Business

Real estate broker warns of California wealth tax’s ‘trickle-down’ fallout

Former ‘Million Dollar Listing’ star Josh Altman joins ‘Varney & Co.’ to break down California’s slow post-fire rebuilding process and warn that a proposed wealth tax could drive billionaires and jobs out of the state.

Luxury real estate broker Josh Altman warned that California’s proposed wealth tax could drive a number of billionaires out of the state and trigger a damaging “trickle-down” effect.

“There’s about 200 to 250 billionaires in California, more than any other state. However, there are also 40 million people in California, 23 [million] of whom are eligible to vote. If this hits the ballot, there is no way that the billionaires come out on top here, and that’s an issue,” the former “Million Dollar Listing” star told FOX Business.

Discussing the matter Wednesday on “Varney & Co.,” Altman said that seven billionaires he personally knows have already left California for other parts of the U.S., including Las Vegas and Florida.

Josh Altman speaks at BravoCon from Caesars Forum in Las Vegas on Nov. 3, 2023. (Chelsea Guglielmino/Bravo via Getty Images / Getty Images)

Though the proposed measure would impose a one-time 5% tax on the net worth of California residents worth more than $1 billion, he argued it is not the billionaires who will suffer most.

“It’s the trickle-down effect. It’s people, the hundreds of thousands of people that work for these billionaires. It’s the trillion dollars in taxes that we’re going to lose,” he said.

An unfurled California flag flies in Oceanside, Calif. on Oct. 24, 2017. (Mike Blake/Reuters / Reuters)

“You know what a billionaire said to me once? He said, ‘You know what the difference is between 100 million and a billion? Nothing.’ They’ll be fine. It’s people that need them that are not, and we’re running them out of California.”

Under the proposed ballot initiative, the one-time tax would be due in 2027, and taxpayers could spread payments over five years with additional nondeductible charges, according to the Legislative Analyst’s Office.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business host Marcus Lemonis discusses billionaires fleeing California to avoid a proposed wealth tax on ‘The Bottom Line.’

FOX Business’ Kristen Altus contributed to this report.

Business

Gov. Kathy Hochul demands $13.5B Trump tariff refunds for New Yorkers

Rep. Jim Jordan, R-Ohio, and former House Speaker Kevin McCarthy discuss Republicans’ midterm agenda after President Donald Trump’s ‘record-long’ State of the Union speech on ‘Mornings with Maria.’

