about 1Fuel, visit their website, Telegram, or X.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Business

Nasal spray for depression now FDA-approved as standalone treatment

© 2024 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell/Share My Personal Information

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.

CryptoCurrency

2025 Will Be a Year of Self-Custody

An industry-wide debate over crypto institutional adoption and centralized custody risk will trigger a surge of interest in self-custody, OKX’s President Hong Fang said in a recent interview with CoinDesk.

While institutional adoption and the increasing popularity of crypto ETFs are a net positive for the industry, there may be a shift in industry narrative to caution against custody concentration risk, Fang argued. She predicts that most native crypto users will adopt self-custody this year.

On OKX, assets held in its self-custody wallets (almost $50 billion) exceed assets on its centralized exchange ($30.8 billion).

This series is brought to you by Consensus Hong Kong. Come and experience the most influential event in Web3 and Digital Assets, Feb.18-20. Register today and save 15% with the code CoinDesk15.

“The tension between adoption and concentration risk will come under a spotlight,” said Fang, who will be a speaker at Consensus Hong Kong in February. “Against this backdrop, I anticipate more industry campaigns to educate why self-custody is important and how to use it, and more products to make it easier for the masses to use self-custody and alleviate the risks accordingly.”

According to Fang, OKX DEX volume has increased 20 times. But she argues that DEXs and centralized exchanges are complementary.

“The crypto-native audience will want to be able to use CEX for reliability and DEX for catching innovations,” she said. “Such supply-demand dynamics will drive further adoption of DEX to enable innovation while supporting the gradual maturity of the crypto regulatory framework.”

A bitcoin strategic reserve?

A national bitcoin strategic reserve, a policy touted by the new Trump administration, would serve to centralize the leading cryptocurrency. But many in crypto doubt it will actually happen, if bettors on Polymarket are any guide (as of Jan. 22, they were putting the chances of Trump creating such a reserve in the first 100 days of his administration at just 30 percent.)

Fang agrees with this sentiment.

“I personally find it hard to believe that major sovereign countries like the U.S. will officially adopt bitcoin strategic reserve at the federal level at this stage, but it is very possible that smaller sovereign countries or states could,” she said.

But, this being crypto, anything is possible.

Very unexpected events — like a lack of follow through by the Trump administration on its crypto promises — could dampen the bull run quickly, she said. But the biggest risk according to Fang remains over-centralization.

For that risk there’s a vaccine: self-custody. Which, according to OKX, the market is quickly adopting.

CryptoCurrency

Ripple (XRP) Price Will Hit $5 In Q1 Of 2025 If This One Thing Happens. What Is The Latest Remittix News

Ripple’s most recent surge saw its price surge past $3.38, causing speculation as to whether Ripple could surpass the critical $5 mark in Q1 of 2025. Meanwhile, a new contender, Remittix (RTX), has been gaining traction for its advanced PayFi solution. It promises to address the longstanding frustrations of individuals and businesses who need to make global payments on a regular basis, often facing high costs, hidden charges, and lengthy delays. Currently powering through its presale, Remittix is seeing major investment, having raised over $3.85 million in just a few weeks. So what could Remittix achieve in 2025, and will Ripple (XRP) be able to reach $5?

Ripple’s Momentum Stalls At $3.15

Ripple (XRP) has been on a real journey this last week. Between 14th and 16th January it shot up from $2.54 to $3.38 in a short window before plummeting to $3.04. It is now back to $3.15 where it seems to be settling. This price point seems to have stagnated for the short term, but where it might head next is unclear. The market cap for Ripple is now sitting at around $180 billion and its 24 hour trading volume dropped by 8% in the last day. Optimistic holders think the new administration will boost Ripple’s price if Trump’s team shows signs of loosening crypto regulations.

Remittix Ushers in a New Era for Global Payments

Focusing on resolving inefficiencies in the cross-border payments market, Remittix (RTX)taps into the $190 trillion industry with precision. Facilitating the conversion of over 40 cryptocurrencies into fiat, the platform allows users to send funds directly to bank accounts worldwide.

For businesses, the Remittix Pay API is a standout feature, simplifying the integration of crypto payments into existing systems while offering easy and accessible fiat settlement options. Additionally, merchant accounts are tailored for companies managing multiple currencies, supporting over 50 crypto pairs and 30 fiat currencies. This flexibility makes Remittix (RTX) an adaptable solution for diverse financial needs.

Helping bridge the gap in regions with limited access to traditional financial services, Remittix supports individuals and businesses by providing 24/7 access to global payment systems. With low fees and efficient processing times, it is particularly attractive to users in underserved areas, breaking down barriers to participating in the international economy.