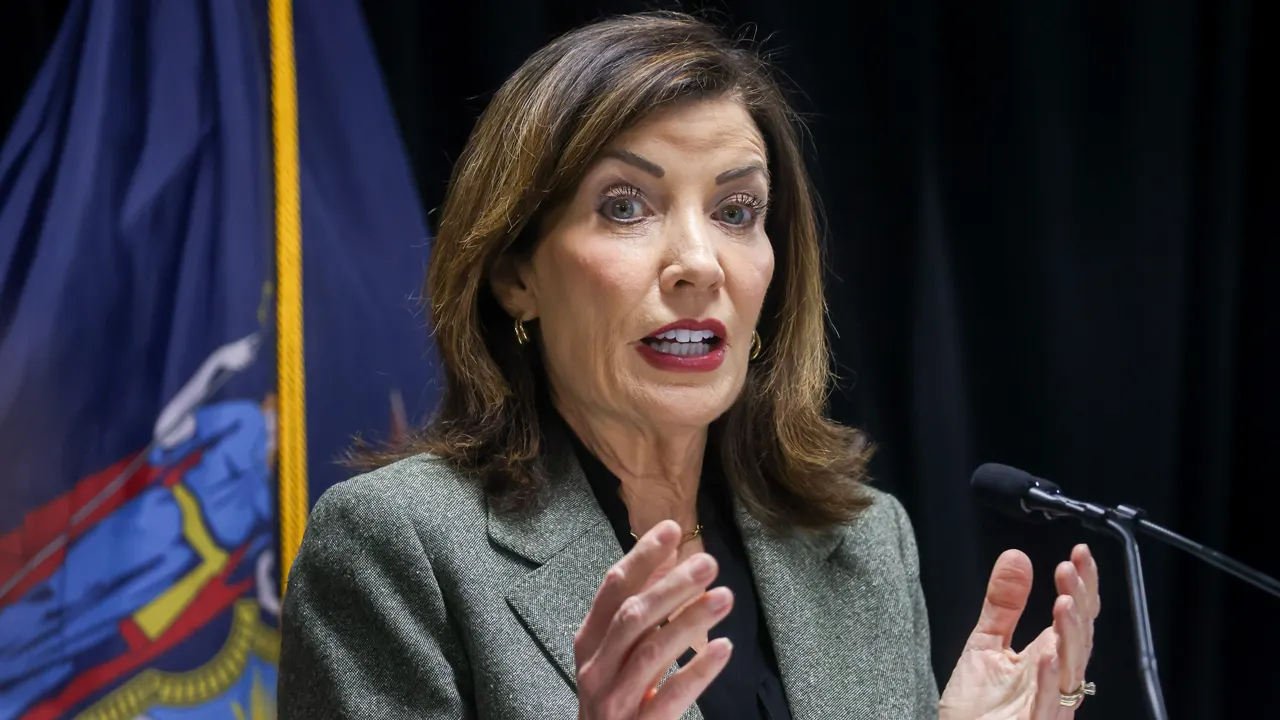

New York Gov. Kathy Hochul is demanding the Trump administration refund an estimated $13.5 billion in tariff payments to New Yorkers after the Supreme Court struck down a key legal basis for President Donald Trump’s import tariffs.

Citing estimates from the Yale Budget Lab, Hochul said the average New York household has paid roughly $1,751 in additional costs since the tariffs were enacted last year — money she argues should now be returned.

“These senseless and illegal tariffs were just a tax on New York consumers, small businesses and farmers — and that’s why I’m demanding a full refund,” Hochul said Tuesday. “I’ll never stop fighting for New Yorkers, and that means staying focused on putting more money back in your pockets — not ripping it away.”

In a 6-3 decision issued Feb. 20, the Supreme Court ruled that Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose broad tariffs was unlawful, finding that it “does not authorize the President to impose tariffs.”

WILL REFUNDS BE ISSUED AFTER SUPREME COURT RULING ON TRUMP TARIFFS?

New York Gov. Kathy Hochul called for tariff refunds after the Supreme Court struck down portions of former President Donald Trump’s trade policy. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

The majority opinion, written by Chief Justice John Roberts, did not address whether refunds should be issued.

Hochul joins other Democratic governors, including California Gov. Gavin Newsom and Illinois Gov. J.B. Pritzker, in calling for tariff refunds following the ruling.

Several companies have also moved to recover costs. FedEx, the global shipping and logistics company, sued the administration seeking a full refund of duties assessed under Trump’s order. The company said it incurred additional expenses to expedite shipments through customs and is seeking repayment with interest, as well as compensation for financial harm.

The White House did not immediately respond to FOX Business’ request for comment.

FEDEX SUES TRUMP ADMINISTRATION FOR FULL TARIFF REFUNDS AFTER SUPREME COURT RULING ON IEEPA

President Donald Trump said he would explore alternative legal avenues to maintain tariffs following the Supreme Court’s ruling. (Nathan Howard/Getty Images / Getty Images)

Trump declined to say during a news conference last week whether the administration would provide refunds.

“I guess it has to get litigated for the next two years. So they write this terrible defective decision, totally defective. It’s almost like not written by smart people. And what do they do, they don’t even talk about that,” Trump said.

After the ruling, Trump announced a 10% global tariff and said he would look into alternative legal avenues to keep them in place. He later raised the tariff to 15%.

Hochul also pointed to a $30 million tariff relief proposal she introduced last month aimed at assisting New York farmers and small businesses impacted by higher costs.

She said over 80% of agrochemical imports and 70% of farm machinery imports are subject to tariffs of at least 10%, making it difficult for farmers to avoid higher prices due to limited alternative suppliers.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The U.S. Supreme Court ruled 6-3 that the International Emergency Economic Powers Act does not authorize the president to impose broad tariffs. (MANDEL NGAN/AFP via Getty Images / Getty Images)

Farmers across the state are facing increased expenses for fertilizer and equipment, with some reporting cost increases of up to $20,000 annually, Hochul said. Milk exports have fallen 7%, she added.

Despite the Court’s ruling, Hochul said the “damage has already been done” for many farmers.

FOX Business’ Eric Revell and Bonny Chu contributed to this report.

Business

Analysis-Japan’s Takaichi gets her doves in a row with BOJ board appointees

Analysis-Japan’s Takaichi gets her doves in a row with BOJ board appointees

Business

City of Perth council to spend $135k to tackle psychosocial risks

The City of Perth council has voted to cut back on the suggested $280,000 spend to tackle workplace issues, including senior executives’ exits and harm that required medical intervention.

Business

Oil Futures Settle Lower Awaiting U.S.-Iran Moves

1502 ET – Crude futures settle lower as the market looks to Thursday’s talks between the U.S. and Iran. Estimates of the risk premium baked into the price go anywhere from $4 to $10 a barrel, Phil Flynn of the Price Futures Group says in a note. “I would argue that it’s fairly subdued,” with President Trump’s record of trying to do the least damage to oil facilities and the market, he says, citing last year’s attacks on Iranian nuclear facilities and this year’s ouster of Venezuela’s leader. A blockade of the Strait of Hormuz could create “real supply headaches,” but “there’s still talks in Geneva and while it’s unlikely that the tensions will go away any sign of a peace deal could see an evaporation of $7 to $10 in oil very quickly.” WTI and Brent fall 1% to $65.63 and $70.77 a barrel, respectively.(anthony.harrup@wsj.com)

Oil Retreats With U.S.-Iran Tensions As Key Driver

1555 GMT – Oil prices retreat as traders assess risks to supply in the Middle East ahead of a third round of nuclear talks between the U.S. and Iran. In afternoon trading, Brent crude slips 0.4% to $70.85 a barrel, while WTI is down 0.5% to $65.50 a barrel after rising earlier in the session. “Most of the recent price increase is due to a widening risk premium,” analysts at Commerzbank say. “The price is thus well above the fair price of oil, which could be explained by fundamental factors alone.” On Friday, a barrel deliverable in one month cost $3.50 more than oil scheduled for delivery in seven months. Compared with 12-month delivery, the premium widened to more than $5. “The last time the time spreads were higher was in June 2025, when the 12-day war between Israel and Iran took place,” the analysts say. (giulia.petroni@wsj.com)

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Adesso reports strong Q4 margin, issues 2026 guidance

Adesso reports strong Q4 margin, issues 2026 guidance

Business

At Close of Business podcast February 26 2026

Sam Jones and Nadia Budihardjo discuss a new research methodology at UWA.

Business

Spain’s looming migrant amnesty strains services, sends applicants scrambling

Spain’s looming migrant amnesty strains services, sends applicants scrambling

Business

Liraglutide still a ‘decent market’ despite Novo’s price moves: Siddharth Mittal, Biocon

On the potential impact of Novo Nordisk’s decision to cut prices for semaglutide, Mittal suggested that the broader market dynamics have already undergone significant change over the past few years.

“See, let us step back. A couple of years back, liraglutide was almost $5 billion in global sales for Novo Nordisk. Since then, it has become a $1 billion product for Novo Nordisk, and patients have moved to Ozempic and Mounjaro. So there has, of course, been a degrowth that we have already seen. But there are patients who continue to take liraglutide even today, and that is where a generic liraglutide will bring down the cost for these patients and the payers. We definitely do not expect market growth in terms of volumes, but in terms of generic penetration, it should be a fairly decent market for everyone. Today, there are very limited players in the US who have commercialised generic liraglutide, and we are very well placed and are going to launch the product very soon in the market,” he said.