Remittix Soars In Presale, Surpassing $4 Million

Central to the Remittix (RTX) ecosystem is the RTX token, intelligently designed for growth with applications in staking, governance, and platform rewards. With a capped supply of 1.5 billion tokens, RTX is rapidly gaining traction among forward-thinking investors.

Currently, priced at $0.0239 in its presale phase, the RTX token has already exceeded $4.6 million raised! Thanks to its compelling value proposition in the lucrative cross-border payments market, analysts project an 800% gain during the presale, with further growth expected as adoption grows. For investors seeking the next major opportunity in PayFi, this is a chance not to be missed.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Coinbase files to dismiss BiT Global lawsuit over wBTC

The complaint, filed in December 2024, alleged “antitrust injury” from Coinbase over its decision to delist wrapped Bitcoin in favor of promoting its cbBTC product.

Technology

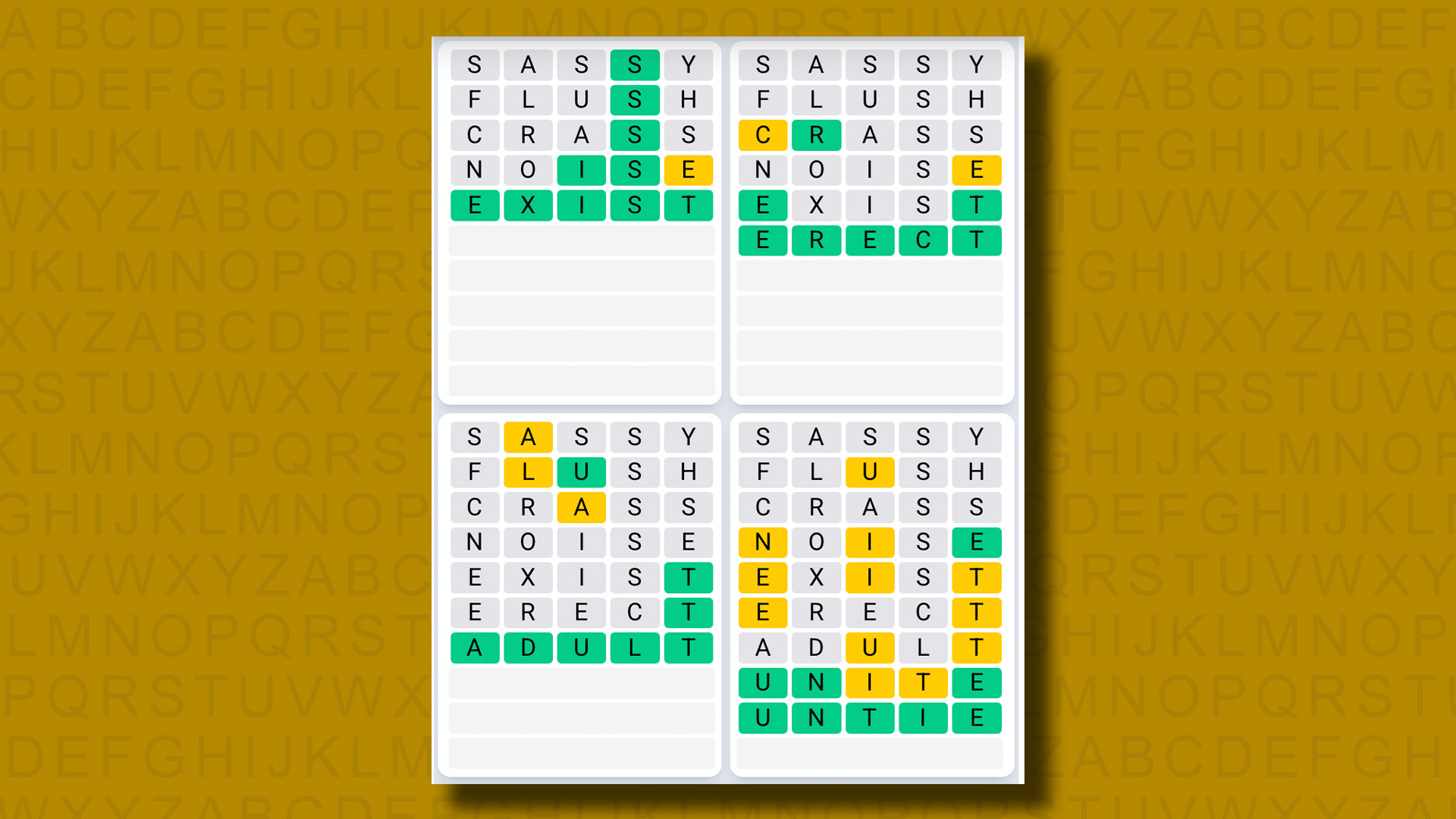

Quordle today – my hints and answers for Thursday, January 23 (game #1095)

Quordle was one of the original Wordle alternatives and is still going strong now more than 1,000 games later. It offers a genuine challenge, though, so read on if you need some Quordle hints today – or scroll down further for the answers.