While acknowledging that the product is no longer the multibillion-dollar opportunity it once was, Mittal emphasised that limited competition in the generic space still makes it attractive.

Beyond the US, Europe remains a key focus area. The company has already rolled out liraglutide in several European markets and plans to deepen its presence.

“We have already launched the product in a few markets in Europe and will continue to launch it in many more European countries in the coming quarter. Apart from the US and Europe, we think there is a big opportunity in emerging markets where we have already done the filing and our file is under review. In countries, especially tender-based markets in Latin America or the Middle East, the cost of treatment is prohibitively high for branded drugs. If a lower-cost option with a generic drug is available, we expect volumes to expand. Next year, we expect approvals from some emerging market countries, and we are very optimistic that this will become an important growth driver for us,” he noted.

In Europe, the early traction has been encouraging. The company has partnered with Zentiva for multiple markets while also going direct in select geographies such as the Netherlands.“We have launched the product in many markets through our partner Zentiva and have also taken it directly to a few markets such as the Netherlands. The Netherlands is a tender market, and we have secured a few tenders there. In just one market such as the Netherlands, we have almost 40% market share. We will be taking this product to many other markets directly. After the acquisition of the biosimilars business from Viatris, we have a strong presence in select European markets such as Germany. So far, we have seen a very encouraging uptick. In our December quarterly results, we had 24% growth in our generic segment and the majority of that growth came from the liraglutide launch in Europe,” Mittal said.

He added that several competitors who were earlier working on liraglutide have shifted their focus to semaglutide after facing regulatory hurdles, resulting in a narrower competitive field.

On whether Novo could extend price cuts for semaglutide to other markets, Mittal remained cautious.

“That is possible, and we have already seen that in India where prices have come down. There is head-to-head competition between Mounjaro and Ozempic, and that is impacting pricing decisions. But it is for Novo to comment on what action they will take in reaction to what Lilly is doing,” he said.

Looking ahead, semaglutide remains a longer-term play. The company has initiated filings in emerging markets and select developed markets.

“We started filing our semaglutide in emerging markets and markets such as Canada, Brazil, and Saudi Arabia a few quarters back. We expect the review cycle to be between 18 and 36 months. In the best case, we expect approval in 2027, followed by a launch. In India, we have received clinical trial approval for Phase III but have not yet started the trial. We are assessing whether to complete the trial or wait for approval in one of the other countries and then seek a clinical waiver,” Mittal explained.

He also clarified that India is not an immediate commercial focus, particularly after the divestment of the domestic formulations business to Eris Lifesciences two years ago.

“India is going to be a competitive market. Pricing is already quite competitive, and we do not commercialise any drug in India directly. Our focus right now is more on exports and emerging markets,” he said.

As the GLP-1 space evolves with pricing resets and shifting patient preferences, the strategy appears clear: target residual demand in legacy molecules like liraglutide while steadily building the pipeline for semaglutide in markets where timelines and pricing offer room for sustainable growth.

Business

Creators Scrap Seasons 4 and 5 in Surprise Farewell

In a move that has stunned the animation community and sent shockwaves through the Adult Swim fanbase, creators Michael Cusack and Zach Hadel officially announced on February 25 and 26, 2026, that their cult-hit series Smiling Friends will conclude after its third season. This decision comes as a massive reversal of earlier industry reports, as the show had been formally renewed for fourth and fifth seasons in June 2025.

The “Not a Bit” Announcement

The news broke via a synchronized video and audio message released across Adult Swim’s social media and YouTube channels. Zach Hadel, known to fans as the voice of Charlie, addressed the audience with uncharacteristic sobriety.

“I’m gonna cut right to the chase,” Hadel stated in the announcement. “This is not a bit, this is not a joke. Michael and I are here to announce that ‘Smiling Friends’ will be ending after Season 3 is done. We know that’s super disappointing to hear, but we’ve put 110% into this, and we want to go out on top.”

The creators emphasized that while the network and their representatives were eager for the show to continue—with some joking about reaching “Season 80″—the decision to pull the plug was entirely their own.

Why Now? Burnout and Artistic Integrity

The primary driver behind the sudden conclusion is creative burnout. Cusack and Hadel, who are famously hands-on with every aspect of the show—from writing and voice acting to character design and final animation reviews—explained that the intense workload has taken its toll.

“To be perfectly honest, after we finished Season 3, Zach and I just both had the same feeling where we felt pretty burnt out after putting years and years into this,” Cusack explained. The duo expressed a deep-seated fear of the show becoming “slop” or overstaying its welcome, citing a desire to avoid the “zombie” status often attributed to long-running animated sitcoms.

The “Lost” Episodes: A Final Encore

While the main run of Season 3 concluded in late 2025, fans have one final date to mark on their calendars. The creators confirmed that two unreleased “straggler” episodes, produced during the Season 3 cycle but held back for polish, will premiere on April 12, 2026, at 11 p.m. ET on Adult Swim.

Hadel clarified that these are not intended to be a “grand, serialized finale” in the traditional sense, but rather a “fond encore” that rounds out the Season 3 order to a total of 10 episodes. These episodes are expected to be added to the Max streaming library the following day.

Scrapping the Future: The Status of Seasons 4 and 5

The most shocking aspect for many was the definitive cancellation of the previously announced Seasons 4 and 5. In June 2025, The Hollywood Reporter had confirmed a two-season pickup for the show following its massive success on Max. However, the creators have officially scrapped these renewals.

Adult Swim leadership reportedly supported the decision, telling the creators: “If you’re not feeling like making a cartoon, we’re not going to stop you. Go have a break. Either come back or don’t.”

Legacy of a Surreal Masterpiece

Smiling Friends debuted as an unannounced April Fools’ pilot in 2020 and grew into a global phenomenon. Its blend of grotesque, elastic animation, deadpan dialogue, and surprisingly grounded takes on mental health made it a flagship for the “Post-Rick and Morty” era of Adult Swim.

| Milestone | Date | Achievement |

| Series Premiere | January 9, 2022 | Highest-rated new Adult Swim original in 5 years. |

| Season 2 Launch | April 1, 2024 | Consistently ranked in Max’s Top 10 Trending Series. |

| Series Finale Announcement | Feb 25, 2026 | Creators cite burnout and quality control. |

| Final “Straggler” Episodes | April 12, 2026 | The official end of the Smiling Friends regular run. |

What’s Next for Cusack and Hadel?

The creators were quick to reassure fans that this is not the end of their partnership. Both are already looking toward new, unannounced projects that will allow them to “refresh” their creative palettes. Cusack likened the move to Paul McCartney forming the band Wings after the breakup of The Beatles—an opportunity to start again with a clean slate.

While the “Smiling Friends” company may be closing its doors for now, the door remains “cracked” for potential one-off specials or a movie in the distant future, should the creators feel the spark again. For now, however, Pim and Charlie’s mission to make the world smile concludes on their own terms, leaving behind a “perfect little box set” of surrealist comedy.

Business

Analysis: Final take-off for tough Fokkers

ANALYSIS: QantasLink prepares for a new era in WA aviation.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports3 days ago

Sports3 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics3 days ago

Politics3 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business4 days ago

Business4 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business4 days ago

Business4 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech2 days ago

Tech2 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat10 hours ago

NewsBeat10 hours agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat7 hours ago

NewsBeat7 hours agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech4 days ago

Tech4 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

Business2 days ago

Business2 days agoTrue Citrus debuts functional drink mix collection

-

NewsBeat4 days ago

NewsBeat4 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics4 days ago

Politics4 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat1 day ago

NewsBeat1 day agoPolice latest as search for missing woman enters day nine

-

Business4 hours ago

Business4 hours agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Crypto World1 day ago

Crypto World1 day agoEntering new markets without increasing payment costs

-

Sports3 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week