Enjoy playing word games? You can also check out my NYT Connections today and NYT Strands today pages for hints and answers for those puzzles, while Marc’s Wordle today column covers the original viral word game.

SPOILER WARNING: Information about Quordle today is below, so don’t read on if you don’t want to know the answers.

Quordle today (game #1095) – hint #1 – Vowels

How many different vowels are in Quordle today?

• The number of different vowels in Quordle today is 3*.

* Note that by vowel we mean the five standard vowels (A, E, I, O, U), not Y (which is sometimes counted as a vowel too).

Quordle today (game #1095) – hint #2 – repeated letters

Do any of today’s Quordle answers contain repeated letters?

• The number of Quordle answers containing a repeated letter today is 3.

Quordle today (game #1095) – hint #3 – uncommon letters

Do the letters Q, Z, X or J appear in Quordle today?

• No. None of Q, Z, X or J appear among today’s Quordle answers.

Quordle today (game #1095) – hint #4 – starting letters (1)

Do any of today’s Quordle puzzles start with the same letter?

• The number of today’s Quordle answers starting with the same letter is 0.

If you just want to know the answers at this stage, simply scroll down. If you’re not ready yet then here’s one more clue to make things a lot easier:

Quordle today (game #1095) – hint #5 – starting letters (2)

What letters do today’s Quordle answers start with?

• R

• S

• W

• B

Right, the answers are below, so DO NOT SCROLL ANY FURTHER IF YOU DON’T WANT TO SEE THEM.

Quordle today (game #1095) – the answers

The answers to today’s Quordle, game #1095, are…

A rare day without an E.

I was thrilled when I got RUGBY in three goes – mainly because after deciding to go with a word that began RU I couldn’t think of any others – but then I really laboured over the next word.

Words beginning in S and ending in Y are pretty common – or at least it feels like it. Getting the second letter narrowed it down a little, but it still took me three goes before I guessed SASSY – another Qourdle deja-vu word that I’m sure was used recently.

Daily Sequence today (game #1095) – the answers

The answers to today’s Quordle Daily Sequence, game #1095, are…

Quordle answers: The past 20

- Quordle #1094, Wednesday 22 January: SLANT, TRUNK, WOOZY, EATEN

- Quordle #1093, Tuesday 21 January: CHART, VIGOR, PRINT, SPAWN

- Quordle #1092, Monday 20 January: SIXTY, THONG, TATTY, ROBIN

- Quordle #1091, Sunday 19 January: WREST, RINSE, SCOUR, CANNY

- Quordle #1090, Saturday 18 January: BLARE, ITCHY, BICEP, PIPER

- Quordle #1089, Friday 17 January: CATCH, WEARY, SWOON, LATHE

- Quordle #1088, Thursday 16 January: PARTY, BLUNT, TWEED, PLANT

- Quordle #1087, Wednesday 15 January: RISEN, PLATE, RURAL, ENVOY

- Quordle #1086, Tuesday 14 January: SWARM, SCRAP, ONION, BELCH

- Quordle #1085, Monday 13 January: EYING, GIDDY, CHEAP, PETAL

- Quordle #1084, Sunday 12 January: BRIEF, PETAL, WOMAN, FELON

- Quordle #1083, Saturday 11 January: ASCOT, FIBER, ROGUE, SMELL

- Quordle #1082, Friday 10 January: BIGOT, INLET, LEECH, TUNIC

- Quordle #1081, Thursday 9 January: RESET, HUMOR, TENOR, IMAGE

- Quordle #1080, Wednesday 8 January: MINCE, SADLY, RISEN, VOUCH

- Quordle #1079, Tuesday 7 January: CREED, FILET, ROUTE, TAPER

- Quordle #1078, Monday 6 January: PIVOT, WOOLY, GRUNT, GROOM

- Quordle #1077, Sunday 5 January: BORAX, JUDGE, CADET, SALON

- Quordle #1076, Saturday 4 January: CORER, CRATE, QUASI, EXIST

- Quordle #1075, Friday 3 January: PERKY, QUARK, NAVEL, SHEEN

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login